Hedgey

Hedgey

Financial infrastructure for DAO treasuries. Escrowless OTC. D2D Swaps. Time-locked token distributions and more.

Subscribe to Hedgey

Receive the latest updates directly to your inbox.

Hedgey Launches on OKC (OKX Chain)

Excited to announce Hedgey’s launch on OKC (OKX Chain). At Hedgey, we build alongside DAOs to help them compensate, collaborate, and grow. And now, this is now available to anyone on OKC. Bringing Hedgey to OKC is a huge opportunity to change how DAOs operate in a rapidly growing ecosystem.

Helping Gitcoin expand their Governance Participation through a Treasury Diversification

Using Hedgey, Gitcoin expanded their governance participation by aligning with their long-term partners through a treasury diversification.

Using locked tokens to pump up end-of-year holiday bonuses

DAOs can show their appreciation for their contributors is by offering end of year holiday bonuses using locked tokens.

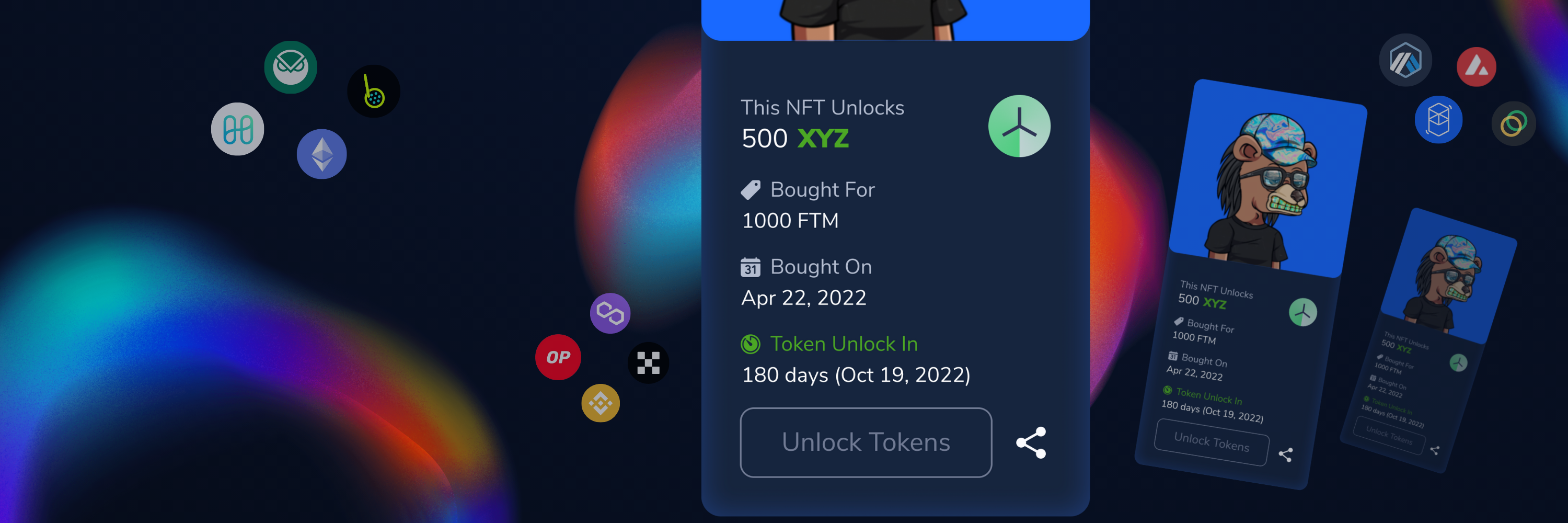

Token Bonuses for the Holidays — Locked inside NFTs

This holiday season, send your DAO contributors token bonuses locked inside Hedgey NFTs.

Introducing DAO-to-DAO Swaps — The Future of Collaboration Starts Now

DAOs work with other DAOs. DAOs swap with other DAOs. Introducing DAO-to-DAO swaps — the future of DAOs, work, and collaboration start now.

Hedgey Contributor Rewards: Adding Locked Tokens to your Compensation Mix

Using Hedgey Contributor Rewards to add locked tokens to your existing compensation model.

Creating powerful partnerships through DAO-to-DAO locked token swaps

The Hedgey protocol is enabling powerful partnerships between DAOs through locked token swaps.

Put your tokens inside an NFT using Hedgey

Using the Hedgey protocol to create community-themed, token-wrapped NFTs with a simple guide to doing it yourself.