Content Contributor:

Chloe: Core contributor for CFG community, Bachelor of Mathematics in UCL, Master of economics in Cambridge. Interested areas include Micro: Game theory, Mechanism design, Macro: Monetary Theory, Credit System, Theory of value, Econometrics. Fallen down into the crypto rabbit hole since 2016.

Frank (Co-founder), core contributor for CFG, starting the crypto business with Chloe back in 2016. He has many years of experience in technology development, artificial intelligence, big data, search engines, and smart contract development. He previously worked in Alibaba as a senior engineer and has accumulated over 6 years of product/operation experience in the blockchain industry. He has solid professional skills in the field of WEB3.0. His interested areas include governance, Web3.0 product tools, on-chain data architecture etc. He is also the Wasm promoter and will take care of the education for Asia Community, such as the modules like Fundamentals for Wasm, Virtual machines runtime for Wasm, Front-end applications for Wasm, Cloud computing, edge computing for Wasm, Blockchain for Wasm

Overview

Several mainstream CEX introduced today include Binance, Crypto.com. OKX and Kucoin. The exchanges are directly and indirectly getting involved in the Cosmos. Of course, the participation strategy and degree of participation varies. Coinbase has made lots of efforts in the staking business through multi-chains and is focusing on developing custody and validators service. Binance and Huobi are strategically getting involved through different ways. This shows the financial conglomerates are beginning to smell the opportunities in this space.

Crypto.com

Crypto.com is a conglomerate crypto company based in Singapore. Its core business includes wallet, transaction, payment, financial management, etc. Crypto.com is the first exchange to strategically deploy through Cosmos. There are two app-chains connected through IBC, of which the one is called Crypto.Org, built on Cosmos SDK, Tendermint (ranked as the 9th), and is mainly used for staking and governance. Another one called Cronos is actually built through the Ethermint. It’s the first chain to be connected through the IBC. Since it’s fully compatible and interoperable with Ethereum, there are many folked Ethereum and Defi applications built on top. The connection to the Ethereum is done through Gravity Bridge (the pegged zone) (will be introduced later). The connection through IBC is done through major ones including Cosmos Hub, Osmosis etc.

Gaming

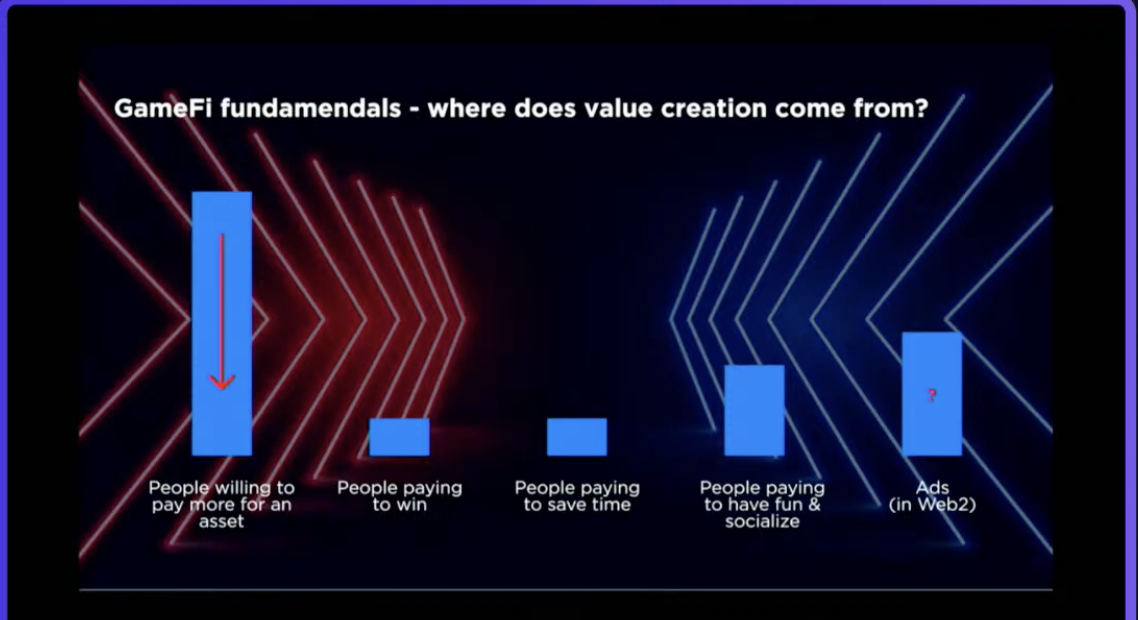

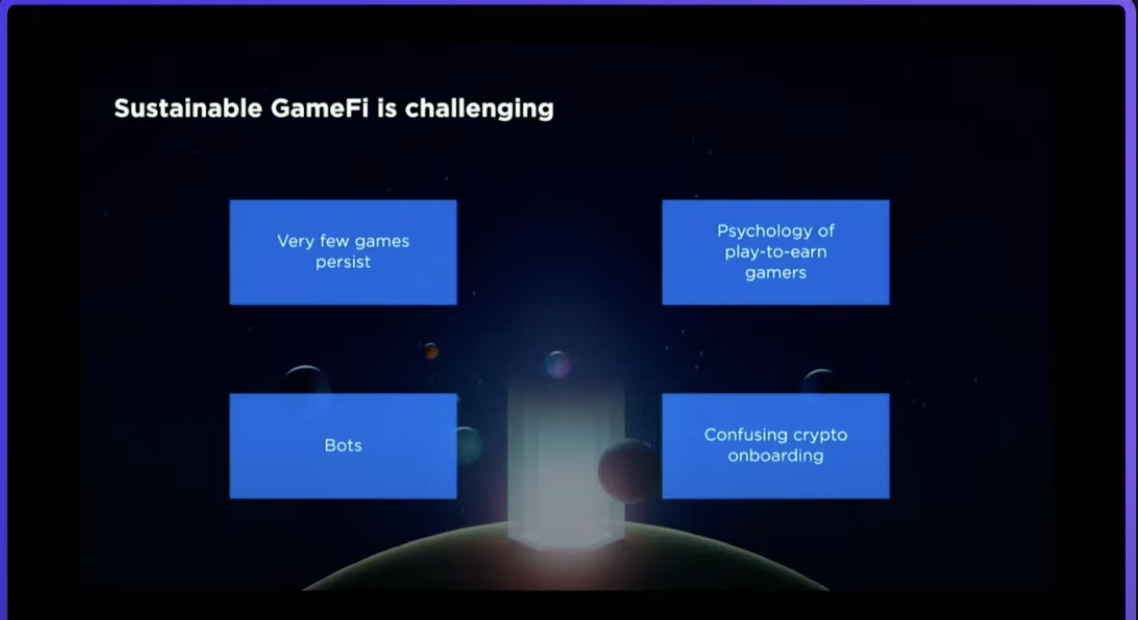

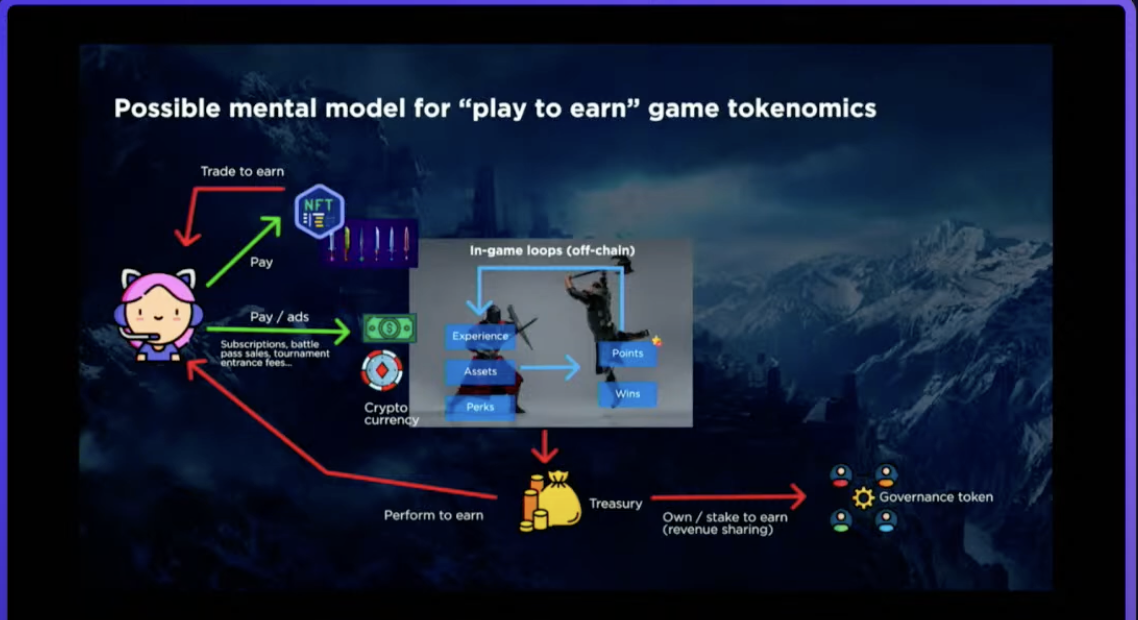

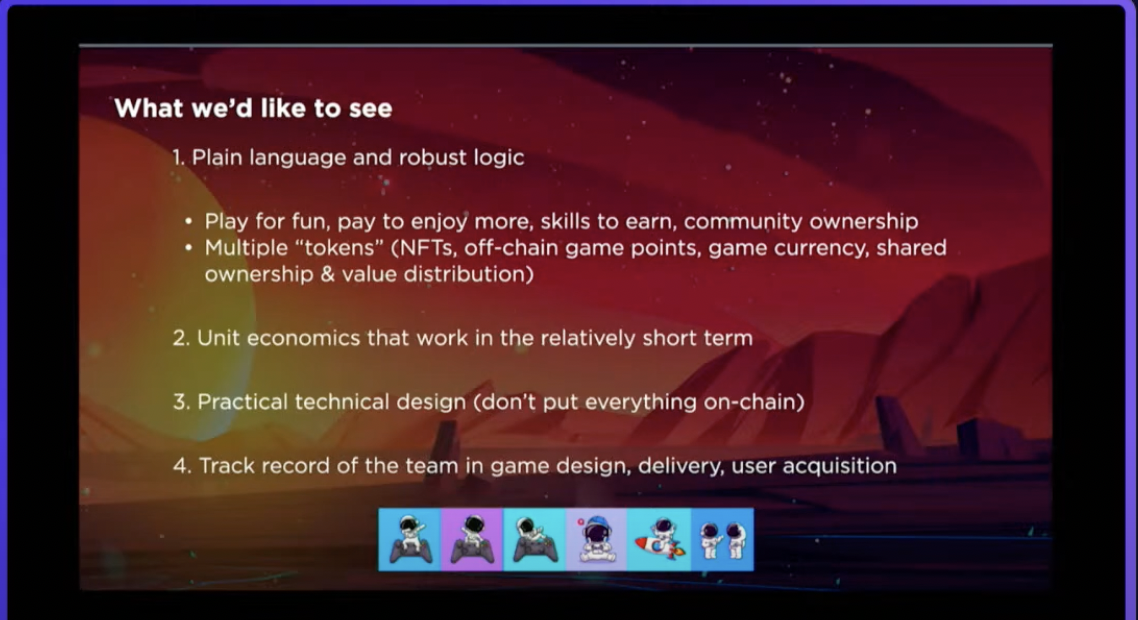

The current ecosystem building focuses on Gaming. They feel like the products launched so far are not from the actual user needs. There are actually problems for both pay to earn and play to earn models. The pay to earn increases the threshold for daily users. while the play to earn provides more value to speculators and ecosystem extractors. We give lots of insights in our previous discussions on the sustainability of thinking for the economics and social benefits for the crypto community. You can check this article if you are interested in the areas of game design, token incentives etc. The most recent report by Crypto.com says real gamers are willing to purchase the games and services, such as NFT assets, tools, points etc which can be used in the game. However, overestimating the incentive itself rather than understanding the users needs will bring more value extractors to the ecosystem. The problems from Axie Infinity, Stepn has brought us more deeply thinking about how to design a good game. A good game should be reasonably done off chain, but through the on-chain business model. For example, a good business model could be the staking, aggregating data for something like 1) the user behaviors 2) %the bots vs real users 3) education and usage for products.

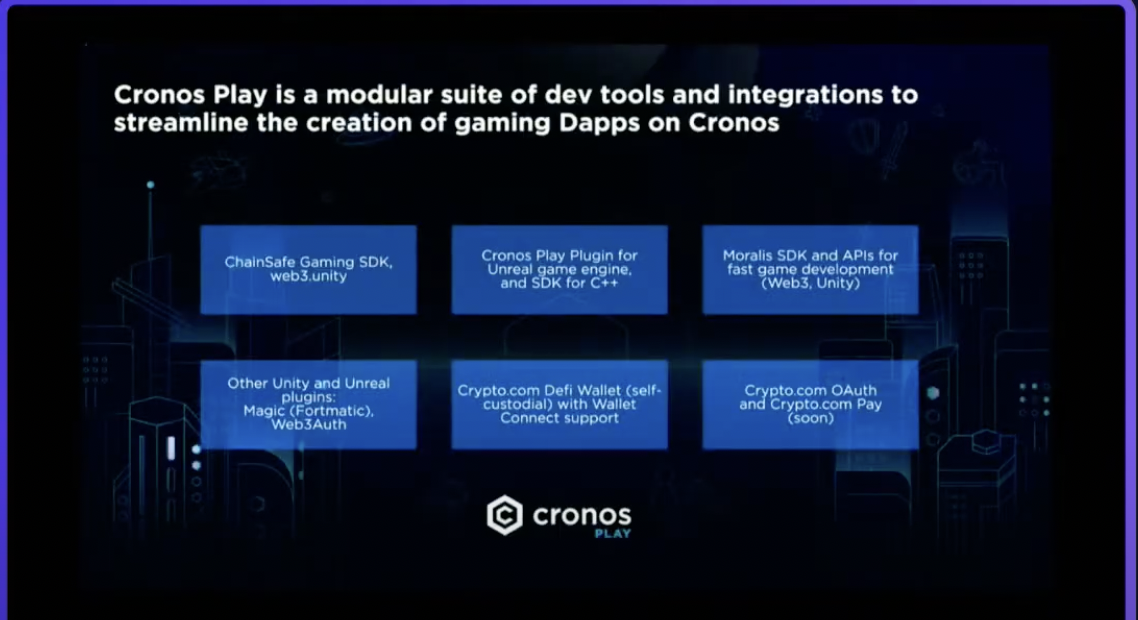

In the infrastructure side, Cronos has also done a series of development tools, helping developers to build on top of chains, in particular for gaming. This mainly includes infrastructure, API, wallets, SDK extensions etc.

Binance

Binance began to deploy on Cosmos in 2019. The standard for Binance Chain is BEP2. It was mainly used for governance and staking. Binance Smart Chain forks GETH. and the token standard for BSC is BEP20 (Ethereum is ERC20).

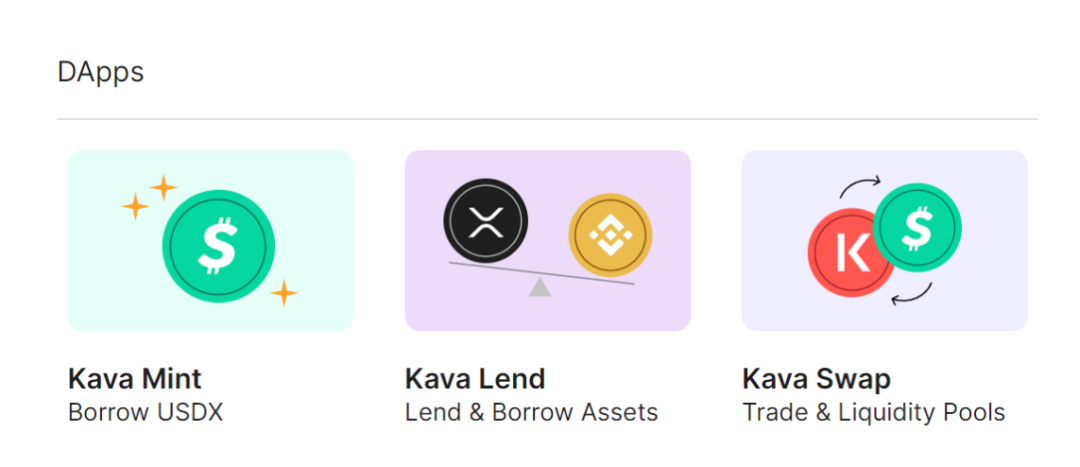

Kava is the important partner for Binance entering into the Cosmos. All the major assets on Binance can be accessed on the Kava, through the DApps such as mint, borrowing, trading etc. Kava is a very interesting Cosmos app-chains and is ranked 12th on the map of the zone by time of writing. It is unique in that 1) the first chain to be connected through IBC 2) benefits from the Defi summer 3) fully compatible and interoperable with Ethereum by building through Ethermint

According to the data by DefiLlama, total TVL is 275million USD, which include 1) CDP (minting CDP) 144million US 2) Lending 115 million, 3) 12million AMM DEX on KavaSwap.

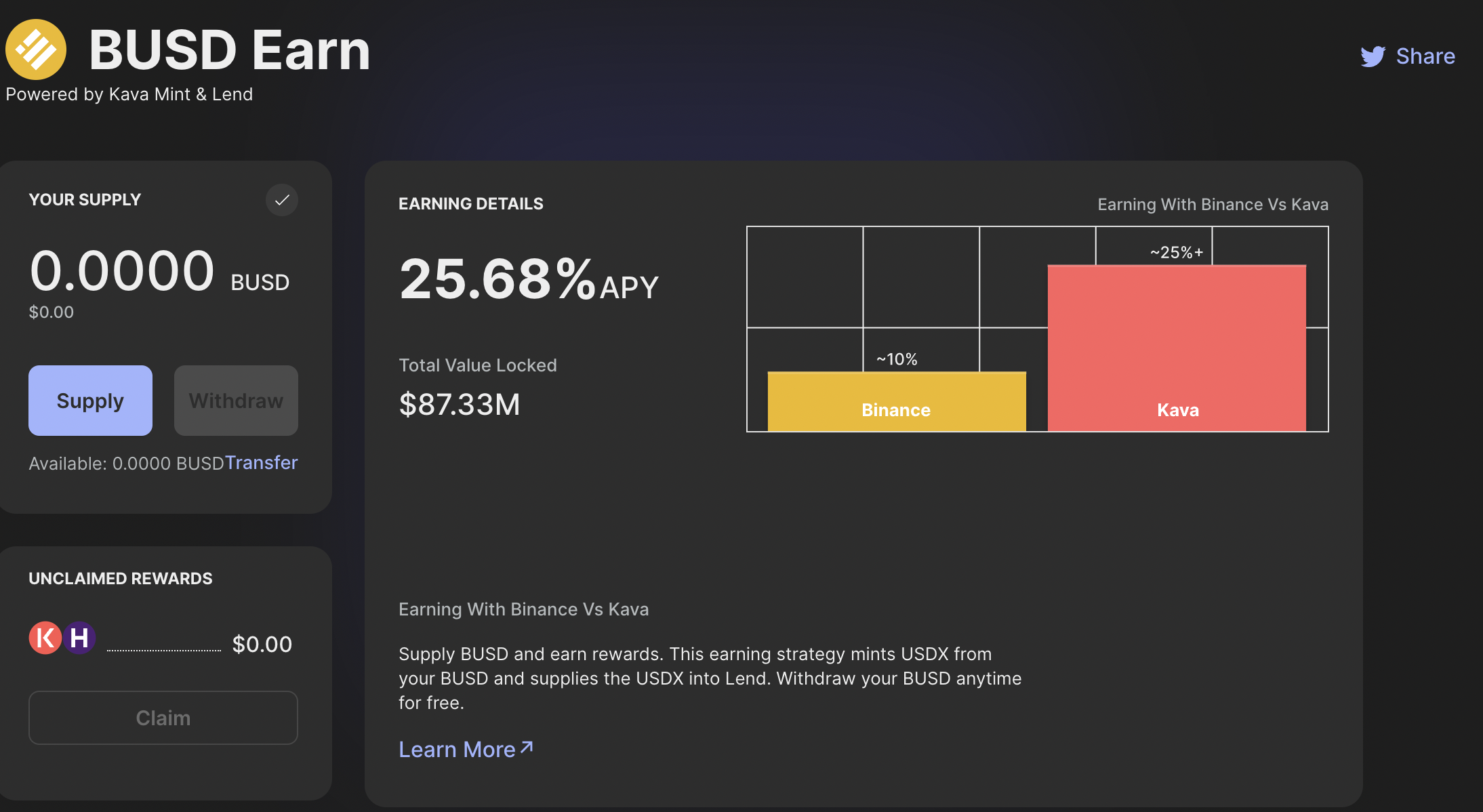

Right now, the BUSD supplied on Kava can earn the annual rate of 20%, much exceeding that of 10% in Binance. The explanation given by the community here is that the current rewards are not paid in BUSD (as what has been paid on Binace on a daily basis) or USDX (except for the smallest %). Rewards are paid out in 90% of KAVA tokens and 10% of HARD tokens. Also you must choose a 12-month release period. So the notional APY is the expected return subject to the 12-months vesting which is not comparable to the 10% APY being paid in BUSD every day by supplying the BUSD in Binance.

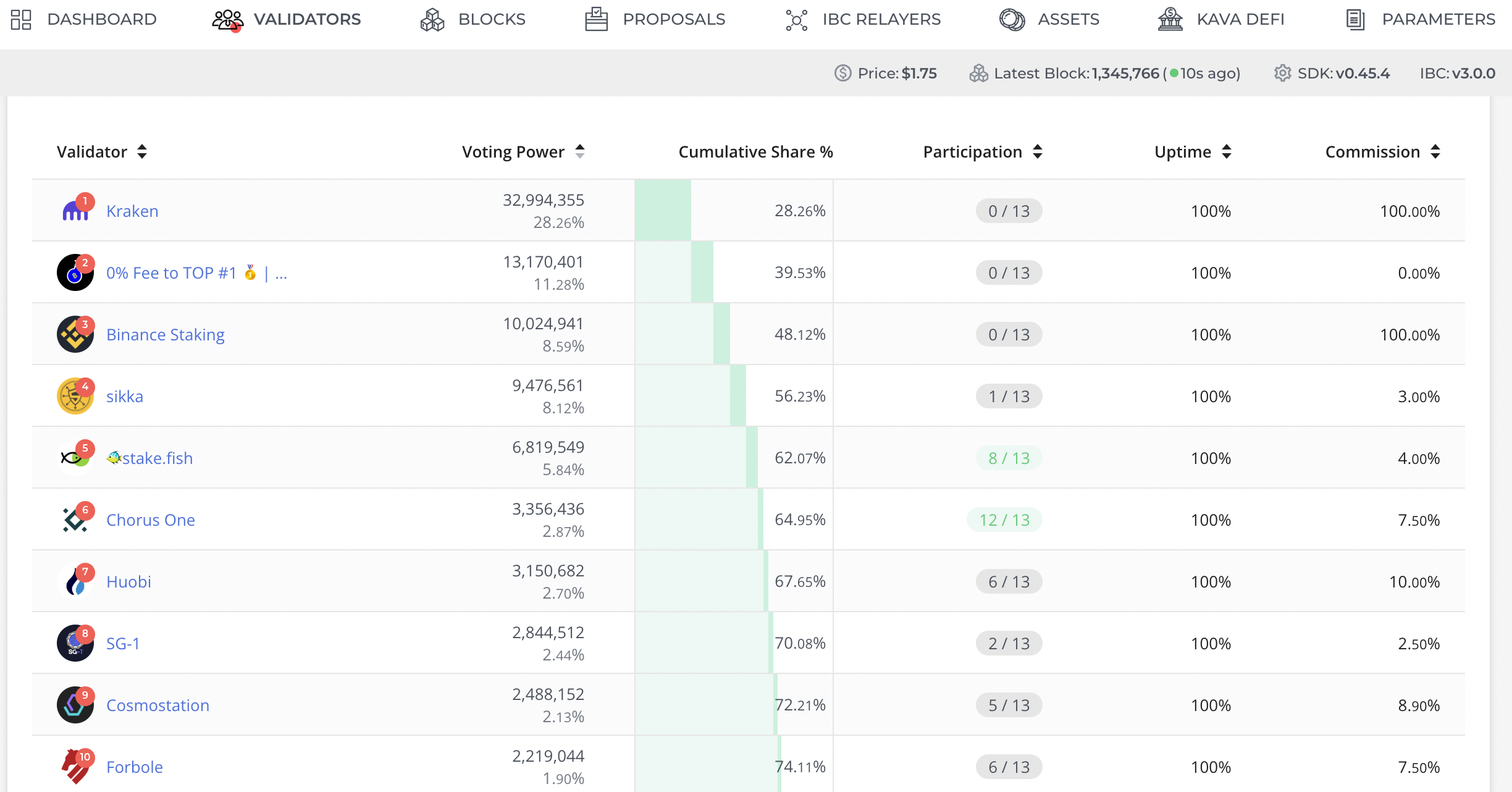

Besides Kava, Binance is also betting on the Band protocol. It is ranked as the No1 among all the exchanges validators accounting for 8.2% of the voting power. Band protocol is also developed through Cosmos SDK.

The developer incentive programme for Kava will be used to incentivise the developer community for 200 million kava tokens. Of course, there are some problems such as the centralization for validators in Kava is very high, but it’s not a rare phenomena for major chains . We believe some other chains built on Ethermint, such as Cronos, and OKX, Evmos are also very powerful players in this space.

Governance

There is a proposal 96 for Kava recently. The Ethermint developers requested 3million Kava tokens (5.45 million USD equivalently) to continue to maintain and improve the critical infrastructure that powers the Ethermint EVM library and thus one of the core value propositions of the Kava’s platform’s Ethereum co-chain. The validators voted yes, but Kava foundation voted no The proposal was finally rejected. As a result, the validators voting yes were very unhappy and discussed proposing a proposal to cancel the liquidity rewards for Kava Osmosis pair on Osmosis. This also shows the realistic problems (validators attack) for governance.

Huobi

In terms of Cosmos, Huobi Incubator chose EVMOS, a appchain that aims to bring the world of Ethereum-based applications and assets to the interoperable networks of the Cosmos ecosystem, while aligning developer and user incentives as their important strategic partner. They are currently hosting a hackathon event until September, as well as regular online twitter space events and workshops. The important partners include IRISNET, Ignite, Interchain, Hashkey, Figment, Kucoin Labs, Web3 Scholarship etc. The Hackathon is judged by Liam Evmos, Rain & Coffee (Mads) Maven 11, Rraneeth Srikanti from Ethereal ventures, Jim Parillo from Figment Capital, Jeffrey from Hashkey capital, Anna Carroll, Protocol Lead from Nomad, Unity Lucia Chaos CEO from Validating Chaos, Esther Guo, Investment Lead from KuCoin Labs, Onur Akpolat, Builders lead from Interchain, Jademont Zheng Co-founder from Waterdrip Capital etc.

From Multichain to Interchain

In order to solve the liquidity fragmentation problems, Evmos is going to launch the interchain accounts functionality which is EVM compatible. Also, Evmos tries to become the Hub by providing the upcoming Interchain security to the EVM chains. This interchain security is similar to the one proposed by the Cosmos Hub. In terms of on-chain governance, Evmos is good in terms of the active community by hosting the weekly community call. The engineering background for the team is also impressive. If you are interested in governance, you can check our previous articles for the latest governance development for Cosmos on mirror or medium.

Cosmos Hub validators

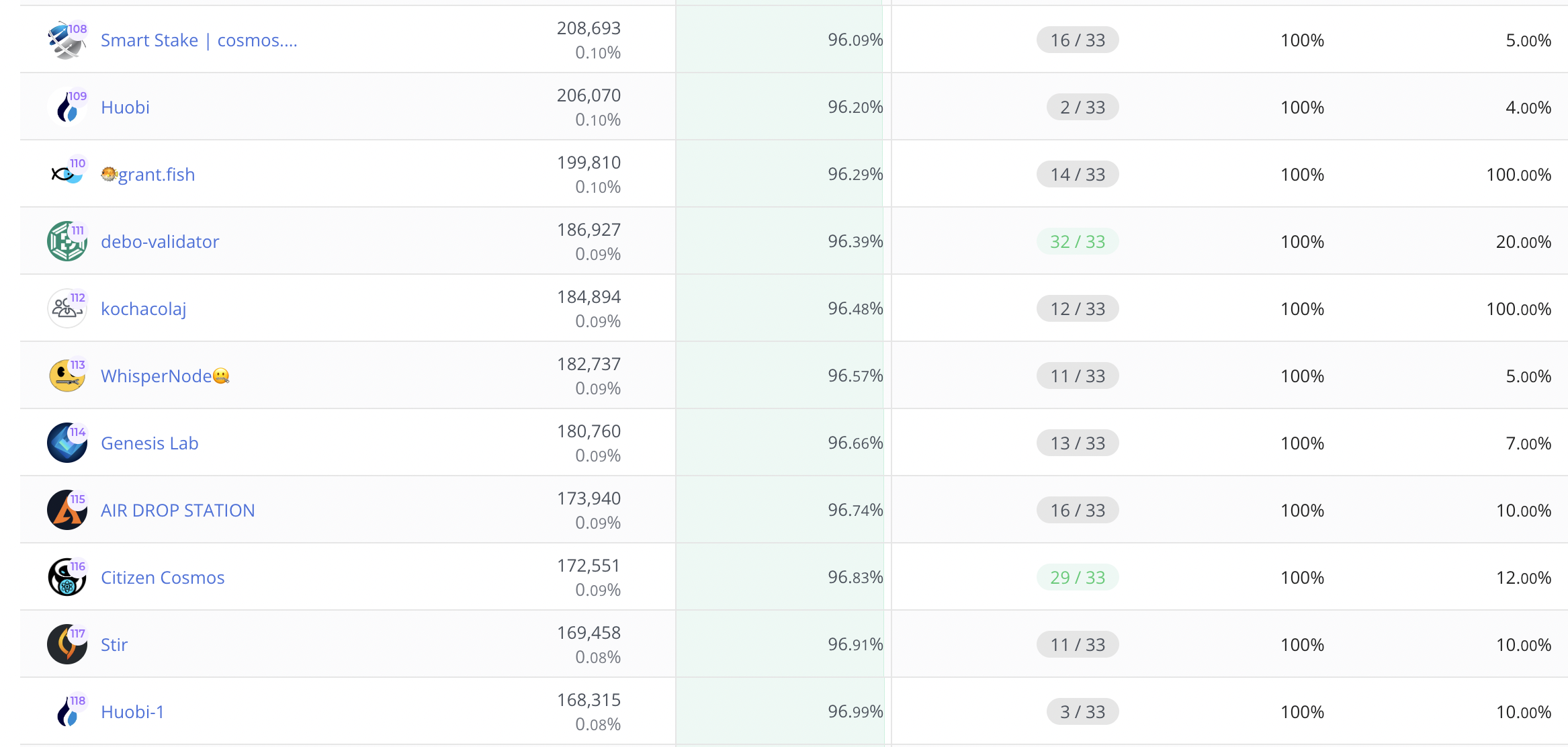

There are two Cosmos Hub validators for Huobi (within the 175), including the one ranked 109, another for 118.

OKX

Multchain strategy

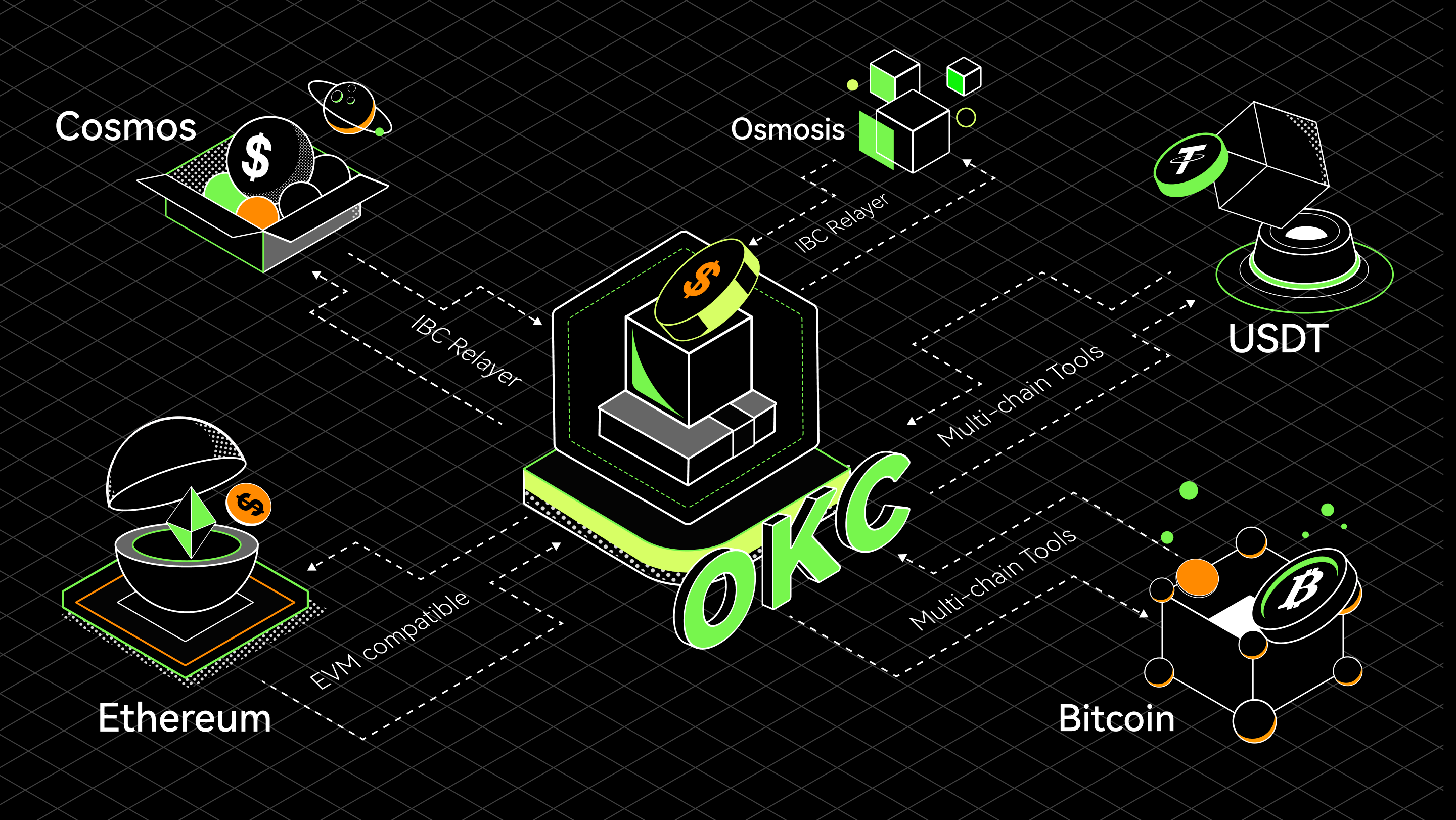

The strategy for OKX is very clear and impressive. Our team was inspired by the multi chain strategy in the developer document. There are few things:

-

The OKX Chain is based on the Cosmos SDK Tendermint and Ethermint.

-

Their strategy is helping develop some middleware tools such as infrastructure, API, wallets,Explorers,etc. This year their strategy changed a bit, including 1) from Move EVM chains to non-EVM chains,

-

actively connecting through the IBC 3)deploying through VasmVM 4) and collaborating with Tether, aiming to bring USDT to IBC through its 5) EMV-compatible feature. Also, it’s said the TPS is higher ,reaching 4000k with lower transaction cost, hence bringing a better user experiences.

orer etc. -

The core business for OKX is trading, other competitors such as dYdX, Sei, Network, Kujira are touching this space via derivatives, spot, AMM order books etc.

-

Collaborate with Tether to issue USDT (native Cosmos SDK token version vs CosmWasm standard CW20 as OKX implements CosmWasm ).

-

Connects with the EVM bridge through the Gravity Bridge, we call it peg zone. Connects with Bitcoin through the wrapped version, multichain tools. Nomic Bitcoin Bridge is interesting as it aims to bring Bitcoin to Cosmos via peg zone. We will introduce it later.

-

Cosmwasm is also a very important part of its strategy. From the official document from Interchain Academy, we understand how the pegged zone is defined. “ How do we connect our chain to a non-Tendermint chain? The IBC connection is not limited to Tendermint-based chains. If another, non-Tendermint blockchain uses a fast-finality consensus algorithm, a connection can be established by adapting IBC to work with the non-Tendermint consensus mechanism.” The examples I think include Ethereum 2.0, Polkadot, Near, Solana etc. If the other chain is a probabilistic-finality chain, a simple adaptation of IBC is not sufficient. A proxy chain called a peg-zone helps establish interoperability. Peg-zones are fast-finality blockchains which track chain states to establish finality. The peg-zone chain itself is IBC-compatible and acts as a bridge between the rest of the IBC network's chains and the probabilistic-finality chain. A peg-zone implementation exists for Ethereum and is named the Gravity Bridge (opens new window).”

Nomic is the first bridge to bring Bitcoin to Cosmos. Bitcoin is based on the POW probabilistic finality, hence a pegged zone is required. Axelar is also a very important player in space. OKX targets to use Multi-chain tools to bring bitcoin into OKC, and hence the entire IBC ecosystem. Correct me if I understand right, it should be done through a pegged zone, in a wrapped version.

The logo for OKC's on the official website of Cosmwasm is very obvious, which shows that OKX is working closely with the CosmWasm Team. Compared with BSC (fork Geth), which is more like the Ethereum side chain, OKC is a more EVM chain developed based upon Cosmos SDK and Tendermint Core, and Ethermint.

Gamefi Strategy

OKC achieves TPS through vertical scaling. At the same time, it utilizes IBC to access more chains through the horizontal scaling method. They think a good Gamefi should be “play and earn” rather than “play to earn”. Real users have the willingness to pay but, incentivised wrongly or overly will change the origin intention from the real users. So two outcomes, 1) real uses become speculative investors. 2) speculative investors are coming into the game to extract value, such as bots etc. So the strategy for OKX for 1) middleware development 2) the design for Gamefi looks very aligned with what we have been putting on Crypto.com.

Kucoin

The current information for Kucoin for Cosmos is not publicly available. We believe they are still focusing more on building their ecosystems and apps, including the EVM development tools, wallets, trusted bridges, API (Scan, infor, explorer) during the current bear market. Kucoin is the No 52 validator in the Cosmos Hub.

Coinbase

Compared with other exchanges developing their own app-chains, Coinbase decided to create the infrastructure services for validators, projects, such as white labeling, RPC services etc. Of course they have wallets, exchanges, payment, investing and other services, but Coinbase Cloud should be the interesting one to check by providing valued added infrastructure services. It also acquired the validator service Bison Trails back in Q1 in 2021. Others important validators include Stake.fish, Doki Capital, SG1, Zero Knowledge Validator, Game etc. Game is based in Japan and got much attention in Proposal 16 for Juno. We will introduce more in our next deep dive articles.

Community Questions:

1)Shushu: I saw CFG 's articles from Mirror, I like CFG 's articles very much, and I think they are very professional. I have also gone through every office hour video. Currently I am working as a product manager in the Web2 insurance industry, and also a freelancer developer. I am a game enthusiast and will myself run some scripts. I am currently learning about arbitrages bot, curious what do you think about the order book exchanges in Cosmos, such as dYdX, Sei, Crescent, Kujira etc. For example, the main thing Crescent mentioned for its order book is the liquidity range pool. I would love to know more about the competitiveness of these types of exchanges.

Frank & Ganthisway: dYdX, Sei is a leveraged perpetual contract product. Crescent is spot one I believe, and I think his flagship product should be the liquid staking.Kujira includes liquidation, order books, bridges and more product lines. So you can understand it as a Defi Hub. It is now ranked as the 7th by mapofzone, growing very quickly. Each product targets different users. For example, dYdX has many bots users right now. Sei is just getting alive and has obtained 5 million funding. Its block time is being reduced to 1 seconds, with a few thousand TPS, very close to Solana now. There are three types of models for derivatives now 1) For example, adding a pool directly to Uniswap V3 represented by the projects such as Perpetual Protocol deployed on xDai . The problem with this model is the liquidity can’t be well managed all the time, and it may be fine when the market is relatively moderate. If the market fluctuates violently, v3 will have problems causing price and slippage. 2) The other ones include Injective, dYdX, etc. This is the same problem with centralized exchanges. Whoever makes the market for it, it can attract users. The recent collaboration between Injective and Jump is also very interesting. Jump is already a strong market maker in the traditional field. The strategy for crypto is also very successful. 3) The third one is called GMX and Mxdex (now called MUX). If a user opens a position and the price for an opening position is based on the price of the oracle. For example, the oracle price of Ethereum is $1,600. When the prices want to open long or short, who is competing with him? The liquidity pool is designed called GLP (GXM) and MULP (MUX). Liquidity providers unconditionally make counterparty orders with users who trade. Users who do provide capital can get 70% of 1) funding rates and 2)transaction fees. The rest will be provided to stakers. The problem with this model is that it will impose restrictions on trader’s opening positions. For example, if a user who has been continuously trading and made lots of money, then the user who funds the pool might lose money. Therefore, there are restrictions on the amount of open positions for traders. So in conclusion, there are three types of derivatives. As for the spot, it started with AMM, and Uniswap launched V3. V3 increased the utilization of capital liquidity by targeting the specified range . There have been lots of order book model businesses on Solana. I think generally the way works is that when there is a pending order, it’s not on chain until the order will be matched. If you are interested, you can read Solana’s technical understanding, design framework, latest updates and ecosystem summary, Solana is ready for counterattack SQLANA, Monolithic vs modular chains: the recent discussions for Founders of Solana and Celestia. Anyone interested in the derivatives, you can check the article called the war among decentralized protocols. We will continue to iterate our research on this part in the future.

Hongyi from Web3 Hitchhiker: Learned a lot during this office hour.I am the tech guy. I want to talk about the Gamefi problem. The current consumption type of gamers are still very concerned about the blockchain. There is a game directly copied from the game Minecraft, and they are issuing the NFTs. The officials said it doesn’t support this event. The future is clear but we are still in the very early stage. In this bear market, I believe gaming has huge opportunities.