Solana has surged in popularity as a high-throughput blockchain ecosystem, largely fueled by its robust staking mechanism.

While staking SOL is a core feature, traditional staking models often hinder liquidity, limiting users' ability to engage in trading and DeFi activities.

Now, we have liquid staking, a solution that unlocks additional value for SOL holders by maintaining liquidity while staking.

Leading this evolution is SolBlaze, offering a comprehensive liquid staking solution that enhances flexibility, accessibility and efficiency for solana holders.

In this article, we explore the fundamentals of Solana liquid staking, its benefits, strategies, ecosystem growth, and potential implications.

WHAT IS SOLANA LIQUID STAKING?

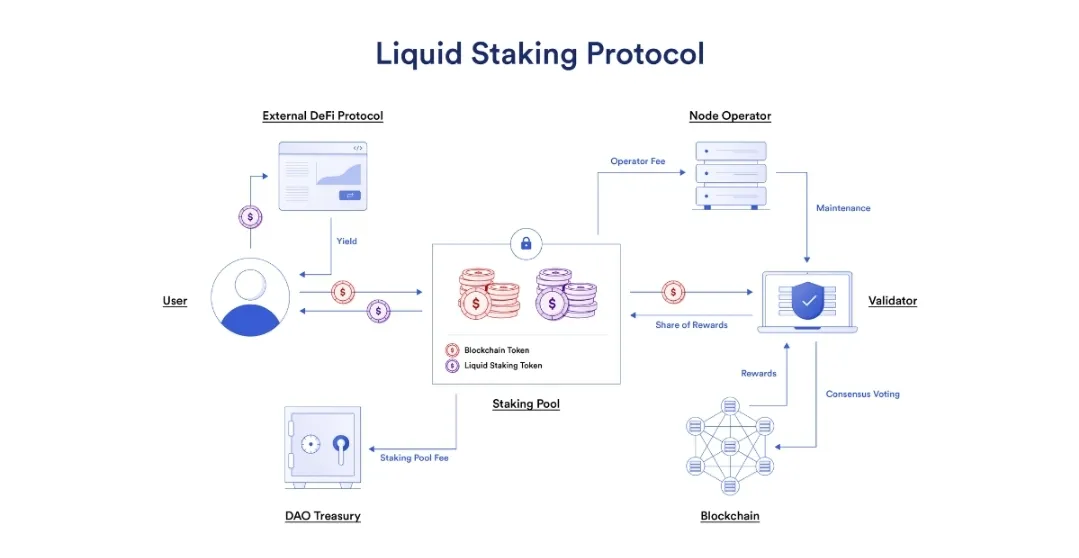

At its core, liquid staking allows you to stake your SOL tokens in a staking pool managed by a protocol, like SolBlaze. These pools aggregate SOL from multiple users and delegate them to validators.

Validators secure the network by verifying transactions, and in return, they receive staking rewards.

Here’s the key difference: instead of receiving locked SOL, you get liquid staking tokens, such as SolBlaze’s bSOL, in return for your contribution.

Here’s a breakdown of how it works:

-

Staking SOL Tokens: You deposit your SOL into a staking pool, which is managed by a stake pool operator.

-

Liquid Derivative Token: In return, you receive a liquid derivative token, such as bSOL in the case of BlazeStake. This token represents your stake in the pool, but it is also freely tradable on secondary markets.

-

Staking Rewards: The stake pool operator stakes the deposited SOL tokens on Solana network. The validators who secure the network earn staking rewards, which are then distributed proportionally to the users who staked their SOL in the pool. These rewards are reflected in the increasing value of the liquid derivative token over time.

WHY LIQUID STAKE SOL?

There are several reasons why you might choose to liquid stake your SOL:

-

Maximize Yield Potential: Holding liquid derivative tokens like bSOL enables you to earn staking rewards while also participating in various DeFi activities that will allow you to generate additional yields on your staked SOL and earn passive income simultaneously.

-

Maintain Liquidity: Unlike traditional staking where the staked tokens are locked for a period, liquid staking allows you maintain liquidity, bSOL can be freely traded, borrowed, or loaned in various DeFi protocols, unlocking additional earning opportunities.

-

Diversification: Stake pools often spread their delegated SOL across multiple validators, mitigating the risk associated with any single validator going offline or malfunctioning.

-

Accessibility: Liquid staking protocol like SolBlaze removes the technical barriers associated with running a validator node. You don’t need to set up and maintain your own infrastructure, making staking more accessible to a wider audience.

STAKE POOL DELEGATION STRATEGIES

Stake pool delegation is a crucial aspect of liquid staking, involving both users and operators in the delegation process. Users delegate their tokens to stake pools, which consist of validator nodes responsible for validating transactions and securing the network.

- From the user’s perspective, different delegation strategies come into play:👇👇

-

Performance-based Delegation: Users may choose pools based on performance metrics such as uptime, commission fees, and historical performance, aiming to maximize rewards.

-

Risk Management: Diversifying delegation across multiple pools helps mitigate the risk of slashing penalties or downtime.

-

Community Engagement: Some users prioritize pools aligned with their values, community involvement, or development contributions.

Meanwhile, stake pool operators play a crucial role in selecting validators to delegate staked SOL tokens to. They employ various strategies to optimize returns and manage risk:👇👇

-

Fixed Validator Set: Operators may select a fixed set of validators and delegate all tokens to them, offering simplicity but potentially limiting returns.

-

Balanced Delegation: Operators distribute staked tokens across a diverse set of validators, aiming to balance risk and reward.

-

Performance-Based Delegation: Operators delegate tokens to validators based on historical performance and uptime, aiming to maximize staking rewards while managing complexity.

These strategies, whether from the user or operator perspective, are essential for optimizing returns and ensuring the security and stability of the liquid staking ecosystem.

NOW, LET’S TALK ABOUT SOLBLAZE’S USER-CONTROLLED DELEGATION SYSTEMS

SolBlaze introduces innovative features like bSOL Custom Liquid Staking and BLZE Gauges, offering users granular control over their staking preferences and delegation strategies. These systems empower users to optimize rewards, manage risk exposure, and participate in governance processes effectively.

-

bSOL Custom Liquid Staking: SolBlaze’s unique feature enables users to select individual validators for their bSOL tokens, enhancing their control over the staking process. By choosing specific validators based on performance and other criteria, users can tailor their delegation strategy to their preferred risk tolerance and potentially maximize rewards.

-

BLZE Gauges: Another user-controlled delegation feature offered by SolBlaze, BLZE Gauges are on-chain mechanisms that allow users to vote on the distribution of BLZE token emissions to different validators. This decentralized governance approach enables users to influence the validator selection process, potentially leading to higher returns and fostering community engagement.

-

Dynamic Delegation Strategy: SolBlaze employs a dynamic delegation strategy that continuously assesses validator performance and adjusts allocations accordingly. By prioritizing validators with strong performance metrics such as uptime and low commission fees, SolBlaze optimizes staking rewards for users while maintaining network security and reliability.

These user-controlled delegation systems empower SolBlaze users to actively participate in the staking ecosystem, customize their delegation strategies, and contribute to the growth and stability of Solana network.

USING LIQUID STAKED TOKENS IN DEFI

Liquid staked tokens like bSOL unlock a plethora of opportunities within Solana DeFi ecosystem to generate additional yield. Here are a few examples:

-

Borrowing and Lending: bSOL can be used as collateral to borrow other crypto assets on lending platforms like marginfi or Kamino Finance, enabling users to leverage their staked assets.

-

Provide Liquidity: Users can deposit bSOL in liquidity pools on DeFi protocols like Meteora or Kamino to earn additional yield from trading fees.

-

Yield Aggregators: Yield aggregators serve as a crucial bridge between staking and DeFi, enabling users to optimize their returns effortlessly. By depositing their staked tokens, users unlock the power of yield aggregators, which automatically allocate funds across various DeFi protocols, maximizing potential returns with minimal manual effort. Marinade Finance, among Solana’s LSD protocols, offers a prime example of an integrated yield aggregator. Through Marinade’s platform, users can deposit their mSOL and seamlessly earn yield across a range of supported DeFi protocols.

-

Participate in Governance: Some protocols on ETH offer voting rights for holders of their LSD, allowing them to participate in governance decisions on the platform. Most protocols on Solana use their utility token as governance token, maybe in the nearest future we’ll see protocols on solana accepting their LSD as a governance token.

AIRDROP STRATEGIES AND INCENTIVES

Liquid staking protocols often incorporate airdrops and incentive mechanisms to foster participation and reward early adopters. SolBlaze is at the forefront of this approach, implementing strategic airdrops and reward programs to distribute tokens to active stakers, contributors, and participants in ecosystem growth initiatives. These incentives catalyze network effects, driving adoption and bolstering network security.

Last year, SolBlaze conducted a successful airdrop, which attracted many users to the platform, including myself. The news of the airdrop initially drew me to SolBlaze, and since then, I’ve continued to stake my SOL with them, benefiting from their innovative liquid staking solution and ongoing reward programs. It’s worth noting that while airdrops and incentives are attractive, they should be considered alongside other factors when selecting a liquid staking solution.

ECONOMIC IMPACT ON VALIDATORS

Liquid staking protocols like SolBlaze can positively impact validator operators by increasing the amount of staked SOL, contributing to network security and stability. Some protocols might also offer validator-specific bSOL tokens, allowing users to directly support individual validators and potentially earn higher rewards.

GROWTH OF SOLANA’S LIQUID STAKING ECOSYSTEM

The Solana liquid staking ecosystem has experienced significant growth, with several protocols like Marinade and SolBlaze vying for market share. This competition drives innovation and benefits users by offering a variety of options and features. SolBlaze specifically focuses on decentralization, security, and user-controlled features, aiming to create a robust and transparent liquid staking experience for the Solana community.

IMPACT ON DEFI PROTOCOLS

Liquid staking unlocks new possibilities for DeFi protocols. By introducing readily available bSOL, it increases the overall liquidity in the ecosystem, facilitating new avenues for lending, borrowing, and other financial activities. This, in turn, fosters deeper integration between staking and DeFi, ultimately benefiting the entire Solana ecosystem.

POTENTIAL USE CASES

Solana’s liquid staking ecosystem holds immense potential for the future. As the technology matures, we can expect to see novel use cases emerge, such as:

-

Liquid Staking Derivatives: These could be complex financial instruments built on top of bSOL, enabling advanced trading strategies and risk management options. Liquid staking derivatives may include options, futures, swaps, and other sophisticated products, providing investors with additional tools for hedging, speculation, and portfolio diversification within the Solana ecosystem.

-

Staking-as-a-Service: This could allow institutions and businesses to participate easily in staking without the need for in-depth technical knowledge. Staking-as-a-Service providers would offer comprehensive staking solutions, including token custody, delegation management, and reward distribution, catering to a broader audience of stakeholders seeking exposure to staking rewards and network participation without the complexities of running validator nodes.

-

Decentralized Autonomous Organizations: Liquid staking can facilitate the creation and operation of DAOs on Solana. DAOs leverage staked tokens for governance and decision-making processes, enabling community-driven initiatives, funding proposals, and protocol upgrades. Liquid staking could provide DAOs with a reliable and secure source of voting power, ensuring transparent and decentralized governance within the Solana ecosystem.

-

Asset Tokenization and Fractional Ownership: Liquid staking protocols can support asset tokenization and fractional ownership of real-world assets, such as real estate, art, or intellectual property. Staked tokens can represent ownership stakes in these assets, allowing investors to diversify their portfolios and access previously illiquid markets. Fractional ownership enables broader participation in asset ownership and investment opportunities, unlocking liquidity and democratizing access to value.

-

Smart Contract Integration: Liquid staking can be integrated into smart contract platforms, enabling developers to build decentralized applications that leverage staked assets for various use cases. Smart contracts can interact with liquid staked tokens to facilitate lending and borrowing, automated trading, decentralized exchanges, and other DeFi activities, expanding the utility and interoperability of the Solana ecosystem.

-

Interchain Communication and Cross-Protocol Integration: Liquid staking protocols can facilitate interoperability and cross-protocol integration between different blockchain networks. Through interoperability solutions, staked assets can be transferred seamlessly between Solana and other blockchains, enabling cross-chain transactions, asset swaps, and liquidity provision across diverse ecosystems. Interchain communication enhances the composability and scalability of decentralized applications, fostering collaboration and innovation across multiple blockchain platforms.

These potential use cases illustrate the diverse applications and transformative potential of Solana's liquid staking ecosystem, paving the way for a decentralized financial infrastructure that is resilient, inclusive, and interoperable across various domains and industries.

CONCLUSION

Solana’s liquid staking ecosystem, spearheaded by SolBlaze, represents a paradigm shift in staking dynamics. By combining the security and rewards of staking with the flexibility and liquidity of DeFi, SolBlaze empowers users to maximize the value of their assets while contributing to the growth and resilience of Solana network. As the ecosystem continues to evolve, liquid staking will play a pivotal role in shaping the future of decentralized finance on Solana and beyond.