The never ending war between farmers and the tokenless farms are only becoming more fierce.

Many times users are getting passively farmed without even realizing it. Here are just a few:

1/ Excessive Fees

Projects are generally in competition with each other to low fees and acquire new users from a limited pool of mercenary capital.

This is healthy, as competition forces better products for consumers.

“Points” have become an alluring veil to hide offensively high (and often hidden) fees. Without points no one would willingly pay more for a bridge or a swap. Add points and users can easily justify the extra expense.

See:

Friendtech = 5% of every trade went to the team (netting them over $27M)

Ekubo = 1% withdrawal fee on the LP position (went to team not the other LPs)

LogX - charge a flat fee every time you want to withdraw anything. This was in addition to much higher trading fees than most Exchanges and decentralized order books. If you farmed the Orderly Galxe campaign you felt the pain of $7+ PER trade with relatively low size and leverage.

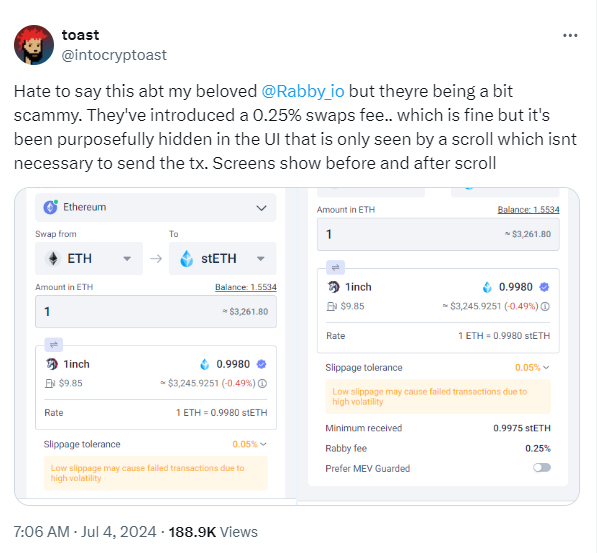

Rabby wallet took criticism for recently introducing a hidden fee to swaps without an announcement and requiring the user to scroll down to see it. Previously swaps had zero Rabby fee and earned points. Oblivious farmers are still swapping daily for those points.

This last example shows that even a (previously) well thought of team with a great product are looking for ways to gouge you the user. Stay vigilant or pay.

2/ Point Dilution

Points have no true value, only a perceived or speculative value. $200 of volume on whales.market does not make you pre-rich.

Points are simply a series of 1s and 0s that make up a database entry on a centralized server.

As a practical matter, teams can disperse as many points as they want, whenever they want.

Many projects have turned to the playbook of one off "events” and the dreaded “campaign" offering “bonus” points - for a limited time!

Unfortunately this meta now resembles a “going out of business sale” from your dodgiest discount retail store. Why run one campaign when you can run it back again a few months later?

If you miss out on a boost event, you can end up feeling angry. Now you know you are diluted you might as well wait for the next "boosted" deposit window.

We saw this with Etherfi, when they had to dial back giving away millions of bonus points down to 300k.

Kamino publicly announced the end date of their season along with linear criteria, inviting whales, funds, and mercenary capital to come in and absorb the largest share of the points within a small time period.

Many such cases. From Hyperliquid announcing Season 2 instead of a token generation to Innit Capital diluting their Mantle users by deploying into Blast liquidity. Justin Sun just deposited another $100M+ into your favourite LST protocol.

Dilution is everywhere.

3/ What can you do?

- Start by choosing to use products you enjoy and have at least some sort of use case.

- Be vocal when projects are trying to pull a fast one. We've seen that social pressure actually works, shaming projects into adjusting pie charts and abandoning or scaling down their milking campaigns.

- Do your research and probe for information when needed. If you are not satisfied with the answers or the direction the project is heading, just get out and save your time and capital.

- Don't be discouraged, stay curious. The space is still highly rewarding for early users. In a bull market we are likely to see vampire attacks where “out of nowhere” projects drop tokens to the type of users they value.

This post was greatly inspired by a newsletter post titled "How You Get Farmed: A Rant" from DefiIgnas I highly recommend you check out.

Strategies on how to maximize your Scroll airdrop

1/ Scroll marks & sessions

Scroll sessions is an official campaign by @Scroll_ZKP where you accumulate points (marks) for your on-chain activities

At present, you earn marks through 3 types of interactions:

• providing liquidity on scroll

• holding designated assets on scroll

• lending/borrowing on scroll

Visit the Scroll sessions page at https://scroll.io/sessions to see the list of eligible assets and DApps.

You can also check if you've earned any Marks from gas burned pushing transactions made before April 29th on the same page.

Not every DApp or asset type will be displayed immediately. Usually, if Scroll announces a partnership or integration on Twitter, they add it soon after if it hasn't been already. (Mitosis being a recent example)

The Scroll team has also confirmed that points for DeFi actions will be awarded retroactively, accounting for past activities.

2/ Boosters:

Focusing LP positions close to the current price speeds up mark collection and increases your fee earnings.

Unfortunately this demands much more hands-on management, as you need to realign the LP whenever the price drifts beyond your set limits.

I opt for a broader range for a more hands-off method with less frequent adjustments, though you will gather slightly fewer marks over the same timeframe.

LP positions in high volatility pairs (like ETH-USDC) accumulate marks faster than those with low or no volatility (USDC/USDT and ETH/WrsETH)

3/ Interaction types

Points breakdown calculated using 1 ETH:

• Providing Liquidity: ~30 points per day per ETH

• Lending/Borrowing: ~20 points daily

• Holding: ~10 points daily

3.1/ LPing (providing liquidity)

Leading DEXs for liquidity provision currently include @ambient_finance @syncswap and @NuriExchange.

Ambient boasts higher TVL and stands a greater chance of delivering a potentially lucrative airdrop.

It should be noted that the marks calculations for Ambient has been reported to be bugged by users for more than a few weeks now. Community members have commented how Ambient is currently working to fix this issue.

Regardless, being the flagship DEX on Scroll I have to have faith that they will work out the bugs around this sooner than later.

I generally like to apply the LP range at a +- range of 10% from the current price if I want to be more active in managing the position or +- 20%+ if I want to be more passive in managing the position.

I have been opting more for the more passive route as managing LP ranges on multiple wallets more than once every 1-2 weeks becomes a major hassle very quickly. I would rather be more hands off and earn slightly less marks and fees from LPing.

If you want to go for 1 or 2 very strong wallets (which proved successful for zkSync) try managing LP within a tight range.

Another strong LP opportunity lies in depositing @ether_fi's eETH into MitosisOrg (Mitosis has $7M in funding).

This allows you to get Mitosis points + Etherfi points + Eigenlayer points + Scroll marks simultaneously.

You can get eETH or ETH (and then swap it into eETH) using a cross chain aggregator like Jumper

3.2/ Lending and Borrowing Approach:

First, loan out an asset and use it as collateral to borrow another asset. You can repeatedly lend and borrow (looping) to increase the total assets involved, thereby boosting your rewards.

Alternatively, after the initial borrowing, you might invest in a liquidity pool on another decentralized exchange to optimize capital efficiency.

Remember, there is a risk of liquidation with lending and borrowing. Maintain a good health factor, ideally at least 1.2 or greater.

3.3/ Holding assets on-chain:

• Keep assets in your wallet on the Scroll chain. This is a solid choice for anyone cautious of smart contract risks, which are inherent in any DeFi protocol or airdrop farming activity.

Enhance this strategy by holding diverse LSTs, allowing you to farm tokens from both the project’s LST and Eigenlayer simultaneously. Stake your ETH via @KelpDAO or @ether_fi to receive wrsETH or weETH.

4/ Important Tips

• Avoid borrowing the same the asset you deposited it will be disregarded.

• Consider looping loans but be aware of the risks and act accordingly. Remembering the Renzo depeg it may be wise to wind down positions near an LST’s token generation event.

• Check the sessions page to monitor your progress as well as Scroll’s twitter account to stay up to date with additional eligible tasks/DApps to interact with.

• Expect a linear distribution for Scroll. Higher holdings consistently over a longer time period in Defi apps generally translate to more points and a larger airdrop.

The airdrop meta has changed and projects have shown and are likely to continue using a TWAB (time weighted average balance) approach like we saw with zkSync.

I have mixed feelings around this, on one hand it is a great natural Sybil filter as there is no advantage to automating transactions or rotating funds.

On the other, this applied a heavy restriction to new and lower capital users and increased opportunity cost.

Every protocol from here on out will be fighting for your limited liquidity and will try to convince you to have it locked for as long as possible. Choose wisely.

5/ Scroll Sessions Resources

FAQ: https://scrollzkp.notion.site/Scroll-Sessions-FAQ-498f70eb33b94d539746a43256956517

If your Marks appear incorrect, you can complete this form: https://tally.so/r/3lNV1B

Crypto Tools Mega list A handy compilation of various crypto tools that I personally use or that come highly recommended by others.

Organized by category and alphabetically within each, it includes some well-known staples you’re likely already familiar with, like Dexscreener.

The tools I've bolded are my top picks—essentials I turn to most often and would choose if limited to just one or two per category.

I suggest setting up labeled folders in your browser's bookmarks to neatly store your preferred tools for quick access.

As always, stay Insightful