NFTs facilitate the freedom for artists to interact with their art and the people who love it, while also creating novel ways to monetize their creations.

“Blockchain fixes this.”

More and more, I find myself saying that phrase out loud, under my breath, and in my head as I experience the day-to-day inefficiencies that are like rocks in my shoe. The thought pops into my mind when I play video games, listen to music, and even when watching TV.

Recently, while infinity scrolling through Netflix, Hulu, and Amazon Prime, straining to pick my next binge-worthy endeavor, I came across the documentary The Lost Leonardo, which details “the mystery behind the most expensive painting ever sold at auction: a $450 million Salvator Mundi, a painting presumed to be a long-lost masterpiece by Leonardo da Vinci.” Even though I thought Art History was one of the more mind-numbing subjects in school, I’ve been fascinated with con man crime documentaries lately, so I decided to take the 100-minute gamble.

If you haven’t watched the documentary like 99.9% of people have (HOW COULD YOU?!), or are as clueless as I was to what the Salvator Mundi even is, I’ll give you the TLDR version. If you want an easily digestible more in-depth history, you can read this linked Vulture article.

The Sparse Background of the Most Valuable Piece of Art in History

Da Vinci has less than 20 paintings attributed to his hand. As of 2005, only two were unaccounted for; one of them being the Salvator Mundi. Salvator Mundi is Latin for “Savior of the World”, and is often referred to as the “Male Mona Lisa” due to the similarities in techniques in the paintings’ faces, as well as the time period (early 1500s) in which they were created.

Note, read this next section carefully because the following murky history is what demonstrates how one aspect blockchain technology can be important to the art world.

A painting believed to be the Salvator Mundi was catalogued by one of Leonardo’s students in 1525. That painting disappears. Over a century later, it inexplicably shows up in the possession of Charles I of England. He sucks, so his head gets chopped off in 1649, and his art collection is sold off; Mundi included. Eventually, the painting disappears again. Another two centuries pass by and in the late 1800s a wealthy British merchant named Sir Francis Cook randomly acquires a Salvator Mundi. Was it just another replica or was it “The OG” oil painting? Well, it sure looks like Francis assumed it was a copy. This is evident when Warren Kuntz bought the painting at a Sotheby’s auction in 1958 for just $60; believing it was painted by a pupil because it was titled as a piece “after Leonardo da Vinci”. It was then given to Kuntz’s nephew, Basil Hendy, passed down through his family, and then was sold at auction on the New Orleans Auction Gallery’s website to Alexander Parish and Robert Simon for $1,000; or as the hip kids say, “one fat stack.”

The Salvator Mundi as an NFT

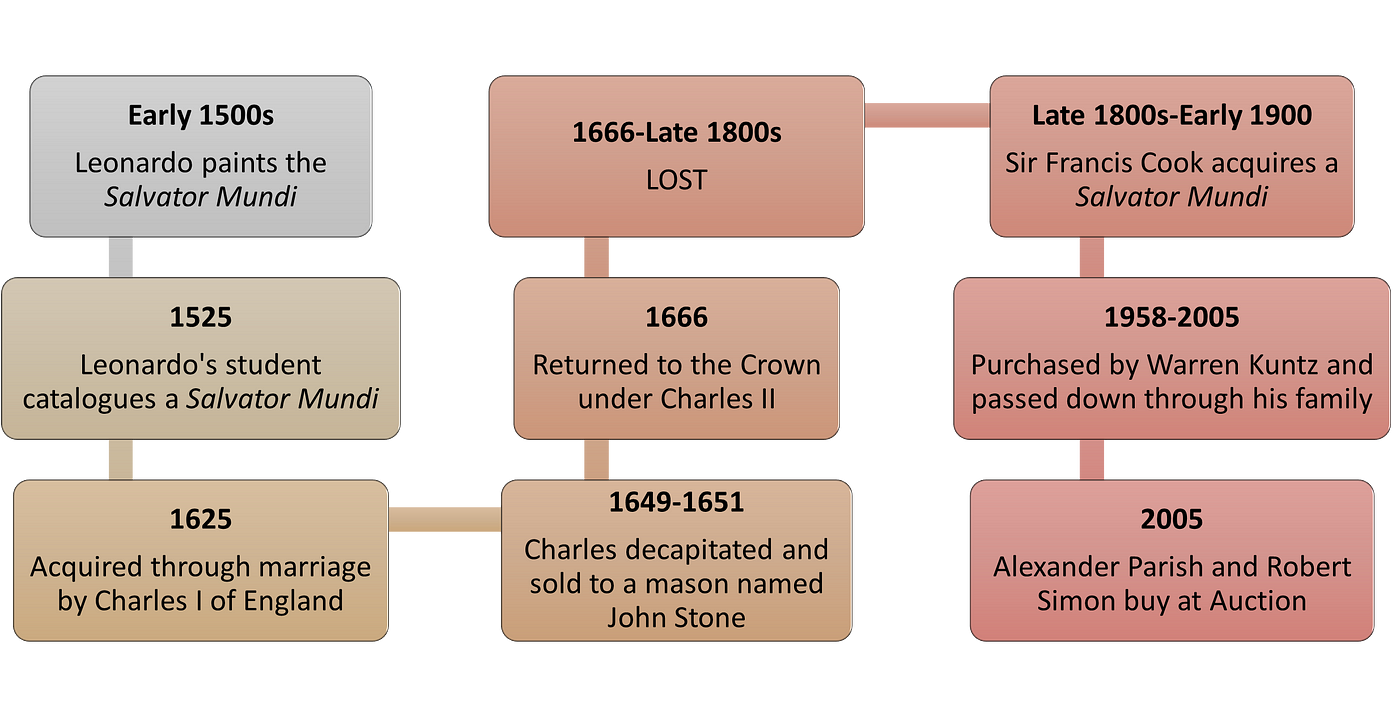

This is where the documentary starts, along with the main plot point about the drama of trying to prove the authenticity of the painting, or not, so I’ll recap real quick as to why there’s so much controversy behind the authenticity of Mr. Munds and why, hypothetically, if da Vinci was able to mint his Male Mona Lisa as an NFT (non-fungible token) on a blockchain, there would be no doubt to its provenance. In other words, if he was to create and add his Male Mona Lisa as an identifiable and unique digital asset on an open and decentralized record that cannot be altered and is available for everyone to see, we would know the exact origin and history of the shadowy Salvator, and there would be no need for a documentary. Here’s a simplified timeline of the events; so far:

Whether it’s a 2.5 year, 25 year, or almost 250 year gap, it’s important to note that every line connecting every box represents an enormous opportunity for the original work of art to be misplaced, mistaken, or forged by an ensemble of bad actors or ill-informed collectors; however well-intentioned they may be. You might as well put a question mark after every transition and an asterisk over every mention of the Salvator Mundi* after it was originally painted because there’s no way to be 100% certain that it’s the same canvas and strokes created by the touch of the master’s-hand. Without perfect provenance we can only refer to the pieces of art mentioned in history, down to the very disputed piece today, as “a” Salvator Mundi, not “the” Salvator Mundi.

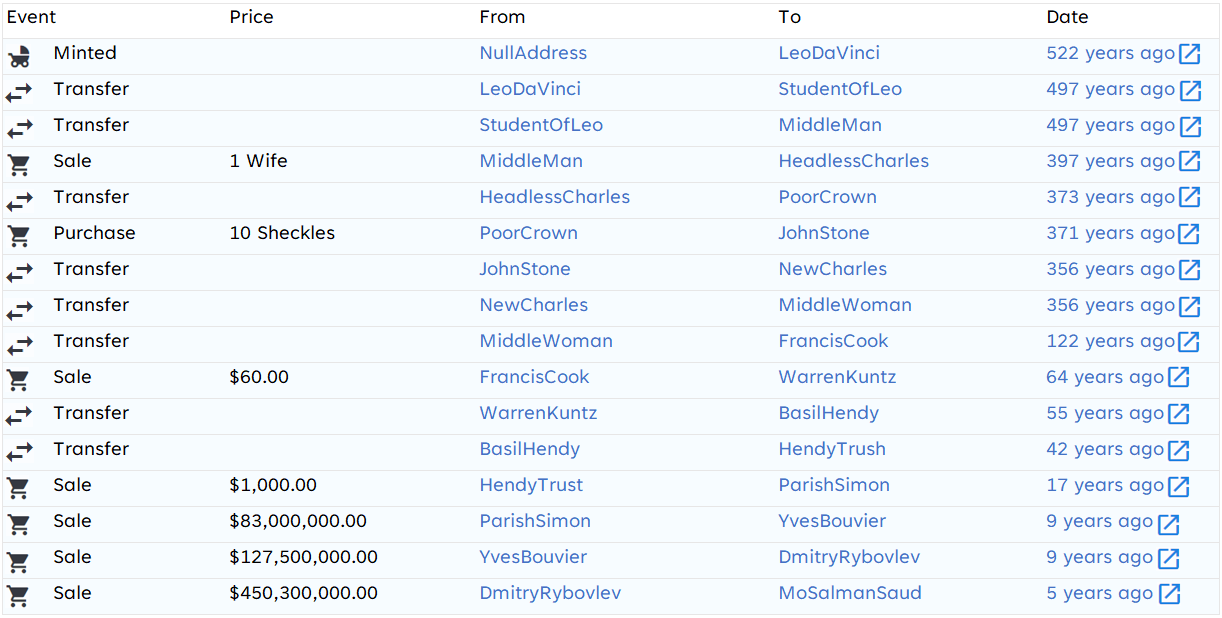

Now back to our hypothetical. What would the history look like of Salvy on an NFT Marketplace if it was minted on a blockchain? Well, if it were listed on the most popular NFT Marketplace, OpenSea, it might look something like this:

Putting aside some artistic liberties I had to take in order to fill in some gaps (since, once again, we don’t have a flawless pedigree), this illustrates how a tokenized item on the blockchain surrenders every detail of its history. From the exact day and time it was minted by its creator, to the various transfers of ownership, and every aspect of all purchases that have ever occurred, NFT technology cuts through the fog of uncertainty to endow the art world with clarity and the ability to confidently claim perfect provenance for a piece of art.

If you want a non-hypothetical example, you can view how an NFT from the popular collection “Doodles” looks like on the OpenSea Marketplace by clicking HERE. You can also see what that very same NFT looks like on the blockchain by using the Etherscan application HERE. Etherscan is an Ethereum blockchain explorer that allows you to drill down into the nitty-gritty of every token and transaction that has ever occurred, and will occur, on the Ethereum blockchain.

Why NFTs are More Than Just JPEGs

If you understand those basic principles of NFTs, you are now equipped to refute one of the most ignorant and inaccurate statements that plagues the comment sections of many Twitter posts today. We’ll say the culprit’s name is “I own this now Isaac”. He may comment something along the lines of, “I just right-clicked + saved your picture and didn’t spend any money! Bwahahah . . .”

Good one. I’m gonna need some ice for that burn. In reality, you “own” just as much of your newly saved JPEG as I own of the property rights of the above clip of Kelso from That ’70s Show rubbing salt in the wound. Zero, zilch, nada. I might as well claim that since I took a picture of your house, your car, or the Mona Lisa (I actually have that one ↓) that I now own them. This guy gets it. Jokes aside, what NFT technology does is allow a better way of proving ownership, validity, and scarcity for digital assets. And in a world that’s becoming more digital by the day, this is, and will continue to be, paramount as we continue to merge our real and digital lives together.

Furthermore, NFTs are useful not just for digital art, but non-digital art as well. Let me explain. Art fraud accounts for around 3% of yearly art transactions. That might not sound like a lot, until you find out that $200 billion is spent on art yearly. So that 3% becomes $6 b…b…b…billion! So how can NFT technology help with that? One great use case of NFTs is that they can be used as certificates of authentication (aka COAs). Former crypto shamer, but now turned crypto advocate, Kevin O’Leary, most known for his role on ABCs Shark Tank, explains this clearly when referencing his illustrious watch collection. He says, “You don’t know if you’re buying a fake watch when you buy a vintage watch. So an NFT can become a certificate of authentication. That’s what the big potential is…I want my own collection to have NFTs for every single watch, have them insured, and have them approved by the manufacturer. That’s the potential. And that just one use. NFTs are going to be huuuge.”

Perpetual Royalties and Other Use Cases for NFTs

What are some of these other use cases for NFTs that O’Leary alludes to? There are many since the applications of non-fungible tokens are growing at a breakneck pace; which is partly why the phrase “blockchain fixes this” or “NFTs fix this” cross my mind so often. Here are a couple of CoinDesk articles from Jeff Wilser that go into a few ways that we may see NFTs become a bigger part of our daily lives sooner than later. Additionally, Pulitzer Prize-winning author and art critic Sebastian Smee mentions that “you can also mint physical works of art as NFTs. The point of doing this is not to displace the painting or sculpture itself. It’s to create a digital bundle of secure data about that work, including a record of its ownership, instructions about its care and display, and stipulations about how much money should go to the artist when it is resold.” Which brings me to one of the most important ways smart contract enabled NFTs are going to become a game changer; perpetual royalties for artists.

In order to illustrate this point, we’ll come back to our old friend, Salvator Mundi, and finish telling its saga. After Alexander Parish and Robert Simon purchased the Mundi in question for less than a new iPhone, they spent several years trying to determine the authenticity of the painting; during which time it went through a generous restoration process, was evaluated with questionable motivates, gained a third investor named Warren Adelson, and was even included in The National Gallery’s Leonardo exhibition. Exhausted from the eight-year ordeal, and not being able to find an institution to acquire the piece at the $100M price point they wanted, the investor trio decided to sell it privately. But who would buy such a potentially risky piece of history? In steps Russian oligarch and multibillionaire mining-ore baron, Dmitry Rybolovlev. Wanting assistance and advice for the purchase, Dmitry reached out to Swiss art swindler, *cough cough* I mean dealer, Yves Bouvier. What Bouvier did was help convince the oligarch to buy the Salvator Mundi for a wallet breaking $127.5M! However, what he didn’t tell the scary baron was that he had already purchased the painting for $83M and, therefore, pocketed the $44.5M dollar difference! The balls on that guy. Obviously, once the news came out of the quick flip, multiple parties were upset. (Just another reason why decentralized, immutable, and permissionless marketplaces and blockchains are super-duper.) Eventually, the disgruntled Dmitry wanted to offload Salvator and did so with the help of the famous Christie’s Auction House. Following a marketing blitz to drum up excitement, and a 20-minute bidding war, Lot 9B was sold for a record breaking $450M to a Saudi prince who is suspected to have bought the painting on behalf of Saudi Crown Prince Mohammed Bin Salman; who probably has Sal on his mega yacht or in a Switzerland free port.

I will now summarize and demonstrate how the first modern investors would have alleviated at least some of their “seller’s remorse” if they would have hypothetically minted the Salvator Mundi as an NFT and sold it that way. Parish, Simon, and Adelson sold the art for $83M; not a bad ROI. However, if the piece of art was an NFT, they could have added a 10% royalty into the NFT smart contract that was paid to them every additional time the NFT sold, in perpetuity. That means they would have received an additional $57.75M in royalties from the other two sales ($127.5M + $450M = $577.5M x 10%). And more than likely, when/if the painting sells again, it will sell for more than last time, theoretically yielding more total money for the first investors than their original sell! To illustrate the point even more dramatically, let’s assume that the Kuntz family were the ones that first minted Mundi. This would mean that the Kuntz family that sold the painting for the incredibly humble price of $1000 would have so far received a 10% royalty on $660.5M, which equates to a jaw-dropping $66.05M (a 66,050x return).

There’s the hypothetical. Now here’s the real-life example of NFTs enabling perpetual royalties. Gary Vee, arguably one the most influential NFT advocates, launched his first NFT collection, named VeeFriends, in early May 2021. The initial sales for the collection totaled around $50M. That’s impressive enough, but when discussing VeeFriends and how NFTs can revolutionize the selling of digital assets on the Full Send Podcast, he says, “What’s even more interesting for the issuers of the NFTs is there’s a royalty contract, similar to publishing music or books, that creates economics that we have not seen before. When somebody re-sells a VeeFriend, I get a royalty. Those become profound economics.” Just how profound have they been for him so far? Well, in addition to the initial $50M made from the primary sale, estimates claim that he has generated around an extra $14M in royalties, so far, due to the 10% royalty embedded within the smart contract of every VeeFriend NFT. This means that if someone purchases a VeeFriends NFT for $50,000 (the current floor price), the smart contract will execute and automatically deposit 10% of that sale, which is $5,000, into his wallet without an auction house, specialist, or Swiss art dealer needed.

The Big Picture for Small Artists

Now, most artists aren’t going to make millions of dollars selling their art, NFT or not. But what NFT and smart contract technology can do is enable artists to have more creative control of their art. Digital artist Ash Thorp agrees with this sentiment when saying, “It means everything for the sovereignty that I want to have with my work…[NFTs] are giving me complete ownership of my digital work for the first time…So it’s incredibly liberating and empowering.” This newly found independence can help create novel ways for artists to monetize their creations and build a community of loyal supporters.

For example, imagine a struggling artist being able to recoup some income from a piece that they sold, way undervalue, to cover basic living expenses, only to later realize that if they would have sold that same piece one month or one year later, they would have made substantially more. Imagine that after saving up money for a long period of time being able to purchase a piece of art that you’ve envisioned becoming the center piece of your home, having full confidence that it’s not a fake without having to vet and fully trust the seller with your hard-earned money. Imagine being able to retroactively give the current holders of your art, the people that have supported you through your struggles as well as triumphs, a gift or one-of-a-kind experience for being loyal for so long. The possibilities are endless. NFTs facilitate the freedom for artists to interact with their art and the people who love it, and it’s that concept that Aorist’s founder, Pablo Rodriguez-Fraile, says will help foster “the most important art historical movement in our lifetimes.”

NFTs are tools. And even though they are not in and of themselves a new artistic medium, they may allow artists to be just as creative with the ownership of their art post-creation as when they were first creating it. Due to the technological breakthroughs that have arisen, NFTs create more possibilities for creators, as well as cure many of the headaches that artists and collectors face. When properly embraced and utilized, NFTs will have artists and the overall art community saying with a collective relief, “I’m so glad ‘blockchain fixed this.’ ”

Spread the Blockchain Gospel

If you’ve read this far, and have inched closer to becoming a crypto convert, you can help support future articles by visiting mirror.xyz/eriktoshi.eth or clicking the blue “Collect NFT” button for this article. That’s right, you can even create an NFT out of an article. Another novel way NFT technology can help support creators. Very meta.

Note: 50% of the proceeds from this article will be donated to the UkraineDAO.eth charity though Mirror’s “Split” functionality.

By doing so you’ll help me continue to advocate for algorithmic stablecoins to earn higher APYs, support other artists and causes that need and deserve attention, and to overall spread the Blockchain Gospel even further.