Last Update: Dec 3, 2021.

Hi readers! First of all, let me introduce briefly about this article series. What I would like to accomplish is to help the readers build some understanding through a journey that will help us build some mental models for Cryptocurrency, Web3, and Blockchain. I choose this approach to because going bottom-up and building the mental model step-by-step might work better than starting with a definition of what it does, which some people call a top-down model of understanding.

This article is not where you will find some deep dive on the concepts and technicalities that enables Cryptocurrency and Web3. This is aimed to the general public that may feel that these things are so out there that you might as well tell them it’s magic (I mean to be honest these things are kind of magic).

Who needs Cryptocurrency anyway?

Let’s start with some general motivation. Everyone is different, but let’s start at the very beginning. The first cryptocurrency is called Bitcoin, and its creator Satoshi Nakamoto argued that

e-commerce has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments

in their white paper here. This reliance has bred its own set of problems as we are taking on the challenge of doing things digitally but with a trust model that is relying on things to happen physically.

When things are happening in two different realms of existence, we can call this being not native to each other. This concept will appear numerous times as we work our understanding upwards.

This means that we put a really big part of our economy to the financial institutions who will help us mediate the transaction between parties. So not only we have to trust them, we have to pay them a hefty fee to enable this transaction to happen. So there is a very select few that are able to demand economic rental payment to the whole community, and these few are usually not even elected, but appointed. This creates what is called a Cantillon effect, more on that here.

Another issue that was not written in the paper but was looming largely in its historical background, is the 2008 financial crisis that happened because these institutions created a large artificial market that was very risky but very profitable. When it collapsed, the community at large brunt the burden when it didn’t profit from the system to begin with. In a sense, we can say that we have a one point of failure for our current economic system.

We trust our government and the institutions inside to execute the monetary policy to the best to their ability, but as humans do they fail from time-to-time. Sometimes spectacularly, sometimes mildly. For a comprehensive report about the case for bitcoin on this issue combined with bitcoin’s electricity usage, NY Dig has published their findings here if you want to read more.

How can we make a better transaction system?

So how do we start to solve the transaction problem? Satoshi expressed the solution as a sentence that many mathematicians and computer scientists have tried to do, with varying success. He argued that

what is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.

Cryptography has been the basis of internet security since its infancy. It evolved along with the Internet and provided the basis for Encryption and Digital Signature. The basic idea is this, a message is turned to be unreadable (encrypted) unless you can prove that you are its intended recipient (digital signature as identity).

After establishing encryption and digital signature, let’s assume we want to create a new transaction system to solve the transaction problem. We’ll say first, we want a ledger (book of transactions) where all participants have one copy, and all transactions are equipped with digital signature so only signed transactions are included and sent over the network. All ledgers need to contain the same transactions and no one can spend what they don’t have (balance cannot go to minus).

Up until this point, it’s a pretty good system except for an issue of trust.

How can we determine whose ledger is official without a central third party being the judge?

In computer science, this is known as a Byzantine Generals Problem.

Up until this point, not diving into technical details are doable. But I am afraid describing Proof of Work (which is how we are going to solve the Byzantine Generals Problem), are rather hard without doing so. I made a short presentation about it in the link below, so please take a look if you’re interested.

Presentation link here.

As we are not going to dive in to Proof of Work, we’ll have to accept some assumptions that are presented here. The big idea is to accept the ledger with the most work into it. What does that mean? That means we will pose a problem, and due to the problem requiring intensive capital to solve, then we can assume whoever solved the problem have incentive to do good to the network by being trustworthy actors.

Why would this assumption generally hold true? Because after allocating capital into a system, you would generally want the system to thrive and prosper in order for your capital to grow. We know that some people just want to see the world burn, no matter the cost, but the Bitcoin Whitepaper actually gives some proof that to do so to the network you would have to amass an unlikely amount of capital (in this case 51% of the network’s processing power).

If you are still with me so far, we only have one problem left to describe this mental model:

How do we exactly verify which ledger has the most work put into it?

By the power of cryptography and the problem set posed by Proof of Work, this is easily done. Because of how cryptographic hash function works, we can safely assume that whoever possesses the solution must have gone through so much work to have it. In other words, anyone can verify that they did a large amount of work without having to go through the same effort.

As the incentive for both validators and workers (usually called miners), whoever possesses the solution are able to include a new block of transaction into the ledger and with it they receive a newly created (we call it minted) asset native to the system. This is the cryptocurrency of that system.

In summary, we now have the following properties in our proposed currency system:

- Decentralized ledger system that is broadcasted over the Internet

- Identity are enforced via digital signature, transactions have to be signed by owner

- No overspend

- Trusted consensus protocol (this example via Proof of Work)

- Participants of the network who did the required work can be rewarded with the native asset of the system (this is how the currency is minted)

We are finally done with the big picture of features that we get in cryptocurrency. All of the attributes above generally describe any cryptocurrency network with Proof of Work. With these, we are finally able to get a transaction system with cryptographic proof which is purely peer-to-peer. This means that trust is built-in on the transaction network and this is huge.

What about the monetary issues?

However this doesn’t solve any of the monetary issue with fiat money. Again, we’ll not cover the issues here as there are many essays already written about this. So in this article, we’ll just cover the ways that are proposed by Bitcoin to solve this inflationary issue.

Bitcoin code puts down a limit of 21 million bitcoin that will ever be created, with new bitcoin coming every around 10 minutes. The more people participate to try to solve the puzzle posed in Proof of Work (miners) the more powerful the network puzzle solving power is, which will naturally make new blocks come faster. So the bitcoin code has a way to make the puzzles harder to meet the 10 minutes rule, and vice versa when the mining power of the network goes down.

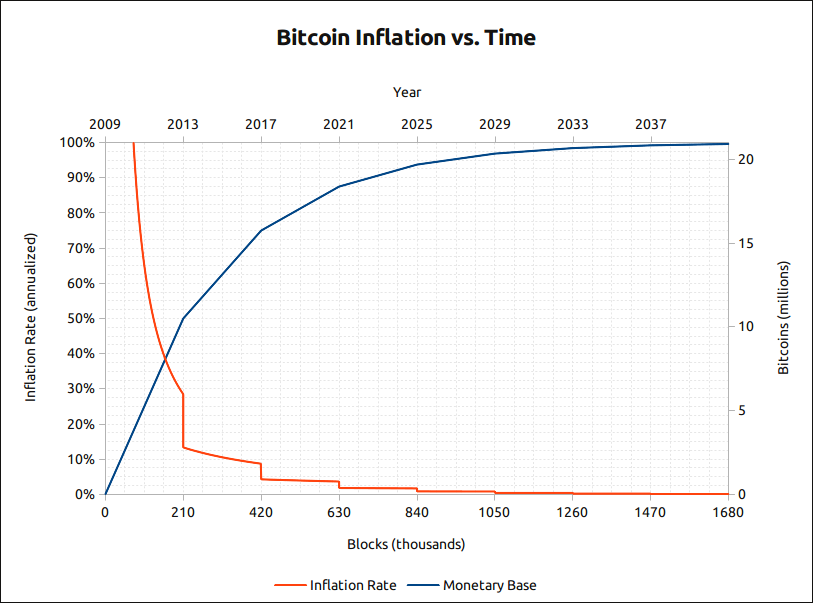

This means by design, bitcoin is going to be deflationary as we get closer to the limit. So far around 18.8 million bitcoin has been mined by Dec 2021 and circulates in the network as shown in here. Every 210,000 blocks created or around 4 years, the reward given from the process outlined above is halved. As of Dec 2021, the block reward is 6.25 bitcoin per block. This mechanic is called the bitcoin halving. The expected inflation rates of bitcoin are shown in the below graph.

Let’s stop here and admire how cool is it that we know exactly how many bitcoins there are circulating in the network, how powerful the network hash rate is, and many other metrics just because it’s all available openly. This enables a more accurate and honest analysis of an underlying asset than ever before.

What about blockchain?

You might be surprised, but blockchain is the ledger system we described above. Each set of transactions are what we call blocks and they are linked to the next one just like a chain, hence the name. For many more technical details, you can go to Wikipedia as one starting point. The difference with other ledgers you have encountered in the traditional sense is that it has:

- Time stamp, so we know how to order them.

- Append-only, so nothing ever gets deleted, and newer ones come in at the end, connecting with the previous block.

Another really interesting point about this information is that if there’s a line in the blockchain transaction saying “Alice gives Bob 1 BTC”, this also proves Bob’s ownership of that 1 BTC. Balaji Srinivasan tweeted the below to bring it further home:

What about other cryptocurrencies?

In the grand scheme of things, the blockchain system described above works the same way in other cryptocurrencies, of course devil is in the details but it should suffice for our current mental model. The difference usually lies in the consensus model. While Bitcoin uses one Proof of Work model, current Ethereum uses another Proof of Work model with different numbers on the monetary side as well. Other cryptocurrencies such as Algo uses another consensus model called Proof of Stake with Solana adding another called Proof of History on top of the Proof of Stake. One research paper for many consensus protocols can be found here.

Summary

These are the mental models we have acquired so far:

- Blockchain is a ledger that is public and decentralized, used to denote transaction of its native assets, complete with information such volume and history.

- Blockchain combined with consensus protocol enables us to have a method of doing a direct (peer to peer) transaction safely to transfer value without the need of a third party.

- Cryptocurrency is the reward given to the validators for doing validations on proposed transactions using the consensus protocol. This is highly programmable and is different from one cryptocurrency to the next.

- Cryptocurrency is simply the native asset that is transacted on a blockchain that has the consensus protocol. So as an example, Bitcoin system has BTC, Ethereum has ETH, and Solana has SOL.

- Trust is built-in inside a cryptocurrency blockchain due to the consensus protocol.

- Information in the blockchain also functions as a proof of ownership of the native asset.

Where do we go from here?

Now that we have equipped ourselves with at least basic understanding about blockchain and cryptocurrency, we can build up on the next mental model: blockchain computing. How is that possible? We’ll try to cover it on the next article of the series. I’ll see you there!

If you are itching to know more and dive deep on Blockchains and Crypto, the awesome folks on a16z has actually compiled a Crypto Canon here with lots of hours worth of reading and tutorial.

If you like what you read, consider dropping me a line or follow me at Twitter below.