Three months ago the long awaited Merge took place with the Paris upgrade that transitioned Ethereum’s execution layer from proof-of-work to proof-of-stake consensus.

Since then, price action and sentiment has obviously been impacted by the FTX collapse. Yet, notwithstanding what could be considered the worst week for the industry since the collapse of Mt. Gox in 2014 and one of the worst years in recent memory for markets in general, ETH the asset has found itself in an interesting spot relative to the fundamental change of flows and technical feat it underwent with the merge.

Around mid-September, we heard that a narrative void and the new macro environment was the explanation for a -30% ETHUSD drop after the merge. More simply, founding itself in a bear market with a lack of liquidity, a ‘sell the news’ event was to be expected. Especially in a crowded trade after a 125% rally from the post-3AC collapse June lows.

We argue that post-merge and with regards to recent events, Ethereum is not simply suffering from macro policy. On the contrary, it is maturing as an asset after experiencing a speculative cycle, carrying a vulnerable industry on its back. Furthermore, we do not believe that the FTX saga will destroy institutional interest in crypto for years to come. Post-merge Ethereum sets the stage for a new wave of institutional adoption and financialization of crypto assets. It also opens the door for much needed innovations that can bring organic usage and value-creation.

Veni, Vidi, didn’t Vici

During this bull market, the usual “This time it’s different!” adage was accompanied by the growing rallying cry that “Institutions are coming!” This turned out to be partly the case as the cycle saw many big players get more involved in different ways: From publicly listed companies like MicroStrategy and Tesla buying BTC bags, to HFT firms such as DRW, Jump Trading and Tower Research expanding further into crypto market-making and of course more investment funds like Bain Capital, a16z and Sequoia spinning out crypto-specific venture arms.

The 2021 bull cycle was special as it was marked by a sort of double top in April and then in November. We believe it was linked to two specific things that shaped this cycle:

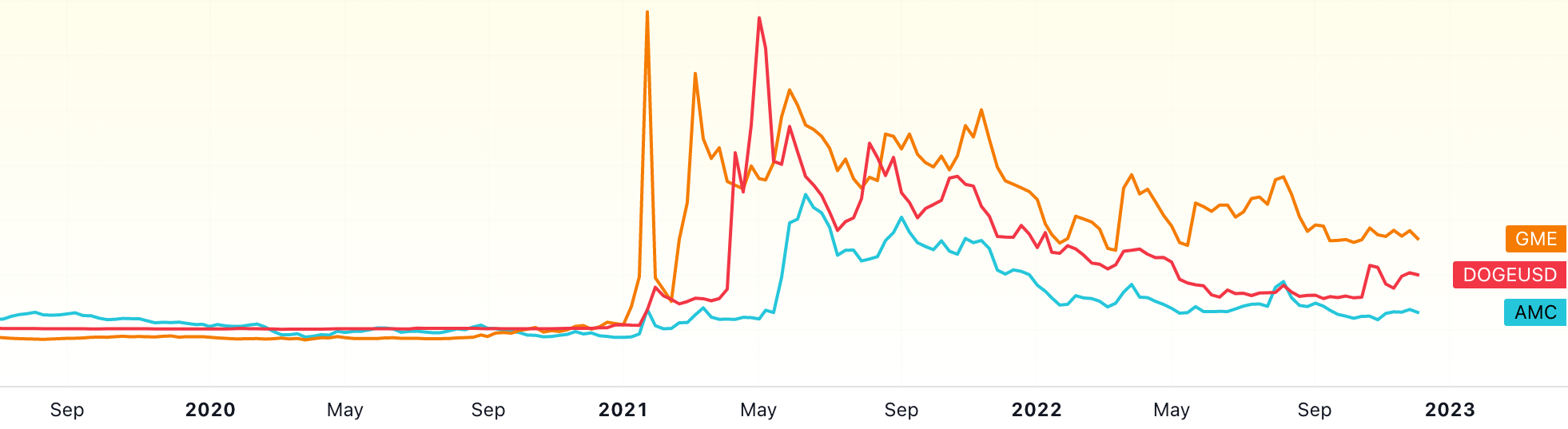

#1 In early 2021, the emergence of a new crypto product, NFTs, which took over the world, attracting hype and hate, and the rise of “dog coins” which blended very well with the retail meme-stock mania that started during the COVID lockdown with GME and AMC.

This first wave crashed in April-May after Elon Musk’s SNL appearance and the Chinese crackdown on crypto mining but was unexpectedly just the start of an even crazier cycle of new ‘Layer 1’ and NFT hyper speculation.

#2 The increased financialization of crypto allowed participants to use considerable leverage and fuel a second wave by funding new crypto projects without limits. The second half of 2021 introduced a dozen of at least mid-9-figures ‘Ecosystem Funds’ that tried to reproduce what had happened on Ethereum a few months before onto Solana, Avalanche, Terra, Near and many more L1s that are better left unmentioned. Retail and prop shops all partook in subsidized DeFi perpetual-motion-machines and niche copycat NFT ‘10K pfp collections’ valued at levels that would make tulip bulb sellers jealous.

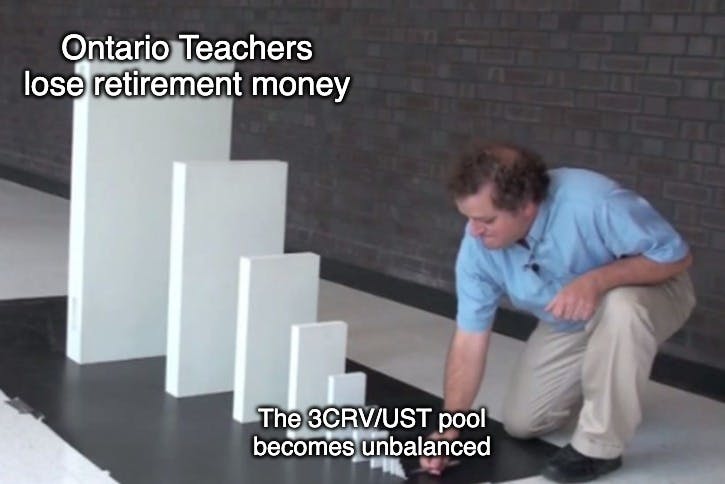

As we witnessed over the entirety of 2022, most of the big players that had carried the 2021 bull market were not smarter participants than the ‘degens & apes’ class of 2021, they just had easier access to capital. The concept of risk management had also become foreign to most of them: To simplify the 2022 domino effect, the collapse of just ONE ultra-reflexive project (Terra) led to the collapse of just ONE leveraged trading firm (3AC) which led to the insolvency of literally ALL major crypto lenders (Genesis, Celsius, BlockFi, Voyager, Hodlnaut, etc.). To top it off, FTX, the industry’s fastest growing centralized exchange, tried to make a show of force and hide its losses only to collapse in a few hours after having fraudulently commingled billions of client deposits with its prop shop Alameda Research.

In the end, many of the more risk tolerant institutions that tried to seize investment opportunities in crypto markets were the ones that were hurt the most. MicroStrategy is sitting on around $1.8B in unrealized losses from its ‘inflation hedge’ bet on BTC. The usual suspects like Tiger Global, SoftBank and a16z lost hundreds of millions throughout 2022 after overvalued illiquid venture deals but even more risk-averse entities had their crypto stakes wiped out: The Canadian CDPQ pension fund lost $150M through Celsius and the Ontario Teachers’ Pension Plan lost up to $95M in FTX.

Ultimately, yes, the macro environment and the US monetary policy had a huge influence and crypto majors found themselves ultra-correlated to QQQ. Still, while the broader macro shifts helped pierce the crypto bubble, the industry now finds itself in its own bear market and thinking that liquidity and interest is dependent on a ‘fed pivot’ is misguided.

With many crypto-native and traditional firms washed out, the industry is in a standstill regarding new institutional inflows in the short term. Like in private equity, a lot of crypto investments have not yet been marked down and venture investors are now holding equity from seed deals that will probably never reach the secondary market.In 2023, projects will struggle to raise new rounds at valuations even many orders of magnitude lower than what they did in 2021. Some of the crypto venture funds that were announced in late 2021 and early 2022 will never fully deploy as the market is already overcrowded. Furthermore, many LPs should be taking advantage of a possible fund redemption opportunity at the end of the year.

Crypto received enormous attention since 2021 because of the high number of people who bought some cryptocurrency compared to other assets. With all that said, it should be noted that for now the capital environment around crypto remains relatively small and the industry has had only few inflows from entities of ‘institutional’ scale.

As they became more familiar with the asset class and warmed up to its potentials and risks from afar over this cycle, we are now seeing a wave of interest from more traditional firms:

-

Financial industry leaders Charles Schwab, Citadel Securities, Fidelity and Virtue announced they backed a new centralized crypto exchange.

-

Credit-focused asset manager GoldenTree recently launched a crypto arm.

-

Blackrock has partnered with Circle for USDC reserves.

-

Onyx, JPMorgan’s blockchain unit, is experimenting with tokenized securities on Polygon.

-

Although already present in liquid crypto markets, Jump Trading has been building a Solana client and more infrastructure projects like Pyth and Wormhole.

Yield, Yield, Yield!

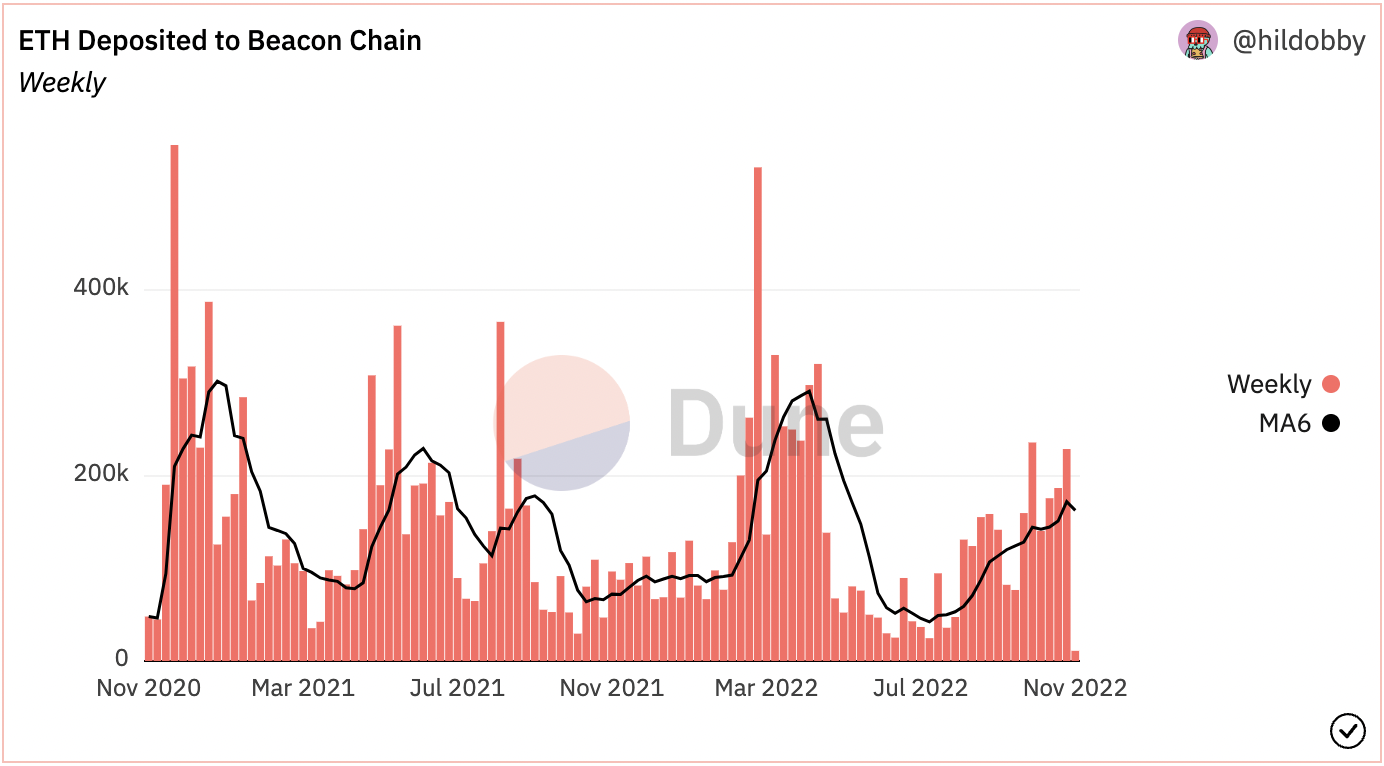

With the merge, Ethereum has become crypto’s most stable source of native yield. Validator nodes currently provide between 5 and 10% APR, depending on average transaction tips and MEV. For additional technical and exchange rate risks, this position can be made liquid with staking derivatives like Lido’s stETH. Ethereum has also changed its supply dynamics with EIP1559 and the merge and has now ‘burned’ more than 2.75M ETH tokens in ~15 months.

As the market stabilizes, new developments around POS yields will bring more opportunities to validators:

-

the increased use of liquid staking derivatives in DeFi,

-

the access to benefits from cross-domain MEV,

-

what Eigenlayer calls ‘restaking’ to provide security to other protocols,

-

or the rehypothecation/bonding of your stake towards a layer-2 sequencer,

-

and more.

Of course, DeFi protocols are already starting to propose highly leveraged strategies to maximize staking yields (as seen with strategies involving stETH in Aave) which should reignite some of the demand for money markets in DeFi. There is also a high potential for a ‘ETH as passive income’ narrative to emerge as a driver for retail inflows. But it is institutional entities who potentially represent the highest driver of demand for ETH through the financialization of staking rewards. As the dominant source of cashflows in crypto, Ethereum is now an accessible asset for institutional entities wishing to create financial products they can integrate with their current offerings.

We expect that there won’t be much impact in the short term. Many native crypto investment funds have an investment mandate to overperform ETH, just buying spot won’t cut it. For others, most asset managers will probably not be willing to allocate until staking withdrawals are enabled and they have had more time to understand technical risks around ETH POS.

Besides, in terms of execution, the industry still lacks a derivatives market liquid enough to handle the short leg of a ‘staking basis trade’ at an institutional scale and enough data to correctly price the many risks that arise with staking. We expect development from traditional entities like CME Group to create deeper markets as liquidity and institutional demand around staking grow. Indeed, there will be a need for more derivatives such as swaps that isolate asset price risks (ETH price) and network activity risks (fee/gas volatility) from validator holdings. In that regard, we believe interesting products to hedge risks from block production will first come from DeFi protocols such as Alkimiya.

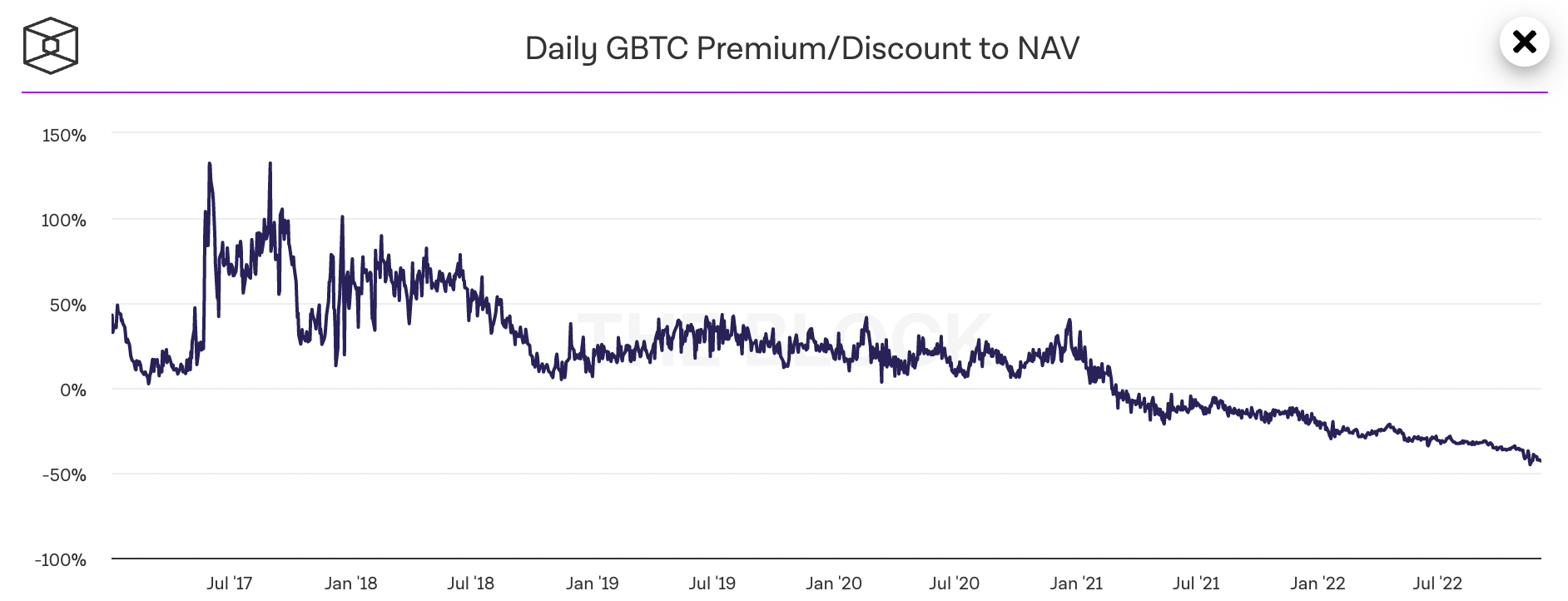

Most importantly, regulatory uncertainty is still the biggest obstacle to more institutional participation, especially for US-based entities. Regulatory barriers even risk giving rise to suboptimal tradfi offerings, similar to the GBTC Trust, that will place certain advantaged players in potentially monopolistic positions.

With the collapse of FTX, regulators will focus more thoroughly on regulating intermediaries in crypto. The two risks are that we see rushed legislation in the US that ignores discussions with the industry and that there is continued dissension between the Congress, SEC, CFTC and Treasury Dept. Each have been voicing sometimes contradicting opinions on what would be the appropriate way to approach crypto legislation and standards. Nonetheless, we hope the US will eventually settle on clearer jurisdiction and guidelines around crypto assets and custody. Regulatory clarity will be net positive for crypto and will reduce aversion from institutions like Fidelity, Blackrock, and more hoping to create crypto services or securities as well as improve confidence in the current crypto custodians such as BitGo or Anchorage.

Overall, we believe that if future regulation in the US and the EU remains constructive, arguments that recent events set back crypto by multiple years are not necessarily true. In the coming years, regulation could force traditional finance companies to build their own infrastructure and partner in trustless ways with decentralized incumbents instead of the market having to rely on the many offshore entities that dominate crypto today. This could likely involve an unbundling of the current activities centralized exchanges offer (brokerage, clearing, lending, custody, etc).It will also probably mean that sub-ecosystems within crypto emerge with partitions between ‘~regulated offchain’ for institutions and exchanges versus ‘~unregulated onchain’ for other users. The ease of movement between the two will determine how much institutions –and by extension their customers– can benefit from crypto markets in those countries.

Moving Forward

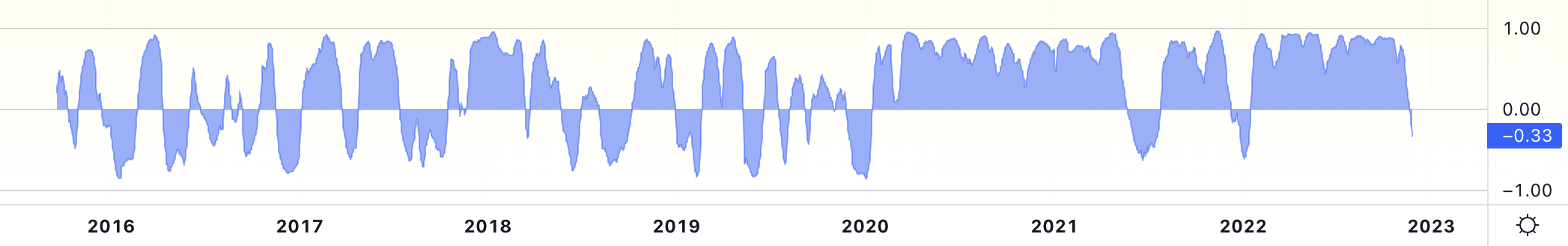

During this cycle, ETH and the crypto market in general traded just like US equities and its trend was mainly a function of overall liquidity in the markets. To become an interesting asset to institutional investors, ETH must become less ultra-correlated to the S&P500 like it has been for the past 3 years.

While changes in the Federal Funds Rate target will likely keep having an impact on crypto as they have done throughout 2022, the correlation with equities will hopefully decrease in 2023. Indeed, markets will still be focused on the evolution of US Inflation, the war in Ukraine, Europe’s energy crisis and China’s lockdown policy. Meanwhile, crypto has been in its own bear market for a year already and now must prove it has more to offer than being a digital casino.

If Ethereum wants to demonstrate its promise of a decentralized and credibly neutral layer for digital money and computation, it must become home to some organic activity and innovative applications that are truly useful to people at scale.

As a blockchain, Ethereum maintains most of the ‘mindshare’ of people pushing crypto and DeFi protocols forward. While cryptocurrencies emerged with bitcoin in 2009 and MakerDAO is now about 5 years old, ‘decentralized finance’ only became something that truly attracted attention in 2020. Since then, it has suffered from many exploits and hacks that have exposed flawed code and mechanism design. This will slow down new entrants from interacting with DeFi but in the long term this type of scrutiny will be necessary to create ultra-resistant systems. Confidence in systems that remain open-sourced and offer the largest public bug-bounties can eventually make smart contracts more attractive than centralized and closed-sourced alternatives.

DeFi has now built core primitives and will keep evolving as it attempts to bring organic users. It already allows users to participate in lending markets, derivatives trading, and more with self-custody and composability. Interesting avenues could be protocols that allow new ways to access credit: for individuals, for financial entities or for businesses.

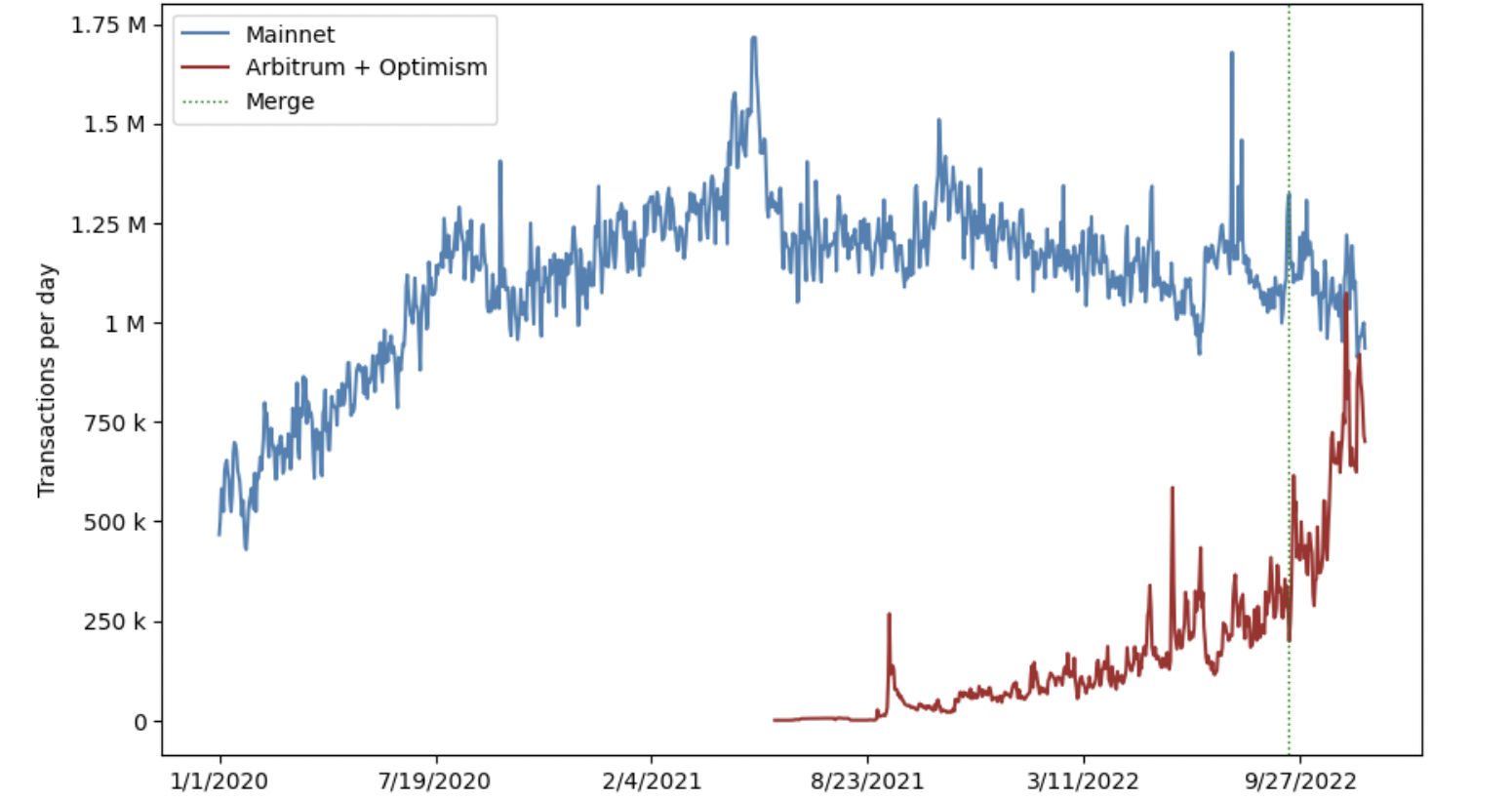

Now that the merge has happened, Ethereum can focus on improving its scalability. Core developers are working on solutions that will lower fees and move the blockchain closer to its vision of a rollup-centric base layer. The different layer-2 solutions are making progress: optimistic rollups are attracting more and more activity and ‘zkEVM’ projects are still under heavy development but show lots of promise.

There are still lots of unexplored ideas for new products in crypto. Layer-2s should allow for more complicated and transaction-heavy applications. NFTs became mainstream as a new product from crypto in 2021 and will keep pushing forward the concept of digital ownership. An interesting question will be how some of the new infrastructure built during this cycle can be the breeding ground for new types of public goods and businesses to emerge from. For example, the idea of the ‘social graph’ as a new form of decentralized social network is catching some steam with projects like Farcaster and Lens.

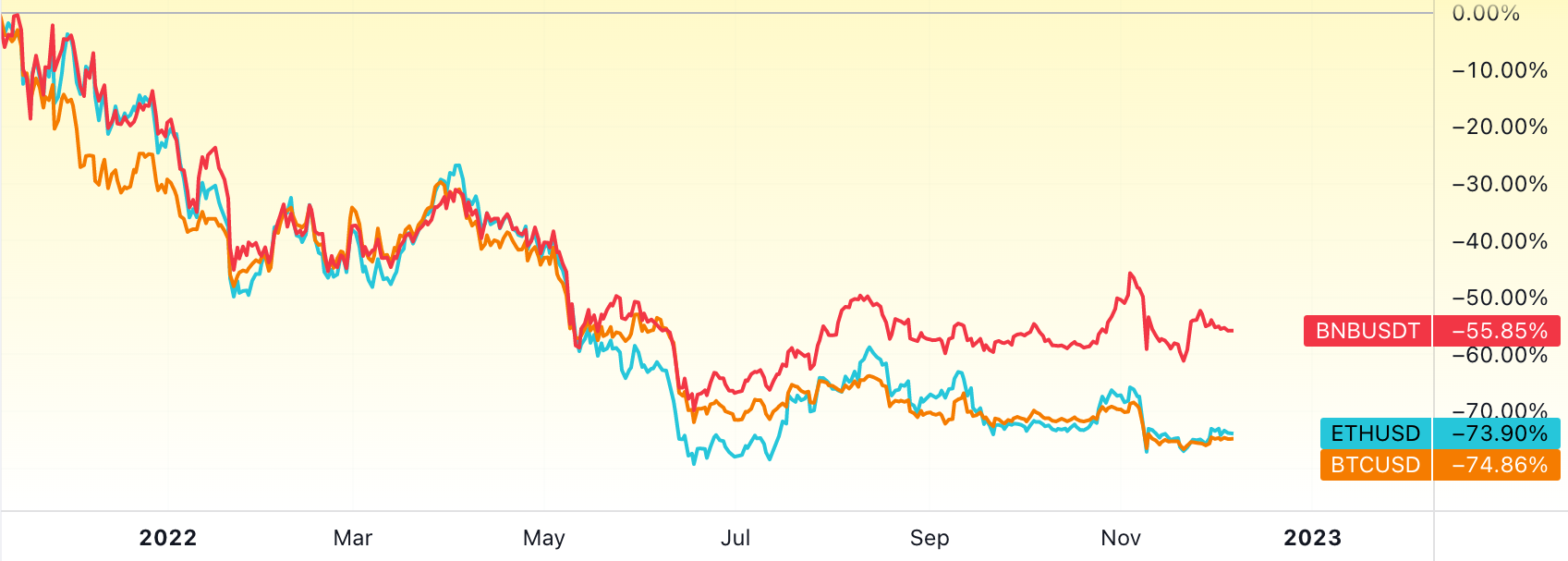

As an investment in crypto, Ethereum now finds itself in between two extremes:

#1 Bitcoin: the first and most decentralized asset that still represents more than a third of crypto’s total marketcap but has been an underperformer this bear market for the first time. BTC has also been relatively weak against ETH in 2022 and we believe that key ETHBTC levels will keep getting tested over the medium term. BTC’s high beta and its correlation with SPX have shattered the ‘inflation hedge’ narrative that carried it in 2020. And the energy-consumption/ESG related criticisms around bitcoin mining have only grown bigger in the mainstream. 2023 could be a difficult year for bitcoin as it will have to absorb selling pressure from unprofitable miners shutting down their operations and hacked coins from Mt Gox becoming liquid.

#2 BNB: the most centralized blockchain out of the major layer-1s that has been one of this bear market’s best performers. More than ETH/BTC, the BNB/ETH pair should be interesting to watch in the coming months. As the exchange ‘utility token’, BNB has benefitted from the huge dominance of Binance in terms of volume and revenue. As a layer 1, the Binance Chain was many entrants’ first introduction to crypto and on-chain trading in 2021. Using the EVM, it reproduced the defi liquidity mining initiatives that had emerged on Ethereum and quickly became the favored spot for retail ‘pump & dumps’ (PancakeSwap now hosts twice as many tokens as Uniswap…). 2023 will be a determining year for the coin as it will have to prove its on-chain ecosystem can withstand a large decrease in activity.

To conclude, we believe that flows will favor ETH over most other large cap digital assets in the medium to long term. Just as the emergence of DeFi and NFTs on Ethereum fueled the rise of crypto in 2020 and 2021, it will most likely be a new innovation that starts the next crypto cycle. The question will be whether the related activity it brings will happen on Ethereum and its rollups or some other ecosystem. Nevertheless, in the meantime Ethereum will keep offering some attractive staking yield and now that the merge is complete with Paris, the next stop is Shanghai!

—

Paul.

You can contact me on Twitter @pamaholdings.