Project Description.

THORChain (Thor Chain) is a decentralized cross-chain AMM trading protocol that was just created by an anonymous group of cryptocurrency developers at Binance's hackathon in 2018. With THORCHain, users can trade tokens between different L1 blockchains, eliminating the need to trade through a centralized exchange. For users who have always sought privacy protection and asset safekeeping, THORChain offers one of the key features to replace centralized exchanges (CEX): uncustodial, permissionless, decentralized transactions across chains.

THORCHain completed its hard fork upgrade on March 22, 2022, and on March 25 reached $1.25 billion in transactions, representing a 400% growth rate.

The mainnet has been announced to go live on March 31, 2022.

Official website: https://thorchain.org/

Twitter (147,000 followers): https://twitter.com/thorchain

Telegraph (22,573 members): https://t.me/thorchain_org

Discord (3,683 members): https://discord.com/invite/KjPVnGy5jR

GitLab: https://gitlab.com/thorchain

Documentation: https://docs.thorchain.org/

Project Explanation

Until now, large-scale transactions in Bitcoin and Ether have generally been done on centralized exchanges, and the business models of these centralized exchanges have often been influenced by the de-globalization of decentralized liquidity pools and the decentralized exchanges they support.

Risks of centralized exchanges.

Counterparty risk: users' privacy is controlled, those with insufficient capital reserves are prone to bankruptcy, and there is even the possibility of market manipulation.

Transaction speed: cumbersome and slow process of withdrawing coins.

Regulatory risk: KYC procedures are being strengthened, certain assets are blacklisted, users in certain regions are blocked from using them, and there is a risk of being called off or having assets confiscated.

Risk of theft: often a key target for hackers.

Transaction costs: compartmentalization of users and large inequities in fee charging.

In 2016, the first decentralized exchanges began to emerge, with DEX providing a way for users to conduct transactions in a decentralized, non-custodial manner, maintaining the value that cryptocurrencies deserve. Decentralized exchanges like UniSwap, SushiSwap, and PancakeSwap, each with billions of assets for trading, prove that there is a huge demand for the DEX model.

However, they are often limited by a single blockchain; UNISwap and SushiSwap can only be traded on the ethereal chain, and PancakeSwap can only be traded on the BSC.

THORChain emerged to solve this pain point.

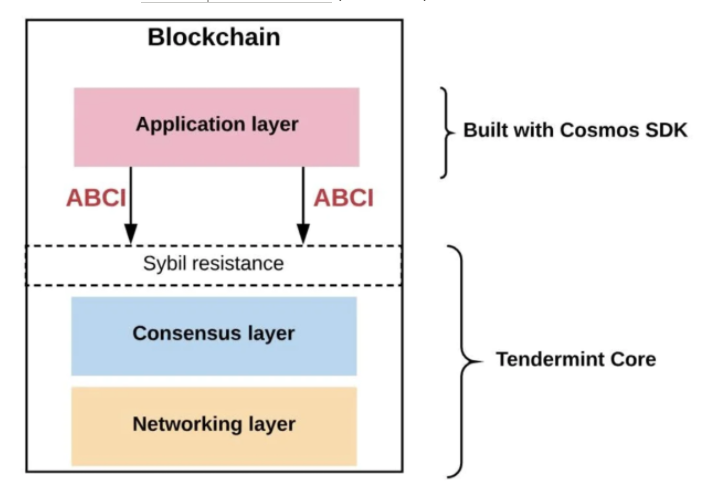

THORChain is based on the Cosmos SDK and uses the Tendermint Proof of Stake (POS) consensus mechanism, which also embeds the TSS codebase from the CoinAchain. blockchain from scratch. The principle is that Cosmos separates the application layer, consensus layer, and network layer. the core components of the SDK and Tendermint are bound by the interface ABCI, which is their translation mechanism. This means that applications can be written in any language and do not need to be conditioned to use native languages and conform to existing consensus mechanisms, as is the case with Ether, completely lowering the barrier to building specific applications.

*** Translated with www.DeepL.com/Translator (free version) ***

THORChain avoids front-end trading by general trading bots and nodes to arbitrage by changing transaction sequencing and execution protocol rules using SDK toolkits, while also reducing unearned losses to LPs. tendermint gives THORChain fork-resistant and near-instantaneous finality, reducing the potential negative impact of forks and double-splits on liquidity pools. THORChain also uses a Threshold Signature Scheme (TSS) to guarantee that nodes do not control user assets, which provides better privacy and lower transaction fees than Multisig, and is chain independent, significantly reducing the workload of supporting new chains.

THORChain's Continuity Liquidity Pool (CLP) - One of the most significant changes since Uniswap introduced AMM, where transaction fees are a function of slippage rather than a fixed percentage of fees, THORChain's CLP is designed so that arbitrageurs have to pay higher transaction fees while driving up prices, thereby increasing LP gains and reducing unearned losses. THORChain's consensus protocol prioritizes transactions with the highest fees, and arbitrageurs must weigh paying slippage fees to avoid splitting transactions into too many small orders to avoid high fees, or risk delays and failed transactions.

THORChain's native token is $RUNE. $RUNE is kept in relative balance with the other assets in the system, protecting the network security. Overall, for 1U of external assets, there are 3U of $RUNE tokens pledged, preventing nodes from operating the network dishonestly (as the penalty costs more than the value received from the liquidity pool). A node must pledge a minimum amount of $RUNE to start validating transactions on the network, and the node switches between active and standby states for a certain period of time, ensuring decentralized node operations. Since the internal operation of the network is separate from the node operator, the network can be upgraded and modified at minimal cost. At the same time, LPs must deposit $RUNE into each pool in the network and each transaction is executed through $RUNE, a process that fully mobilizes the liquidity of $RUNE.

Incentive Pendulum - When the system is out of balance, the network adjusts block rewards and network fees to incentivize node operators and LPs to return to equilibrium. When the system is stable, nodes will receive 2/3 of the system reward and LPs will receive 1/3. If the system deviates from the threshold, the protocol will transfer the reward through the corresponding algorithm.

*** Translated with www.DeepL.com/Translator (free version) ***

It is worth mentioning that the THORChain community has done an excellent job in cultivating its culture, with the core development members transferring ownership of the code base to the community and letting the community maintain it, fully embracing the spirit of decentralized networking and thus, making the community stronger and stronger. The team's style is very transparent, providing continuous development progress, vault management, and regular development pace for long-term reporting and tracking strategies.

Brief description of the disadvantages of competing products ChainFlip: support for additional blockchains is more difficult and time-consuming, and subject to a larger attack surface. PolkaSwap: cannot handle spot native ETH and BTC exchanges. REN: encapsulates tokens, not spot, with the risk of losing anchor.

Economic Model Token Model Token symbol: $RUNE

Contract address: RUNE-B1A (BNB Beacon Chain)

Token Price: $8.71

Current Market Cap: $2,881,715,034

Max Market Cap: $4,357,150,093

Total locked position: $305,102,080

24-hour trading volume: $520,429,266

Liquidity: $330,688,061.33

Total Supply: 334,937,975

Maximum Supply: 500,000,000

Token Allocation Allocation at initial release.

Circulation: 19.8%.

OP Reserve: 10.5%;

Community: 10.4%.

Team: 10.0%.

Seed investors: 5.2 percent.

Agreement reserve: 44.1%.

Token Key Roles Liquidity: asset settlement. Security: cybersecurity. Governance. Incentives.

Token Important Functions Node Binding: To stop nodes from colluding and stealing LP/Swapper funds locked in the vault, nodes need to lock in a certain percentage amount of $RUNE collateral. Liquidity Provider: $RUNE can act as the underlying pair for all external assets in the pool. In the liquidity pool, 50% of the assets are $RUNE and 50% are external assets.

Project Background

Funding Status

In 2019, $RUNE IDO was issued on the Coinchain, raising $1.5M.

In 2021, its trading protocol THORSwap closed a $375 funding round led by IDEO CoLab Ventures.

In its latest financial status, the vault has a total of $146 million for investment protocol development, liquidity, and giving back to the community in donations. The debt has now been fully repaid. The agreement has $174 million in RUNE reserves valued at $1.2 billion.

Investment Institutions

NxtBlock Capital, Coin98 Ventures, OPW Ventures, etc.

Project Team

The core team consists of 8 developers

Leena M.: Project Development Assistant at ThorChain.

Kai Ansaari: THORChain project leader.

Jazear Brooks: THORChain Blockchain Architect, Director of Engineering at Swish.

Jessica Watson Miller: organizer of Near community events.

Philip Stanislaus: former THORChain Chief Architect and Development Engineer.

Jon Carr-Harris: founder of CRED Investments.

Chaitanya Shah: Director of Engineering Development, CRED Investments.

Josip Zdilar: THORChain Community and Marketing Manager.

THORChain's investments

XDEFI Wallet, ASGARDEX, BEPSwap, THORName, THORSwap, etc.

Roadmap

THORChain's roadmap, released on March 16, will soon see the phased launch of a cross-chain aggregator, a redesigned front-end, and a unilateral pledge of vTHOR.

Highlighting the 5 phases of the aggregator.

V1: Enabling cross-chain aggregation between Ether long-tail assets and native assets on THORChain (BTC, DOGE, LUNA, UST, BNB, etc.).

V2: implementation of Terra aggregator integrated with Terra eco AMM exchanges Astroport and Terraswap.

V3: aggregation of additional EVM L1 and L2 chains (Avalanche, Fantom, Polygon, Arbitrum, etc.).

V4: aggregation of Solana long-tail assets.

V5: aggregation of IBC assets.

In addition, the THORSwap aggregator will unlock its own incentives by introducing vTHOR (unilateral pledges) that add value from transaction fees, with 75% of the protocol's revenue being distributed to vTHOR holders rather than charging any fees.

Regarding progress degree reporting, THORChain's team does a particularly fine job of scrapping plans on a weekly basis for every plan achieved, which is a powerful aspect of its community. More details can be found at: https://medium.com/thorchain

As of March 21, 2022.

Last week.

Completion of the hard fork test network and the staging network. Release of 0.81.2,0.81.3,0.81.4. This week

Completion of hard fork chaos network Next week

TERRA launch

Summary Since its establishment, THORChain has suffered many hacks, yet it has been able to grow against the trend in the bear market, and it has been proved by experiments of well-known institutions that LP is indeed more profitable than in Uniswap, and the architecture has become more and more mature and stable after numerous improvements. Likewise, as more and more chains and ecosystems join, more and more problems will be encountered. With the team and community's continuous down-to-earth efforts, coupled with the current sufficient amount of funds, it is believed that the problems will be overcome and broken through one by one. With its current strength, THORChain is not too much to be evaluated as the hidden weapon of Coinan. Perhaps, it represents the future of minimal trust cross-chain transactions.

Welcome to join #NowhereDAO, a free information and token information sharing platform discord.gg/UUU8wbHmdDa