Public team members: @haycarlitos, @espejelomar, @eespejel.

1. Description

Apprecio.Finance is a decentralized inflation dashboard for multiple countries. Starting with Mexico as the minimum viable product. The next step: United States of America (white paper).

2. Problem

The increase in inflation rates could encourage governments to intervene in the measurement of inflation.

3. Why

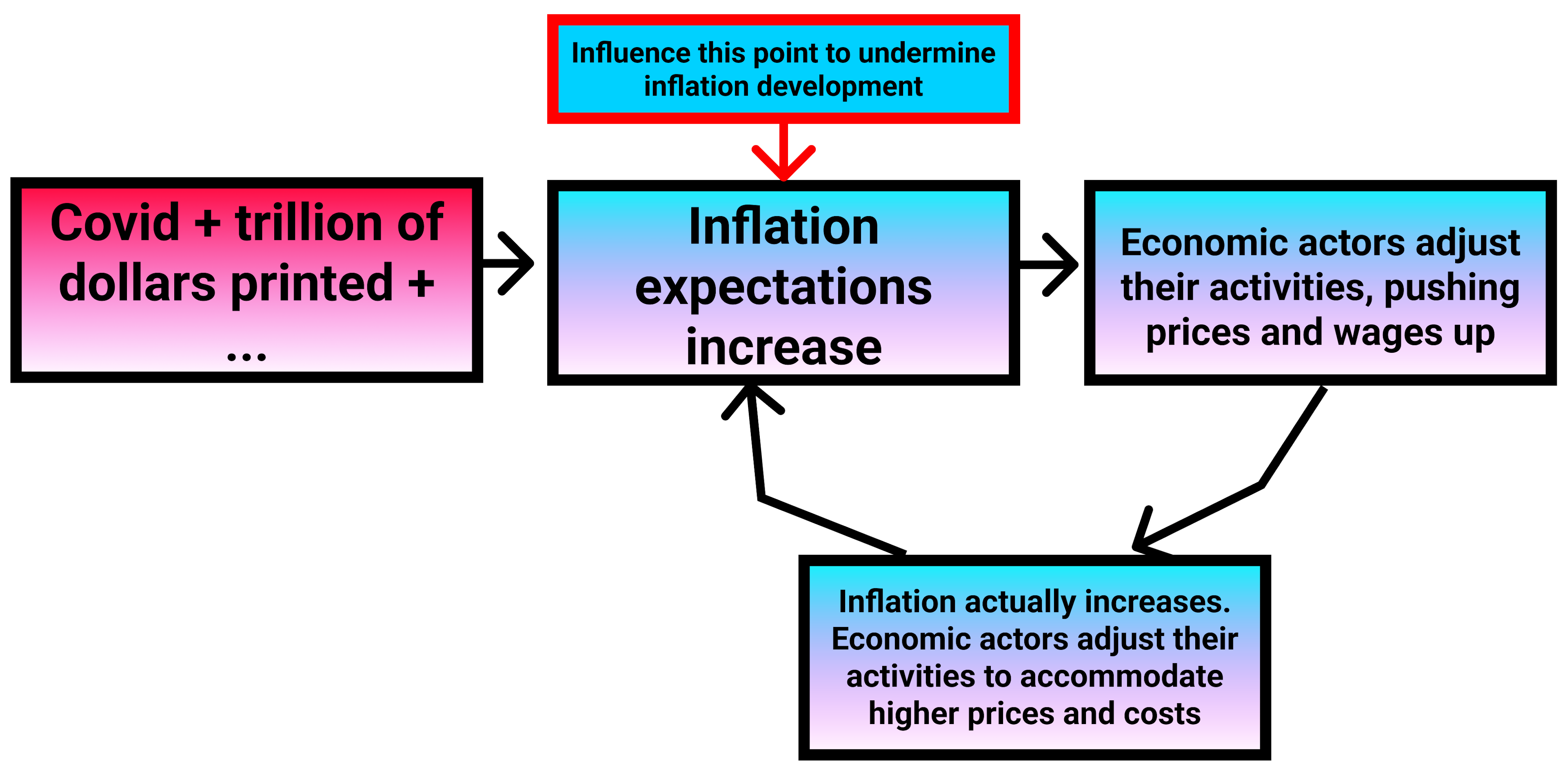

In general, high inflation is not desired by governments in turn (see here, here). However, when economic actors expect inflation to rise, they can influence real prices and fulfill the prophecy. Therefore, one way to undermine the development of inflation is to influence (or censor) inflation expectations (see the simplified figure below). Therefore, there is an incentive to intervene in the evolution of inflation expectations. One way to do this is by censoring or tampering with inflation data, which creates the need for an uncensorable tool to measure actual inflation (more details below).

Step 1: Higher inflation expectations could lead to higher inflation rates

Individuals change their behavior according to what they believe prices will be in the future, these are called inflation expectations (expected rate of increase in prices).

Here are examples of actions that actors in the economy might take when they expect high inflation:

- People might increase their spending today to get cheaper prices. However, increased spending will tend to push prices up.

- Workers may seek higher wages in anticipation of a rising cost of living. Higher wages would drive up prices in the economy since (1) firms would tend to raise the prices of their products to pay for higher labor costs, and (2) workers can now buy more goods in the economy, which drives up prices.

- Firms, to increase their profit margins, may raise their own prices in anticipation of, for example, higher prices from their suppliers and wages. This anticipation of high prices would tend to push prices higher (this example was given in the reverse order here).

In other words, inflation expectations can affect actual inflation. If economic actors expect higher inflation, inflation could rise and vice versa (Director of Cleveland Fed’s Center for Inflation Research, 2019).

Step 2: So Controlling Inflation Expectations Might Lower Inflation

“If enough of the right people believe that inflation is going to happen, it will. As such, when inflation is happening, there is often a push to censor discussion of inflation itself, under the grounds that discussing the problem actually causes it in the first place.” (1720 Newsletter, 2021)

Stakeholders that benefit from a lower rate of inflation, such as a government, could benefit from avoiding expectations of high inflation (for example, by arguing that inflation is transitory, not to worry).

In the worst case, governments could censor discussions of inflation. The Argentine government went so far as to prohibit the general public from creating their own inflation measures, citizens must believe the rate they publish centrally.

This might not present a credible threat today in advanced economies. However, there is the incentive for a government that controls inflation measures to intervene in the data. We can develop an alternative (for example, with a theoretically uncensorable technology like the Ethereum blockchain) or get used to the fact that governments have an incentive (and some, competition) to provide biased inflation data.

4. How Apprecio.Finance looks like

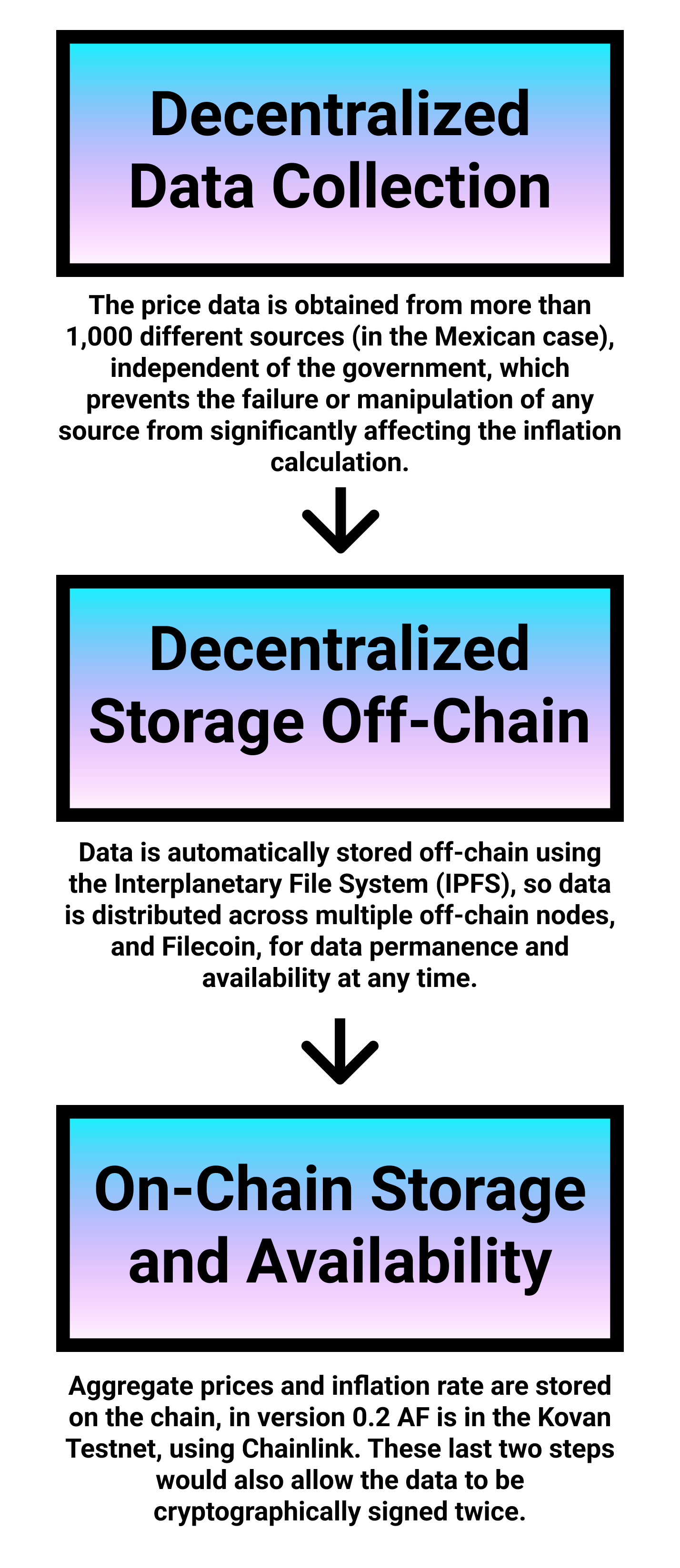

We calculate inflation in a decentralized way and store it on the Ethereum blockchain (Kovan testnet for version 0.2) so no one can censor it.

Please refer to the Apprecio.Finance whitepaper for more details.

To achieve the greatest possible resistance to censorship, the minimum viable product for Mexico consists of 3 layers of decentralization that could be replicated for the following countries (diagram below).

In particular, data collection is a crucial step to maintain decentralization. If manipulation of the data source by a third party can significantly alter the inflation rate measurement, then the objective of censorship resistance would be compromised.

Thus, for the Mexican case, our first measure, the data are obtained from two different types of sources.

- Small sellers. Through the Apprecio web and mobile applications.

- Medium and large sellers. Through web scrapping of online stores.

5. Last thought

We deeply believe in the impact that a decentralized inflation measure could have on the world economy. While we haven't (yet) figured out a business model. This can be the beginning of a strong community that could guarantee the quality of life, purchasing power and assets of the citizens of the Network State throughout the world.

WITH 🌶️ FROM MEXICO CITY: Omar, Eduardo, Carlos

Sources

- Rob Rich, Director of Cleveland Fed’s Center for Inflation Research (2019). “What are inflation expectations, and why do they matter?”. The Cleveland Fed Digest.

- Nelson D. Schwartz and Jeanna Smialek (2021). “Inflation Fear Lurks, Even as Officials Say Not to Worry“. The New York Times.

- Simone Foxman & Roberto A. Ferdman (2013). “Argentines are now allowed to know the real rate of inflation, thanks to their courts“. Quartz.

- 1729 (2021). “A $100k Prize for a Decentralized Inflation Dashboard”.

- Matt Viser and Jeff Stein (2022) “Democrats worry Biden could pay the political price for rising inflation“. The Washington Post.

- Jim Tankersly (2020) “The Inflation Miscalculation Complicating Biden’s Agenda”. The New York Times.