Introduction

The period of 2007-2009, known as the Global Financial Crisis, caused some of the deepest recessions worldwide. The crisis was fueled by a lack of regulations within the financial industry which lead to reputable financial institutions becoming over-leveraged and eventually collapsing. The event caused global financial stress and loss of employment internationally. This period lead to an increased distrust in financial institutions and other regulated and trusted systems.

The frustration caused by the betrayal and opacity of the financial systems has prompted people to ask for more transparency and for a financial system where trust is not required. From the crisis, Bitcoin was born. Bitcoin promises full ownership of one’s assets and complete transparency in the settlement of transactions and governance of the network. Since the whitepaper was published in 2008, the term “decentralized finance (DeFi)” has been coined and expanded into much vaster definitions and networks than just Bitcoin.

This article will take a deep dive into the DeFi ecosystem built on top of the DLT (distributed ledger technology) known as Hedera Hashgraph. We will answer the following questions:

-

What is Hedera?

-

What is DeFi

-

What is Institutional Defi?

-

What Makes up DeFi on Hedera?

-

DeFi Analytics

-

Benefits of DeFi on Hedera

-

How to Get Started

-

Resources

It is important to note that DLTs and blockchains are often used interchangeably, in fact, blockchain falls into the category of DLT. They both achieve the same goal - Transaction ordering on a distributed ledger technology in a way that can be open-sourced and permissionless.

What is Hedera?

Most distributed ledgers on top of which DeFi is built are owned and governed by the people and avoid regulations in the name of self-custody and anonymity with the goal of building a financial system that is trustless and decentralized.

Although Hedera also values self-custody and anonymity, the network has taken a top-down approach to decentralization in order to transfer the power of a revolutionary and trustless financial system not only to individuals but to the broader global economy. Hedera is governed by a permissioned, decentralized LLC that operates as a DAO known as the Governing Council (GC). The GC is made up of 26 of the world’s leading enterprises including Google, IBM, DLA Piper, LG, Boeing, and many more. This approach was taken in order to optimize for transparency on an institutional level first. This means that Hedera has been careful to remain regulatory compliant and to develop a technology that is scaleable since its inception.

Hedera is a DLT that utilizes the Hashgraph consensus algorithm which enables the unique benefits of the network, notably; incredible transaction and finality speeds, energy efficiency (carbon-negative), and enterprise-grade security. Hedera is an open-sourced, decentralized public network that offers developers four services: Solidity-based smart contracts, consensus, file, and token services.

What is DeFi?

Finance on decentralized applications (DApps) on a DLT such as Hedera is considered “Decentralized Finance” because there is no third-party custodian or intermediary involved in transactions. Transactions are instead facilitated by open-source computer programs verifiable by all.

This unlocks a feature known as “self-custody” where a user has complete control over their funds. You might think that while keeping your money in banks, you retain full access to your funds but that is not the case. The perfect example is when Trudeau froze the bank accounts of thousands of Canadians who donated to the trucker’s convoy’s GoFundMe in 2021.

When keeping funds within a DeFi network, no one has the power to freeze, touch or move your funds. No one can block or approve transactions on your behalf and no one can lend out your funds while keeping a fractional reserve for safe-keeping without your consent.

The programs that enable the decentralized transactions on the ledger are known as “smart contracts” and run, on a high level, with “If, then” statements, allowing digital assets to be moved depending on the fulfillment of coded conditions. The third-party intermediary that would be a bank in traditional finance is thus replaced by code.

IE: If 100 $HBAR (the Hedera token ticker) is deposited in this smart contract, then return 4.1% of the balance as APY. After one year, that 100 $HBAR will be 104.1 $HBAR and the user can withdraw the total.

In this example, the accumulation and distribution of the APY and financial operation were concluded solely with the code making up the smart contract and without any other intermediaries, classifying this operation as a trustless “defi transaction”.

Institutional DeFi

This is a new wave of DeFi that offers centralized and permissioned finance on top of a decentralized DLT. As the values that underpin the primordial DeFi industry are found to be important in the modern-day world, financial institutions are realizing the importance of innovating their service to cater to the demand for trustlessness, transparency, and self-custody of the public.

Regulated financial products are emerging such as CBDCs, and on-chain bank remittances. Institutional DeFi is growing and is a very important subject that I may cover at a later date, but today we will focus on DeFi that is operating using peer-to-peer, or peer-to-pool instead of peer-to-institution.

What Makes up DeFi on Hedera?

Wallets

Wallets are the vehicle that will transport our funds. We cannot interact with defi protocols on the network without wallets. Wallets are to DeFi as bank accounts are to TradFi(traditional finance). This is where all your funds are stored, where you can see all your different digital assets and track your transactions. Here is a list of the dominant wallets on the Hedera network:

Hot Wallets (Online Wallets)

Cold Wallet (Offline Wallet)

Opening a wallet is the first step to interacting with DeFi on any network. Before you do so, make sure to understand the risks associated with DeFi wallets. Safety precautions are one of the most important measures you can take to protect your crypto. Please be sure to do your due diligence and understand all the risks before you decided to start interacting with cryptocurrencies. Today I will only link safety articles for your reference but I will stress the most important precaution which is NEVER TYPE OR COPY PASTE YOUR SEED PHRASE. This is the most common way that DeFi users get scammed. Please read more about it here.

Bridges

Bridges allow for the bi-directional transfer of digital assets from one network to the next. The dominant bridge for Hedera is Hashport which allows the transfer of assets between Hedera and Ethereum, Polygon, BNB chain, and Avalanche. Bridges allow for protocols to operate cross-chain and allow for users to send each other funds from across different networks.

Staking

Staking is when you provide your digital assets as a resource to secure a network or protocol. There are two types of staking to differentiate between - Network staking and DApp staking.

Network Staking

is when you stake your $HBAR (Native token of the network), to the Hedera network in order to help secure it. The hedera network is Proof-of-Stake meaning that the network is secured by the staking of economic resources (in this case $HBAR).

As a $HBAR holder who is staking, you choose which validator you trust most and stake your $HBAR to it in return for some rewards. This is called network staking because you are staking directly to the network.

As a user, you can stake your $HBAR to the network directly through your Hedera wallet and decide which node you stake to.

DApp Staking

is when you are staking your $HBARs, still as a “vote”, to protocol running on top of the Hedera network in order to earn rewards. In the same way that you cast a vote to a node in network staking, you are casting a vote to the protocol by staking to it because you trust it with your assets. In return for locking up your assets, the protocol will generate revenue either through fees or by making profits in trading your funds and redistributing some of that profit to you. At the moment, you can stake your $HBARs on Stader Labs, or on Saucer Swap.

DEXs

AKA “decentralized exchanges” enable the exchange of digital assets without a third party. They are a marketplace for digital currencies and allow users to buy and sell different assets.

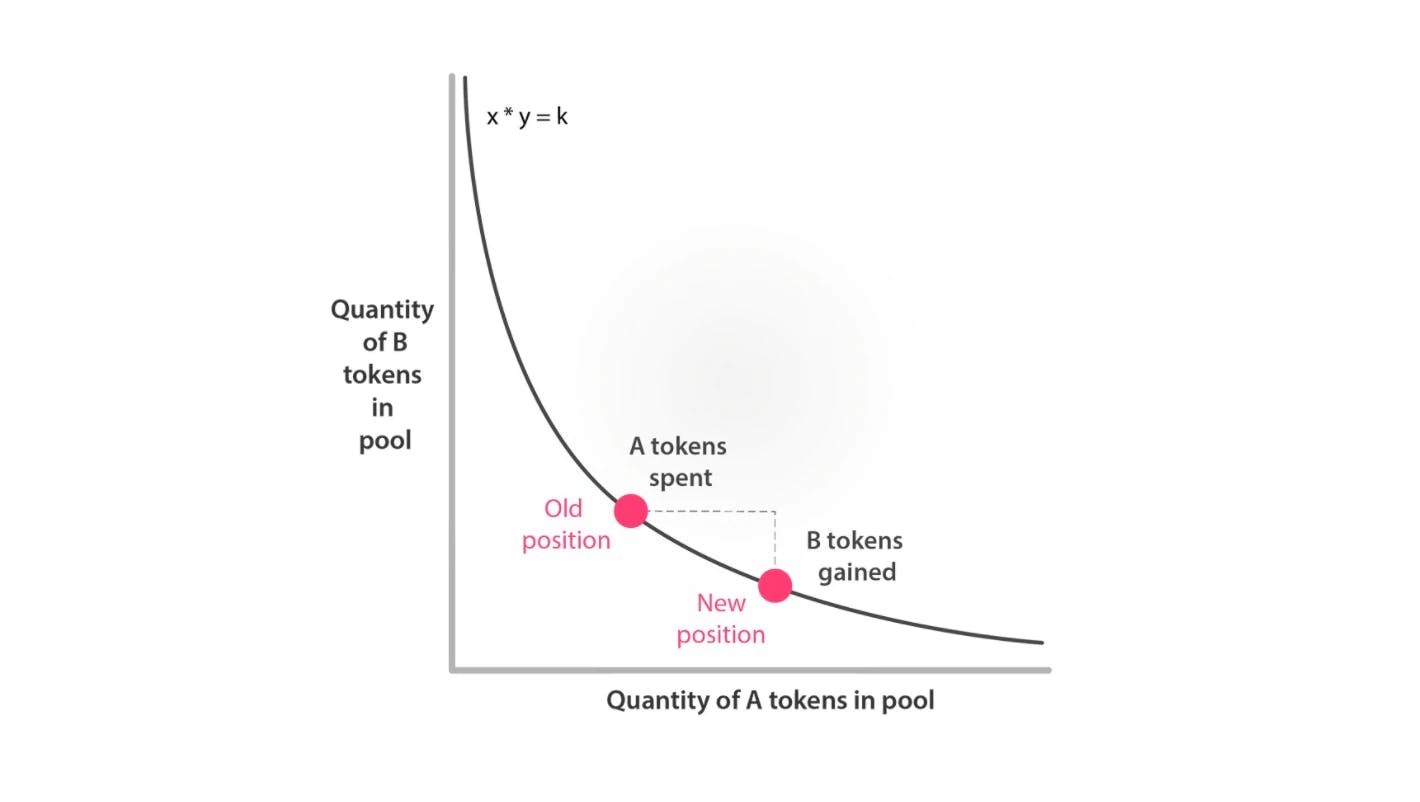

Most DEXs in defi will employ a model known as the Automatic Market Maker or “AMM” which is exactly as it sounds - it makes a market, you guessed it, automatically. The most common type of AMM is the constant-function market maker or “CFMM”. This type of market is made by the following mathematical equation:

xy=k* where x = Value of token A, y = Value of token B and k = constant

Above is a representation of how the price of two assets within a pool is adjusted after a user buys token B by selling token A to the liquidity pool.

Decentralized exchanges provide liquidity to a network by enabling liquidity pools where users can provide liquidity in return for rewards and where traders can buy and sell digital assets from those liquidity pools.

There are currently two DEXs live on Hedera:

Launchpads

A launchpad is a platform used for launching new tokens, projects, networks etc. This platform enables projects to raise capital from an existing community or while bootstrapping their own and granting their supporters access to early-stage token sales. This means that the early investors get a bargain price for the asset before it is released to the public market.

Launching a project on a launch pad provides benefits to both the investors and the projects - investors get a project that is fully vetted by the launchpad and the project gains investors and potential community through the one that already exists for the launchpad.

There are currently two launchpads on Hedera:

DeFi Opportunities on Hedera

Hedera’s DeFi ecosystem is growing and developers might be wondering what type of protocols they could add to the network that would provide value.

The opportunities for developers to bring innovation and use to DeFi on Hedera may include the following:

-

Decentralized Stablecoins. at the moment, there is only USDC as a stablecoin on Hedera. Decentralized issuers are welcome. Stablecoins are crypto assets that hold a peg to another currency, most popularly, USD.

-

Decentralized lending/borrowing. These are protocols that will allow users to lend out assets they won’t be needing in the close future. These protocols also operate on a P2P network, allowing users to directly borrow from other peers.

-

Decentralized Insurance Platforms (DIP). These can be viewed as alternatives to traditional insurance and function in the same way - The insured is charged a recurring fee in exchange for protection against certain risks ie smart contract bugs, and hacks, and could also be useful in protecting your collateral on loans, and crypto-wallets.

-

Decentralized Prediction Markets (DPM). These are platforms where users can bet on the protection outcome of future events by buying shares that align with their predictions. Bets don’t necessarily need to be placed on currencies or assets, users could bet on the predicted winner of a race, a fight, or even the weather tomorrow.

-

Asset management tools. This is a platform that helps users manage their investments and funds by providing them with proven and researched investment portfolio opportunities and management.

Development of the DeFi Accelerator by Swirlds Labs

Swirlds Labs, the company spun out of Hedera to help grow the network by designing Hedera native products is working on a suite of products for the DeFi ecosystem that include community tools and open-source enterprise components.

The lab is working on products that leverage Hedera’s unique technology in order to provide the best UX across different benefits.

What are the Benefits of DeFi on Hedera?

There are many reasons why one might one to build or use defi on Hedera, but today, we will cover the following:

-

Hedera native services and EVM compatibility

-

Fair Ordering

-

Predictable Fees

-

Great UX

-

Sustainable

Hedera Native Services and EVM Compatibility

The hashgraph technology is one that is different from mainstream blockchain tech - Hedera is faster, more scalable, more efficient, cheaper to use, and more sustainable than most other DLTs. These properties arise thanks to the underpinning Hashgraph technology.

Although the native services of the network offer many advantages, the industry has established EVM compatibility as a standard for web3 builders. Catering to market demand, Hedera is now also EVM compatible and working towards EVM equivalence.

Fair Ordering

A notable difference between Hedera and most DLTs is that the Hashgraph does not have a mempool and does not order transactions. It is in fact a “leaderless network”. This means that transactions are timestamped when they hit a node and then settled onto the ledger accordingly.

An example of applications that could be built utilizing fair ordering include:

-

A game of hot potato

-

Musical chairs

-

An auction house

These are examples of on-chain activities that can only happen in a system that implements fair ordering.

Predictable Fees

Fees on Hedera are denominated in USD and paid in Hbar. The fees are fixed and the list of fees can be found here.

This is great for builders because they can estimate the cost of launching an NFT collection or how much it will cost them to run their smart contracts over a given time period. This is also beneficial to everyday users of the network as they don’t have to worry about a fluctuation in fees that may determine whether or not a transaction is worth the fees.

Great UX

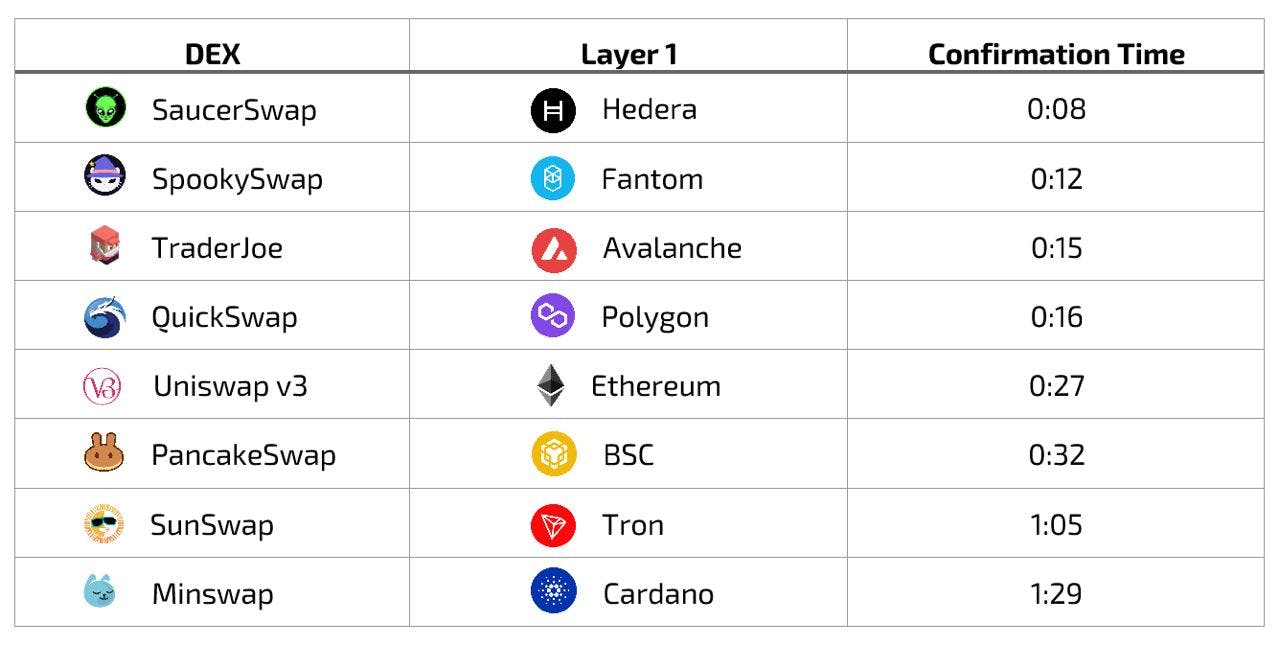

When it comes down to it, users gravitate toward the experience that caters most to them. Hedera offers one of the best user experiences because of the speed of the network. Transaction times are nearly instant, and compared to other networks, it makes a great difference.

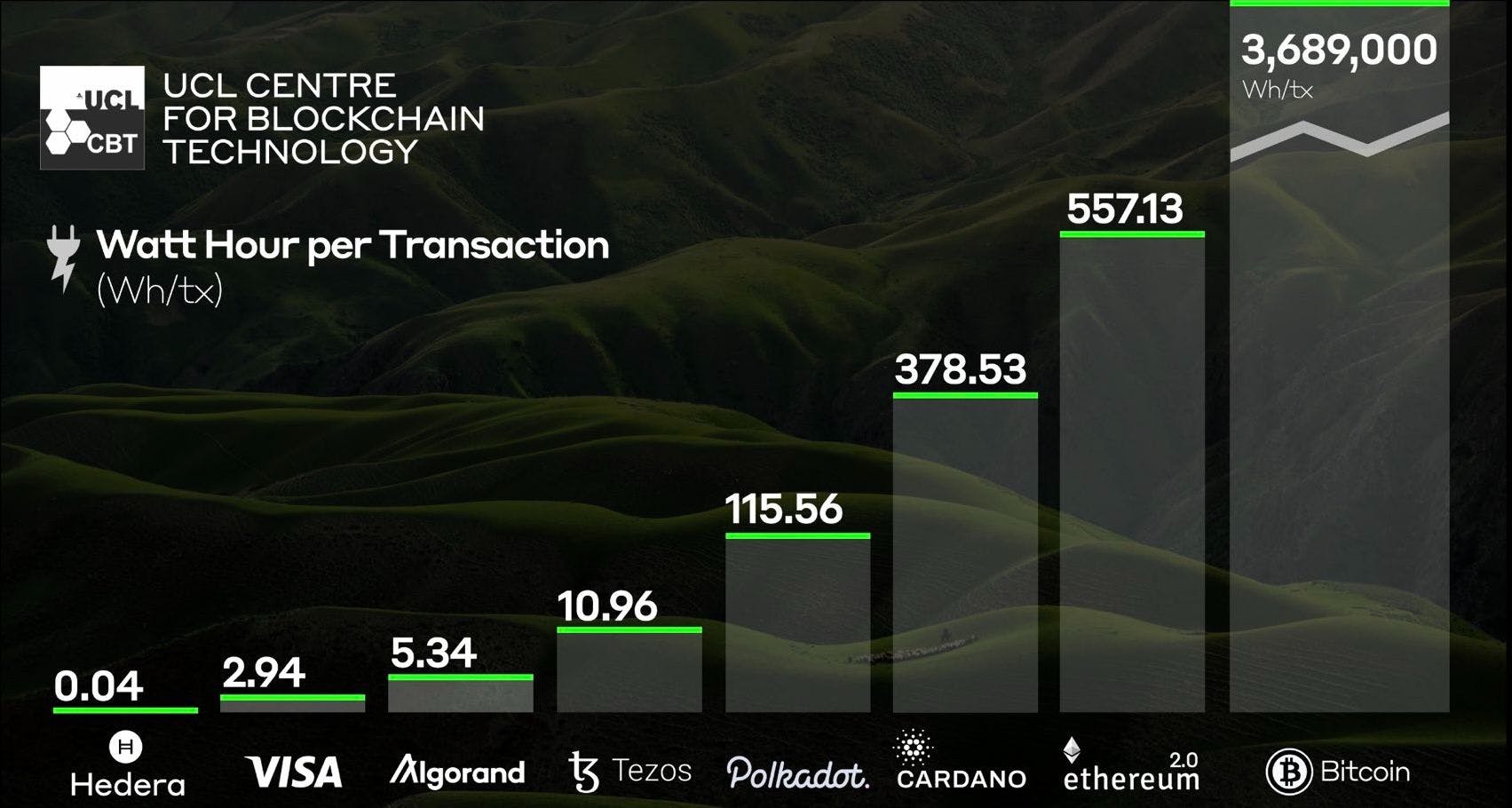

Sustainable

Hedera is committed to having a positive impact on the world and ensures to give back to the environment. On top of being an incredibly efficient technology, the network is carbon-negative and achieves this by purchasing carbon offsets. Hedera prides itself on consuming less energy than the highly revered Visa network.

Hedera Metrics

Defi on Hedera is relatively new as the network has only recently become open-sourced (as of August 5, 2022). The open-sourcing of the network, and consensus algorithm allows developers to leverage existing developer tooling that can be used to build applications on top of the hashgraph.

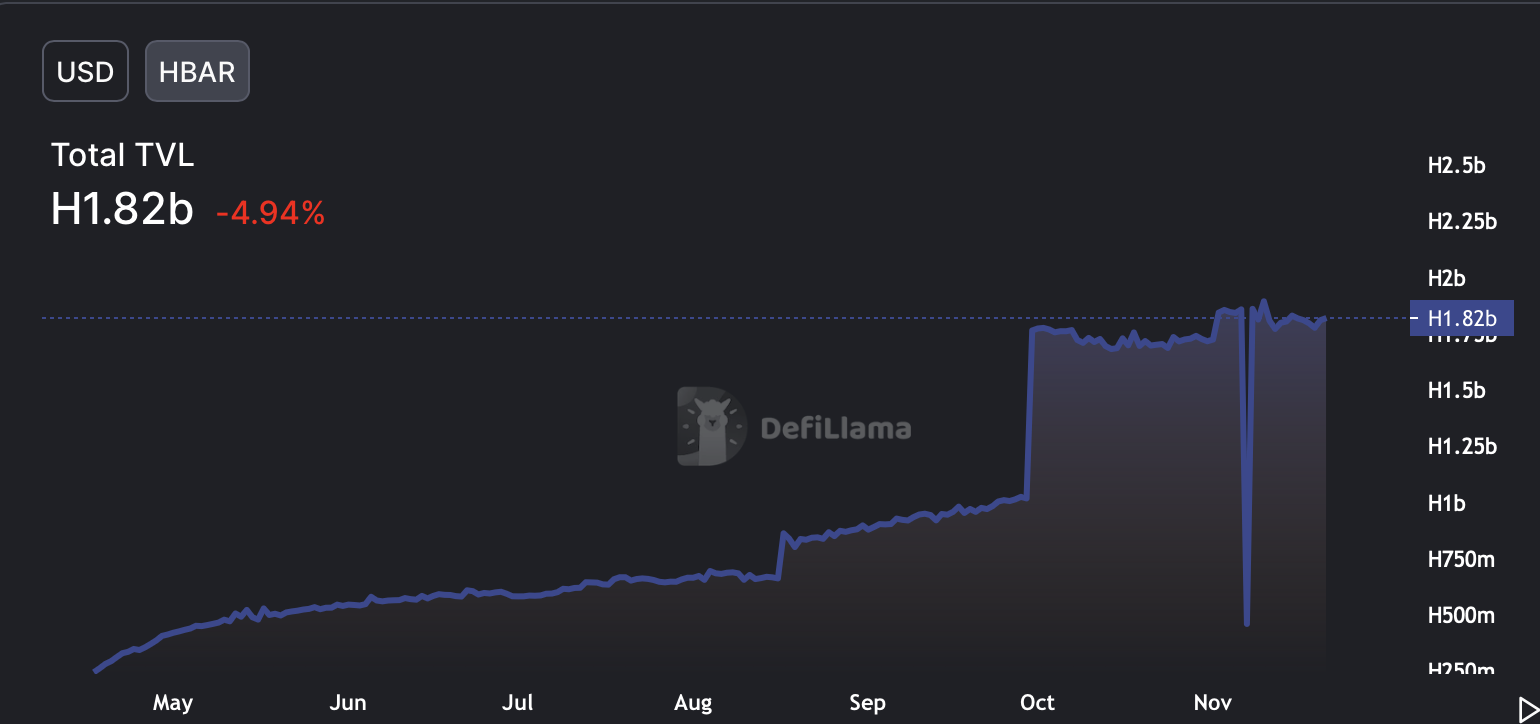

The graph below is a representation of the timeline of the TVL (total value locked) on the Hedera network. The initial liquidity was brought onto the hashgraph by the launch of the first defi protocol, Stader Labs, in April 2022.

The accumulation of TVL steadily increases until mid-August when there is a significant spike - this is when Saucer Swap, the first DEX was launched on Hedera. In October we witness an even bigger spike in TVL which can be correlated to the launch of two more DEXs on the network, Heliswap, and Bubbleswap.

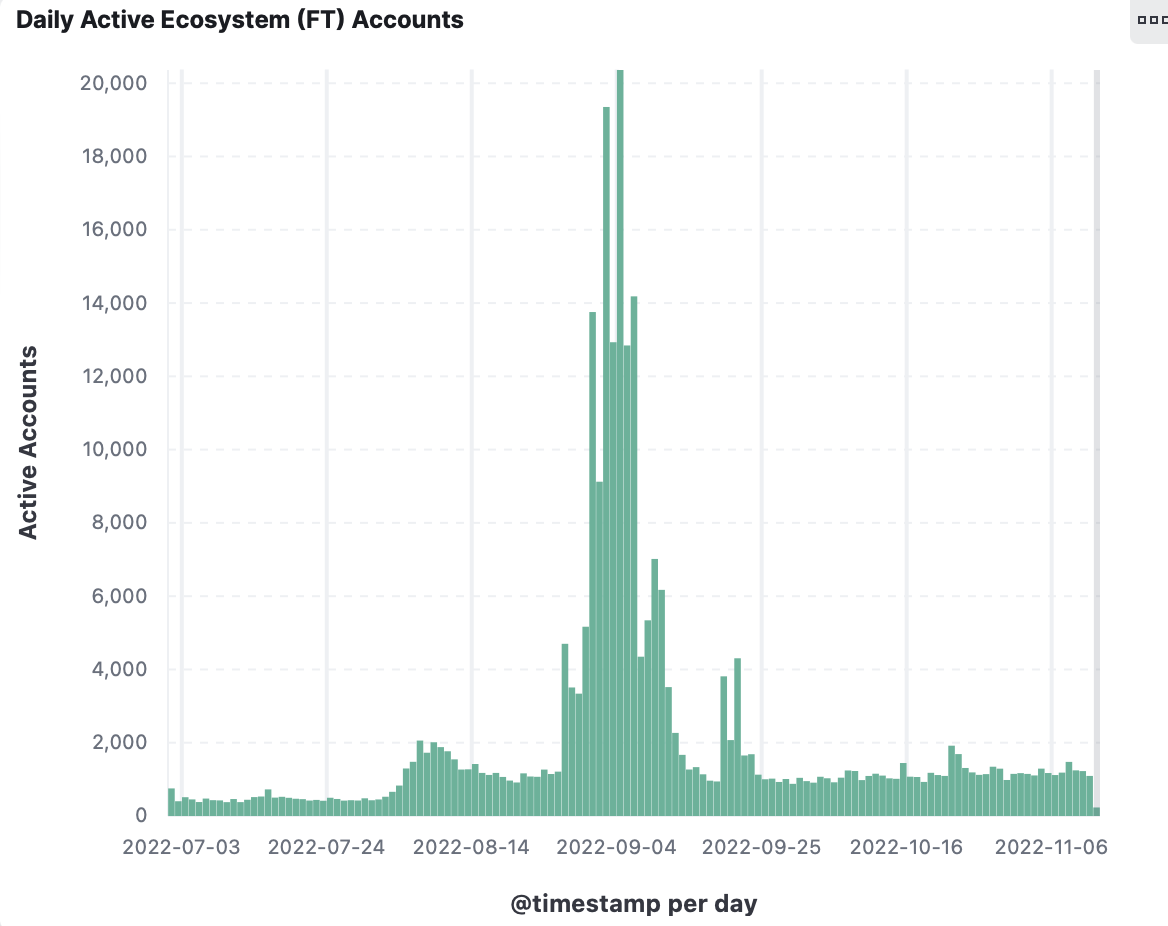

The analytics below illustrate how the dawn of DeFi on the network has brought with it an increase in daily active ecosystem accounts - an indicator of the growth of the network. The number of active accounts picks up at the time of the launch of Saucer Swap which went live (August 3-5). After the launch, the number of daily active accounts has maintained an equilibrium at double the initial number. From this we can hypothesize that an increased number of defi applications on the network will also increase the number of total active users.

Hedera Community

To add to all the benefits of building on Hedera, one should also consider the amazing community that has formed around the growing technology. Enthusiasts from all corners of the world have come together to provide open-source resources for users and builders of the network.

Here is a list of a few useful resources created by the Hedera community:

-

Hashgraph Defi Alliance - This is an alliance between different defi protocols on Hedera that are committed to building out the defi ecosystem. If you are building a defi protocol, reach out to them on Twitter!

-

The Hbar Bull - This is a youtube channel featuring the lovable duo; Brandon and Zepzi! They do weekly updates on the Hedera ecosystem along with more specific videos on trending or relevant topics.

-

Hello Future Buzz - This is a Twitter account that hosts regular spaces revolving around Hedera. The spaces are hosted by the one and only Elizabeth and go a long way when bringing the community together.

-

Hashpack Community Page - This is a page dedicated to the community of Hedera by showcasing all community-led projects on the network. The page was built by the team at Hashpack.

-

Hedera Strato JS - This is an SDK developed by the team at HeadStarter.

-

Discord Faucet Bot - This is a bot for your Discord server that dispenses HTS tokens/HBAR via Discord's API created by the Hashgraph Defi Alliance

There are many more resources sourced by the community but these are just a few stellar highlights.

How to get Involved with Hedera

How to Get Involved

Builders:

If you are building a DeFi Dapp, reach out to the DeFi alliance on Twitter and make sure you check out these open-source [DEX tooling](https://: https://github.com/hashgraph/hedera-accelerator-defi-dex-ui). Make sure to also connect with the community and ecosystem teams on Discord.

Community members/retail users:

Check out our ecosystem page to get insights on all the protocols available to you. Get started by downloading one of the many Hedera wallets mentioned earlier. Also, make sure to join the community on Discord.

If you are an Enterprise:

Looking to get involved in institutional DeFi or to offer some of your products on the Hedera network? Fill out this form or reach out to me directly on Telegram or Twitter!

Thanks for tuning into the overview of the current defi ecosystem on Hedera! Feel free to DM me on Twitter or Telegram.