It’s Arbitrum yield farming season soon. It’s intimidating to see so many projects submitted but the final 30 have been chosen. Thank you Cliffton for the excel sheet, it made it easier to do some analysis. Let’s dive in!

STIP Result Analysis

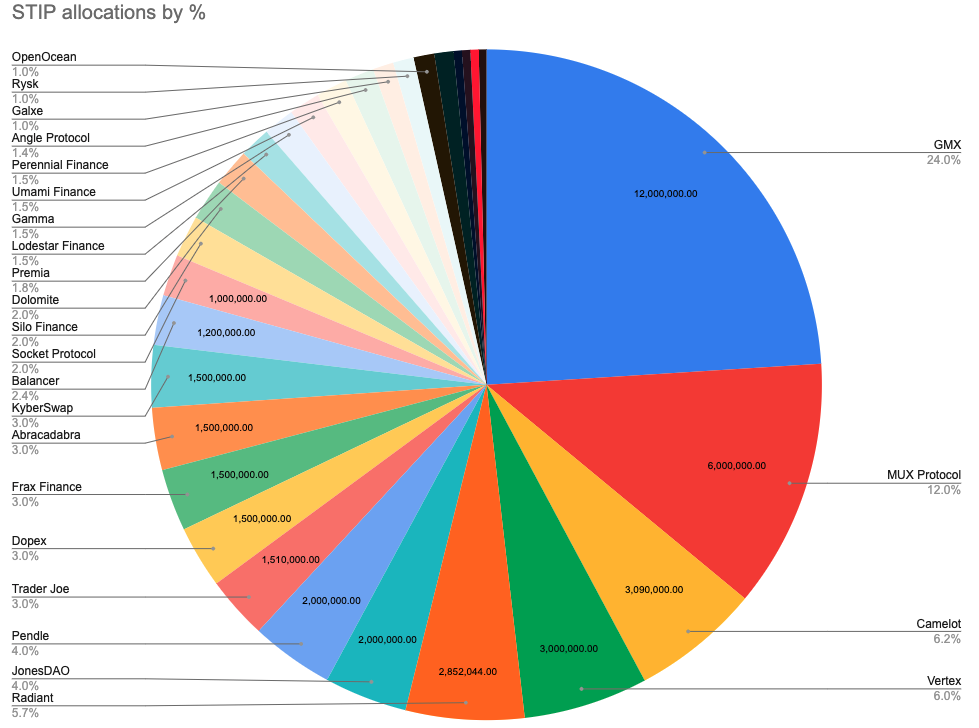

These 12 projects with their proposals hyperlinked garnered 80% of the STIP(38.45M ARB): GMX, MUX Protocol, Camelot, Vertex + Elixir, Radiant, JonesDAO, Pendle, Trader Joe, Dopex, Frax Finance, Abracadabra, KyberSwap.

For the curious, here’s a Twitter list to follow announcements from these projects and the other 18!

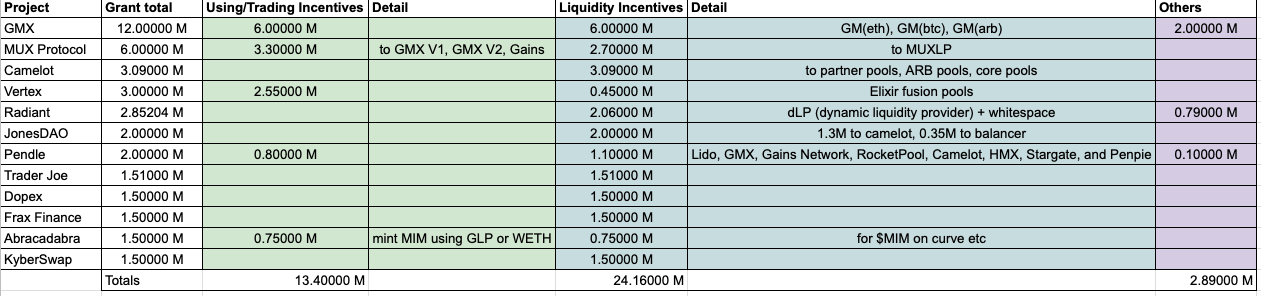

Now let’s look closer at the grant ask just for the top 12

It seems 60+% will go into liquidity incentives and 35+% go into using/trading incentives for these protocols. A good ~16+M will be going to GMX with support from MUX protocol, Pendle, and Abracadabra. This shows just how important GMX is for Arbitrum. Therefore understanding GMX will be key. Next in line is probably Camelot with its own incentives boosted by JonesDAO’s and Pendle’s.

On Arbitrum’s governance

There’s some discussion on extending the STIP due to it being heavily oversubscribed. It’s interesting to see how Arbitrum's ecosystem coalesced the way it did. You see many familiar faces, Stable Lab, Plurality Labs (couple ex-gitcoiners), questbook coming in to participate and be a part of the DAO.

Looking at this first proposal, with 50M ARB is being used at one go, the one question that I have is: how does the DAO treasury replenish itself?

For a couple years I’ve seen many DAOs simply draw down the treasury day after day, many not even diversifying from their native token. It will be interesting to see the kinds of dynamics that emerge:

-

Do protocols eventually dedicate a portion of their revenue to the DAO as a ‘tax’?

-

Will $ARB continue to be some kind of multi-purpose governance + incentive token?

-

Will there by some kind of global tax to the DAO? eg. some chains send some gas fees to some agreed upon entity

Either way, I think Arbitrum is off to a very strong start!

What might happen?

The essence of the STIP is centered around bringing new users to Arbitrum (bridging to Arbitrum), increasing TVL (liquidity incentives), increasing activity (usage/trading incentives). Hence most projects seem to be focused on these core objectives.

Bridging to Arbitrum

-

Arbitrum’s official bridge only support Mainnet <> Arbitrum

-

There are 24 bridges to Arbitrum as reported by Alchemy

-

Interestingly, among the winning projects only Socket Protocol seems to be focused on bridging, specifically the L2/L3 Superbridge and Sockets API/SDK bridges.

Liquidity incentives

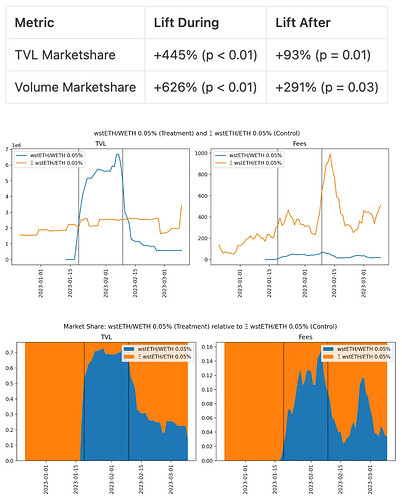

- Looking at Uniswap Foundation’s analysis done by Gauntlet, liquidity mining does have the potential for sticky liquidity with 40% of their incentivised pools seeing some result. What’s important to note in this report is that it seems liquidity incentives help to unlock pent up demand as with the wstETH/ETH pool.

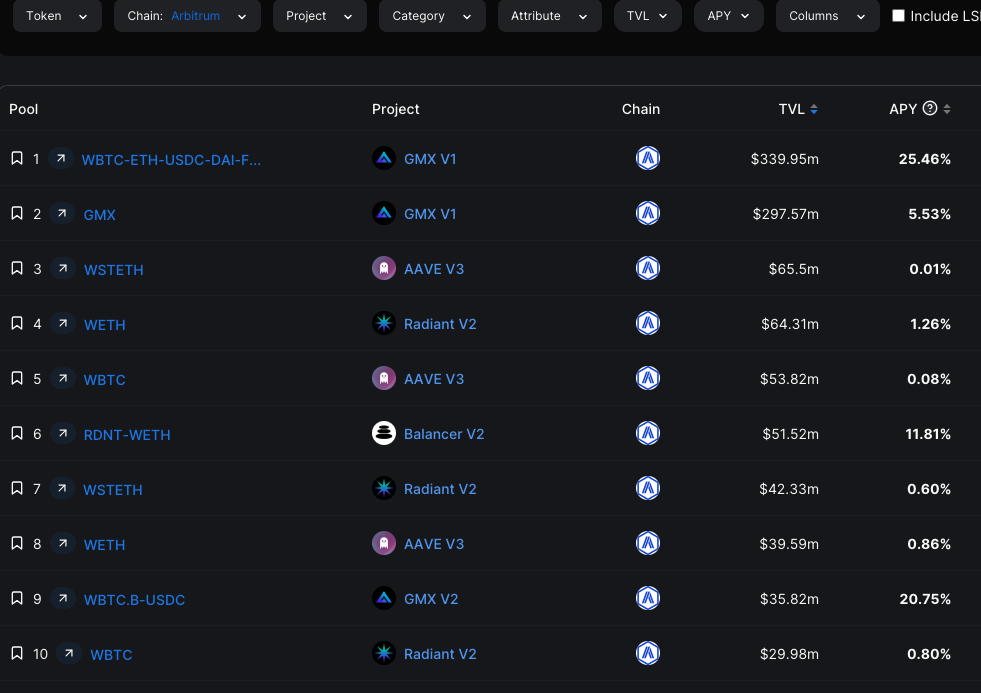

- Sorted by TVL, Arbitrum doesn’t seem to have really high APYs (which is a good sign because it doesn’t rely on wild ponzinomics) so liquidity incentives concentrated around GMX and its dominant protocols would probably help incentivise people to try things

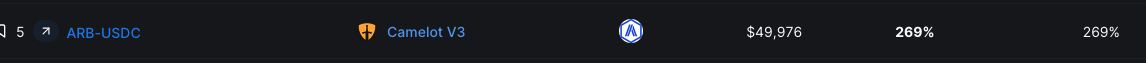

- Camelot has a crazy APY ARB-USDC pool, not sure why

Using/ Trading Incentives

-

It seems that anything goes here as each protocol is differentiated and incentivises users to work with them.

-

There is some synergy as so many protocols are integrated into GMX and Camelot

-

Arbitrum’s strength is its suite of defi protocols, regardless of market conditions, the flywheel of trading + liquidity incentives will probably lead to a lot of activity during the STIP

Some predictions, obviously NFA

-

Your timeline will be only talking about Arbitrum from November to January

-

Yields will probably go up (h/t to Pendle) as the liquidity incentives kick in. Knowing how awesome their twitter account is, a lot of TVL will probably be attracted to Pendle and get locked up in their products.

-

A unique thing about Arbitrum is the sheer abundance of LP tokens, yield tokens, rev-share tokens which make it easy to build integrations with. I’ll be watching Frax Financ and Abracadabra.

-

But don’t fade on the smaller protocols as they might have higher APR. Especially the ones integrated closely with Camelot and GMX. Projects like Gamma (had experience with liquidity incentives for Uniswap’s), Stella (profitable strategies on Pendle), Lodestar Finance (Aave-like money market) have very simple ways of taking part too.

-

GMX’s (and other exchanges) model is dependent on volatility, so going for pools that you expect more volatility might lead to higher fees and thus APR

-

Even though you see 50M ARB released, the next big unlock is Mar 2024 so I don’t expect much dumping soon. Also based on the airdrop, many of these protocols realise that participating in DAO governance is probably a good idea rather than instadumping. So h/t to Stable labs, Plurality labs, and the foundation team for demonstrating value so quickly.

What should I do?

-

Pin the Twitter list to follow announcements as you will suddenly see 30 programs spring up at the same time

-

Get ready ETH or stables to bridge, and probably through Socket Protocol bridges to save on fees if you want to participate

-

Use Arbitrum when the programs begin. Have fun and may defi summer begin (in the middle of winter season)