As Terra climbed crypto market cap rankings at the start of 2022 while most of the market fell or remained flat, with LUNA being the only crypto asset in the top 20 with positive 2022 Year-to-date returns at the time of writing, much was justifiably said about its sustainability.

The two recurring concerns mainly stem from 1/ Anchor and its 20% APY rate, and more generally 2/ the UST peg and the risks of a death spiral.

While those two are increasingly related (~73% of UST’s supply is currently sitting in Anchor), here we will focus on the main point of concern which is the algorithmic mechanism that surrounds the peg of Terra stablecoins. Finally, we will shortly explore how Terra’s new direction towards partial-collateralization using Bitcoin reserves could impact this mechanism.

Algostable Design 101

Most algorithmic stablecoins until now have adopted a ‘coupon coin’ model where they issue new stablecoins when their price rises above the peg and sell bonds/coupons when their price falls below the peg. In its most basic form, the logic behind this mechanism is that in periods of contractions investors will exchange their stablecoins in favor of those ‘interest-bearing coupons,’ thereby reducing supply and restoring the stablecoin’s peg. The incentive for investors to participate in such schemes is the guarantee that in an upcoming period of expansion, they will be rewarded with a lion’s share of the new stablecoins minted to increase the supply.

Stablecoin projects that adopted such a model like Empty Set Dollar and Basis Cash failed to maintain their peg and entered the much dreaded ‘death spiral’. More recently, the Iron/Titan project even made headlines in the more traditional finance world after a bank run on its stablecoin. Yet, some new projects (such as Beanstalk) are still adopting similar designs and mechanisms to attempt the feat of achieving what they call a “Decentralized Stablecoin with an Algorithmic Central Bank.”

Since the emergence of algorithmic stablecoins in 2020, Manny Rincon-Cruz who coined the term ‘coupon coin’ has written about The Insurmountable Flaws of so-called Algorithmic Stablecoins. He argues that stablecoin protocols adopting a coupon model cannot succeed as they attempt to replicate central banks’ open market operations (OMO) but do not possess the ability to intervene in markets to nearly the same extent as central banks (since governments have the authority to regulate away assets’ risk and to enact capital controls to stabilize the peg of their fiat currencies).

His arguments show that ultimately algorithmic stablecoin protocols can only thrive and retain their peg if the demand for their stablecoin is monotonically increasing. During periods of contractions (which until now have been inherent to crypto markets), a sustained reduction in demand for the stablecoins will fragilize the stability of the peg and create a feedback loop where the confidence in future demand will plummet. Indeed, the incentives required for stabilization in such conditions will grow to a point where the interest to be paid to coupon buyers down the line would only further the instability.

The UST ‹› Luna Mechanism

Terra’s design for its multitude algorithmic stablecoins such as UST or KRT differs slightly from the coupon coin model. It introduces a token called LUNA, with the equivalent function to the coupons or bonds seen in other designs, to absorb the price volatility of its stablecoins.

A major difference from many algostable experiments that emerged on Ethereum is that Terra is its own proof-of-stake blockchain, built on the Cosmos SDK. Using the Tendermint consensus engine, the LUNA token is the protocol’s native staking asset that secures the blockchain and enables participation in its governance.

LUNA serves as the backbone of Terra stablecoins’ price stabilization mechanism, in which the protocol’s algorithmic market module incentivizes the minting or burning of stablecoins through arbitrage opportunities.

Using this market module, anyone can always swap 1 USD worth of LUNA for 1 UST, and vice versa. Therefore, the Terra protocol incentivizes investors to mint new UST by burning LUNA when it trades above peg and to sell their UST in exchange for newly minted LUNA when it trades below peg.

(note: This is obviously a simplification of the mechanism, for more details check Terra’s official documentation and Jump Trading’s posts regarding on-chain swaps liquidity parameters and redemption daily caps.)

The difference with the mechanism described earlier is that LUNA doesn’t act as a bond with an explicit interest rate to be redeemed later. Instead, it provides arbitrage opportunities to investors willing to swap LUNA and UST and profit from price differences between the market module and non-native markets (centralized and decentralized exchanges).

Still, a feedback loop structure similar to the one which plagues coupon coin remains for the Terra protocol.

Indeed, from an investors’ point of view, in periods of contraction the incentive to swap some UST for LUNA (a relatively volatile asset, especially during contractions) only makes sense if you can make a profit from this arbitrage. Yet, an investor potentially has multiple options in such case:

-

Immediately sell LUNA on the market and book profits from the arbitrage on the spot.

-

Hold the LUNA to sell it later on the market in the hopes of further increasing profits (→ assuming that LUNA’s price increases due to speculation or other exogenous factors down the line).

-

Hold the LUNA and wait until a reverse arbitrage opportunity emerges and swap back the LUNA into UST (→ assuming that LUNA’s price remains at least constant and that future demand for UST will create the need to increase supply).

-

Hold the LUNA and delegate it to a blockchain validator to receive staking rewards (→ assuming that LUNA’s price remains at least constant and that staking rewards remain high enough to outweigh the opportunity cost of other options).

Under such assumptions, a risk-averse arbitrageur will choose Option 1 and sell LUNA.

While at first glance his action will help maintain the peg by reducing the UST supply, in an environment where all arbitrageurs choose for Option 1, a continued decrease in UST demand will lead to a reflexive spiral at the protocol level:

UST redemptions in favor of LUNA that is being sold on the market by arbitrageurs sparks a significant decrease in LUNA’s price. This price decline leads to more LUNA being minted for each UST burned (since 1 UST can always be redeemed for 1$ of LUNA), creating a hyper-inflationary loop in LUNA’s supply. This can then trigger a crisis of confidence in LUNA’s ability to retain value and further reduce demand for UST.

One end state of such a spiral would be the implosion of the mechanism as it fails to adequately reduce supply and UST’s peg inevitably breaks.

Due to those constraints, Terra’s algorithmic arbitrage is not enough to maintain its stablecoins’ peg. Indeed, the protocol also needs to incentivize its investors to hold LUNA in periods of contraction. Terra needs to find an equilibrium where a majority of LUNA holders believe that the token will maintain its value. Therefore, the protocol must incentivize arbitrageurs (or other investors who buy LUNA from them) to choose Option 3 or 4:

Option 3: In its most basic interpretation, investors will only choose Option 3 if they believe that the LUNA token will at least retain its value and that the increase in UST supply in an upcoming period of expansion will be higher than the decrease in UST supply of the current period of contraction, which will lead to a burn that reduces LUNA’s circulating supply. Since the Terra protocol has no ability to mechanically incentivize demand for UST, it needs to use exogenous incentives (which will be explored in the next section).

Option 4: To make investors choose Option 4, Terra must create a token sink where investors believe that LUNA will at least retain its value and choose to lock their tokens to receive staking rewards that outweigh the opportunity costs of other options, reducing LUNA’s circulating supply. Therefore, the protocol must maximize LUNA’s staking yield which is made of fees from swaps (such as a minimum 0.5% spread fee on market module swaps) and from gas paid for network transactions.

Ironically, by incentivizing investors to hold LUNA by offering them staking rewards, the Terra protocol adopts a similar incentive model to coupon coins but through an implicit interest rate. Yet, whereas coupon coin designs tend to have an algorithmically set interest rate depending on the degree of incentivization needed to stabilize the peg, Terra’ staking rewards are simply a product of the activity on the underlying blockchain.

Terra’s governance module can tweak some parameters to modify swap fees and the blockchain’s validators set their own gas price, meaning that although the Terra protocol can marginally maximize staking rewards from existing activity, it has no direct control on the amount of activity on its chain. It therefore needs to use exogenous incentives to increase user activity.

Exogenous Incentives: Building the UST Ecosystem

As described above, the Terra protocol appears to be in a similar predicament to coupon coins since its mechanism lacks the ability to force supply reduction when its stablecoins fall below their peg. Therefore, Terra must incentivize investors to protect UST’s peg by holding LUNA with exogenous incentives—meaning incentives that are external to the algorithmic mechanism which is supposed to stabilize the peg.

The two exogenous incentives mentioned in the last sections are demand for UST and blockchain activity, which as we will see are very related. Until now, Terraform Labs (aka TFL, Terra’s parent company) has taken charge of bootstrapping those incentives through various initiatives:

UST Demand

First, on a side note, of course it might seem self-defeating to claim that Terra needs to incentivize UST demand in periods where the demand for the stablecoin is decreasing. Instead, the creators of Terra’s idea is rather that the protocol needs to incentivize diverse sources of UST demand so that periods of contraction are short-lived.

If those incentives are strong enough, investors will hold LUNA as they believe that a future UST’s supply increase will give them the opportunity to profit once the period of contraction come to a halt (cf. Option 3).

In that regard, TFL has made it their mission to maximize UST’s utility as a stablecoin. They attempt to make it what they call a “superior form of money” in terms of spending, investing and saving:

1/ Spending: Terra first emerged as a blockchain protocol that served as infrastructure for CHAI, a Korean neo-bank, through its TerraKRW stablecoin. Today, multiple projects are attempting to further this vision by integrating UST or other Terra stables into neo-banks and fintech apps with varying degrees of non-crypto-friendly consumer interfaces.

2/ Investing: The first application that TFL launched on the Terra blockchain is Mirror, a protocol which enables the creation of synthetic assets that “give traders price exposure to real-world assets while enabling fractional ownership, open access and censorship resistance as any other cryptocurrency.” More importantly, TFL is actively working towards making UST the stablecoin of choice across the multi-chain ecosystem with many integrations into DeFi protocols on Ethereum, Cosmos, Avalanche, Solana, Near, etc.

3/ Saving: The second application that TFL launched on the Terra blockchain is Anchor, a protocol which offers users a stable yield on their UST. Once underestimated by many DeFi natives when 3-digits yields were commonly found, its ~20% APY has made it become Terra’s flagship project with more than 11b UST deposited at the time of writing, propelling the blockchain to #2 after Ethereum in terms of TVL. Furthermore, it is reported that institutional buyers and consumer applications have expressed interest in depositing funds into Anchor (but are waiting for “protection against smart-contract risk”). (note: For more details regarding the vision for Anchor and its economic model, we suggest Ninor & Ninos Mansor’s Anchor investment memo.)

Blockchain activity

To incentivize on-chain activity, TFL has built Terra as its own full-fledge smart-contract blockchain (integrating CosmWasm) and has encouraged the development of an ecosystem of projects, through various grants and a $150m Terra Ecosystem Fund as well as hackathons that saw some of the first community-built dapps on Terra.

Today, the Terra ecosystem is seemingly made up of hundreds of projects integrating UST in some manner (cf. ecosystem map above). This surge in projects has made Terra part of the ‘Layer 1’ conversation and it is now considered in the same breath as other smart-contract blockchains like Solana or Avalanche. They have all seen a large spike in activity in H2 2021 and are attracting a new set of developers wanting to build in DeFi.

By creating a standalone L1 ecosystem, Terraform Labs hopes to bring in new users interested in its DeFi applications who will transact and pay the fees that constitute the yield that LUNA validators and delegated users earn. Since the Columbus-5 update, the staking rewards have increased to between 5-10% APR (with avg. 35% of supply staked). This APR is being boosted by swap fees which were previously burned, meaning that it benefits from arbitrages caused by UST supply’s fluctuations. Still, Terra’s staking reward are significantly high considering it is one of the few Proof-of-Stake blockchains that doesn’t use inflation (aka token holder dilution) to incentivize security.

Wait, its all network effect?

Looking at Terra’s rapid growth in 2021, it seems like the TFL team was very successful in propping up UST demand and building an ecosystem that drives on-chain activity. Yet, it’s hard to measure the sustainability of their efforts and the incentives they created in making LUNA a valuable asset to hold when factoring in the general speculative frenzy of last year’s crypto bull market.

On the activity front, Terra is still a very nascent ecosystem in which Anchor represent ~80% of the TVL (not taking into account Lido which is currently mainly used to create bLuna collateral). Unfortunately, the Mirror protocol has seen a large fall in active users during the last few months and the V2 that released in July failed to reignite its growth (note: Mirror protocol is the focus of an ongoing SEC subpoena targeting TFL and its founder Do Kwon).

Other protocols like Astroport, Levana, Nebula or Mars will attempt to lay roots for a DeFi ecosystem on Terra but only time will tell if they are successful.

In the realm of payments, the CHAI app which represented most of Terra’s on-chain activity in 2020 has reduced its reliance on blockchain technology after hitting regulatory crossroads in its SE Asian regional expansion initiatives due to compliance issues and delays in obtaining banking licenses. The memePay payments app targeting the Mongolian market –using TerraMNT– seems to have also been put to a halt. The CHAI company has now branched off from TFL and refocused on the Korean market, offering B2B payment infrastructure through its CHAI Port solution.

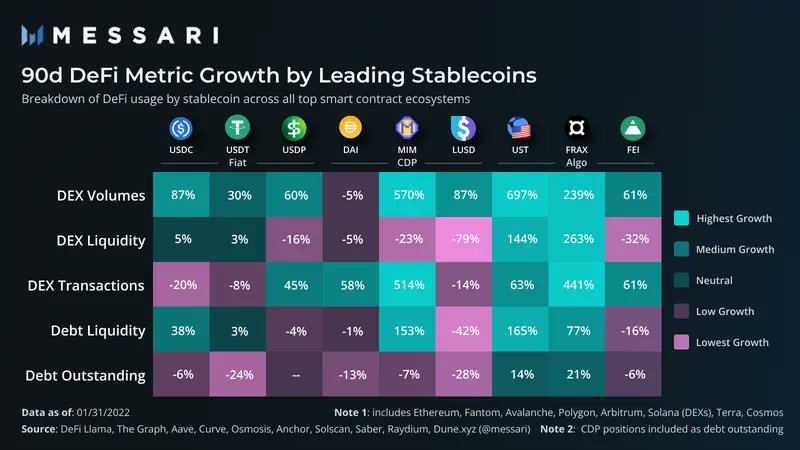

Regardless of those challenges, TFL has been very successful on the UST demand front. Their dollar denominated stablecoin now ranks 3rd after Tether’s USDT and Circle’s USDC, reaching more than 15b of supply in March 2022. Its growth metrics have been impressive, gaining an upper hand relative to other DeFi stables such as DAI, FRAX and MIM since late 2021.

The main issue regarding UST demand growth is the obvious elephant in the room, Anchor, which has attracted an immense quantity of capital looking for yield after the November 2021 crash and the slowdown of leverage-boosted yields in crypto markets.

Although with the increasing dominance of Anchor as the source for UST demand, Terra is growing at unprecedented rates, one might argue that it is currently going in the wrong direction regarding its vision of making UST a sustainable stablecoin. Indeed, as recognized by Do Kwon, stablecoin ecosystems need velocity and various use-cases to be successful:

While TFL and other ecosystem stakeholders are aware of this dangerous reliance on Anchor, they have chosen to embrace it with the goal of creating a network effect that will help Terra reach sustainability in the long run.

Their bet is that by the time that Anchor’s rate is either too expensive to sustain or otherwise potentially not competitive enough to attract its current capital, Terra will have developed a blockchain ecosystem and strong cross-chain ties that create token sinks and make Anchor only one of the many sources of demand for UST.

Meanwhile, as they attempt to reach this ambitious network effect, they have accepted to fund Anchor’s yield reserve, spending millions of dollars to retain capital and UST demand. The ultimate question is whether this can be enough to last until a network effect that creates healthy demand for both UST and LUNA is achieved, along with the strong possibility that even that might not be enough.

Coming back to the reasons why people may choose to hold LUNA, investors should not forget about Option 2 which was outlined above: How many people are holding LUNA to ride its wave and how high can the speculation premium go?

The problem with issuing a token that absorbs the price volatility of your stablecoins is that during bull markets leverage builds up in the system and the speculators you attract might not understand the mechanics underlying the increase in value of their investment. Lik John McAffee’s 2017 BTC tweet, below is a great reminder that speculation and euphoria might currently be reaching a ceiling and that believers in a new paradigm are behaving dangerously.

In May 2021, the crypto market crash saw LUNA’s price fall by more than 70%. This drawdown that threatened the peg was accentuated by liquidation cascades on Anchor and oracle transaction failures caused by network congestion. With the support of buyers of last resort like Jump Trading, Terra was able to survive and UST’s peg was restored.

While changes were subsequently made to avoid future market stress conditions from affecting the protocol this way going forward, one might wonder if a market drawdown of similar magnitude would still be able to be contained now that UST’s capitalization is 10x what it was in May.

TFL’s partnership with Jump Trading, a leading trading and market making firm, has proved to be very helpful in times of stress. They have reportedly been providing services for large scale UST arbitrage and have significant vested interest in Terra. While they would most likely attempt to create a bottom for LUNA in a situation where the peg is threatened, it is hard to calculate the extent of leverage that LUNA has accumulated and how the protocol would fare under extreme stress and volatility today.

A market crash that leads to a correlation 1 moment in crypto assets would once again be reflected even more harshly on Terra due to its excessive reflexivity. A sharp decline in LUNA’s price that wipes out the speculation premium accumulated during the bull market would threaten to topple the entire system.

When investors in LUNA see their paper net worth diminish in real time, how confident can they be that others will keep holding as well? And how confident can users of UST be that the demand will keep increasing with no regard to market conditions?

A silver lining of Terra’s bet can be that since their emergence none of the major stablecoins have experienced a significant reduction of their supply. With that said, investors must realize that although Terra has achieved a lot since 2019, it is most likely far too early for this experiment to elude the cyclical periods of boom & bust that have defined crypto markets since their genesis a decade ago.

The New Bitcoin Standard

It would seem like although TFL is confident in their bet, they recognize that the reflexivity accumulated by their system might have become too large to be contained now that it has reached such a size. As of now, they have relied on a paradigm where UST demand must increase monotonically until Terra achieves a network effect, hopefully making LUNA a token worth holding during periods of contraction, or risk a complete implosion of the protocol.

More recently, their posture has changed and a new narrative has emerged: Welcome the “Bitcoin Reserve.”

In February, TFL announced a raise of $1b that would be used to capitalize a reserve fund for UST, initially denominated in bitcoin, held by the Luna Foundation Guard (LFG), a new non-profit organization helmed by representatives of the Terra ecosystem. While the details of the raise remain unclear, LFG plans to purchase ~$3b in BTC with funds from the February raise and some of TFL’s own LUNA holdings. As it has been communicated, this “decentralized forex reserve” will also eventually be opened to any investor wishing to mint some UST by depositing BTC.

Unsurprisingly, Terra is drawing parallels with central banks and fractional-reserve banking to describe the new mechanism. Kanav Kariya, president of Jump Crypto, said that the reserve mechanism “is similar to how many central banks hold reserves of foreign currencies to back monetary liabilities and protect against dynamic market conditions.” (source: Ryan Weeks @ The Block).

Jump Trading has released a proposal with a MVP regarding the reserve’s mechanics:

While it may be too early to comment on those mechanics as they are still being designed, it is interesting that they are considering an asymmetrical pricing function with BTC redemptions being discounted (e.g. $0.98 BTC <> $1 UST). This reflects their wish for the reserve “not to provide liquidity for the ordinary expansion and contraction of UST as the LUNA <> UST on-chain mechanism does” but rather to provide liquidity in times of market shocks.

In terms of decentralization, the choice of onboarding BTC as the main reserve asset is great from this perspective and adds to the narrative of UST as a ‘decentralized and censorship-resistant stablecoin’ versus all centralized alternatives but the current reality is still far from UST being truly decentralized. There needs to be serious improvements regarding the centralization of staking power and the validator set’s low Nakamoto coefficient, which improved since the linked data was posted but still remains shallow for a protocol of this magnitude—currently only the top 12 nodes account for over 1/3 of the total stake (the threshold to mount an attack).

Most importantly, TFL’s still holds concentrated control and influence over the protocol, which can be understandable considering Terra is still a fairly young project and TFL’s input has been vital to its growth but there are no needs for illusions of accountability and decentralization if the situation doesn’t evolve.

The introduction of this Bitcoin Reserve could propel UST further and fix its shortcomings. Yet, this important shift in narrative is also a dangerous recognition on TFL’s part that Terra’s design is flawed. Rather than correcting inherent issues to its model, some might argue that adding this reserve will not bring true resilience to Terra but simply extend its life span.

Although Terra’s stakeholder are willing to accept exogenous collateral backing for their stablecoin, they are not willing to completely abandon the original design. This intriguing marriage will present its own set of challenges:

1/ If the reserve is only there as a backstop and to build resilience for times of crisis but the protocol is only partially collateralized, a bank run situation would simply result in a race to redemptions as investors know that a portion of UST’s supply will not get access to that exit liquidity. Indeed, the reserve does not prevent a death spiral but simply intends to slow it down.

Knowing that, while Terra’s dual minting mechanism should allow it to scale UST growth faster than an over-collateralized model could, it’s possible to imagine a situation where if UST’s supply grows and gets implemented as a leading stablecoin in a cross-chain future, the market prefers to maximize stability over growth and investors confidence in UST becomes mostly derived from its BTC backing ratio.

In that scenario, Terra might be able to sometimes grow UST supply faster than its BTC backing but each period of contraction would lead to UST’s supply shrinking back to the size of its reserves. Therefore, if the BTC reserve is the source of confidence in UST, Terra loses much of its advantages as a capital efficient stablecoin issuer and could gradually switch to a model that resembles fully collateralized systems.

2/ Another concern is the risk that in the long term LUNA becomes a second grade citizen on its own chain. By introducing a Bitcoin reserve, Terra is making its investors choose between arbitraging with LUNA or BTC during periods of contractions. While this means less selling pressure on LUNA, the recovery from crises where UST supply expands again will likely also bring less benefits to LUNA holders as well.

The mechanism proposed by Jump would limit situations in which UST can be minted with BTC to the aftermath of crises where the BTC pool was depleted. As pointed out above, over time the BTC reserve should have to represent a larger ratio of UST supply as it grows for stability. This means that the protocol would eventually adapt the mechanism so that investors can mint UST through the reserve even in times of expansion.

3/ The most important issue is the risk that over time the incentives to hold LUNA are undermined by the introduction of BTC and the growth of the protocol. Terra ambitions to become the leading stablecoin in crypto, expanding to a multi-chain world where it replaces centralized alternatives. In such a case where a majority of UST’s supply sits cross-chain, the transaction fees involving the stablecoin won’t accrue to LUNA stakers. In the long term, as the stablecoin supply starts to stabilize, even swap fees from UST minting should reduce drastically. A subsequent issue is that as UST supply increases, LUNA’s staking APR should decrease. The reduction of incentives to hold LUNA risk to undermine the Terra blockchain’s security and will probably require changes to LUNA’s economic model.

On a final note, the introduction of this BTC reserve should be welcomed by investors as it represents an additional security against a death spiral situation. Still, they should remain aware that in its current format, this critical risk is not completely eliminated either. Ultimately, there is a world where Terra becomes decentralized and UST succeeds to become a large scale stablecoin by evolving its design and surmounting the flaws of the many ‘coupon coins’ that have crashed before it. Yet there is also a world where unfortunately Terra falls short of its ambitions, creating chaos across multiple chains as UST implodes.

Best of luck.

—

Paul.

*You can contact me on Twitter @pamaholdings. *

Edit March 2023: Fix broken links due to the fork of the original Terra blockchain after its collapse in May 2022.