For weary farmers, the news that zkSync, Layer Zero, Blast and Hyperliquid will all be dropping next month feels like all our Christmases came at once.After almost 3 years of farming, we will finally claim our tokens alongside an Ethereum ETF narrative in a bullish market. We seemingly could not have timed our harvest any better.

Will I be staking and hodling my coins for Valhalla or dumping them all day one?

Will I attempt a big brain play where I hold through the initial jeet and then sell into into a perfectly timed picotop pump?

Let’s take a look at the risks & rewards of holding vs selling

As I and others noted before the $W airdrop, not a single notable airdrop peaked on day one of the claim.

The classic example of rewarding patience in a quality project was $JUP. Many farmers were unhappy with the token launch and dumped their allocations for 24 days straight. Then over the next 5 weeks $JUP rattled off an astonishing sequence of daily green candles, nearly a 4x in 5 weeks.

The earliest all time high for a major airdrop was $JTO on day 2 which could be put down to massive selling pressure from poor distribution (1 staked $JTO receiving thousands. Sybils rejoiced.) $DYM peaked at day 5 amidst modular mania and 1 $TIA staked earning a 3k reward.

For every other major airdrop of Q4 2023-Q1 2024 it paid to hold your bag for at least ten days.

Then $ W launched at the expected $3+ billion valuation and dipped and dipped and… never recovered.

Let’s skip over the reasons why $W failed spectacularly and look at every major launch since $ W.

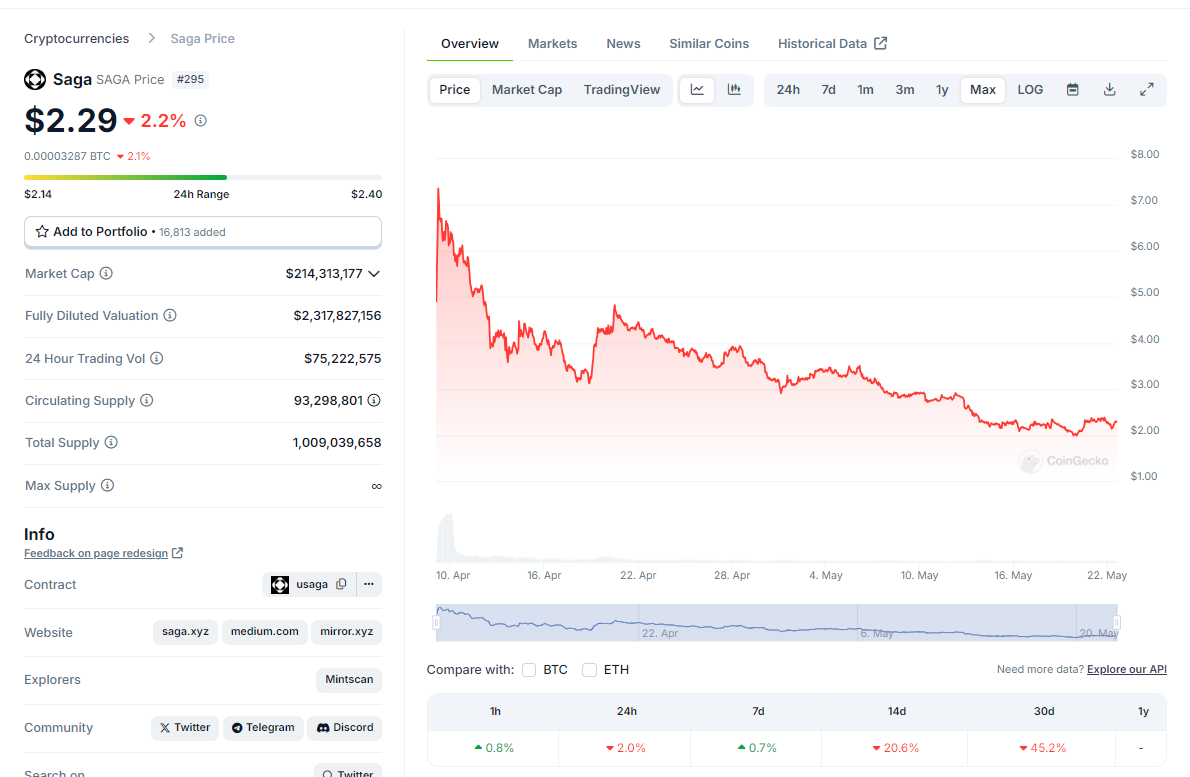

$ SAGA Peaked in hour 1$

REZ - Peaked in hour 1

$ KMNO - Peaked in hour 1, dropped 75%, did a quick 2x and stalled out on day 3

$ MODE - Peaked in hour 1

$ DRIFT - The team actually offered rewards for not immediately dumping. Still dumped. Now up 2x from the lows.

$ PRCL is an interesting one. It opened at 0.62 and dumped 50% in the first 24hrs.

Over the next 7 days it ground its way up to make a new high at 0.72 before beginning a steady bleed below the day 1 lows.

The chart farmers have come to fear

Did you manage to sell the top anon? Is this small sample size, bad tokenomics or have we seen a shift in airdrop sentiment where we all race to dump in the first candle?

I would emphasize that in this market that opportunity cost is everything. Down only charts are generally the result of all the upside being captured in the initial valuation.

If the upside is already priced in, why wouldn’t I convert my airdrop to BTC or ETH?

If predicting token price was easy, no one would get wrecked on whales.market.

To predict a tokens launch price we estimate an expected market cap and divide it by the circulating supply of tokens.

For $W the prevailing wisdom was a 3 billion MC on launch (putting it in the 40s by MC rank) that would eventually push up to 5 or 10 billion as the cycle continued.3 billion divided by a circulating supply of 1.8 billion tokens gave an expected launch price of $1.66. Most of the trading on whales.market occurred in the $1.20-$1.45 range.

Buyers had the pleasure of appreciating their 10% savings for a few hours at least.

So how do we assess the potential market cap of $ZKS, $ZRO, $BLAST and $HL?

The key metrics I am looking at are:

-

Adoption & TVL

-

The market cap of similar projects

-

Fundraising (becoming less relevant)

-

Circulating Supply to Fully Diluted Value ratio. FDV may be a meme in a bull market but buyers are now much more wary of low float, high FDV.

-

I will glance at points/prediction markets but mainly to sell if the market is too exuberant.\

The question I am asking myself is at what valuation is my upside limited and not worth the risk? At what valuation has “the selling has gone too far” where I would be a buyer and look for a bounce?

If I wouldn’t buy my airdrop at listing price then why would I hold it?

So let’s take a look at the big 4 incoming airdrops.

zkSync raised a comical $458 million over multiple years and raises. The tech is the preferred rollup solution of Vitalik Buterin. The blockchain is fast, the average transaction costs 2 cents and airdrop incentives are likely to continue into the future.

The problem is that zkSync has achieved very little adoption despite the giant carrot of $ ZKS.

The TVL should be peaking at snapshot but is only 150 million, half of what Starknet has currently. The all time high for zkSync TVL was 190 million.

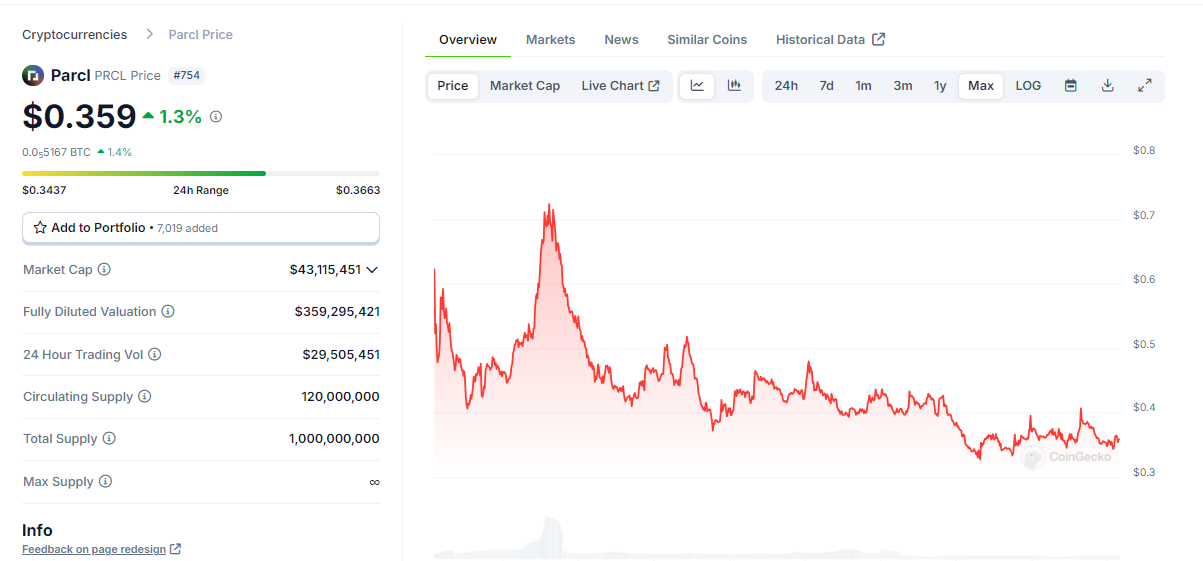

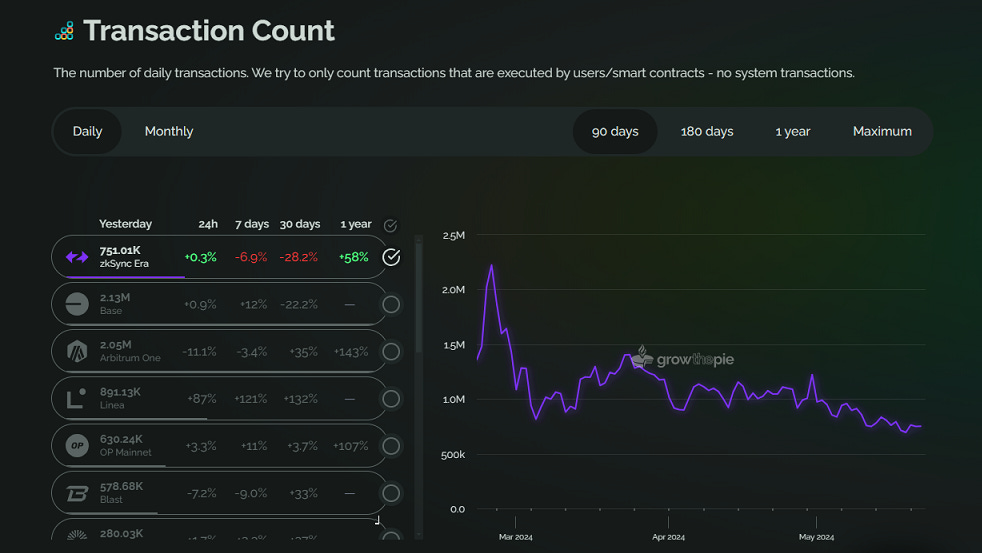

Source: Growthepie.xyz

Transaction count has already declined by 28% in the last 30 days. Only 44% of wallets have interacted with another chain in the past 7 days, compared with 77.6% of Zora users. Many of these are dormant sybils. Very few native dapps of note have been built since mainnet deployed over a year ago.

Looking at leading Layer 2’s for comparison:

$ MNT (Mantle) has the highest market cap of any Layer 2 at 3.5 Billion. They have $350 million TVL, $1.8B in mETH and a treasury of majors worth $350 million. (6.5B FDV)$ ARB has a 3 billion MC with 3 billion in TVL and little to no use case for the token. (11B FDV)$ OP has a 3b MC with 870mil TVL and a “superchain” narrative. (11B FDV)$ STRK has a 1.4 Billion MC, 290mil TVL “gud tech” and 8 users (12.4B FDV).

The bull case for $ZKS is that eventually the tech drives Arbitrum like adoption but with better tokenomics. If that is ever going to happen, it won’t be overnight.

**Verdict: **If $ZKS launches at anywhere close to $3billion MC I will be joyously insta-jeeting.

Layer Zero

If it opens around $2billion I will sell and not worry about losing a potential 50% upside for a longer hold in this market.zkSync would have to launch at or below Starknet’s valuation for me to see any upside in it at all. If it did launch that low something probably went wrong.I plan on selling and hoping the ETH narrative brings a buyer for our bags.$ ZKS is the future of blockchain

The OG sybil farm. Unless you were using Ardizor’s bot farms you probably got away with it. Every bear market veteran’s Mother’s Aunt is rumored to have 19 wallets that enjoy moving funds around on Stargate & HNFTs on Merkly.

To get an idea of what actual adoption is, in April before the token announcement, Polygon was relaying 35-40k transactions per day. A typical day in late May after the token announcement saw 2300 L0 transactions.

90% of the users disappeared overnight.

Are the fees generated by a few thousand daily transactions on cheap chains enough to justify a multi billion dollar valuation? The use case for the token remains unclear and we have seen how Governance only tokens perform.

Verdict:

Jeet. We can look at $ W Market Cap of $1 billion as a potential floor comparison but I will be selling ASAFP

BLAST

After farmers spent the entire bull market with their liquidity locked, farming gold and points for 8 months, what do you think everyone is waiting to do?Verdict: Jeet with haste

Hyperliquid

Hyperliquid started as a fairly humble Layer 3 perps DEX.Launching without VC funding, Hyperliquid seem to have built a platform that has the stickiness to survive past the points based incentives.

Hyperliquid began with a first rate UI, then integrated trading vaults and a spot order book. Hyperliquid now has its sights set on transitioning to an ultra fast L1 that can process the entire order block on-chain.The Hyperliquid L1 will use modified Tendermint consensus and reportedly handle 20,000 orders per second.

More important than the tech, Hyperliquid have the organic users most crypto projects cannot buy. After the points program ended the “open and close a minute later” farmers are gone but the open interest remains steady. The traders are still trading. The Hyperliquidity Vault still has $130 million deposited without points rewards. The meme coin $PURR airdropped to users is maintaining a $70 million market cap when most users could instantly sell for thousands.By 2024 standards, these are diamond hands.I also like the “No VCs” narrative. If successful, the HL team’s “bet on ourselves” play would become the talk of crypto and have devs questioning conventional wisdom.

The obvious comparison for valuation is $ DYDX at 1.1 billion. DYDX does 30% more weekly volume than Hyperliquid with less users. Hyperliquid has the same TVL and a largely retail/degen user base. Smaller, more frequent trades generate more fees for the protocol. If we value $ HL as a Layer 1 who’s first major dapp was a smash hit, the ceiling is much higher.Verdict: Cook. I know this is a strange metric but I find it hard to imagine a layer 1 trading at less than 20x the value of its memecoin. In this case that would be $1.4B.I expect $ HL to launch at or be bought up to a $1B MC and there is room for it to 2x or more from there given the lack of selling pressure.This is one I’m going to have to play by ear but my instinct is not to dump it day 1.