Let’s keep the Layer 2 conversation rollin’ 😏 with Arbitrum. Built by Offchain Labs, Arbitrum believes they are the ideal scaling solution for any Ethereum contract. Instead of using ZK-Rollups, Arbitrum uses Optimistic Rollups technology. Arbitrum One mainnet first opened beta to developers on May 28, 2021. After it fair launched to the general public on August 31, the team announced they were happy to provide gas relief to the Ethereum network. Founders Steven Goldfeder, Harry Kalodner, and Ed Felten confirmed full decentralization was the ultimate plan for Arbitrum One and launched under the moniker ‘beta’ to ensure accountability on that transitional goal. This honest decision did not phase investors. Aside from the $120M Arbitrum raised through its Series B prior to launch, they were able to hit $50M TVL in 3 days post-launch. Moreover, they secured Reddit as a partner due to their strong long-term commitment to the decentralization ethos. 🚀

First, let’s review a story Arbitrum’s founding team shared in a Blockcrunch podcast. Before rollups became the popular Layer 2 solution, Ethereum scaling had Side Chains, State Channels, and Plasma as the development topics of conversation (find definitions here). Everyone was talking about State Channels and Plasma. When Arbitrum was raising seed round financing in 2018, investors were asking if their scaling solution was a State Channel or Plasma. At the time, Plasma had the ambitious goal to make transaction fees cheaper than rollups because not only was the execution being scaled but the data was taken off-chain. However, rollups were a simpler model and put the data on-chain. While Plasma did have successful implementations, rollups won the smart contract composability race. That is the key to rollups’ current success in DeFi. 🔑

What is Arbitrum?

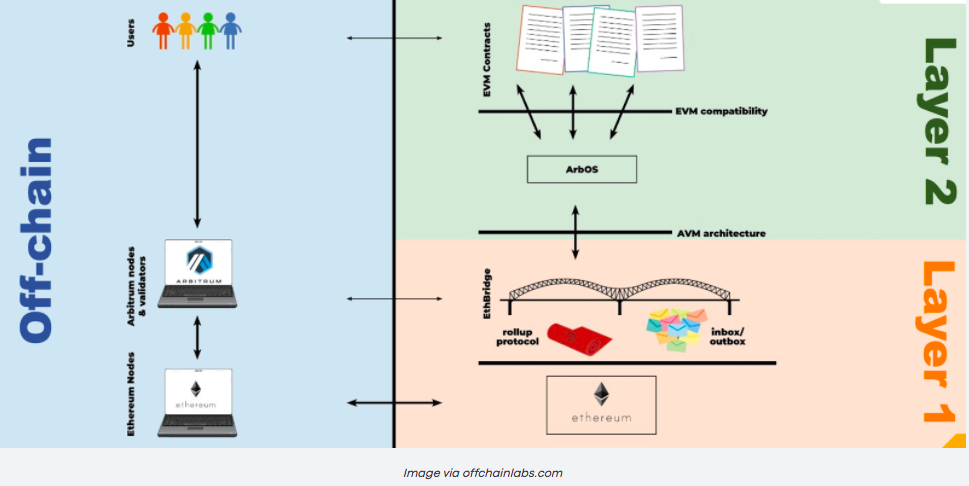

Arbitrum is a Layer 2 solution built to improve the capabilities of Ethereum smart contracts by boosting their speed, scalability, and privacy. The goal is for developers to run unmodified EVM smart contracts while improving the Ethereum user experience via more efficient smart contracts with lower execution costs. In Arbitrum’s opinion, this is where the Optimistic Rollups come into play. According to Medium, the team believes that “Optimistic Rollups are the best way to meet users’ realistic needs for a secure, trustless, EVM-compatible L2. They chose Optimistic over ZK because of the inherent scalability and cost advantages of optimistic systems.” In addition, “Optimistic Rollups are the only ones that support the open deployment of general smart contracts.” Arbitrum scales Ethereum smart contracts by passing messages between smart contracts on the Ethereum main chain and those on the Arbitrum Layer 2 chain. Ultimately, Arbitrum is a smart contract chain, and it’s all about creating a composable and harmonious DeFi ecosystem. Its intended design is to provide a developer-friendly means to launch highly efficient and scalable EVM-compatible smart contracts. 🦄

What are Optimistic Rollups?

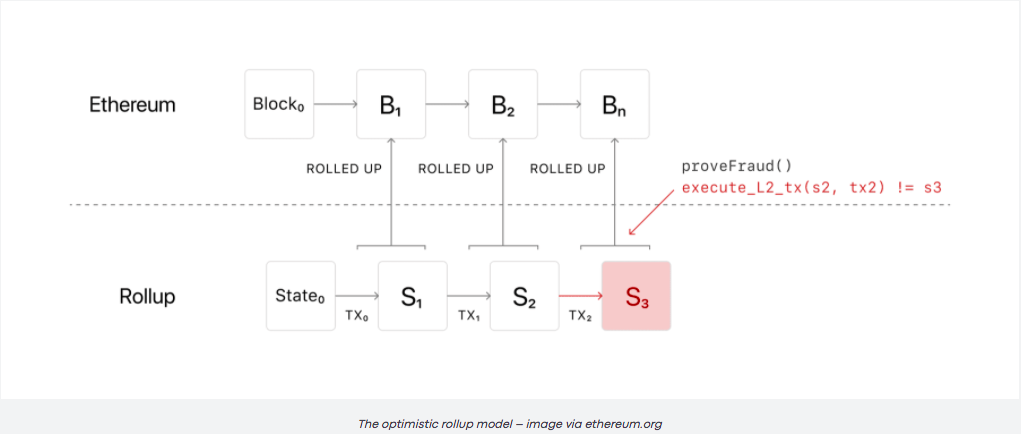

Optimistic Rollups (ORs) are one type of Layer 2 constructions that do not run on Ethereum's base layer but on top of it. This allows smart contracts to run at scale while still being secured by Ethereum. These constructions resemble Plasma but trade the almost infinite scalability of Plasma to run an EVM-compatible Virtual Machine called OVM (Optimistic Virtual Machine), which enables ORs to run anything Ethereum can.

The name Optimistic Rollups originates from how the solution works. 'Optimistic' is used because aggregators publish only the bare minimum information needed with no proofs, assuming the aggregators run without committing frauds and only provide proofs in case of fraud. 'Rollups' is used because transactions are committed to the main chain in bundles (i.e., they are rolled-up).

How does Arbitrum work?

Paraphrasing the founders’ explanation from Blockcrunch: A user posts a transaction. Then, bits of that transaction will get posted, aggregated to the Ethereum chain—meaning bits, data, and transaction instructions. In a rollup, the call data is posted on Ethereum but the results and execution or building of the state happen on Layer 2. You want Ethereum to vouch for the correctness; you want to prove to Ethereum that what happened on Layer 2 is correct. Using Optimistic Rollups, the Layer 2 validators do the execution. They say, “Hey! We executed these transactions and this is the result we got via an image/hash of the resulted state.” This is posted optimistically without proof. But someone can say they disagree, offering fraud proof. Arbitrum has an interactive process that mediates this dispute. As long as there is one honest person in the system, they can guarantee correctness. Fraud is disincentivized because bad actors lose a lot of money.

Next, let’s review the differences between Optimistic Rollups and ZK-Rollups. In a recent Medium article, the Arbitrum team explained why they feel Optimistic Rollups are the superior choice. Essentially, Optimistic Rollups have lower operational costs because executing code is cheaper than computing complex cryptographic proofs in the ZK world. Also, ZK-Rollups have higher off-chain costs. Plus, ZK-Rollups require special hardware and/or massive parallelism.

Here’s the tl;dr breakdown: 👍🏽

- Proof Type (i.e., How You Post Data)

- ZK uses validity proofs.

- OP uses fraud proofs: strong incentives to post correct claims that are valid unless challenged.

- Cost

- ZK needs to produce a complex cryptographic proof that requires hundreds or thousands of operations per instruction of the proof.

- OP requires nodes to simply execute contracts. They have low fixed costs per transaction batch and lower off-chain computation costs.

- Compatibility with EVM

- ZK often requires learning custom languages. Some projects aren’t trying to be compatible. “What doesn’t exist today is a generic compiler that allows one to go from EVM to ZK circuits in a compatible way.”

- OP is fully EVM compatible: utilizes the same RPC interface and accepts the same bytecode as Ethereum.

- Trustless Visibility and Compression (i.e., ****“Anyone can see or derive, without help from a centralized party, the contents of the chain.”)

- ZK cuts corners. Only the prover knows the chain. ZK claims better compression but at the cost of visibility.

- OP allows everyone to see the full history of the chain.

- Trustless, Timely Finality

- ZK has a tradeoff dilemma between cost-effectiveness and finality.

- OP has minimal overhead to post to the L1 chain.

- Trustless Liveness (i.e., Anyone can force the system to make progress.)

- ZK progress requires that any node can create and post one of the ZK proofs needed to progress the chain’s state. There may be hardware and software barriers to progress, creating centralization.

- OP allows any node to claim a correct execution.

- Bridging

- ZK wins by a narrow advantage, yet mitigated due to fast bridges and multi-chain usage patterns.

- OP “expects weeklong delays to transfer funds from the rollup to L1” (i.e., withdrawals).

Arbitrum feels it’s the winning Layer 2 solution with Optimistic Rollups because of costs and ease of development at the bytecode level. The team believes it supports the extreme case for developer compatibility. They feel it’s the easiest solution to build a synchronous and composable DeFi ecosystem. Looks like the developer and investor communities feel the same. 💸

Another important distinction is how Arbitrum differs from its closest Optimistic Rollup Competitor, Optimism. The main difference is between the fraud proofs; in other words, how they handle disputes. Arbitrum believes its Interactive Proving drives its winning design:

- More efficient in the pessimistic case

- Much higher per transaction gas limit

- No limit on contract size

- More implementation flexibility

Optimism’s fraud proofs are on a per transaction basis. Arbitrum uses an interactive process between the challenger and asserter, getting down to the smallest unit of dispute.

“Unlike Optimism, which executes the whole Layer 2 transaction, Arbitrum takes a multi-round approach where it executes small chunks of the L2 transaction until it finds a discrepancy. This approach has the benefit of enabling higher transaction capacity. On the downside, generating fraud proof this way typically takes a week—and can take up to two weeks in some cases—much longer than the method used by Optimism.” - LimeChain

When it comes to each’s sequencer model, Arbitrum plans to decentralize the sequencer via a Fair Ordering Protocol. This protocol distributes the sequencer with many nodes and comes to an agreement of ordering the transaction in a way a single minority of nodes wouldn’t be able to change the transaction ordering. Optimism has a different system that involves auctioning off the right to be the sequencer called MEV Auction. The Arbitrum team doesn’t like this approach because it benefits the highest bidder—the one who extracts the most MEV.

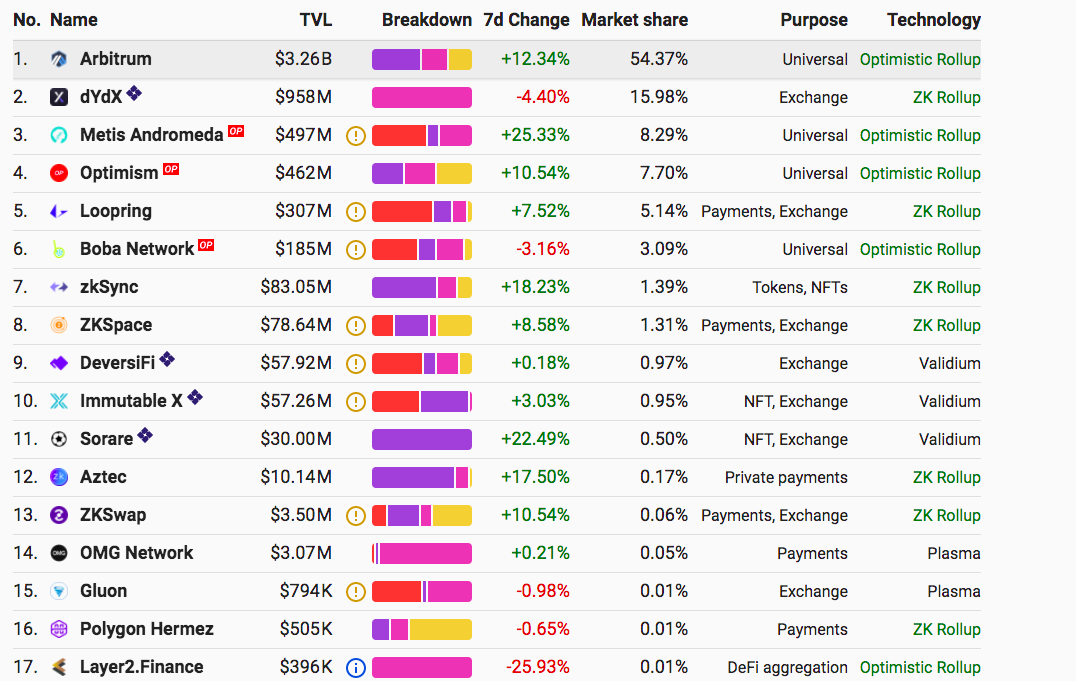

Time for the Decent grand finale take. Look at that L2beat TVL; nearly 4x TVL compared to second place dYdX is impressive. Arbitrum got off to a reputable start launching to developers back in May and then securing a couple of partnerships prior to the general mainnet launch. We feel Arbitrum’s biggest competitive advantage boils down to its EVM compatibility and ease of launching new dApps. It’s all about quick and dirty go-to-market strategies. What’s the onboarding experience? It’s a piece of 12-hour cake. While the front end and UI are different, the contract deployment and testing are a smoothie breeze on Arbitrum. I imagine this being a developer's dream. There’s also extensive developer documentation using existing ETH tooling (i.e no need for Hardhat or Truffle). Then, add the lower fees and fair launch (no token, but I expect this will come around soon). The founders feel they’ve hit a sweet spot where fee-and security-sensitive people are happy. There’s even a big update coming soon in the form of Nitro, which includes lower cost and better-optimized lossless compression for on-chain data. Arbitrum is a community project; it’s focused on decentralization and reinvesting resources. Arbitrum’s founders are humble and genuine.

Am I skeptical? What stands out to me is the 7-day lock period for fraud proof verification. This feels WAY TOO LONG. Although this is an industry trend (launching with aspects of centralization and building towards a decentralized end goal), I picked up cues from the founders that made me feel there’s centralized choice and decision-making power in certain protocol mechanisms. I feel Optimistic Rollups are winning now but sense ZK-Rollups have more long-term potential.

P.S - I appreciated the tidbits I learned regarding Layer 2s being bullish for ETH 2.0. Layer 2s and ETH 2.0 are very compatible. As we know, Vitalik feels so as well. Essentially, Layer 2s are bullish at least until ETH 2.0 Phase 2, Execution. How? Layer 2s are launching and undergoing extensive R&D now but will shine from ETH 2.0 Phase 1, Sharding. During this phase, the blockchain can’t do anything with those shards because shards only hold data. But Rollups need data to post. Therefore, sharding increases the need for rollups. Rollups be like “give me dat data, nom nom.” 😈

Sources:

https://offchainlabs.com/

https://bridge.arbitrum.io/

https://arbitrum.io/

https://docs.ethhub.io/ethereum-roadmap/layer-2-scaling/optimistic_rollups/

https://medium.com/offchainlabs/optimistic-rollups-the-present-and-future-of-ethereum-scaling-60fb9067ae87

https://medium.com/offchainlabs/optimistic-rollups-the-present-and-future-of-ethereum-scaling-60fb9067ae87

https://medium.com/offchainlabs/interactive-fraud-proofs-arbitrums-secret-sauce-debc3b019418

https://open.spotify.com/episode/1tM3woQNyhWqkjZXNaKNUL?si=baa4779e4e474ddc

https://www.trustnodes.com/2021/11/21/vitalik-buterin-praises-arbitrum

https://techcrunch.com/2021/08/31/offchain-labs-raises-120-million-to-hide-ethereums-shortcomings-with-arbitrum-scaling-product/

https://limechain.tech/blog/optimistic-rollups-vs-zk-rollups/

https://www.defipulse.com/blog/what-is-arbitrum

https://chaindebrief.com/optimistic-zero-knowledge-zk-rollups/#:\~:text=A%20ZK%20Rollup%20has%20the,and%20more%20scalable%20than%20previously

https://www.mev.wiki/solutions/faas-or-meva/optimism