In my first article, I argued that money remains the most important application of Blockchain. However, for this vision to be successful, we need Stablecoins. This is because volatile assets like cryptocurrency cannot be used for daily transfers. Additionally, while many NFTs are priced in terms of ETH, this is not ideal. Ultimately, the value is converted to USD representation anyway.

In this article, I will share my understanding of stablecoins.

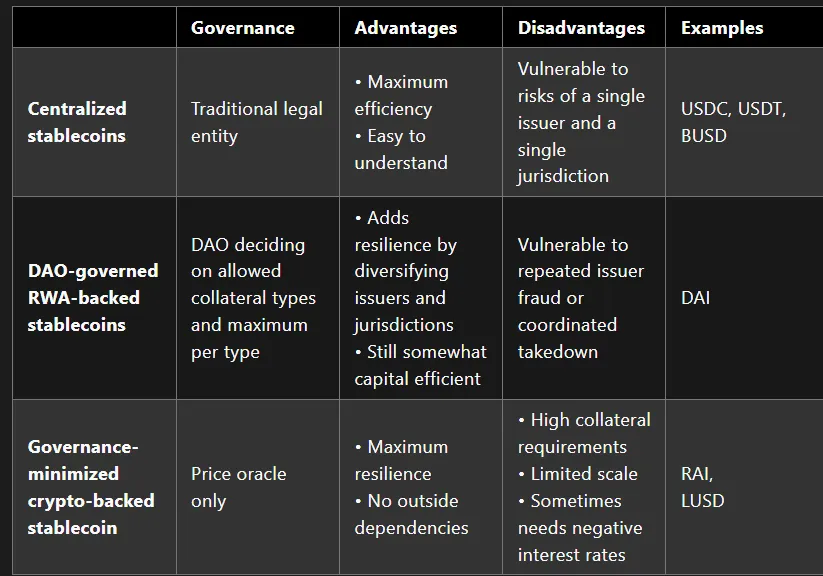

Vitalik has categorized stablecoins into three different categories: centralized stablecoins, DAO-governed real-world-asset backed stablecoins, and governance-minimized crypto-backed stablecoins.

Stablecoins in various categories have their pros and cons, as mentioned in the table above. However, a common issue is that most stablecoins [Except Rai] are tied to the value of the USD Dollar, so when the Dollar’s value decreases, so does theirs.

Stablecoins don’t necessarily need to be tied to a specific currency; their primary aim is to maintain a stable purchasing power. Surprisingly, this fundamental concept often goes overlooked.

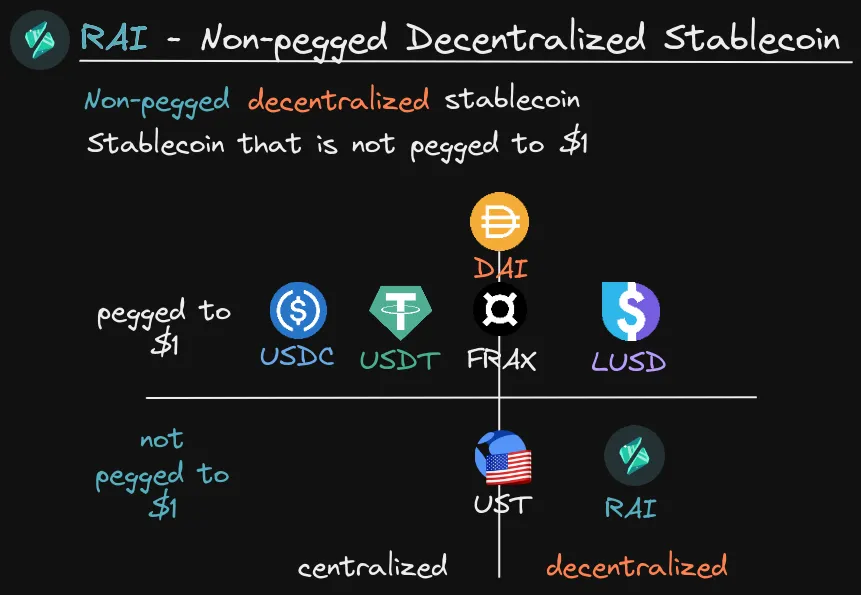

Let’s discuss RAI — RAI is a non-pegged decentralized stablecoin, essentially a low-volatility version of ETH that is 100% backed by ETH and not tied to the value of the Dollar.

Watch this video to learn more about how it works in depth.

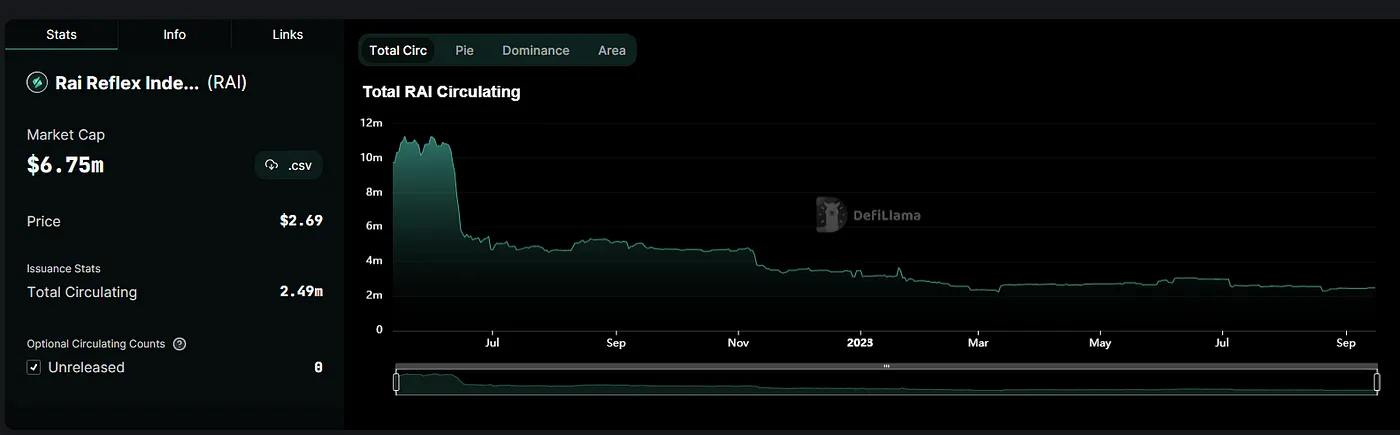

Even though RAI is perfectly aligned with cryptoPunk values, its adoption hasn’t been great. Take a look at the chart below.

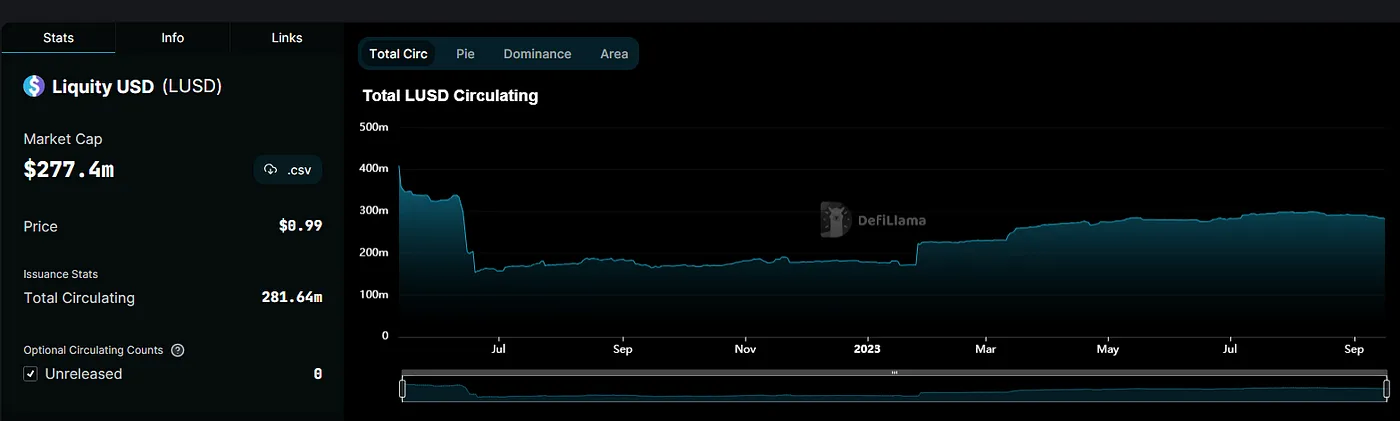

However, the adoption of LUSD has been better compared to RAI. LUSD is fully backed by ETH, but its value is pegged to the Dollar.

Certainly, RAI faces several challenges:

-

High collateral requirements

-

Limited scalability

-

Occasional need for negative interest rates

However, the world unquestionably requires a stablecoin that operates independently from traditional financial institutions, relying entirely on the cryptosystem. This makes it considerably more challenging to attack.

What can we do?

The need for more education: Many crypto users still lack awareness about the difference between centralized and decentralized stablecoins.

Incentivizing developers to create new algorithmic stablecoin protocols with innovative mechanism designs.

Reference