The market has been extremely volatile last week. FTX, a leading crypto exchange of $32B valuation, declared bankruptcy and halted its operations including Alameda Research. Our portfolio company, iZUMi Finance, published a research report on the growth potential of decentralised exchanges (DEX), the state of Uniswap v3 and DEX aggregators. In summary, the recent market turmoil highlights the lack of integrity in certain CeFi players, and DeFi has huge room to grow for mitigating trust issues between customers and service providers.

Here are some key takeaways of the report:

-

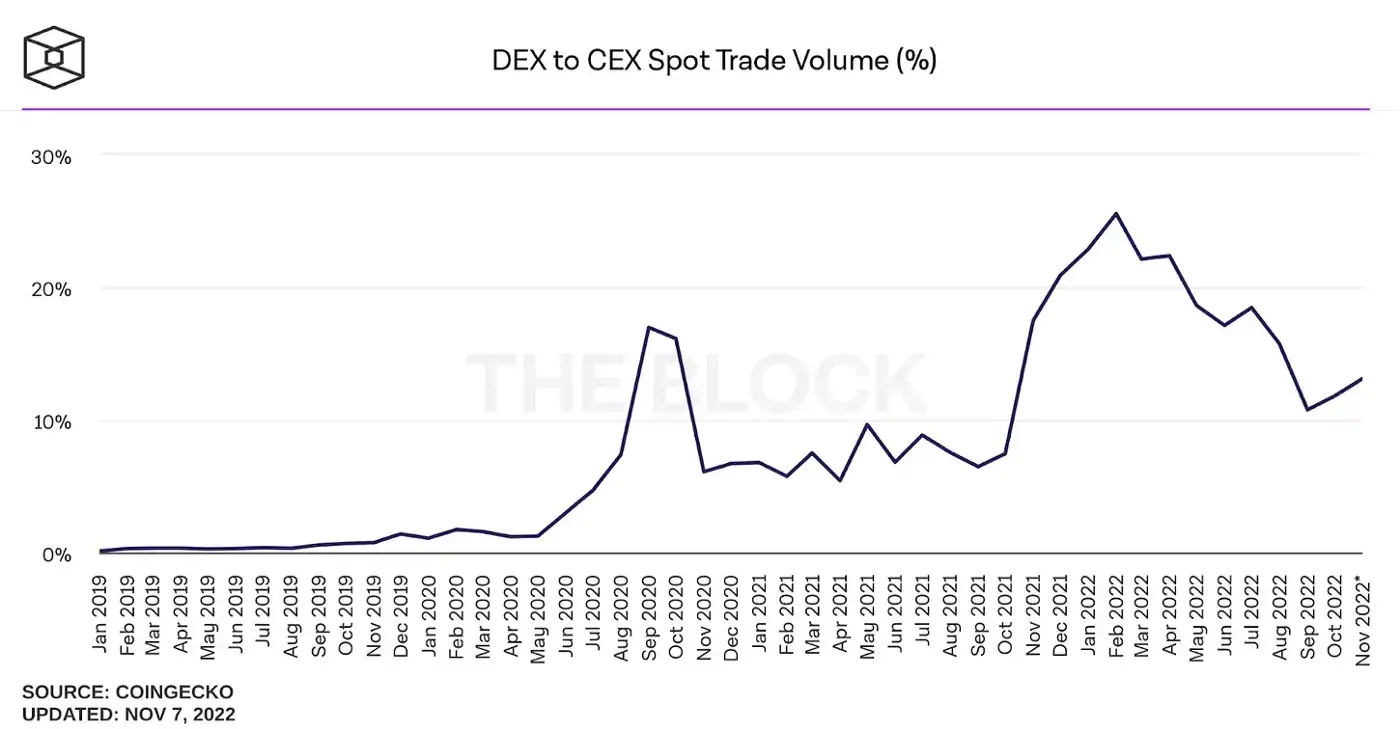

DEX accounted for around 15% of total trading volume in the crypto industry. It has been rising consistently in Q4 and shows growing demand post-FTX collapse.

-

WETH/USDC is the largest pool in Uniswap v3. WETH/USDC 0.05% and 0.3% pools have $300.3B and $65.48B trading volume respectively ever since the launch of Uniswap V3, and account for 39.4% and 8.6% of the total trading volume.

-

The share of aggregators increases significantly in a bullish market environment and then decreases. The main reason for this is that during bear markets, on-chain activities shrink, and most of the trading volume comes from arbitrageurs and other trading bots, which interact directly with the Uniswap pool and generally operate less through aggregators.

-

The top DEXes are focusing on bringing in new users, including improving user experience and achieving traffic exposure on both the mobile and the web end.

-

The emergence of CL-AMM DEXes on multi-chain, and the professionalization of AMM market making. We have seen new players in various blockchains like Ref Finance v2 in NEAR, Trader Joe V2 on Avalanche and Sui ecosystem’s MoveX.

Read the full report at

About Everest Ventures GroupEverest Ventures Group (“EVG”) is a Web 3 focused venture studio with presence across five continents. Since 2018, it has incubated multiple technology infrastructures such as Kikitrade, Aspen Digital, Vibra Africa, LiveArtX, Cassava and BlockTempo to drive the mass adoption of digital assets. In addition, EVG is an early investor and advisor to 40+ blockchain projects globally, including renowned startups like Dapper Labs, Animoca Brands, Immutable, The Sandbox, Yuga Labs, Kraken, Lukka, Celestia, Upbit and more.

About iZUMi

iZUMi Finance is a multi-chain DeFi protocol providing One-Stop Liquidity as a Service (LaaS). Its philosophy is that every token deserves a better on-chain liquidity in an efficient and lasting way. Deployed on Ethereum, BNB Chain, Polygon, and Arbitrum, iZUMi has provided liquidity services for BitDAO and 10+ protocols, and managed over $60M liquidity from reputable institutions and 8,000 individual LPs.