In a past life, I was a quantitative trader at a global HFT firm. Now, I’m just having fun on the internet and documenting things I find interesting :)

The Cannibalization Problem

Many Web3 brands build on the success of their flagship NFT collection by launching follow-up projects. It’s a proven way to monetize an existing fanbase and grow an ecosystem. Follow-ups (also known as derivatives) usually take one of two forms:

-

Variation of the flagship. For example, Yuga Labs built Mutant Ape Yacht Club (MAYC) as a creative extension of Bored Ape Yacht Club (BAYC).

-

Accessory to the flagship. For example, Remilia Corporation designed Banners to accompany Milady Maker as the header to Milady’s profile picture.

In both cases, the flagship and the follow-up compete for liquidity, putting an effective ceiling on both floor price and market cap.

Why?

My view is that institutional buyers (read: whales) treat distinct NFT collections from the same creator as fungible assets and diversify by owning NFTs from different ecosystems. I’ll motivate the thesis with an example.

NFT Whales Just Don’t Care

Suppose you are a fund manager whose LPs want exposure to digital assets. You have a broad thesis that popular NFTs will outperform ETH in risk-on markets but also recognize that you have no edge in appraising individual art pieces or ecosystems.

As a result, you decide to diversify. Naively, let’s say you have two options:

-

Buy an evenly-split basket of each of the top trending NFT collections

-

Buy an evenly-split basket of NFTs from each of the top trending creators

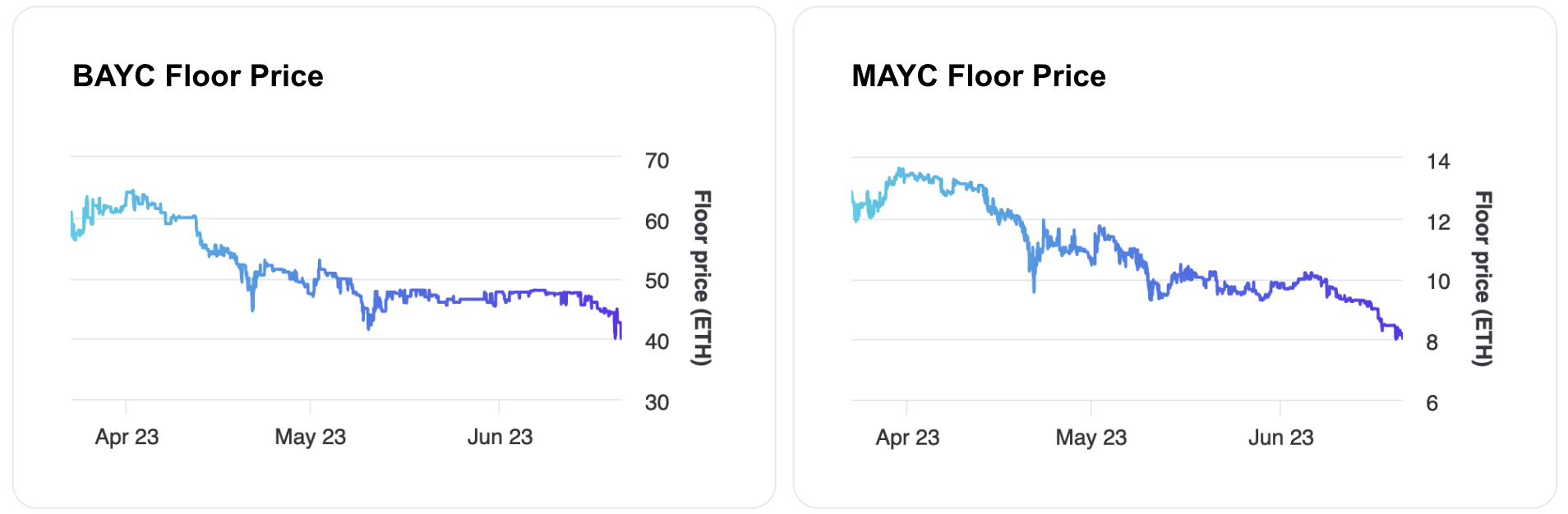

These sound similar but actually result in wildly different portfolios. The reason? Leading NFT creators often have multiple projects on the “trending” leaderboard. If you bought a basket of of the top trending NFT collections, you’d be overexposed to Yuga Labs; BAYC and MAYC are consistently among the top trending NFTs. This isn’t necessarily a bad thing, but it is something you need to be aware of and have an opinion on.

Upon investigating, you confirm there is practically no difference between buying a BAYC and a MAYC from a risk-reward standpoint. Empirically, the beta between the two is close to 1. Intuitively, the beta between a BAYC and a MAYC will always be higher than the beta between a BAYC and a non-Yuga Labs NFT because BAYC and MAYC give exposure to the same thing: the Yuga Labs ecosystem and associated narratives.

If you thought you could diversify by buying different NFTs within the same ecosystem, you’re out of luck.

As a result, you buy a basket of “blue chip” NFTs with equal allocation to each top creator. This varies, but an example allocation might be 25% Yuga Labs, 25% Remilia Corporation, 25% Chiru Labs, and 25% DeLabs. And if your thesis remains the same, you’ll periodically rebalance your portfolio (let’s say once per quarter) to maintain diversification.

While I made some simplifying assumptions, this is a roughly accurate framing of how crypto/Web3 funds approach NFT trading. When big buyers cap their exposure to individual artists instead of individual collections, there is a ceiling on the amount of money flowing into any given NFT ecosystem.

Who’s Buying Follow-Ups?

Now we know institutions are less likely to buy into a new collection by an established artist because they already have exposure to the flagship collection. So who’s buying?

There are only two natural buyers of follow-up/derivative collections:

-

Superfans. These buyers are usually price-agnostic and fiercely loyal to a specific creator/ecosystem and want a piece of any new collection they release.

-

Speculators. These buyers are profit-seeking and only buy into a follow-up collection if they see it as undervalued relative to the flagship. If they’re bullish on the creator but have no opinion on the relative value between the flagship and the follow-up, they’ll just buy the flagship as it’ll be far more liquid and less volatile.

I suspect that the true number of superfans is lower than most think and that most "superfans” are actually just naive speculators doing -EV trades. There’s a reason the sentiment of “the more expensive an NFT gets, the better it looks” is so common.

As such, the long run bidding of most follow-up collections should tend to zero, provided that true superfans are scarce and liquidity accrues to the flagship.

Most NFT creators are aware of this, seeing their projects dumped by so-called “superfans” when the number stops going up. Many have fully pivoted their business models away from selling follow-up NFTs to selling physical merchandise, licensing their IP, and even building metaverses (I remain skeptical). But without an organic fanbase, they are doomed to fail.

Remilia’s Winning Strategy

Remilia Corporation is perhaps the only leading NFT creator immune to cannibalization. They have genuine superfans who buy all their collections and are able to provide new value with each drop, allowing them to stick to their core competencies.

How did they pull this off?

As part of catering to their Terminally Online fanbase, Remilia embraced that the internet is full of subcultures; each of their pfpNFT collections caters to a specific online persona. I touched on this in my previous article:

“Remilia has an uncanny ability to spin up self-propagating online communities (read: viral cults), each with its own distinct aesthetic, leadership, and posting style.”

Whenever someone wears a Milady as their profile picture and adopts its unique posting style, they become part of the Egregore. And with each follow-up project Remilia drops, their fans are rewarded with a new digital identity to channel their creativity through. All they need to do is show up and start posting :)

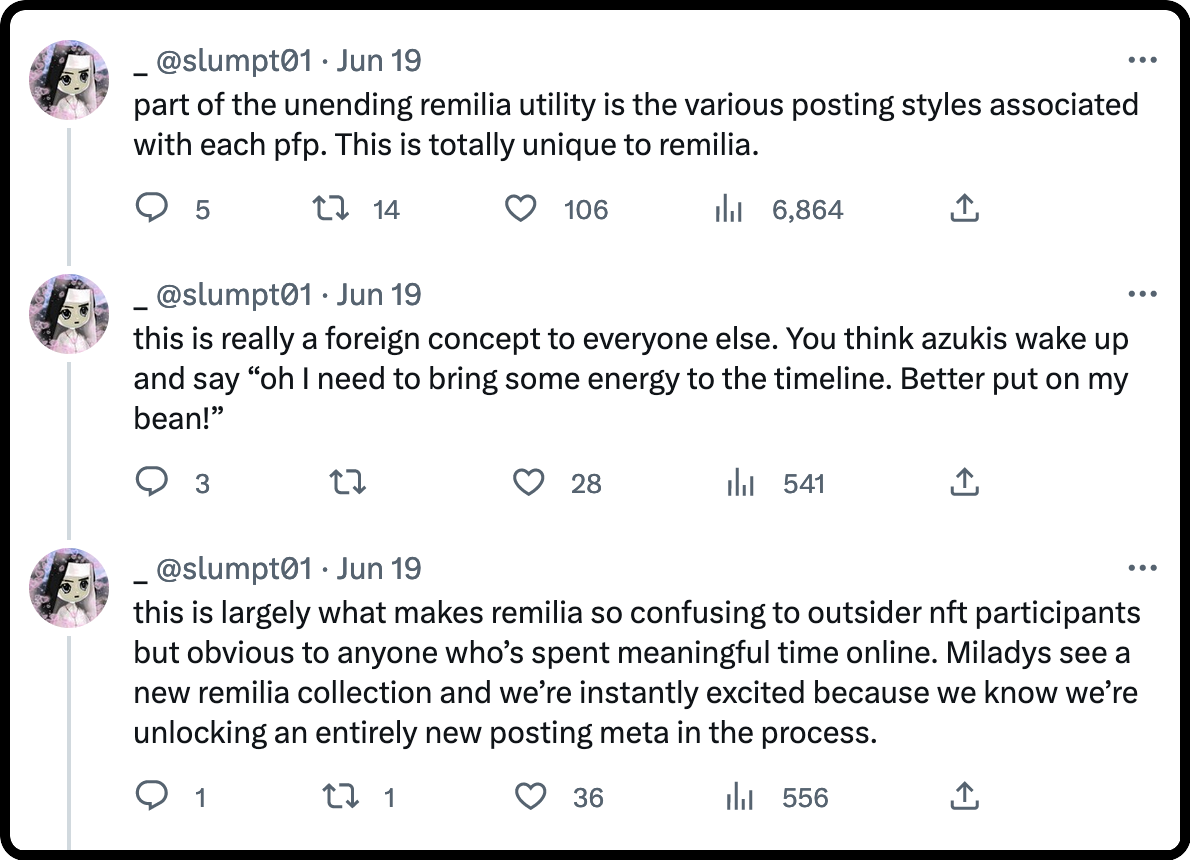

Here’s a neat thread from @slumpt01 that explains the strategy:

Ultimately, the best hedge against cannibalization is having genuine fans who are rewarded for their loyalty. Who would’ve thought?