Disclaimer: This article was originally published on 01/24/2022 in Spanish, therefore all data mentioned may have changed by today (not that much tho).

Contents

- My great aunt asked me what an NFT is

- The OG’s

- The 2020/2021 Boom

- What did the best ones do?

- Closing thoughts

1. My great aunt asked me what an NFT is

Sometimes it seems like a top signal when your 4 year old cousin or the neighborhood plumber asks you: what the hell is a NFT? Being an increasingly common situation in my daily life, I am forced to explain it several times a day. Formerly called a deed, an NFT represents a Non-Fungible Token. Whether it is an ERC-721 or 1155, for a token to be non-fungible means that it is unique and cannot be replaced or exchanged for another. For example, a cryptocurrency such as Bitcoin or Ether, is fully interchangeable for another unit of them, since all units in circulation are exactly the same.

In the term alone lies the greatest disruption of this invention, that something is unique and cannot be copied. And why couldn't it be copied? Because an NFT is powered by a tamper-proof decentralized registration system based on blockchain technology.

Therefore:

- Each NFT is associated with a unique Ethereum address and is simply verifiable.

- It is indivisible and is not exchangeable at a 1:1 ratio.

- No one who buys an NFT can change the information about its previous owner.

- It "lives" on Ethereum and is bought and sold on Ethereum-based marketplaces.

2. The OG’s

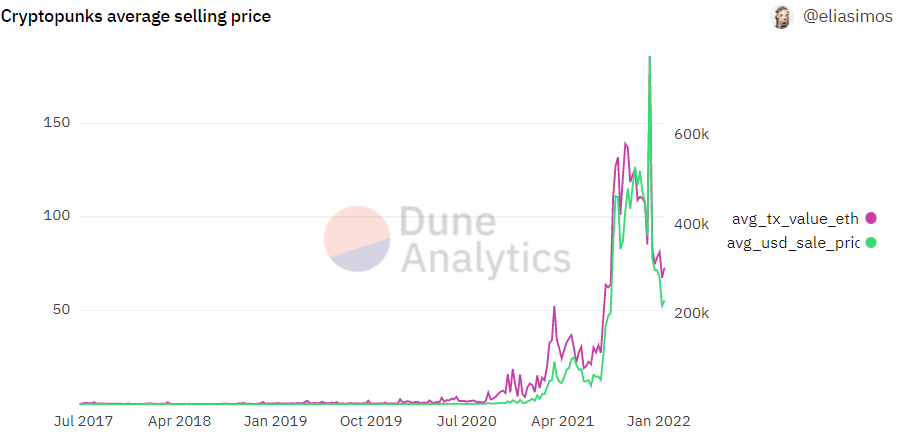

Back in June 2017, John Watkinson and Matt Hall came up with the great idea of creating 10,000 pixelated (with a piece of neck) 24x24 heads, and selling 9,000 of them practically for free, on the Ethereum network. What made this project interesting was the concept that none of the 10,000 CryptoPunks were going to be the same as any other in the collection, they were all going to be different. Years after the mint, we could see the floor price of a CryptoPunk at 186 ETH or USD 780,000 at the time, an absolute madness…

An absolute madness, unless this is the NFT that inspired the ERC-721 standard, was the first avatar-PFP (Profile Picture) style project, was the first project to set the maximum supply at 10,000 units, was the first project to capture the attention of people like Jay-Z, Snoop Dogg and Serena Williams; or unless this is the first NFT to have made it to places like Christie's of London, The New York Times, Bloomberg, The Outline, and more. These pixelated avatars massified the concept of generative art, where many images can be created algorithmically by generating different combinations with different attributes. At the time of writing this article, CryptoPunks accumulates a total volume of 658,273 ETH or USD 2,046 million, a figure that would be enough to hold a DevCon in North Korea, hire Metallica and have them cover "Baby" from Justin Bieber. Yeah, that much.

While CryptoPunks did not bring any utility as many projects that I will discuss later did, they started the cycle in which people were willing to pay millions of dollars just to have one as a profile picture on Twitter, CryptoPunks are the Bitcoin of the NFTs-PFP. Of course, then Ethereum came along and revolutionized the blockchain that Bitcoin had created, but that doesn't mean that Bitcoin is no longer worth anything (the flippening I can feel you).

Long after, projects like Bored Ape Yacht Club, SupDucks, Doodles, World of Women, Loot, VeeFriends, Lazy Lions, Pudgy Penguins, Cool Cats, CyberKongz, Alien Frens and many more; resoundingly changed the concept of NFTs established by CryptoPunks and CryptoKitties. Before explaining the new narrative that was born in 2021, let's go with a bit of history.

3. The 2020/2021 Boom

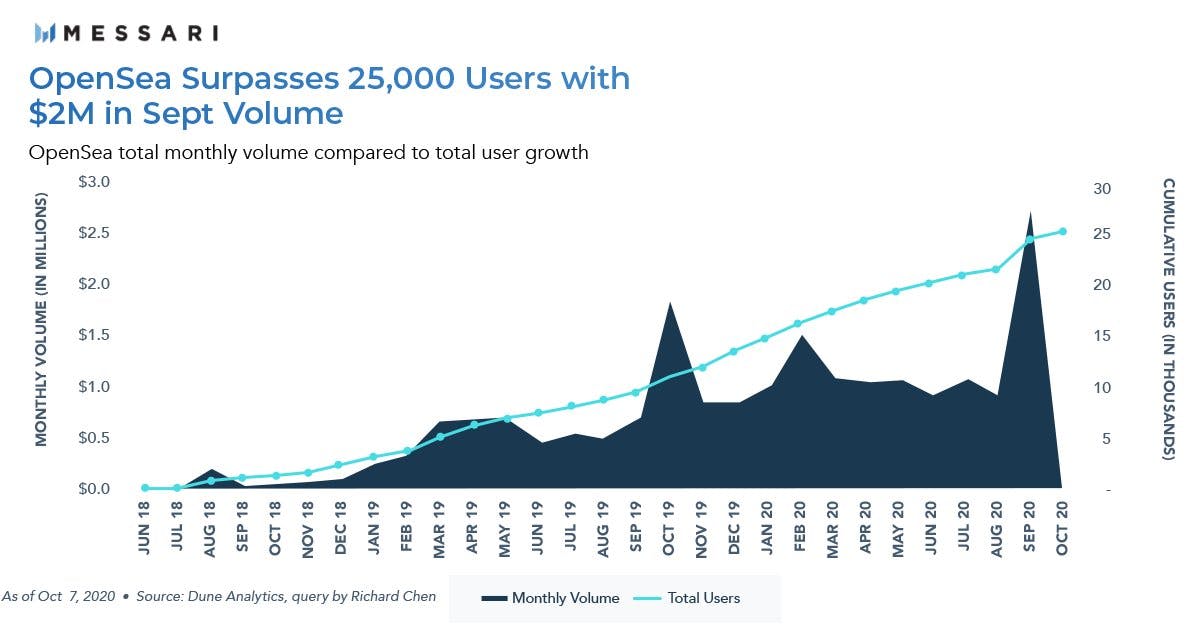

While most of the world started hearing about NFTs in 2020, the reality is that the marketplaces we know today like OpenSea and SuperRare were created in 2017, when nearly 100% of the market was dominated by Ethereum. That changed in 2020 when blockchains like WAX and Flow launched networks specifically for gaming and consumer applications. In 2020, the average monthly sales on OpenSea were USD 1 million, but December marked the first growth, with hype building up for the release of NBA Top Shot and games like Axie Infinity and Sorare. 2020 ended with a cumulative total volume of USD 130 million and an average price per NFT of USD 161 (the highest since 2017). But more importantly, 2020 brought record demand for NFTs, when the number of users interacting with OpenSea went from over 10,000 to 25,000 in just one year.

2021 arrived and changed everything. The first narrative to explode at the beginning of the year was sports, with NBA Top Shot leading the way. By Q2 2021, sports NFT projects accumulated more than USD 50 million in secondary market volume. As the traditional marketplace noticed the gradual entry of artists into the digital world, platforms such as Nifty Gateway and SuperRare dominated the business model, offering artists a new way to monetize their work. By collecting royalties for each sale on the secondary market, this nascent industry was showing the world how Web 3 could change forever the way art was bought and sold. Later, heavyweight competitors such as Art Blocks and Foundation joined in.

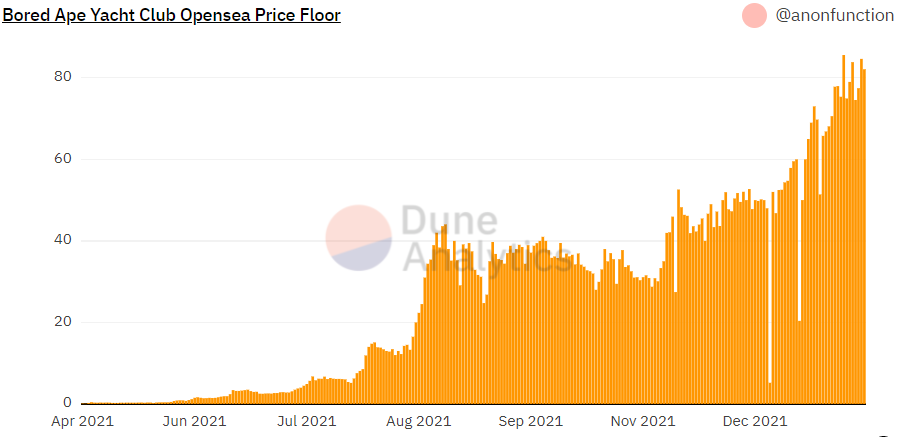

Back to the PFP world, April 2021 saw the arrival of some primates that simply took everything out of control; I'm talking about Bored Ape Yacht Club (BAYC). With over 600,000 ETH of volume across their 4 collections, these 10,000 monkeys on the Ethereum network managed to put together one of the most well-known PFP projects in the world. Having a floor price of 100 ETH and being the highest among all collections, each holder of an Ape has access to exclusive benefits. When Bored Apes went public they cost 0.08 ETH + gas, which (at today's price) would give us a return of over 100,000%, a number 10,000 times greater than the average annualized return of the S&P 500 since 1957.

Any inhabitant of the earth, even its creators, must have wondered: how could a digital drawing of a monkey have achieved such things? In the next section I will try to explain how BAYC and a few other projects changed the narrative of the NFTs. In the meantime, let's continue with the year.

Looking at other collections, we can see that some experienced short but very strong spikes in transactions, though failing to sustain that growth in popularity. For example, Hashmasks had USD 380 million of volume in just one week in the month of July, which is curious since in all of 2021 the project had no more than USD 95 million of volume in one week, and the average weekly volume for the year was USD 21 million.

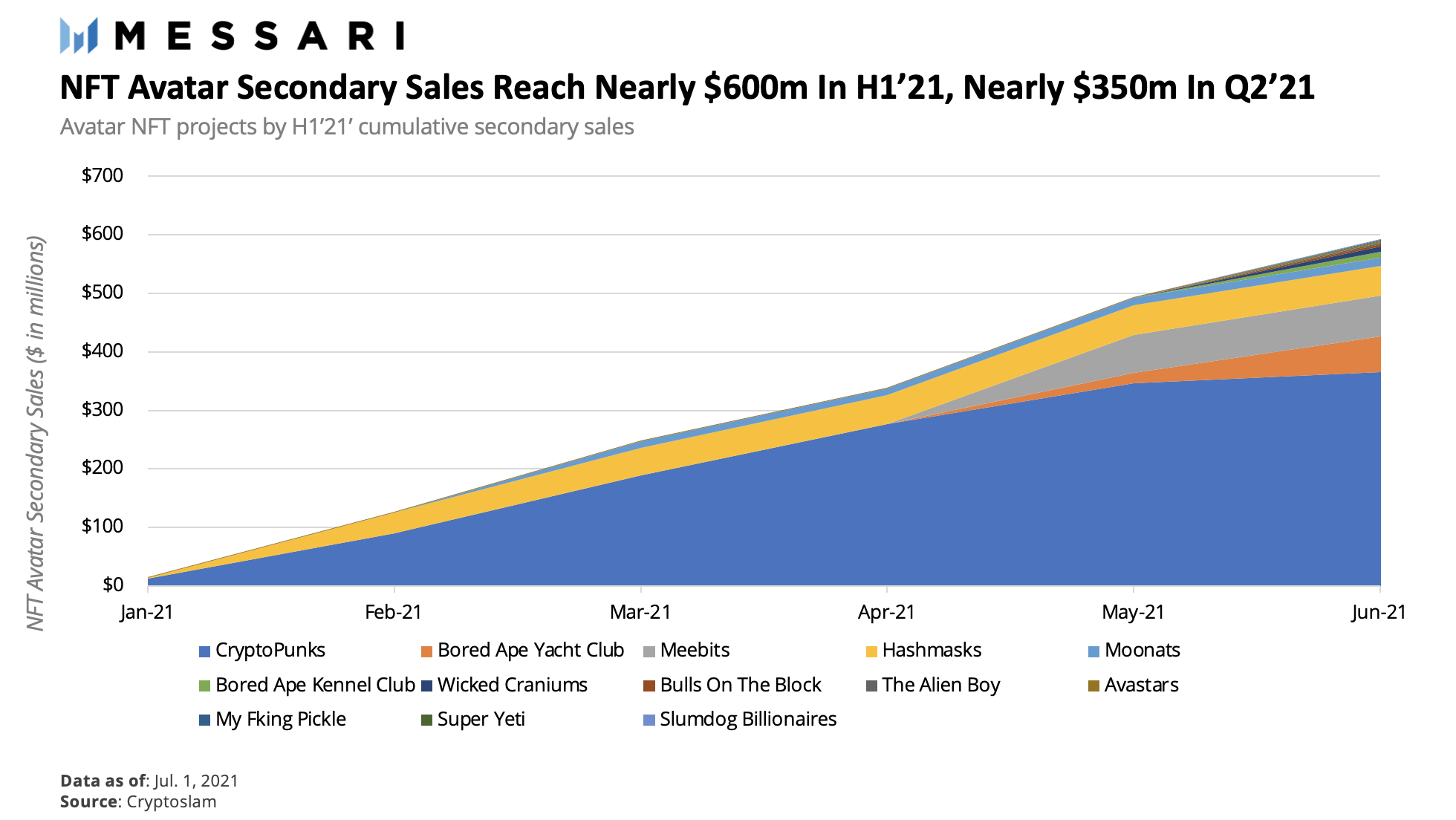

One of the most significant trends in the first half of 2021, were PFP projects. Avatars continued to grow in popularity as more and more people sought to have one to represent themselves on Web 3. What, in my opinion, made PFP avatar collections (collectibles) the highest volume sector of the NFT market was the need for users to have one more attribute pertaining to a decentralized world. It was not enough to have an ENS, or to play Axie Infinity, or to have a plot in Decentraland; now the graphical representation of a user in Web 3 had to come from an NFT, and what better than a custom-made PFP collectible to be your new profile picture. So it was that in Q2 this sector generated almost USD 350 million in secondary sales, and almost USD 600 million in the first half of 2021.

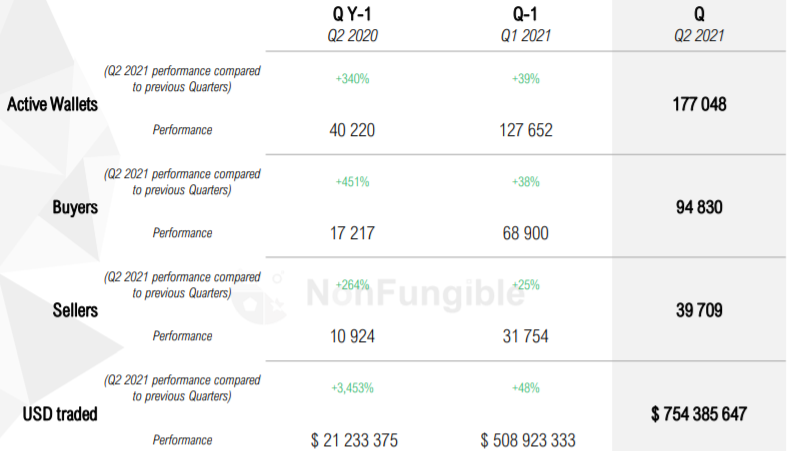

Q2 2021 was a record period for the NFT market. In Q1, total volume exceeded USD 500 million, while in Q2 this exceeded USD 700 million, up 48%. Q2 also saw a record number of active wallets with over 127,000, an increase of 39% versus Q1. On the other hand, in Q2 the number of buyers increased by 38% compared to Q1, while the number of sellers increased by 25% in the same period, implying that in Q2 NFTs attracted the attention of more people who wanted to buy them rather than sell them.

Between the end of April and the end of May, weekly volume rose from USD 50 million to USD 200 million, an increase of 300%. Despite a drop close to 60% at the end of May, volume started to grow again, after hitting a weekly low of USD 27 million in June.

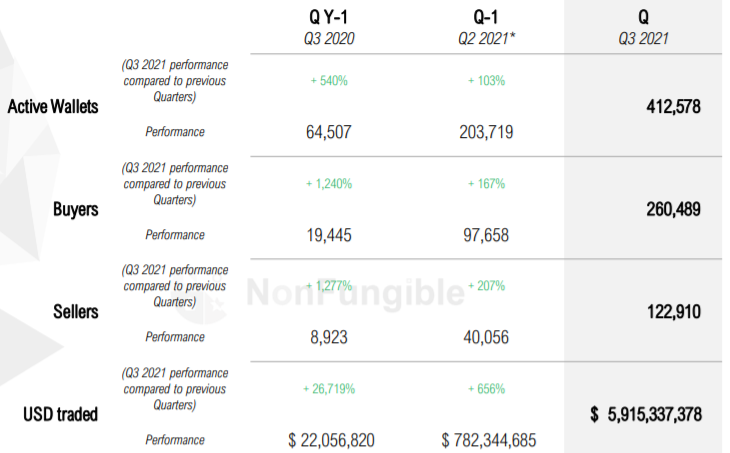

Two paragraphs back I said that Q2 was a period of records, with much larger numbers than Q1. And as they say, "history repeats itself". Q3 brought us total volume of almost USD 6 billion, up 656% from a quarter ago, and up 26,719% from a year ago. Passing 410,000, the number of active wallets increased by 103% versus Q2. The number of buyers and sellers grew by 167% and 207%, respectively, although while being larger numbers, they indicate that the trend of an increase in buyers outnumbering sellers was reversed. The latter makes economic sense, since in this period, due to the very high global demand for NFTs, their prices skyrocketed, which made it more difficult to buy and more tempting to sell and take profits.

In August we saw two distinct all-time highs: one for total volume and one for active wallets. Total sales, which aggregated USD 91 million at the end of May, soared to USD 1,674 million in just 2 months. After this peak, we saw total sales stabilize at USD 300 million, a value 3 times higher than two months earlier.

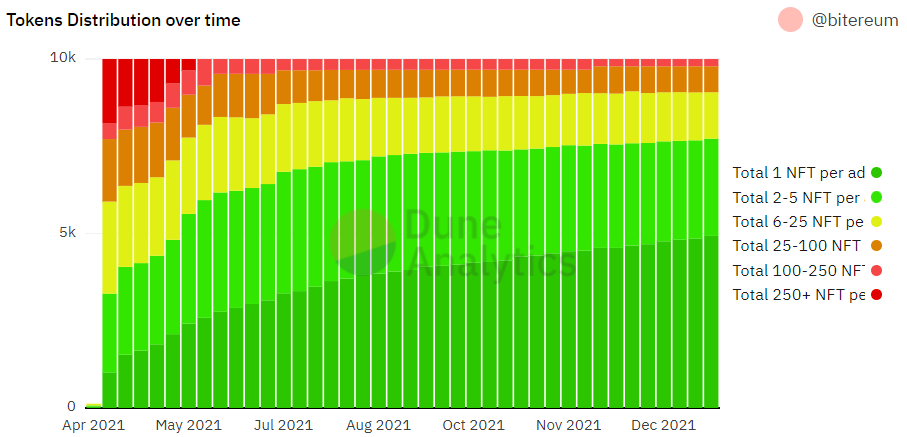

Finishing with the 2021 review, we can see that in April, only 1021 addresses had 1 NFT, 2638 addresses had between 6 and 25 NFTs, and 458 addresses had between 100 and 250 NFTs. By December and having completed a pivotal year for digital art, 4821 addresses had 1 NFT, 1397 addresses had between 6 and 25 NFTs, and 742 addresses had between 100 and 200 NFTs.

2021 was a year of massive adoption for the NFT market, a period that in my opinion, changed everything. Not only because of the increase in traded volume, active users and collections on OpenSea; but because of how NFT projects started to approach their work. Instead of simply creating a collection of 10,000 PFP units, like CryptoPunks, 2021 was the year where they started to give value back to the community, the very people who made those projects successful. Utility became a keyword for any NFTs project, just as scarcity did at the beginning of this whole new market. It was the most successful projects that innovated creatively and artistically in order to form a community that transcended the art of the project itself, to unite people from all over the world with the same common goal: to say gm on Discord. How they did it is what we will see below.

In March, the number of weekly collections on OpenSea was less than 200. By December, however, the number had risen to 3,264. According to Dune Analytics, the year ended with a total cumulative volume of 8,180,081 ETH or USD 26.733 million, and a total of 11,612,441 NFTs transactions, as of this writing.

4. What did the best ones do?

Since 2020, the world has not stopped seeing new NFT projects. In July 2020, OpenSea's monthly volume was just over USD 1 million, while today it is over USD 4 billion, a 400,000% increase. With tens of thousands of collections available on the marketplaces, not all of them are as successful as the best known ones, in fact only 10 projects account for 43.61% of the total volume. There is a reason why this happens, and it is simply because of the strategy behind each project. If there is one thing that NFTs have taught me over the last few years, it is that they don't have to have art as pretty as The Starry Night, they have to have art that is more useful than The Starry Night.

I take this moment to clarify that the intention of this article is not to delve exhaustively into technical definitions, so the following explanations will not go into much detail.

Let's continue with the example of van Gogh. A beautiful work of art that is in the MoMA, New York. Now, what if I were to tell you that it is much more difficult to verify the authenticity of a physical artwork, than of an NFT in Ethereum? In 2014, a report by the Fine Art Expert Institute (FAEI), determined that at least 50% of artworks circulating in the market are fake. Scientists at the institution located in Switzerland said that between 70% and 90% of the works that pass through their laboratory end up being fake.

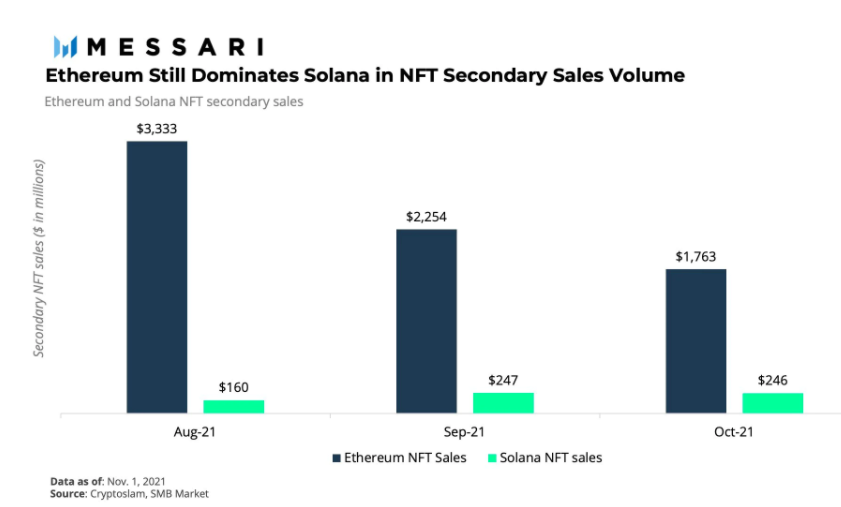

From here comes the first point to cover in the section analyzing the success of the most well-known projects: they are on Ethereum. According to DeFi Llama, 97.31% of the total volume on all blockchains comes from Ethereum. Some of the most significant advantages Ethereum offers is the community it has, both in developers and simple users. Despite having (at times) sky-high fees, it is still the favorite blockchain of many due to the huge and collaborative community it formed, unlike Solana, for example.

Other Layer 1s are just starting to launch NFTs. Ethereum was the pioneer and prime mover behind NFTs, and remains by far the most popular network despite gas levels and a reputation for always being congested. Blockchains like Avalanche, Cardano and Solana are trying to compete against Ethereum, but are finding it hard to challenge the community because the incentives in other Layer 1s are not as strong. The network effects that Ethereum has been producing are gigantic, and increasing exponentially.

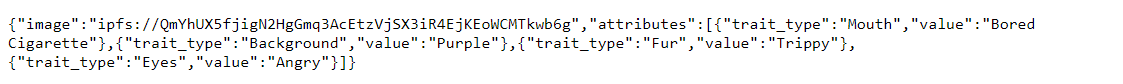

As a second point, a very important feature is to know what degree of trustlessness a collection has. NFTs use something called URI (Universal Resource Identifier), which is a string of characters used to identify physical or abstract resources on the Internet. In most cases it leads to a JSON file, where all the NFT information is stored. This happens because very little data is stored directly within the contract, as it only includes information about where a description of the artist's name and the title of the work can be found, but that information is not usually in the blockchain itself. NFTs include information about where the artwork they represent can be found, but the actual artwork is still a link away.

Because traditional URLs lead to centralization problems, many NFTs resort to a system called IPFS (InterPlanetary File System). Instead of identifying a specific file in a specific domain, IPFS addresses allow a piece of content to be found whenever someone somewhere in the IPFS network stores it. This means that, instead of there being a single domain owner, a multitude of nodes will ensure that the uploaded file remains online. Unless the data is stored on the NFT creator's own node, the content will be deleted if no one "pins" it within 24 hours. For this reason, pinning services such as Pinata or NFT.Storage are recommended to guarantee the availability of the metadata.

tokenURI: ipfs://QmeSjSinHpPnmXmspMjwiXyN6zS4E9zccariGR3jxcaWtq/2087

Bored Ape Yacht Club is an excellent example of a project that tends to be trustless, and look at how it went for them! Looking at the JSON above, we can see that BAYC uses IPFS, both to store the metadata and to store the NFT image. That means that neither the metadata nor the image of a BAYC can be changed at any time (although the baseURI can).

The reality is that any project that allows on-chain mutability, i.e. that the baseURI can be changed (either limited or unlimited times), makes it not really trustless. Since if the baseURI is changed, our metadata could point to anything else but our NFT. But, as in everything, there are better and worse options; which makes BAYC one of the most trustless projects we can find today.

Another aspect, and linked to the previous one, for the success of any project, is the reveal of the metadata. When minting a collection of NFTs, the order in which each token is assigned to each artwork and its metadata is very important. If that order of assignment is not revealed until after the mint, buyers have no guarantee that the creators of the collection will not manipulate the post-mint assignment for their own benefit. However, if the tokenURI is determined in the final list of metadata and images, buyers will be able to see all the metadata and images for the entire collection before the mint ends; which would allow them to exploit the collection by trying to keep the rarest NFTs for themselves. That is why no NFTs project should show any tokenURI until the last NFT has been minted.

Since there is a strong correlation between rarity scores and prices, it is important to have randomness in the mapping between metadata and NFTs.

Taking BAYC again as an example, what its creators did was to implement a provenance hash. A provenance hash is a unique signature created from any set of images, with it you can check that the images that the project is going to reveal are the same images that you have purchased. This hash also solves the problem of later tampering, since the host of the image set cannot change the images, or the entire signature will change.

The provenance hash approach consists of:

- Use a hashing algorithm to generate a hash of each metadata, token by token.

- Hash the string of hashes to generate the provenance hash.

- Publish the provenance hash before the mint, to show that the metadata was set pre-mint and cannot be tampered with.

- Generate a random number to change the metadata after the mint has finished.

That the contract has a good source of randomization is another key point. While most projects usually set up functions within the contract that provide a random number for the assignment of the metadata to each token, it is advisable to use a provider such as Chainlink VRF. As this option is not the cheapest in gas and perhaps not the best in terms of UX, it is not often used as much, but it should not be disregarded. An example of randomness that comes from the contract itself, can be one where there is a function that takes the hash of the block of a transaction sent by the deployer to itself, in order to function as a seed and generate random numbers.

Leaving aside the technical part, let's review some strategic points that have boosted the success of many projects. Broadly speaking, there are three types of marketplace:

- Centralized: Nifty Gateway, Binance NFT, Coinbase NFT.

- On-Chain: Zora.

- Off-Chain: OpenSea, Rarible, LooksRare.

Since there are different types of platforms to launch a collection of NFTs, when analyzing one it is very important to know what type of marketplace it uses. The centralized ones are launched by large exchanges, and usually have a great brand value (thanks to the exchange) and also partnerships in which they are leveraged. In addition, these platforms have a huge user base, users who are used to the exchange owning their cryptocurrencies. Thus, centralized marketplaces can be the right place to bring in new users who have not delved into the technical and security side.

In on-chain marketplaces all transactions occur on-chain, which allows for greater composability and flexibility for innovations in NFTs like PartyDAO. However, the cost of gas in Ethereum in general makes these marketplaces inaccessible.

The most widely used, off-chain marketplaces are those that combine on-chain and off-chain transactions. While they limit composability, they offer great savings in terms of gas.

Following collections that have a volume greater than 40,000 ETH such as CyberKongz, Pudgy Penguins, Cool Cats and BAYC; all use off-chain marketplaces for their secondary market sales

As a last point, and in my opinion the most important, let's stop to analyze the cornerstone of any NFTs project: the community. NFTs can function as a membership that provides access to events, exclusive merchandising, or special discounts. They can also serve as a digital entrance to an exclusive space in a metaverse, where only holders of a project can enter. All of this gives NFT holders value beyond simple ownership, and provides creators with a vector for building a highly engaged community around their brands.

Most projects start with a collection of NFTs, but also project a roadmap that sees the holders of those first NFTs begin to have access to a growing range of products, activities and experiences. Proceeds from the sales of that first collection can be reinvested in the brand, which ends up raising the value of the NFTs themselves. People often buy an NFT more for the community than for the art itself. Each community has different personalities and purposes, and there are so many that almost anyone can find one with which they feel represented. In this sense, having an NFT immediately provides a key to connect you with other people with common interests.

In many of these communities, the right of ownership of the NFT may also carry with it commercial rights, or some degree of decision on how the project will continue, which means that the members of that community will be able to build something on top of their NFT; which will ultimately enrich the brand. All of these benefits make the NFT of a project more valuable, which ultimately appreciates the right to be a member of the community, which ultimately makes the NFT worth more and more.

Without a large and established community, NFT projects can fail to convey their value proposition in a clear and concise way, ultimately losing people's interest. Let's take a look at a list of projects that were able to communicate their mission, and thus transfer a great deal of value to their holders:

- Bored Ape Yacht Club: in addition to exclusive merchandising and holder-only parties, the minds behind BAYC created two further collections, which were available at no cost (only gas) to BAYC holders. Bored Ape Kennel Club and Mutant Ape Yacht Club have a floor price of 6.4 and 15.2 ETH, respectively.

- VeeFriends: Gary Vaynerchuk's project has a real-world connection like no other. Holders of a VeeFriend have exclusive access to one of three future VeeCon, multi-day events where holders can meet each other and also meet Gary. In addition, all holders have access to activities involving Gary and other holders, such as outings, dinners, and tennis matches.

- Cool Cats: in addition to having done a lot of raffles and contests, where people won both NFTs and ETH, the creators of this project returned 20% of the initial sale to the community. Through raffles, contests and more, they sent more than 30 ETH to a community wallet that is being managed by all the holders together.

- SupDucks: one of the first large projects to have its own utility token, $VOLT. Each SupDuck holder receives 100 VOLT per NFT, generating 10 VOLT per day. The tokens are needed to unlock accessories, characters and physical content. In addition, it is used to reward members who help in the community.

- Gutter Cat Gang: apart from airdrops, merch and events, this project focused on delivering value through the metaverse. Each holder will have exclusive access to various 3D and voxel in-game assets. In addition, holders will have voxel versions of their NFTs, usable in The Sandbox and other metaverses.

5. Closing thoughts

NFTs enable the formation of new markets, where people can create and build new forms of ownership. The projects we have seen achieve success are leveraged on a fundamental concept in crypto: a token is worth whatever the users define together. This is because the communities behind the NFT projects are the ones that really generate the intrinsic value of the NFT. And the more these communities continue to grow in connections and become part of people's daily lives, the more value they will generate.

I see a future where an NFT is an access key to a DAO, which works together and distributes dividends (and royalties from the sales of NFTs) to the holders, and at the same time increases the value of the NFT as a gateway to the community. The number of integrations that can be built on top of an NFT are infinite, and we only know of a few, for now.

According to Finder's statistics, although they predict a large increase in the adoption of NFTs, the vast majority of the world still does not know what they are. Japan is the country with the highest number of people who say they do not know what an NFT is (90.0%), Germany the second (82.6%) and England the third (78.8%). On the other hand, the Philippines is the country with the lowest number of people who say they do not know what an NFT is (48.7%), Nigeria the second (52.0%) and Thailand the third (52.7%). It was also noted that there is a high correlation between people who know what a NFT is and those who have one, suggesting that ownership will increase as people begin to know what they are.

With all that has happened so far, and with the huge number of people who have yet to discover NFTs, I can assure you: we are still early.