A simplified primer on MakerDAO real-world asset on-boarding (with pictures!)

Assets like ether and bitcoin exist natively “on-chain.” The applicable blockchain — Ethereum in the case of ether, Bitcoin in the case of bitcoin — recognizes the asset and, as a result, the asset is easily transferable on-chain and usable within the crypto economy. So, for example, ether can be deposited into a smart contract within the Maker Protocol where it can then serve as collateral for a stablecoin loan. All other assets (whether the assets are gold, mortgages, U.S. treasuries, art, real estate or otherwise) are not recognized by blockchains and are not directly usable within the crypto economy. Recently, MakerDAO has focused on bringing these real-world assets on-chain or, more specifically, into Maker vaults so that these assets can collateralize DAI (and the interest generated by these assets can accrue to the benefit of the protocol). So how does a real-world asset become integrated into the crypto economy? How is it brought on-chain?

Four Basic Ingredients

Each real-world asset is brought on-chain through the combination of four basic techniques. Let’s give a brief overview of the role each plays:

Securitization

Multiple similar assets (e.g. 30-year mortgages) are pooled in a legal entity that holds only those assets. Securities of that entity can then be sold, giving investors in those securities direct exposure to those assets.

ERC-20 Token

The security sold by that legal entity is an ERC-20 Token that entitles the holder to the cash flows from the legal entity (and, in turn, the assets that the legal entity holds).

NFT

A NFT is minted that represents the material features of assets so that the assets can be tracked on-chain. For example, if the asset is a mortgage and needs to be written off because the home-owner can’t make its payments, the attributes of the NFT can be adjusted accordingly.

Governance Avatar

In the case of MakerDAO, there is no legal entity that can interact with the ERC-20 token (and, indirectly, the real-world asset), so a legal entity that follow instructions issued on-chain is necessary.

Stepping Through the Portal

Now let’s see how each ingredient is used to port assets from the real-world to the on-chain economy by using a hypothetical example of a mortgage portfolio being deposited into a Maker vault. Throughout the example we’ll monitor what occurs in the real world and what occurs on-chain.

Note that this example (and these steps) does not reflect any particular MakerDAO real-world asset transaction, but is instead meant to exemplify the basic principles used in these transactions. Additionally, these steps do not necessarily occur in the order presented, rather they are presented this way for illustrative purposes.

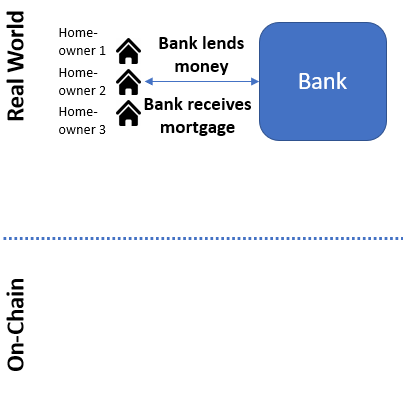

Step 1 - Initial Real-World Transaction

In the first step, a bank lends money to different homeowners in exchange for a mortgage on each property.

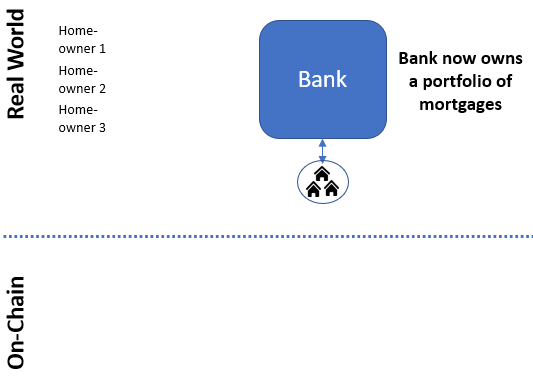

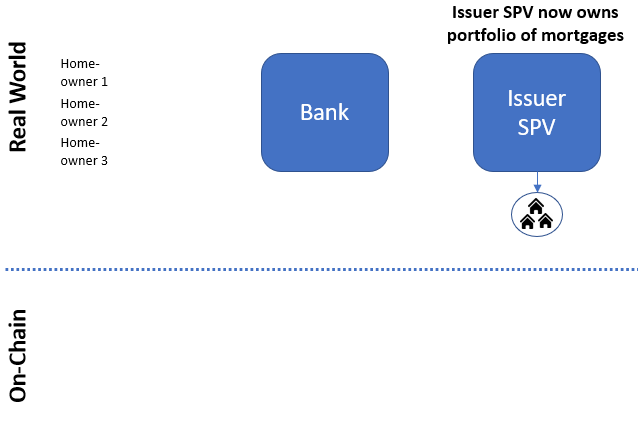

Step 2 - Post-Initial Real-World Transaction

Now the bank owns a portfolio of mortgages. So far, nothing special has happened. There has been no on-chain activity and none of our four ingredients have been used.

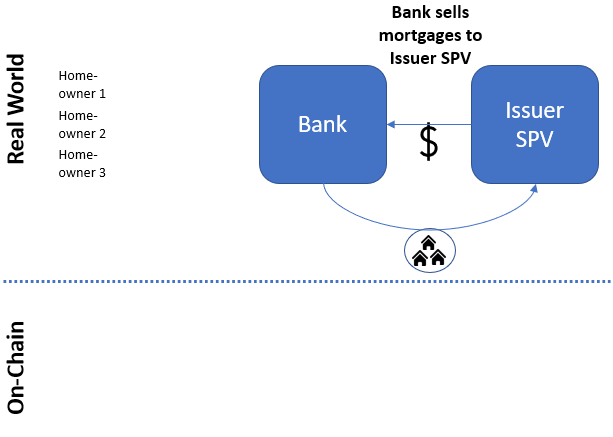

Step 3 - Securitization Begins

We can introduce our first ingredient in this step — securitization. To begin this process the mortgage portfolio is sold to a newly-created legal entity (a “special purpose vehicle” or “SPV”).

Step 4 - Post-Initial Securitization

Now the SPV holds the mortgage portfolio. In fact, the SPV will hold only this mortgage portfolio and won’t have any other assets or engage in any operations.

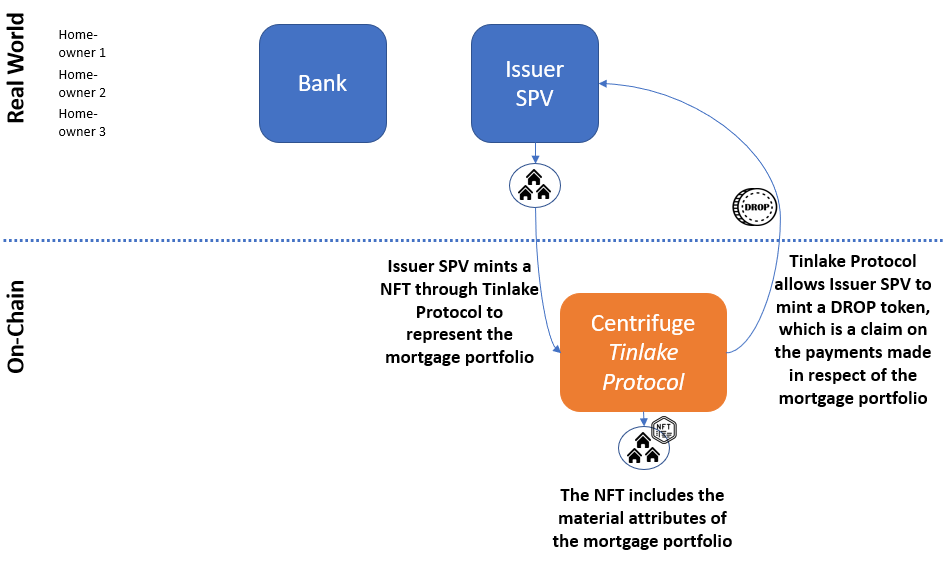

Step 5 - Bringing the Asset On-Chain

This is the first step in which on-chain activity occurs. The SPV that holds the mortgage portfolio (now referred to as the “Issuer SPV”) mints a NFT representing the mortgage portfolio using the Tinlake protocol. The NFT includes the material attributes of the mortgage portfolio so that the performance of the portfolio (e.g. have any mortgages been written-off?) can be monitored and adjusted on-chain.

The Tinlake protocol also allows the Issuer SPV to mint an ERC-20 token (a “DROP” token) that represents an interest in the Issuer SPV (and, indirectly, the mortgage portfolio). In other words, the DROP token holder is entitled to the cash flows of the Issuer SPV that are generated by the mortgage portfolio.

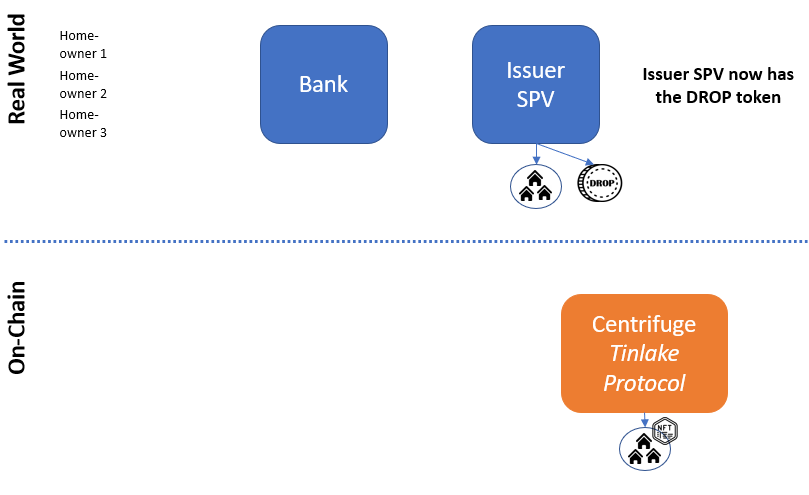

Step 6 - Post -Deposit On-Chain

A lot happened in the last step, so let’s take stock of where we are. In the real-world, the Issuer SPV still holds the mortgage portfolio (although it is restricted from transferring the mortgage portfolio in ways that are beyond the scope of this article). A NFT representing the mortgage portfolio exists on-chain and can be monitored. Lastly, the Issuer SPV holds a DROP token that represents, indirectly, an interest in the mortgage portfolio.

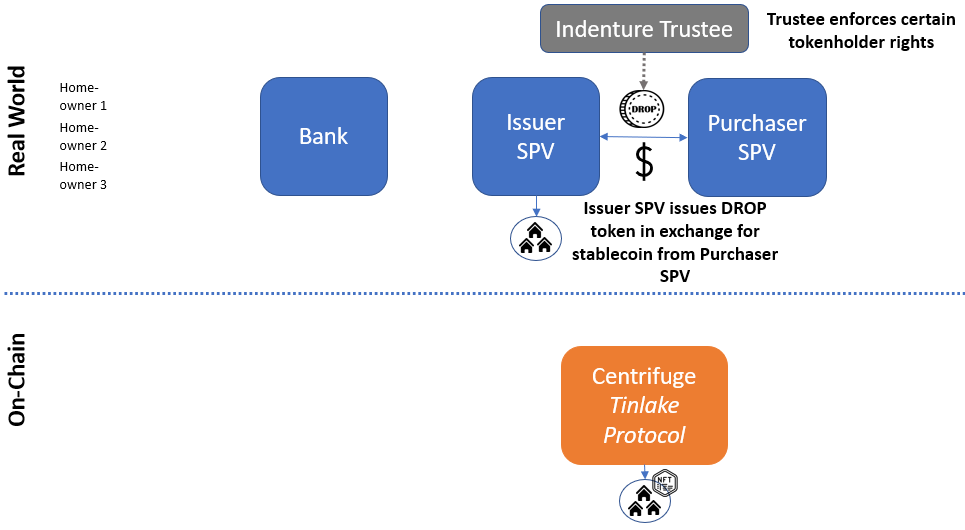

Step 7 - Transferring the Token

Having minted the DROP token through the Tinlake protocol, the Issuer SPV issues the DROP token to a different newly-created legal entity (the “Purchaser SPV”). The Purchaser SPV purchases the DROP token with a stablecoin (DAI). This stablecoin is minted and lent to the Purchaser SPV in the following step.

Additionally, an “indenture trustee” (a real-world legal entity, typically a bank or other financial institution) is engaged to enforce certain rights that holders of the DROP token have. This facet of the process will be familiar to those accustomed to securitization transactions in the real-world, but the details are beyond scope of this article. I just note the existence of the indenture trustee here to help illustrate how many actors are involved in this process.

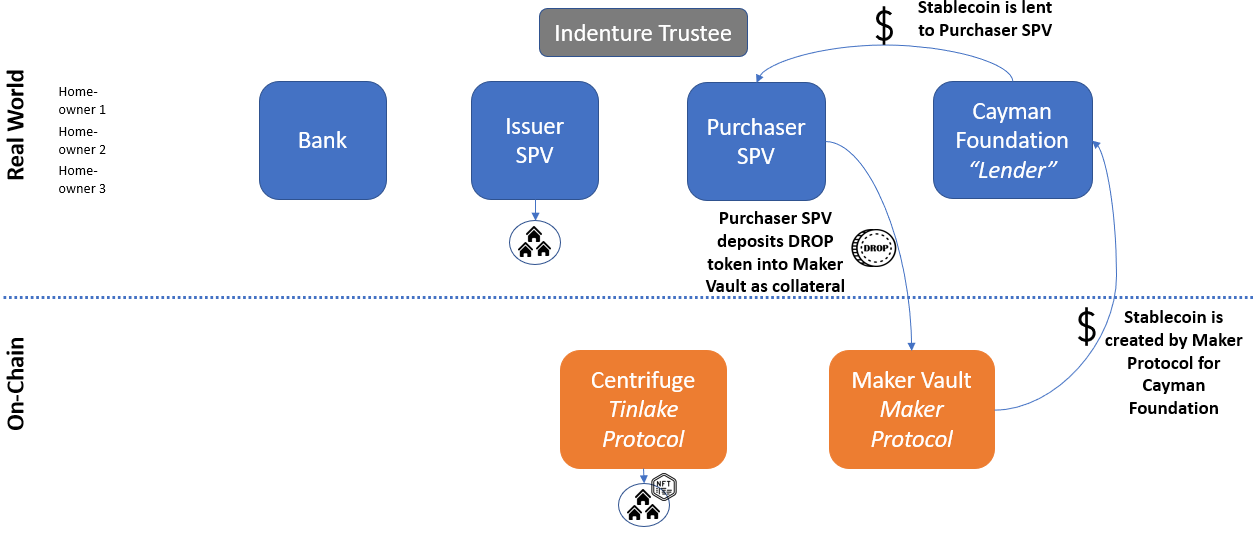

Step 8 - Minting the Stablecoin

Once the Purchaser SPV has the DROP token, it deposits the token into a Maker Vault. The DROP token acts as collateral in the Maker protocol and allows the minting of a Stablecoin (DAI) by a newly-established Cayman Islands foundation, which functions as the “lender” in this transaction as well as the governance avatar (more on that in a couple steps). The Cayman foundation then lends the stablecoin to the Purchaser SPV.

The transactions described in this step are simplified for purposes of this article. Readers familiar with securitization, structured finance or traditional debt transactions will note that I have not described the various pledges and other contractual arrangements that typically would be (and are) involved in a transaction like this.

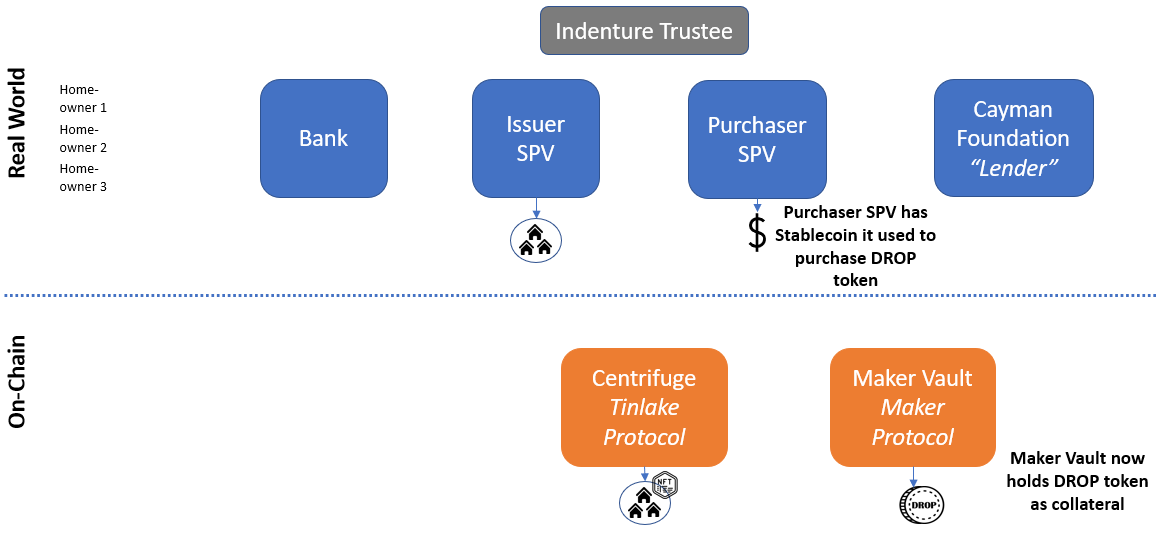

Step 9 - Post-Stablecoin Creation

Following the minting and loan of the stablecoin to the Purchaser SPV, the state of play looks similar to how it would following a deposit of any other ERC-20 token into a Maker Vault. The user (the Purchaser SPV) now holds a stablecoin (DAI) as a result of its deposit of an ERC-20 token (the DROP token) into a Maker Vault.

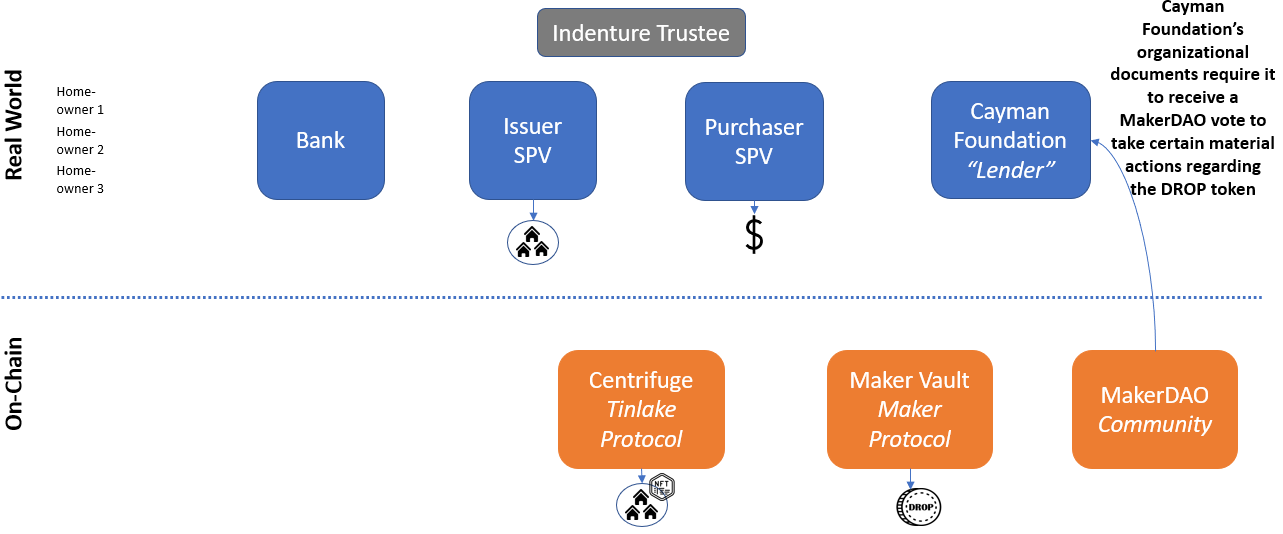

However, the Maker community (MakerDAO) is supposed to have some say over this collateral, so we have to introduce one additional step.

Step 10 - Governance Avatar

In addition to its role as “lender,” the Cayman foundation serves as the “governance avatar” for MakerDAO. It’s founding documents require it to abide by the results of an on-chain MakerDAO vote with respect to certain material issues relating to the DROP token. For example, if there is an event of default under the terms of the DROP token, the DROP token holder may be required to take certain actions. In that event, the Cayman foundation will only take those actions that are confirmed by a MakerDAO vote.

Concluding Thoughts

When people talk about bringing assets on-chain, it can be difficult to understand how that actually happens. I’ve purposely omitted a lot of detail from the above description in the hope of providing a basic explanation of how it works. If you are interested in delving deeper, most of the relevant transaction documents are posted on the MakerDAO forum.

Lastly, the above structure is, even in the simplified form presented here, complicated. Some of this complication may be necessary, but some of it arises simply from a need to fit into the legacy systems of the real-world. In future posts, I hope to suggest some ways in which it may be streamlined and create the opportunity for more real-world assets to be brought into the crypto economy.