As Elys Network reaches the six-month milestone since its mainnet launch in December 2024, it's the right time to reflect on our journey—what we’ve accomplished, what remains to be done, and how we’re positioning ourselves for the next phase of growth.

From our first lines of code and testnet deployments over two year ago, to shipping a robust mainnet and attracting tens of thousands of users, the past year has been a period of rapid development and deep learning. This article serves as a progress update and a transparent look into the future of Elys.

Growth to Date

Since launch, Elys Network has achieved meaningful growth across core metrics:

-

TVL: Grown from $500K to almost $6M, a 12x increase since launch

-

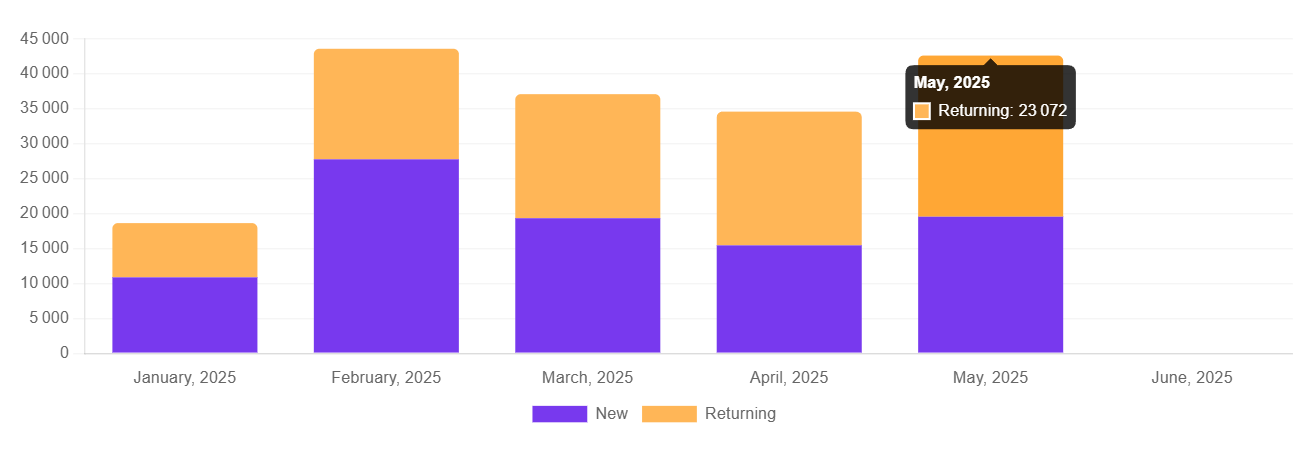

Total Users: From 17,000 in January to a peak of 42,000 in May

-

Returning Users: From 7,700 in January to 24,000 in May, indicating increasing engagement and user stickiness

These figures reflect strong interest in the DeFi products we’re building and validate the need for a more seamless, unified experience in DeFi.

Where We Stand Today

Despite strong traction, we recognize that significant challenges remain. Specifically, for Elys to reach meaningful product-market fit, two things are critical:

-

Volume generation: Some liquidity pools perform well, especially those with lower liquidity and higher fee concentration. However, flagship pools like BTC and ATOM currently lack sufficient volume to produce higher fees for liquidity providers.

-

Token sustainability: Incentive-driven growth (via EDEN) is not a long-term strategy. Transitioning to a sustainable incentive model is necessary to protect the health of our ecosystem and token economy.

What’s Changing

Introducing the PerpDEX

A perpetual DEX focused on high-demand assets like BTC and ATOM will go live soon. This product is designed to:

-

Generate fee-based yield for LPs and ELYS stakers

-

Create new trading demand within the ecosystem

-

Anchor liquidity in strategic pools

Launching AI Vaults

Our AI-powered vaults will automate:

-

Pool rebalancing

-

Arbitrage vaults

-

Delta-neutral strategies vaults

The aim is to generate returns for users while driving protocol-level volume and utility across LP pools and the broader ecosystem.

Adjusting Incentive Mechanisms

We will initiate a governance proposal to:

-

Reduce maximum EDEN APR across vaults, pools, and staking

-

Phase out the bootstrapping phase responsibly every month starting from this proposal to improve sustainability over time.

These changes are aligned with the launch of the PerpDEX to ensure that volume—not emissions—becomes the primary source of rewards.

Enhancing Utility for ELYS

The upcoming product suite—PerpDEX, vaults, and more—will all embed deeper utility for the ELYS token.

But we don't want to stop there. Elys needs to be more useful and bring more benefits to holders who use the platform. So we're working on different innovative ways to make ELYS the token you need to hold when using our app.

Strategic Objectives

To summarize, our roadmap for the coming months revolves around four key objectives:

-

Drive sustained volume through the launch of the PerpDEX

-

Reduce and realign incentives as we exit the bootstrapping phase

-

Deploy AI vaults to automate capital efficiency and deepen yield strategies

-

Expand the role and utility of the ELYS token across the ecosystem

Looking Ahead

Now that our v1 product stack will be complete, the next phase is about scale.

Our focus is simple: volume, and value creation. Without volume, DeFi ecosystems cannot sustain liquidity, usage, or token value.

Over the coming weeks, you will see the first steps of this new direction, starting with the launch of the PerpDEX and more information about upcoming products.

Thank You

From the earliest testnet contributors to today’s liquidity providers, stakers, and governance participants—thank you.

Your belief in Elys Network has made the last six months possible. We’re more focused than ever on building products that serve your needs, generate sustainable yield, and create long-term value.