A BASIC INTRO TO NON FUNGIBLE TOKENS AND COLLECTIBLE DIGITAL ART

By Guy Noir, Private Investigator (not an actual private investigator)

PUBLIC EMAIL: Guy.Noir.P.I.713@protonmail.com

DONATION WALLET ADDRESS: 0x0DE4C6EAcc31435A15f6505DBe6d0da8B1D253E6

PREFERRED NETWORKS: MATIC, ETH, FTM, BNB, AVAX, MOVR, CRO

Please send tokens on their respective network. ETH on ETH, FTM on FTM, AVAX on AVAX, etc. I teach you how to do that in this post.

MY CURRENT EDTIONS: Thich Nhat Hanh, and Shunryu Suzuki

DIFFICULTY: beginner-intermediate

DESCRIPTION: Explanations and opinions on various elements in the digital art market directed at laymen considering the space. DISCLOSURES APPLY. REFER TO MY FIRST POST HERE. DISCLOSURES ARE IN ALL CAPS.

PLUGS AND PROMOTION: As of now, these are the people I’m most interested in. None of them paid me. I just like their art and have sentimental attachment to it. Blaquecloud is one of my oldest friends. She doesn’t have any NFT collections. It’s still great art. You can buy her prints if you agree. Zaldin tarot was the first person who’s work drove me crazy on Opensea. I want to see his tarot cards on a shelf someday. Mehrdad Malek is a videogame designer and generally solid artist. I loved his inktober collection. It gave me hope that this space will attract people working in a classical medium still. Londonpixel club was the first person I ever bought from. I’m not usually a fan pixelated cryptopunk art styles. I like that he was a “littleguy” in the space however, and enjoyed the idea of regional themed punks made by ordinary people attached to their cultural identity. If you can’t buy, that’s fine. If you like it, then like it. I hope you enjoy.

https://www.blaquecloud.com/

https://www.instagram.com/zaldintarot/

https://opensea.io/collection/zaldintarot

https://mobile.twitter.com/MehrdadMalek1

https://www.instagram.com/londonpixelclub/

NOTE

I maintained a delicate balance in this report. It was a difficult conundrum. What information is vital? What questions will it induce? How many answers will I have? What further questions will those answers induce? If I try to anticipate them and expand the article, how much will I test people’s patience? I’m trying to shoot a shotgun where some may prefer a laser.

I fell back on lingo and jargon that comes second nature to me at times. I try to explain it in an abbreviated fashion. I also researched a wealth of other educational articles. The bottom of this report holds the scaffold for a solid knowledge base with links. I’ll also link them in important vocabulary and referenced news events throughout the article. I struggled with the order to reveal information. Please use my descriptions of sections in the table of contents to assist with jumping around as needed for you.

If you’re racing to get into this space, and willing to enter a little more blind than others, there's a list of video tutorials diving right in under this note. I strongly suggest you at least read my security guidance in the section titled “SECURITY. DON’T FUCK THIS UP”. Custodial centralized services might be the best bank account for you. Were I a creator with little interest beyond profit, I’d use wallets as simple payment processors. I'd move funds to centralized accounts like Coinbase or Gemini on a daily or weekly basis. Coupled with these videos, I believe that's the absolute bare minimum of necessary information.

As I’m still new to this service, I’m still figuring out navigation and features. My original article was a simple PDF sent to friends. My hyperlinks for sections inside this article worked seamlessly in that format. I looked closely, but found no features for navigation inside an article, just hyperlinks for outside sources. Sorry, but you’ll have to do the old CTRL+F in this format. Enter in my section titles from the table of contents and you should be just fine. An old technique I’ve always used for markdown and text documents for myself is using # symbols as a visual cue for section breaks. You could also use CTRL+F and enter “######” to quickly section hop up and down.

If you have questions I didn't address, feel free to contact my public email. I'll try responding in a timely fashion. I make no promises.

######

TUTORIALS

I didn’t believe it was appropriate to attempt a long form video tutorial myself at time of writing. I don’t have particularly good quality audio recording tools, or experience creating video content. I looked for previously published content to share. I wanted to give you at least 2 options, one well established NFT marketplace, and one niche one. I settled on Opensea and Paintswap. I’ve since found many many many marketplaces between all of the networks I’ve explored. Opensea and Paintswap only require Metamask to navigate the Ethereum/Polygon network and Fantom network.

Let me quickly summarize the tasks if you’re only interested in Opensea and Paintswap. Set up a wallet to use as a payment processor, making sure it has the appropriate networks available, link to the appropriate decentralized applications, and open up a centralized service to use as a cash out point as you please.

As you will see below in the “multi-chain swaps” video, you now don’t even need the centralized service as an on-ramp to these networks. You could open up a wallet tomorrow, use the fiat on-ramp at the Rubic exchange from the convenience of your wallet and purchase directly there as needed. Were I in your position, I’d just buy somewhere between $100-500 MATIC in the polygon network directly from the Rubic exchange. That’s all I’d imagine needing for gas fees, really probably more than you need, but the exchange might have a minimum purchase amount around $100. That’s likely all the starting capital you’ll need to add a blockchain storefront to your tool box. You probably won’t even require a centralized service for a while, as it will take time to accumulate sales justifying their service as a fiat off-ramp. I also have a post here that details of managing these network and token swaps. The article difficulty is advanced, but only the first few sections apply to what you’ll need. Don’t dive into DEFI yield farming if you’re not ready.

If you choose Opensea as your storefront, you don’t even need any starting capital for your gas fees. They implement “lazy minting”. Creating NFTs is free for the creators. No token is minted until point of sale. I’m not certain however, if this feature is available on both Ethereum AND Polygon (they use both networks to help reduce gas). That’s why I’m leaving these tutorials to acquire the polygon network token MATIC just as a precaution. You can buy MATIC on the Polygon network directly from the fiat on-ramp in the Rubic Exchange. If you want the more niche Paintswap to be available to you, you may then perform a multichain swap to acquire the Fantom network token FTM from within the exchange, as will be detailed below.

If you’re going to go with either of those routes, you can ignore the Solana and Terra Luna oriented tutorials all together. I wanted to leave some nuggets of wisdom juuuuust in case people dig deeper and become interested in the art exchanges in those networks. Getting starting capital there will be more complicated. Solana is also available on Rubic, but requires a different wallet altogether. The network isn’t supported in the Metamask wallet yet. I know that sounds weird that Rubic supports it. You just give them a send address for a wallet in a different service. Solflare is a good browser web wallet for this purpose.

Rubic doesn’t support Terra Luna yet to my knowledge. For that you’ll have to send to a centralized service like crypto.com, perform a swap there, then transfer to a wallet that can interact with decentralized apps like talis which is an NFT marketplace open to creators on the Terra Luna network. Feel free to contact me if those interest you and I’ll offer more detailed instructions. Opensea and Paintswap are 2 solid new tools to start with. Solflare and Terra Station are just hints at what more is available. With that, here’s the videos with descriptions.

Shorter Metamask browser setup.

Adding Networks to Metamask. Search for and add Fantom, Polygon, and/or others as needed.

Metamask Rubic swaps. Remember this is only necessary on an as needed basis. basically just if you’re interested in Paintswap. You just swap to Fantom network for your starting capital gas fees.

How to send and receive assets on Metamask.

Fast NFT creation tutorial.

Fast Opensea Polygon NFT tutorial.

Longer detailed breakdown of Opensea.

Creating NFTs on Paintswap.

Node JS guide to creating collections from layers.

Alternative collections software called Visual Studio.

Short Solana web wallet setup.

Short Terra station browser wallet setup.

######

TABLE OF CONTENTS

GREETINGS. Introduction and setting the tone.

JUST WHAT IS THIS NFT? Basic NFT definition.

WHY THEY DO DAT? Reasons to make NFTs, and opportunities.

HOW THEY DO DAT? General overview of NFT engineering.

WAIT A MINUTE. IT’S JUST A URL? Continued engineering explanation of relationship between NFTs and newer storage protocols.

BUT, MUH RIGHT CLICK. LOL. Dismissing concerns over ease of piracy.

HOLD UP. I THOUGHT ALL THE CRYPTOS WERE PRIVATE AND ANONYMOUS. Addressing issues of privacy.

I’M STILL SCARED AND CONFUSED. HOLD ME. Assurance of my availability for continued questions.

YOU SON OF A BITCH I’M IN. Presenting options of centralized vs decentralized storefronts.

SECURITY. DON’T FUCK THIS UP. VITAL SECURITY GUIDANCE.

I WANNA MAKE MONEY. I LIKE MONEY. Collection creation and marketing strategies I’ve seen.

CAN’T MAKE ART. I JUST WANNA BUY AND SELL. Investor guidance.

GOODBYE. Conclusion.

TOOLS, SERVICES, AND STOREFRONTS REFERENCED. Self explanatory.

OPTIONAL EXTRA HOMEWORK. Previously mentioned knowledge base to help explain obscure vocabulary. Some links will have been previously given in the article. This

######

GREETINGS

The article title says it all. I presume you heard about this weird new asset class on either social media, or the tube. You’re likely one of 2 people. You missed the buck on Bitcoin and think you can get in early on something similar. Or, you're a starving artist and heard how expensive simple drawings of cartoon monkeys are. I hate starting on a somber note. You are definitely not early, and there are many, many monkeys not selling at all.

Despite this, NFTs can still be a profitable venture, but now resemble the actual art markets. There's unmistakable classics, famous historical pieces, amazing talent wasted without attention, and permanently doomed unknowns screaming into the aether. Diving in as an investor or creator requires patience, lots of homework, interaction, marketing, and acceptance of risks. I will address frequently asked questions, concerns, and developments, as well as offer some opinions and warnings.

######

JUST WHAT IS THIS NFT?

A non-fungible token or NFT is digital content with unique identifiers vested on it by a blockchain network. These unique identifiers distinguish it from all other jpeg files no matter how many times someone copies it. People can audit a blockchain’s ledger history and identify the original instance. Digital content can now possess a history of ownership. Everyone in the world can see where it touched your hands. There's identifiable moments of issuance for first or second editions.

######

WHY THEY DO DAT?

Why else? To capitalize on people's lizard brains. This technology makes creating collectibles insanely easy. IT’S NOT A GUARANTEE OF SUCCESS, but it's an excellent technique to leverage attention and induce urgency to acquire content on a digital plane. You could create a collection of whale pictures and issue them as NFTs for charity. You could raise money to support you while you develop a game with samples of art. In my opinion, it's far superior to fundraising platforms like kickstarter or patreon. Decentralization offers unprecedented creative control.

Patreon can, and has revoked, service for political dissidents. Gofundme temporarily denied service to Kyle Rittenhosue during his trial for the Kenosha riots. Have whatever opinion you please about whatever political event or character, but I can’t stress this enough. That can be you some day. You may not believe it. You may not want to think about it, but it's true. It could be you facing the firing squad of censorship.

I myself might face related strictures. Regulation in the “infrastructure bill” of 2021 sought to expand the definition of a broker. This may effect me personally when it goes into effect in 2023. Anyone using certain decentralized finance applications or providing vital mining/staking infrastructure to blockchain networks may be swept into this definition.

We may be made subject to obsolete financial regulations and forced to reduce transaction volume for no explainable reason. Interacting with these tools requires little to no technical knowledge beyond poking icons on your phone. I’ve yet to hear a reasonable explanation why they cause any more harm to consumers than casinos or legacy stock exchanges. I mention this to illustrate the slow grind removing essential rights like freedom of movement for our assets and valuables. Sometimes it’s corporations censoring you, other times it’s congress “regulating” you.

Rant aside, there's even more budding applications. You might have heard of Cryptokitties or Axie Infinity. Gaming elements are tokenized within them. You can insert enough information into tokens for stats of creatures and weapons that games recognize and interact with. Cross game elements recognized in a single token may soon be possible. Tokenizing them will make them infinitely more easy to transfer and transact with. People could trade collectible skins or weapons seamlessly which work in multiple games at once without signing into Steam or Nintendo, or giving them a cut of their profit.

There's even more possibilities than entertainment. Many governments now recognize blockchain's resilience for data storage. Legal documents and credentials may soon be tokenized as NFTs. Birth and health records, deeds for real estate, car registration, and licenses to name a few. All that remains is standardizing protocol for additional encryption. Unlike the NFT art market, some of these documents can't be publicly viewable without the owners allowing. Everything that can be tokenized, will be tokenized.

Lastly, there's exotic investment opportunities tied to NFTs. Ownership of an NFT can unlock features of a platform. Decentralized finance applications sometimes bundle bonus privileges to an NFT collection. I paid 1500 Fantom (2300$ at time of purchase) for a lovely landscape painting on a decentralized art exchange. Lovely as it was, I bought it because the art exchange offers bonus features on the platform for collection holders.

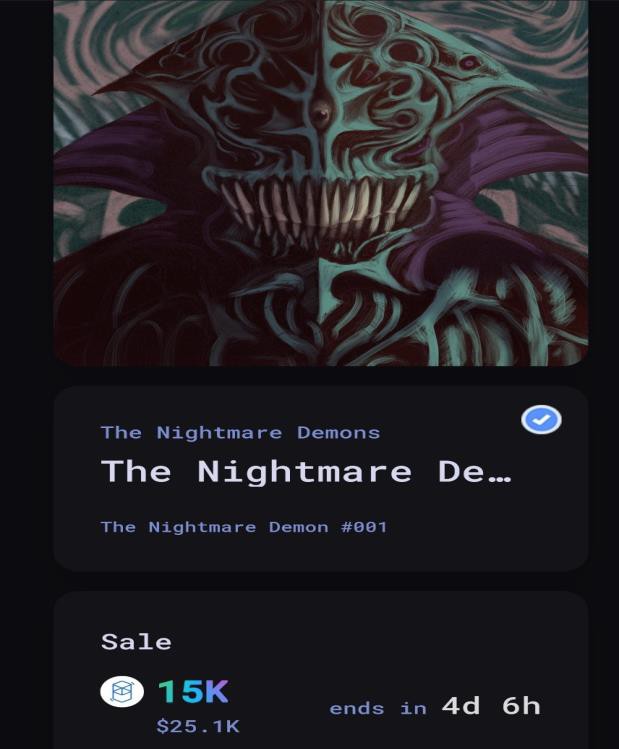

There's exotic investment opportunities for the creators too. Some platforms allow artists to mint NFTs that pay royalties on resale. A single piece can provide an artist passive income as it changes hands more and more growing in popularity. Take note, royalties are usually capped for creators. I’ve seen some platforms cap at 10% See below for an example.

Also take heed, that's an extremely new and questionable feature for regulation. When you mint an NFT with royalties, you clearly created an asset with the intention of extracting future value. That sounds innocent enough, but may soon be considered an unregistered security. You may, like me, go to sleep one night and wake up to learn of possible rulings and regulations affecting you with zero preparation.

My OPINION is the genie's out of the bottle. I believe we’ll see a series of events similar to the piracy crisis music went through in the 90’s and early 2000’s. Regulators are refusing to acknowledge the fast approaching reality of ungovernable, open source, mass dispersed, mesh networked assets, in innumerable legal jurisdictions. I don’t say ungovernable in the lolbertarian sense. I cast no moral judgement about what a state actor should/shouldn’t be allowed to touch by their people. I’m trying to hammer home to you the logistical nightmare approaching these snivelling bureaucrats with zero technical knowledge or creative capacity.

When was the last time you heard of anyone getting their home raided for torrenting a season of “Game of Thrones”? When was the last time you heard of the FBI calling someone for handing their friend a flash drive with their favorite playlist? In the early days of the cyberpunks in the music crisis some people stupidly opened themselves up as symbolic targets. Napster had a figurehead. They had a clear line of assumed authority and responsibility. What do you think was going to happen? When you don’t try to play their game, however, you have tools a state or institution would never consider.

When even just 1000 people say no, when they download a movie without care for copyright and break the law, the state “technically” has authority to convict. What they don’t have however, is time. Just one arrest carries with it countless hours of labor, court appearances with lawyers and judges who must be paid, infrastructure and maintenance to equip police officers and holding areas. The funding JUST. DOESN’T. EXIST. This is the nakedness the emperor doesn’t want you to see. Now you have 10 dollar music streaming services. The music industry caved. They found the floor price to keep you lazy and off of torrents. Go thank your local pirate.

What’s the parallel with NFT royalties you ask? Well… I told you the effect of 1000 seeders and torrents… There’s freaking millions of NFTs now minted to provide artists passive income. Millions. Upon millions. Upon millions. What’s more, there’s even less attack vectors than torrenting peer to peer networks. Law enforcement could technically target seeders or small scale server farms providing pirate bay bandwidth. They couldn’t do jack shit about the one’s in Estonia, but they could do something. NFTs are embedded into an insanely larger network that you’d have to target all at once. It’s even less economically feasible by orders of magnitude.

Obviously I’m not a prophet, but my thoughts are the creators physically can’t be targeted. Their tokens are made. If there’s damage to be done, it’s done. You’re not going to get these millions upon millions of token holders to burn their property. Try to burn them in one country, those citizens see they’re considered cattle because no one else had to do it, they riot or run to where they’re treated better. Tale as old as time.

You might, like in the music crisis, see some attempts at useless posturing and symbolic victories. Regulators and law enforcement might take a stab at shutting down a couple centralized NFT service providers. It won’t effect token holders. You can migrate your tokens to other services. Thank sweet baby Jesus for decentralized exchanges and VPNs.

Were I in your position, I’d mint away (creating an NFT is called minting).

######

HOW THEY DO DAT?

That's explainable in multiple degrees of complexity. Some are beyond me. It boils down to how transactions are recorded in a distributed ledger, and what features the programming language of a blockchain allows. You might have heard of Bitcoin and wonder "why don't we have Bitcoin NFTs?" The goal of Ethereum was very different from Bitcoin. Nobody involved in Bitcoin's creation imagined tokenizing other assets. They simply wanted apolitical digital cash.

Ethereum created a decentralized world computer able to recognize and transfer multiple asset classes with and without continued human interaction. What does this mean? It means Ethereum was coded very differently to allow something called smart contracts. These are basically automated escrow accounts. The best metaphor used by Ethereum engineers is ‘hyper complicated vending machines”. Wallets can be pre-programmed to execute thousands of transactions automatically depending on conditions you code them to recognize. People are continuously developing hundreds of applications with this capability, NFTs among them. They also use very different ledger models. Bitcoin's model is called unspent transaction outputs (UTXO). Ethereum more closely resembles traditional banking with an account-based model.

I'll be honest. I don't know the finer points to describe the difference between their ledger models. I have however, watched many subject experts break it down in multiple ways. Put simply, Bitcoin truly does resemble actual cash transactions. Some very rudimentary smart contracts are technically possible. For the most part however, all that network will ever recognize is "wallet A has moved X amount of Bitcoin to wallet B". The format of that transaction is very lengthy and cumbersome. The ledger model in Ethereum is much more abbreviated. It’s programming language called “Solidity” allows wallets to be semi-autonomous, as previously described. Transactions can carry a wealth of metadata. That metadata can tell wallets what to do and where to send funds depending on programmed parameters. This metadata is where all the code for decentralized applications runs.

When you mint a non-fungible token a URL of your specific .jpg upload is recorded in that metadata. That's where your picture comes alive. Or at least, that's the side most people took now that there's money to be made. It seems fair enough to me so long as there's no solar flares or giant asteroids. If there were, we'd have much bigger problems than identifying who owns a picture of a cat or monkey.

######

WAIT A MINUTE. IT’S JUST A URL?

Aaaaaah. You're cleverer than most if you know this is a vulnerability. Yes it's a URL. BUT. There's more. Traditionally, URLs are hosted by giant server farms and internet service providers. You might have seen loading pages saying "hosted by Cloudflare" or AWS (Amazon web service). Those are centralized services. Not all of the data is encrypted, and centralized custody can be a vulnerability.

You might have heard of the Cambridge Analytica scandal. Maybe you even remember a few days in 2021 when popular websites and services like Facebook and Whatsapp crashed. Many now believe (myself among them) that siloed data structures and bottlenecked routing connections are inadequate platforms for future connectivity. We want to provide internet services to billions more people. We want the people connected now to have better service. If we used our shiny new blockchain technology as a layer on older routing protocols, we'd be idiots.

Fortunately we don't. Blockchain allows us to leverage newer routing and data storage protocols like the interplanetary file system (IPFS). IPFS is a peer to peer network. Data is copied several times over, broken up, encrypted, and stored on multiple hosts throughout the world. There's no server farms for the CIA and NSA to monitor from backdoors. Instead, there's dozens of independent providers who don't even know each other.

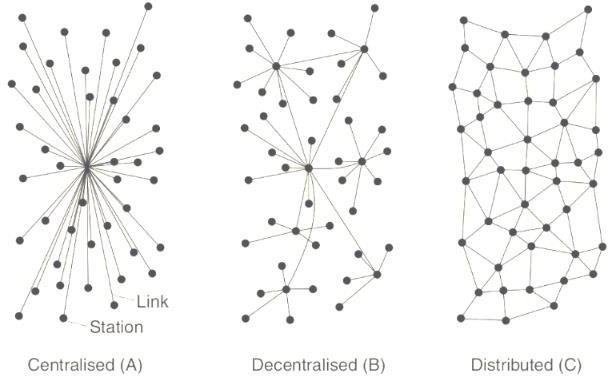

Storage and hosting requires far less capital investment, and routing requires far less energy. The URLs can be locked. People can store data with keys in the form of hashes (serial numbers tied to metadata) to access them. Here's a classic simple image illustrating the difference in network routing models. Blockchain and peer to peer networks aim at maximizing distribution of data storage/streaming, among other things. Think of the dots in the image as a mix of personal computers and data storage providers. The lines are their routing connections. In the far left you see all these people streaming information from one overworked server. That’s what you have now. That center point is your Netflix, Google, Amazon, etc. As you move further to the right you see a service breaking up it’s storage. It’s stream of information is more resilient, has more options to reach people as needed, and becomes more efficient.

The furthest right model is a bit of pipe dream for large scale services at this point, but it’s a beautiful one for us nerds. That’s called a “mesh network”. Everyone’s devices are a mix of both consumer and provider of data. It would be like everyone buying mini servers they keep at their home in a public routing infrastructure program. Fiber optic cables would have be integrated in tandem with public electrical lines on a much more massive scale.

"But wait I'm looking at pictures on Opensea right now and don't own the tokens."

Yes you're looking at a picture. You can even screenshot and right click it. That particular URL was not made to be locked. It was made as a reference point. Everyone sees the URL was created in conjunction with a publicly tradeable unique token. A print of the Mona Lisa does not a million dollars make.

The point is the IPFS is immeasurably more secure, economic, and environmentally friendly. They've even tokenized IPFS bandwidth and data storage with projects such as Filecoin and Arweave. Nobody hosting nodes can change the URL or the metadata in any token representing ownership of it. Best of all, there's no server farms burning through millions in e-waste heat thermoptically visible from space.

Traditional art insurers are currently discussing how/if they can even offer their services to digital art collectors. Some NFTs do use older URLs hosted on Cloudflare and AWS. Those might be the only tokens they can offer services for. The overwhelming sentiment is if it uses IPFS URLs there's nothing to insure.

NFTs, like any cryptocurrency, can be stolen through social engineering or physical force. However, someone would have to know to target you. It's possible to identify people from ledger activity, but takes an enormous amount of work performing pattern of life analysis. Such work is far beyond most petty criminals. Blockchain networks and the IPFS infrastructure are immutable. Maybe things will change with quantum computing, but I imagine there will also be quantum resistant financial engines we can bridge assets to.

######

BUT, MUH RIGHT CLICK. LOL.

Nope. Just nope. I glued a picture of Charizard to card stock. It's not Logan Paul’s Charizard. No one gave me a million. I tried to enter a Magic tournament with my $650,000 deck filled with nothing but black lotuses I printed just to flex. People laughed at me. One day I will hurt them as much as they hurt me.

######

HOLD UP. I THOUGHT ALL THE CRYPTOS WERE PRIVATE AND ANONYMOUS

Nope. It's incredibly difficult to make a completely private cryptocurrency. It's even more difficult to make one capable of smart contracts and tokenized internal assets. The only one I'm aware of is Monero. It can't run smart contracts required for NFTs. While it interests me, I currently know very little about it. Bitcoin was never private, not even in its infancy. Illegal transactions were easy because of its novelty. Getting useful information from a 20 GB spreadsheet is like drinking from a fire hose. The information is there forever, though. I presume machine learning will catch up to those people buying heroin and speed balls eventually. The Silk Road bust is evidence enough of that, although there were multiple security failures involved on the part of criminals in addition to ledger activity.

This new technology is a kind of gamble/bargain. It's not private by default, but there are applications to anonymize transactions called mixers. These are decentralized applications that split your one transaction into many thousands more. Your assets move between a thousand wallets before settling in your intended destination. It's automated money laundering. There's no getting around creating a public record, so developers obfuscate it by turning the fire hose into an ocean. To my knowledge, there's no similar applications for moving NFTs anonymously. NFTs can't be fractionalized. You must use the default network transfers baked into wallet applications.

"But I'm a cyberpunk who wants to burn this mother to the ground. End the FED. No more surveillance."

Hey. I feel ya. Like I said. In my opinion, this new technology is a bargain/gamble between both ordinary people and financial oligarchs/state actors. It's a chance to renegotiate the social contract. The bargain in question is "hey government, give us complete absolute freedom of movement for value, give up all power of issuance, and we'll actually give you all the information you could ever want."

That's a dangerous gamble. I believe integration of public ledgers would benefit ordinary people the most. At the very least, it could be an equalizing movement. Remember it's a completely public ledger. Law enforcement could track your financial activities through pattern of life analysis. Likewise, independent citizens could come together to track institutional entities and state activities, then foment public outrage.

What's more, remember our end of the bargain. Complete freedom of movement. It would be a completely different financial landscape. There's zero barriers to entry for installing a wallet. You don't need intermediaries to interact with decentralized finance applications. You don't need auction houses to insure your work while you wait for a sale. The only ground we give up is surrendered while drawing institutions to a level playing field for enforcement, and granting ourselves far more benefits in applications.

We're opening Pandora's box. It's insanely disruptive technology. As with any human venture, we'll likely cause untold horrors and miracles simultaneously.

######

I’M STILL SCARED AND CONFUSED. HOLD ME.

I understand. It's a scary confusing world, and it's gonna get worse. You want to see a freaky yet amusing estimation of the future? Try reading Accelerando by Charles Stross. Humanity as a whole may build a very precarious relationship with emerging technologies like artificial intelligence and financial developments. Obsolete, bored, kept like pets, desperate to find other life and prove hyper capitalism isn't a great filter.

I am a freak of nature. I shouldn't exist. I'm not braver than you. My risk assessments are just insanely warped. My threshold of knowledge to embrace adoption was lower. I was insanely curious about a weird nerdy space that puts everyone else to sleep. I crossed my threshold faster. To me, it's more insane thinking traditional banking was ever going to onboard 7 billion people. It's more insane to think intellectual property law made in the 70s and 80s can regulate infinitely replicable jpeg files.

Let me be clear about the risks too. I don't know if we're looking at the final form of digital content markets. We might see tokens hosting the actual content somehow, rather than bootstrapping URLs. I'm not a technical expert. I don't even know what the final form of cryptocurrencies will be. Maybe a 4th gen project like Radix will make everything else obsolete. Everyone will shit up it's bandwidth for weeks desperately trying to bridge their shitty dog coins to that network.

Technological development is never executed in the perfect order. We used to piss off our parents taking up bandwidth over phone lines to look at boobs on the internet. Bitcoin is already a joke technically speaking. I think we'll attempt to bridge it's ledger history over to a completely different consensus protocol someday just for posterity, but I can't know. Collect your thoughts so you know your finite threshold of knowledge and I'll try to help you if I can. Hopefully this article makes your questions clearer.

What I can tell you is people are definitely treating these silly tokens with URL bookmarks like digital collectible property. They've been doing it for almost a decade now. I see no cultural or market signals indicating they'll flip the script. I might make a sequel to this article detailing court rulings that have added legitimacy to this movement. Making one of these tokens, or even a 500 piece collection, isn't difficult or expensive. It's just time consuming. At one point people were treating sea shells as currency. Humans are weird.

######

YOU SON OF A BITCH I’M IN.

Oh... Oh so you wanna make an NFT? Okay. Too easy. Bet. You currently have 2 options. One might be easier, but miss what little early opportunity remains. The other is harder, but may grant you access to niche markets. Do you want to wait until normies can use their credit cards on centralized services, or do you hate life and want to invest endless hours learning to navigate decentralized finance and wallet applications? I know which one I picked.

You might not have to wait long on the first option. Time of writing is December 2021. Every centralized service I'm aware of plans to release NFT markets alongside their current services. I believe we'll see them 1st/2nd quarter of 2022. Until they release them, public reception remains a mystery. People's attention is fickle. There will be trends within trends after previously trending trends. Some people will have cyclical success, others will be sustainable. The best option might be to do both. Artists could probe how well they're received on multiple platforms.

There's clear distinctions in personality types attracted to either platform too. People successful in decentralized finance might want to keep their funds on their private wallets. I know I don't want to mingle with the ignorant unwashed masses. Your work might sit unnoticed for months on the Terra Luna network, only to be gobbled up in a heartbeat by a ghoul-like obsessive crypto baron living with his mother chilling in her basement in his underwear. NO THAT'S NOT ME. MY MOTHER LIVES WITH ME. I TOKENIZED THE DEED TO PROVE IT.

In my opinion, the biggest names in centralized exchanges are Coinbase, Crypto.com, Gemini, and Binance. All of them intend to release NFT marketplaces in the near future. Crypto.com is operated out of Hong Kong. Coinbase and Gemini are American. Binance has a sister company specifically for American users called Binance U.S. It's founder is Chinese and it's central location is often under question. It was Malta at one point, but they're working to become decentralized since launching their own cryptocurrency, Binance coin. It was launched as an alternative to Ethereum. I’ve just barely started using it and withhold any opinion for the time being. It's gas fees are cheaper, but this space is rife with “Ethereum killers”. It will take time to see the effects of adoption and continued development.

All of these exchanges might lose the race to NFTs, however. Blockfolio, a well established company for tracking portfolios, recently rebranded themselves as an exchange. They are now called FTX. Their NFT market is imminent if their application is an honest metric. The feature isn't on yet. They might have it there to simply attract attention. See below for a snapshot of its layout.

If you elect to wait on centralized exchanges you will see the setup process on their platforms is fairly easy. They make you create an account with your email, create a password, and pass KYC (know your customer) procedures to link your bank account or debit/credit cards. They all have an ubiquitous design like you see above. The navigation bar leads you to pages for market information, performing trades, wallet information for deposits/withdrawals of cryptocurrency, and application settings. Depending on the platform, they may allow advanced features like prediction/futures markets and margin trading.

Everyone calls investing in stocks and crypto gambling. In my opinion, those two functions are where people go to let the house win. I have never liked or used them on principle. That is gambling with money that isn't yours to buy truly nonexistent assets. At least when my Bitcoin went down to 3000 dollars in value, I still held the Bitcoin. I wasn't liquidated for believing it was worth a million and giving a whale all the information he needed to fuck me. Just an aside for young paper handed investors.

Also, exchanges will likely bug you endlessly to set up 2 factor authentication. They can't force you, but be prepared for weekly notifications if you don't turn them off. You could also just use 2 factor authentication. I don't like using my phone number and giving the government another marker for my personality profile and contact tracing, but I do understand the need to increase personal security. My wallet applications don't use 2FA, but I secure my most important personal information with hardware keys in addition to passwords. If it's possible, I try to control everything involved with creating that second factor element.

Now we get to the fun part. Decentralized/semi-centralized art exchanges. This is where all the magic happened. This is where the OGs are. Even if you don't have money or talent, the people in this space are moderately more accessible. If you don't want to feel like a consumer whore you can mingle on discord servers and get to know actual artists for fun. Don't just slop up pixelated garbage on FTX when they release it. Rifle through the new internet flea market for oddities. Go hunting for hidden talent. Like this guy. Zaldin tarot I will shill you endlessly for free. Keep it up buddy. I believe in you.

"But how," you ask.

"SHUTUP AND TEACH ME WIZARD!"

Alright. You chose the hard way. Again, everything you needed to actually do anything was at the top in the tutorials I collected. The article was just meant to inform your decisions. Now you have three more decisions to make. What platform? What network? What wallet? I'll give you a hint on the wallet. It's gonna be meta mask. That's the only one I know how to use decentralized finance applications (DEFI) with, and thereby feel comfortable teaching. Other wallets like trust wallet or exodus might work smoother and I’m simply unaware. We'll cross that bridge when we get to it.

There's already a good dozen or so NFT market places between 4 or 5 networks. Some integrated with multiple networks to give people options. From what I've read and understand, there’s three or four oldest of the oldest and most famous platforms. These are Known Origin, Super Rare, Nifty Gateway, and Async Art. They are exclusive and selective in the artists they host. They want to position themselves as “high digital art”. Their artists rarely release 2000 piece generative collections. They release well thought out, thematic series of 1 of 1 pieces starting at thousands of dollars.

Async art wants to explore creative possibilities in digital art. They sell master copies of artwork, as well as programmable layers the master copy is composed of. Owners of layers are allowed some creative control. Master copies change overtime with the input of layer owners.

I'm not familiar with Nifty Gateway beyond awareness of its existence. It might be less exclusive. I mention it with the oldest because it recently changed hands to significant investors. It was purchased by the Winklevoss twins. They own the previously mentioned Gemini exchange. It will likely be integrated with Gemini in the future. Until that time, it remains beyond the reach of credit cards.

I mention these storefronts so you have some historical context and possible long term goals. After the heavy hitters, you have the ebays. These are unfortunately saturated markets. You'll see cryptopunks and cryptokitties sold alongside millions of “rare pepes” and gifs of anime boobs. The biggest ones I'm aware of are Opensea, Rarible, and Mintable. If you have a wallet and some original creations you can start listing now.

“What do you mean host? I thought it was all decentralized.”

Aaaah, good catch. The underlying technology is decentralized. Anyone can create an NFT. As I also said however, NFTs are just bookmarked URLs with the date and purpose of their creation immortalized on a public ledger. On very rare occasions semi centralized marketplaces like Opensea and Rarible have chosen to blacklist those URls from their frontend (what users see available). The tokens still exist. The content can still be traded. The most famous case in recent events is Flurks by Stonetoss.

Many consider this cartoonist to be a far right extremist. In order to fund his work he released an NFT collection. It was cartoon characters drawn with offensive attributes. Some held confederate flags, among other things. Histrionic journalists moaned at the concept of someone they don't like making more money than them without sucking off think tank oligarchs. Opensea and Rarible delisted the project. Law suits are pending. He's perfectly capable of funding them with the 2 million dollars he made from initial purchases. The NFTs are still available on Mintable.

What's more, Stonetoss wrote he’s perfectly capable of launching an internal flurk market place from the original project website. He chose not to do so unless absolutely necessary. He wishes to seek legal reprisal before resorting to such retaliation. Journalists achieved nothing. That's usually par for the course in their field. They just quadrupled the value of all flurks holding confederate flags in aftermarket resale. I consider the episode an interesting stress test on the founding principles of the technology. If the reader’s wondering about the writer’s political leanings. No. I don't own a flurk. Yes. I own gifs of anime boobs. They're mine. Not yours.

Last in the categories we have niche weirdos, and upstarts with potential. These are marketplaces open for all creators, but nobody's aware of them yet for various reasons. The usual reason is their choice of network they launched on. Artion and Paint Swap are very well made web applications, but they're on the Fantom network. Normal people just barely became aware of NFTs. Obviously, nobody knows about the Fantom network.

“But I want people to know about me. Look at me.”

Really? Do you? Have you seen most people? Savage, disgusting people. Uuuugh. What I'm getting at, is these platforms are accidentally exclusive. This can be a feature rather than a flaw. People experienced in cryptocurrency and decentralized finance flocked to these new networks to yield farm shitcoins free from the burden of gas fees.

What that means for you is a bunch of obsessive nerds are looking for more avenues inside these new networks to entertain ourselves and continue gambling. We don't want to bridge back to Ethereum to drown in cryptopunk rip offs on Opensea. We want to see aesthetically pleasing collections with an interesting story like these weird black hole themed portraits partially created with the help of artificial intelligence (alright their floor price went down lately, I might be the only one that likes them… BUT I STILL LIKE THEM).

Even I'm not very familiar with all these niche markets. I just started bridging to Polygon and Fantom. I have funds in Terra Luna as well. An NFT market named Random Earth recently launched there. Sorare has launched on Solana catering to sports-based collectibles. Several famous artists, celebrities, and organizations allegedly intend to launch projects inside Solana. With all that in mind I've probably induced enough questions in your mind to get to the second decision.

“What network? What do you even mean what network?”

Okay. This is entirely my own idea of how to visualize this landscape. There are many, many cryptocurrencies. Developers everywhere are thinking of ways to tokenize services and raise funds. I classify these currencies in 3 categories. These are base service tokens, network tokens, and hybrid tokens.

Arweave, Filecoin, Vechain, and Synthetix are good examples of service tokens. They provide very specific functions like IPFS storage, supply chain maintenance, and derivatives trading. I consider Terra Luna a good example of a hybrid token. Its key service is independently hosted algorithmic stable coins, but it’s capable of hosting a variety of smart contracts for other applications and tokens.

I could attempt to cover how they provide their services. That's a very lengthy discussion about oracles, tokenomics, game theory, and more. Many fail at their attempts, as seen in the ICO craze. The cream is at last starting to rise in recent years. For now, just take me on my word that providing a service free of corporate hierarchy is their intention.

The key service people compete to provide is broad financial network communications. Tokens targeting this service host a plethora of service tokens and decentralized applications. If every service had its own base network it would be utter chaos getting all these applications talking to each other. Building projects inside the base networks streamlines the process and eases communication bottle necks. Ethereum is like a humongous city and web of roads. Vechain, Aave, Synthetix, etc. are buildings or subdivisions of the city.

Multiple network token projects are still hammering out details on the best protocol and strategies while they compete against each other. There are unique features which distinguish them from each other. Ethereum is the first and most ubiquitous. It's not the best, but it’s in the process of upgrading. The others I personally use the most are Polygon, Fantom, and Terra Luna. I will not tell you these are the best. I don't know if they're the best. I may also use Cardano, Solana, or even Radix in the future.

I don’t know how to best summarize their differences to the uninitiated, or what information a content creator needs the most. I can go off about byzantine fault tolerance, zero knowledge proofs, ZK Rollups, and layer 1 vs layer 2 solutions all day and quadruple the size of this article, or I can give a very elemental run down. I think most will want the latter, I am available if you want to discuss the former.

Here’s what I think most will care about. Transaction speed, operational costs, and platform integrations. Some might also be concerned about what happens if a network dies tomorrow. That’s very unlikely. I don't believe any network will “die” in the space of 24 hours. Everyone knows Craig Wright isn’t Satoshi Nakamoto, but there’s still people mining his stupid “Bitcoin Satoshi Vision”. There might be noticeable decline in development over months and years. Fortunately, it's possible to bridge assets between networks.

Yes. A crypto punk made in Ethereum can be moved to the Fantom chain and sold on Artion. That’s mildly more advanced. I only mention that to set your mind at ease about picking the “wrong” network. I could make follow up articles you can point buyers too if they want to move to a shiny new network that solves the blockchain trilemma better then the last one that was supposed to do that.

Let's start with speed and operational costs. Basically, pick anything other than Ethereum. If you pick Ethereum, what you're saying is “I hate my customers”. Opensea has reduced the costs to creators with a process called “lazy minting”. The gas fee however, has to come to someone eventually. That someone is your buyer. You might think you're only charging 20$ in ETH, but everything on opensea in Ethereum costs what you're charging + 70$ minimum in ETH for gas. As a customer, I ask you not do that.

“I keep hearing about this gas. What is this gas?”

Gas fees are tiny amounts of a network token required for any transactions inside the base network. Think of it as a toll on that highway infrastructure, or a tax. Gas fees are paid out to miners/stakers validating and backing up the history of the ledger. If transaction volume increases, gas fees sometimes increase proportionally. Hence why games like cryptokitties almost crashed the entire Ethereum network in its infancy.

It’s messy work trying to provide a service purely through decentralized incentives rather than formal authoritative hierarchies in traditional corporate structures. In my opinion, things are starting to improve. People benefitted from watching Ethereum’s mistakes, including Ethereum itself. It's tough vouching for ETH at times, but I remain hopeful for the final form if we reach the end of the roadmap.

On top of that flaw, Ethereum is currently among the slowest. Some of your customers may be irked waiting for confirmation. They'll wonder if they really bought your water color of a cat, especially if they're newer to the cryptocurrency space. The attitude behind development was to move fast and break things (development-wise not transaction-wise lol). Vitalik Buterin was in a race to show the world smart contracts could exist, graphics card prices be damned. The end of the roadmap aims for around 2023. Some improvements will roll out incrementally. Some may even solve gas prices.

If you pick Polygon, Solana, or possibly even Terra Luna or Cardano in the very near future, speed and cost will be negligible issues for you and your customers. You can set up your collection on Opensea on the polygon network for pennies. I can’t speak for Solana or Luna NFTs, but transaction fees there are also minimal in my experience.

Transactions in Fantom are also insanely cheap and fast, but there’s a caveat. Getting into the actual Fantom network. The centralized tools I use currently don’t allow you to withdraw Fantom tokens to the Fantom Opera main-net. You will have to bridge them from the Ethereum network. Instructions are in the tutorials listed above this article.

To my knowledge, the oldest platforms I detailed above like Known Origin only use Ethereum. Their customers can afford it. Opensea integrated both Ethereum and Polygon. They're currently working on integrating Fantom as well. Rarible uses Ethereum and Solana. FTX advertises that they’ll also use Ethereum and Solana. They may not charge gas fees if it’s like other services on centralized exchanges. You already know how crazy I am about paint swap and that it's on Fantom.

I started planning how to write in intricate detail step by step every part of the process to setup wallets. The more I thought about it, the more I imagined this article growing to ridiculous length. It's already growing quite large. Adding 50 pictures and writing the steps would get it to 200 pages. Refer to the top of this document a series of tutorial videos I researched or made. I tried to keep them below 10 minutes each.

######

SECURITY. DON’T FUCK THIS UP.

Now we get to some vital guidance. WALLETS. OH BOY. Now is the part I can most easily fuck myself over and feel especially obligated to offer warnings and expand on a few things. Let me make this clear. This is a big boy toy. Okay??? Hey. HEY YOU. THIS IS A BIG BOY TOY. DID YOU HEAR ME?

Never. Never ever, ever give your recovery phrases and private keys to anyone. EVER. FOR ANY REASON.

Your in a hostage situation?!? MAKE THEM SHOOT YOU (parody not actually advice though it's what I'd choose).

Someone called you claiming to represent metamask? Nope. Just nope. They’re lying. Don't do it. Okay?!?

Did you see a YouTube ad from Elon Musk claiming he's doing a Bitcoin give away? Just send him one and he’ll send you two? Why? Why would he do that? Is he your mother? Is it your birthday? Why would Elon Musk love you enough to do that? He doesn’t. He wouldn’t. That's why. Nobody other than your mother loves you enough to send you money. Some of you, not even your mothers. Alright?

Okay. Moving on to the phishing attacksI can’t judge you for falling for.

A common attack is fooling people into thinking they’re on a page for a reputable service. Yes dear reader. I fell for this once. Atomic wallet is a perfectly legitimate proprietary wallet with a mobile app. THEY DON’T HAVE A FIREFOX EXTENSION. I searched to see if they did intending to setup my laptop as a backup device. I saw some random website I didn’t inspect closely posing as them. I dumped my recovery phrase and lost everything in that wallet. It was mostly a humungous amount of Cardano valued at 80,000$ at time of theft. Yikes. At least I didn’t beg congress for a bail out. I never will. Education always beats regulation. Experience always beats enforcement. Learn from my mistake padowans.

I’ve heard of a newer even more subtle grift lately. I keep my ear to the ground constantly for new warnings due to my first hand experience. The new scam is airdropping large amounts of completely useless tokens. These tokens have names used to entice you to malicious unaudited decentralized applications.

Their websites offer exchange services for the tokens they airdropped. They’ve amplified the permissions you sign off on when you link to their applications. Shortly after you link to their services, they drain you. That sounded like an elaborate con indeed to me. I think someone attempted to pull this one on me once. I was using a wallet service built into Samsung phones and saw 300,000 of a weird token appear. I’d never heard of it before. I just ignored it. That was the right call apparently.

I encourage you to look into best practices in general for security. Start using password generators and maintaining your own databases. I personally prefer Keepass2. Its available for both phones and computers. It’s open source and completely free. You can generate and manage passwords up to 256 characters. Such a length would take a millenium or more to brute force. Many phones ship with password managers from Google or Samsung now… I don’t want to use those. I feel okay storing personally encrypted keepass databases on cloud storage, provided I have an offline 2nd factor authentication measure tied to them like a keyfile or a hardware key.

I recently learned some basic steganography (hiding files in jpeg pictures). Through 2 simple command prompt commands you can hide your databases or really any file inside .JPG files. You can get some extra utility out of your giant collection of memes or family photos. A 3GB collection of 1000 pictures suddenly turns into a very large keychain bad actors would have to comb through. They could probably still crack it, but it could buy you vital time.

Consider adding hardware keys to your personal databases. I’ve started investigating products like Yubikey. These devices make your phones, computers, and password managers function more like a car or door to your house. Someone could dump a terrawatt of energy into a processor to brute force your databases. It can’t open without authentication from plugging in the hardware key or tapping NFC connectors on it. GUARD THOSE AS CAREFULLY AS YOUR RECOVERY PHRASES IF YOU USE THEM. Make a backup you can secure in a safe if possible.

Interact with these applications carefully when you’re out in the meat space world. I know it sounds like a headache managing multiple accounts. I manage 16 pools of assets at times. I’m a freak who enjoys masochistic demands on my neural processing power. I wouldn’t wish it on anyone who didn’t want to do it. You should however, consider having at least 2 or 3 services or wallets you use. One of them you treat as a savings account and access in the privacy of your home. The others you have as petty cash pools or payment acceptance locations.

If your services allow you to obfuscate the total value of your pools when you use the app, use that feature. You never know who might be looking over people’s shoulders staring at phones when you’re in public. You don’t brandish your fancy gold encased i-phone in dive bars in Mogadishu. You especially don’t give people the opportunity to see you live in 6 figure hell or 7 figure purgatory. Maybe you want to see how much torture you need before you cave and tell people everything they need to take it. I don’t know. There’s all sorts of fetishes out there.

Observe and cultivate your personal habits mindfully. Vet the applications, websites, and web services you use carefully. People in the crypto space are still debating whether a phone is an acceptable trading device. I feel I’ve hammered out some best practices with mine. Only using wallet applications provided by app stores provides some security in its own right. Apple and Google legally have to at least try and vet those platforms. Hence why it was easier to fall for a fake browser extension than it was a fake wallet app.

Separate user accounts on phones or use hidden folder applications. I’ve caved and committed completely to Samsung phones because they come with secure sandboxed folders baked in. Their Knox security chipsets are considered an industry standard. State actors permit them as work phones for people with security clearances. Research those features thoroughly and use them. They’re not gonna do you any good if you don’t. I’m not gonna shill you any particular phone. Samsung didn’t pay me. You’d have seen more mentions by now to optimize this article for search engines if I was. Just telling you my approach. Separating your user accounts and adopting physical hardware security keys is certainly orders of magnitudes better than any choice of phone alone.

Try to stick with apps and games made by major companies or well established communities. Try to use frequently audited open source apps. Metamask, as buggy as it can be at times, is open source. You might be waiting on it to behave, but I’ve yet to see any exploits directly from the developers in its history of updates. I especially prefer apps made from developers directly involved with cryptocurrency networks. Cosmos station is a wallet application made specifically by and for the Cosmos network (not related to NFTs just an example for community projects). Likewise for Terra Station with Terra Luna. Yoroi is a Cardano wallet application developed by IOHK which is a sister company directly under Cardano itself.

Do at least 1 of the things listed in the section. Do 3. Do all of them. Just do some number, please. People well versed in cryptocurrency aren’t understating with the catchphrase “be your own bank”. Think like a bank (in regards to operational security, not begging state actors to inflate the currencies of host countries). These technologies offer a wealth of freedoms. True freedom , the kind the state has tried to insulate you from with permadaycare, carries responsibilities. There’s no escaping risk here in cryptocurrency. In my mind, there was never any escape from risk anywhere. There’s just especially fewer lies about risk in cryptocurrency. You’ll have to be mindful here. It’s inescapable.

I know I project superiority and contempt at times over here with my dozen different wallets and apps. It’s faux contempt, I promise. It’s just a joke. There’s no shame if you stay in centralized exchanges sheltered in their legal liability to insure your assets. I still highly encourage you to use an insanely long 256 character generated password to access them, and change it every few months. Good security is always in style.

######

I WANNA MAKE MONEY. I LIKE MONEY.

Same. So. The next question for artists is “how do I sell the damn things?” Good question. Here, more than any other section, I’m clearly under qualified. You'll remember my disclosures. I’m also not a business consultant. I've never sold an NFT. This is my opinion as a consumer and moderately knowledgeable speculator.

Therein lies most artists's first mistake. They only know how to think like artists. Never forget. If you enter this space, you’re now also a speculator. You’re speculating on the collectability of your art. You don't need vast artistic talent to make something collectible. Pogs are collectible. Pepsi signs are collectible. Literal feces from alleged holy saints are collectible.

Talent can be really, really helpful, but I feel some artists shoot themselves in the foot. They forget scarcity and rarity is the name of the game. It doesn't matter if everyone knows you can always mint 1000 more. Just don’t do it, and everyone will keep drooling over the last piece you held onto in your collection.

You feel bad about knowingly fucking with the lizard brain?

Leave a link in the description of your piece for physical prints. People always have the option to leave the game. That's their choice. Don't treat NFTs like prints. Everyone else wants them to be special. Don't ruin their game. It's a fun game.

How do you make them collectible?

I've seen 2 strategies. You can do a series of 1 of 1s with a tight impressive theme, or shit out 2000 with generative programs. Sometimes the 2000 piece generated collections have an interesting aesthetic theme as well. Most are pixelated garbage people fooled you into thinking are original crypto punks, or will be as successful by riding their coat tails.

Personally, were I talented, I would consider both strategies. Some generative collections could get people hooked on your style. Nobody wants to feel excluded. Maybe that's a mistake. Or maybe, you could leverage the pseudonymous capabilities of this new technology. You could dump some generative collections on Opensea, accept Known Origin’s invite, and sprinkle super high definition hentai on the Fantom network, all from 3 separate wallet addresses and different platform profiles. What a magical time to be alive.

A generative collection is when you create enough variations of a single picture to generate hundreds of other versions mixing layers. It would be nice if art software came with this function automatically. I don't believe it does at this time.

I've seen how people do this with layer files. People use a program called “node js”. I've never used it. I left links in the tutorials above. It doesn't require any coding ability, but it does require some basic terminal navigation. There's other simple applications run in the programming language “python”. I haven't used that either. I will consider investigating these programs further to offer generative collection creation as a service. Such a service might be unnecessary in the near future. I imagine that feature will be baked in to art software soon enough.

When you make a generative collection you can modify rarity of features to scale their desirability. I imagine confederate flags and FBI caps were a “rare” feature in flurks by Stonetoss. You can make a collection of cats where Siamese are rare, any cat with laser eyes or holding a gun is rare. If your collection catches on, people will go crazy for the one and only Siamese cat with laser eyes holding a gun.

If you go for 1 of 1s keep your theme very coordinated. If it’s good enough, it can be sold for quite a bit. Sometimes it won't even require much marketing. Have you heard of “Nightmare Demons”? Have you heard of “Fantom Gates”? No. I doubt you have. Two pieces I showed off to you in this article are from those collections. You might have noticed the first Nightmare Demon is 25,000$ in Fantom on resale. I don't own anything in that collection, but I'm drooling over it. People are definitely buying other nightmare demons for at least 1500$ in Fantom. I've seen the sale histories.

Fantom Gates is especially interesting for a large collection around 2000 pieces. It's an evolution and demonstration of advanced generative art.

People leveraged artificial intelligence to create very unique pieces very quickly. Even with their quantity being so high, many sold easily for $100-$500 each. You could say it's a perfect fusion of generative art with a 1 of 1 approach. There are no features indicating “rarity”. Every one of them is unique. There's just a large quantity sharing a well executed theme.

Lastly, and I cannot stress this enough, you’ll likely need to be more visible. If not you, at least your project. You can make social network accounts just for advertising your project. You don't have to post your face. I know I wouldn’t. You don't have to be an Instagram thot or Tik Tok investment bro. You should however, probably consider talking to people.

Collectors might not contact you or interact as much, but they could be lurking on discord. They sometimes look for random names to search on Opensea just for shits and giggles.

IRL meetups are probably still the best marketing opportunities. Especially coming out of COVID. People are desperate for chances to mingle again. Art, anime, scifi, and fantasy conventions are notorious for attracting collectors. You can definitely add crypto conventions to that list now. Yes. Those exist. There's likely some bleed over between those communities.

######

CAN’T MAKE ART. I JUST WANNA BUY AND SELL.

Ooooh? You want to join the degenerates like myself? You really want to fuck me dancing on the edge of financial advice… uuuuuuugh. Okay. Again, and I really mean it, THIS IS NOT FINANCIAL ADVICE. Please, please, please talk to someone licensed. They will tell you I am insane, but free me from liability. There. YOU'RE WARNED. OKAAAAY?!?

…

Okay. What follows is a glimpse into my attitude and some options you won't hear those advisors entertain. Nothing more. My risk profile is through the roof by their estimation, but here's how I've seen things during my journey.

First of all. I’m not a day trader. I’ve never been a day trader. I've never even done technical analysis beyond the odd glimpse at daily market cap. I’m not a swing trader. If it weren’t for losing my job and having to commit to passive income strategies, I'd still be a long term investor.

Now I call myself a medium term investor. My first and most important positions were held over a period of years. Now I make 5-20 moves throughout the year with small bits of other people’s technical analysis describing over arching market trends in 1-4 year cycles. I didn’t get rich quick. I got financially independent kinda fast.

What I do is look for value, listen to value propositions, and exercise judgement on their validity. That's it. If I believe the proposition, and I'm satisfied with the engineering, I don't fuck around diversifying.

That’s the risk I take everyone else will call insane. I've barely started diversifying, and my portfolio isn't even very diverse. It’s 6-8 positions. You see what I'm saying?

Bitcoin’s value proposition was/is, “we need an asset that does the opposite of fiat currency.” I agreed with that thesis, liked the novel engineering approach, and aped in. Every dollar that wasn't food was Bitcoin. The price didn't matter to me. I'll say that again. THE PRICE DIDN'T MATTER. Every day I was thankful someone accepted my toilet paper money for something a central bank never touched.

Were I more committed to the NFT markets as a long term investor, I would just buy cryptopunks, cryptokitties and Bored Ape Yacht Club. The price wouldn't matter. They’re the obvious historical pieces. I believe future trillionaire collectors will obsess over them.

The value proposition of those collections is “humans obsess over inane bullshit. They want pieces of art celebrities touched, and everyone talked about.” I agree with that thesis. I just don't care as much about that sector of the market. I don't want to treat art like just another money grab.

WOAAAAH WOAH WOAH. Remember the disclosures. I am very different from you. I have no children or mortgage. Furthermore, there's levels of commitment and alternative moves with less risk. I'm involved in the NFT market in other ways. I'm cultivating my own tastes for unique art. I’m talking to many artists. I’m listening to their life stories. I’m asking them about their compositions.

That's the advice I've heard from professionals in physical art markets. I’m just following it for digital art markets. I'm promoting legitimacy for an asset platform to help artists. It's somewhat about cash, but also more. I'd do the same thing for physical art. I would never buy a Warhol or Pollock. I don't like their art. No offense. It's just not my taste. I’d kill to own a William Blake. That's my taste. I’d personally kill your mother or father in front of you for 2 William Blakes. One I would die with, the other I'd sell in an emergency, and cry while I part with it. At least its time with me would be added to its story. There you have it.People want to be part of a great story. Now we can keep a perfect history in public ledgers.

“You said I could make money. I don't wanna be cultured.”

Yes. Yes I did. Okay. Let's surrender completely to money grubbing without thought. NFTs and memetic cultural trends will indeed continue to be a gold mine IN MY ESTIMATION. Like the actual gold rush, that value will be spread unpredictably over a vast landscape. Who made the most money during the gold rush? People who made shovels.

So, I'm also looking for blanketed exposure. I'm looking for infrastructure services. That's why I'm also staking with Paint Swap. That's why I look for other art exchanges with governance tokens like Rarible. Allegedly, Opensea is going public or releasing an initial coin offering in the near future. If I was still in the stock market, I’d buy stock in Coinbase prior to their NFT market release. I believe that’ll be a positive news cycle for them. Also, remember. All these projects run inside other networks. Simply buying Ethereum or Fantom gets me exposure to the NFT markets inside them, albeit a couple degrees away.

That's everything I'm doing as a talentless hack. That's how I think and FEEL as a speculator. DON'T DO IT JUST BECAUSE I SAID IT.

######

GOODBYE

Yup. That's the whole kitten caboodle. Hope it's all of some use to you. I assure you I could go on. I’m considering an additional more technical article aimed at collectors to help them view, transfer, resale NFTs, and more. I look at this article as an introduction to the “idea” of NFTs for artists and consumers. It’s not a book, but paired with the links I’ve sprinkled in here, it really does compile to book size. By all means, lose yourself in the deep dive, and we can see what questions remain after that to direct my future writings.

Artists. I've said it before, but I'll say it again. I can't promise success, but I promise you, you can make NFTs. You know how I know? Your staring at one right now. That's right. I made this article into an NFT. It cost me all of 120 dollars in ETH gas fees. Sometimes you just gotta follow through to make a point.

So artists. Please. I beseech you. Let me give you my money while remaining a degenerate speculator. I'm racked with residual guilt and impostor syndrome. I need to complete my transition from undeservingly lucky nouveau riche, to daring upstart patron of the arts.

Best of luck. Stay safe out their gamblers.

Thankyou for reading my blog post.

######

TOOLS, SERVICES, AND STOREFRONTS REFERENCED.

EXCHANGES

Browser/mobile Metamask ethereum virtual machine network wallet.

Browser/mobile Terra Luna Terra station wallet.

Browser/mobile Gemini exchange.

Browser/mobile Coinbase exchange.

Mobile Crypto.com exchange.

Browser/mobile Binance US exchange.

Browser/mobile FTXpro US exchange.

DAPPS/STOREFRONTS

Fantom Paintswap NFT store.

Ethereum/Polygon Opensea NFT store.

Terra Luna Randomearth NFT store.

Terra Luna Knowhere art NFT store.

Terra Luna Talist NFT store.

Ethereum Known Origin NFT store.

Ethereum Async Art NFT store.

Ethereum Nifty Gateway NFT store.

Ethereum Super Rare NFT store.

Ethereum/Solana Rarible NFT store.

Ethereum Mintable NFT store.

Fantom Artion NFT store.

######

OPTIONAL EXTRA HOMEWORK.

Warning. Could be overwhelming. Really, completely totally optional.

Basic blockchain definition and outline (additional video explanation).

Kyle Rittenhouse service denial during his court case.

How the infrastructure bill may effect crypto traders.

Mining/staking explanations and other consensus mechanisms (additional sources 1, and 2).

Blockchain games like Cryptokitties and Axie Infiity explained.

How NFT royalties work.

NFT relationship to securities.

Notable events in the music piracy crisis. (Additional reading, very interesting).

Detailed history of torrents and peer to peer filesharing.

Most notable attempt at violent shut down of torrenting.

Explanation of smart contracts and automated digital acounts.

Comparison of UTXO VS account ledger model.

Solidity explanation and features.

Summary of the Cambridge Analytica scandal.

Recent major service outages and failures.

Explanation of IPFS storage protocol (additional sources 1, 2 (directly from an IPFS provider no less), and 3,).

Law enforecement backdoors to everything. Definitely tip of the iceberg. Reject Pluton chipset. Embrace vintage Thinkpad collection.

Explanation of Filecoin service.

Explanation of Arweave arweave.

Server farm waste heat applications. Might not be that bad a flaw. People are discussing repurposing waste heat for energy. Would be fucking genius to just not use that much energy though… Like Arweave maybe?!?

Logan Paul showing off his prized Charizard.

Explanation of Monero privacey vs other cryptocurrencies.

Explanation of the Silkroad bust.

Explanation of cryptocurrency mixer and tumbler services.

Free ebook of Accelerando by Charles Stross. Completely free. No torrents needed. Go ahead. Take it. Join me in the pirate master race. Charles Stross has enough money.

Explanation of Radix token.

Explanation of crypto network bridges and transfers.

Summary of NFT legal status with copyright.

NFTSupreme Court ruling.

Interesting review of seashell money.See? It’s real.

Explanation of Terra Luna coin.

Explanation of Binance coin.

Explanation DEFI application.

Summary of Flurks by Stonetoss in recent memetic history

Explanation of Polygon network.

Explanation of Fantom network.

Explanation of algorithmic stablecoins.

Explanation of oracle services.

Explanation of tokenomics and its role in cryptocurrency.

Explanation of game theory and it’s role in cryptocurrency.

Explanation of the ICO and craze and its historical impact.

Explanation of the Cardano network.

Explanation of Solana network.

Explanation of byzantine fault tolerance and its role in network security.

Explanation of zero knowledge proofs and secure private transactions.

Explanation of ZK rollups and scaling solutions in crypto.

Explanation of layer 1 vs layer 2 solutions.

Explanation of Craig Wright, the man attempting to prove he’s Satoshi Nakamoto

Explanationf of the blockchain trilemma and scaling issues.

Opensea lazy minting explained.

Basic phishing techniques.

Downloads for KeePass database manager. Get it people. Own your own databases damn it.

Most basic steganography commands.

Where to buy yubikeys hardware keys. Use them or don’t. I ain’t got no affililate link. I just like them.

Instructions for making multiple accounts on Android.

Useful app to help further sandbox your applications on android

details on the KNOX chipset and practices. They’re likely over selling themselves. The only completely “secure” phone is likely this.

Description of open source code and benefits.

Auditing service example (additional reading).

Explanation of ERC token types and their application.