Following the huge run the NFTs had in 2021, with most of the focus being on visual art and collectibles, there is a tendency to associate NFTs with .jpegs. Considering the interest lots of relevant people & brands have shown towards owning a Cryptopunk / a Bored Ape, or launching their own collectible NFT collection, it is easy to believe that here’s the big boom.

However, “.jpegs” are just level 1. Communities are built by people holding the same collectible and (generally) sharing the same interests, vision and mission. In web3, the era where people grab (some) power back, given the right bootstrapping and under the right conditions, this translates into development and innovation being every step of the way.

NFTs can be the entry point into a DAO, a genesis into a project, access to a Discord server or a blog. A cinema ticket or a COVID-19 certificate. They can be (and will be) the standard for most items that require some sort of authentication.

On top of that, NFTs make the internet ownable. Or even better, they make the internet co-ownable. You can leverage intellectual property in order to be a part of / co-create / co-own any digital product, and alongside anyone. Yep, I mean even your favorite content creator.

Books

Have you ever thought you could co-write a book with a New York Times Bestselling Author, meaning you create a character, mentioning traits and telling a couple of stories about him / her? With you proposing ideas / helping the author with potential answers?

That is exactly what Jenkins the Valet is doing. They have partnered with 10x NYT Bestselling Author Neil Strauss to write a book about Bored Ape Yacht Club. The book will feature Bored Apes and Mutant Apes, but in order for them to appear, a licensing agreement must be signed between a holder of an Ape / Mutant and a holder of a Jenkins the Valet NFT (Writer’s Room).

There are approximately 4.000 unique individuals who have signed licensing agreements, making them co-writers of the book alongside Neil Strauss, and deciding from title and genre to plot twists and ending.

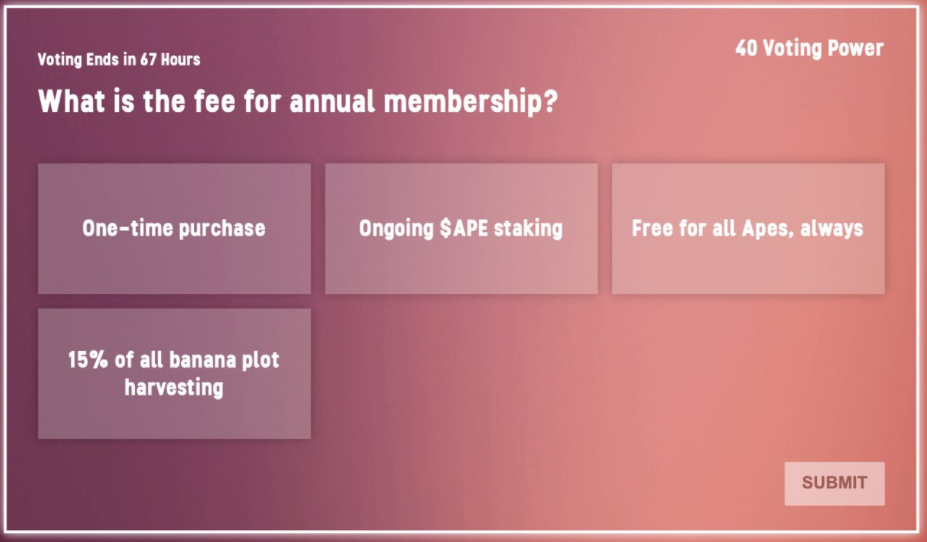

There will be 4.075 characters in the book, and there are 4 types of Writer’s Room, each one pointing to the level of involvement the Ape / Mutant has in the book. This one also comes with a corresponding voting power, but it is worth mentioning that all the Writer’s Room provide equal royalties, no matter the tier.

The royalties are proportionally shared between the ¬4.000 co-writers and include income generated from the book’s NFT primary sales, secondary sales, and potentially traditional publishing or film rights.

This is a proof-of-concept of a mass IP licensing in the NFT space that paves the road for infinite possibilities in the creator economy.

Music

Timbaland and other members of the Bored Ape Yacht Club have created Ape-In Productions, an artist-owned entertainment company with a goal to “discover and amplify music artists while unlocking nascent creative content through premium NFTs”.

Firstly, TheZoo (hip-hop group of Bored Apes) released their debut single “ApeSh!t”, produced by Timbaland himself. Then, exclusively for the Ape-In OG token holders, there was a rap contest where people submitted one 16 bars drop / token and Timbaland & the team listened to it and judged it live on Twitch. The winner got 1 ETH + 1 Ape-In OG token. Pretty cool, right?

But let’s look at the potential here. How about a contest exclusively for the token holders with the winner actually getting featured in a song to be released? It could be a rapping contest, a lyrics contest, an instrumental contest etc. . This means that you, the fan, feature alongside your favorite artists. You name them, they will most probably be on this stage sooner rather than later.

Of course, all of these will come with 1/1 special NFTs marking a percentage of the revenues of the song to be claimed by the co-creator.

It could be somehow counter-intuitive how the music industry, probably the industry that links and gathers the most people together, was not the first one to go big on blockchain. But the infrastructure was not ready and, as for any big innovation, with no proper infrastructure, leveling up gets postponed.

Enter Royal

Royal is a platform that enables anyone to own a piece of their favorite songs and to earn royalties alongside the artist. It was created with the aim of democratizing investment in music, having the royal tokens offering partial ownership in a song’s streaming royalties rights.

“We believe blockchain technology has the ability to transform music ownership the same way the internet has transformed the way music is listened to” — Chainsmokers duo, investors in Royal

The first artist to launch a song on Royal and share 50% of the streaming royalties was founder 3LAU, who has offered (gas fee only) 333 LDAs (Royal’s extended version of an NFT) of single “Worst Case” to the most active people in the community. Within 2 weeks of the launch in October, the song reached an implied value of over $6 million. Moreover, the tokens have traded so far over 280 ETH on OpenSea (more than 900.000 US dollars at current prices), making a great case on how ownership in music royalties is valued in an open market.

On 20th of January, Nas will release 2 songs on Royal, with 50% of the streaming royalty rights offered for sale / song. For “Rare” there will be 3 tiers of revenue (0.0133%, 0.0658% and 1.5789%) according to the mint prices ($99, $499, and $9.999). Apart from sharing their success, you can get exclusive merch, VIP concert tickets, signed vinyls or a video conversation with producer Hit-Boy.

People are now being incentivized to listen to certain songs. This means that game theory is on.

Who’s next?

Movies

Recently, Tom Bilyeu explained to Quentin Tarantino what it would mean to NFTize frames from Pulp Fiction and offer them for sale to fans. Some of the frames would probably be worth millions of US dollars. What about the final reveal from “The Usual Suspects”? Or the spinning top finale of “Inception”? How valuable are these?

Not only in regards to the actual sense of ownership / money price. Owning one could come with a pack of meet & greet part of the team, get access to unpublished content, get a chance to an yearly dinner with the producer. And, as with any NFT, the outcomes for the holders can go as far as the imagination of the community goes.

Let’s juggle a little bit with what NFTs in the film industry could bring.

There could be a DAO that will create movies. According to how the project is bootstrapped, using community voting, they could decide to go on with X as a producer, and a certain set of lead actors. The screenplay can be co-created by the community or a scriptwriter could be chosen. Other potential outcomes? A number of true fans, part of the DAO, to be extras in one / multiple scenes in the movie; royalties to be shared between fans (co-creators) & actors as per a signed agreement. All based on the project’s NFT.

We could expand it to actors. Let’s take Matthew McConaughey. He has a brilliant career and should he decide to create a number of NFTs providing a set of incentives for his fans, they’ll definitely sell out. Now, what if for a number of the holders, he guarantees that they’ll figure in one of his next movies? According to the role in a film, an actor might be entitled to bring on extras.

Final thoughts

Content creation — pictures, blogs, books, music, movies — as we know today, will be totally redefined in the following years. The infrastructure for building the creator economy is being assembled, having the focus moved from a platform-driven monetization to creators and their audiences.

Collaborating on and co-owning a digital product, with the details being written on a blockchain and a smart contract executing agreements when preconditions are met, set the stage for shared creativity and innovation at a completely new level.

How far can the co-creation go? How linked will the artist and the fan be? That’s for creativity to let us know. At the end of the day, “if you want to go fast, go alone. If you want to go far, go together”.

Cover image credits: Magda Ehlers / pexels.com