Special thanks to Steven Rico for the conversation on which this article is based and for helpful feedback on earlier versions.

TLDR

-

Contributions are data. Data are contributions.

-

Each piece of data is a data asset represented on-chain by an IPFS CID (the hash of each individual contribution).

-

Data assets can be owned by any number of people, from zero (free in perpetuity) to everyone. Permissions are determined by the data asset owner(s).

-

Non-transferable ERC-20 governance tokens link the economic value created by individual contributions directly to each contribution and its perceived market value over time. Non-transferable governance tokens hold no economic value. **Each shared data asset is governed by a unique ERC-20 governance token. -

Data assets represented as ERC-721 NFTs enable multiple DAO members to be co-owners of an individual data asset and exercise shared governance over its use. -

Using ERC-1155 token contracts for membership NFTs enables user accounts to be managed, stored, and burned in a fully decentralized manner. This allows users to recover the full liquidity they would be entitled to in the event of a rage quit.

-

Data assets should be valued in network tokens (e.g. ETH, MATIC, FIL, USDC) which increases the security of the base network each time a data asset creates value. No more DAO shitcoins. Just real value created and economically backed by tangible data assets.

-

People can invest in a data asset through data farming. This creates an idea market for contributions (data) where the best contributions are curated through liquidity to reward both the dataset owner(s) and curators.

-

The primary ledger of data asset owners is controlled exclusively by a smart contract (basically a wallet) maintained by a DAO consisting of all contributors across all DAOs. It’s the dataset everyone owns by default. Knowledge as a fundamental human right and public good.

-

Data assets are not securities because:

-

Ownership of a data asset does not require financial investment

-

In cases where a user can invest financially (e.g. by means of data farming):

-

Data is ubiquitous and indistinguishable from user to user when de-identified

-

Different data types (file formats) can contain the same types of information (fields)

-

Lookup how Ocean Protocol deals with this

-

-

Prerequisites for DataDAOs

-

“Maybe governance over default licensing agreements, contracts, etc? Governance over metadata standards?” - Clinamenic

-

“Consent handling, governance, incentives, revenue/ip sharing, data handling, buyer management, community management, simple UI/UX to onboard users eg mobile app, data exploration and pricing for buyers, clear use cases for the data collected, data cleaning and enhancement.” - Robin Lehmann

-

“A database duh” - At0x.eth

Let’s unpack these one by one.

**Governance:**

- Licensing agreements - Metadata standards - Other?

Governance

What would an ideal Data DAO look like and how would it operate? How is the DAO structured?

This structure is borrowed from Shapeshift DAO.

That's pretty much what I'm thinking, except add one layer. I was thinking of using a workstream / working group plus a subDAO structure. We're essentially building a general template for data DAOs which can be replicated within a DAO itself.

I made this for MedDAO last year. https://twitter.com/MedDAO_xyz/status/1602746150003658752?s=20

Working groups are defined internally (but usually things like ops, gov, mktg, design, dev, etc) and can operate either on a periodic token distribution (e.g. quarterly budget for elected role holders, bounties, and peer reward systems) and/or an RFP grants system. https://annika.mirror.xyz/gKDxr6uewHaeyt3_ZY6wA2hB4iobPP8Ne_EsBy3cp7k

This is where tokenomics comes into play. How long of a runway does the DAO get? Is there a accountability in how the DAO gets ROI for remunerating contributors with tokens? Is there infinite minting or a fixed total supply? Are tokens transferable to create a secondary market, or non-transferable and purely accrued for governance or other utility?

Tokenomics

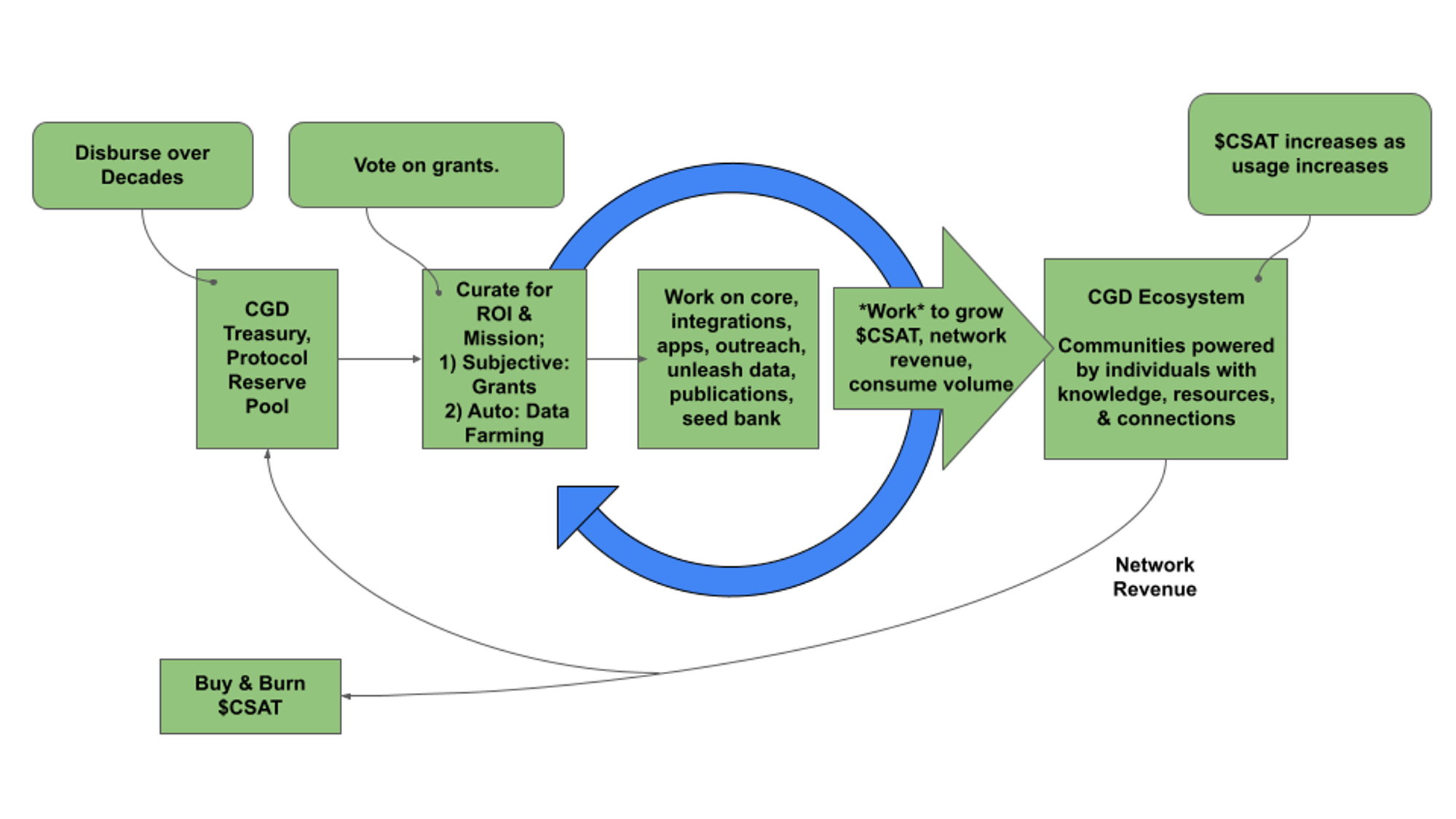

The best answer I've ever seen to these questions came a few years ago by cofounder of Ocean Protocol, and Balancer multi-sig member, Trent McConaghy. https://blog.oceanprotocol.com/the-web3-sustainability-loop-b2a4097a36e

This is the sustainability loop concept translated to CGD:

The token that accrues value and is used for processing transactions is just the regular network token: ETH, FIL, MATIC, etc. This has two benefits, 1) it increases security of the network on which the DAO relies, 2) there will always be more liquidity for the network token than a DAO token.

The second token, the DAO token, would be non-transferable and only used for governance and/or additional utility (e.g. gated content or permissions). This removes any potential financial value from the token, therefore eliminating any potential concerns about securities laws because they can't be bought/sold. That in turn eliminates the biggest potential attack vector on the governance surface of a DAO = hostile takeover.

The only problem is, how to reconcile a non-transferable DAO token with the sustainability loop? If the DAO token is what's disbursed to contributors, then how would the network revenue grow because of it? So, basically, although there would be qualitative advantages to a two-token model, I don't quite have the value capture side worked out yet. I'm thinking it would involve something of a reputation staking/lending model, wherein members who have earned governance tokens would be able to stake them when submitting a proposal and asking for payment in network tokens. If they complete the job, they get paid and get their staked tokens back. If they don't their stake gets slashed. This would require kickstarting the economy so the DAO has network tokens in the treasury to pay people, but, any economy requires kickstarting. It also protects the paid roles bc people need to earn reputation first before having tokens they can stake to apply for the role/task.

The initial proposal for a DAO would need to contain a revenue generating business model, something most DAOs don't think about until after the fact. But, data DAOs all have an internal revenue model built in by selling the data they produce through their own activities. DAOs are Schelling points for expert knowledge, and that's valuable. So, in theory, any DAO should be able to sustain itself through selling data, which would potentially enable a two-token model sustainability loop where the DAO token is non-transferable.

It turns a zero sum economy where money is exchanged for (presumably) equal value; 1 - (+1) = 0, into an economy where both sides are giving because of the reputation staking; 1 - (-1) = 2. I've been playing with the idea that this is the core mechanism behind ReFi. Cryptoeconomic systems aren't subject to the same thermodynamic limitations that real world economies are. This enables us to bend the rules and not just capture value but create it as well.

So, that means variable total supply (yes minting, yes burning, no transferability). I think it means initial supply is either zero or arbitrary, but would be set by the remuneration for publishing the initial proposal + dataset on which the DAO is founded (genesis allocation). Buybacks become stake slashing. And the network token is what grows in value instead of the DAO token, but, the DAO has data assets valued in network tokens so the DAO does still have a mechanism to accrue value over time.

It's kind of like applying the concept of IPC (interplanetary consensus) to social interactions (e.g. DAO contributions).

The DataDAO Protocol

-

A "focused" DAO like the Cannabis Genome DAO that is focused on improving the quality and distribution of cannabis genome data shouldn't have to think or be responsible for creating liquidity, it diverts attention and resources away from it's mission.

-

At this present moment in time, stablecoins (USDC/DAI) are the most useful token for a working DAO ie. where contributors are using the earnings to pay for rent and bills.

For governance:

- I would like to test multiple reputation tokens that can be tracked and analyzed over time. Each reputation token is tied to actions taken by contributors. In order to answer questions like: Who is making the best decsions within the DAO that leads to revenue? Which reputation token should have greater weight when it comes to making governance decisions?

For value capture, I have used an idea from the book Profit First:

-

The treasury is split up into three safes: profit, tax and operation expenses. When revenue enters the DAO it is split into these three safes, the allocation % change programmatically according to annual revenue or other parameters.

-

The profit safe is value capture which can then be sold as Treasury Bills. This profit is distributed to investors or contributors that decide to opt-in to investing financially.

-

Owners of Treasury Bills, could have voting rights alongside those that have reputational tokens.

-

Treasury Bills are another way to raise capital for the DAO.

-

ROI of Treasury Bills is correlated with the profit safe or set by the DAO. Investors and contributors can make informed decisions by tracking transactions on the blockchain and decide their value.

(I'm thinking that Treasury Bills would be similar to the rETH token, I haven't spent enough time looking into to know if it would work)

Very cool. I've also played with the idea of multiple treasuries, and even a protocol managed reserve pool, but ultimately decided I think they're both potentially detrimental at genesis. It also creates the problem of having to deal with a margin of error when predicting future expenses and profit. Those issues are avoided with a single treasury governed by a condition that prevents approving proposals that spend more than exists. If we also simply assign a multiplier to contributions, we can monitor smart contracts for triggers and avoid the need for multiple tokens. Last, what if you replace Treasury Bills with Membership NFTs (soul bound and upgradeable)? I think it would have the same effect where they can be bought as an investment vehicle, but managed as an account. Then, that just becomes one more smart contract to monitor and factor into governance token weighting during votes and if the DAO is profitable, dividends. Let's try to define what we think the necessary genesis conditions would be for a data DAO like this. There needs to be a proposal including a CID of the initial co-owned and hopefully revenue generating dataset, the arbitrary token allocation for the initial contribution, and an arbitrary financial commitment (e.g. from the founders, investors, utility NFT sale or membership NFT sale). Maybe the financial commitment would be that the founders all have to put a price on the dataset or something. I see what you mean in terms of having something people get in return for their investment (e.g. analogous to rETH tokens) and that's something they could use to rage quit with.

Potential Caveats and Unanswered Questions

-

Contributions are data. Data are contributions.

-

Each piece of data is a data asset represented on-chain by an IPFS CID (the hash of each individual contribution).

-

Data assets can be owned by any number of people, from zero (free in perpetuity) to everyone. Permissions are determined by the data asset owner(s).

-

Non-transferable ERC-20 governance tokens link the economic value created by individual contributions directly to each contribution and its perceived market value over time.

-

Non-transferable governance tokens hold no economic value.

-

Each shared data asset is governed by a unique ERC-20 governance token contract.

-

Data assets represented as ERC-721 NFTs enable multiple DAO members to be co-owners of an individual data asset and exercise shared governance over its use.

-

Using ERC-1155 token contracts for membership NFTs enables user accounts to be managed, stored, and burned in a fully decentralized manner. This allows users to recover the full liquidity they would be entitled to in the event of a rage quit.

-

Data assets are valued in network tokens (e.g. ETH, MATIC, FIL, USDC) which increases the security of the base network each time a data asset creates value. No more DAO shitcoins. Just real value created and economically backed by tangible data assets.

Global Public Goods and The Protocol Sink Thesis on Bankless

Settlement Assurances and the Protocol Sink Thesis | Ethereal Virtual Summit 2020

-

People can invest in a data asset through data farming. This involves staking network tokens on the protocol to earn veGov tokens. veGov tokens can be staked on data assets to earn network tokens through a share of the profits generated by a data asset. This creates an idea market for contributions (data) where the best contributions are curated through liquidity to reward both the dataset owner(s) and curators.

-

The primary ledger of data asset owners is controlled exclusively by a smart contract (basically a wallet) maintained by a DAO consisting of all contributors across all DAOs. It’s the dataset everyone owns by default. Knowledge as a fundamental human right and public good.

-

Data assets are not securities because:

-

Ownership of a data asset does not require financial investment

-

In cases where a user can invest financially (e.g. by means of data farming):

-

Data is ubiquitous and indistinguishable from user to user when de-identified

-

Different data types (file formats) can contain the same types of information (fields)

-

Lookup how Ocean Protocol deals with this

-

-

Additional References

-

https://cannabisgenome.notion.site/Community-Values-4b22ab41aa324ae7b09ccdbfd6cb92d3

-

https://docs.google.com/document/d/1ownbpMzTYqc_nIY05ZbPYKq32CF0T3yet6pAhmp5JFM/edit?usp=sharing

-

https://twitter.com/curiosoacerca/status/1540273580503715841

-

https://mirror.xyz/elijahspina.eth/1ll79DEikQuPkMvjBXVg2XQn4IVtbkGrUUk4SygHlho