Overview

As noted by the Silicon Valley Bank, debt follows equity; it doesn’t replace it. As the cryptocurrency and blockchain industry hit record volumes of equity financing in 2021, it is simultaneously fast emerging as a sector for debt or hybrid capital providers to earn attractive risk-adjusted returns.

Cryptocurrency and blockchain companies are underserved by the existing capital markets, opening up an opportunity for entrepreneurial lenders to be first movers in the crypto credit markets. The post below aims to lay out the diverse types of lending structures available and as they would apply to the blockchain ecosystem including examples for reference. For the avoidance of doubt, the examples below focus on the provision of “off-chain” credit financing to projects and/or entities in the ecosystem.

Fundamentals

Definition of credit

For the purposes of this post, the definition of credit (“debt”) encompasses financing solutions that provide monies to a borrower with minimal to no dilution of the equity ownership in the company. However, unlike equity, debt financing comes with a contractually obligated repayment over a given time period and can be configured to include various “structural” characteristics such as covenants, repayment terms, to mitigate credit risk borne by the lender.

Benefit to entrepreneurs

Debt is an attractive financing vehicle for entrepreneurs since it avoids equity dilution and tends to be cheaper than equity financing. However, debt is usually only available to companies that either have assets and/or cash-flows that lenders are capable i.e., have the sophistication and/or wherewithal of underwriting. Furthermore, entrepreneurs need to be mindful of how the “structural” characteristics of the debt instrument interplays with (or limits the flexibility) with which they are able to manage their day-to-day operations. The cheaper cost of debt may come at a price of limitations on a company’s operational flexibility as the lender seeks to mitigate repayment risks by ensuring that it has the capability of “stepping in” for any unexpected outcomes.

Excess risk-adjusted returns

It is not unusual for a “debt financing gap” to arise for any new set of emerging assets since it takes time for debt investors to evaluate the creditworthiness of a given asset. There are a variety of reasons why existing lenders are unwilling or unable to underwrite new asset classes including, but not limited to, new (and sometimes volatile) asset valuations, technologies with uncertain commercial viability, unproven commercialization strategies, lack of established credit metrics, cash flow uncertainty, etc. While capital markets are beginning to understand the asset class, there exists an opportunity for fast moving lenders to capture the spread between a company’s equity cost of capital and the debt cost of capital before the market matures.

Lending structures

There are many types of lending structures (with sometimes overlapping characteristics). The following section attempts to categorize the different types of structures in a simplified way to facilitate a “template” that can be superimposed on prospective lending opportunities in the blockchain ecosystem.

“Off balance sheet” financing

Loosely used. Financing liabilities that do not arise on a borrower’s balance sheet. For example, for Project Financings, the debt is repaid by the stand-alone cash flows of a given asset and is non-recourse to the parent company. Specific examples of project financings include Sale-leaseback financing, Inverted Leases, Partnership Flips, etc.

“On balance sheet” financing

Financing liabilities that would commonly be shown on a borrower’s balance sheet broadly categorized into (1) Unsecured and (2) Secured loans.

(1) Unsecured (Non-collateralized) loans that have short durations and typically come with high fees. Common examples include corporate revolvers, consumer credit cards, or student loans.

(2) Secured (Collateralized) loans that require the borrower to pledge collateral to the lender in exchange for lower fees and/or longer terms depending on the features of the collateral, which can generally be categorized between (a) cash flow-based loans and (b) asset-backed loans.

(2a) Cash flow-based loans are based off of a pledge of the cash flow of the company. Lenders underwrite these loans based on past and future expected cash flows. Credit-ratings are used as reference for the relative creditworthiness of a given borrower. Loans can be sized using EBITDA with a credit multiplier. Alternatively, loans can be sized as the present value of cash flows expected to be received by the lender. Cash flow loans tend to be suitable for companies that do not have hard assets and have high margins. Broadly speaking, interest rates tend to be higher for cash flow-based financings due to a lack of physical collateral.

(2b) Asset-backed loans are based that have an underlying asset (and its corresponding cash flows) as collateral. Lenders underwrite based on the characteristics of a given asset such as its liquidity, cash flow profile, valuation, etc. Asset-based lending strategies are suited to capital-intensive companies and/or companies that have low margins. Common financings include assets that are on a company’s balance sheet such as inventory, accounts receivable, real estate, properties, equipment, among others.

(2c) Warrants. In some instances, lenders are willing to provide debt capital to companies that have no assets or positive cash flows in exchange for warrants. Warrants help lenders mitigate repayment risk by giving them the opportunity to buy company equity at a particular price in the event the borrower defaults on its loan obligations. Warrants tend to be used as “credit enhancements” that are added in order to improve the creditworthiness of a given financing (as opposed to being relied upon as the primary source of debt repayment).

Crypto lending frameworks

The above section provided an overview of the existing “templates” available in the industry that can be “mixed-and-matched”, as appropriate, for debt opportunities in the digital assets space. A simple way to evaluating prospective lending opportunities would be to divide the blockchain ecosystem based on their business models, which would help delineate they would be underwritten.

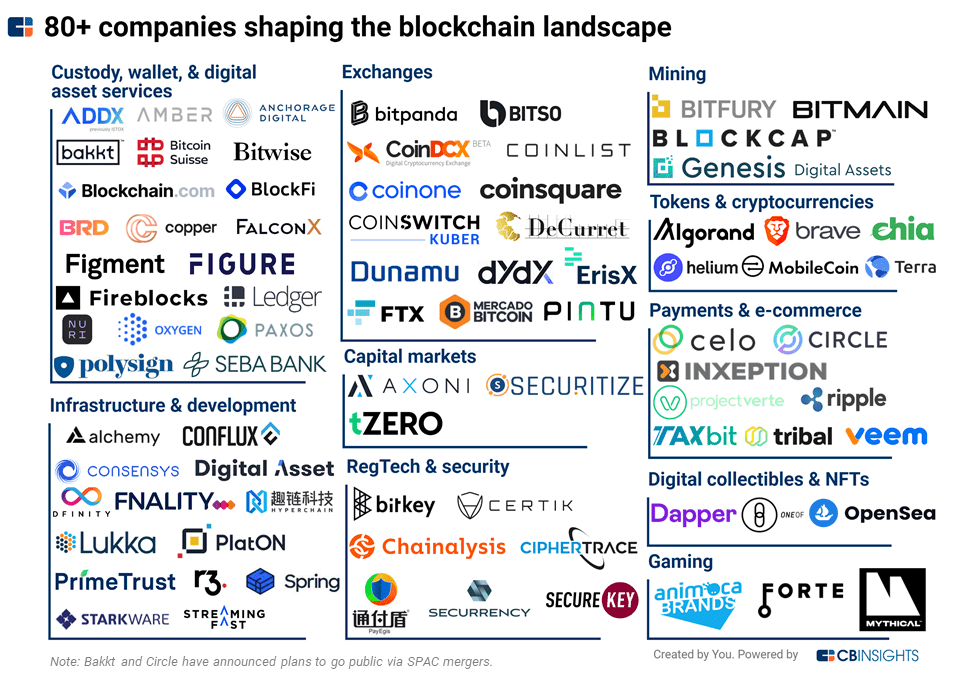

Using the above CB Insights “blockchain landscape”, the following ideas can be prospectively investigated as an initial step for lending opportunities against cryptocurrency and blockchain companies.

As a rule of thumb, the lender would be evaluating these companies with an eye towards “financeable” assets and/or cash flows, pitching to companies that taking on debt capital would provide a cheaper supplement to equity capital. To the extent prospective borrowers do not have sufficient track record of cash flows and/or asset value, a lender may want to craft time and/or value-based covenants that enable its credit committees to get comfortable with the risk of the potential lending opportunity.

Exchanges

When Coinbase went public in 2021, it was a watershed moment that enabled exchanges as a business model to “cross” the psychological barrier from being classified as crypto companies to venture backed technology firms. Given this development, exchanges are on the cusp (if not already) receiving broad based access to lending capital from traditional institutional providers such as commercial banks, investment banks, and institutional investors, among others. Exchanges benefit from having both assets (e.g., monies and crypto assets held in treasuries) and cash flows (e.g., exchange fees, staking revenues, etc.). A number of exchanges are EBITDA positive and are therefore are eligible for “traditional lending products” such as high yield loans, which Coinbase itself availed of in 2021 at a sub-4% cost of financing. There are a range of different structured capital solutions depending on the size, term, and collateral that the exchange would be willing to provide.

Miners and validators

Similar to exchanges, miners and validators benefit from having both assets (e.g., inventory, accounts receivable, property, etc.) and cash flows (e.g., sales revenues, ongoing mining earnings, etc.). Broadly speaking, the challenge with mining companies is that majority of their capital expenditures are spent on procuring ASICs and/or GPUs. Therefore “crypto native” financing providers such as NYDIG, The Foundry, and others have been willing to extend short-term ASIC financing i.e., 1 year or so at mid-teens 15% interest rates. Miners, node-operators, and validators have capital intensive businesses that would be eligible for “off balance sheet” financing solutions such as project finance. However, the traditional banks that have the sophistication and wherewithal to structure and underwrite project finance loans have not yet have “comfort” in the operating history of miners and validators to be able to come up with a financing proposal that is cheaper than the cost of equity for these companies.

Custody, wallet, digital asset services

Digital asset services that have contracted cash flow streams across multiple customers and/or rapid growth may be a fit for SaaS based lending opportunities wherein lenders underwrite the company based on monthly recurring revenue (MRR), annual recurring revenue (ARR), or other growth metrics.

Venture-backed debt

In general, many of the companies in the cryptocurrency and blockchain industry are start-ups that may benefit from venture-backed debt such as growth capital, typically term loans that extend runway between equity rounds, for M&A activity, milestone financing or working capital. Depending on the assets that are on these companies balance sheet they may also be eligible for accounts receivable or asset-backed financing. For example, Fold one of the leading crypto card issuers gives users the benefit of purchasing gift cards but uses their equity capital, which can potentially be substituted by debt capital.

Tokens & cryptocurrencies

Given the diversity of token and cryptocurrency projects, there is no one size fits all solution for financing. Projects span the range from DeFi, NFTs, Games, Digital Collectibles, Payments, etc. Broadly speaking, below are some applications analogous to cash-flow and asset-backed lending which can be implemented depending on the sophistication of the lender and the complexity of the structuring:

(a) Token-project treasuries - Lending against assets held in project or development team treasuries while having governance tokens held as collateral (or having assets locked in a multi-sig smart contract).

(b) Staking or yields - Providing an advance against a pledge of staking or yield streams for a given term akin to securitization financing.

Takeaways

Existing lenders typically want to see a history of value, whether it’s a range of historical prices or a period of operating cash flows, to be able to understand the base case and downside scenarios of any given asset or opportunity that is being financed. While these existing lenders build their comfort levels with blockchain companies as a debt-financeable asset class, there exists an opportunity for fast moving crypto savvy lenders to capture the spread between a company’s equity cost of capital and the debt cost of capital before the market matures.

As outlined in the earlier sections, there are a variety of different lending structures and mechanisms that can be used to capture value across the blockchain ecosystem while adequately protecting downside risk of prospective lenders. Entrepreneurial firms that have a steady stream of access to crypto and/or blockchain debt opportunities that earn interest rates that are above the lender’s cost of capital are highly likely to profit off of a consistent flow of highly attractive risk adjusted returns in the coming years. As a rough analog, it took several years for lenders in the solar securitization market to get comfortable with the asset class. Securitization interest rates started out at 5.17% in 2016 and took almost 5 or so years to drift down to a record low of 1.94% in 2021, all the while allowing financiers that had an early mover advantage in the solar securitization market to earn attractive returns for their investors.