Overview

The following write-up aims to propose a structure for real-world infrastructure that supports Goldfinch’s launch into Singapore, allowing it to access the rest of Southeast Asia. The structure’s primary aim is to support a scalable off-chain end-to-end product experience from the smart contracts through to the real-world assets and counterparties.

Organization

The write-up is organized into the following sections:

- Key Areas to Assess: Key considerations relating to Goldfinch’s growth that the structure aims to solve.

- Why It’s Important: Rationale for solution from perspective of Goldfinch’s Borrowers and Investors.

- Ideal structure: Description of structure that aims to achieve scalability and legal infrastructure that’s consistent with Goldfinch platform.

- MVP structure: Description of a minimum viable structure that addresses the Key Areas outlined in (1).

Guiding principles

The following guiding principles underlie the write-up:

- Emphasis on structural scalability with the goal of enabling all types of private debt (non-dilutive) financing transactions to be created, managed, and retired on-chain.

- The Goldfinch platform, as a multi-sided marketplace, enables the above vision by bridging Borrowers and Investors through smart contracts that are backed by real-world assets and collateral.

1) Key Areas to Assess

Top consideration(s) when standing up a legal structure relate to the Goldfinch platform’s scalability and product-market fit. Regulatory requirements may create frictions to platform adoption but, as a multi-sided marketplace, the foundational element that “legal structure” needs to re-inforce is creating network effects for borrowers and investors, respectively. The section below outlines the key areas that structure would address:

Borrowers

- Template deal structure and documents

- Legal structure and negotiation processes can take weeks to months to complete. Template deal structure and secured loan agreements can help greatly streamline and shorten transaction execution timeline.

- Promote legal and regulatory clarity

- Creation of legal structure should help mitigate borrower’s regulatory concerns of receiving capital from Goldfinch investors e.g., Singapore credit funds concern about losing RMFC license if lack of clarity re investor accreditation, residency, and source of funds.

- Reduce borrower onboarding “frictions”

- Accelerate network effects by introducing third-parties that facilitate platform scalability by streamlining borrower onboarding and set-up processes e.g., onboarding agents that provide template dataroom materials, preferred partnerships with wallets, fiat-to-crypto exchanges, crypto-friendly banks, etc.

Investors

- Streamline loan underwriting

- Evaluating and assessing borrower loan requests requires effort and takes time. Structure needs to encourage a scalable underwriting process either through working with third-parties and/or providing automated (e.g., AI/ML) credit ratings services.

- Loan underwriting is a fundamentally important area given that attracting investors over the long-run will depend on providing a steady pipeline of deals that provide attractive risk-adjusted returns.

- Diversifying investor base through recourse

- Eventually attract “stickier”, larger, and more sustainable sources of capital by using structure to enable “real world recourse” to underlying fintech loan receivables and/or borrower assets. Crypto-native investors have high risk tolerance, which has been excellent for bootstrapping protocol, but diversified investor base is necessary to facilitate a more sustainable Goldfinch platform.

- Security and recourse against borrower provides investors, such as institutions, a feasible alternative to existing channels used to access the same type of credit profile i.e., their investments in private credit funds have recourse to underlying fintech borrowers.

2) Why It’s Important

The root consideration of any structure is enabling and/or accelerating the “network effects” of the Goldfinch community by solving borrower and investor pain points, respectively, as listed below:

Borrowers

Borrowers need efficient and ongoing access to fairly priced non-dilutive capital to continue originating loans and/or providing financial services to underbanked individuals and/or SMEs, who are the ultimate beneficiaries of the capital.

Investors

Investors need efficient and ongoing access to a pipeline of attractive risk-adjusted investment opportunities that are backed with security against “off-chain” assets and legal recourse.

3) Ideal structure

If not constrained by time or capital, the ideal structure would provide a scalable end-to-end product experience by leveraging templates to streamline the borrow/lend process, third parties to expand scale, and/or automation to execute repeat workflow (where relevant).

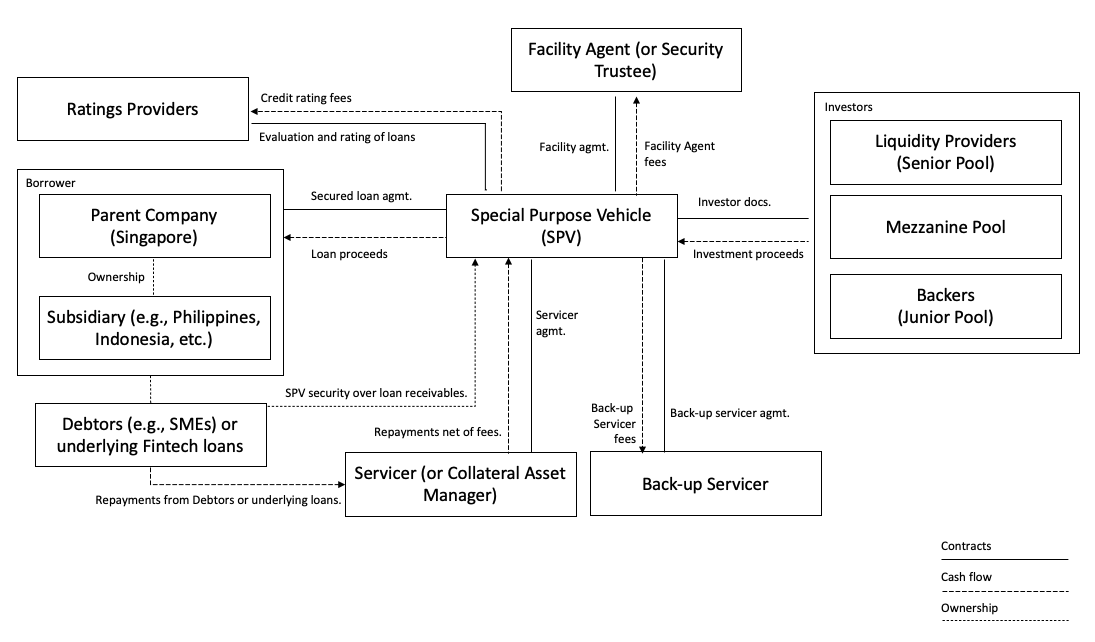

Special Purpose Vehicle (SPV) - An SPV structures risks, covenants, and payments waterfall consistent with the terms and functionality of the underlying Goldfinch platform. SPV would have appropriate Singapore regulatory requirements or licensing e.g., CMS or other license.

Investors - The SPV provides flexibility allowing different tranches and types of investors to have products with investment features tailored to their corresponding risk profiles e.g., Backers, Liquidity Providers, Mezzanine Pool, or others. Investor interests represented on-chain also take the corresponding legal form of notes, equity, or quasi-equity securities with legal terms that correspond to the underlying smart contracts on Goldfinch platform.

Facility Agent (or Security Trustee) - To facilitate seamless product experience, third-party Facility Agent (or Security Trustee) acts on behalf of investors representing their interests and communicating with Borrower. Facility Agent also holds the benefit of the covenants and the rights of the securities issued by the SPV on behalf of the investors.

Borrower - Borrowers execute template loan agreements with SPV to facilitate real-world investor recourse. SPVs credit exposure is primarily underlying fintech loans with credit support in the form of lien over assets (typically cash balance of Borrower). Perfection of security over assets achieved through registration of lien (and/or pledges) with Singapore regulatory authority (e.g., ACRA).

Ratings Providers - Third-party Ratings Providers act to increase scale of platform by streamlining credit evaluation process, providing scores/ratings to facilitate more efficient underwriting. Ratings providers are either compensated through token payments from the Goldfinch community and/or directly by the SPV for “standing up” a new Borrower Pool.

Servicer (or Collateral Asset Manager) - Third-party Servicer (or Collateral Asset Manager) services and collects underlying loan receivables. In instances where collateral pool changes over the life of the transaction (e.g., SME loan receivables book that is being swapped in-and-out), a Collateral Asset Manager can be utilized to reduce credit risk by applying best efforts to maximize the value of asset pool on behalf of investors.

Back-up Servicer - Third-party with ability to step-in if primary Servicer (or Collateral Asset Manager) is unable to perform its duties. Back-up Servicer is an essential provider that ensures minimal to no interruption of loan repayments in the event of Borrower insolvency.

Debtors or underlying Fintech loans - Debtors to the original contracts (i.e., the underlying SMEs that are paying off the loan receivables) or the underlying asset pool of Fintech loans. These are assets owned by the Borrower to which the SPV will have security over, as a part of the secured loan transaction.

4) MVP structure

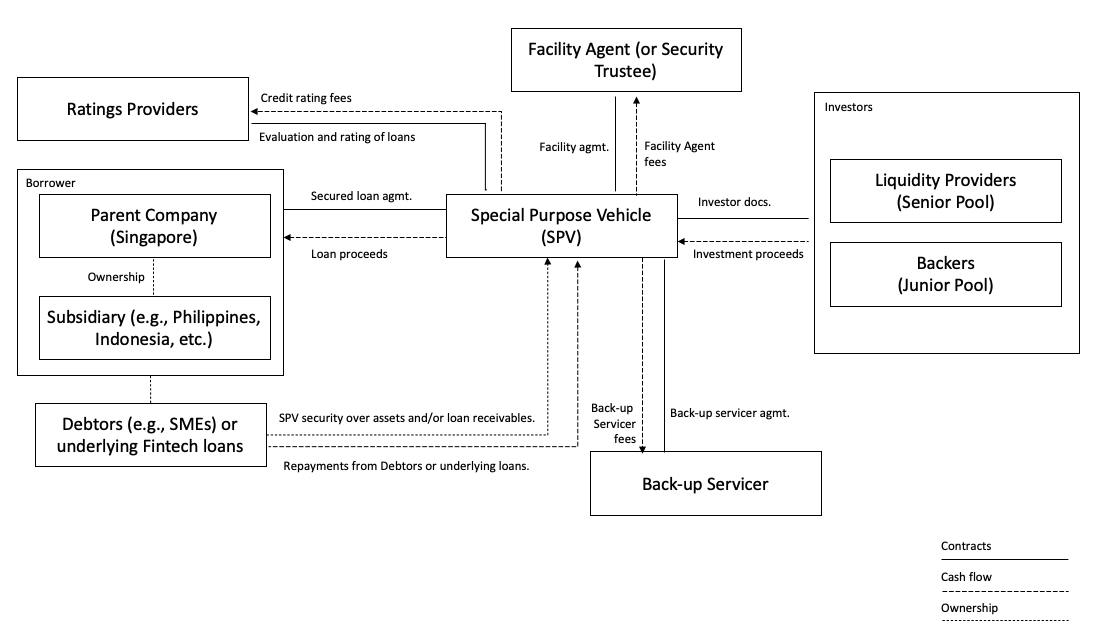

The primary difference between the Ideal and MVP structures is the exclusion of the primary Servicer (or Collateral Asset Manager). The MVP aims for a “minimum viable structure” that addresses the key areas, which can be summarized as implementing template deal structure and documents, promoting regulatory clarity, streamlining loan underwriting, and diversifying investor base through recourse.

Special Purpose Vehicle (SPV) - The SPV is the primary vehicle that enables real-world recourse for Goldfinch investors. By holding a secured loan against the Borrower and raising capital through legal form of notes, equity, or quasi-equity securities from Goldfinch investors, the SPV creates an end-to-end bridge for on-chain capital and off-chain assets. To promote regulatory clarity, the SPV takes the form of a Singapore limited liability company and is set-up independently from Borrower for insolvency remoteness.

Investors - On-chain investment terms (such as interest rate, payment frequency, payback term, etc.) for each type of investor group have real-world legal ramifications since they are structured as securities. This type of structuring also permits the diversification of Goldfinch’s investor base since, under Singapore law, securities issued by SPVs can be offered to institutions, accredited investors (both domestic and international) and also to retail investors.

Facility Agent (or Security Trustee) - To streamline the borrow/lend process and promote scalability, the third-party Facility Agent (or Security Trustee) will represent the interests of the investors and coordinate communications with the Borrower. On behalf of all the investors, Facility Agent will also be the beneficiary of the security over the underlying asset that the SPV holds through the secured loan agreement.

Borrower - Template secured loan agreements will be executed between the SPV and the Borrower’s “Parent Company” based in Singapore. As part of the template deal structure, loan agreement will have covenants requiring minimum cash runway, coverage ratios, and a perfected lien on underlying fintech loans that are held by the respective operating “Subsidiary (e.g., Philippines based entity), among other terms.

Ratings Providers - The presence of third-party Ratings Providers increase platform scalability by facilitating efficient deal underwriting. As a multi-sided marketplace, faster loan underwriting on the investor-side may also lead to increased demand for borrowings (since efficient disbursement of funding can be perceived positively by prospective Borrowers). Ratings can either be performed by third-party professionals or Warbler Labs affiliates.

Back-up Servicer - Payments on the secured loan can be made directly by Borrower to the SPV. But a Back-up Servicer needs to be in place to facilitate a transition process in the event that a Borrower breaches their obligations under the secured loan agreements.

Debtors or underlying Fintech loans - Consistent with the “ideal structure” the payments owed by the debtors (e.g., SMEs) or cash flows received from the underlying Fintech loans are pledged to the SPV, as a part of the secured loan transaction.