Disclaimer: All Information used within this dialogue has been referenced from public information. Dates, timelines, and graphics may be subject to imprecise information. Rediscoveries, Relaunches, and Revivals are likely to have found activity hours, days, or weeks prior to their shared publicity. For the purpose of narrative and story the entirety of this series will follow the public timeline.

Created by: Jake Gallen

Published: March 15th, 2023

Last Edit: March 15th, 2023

As we begin to transition into a fully digital world, the concept of provenance transcends its physical form and permeates into its open-source nature. One question that arises during this transition is how value is affected. Additionally, how is significance attributed without a foundation of provenance history to use as a reference?

In previous articles, we have examined the birth of NFT archaeology in three parts, the history of NFT marketplaces, and the progression of provenance through a philosophical lens. We have established a foundational approach to evaluating tokenized history, which only a small number of individuals are currently doing.

Now, it is time to take a closer look at where capital is flowing and where value is accruing. While there may be differing perspectives on the correct approach, ultimately it is the market that determines the value of NFTs.

As we delve deeper into the topic, here are some questions to keep in mind while exploring Smart Contract Provenance vs. Token Provenance:

-

What does it mean for something to exist as a NFT?

-

If NFTs existed prior to the “NFT standard” (2018), are they considered NFTs?

-

The implications of infinite minting vs. a fixed maximum supply.

-

The difference between hard-coded maximum supply and artificially imposed maximum supply.

-

The distinctions between ERC20, ERC721, and ERC1155.

-

The significance of rediscoveries, discoveries, and “lull” periods.

-

The unique cultures of each blockchain.

Smart Contract Provenance

How forgetful of me! Let me define Smart Contract Provenance and accompany it with some history.

Smart Contract Provenance: The process of determining the authenticity and history of a smart contract, including its creation, ownership, and transactions.

Ethereum launched on July 30th, 2015 as the first smart contract platform in blockchain history. However, it is important to note that Nick Szabo developed the idea of smart contracts in the 1990s. According to StateoftheDapps.com, the first smart contracts on Ethereum were not NFT-based; they ranged from exchanges to governance protocols to media and tools. The first “NFT” contract, Linagee Name Registrar (LNR), was not launched until August 8th, 2015, nearly nine days after Ethereum’s public launch, originally named as “Global Name Registrar”. LNR originally aimed to tackle the decentralized identity conundrum that projects like Namecoin Identities had attempted to solve three years prior.

However, the project was abandoned shortly after its launch due to its early deployment in blockchain history and the fact that it had been replicated dozens of times before and afterwards, line of code for line of code. It wasn’t until it was rediscovered in October 2022 that it brought about a slew of controversy and discussion around the idea of provenance.

This “historical” smart contract was issued as an infinite mint contract, meaning there is no limit to the amount of tokens that could be created. When combined with the seven-year gap between the contract’s deployment and when the newly issued tokens were being minted in 2022, it sparked a wide debate surrounding the idea of whether these new tokens should be considered historical or not.

At the time, Etheria was considered the oldest NFT smart contract with a deployment date of November 1st. With these new tokens being minted on an old smart contract, the question of which one should be considered the first became a heated debate. Does the token provenance take precedence over the smart contract? Does an older contract, which was “empty,” become the first if the tokens were minted seven years later?

This debate was resolved a few days later when it was revealed that Linagee Name Registrar had minted 58 tokens in 2015, beginning on August 8th, 2015. MyFirstCoin was unveiled as the first NFT to be minted in Ethereum history, granting Smart Contract Provenance and Token Provenance stewardship to LNR.

Token Provenance

Smart contracts are like parents and tokens are their offspring. Just as a human’s ability to reproduce is limited by their genetic code, a smart contract’s ability to produce tokens is limited by its own code.

Token provenance: The process of determining the authenticity and history of a digital asset, including its creation, ownership, and transactions.

The Linagee Name Registrar serves as a prime example in the debate between smart contract provenance and token provenance, although it is not the first example of this concept. Due to its historical precedent, it helped the community reach a majority consensus more quickly, despite some differing opinions.

Smart contract provenance is relatively straightforward, as once the contract is deployed, there isn’t much room for debate. Token provenance, on the other hand, introduces multiple variables that determine the authenticity and value of a token, such as:

-

Timestamp

-

Significance (historical and cultural)

-

Metadata

-

IPFS storage solutions

-

Context of rediscovery

-

Community

-

Operator

-

Floor price

-

Transfer history

-

Blockchain it exists on

As you can see, token provenance can be a complex concept when it comes to valuing an asset. For example, a token’s value could drop to zero if the metadata was stored on a centralized server that went out of business, or it could skyrocket if the prospective buyer is a historical NFT collector and the timestamp is early enough to meet their satisfaction. Additionally, factors such as the number of the token, or the leader of the community, can greatly impact the value of a token.

Historical NFT collectors take all of these factors into consideration, as well as their own personal viewpoints, when purchasing vintage assets. Now is the time to look at data across multiple projects and blockchains to see where value is accruing.”

Namecoin

Namecoin is home to some of the earliest non-fungible assets in blockchain history. Originally created to address the issue of decentralized domains, early adopters soon discovered that this blockchain had the capability to store additional data within the token and track its chain of ownership. However, collecting these early blockchain collectibles is not without controversy. Let’s delve into the specifics of the blockchain and examine the value of “token provenance”, as smart contracts were not introduced to the blockchain industry until four years later.

-

Year: 2011

-

Blockchain: Proof-of-Work

-

Token Type: UTXO

-

Value of Provenance: Chain of Ownership

-

Value Points: First Altcoin, Decentralized, Merged Mining with bitcoin, Proposed by early Crypto Pioneers including Satoshi Nakamoto, Cited in Ethereum Whitepaper as “Non-Fungible Assets”, History of Chain of Ownership

-

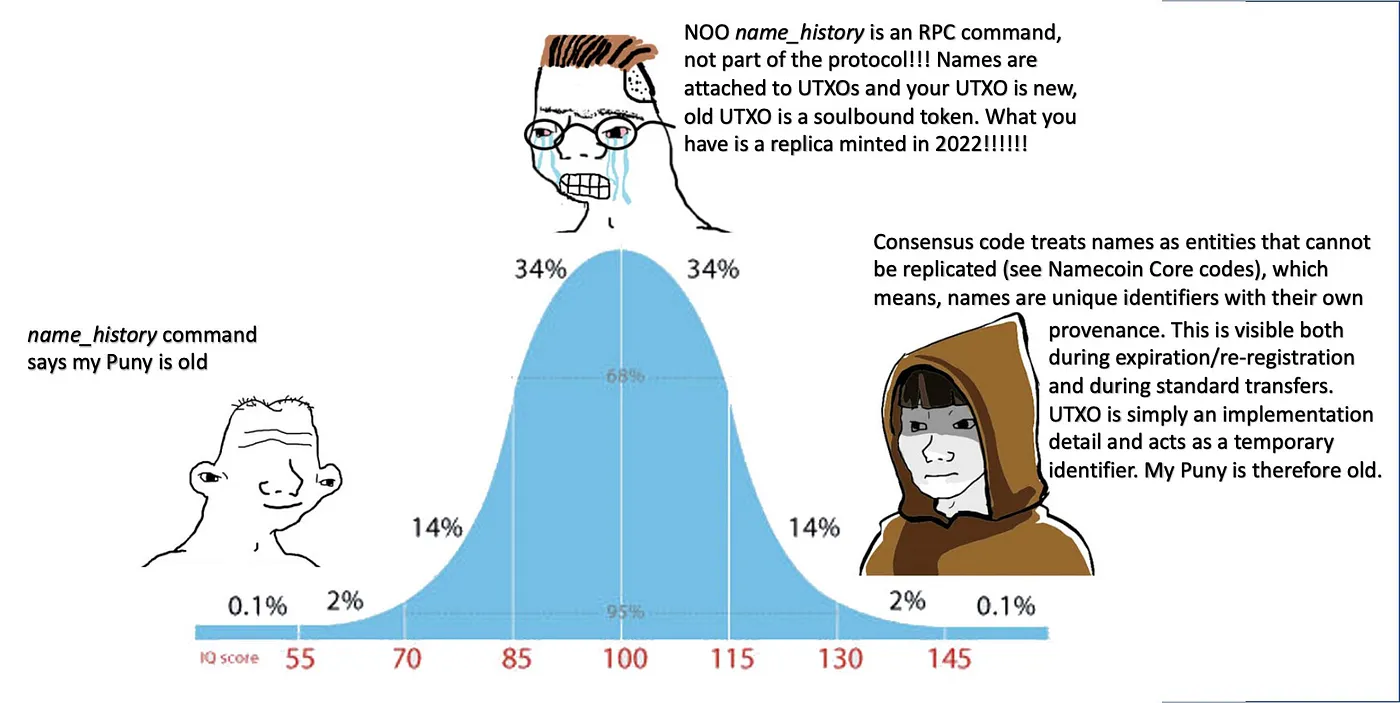

Common Criticism: Token Expiration, New UTXO upon expiration, Unlimited Supply, Ghost Chain, “Not NFTs”

Now that we’ve discussed how the Namecoin collector base determines value, let’s evaluate where the value exists on-chain.

It’s important to note that this analysis is focused on the value of those who choose to collect on a specific blockchain. As those who disagree with a particular collector’s perspective are unlikely to allocate resources to that blockchain, it would be unproductive to dwell on their dissenting views. Ultimately, the market will make its own decisions and that is where our attention should be directed.

.bit Domains (2011)

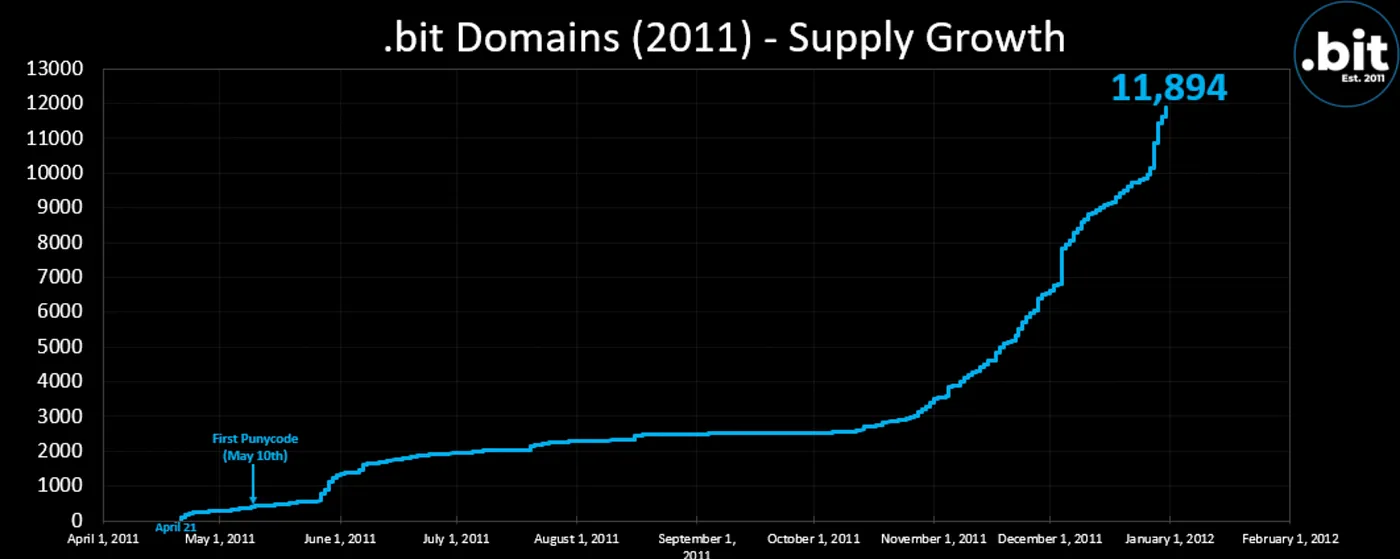

First Issuance of Collection: April 21st, 2011

First Asset: bitcoin.bit

Last Issuance of Collection: December 31st, 2011

Last Asset: programming.bit

Total Supply: 11,894

Claims of Significance:

-

First non-fungible asset collection in blockchain history

-

First decentralized domains

-

Registered on first altcoin which also houses first tokenized imagesgifs, and other early experiments

Critiques:

-

Tokens expire every ~8 months

-

New UTXO upon re-registration

-

Provenance follows “chain of ownership” and not token.

Highest Sale: ~20 ETH OTC “dns.bit” (#54 registered asset on April 21st, 2011)

Floor: .165 ETH (December 1st-December 31st)

Premium Trait Floor (April 21st, 2011): 15 ETH (darts.bit)

Premium Ratio: 80x-120x

Rediscovered: Kinda

Value Amplifier: Earliest First Registration Date

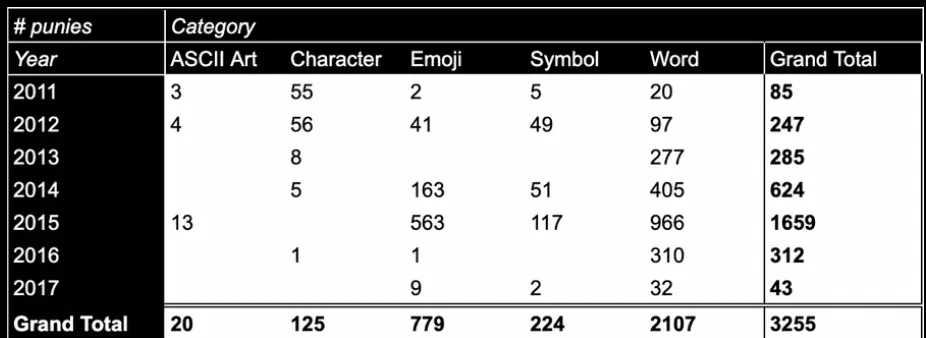

PunyCodes (2011–2017)

First Issuance of Collection: May 10th, 2011

First Asset: d/xn — 9ca (é)

Last Issuance of Collection: October 19th, 2017

Last Asset: xn — ume-wla (umeå)

Total Supply: 3255

Claims of Significance:

-

First on-chain art

-

Intentional experimentation

-

First asset created by Namecoin Identities creator Khal

-

966 created by Halluciphile

Critiques:

-

Retroactive Collection

-

Unintentional Collection

-

Tokens Expire

-

Different UTXO upon Reregistration

Highest Sale: 28 ETH (2011)

Floor: 0.3 ETH (2015–2017)

Premium Trait Floor (2011): 50 ETH

Premium Ratio: 150x-200x

Rediscovered: Brand New Discovery

Value Amplifier: Earliest First Registration and Emojis

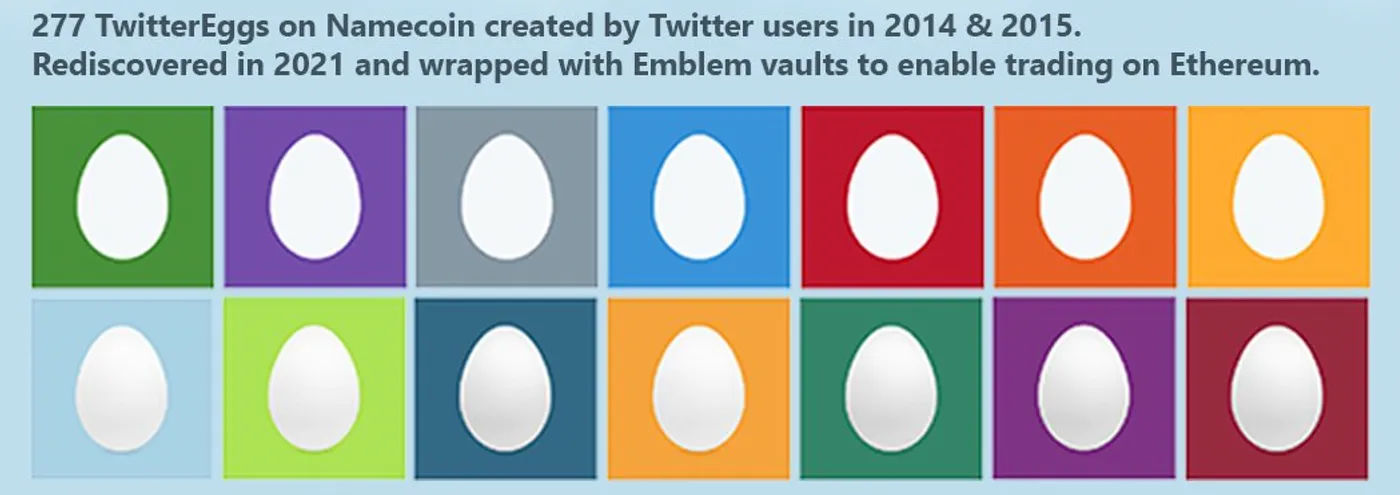

Twitter Eggs

First Issuance of Collection: July 27th, 2014

First Asset: u/loopman (Neon Green)

Last Issuance of Collection: August 20th, 2015

Last Asset: i/tommiw-1 (Red)

Total Supply: 277

Claims of Significance:

-

Some of the earliest Tokenized pfps

-

Registered to Namecoin through Onename (dapp) using real Twitter pfps

-

Twitter and Crypto Cultural Relationship

-

Eggs Popularity on Twitter from 2010–2017

Critiques: Retractive collection, expired profiles of previous individuals, expiring collection, New UTXO upon re-registration, whale owns large % of supply

Highest Sale: 80 ETH (Dark Green)

Floor: 8 ETH (Green)

Premium Trait Floor: None listed

Premium Ratio: 10x

Rediscovered: Yes

Value Amplifier: Earliest First Registration and Neon Green

Namecoin Provenance Summary: With the absence of a smart contract the community turns to “Chain of Ownership” to establish provenance. Expiring tokens has not prevented the community from favoring “First Registration” date over “Has Token Expired”. Although, the token expiration feature has deterred many from entering the market as they believe in a more pure token provenance metric. When it comes to unlimited mint assets they are required to curated specific collections to create artificial scarcity, and when this happens value tends to accrue within the Top 1% and only grows larger.

Counterparty

Counterparty’s legendary status in NFT history is undeniable. Many of the earliest tokenized experiments, including the birth of crypto art and mobile blockchain gaming, took place on this platform. Counterparty has cultivated a community of memetic desire and power. After a quiet period during the 2018–2020 crypto winter, Counterparty has reemerged with a vengeance and the ecosystem is as vibrant as it has ever been in the present day.

-

Year: 2014

-

Blockchain: Bitcoin

-

Token Type: Proof-of-Burn

-

Value of Provenance: Token and File Storage Timestamp

-

Value Points: First token creation platform on Bitcoin, Decentralized, houses historical collections including Spells of Genesis, Rare Pepes, and Sarutobi Island, home to some of the earliest token experiments, low transaction fees

-

Common Criticism: Semi-fungible tokens, unlocked tokens can change metadata, retroactive addition of metadata on empty tokens with vintage timestamps

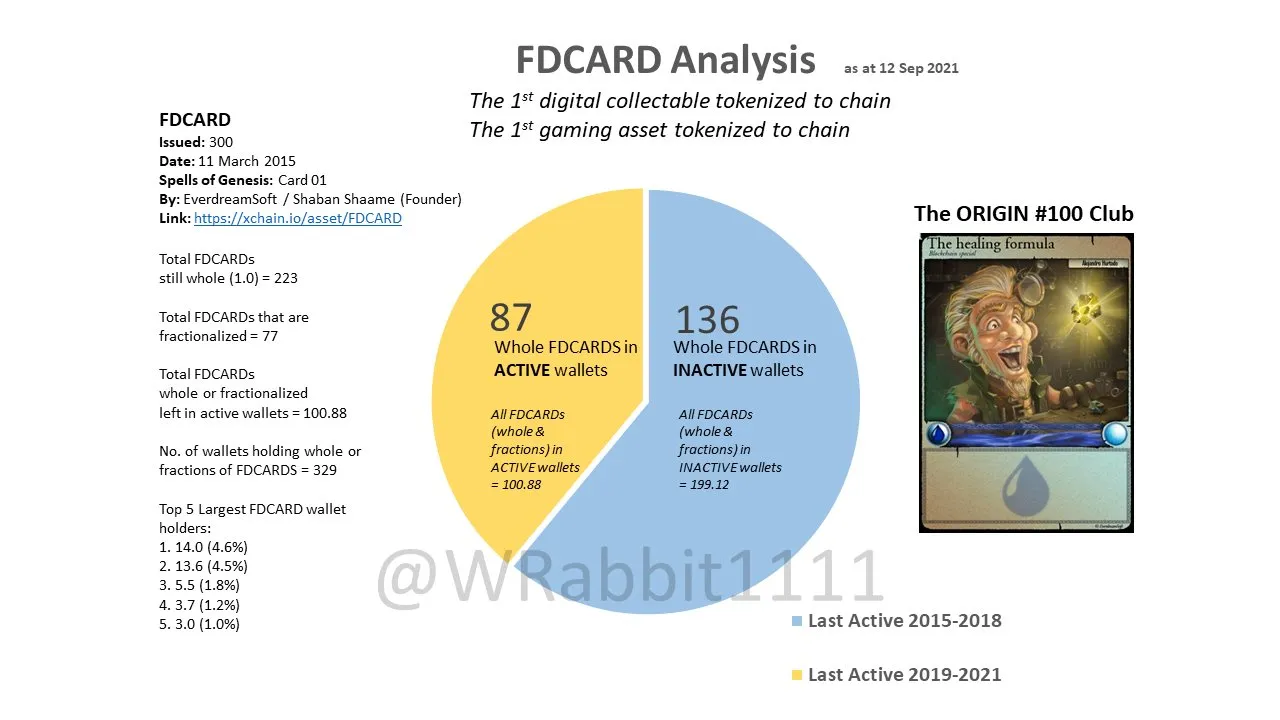

Spells of Genesis (2015–2017)

First Issuance of Collection: March 11th, 2015

First Asset: FDCARD

Last Issuance of Collection: December 1st, 2017

Last Asset: CALABASTER

Total Unique Supply: 228

Claims of Significance:

-

First Mobile Blockchain Gaming project

-

First Gaming NFT

-

First NFT depicting Satoshi

-

Proof-of-Work style method for FDCARD

-

First XCP Marketplace

-

Crypto-influenced art

-

First interoperable assets w/ Moonga

-

Oldest active NFT Project

Critiques:

-

Game has found mid-moderate success

-

Wasn’t intended to be a collectible

-

Limited visibility and marketing woes

-

Counterparty liquidity struggles

Highest Sale: 300,000 USDC (SATOSHICARD)

Floor: .05 ETH (2017)

Premium Trait Floor: 50 ETH (FDCARD & SATOSHICARD)

Premium Ratio: 750x–1250x

Rediscovered: No

Value Amplifier: Early Timestamp, Low Supply, Innovative Assets

Rare Pepes

First Issuance of Collection: September 9th, 2016

First Asset: RAREPEPE

Last Issuance of Collection: February 21st, 2018

Last Asset: PEPEBUSHIDO

Total Unique Supply: 1774

Claims of Significance:

-

“Birth of the Crypto Art Movement”

-

First decentralized crypto art project

-

Tokenizing one of the most popular memes on the internet

-

Predecessor to Fake Rares

-

First NFT wallet and marketplace (RarePepeWallet)

-

Claimed inspiration of many succeeding crypto art projects and artists,

-

Has Collection explorer (pepe.wtf)

-

Organic and Natural creation of project

Critiques:

-

“Not the birth of crypto art”

-

Limited visibility and technical capabilities

-

Associated with right-wing culture

Highest Sale: $3.65M (PEPENOPOULOS)

Floor: .01 ETH

Premium Trait Floor: 100 ETH (RAREPEPE)

Premium Ratio: 5000x-1000x

Rediscovered: No

Value Amplifier: Series 1, Low Supply, Artist, Art Derivatives

Sarutobi & Sarutobi Island

First Issuance of Collection: May 6th, 2016

First Native Asset: NINJASUIT

Last Issuance of Collection: August 6th, 2017

Last Native Asset: KOSMOCD

Total Unique Supply (including interoperable assets): 10

Claims of Significance:

-

First interoperable metaverse

-

First tokenized gaming skin (NINJASUIT)

-

Tokenized within Spells of Genesis and Rare Pepes collections

-

Early Blockchain Mobile Game

-

Used in Takara geo caching app

Critiques:

-

Tokens were burnt down to become collectibles after rediscovery

-

Small collection

Highest Sale: 28.88 ETH

Floor: 0.4 ETH (MANCHANCD)

Premium Trait Floor: 12 ETH (NINJASUIT)

Premium Ratio: 25x-50x

Rediscovered: Yes

Bitcoin/Counterparty Provenance Summary: As the successor to Namecoin, a platform designed to house non-fungible assets, the lack of token expiration creates a vast market of provenance for Counterparty assets. The majority of value tends to flow towards collections rather than specific assets, with cultural significance primarily attributed to “Rare Pepes” and historical significance primarily attributed to “Spells of Genesis.” Collections with their first token minted between 2014 and 2018 are generally considered Historical NFTs. However, it is important to be aware of vintage tokens that have had metadata added years after their creation, as this is a major red flag for many collectors.

Ethereum

It is now undeniable that Ethereum is the leading smart contract platform in existence. Its ever-changing ecosystem of evolving mechanics and tokenomics is the reason it is so widely adopted today. However, it is also the reason why some choose to stay away. Its complex nature is an obstacle that not many are willing to overcome. Those who do, however, find glorious returns, wreckage, and innovation on the other side. Ethereum is home to the most valuable NFTs and metaverses created. Its cultural and historical significance gives Bitcoin a run for its money. The early Ethereum NFTs that experimented with this young technology have gone on to become out of reach for 99% of the population.

-

Year: 2015

-

Blockchain: Proof-of-work until Proof-of-Stake Migration (2022)

-

Token Type: Proof of Stake

-

Value of Provenance: Smart Contract and Token Provenance

-

Value Points: Decentralized, Leader in Innovation, First Smart Contract Platform, Leader in NFTs, Leader in Metaverse, Leader in L2 scaling ecosystem, second largest Cryptocurrency by marketcap, Deflationary tokenomics, 100% uptime, First to migrate from PoW to PoS

-

Common Criticism: Possible securities violation with ICO, Large scale hacks, claims of insufficient decentralization, Ethereum Foundation, Central leader, Looming validator centralization, High gas fees

Max Supply Contracts

Let’s explore three popular historical collections on Ethereum that check for a majority of the value criteria that collectors rely on when valuing tokenized provenance.

Curio Cards

First Issuance of Collection: May 9th, 2017

First Native Asset: Apples

Last Issuance of Collection: August 23rd, 2017

Last Native Asset: Eclipse

Total Supply: 29,700

Claims of Significance:

-

Was “First NFT art collection on ETH” until January 2023

-

Decentralized art collection,

-

Artists went on to have successful careers in crypto,

-

Full set of Curio Cards sold at Christies for $1.2M,

-

Rejected XCOPY submission in 2017,

-

Unique Vending Machine distribution mechanism

Critiques:

-

Individual smart contracts for each card

-

multiple misprint cards

-

turmoil between co-founding team,

Highest Sale: $1.2M at Christie’s Auction House (Full Set)

Floor: 0.25 ETH

Premium Trait Floor: 30 ETH

Premium Ratio: 100x — 150x

Rediscovered: Yes

Value Amplifier: Low Supply Cards

CryptoPunks (V1 & V2)

First Issuance of Collection: June 9th, 2017 (V1 Launch)

First Native Asset: CryptoPunk #0

Last Issuance of Collection: June 23rd, 2017 (V2 Airdrop)

Last Native Asset: CryptoPunk #9999

Total Supply: 20,000

Claims of Significance:

-

First intentional pfp project

-

First generative NFT project

-

Native NFT marketplace with 0% royalties within contract

-

Most cultural significant NFT project

-

Highest non-auction NFT sale

-

Community and Devs Survived 2018–2020 Crypto Winter

-

Set of 9 CryptoPunks sell at Christies for $17M

Critiques:

-

V1 disowned by creators and current CryptoPunks IP owners

-

Fractured Community

-

Two Smart Contracts (V1 Needs Wrapper to function)

-

Larva Labs dumping V1s on community, caught, and then files lawsuit

-

Creators were “out of touch” with community

Highest Sale: 8000 ETH [$23.7M] (CryptoPunk #5822)

Floor: 65 ETH

Premium Trait Floor: 1,370 ETH ($1.2M)

Premium Ratio: 20x-30x

Rediscovered: No (V1 Wrapper created in 2022)

Value Amplifier: Trait Scarcity (Zombies, Apes, Aliens)

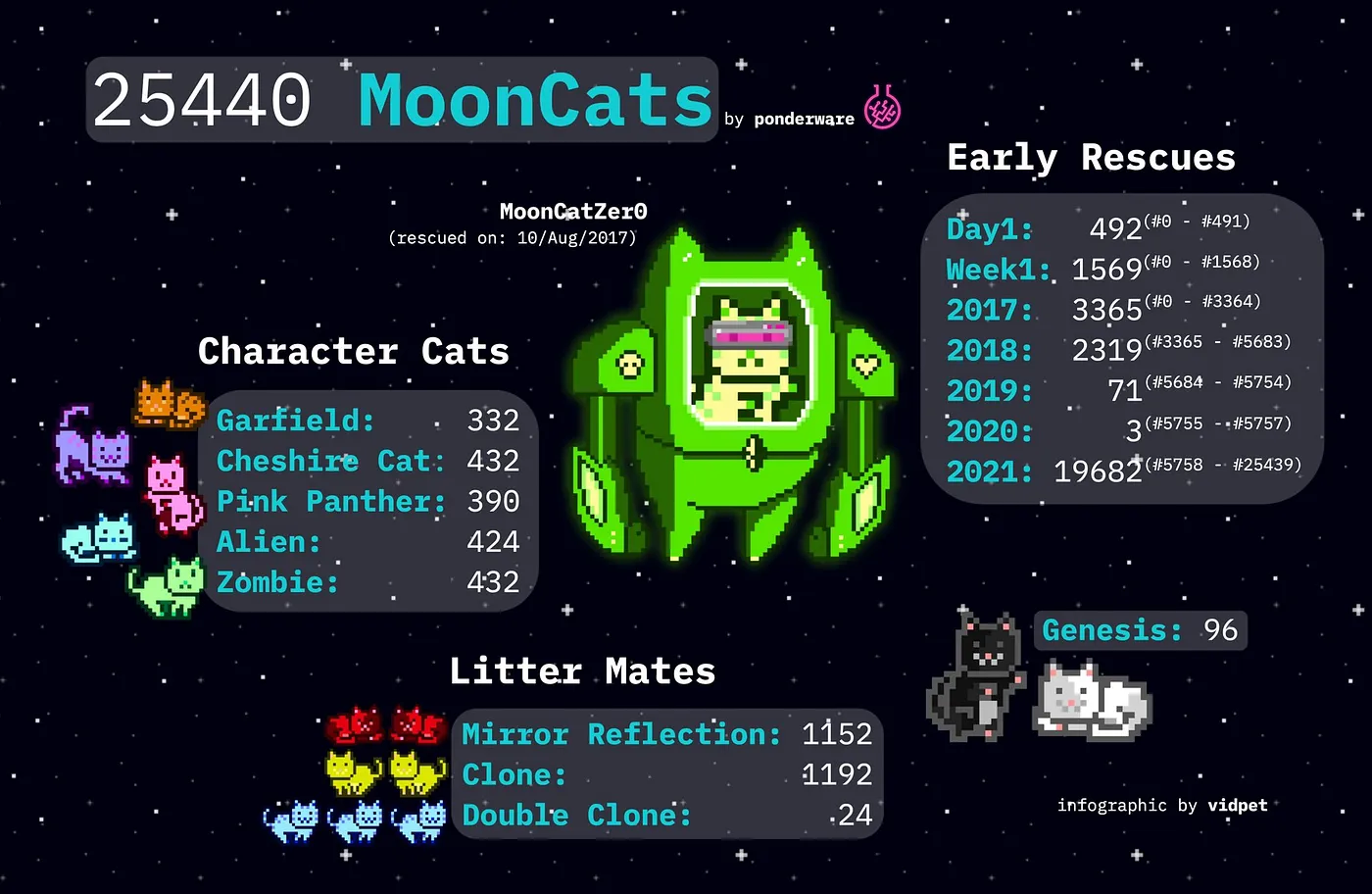

MoonCatRescue

First Issuance of Collection: August 10th, 2017

First Native Asset: MoonCat #0

Last Issuance of Collection: March 12th, 2021

Last Native Asset: MoonCat #25439

Total Supply: 25,440

Claims of Significance:

-

2nd Generative NFT Project

-

Most “on-chain” NFT project at launch

-

First Cat NFT Collection

-

First Marketplace Bonding Curve

-

2nd On-Chain Naming System (1st Irreversable)

-

“MoonCat Rediscovery” known as the birth of NFT Archaeology

-

1 of 2 collections to have mints in each year 2017–2021

-

1st on-chain accessory boutique

-

3 MoonCats sell at Sothebys in 2021

Critiques:

-

ponderware leadership questioned by community

-

ponderware sold IP to team with other offers

-

Accessories causing confusion to potential buyers

-

Rediscovery takes away any culturally significant claims

Highest Sale: 160 ETH [$560k] (Genesis MoonCat #527)

Floor: 0.3 ETH

Premium Trait Floor: 30 ETH (Genesis)

Premium Ratio: 75x -125x

Rediscovered: Yes**

Value Amplifier: Low Mint # and Genesis MoonCats (Trait Scarcity)

Max Supply Contract’s Provenance Summary: The introduction of smart contracts has brought about a new set of provenance standards unlike anything previously seen in human history. It is not only important to know when the contract was deployed, but also when the tokens were minted and how they have been maintained over the course of their existence. Factors such as rediscoveries, community standards, market dynamics, timeliness, and creator visibility can greatly impact the value of a token. Additionally, direct technical factors such as contract purity, late metadata additions, wrapper constructions, and the existence of a master key can also affect a collector’s perception of value.

Infinite Mints

Infinite mint contracts typically fall into two categories, but are not limited to gaming NFTs and identity protocols. Gaming mechanics are not limited to one implementation and generally encompass thousands of styles, including battles, breeding, and metaverse worlds. The current forms of digital identities generally fall into two categories: avatars and names. Decentralized identity is the oldest form of non-fungible assets and therefore has a much wider spectrum of historical practice and provenance.

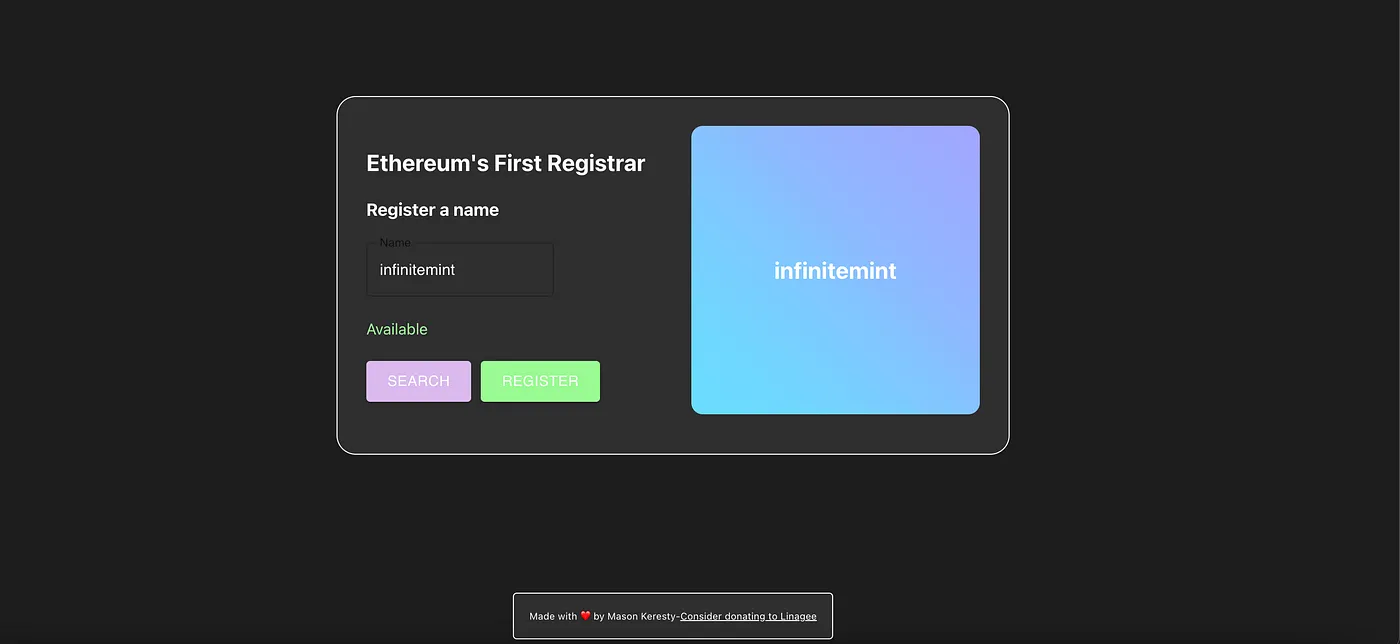

Linagee Name Registrar

Smart Contract Deployment: August 8th, 2015

First Issuance of Collection: August 8th, 2015 (6:22)

First Native Asset: MyFirstCoin

Last Issuance of Collection: Current Date

Last Native Asset: Infinity

Total Supply: Infinity

Historical Supply: 75 2015 NFTs

Claims of Significance:

-

First NFT Smart Contract

-

First NFT (MyFirstCoin)

-

Launched 9 days after Ethereum’s Launch

-

Predates ERC20, ERC721, & ERC721

-

75 Assets minted in 2015

Critiques:

-

Rediscovered 7 years after creation

-

Contract is copy of Global Name Registrar

-

Over a dozen similar contracts from 2015–2017

-

Name changed from “Global Name Registrar” to “Linagee Name Registrar”

-

.og is a community created domain system (in progress)

Highest Sale: 3 ETH (412.og)

Floor: .0003 ETH [$0.45]

Premium Trait Floor: N/A

Premium Ratio: N/A

Rediscovered: Yes

Value Amplifier: 2015 Mints (No Sales)

Ethereum Name Service (Pre-Punk)

Smart Contract Deployment: May 4th, 2017**

First Issuance of Collection**: May 4th, 2017

First Native Asset: rilxxlir.eth

Last Issuance of Collection: Current Date

Last Native Asset: Infinity

Total Supply: Infinity

Historical Supply: 79,000 (Pre-Punk)

Claims of Significance:

-

Most successful decentralized identity and domain project in blockchain history

-

Exists on most popular smart contract platform

-

Predates CryptoPunks

-

Largest NFT community in blockchain history

-

3 digit and 4 digit club setting new trend of digital identity

Critiques:

-

rilxxlir.eth lost until 2030 upon expiration

-

Migrated from original 2017 contract to new contract in 2019

-

Pre-Punk domains value comes from First Registration date and not token provenance due to contract migration

-

Clubs are Artificial Scarcity

Highest Sale: 420 ETH (paradigm.eth)

Floor: .005 ($4)

Premium Trait Floor: 20 ETH (999 club)

Premium Ratio: N/A

Rediscovered: No

Value Amplifier: 3-digit and 4-digit clubs

Historical Amplifier: First 1000 Registrations

CryptoKitties

Smart Contract Deployment: November 23rd, 2017

First Issuance of Collection: November 23rd, 2017

First Native Asset: Genesis #1

Last Issuance of Collection: Current Date

Last Native Asset: N/A

Total Supply: Infinity

Historical Supply: 100 Founder Kitties

Claims of Significance:

-

First major NFT Project to breakout and gain popularity

-

Created by Dapper Labs (Flow and Top Shots Founders)

-

Clogged ETH blockchain in 2017

-

First breeding mechanics

-

Over 200,000 unique owners

-

Innovative Marketplace at launch (UI/UX friendly)

-

Inspiration to many Gaming NFT projects

Critiques:

-

Inflated supply into community abandonment

-

Inflated value away for 99% of collection

Highest Sale:Floor: .0049 ETH ($5)

Premium Trait Floor: 55 ETH (Founder Kitties)

Premium Ratio: N/A

Rediscovered: No

Value Amplifier: Founders Kitties, 2017 Gen 0 Kitties

Infinite Contract Mint Provenance Summary: When a contract has the ability to mint an infinite number of tokens, a common trend is that value accrues to the earliest registered tokens. Similar to how Namecoin assets follow value, LNRs, ENS, and CryptoKitties follow a similar path within their own unique framework. The recent breakout of ENS digit clubs has moved the collection towards the culturally significant category, where most value is accruing within this 11k collection, leaving Pre-Punk domains behind. The CryptoKitties Founders Club has found a firm floor of 50 ETH as their historical and cultural significance maintains relevance among the earliest kitties. LNRs historical significance is yet to be realized as none of the 2015 NFTs have changed hands yet.

If you enjoyed this content follow me on Social Media for even more Historical NFT content!

Twitter: https://twitter.com/jakegallen_

Youtube: https://www.youtube.com/c/JakeGallen

Podcast: https://podcasts.apple.com/us/podcast/jake-gallen-podcast/id1508044547**

Website: **https://www.jakegallen.com/