Introduction

Dolo Finance (Sway Technology, Inc.) intends to disrupt the credits markets by creating a unique uncollateralized lending protocol that combines real world off-chain and on-chain data. The Protocol will allow entities to borrow funds through its system of distributed banking lenders and originators.

In recent years Blockchain technologies have enabled new forms of lending and has turned credit markets on their head. DeFi Lending APY returns are multitudes bigger than traditional financial instruments and there are new vehicles for individual investors to earn high yields. However, most protocols today require over collateralized loans, thereby limiting the scope of users and businesses who can participate in these markets to only those with sufficient collateral.

The next wave of DeFi innovation will bring uncollateralized debt to crypto lending. These protocols will be more effective in combining real world off-chain data and on-chain data. During “DeFi Summer 2020” billions of dollars flooded the DeFi markets and new efficient lending and borrowing protocols were created. Almost all the lending was overcollateralized, with ratios ranging from 150% to 500% of collateral required for the borrowed amount.

Currently off-chain businesses and originators experience an inefficient and arduous underwriting process. There are currently no vehicles for mixed collateralized lending where businesses can use a portion of their collateralized capital for other opportunities. On the other hand, the groups benefiting most are large institutional banks whose processes aren’t transparent or accessible.

Some companies are allowing individuals to support business loans through Regulation Crowdfunding. The shortcomings with these methods involve: no transparent underwriting process, one entity decides sound lending practices, individuals are exposed to only one business, there are no methods for diversifying credit, and the funding process takes months not days. Most of the individuals backing these projects select to remain anonymous. It is important to allow the community to back your project but not necessarily need to know their identity.

For businesses and originators, the process for gathering all the right documentation for regulation crowdfunding or other loan applications is lengthy and inefficient. Dolo Finance plans to release innovative underwriting models with the use of APIs, artificial intelligence, and metrics driven analysis to make the approval process just a couple clicks away. Examples include: POS account syncing (such as Toast, Stripe, Square), tax preparation software integration, and wallet scanning. Dolo Finance’s goal is to make the debt capital underwriting process cheaper, faster, and easier for SMBs and loan originators.

We will create the Dolo Money protocol to allow uncollateralized crypto lending to SMB originators and businesses. Our protocol merges traditional finance with decentralized finance to provide benefits to all parties involved. Designated loan originators handle risks in the lending and underwriting process as well as pool operators and lenders. Our system delegates most of the risks of loans to the originators and lenders to create a reward/punishment system that is transparent and fair.

Originators underwrite the initial loans and have the autonomy to request funds from pools based on open sourced underwriting models and software. We whitelist unique originators so when requesting or depositing funds they are locked into specifics such as loan amount, rate, payback period, and other loan terms.

Glossary

Originators — Can request capital from a lending pool to allocate for business loans. They are in charge of underwriting business loans and assessing business borrowers. Originators broadcast all prior transactions and lending history that are summarized into easy to understand metrics.

In order to qualify as an originator one must be approved by pool operators selected on a random basis. During the initial launch Dolo originators will need to be whitelisted and approved by Pool Operators.

Each originator will have its own unique terms in regards to obtaining a debt capital line from the Dolo Finance protocol. A Pool can be set for one originator or multiple originators.

Pool Operators (“Life Guards”)— Are token holders who will be able to vote to slash or reward originators based on open and transparent underwriting processes. A pool operator and originator are not allowed to borrow and lend in the same pools. A Pool operator will need to work with other pool operators to approve terms of new originators coming to their pool or for the creation of a pool. Pool operators are rewarded for maintaining checks and balances within their pool portfolio.

Lending Pools — Are designated to work with specific originators in order to allocate capital. In the future we expect to incorporate many different types of lending pool exposures with multiple originators. Pools can work similar to ETFs or rating agencies. Pools will be able to designate types of pool allocations based on risk, loan types, geography, or collateralization type. Pool liquidity providers and operators will receive a portion of interest revenue paid out by the borrowers.

Pools can have different levels of tranche exposures. Starting out there will be a senior tranche and direct exposure to originators.

Pools can also have debt utilization ratios in regards to how much can be lent out of the total pool liquidity. This allows for other favorable stable coin yield to balance risk and allow for funds to always be available for originators.

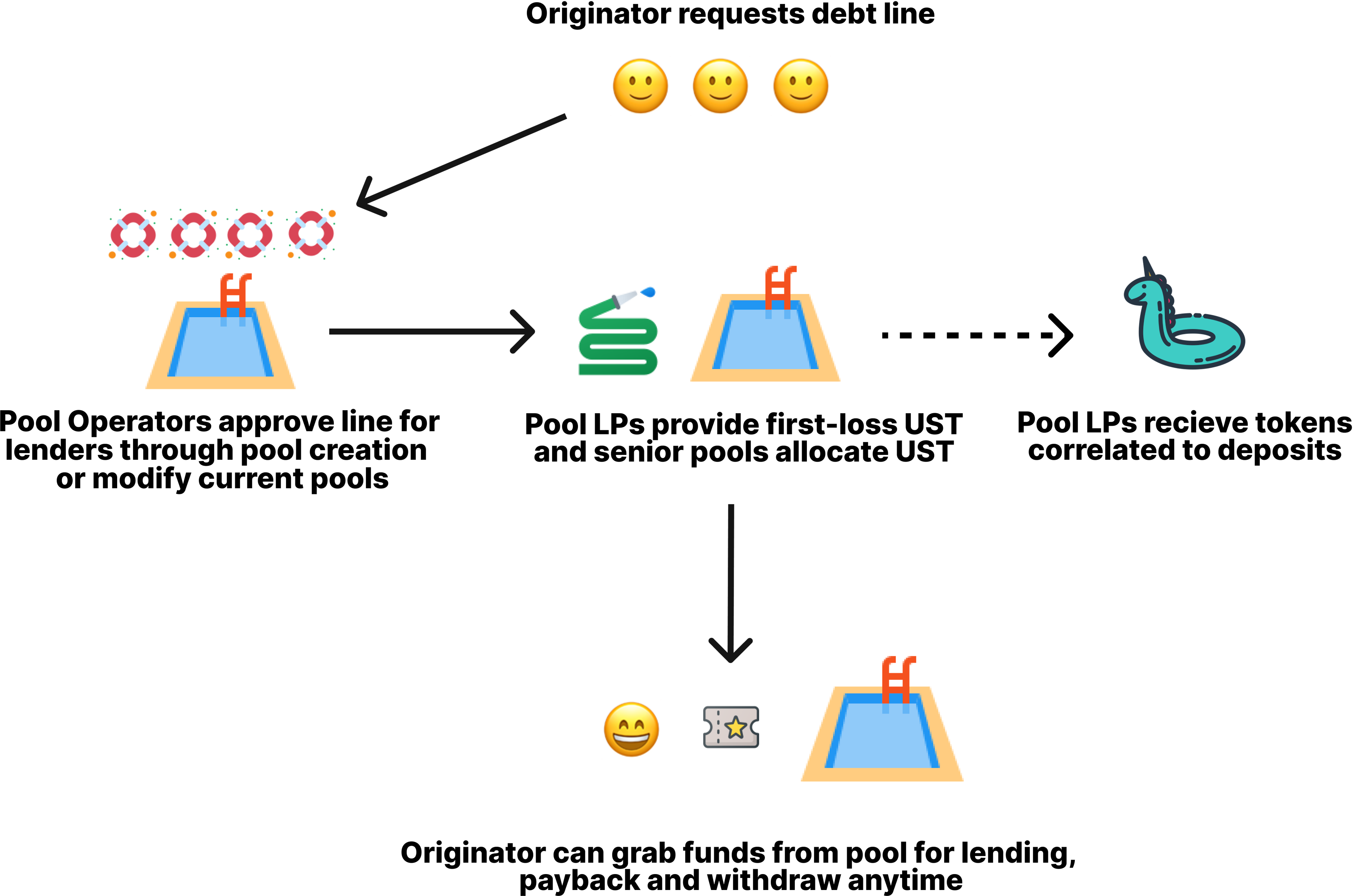

Pool Liquidity Providers ( Pool LPS )— are any protocol participant that chooses to delegate stable coins to the lending pool. These backers will receive a token correlated to their deposit made. This token (floaties) will be correlated to their amount deposited, interest income, and remaining principle.

Within the protocol, transparent loan data will be recorded on the Blockchain including stats such as total capital managed, interest accrued, average APY, total default loss etc., as well as more detailed descriptions provided by originators on their lending procedures. All individual Borrower loan contract data will be available as well.

Pool Seniority and Exposure types — Pool seniority and exposure will be key in handling risk for pool liquidity providers. Pool operators can vote for pools to have different levels of seniority and work with different originators of their choosing. It is possible to have multiple pools to a single originator creating different levels of payback priority and APY.

Borrower — Any entity who uses funds from lending pools for borrowing capital. These borrowers can apply for loans by working with pool operators to create a lending pool. They are subject to KYC and credit checks. They have the flexibility to shop for the best rates and terms on the market, empowering them with options outside of legacy systems.

Process for Pool Creation

Pool operators (lifeguards) are in charge of lending pool creations. Pool operators (lifeguards) will be designated through the protocol and cannot transfer their role. Pool Operators will need to complete specific requirements by the protocol for them to attain the role. They will receive token rewards for new pool creations and for maintaining proper checks on pools.

Handling Debt Drawdown and Redemption

One of the key benefits of dealing with a decentralized debt warehouse line is a reduction in time needed to manually verify balance sheets and pay back loans at intervals inconvenient for the borrower.

With traditional debt lines, originators are sometimes faced with interest charged on their loans when they are ready to payback a line but can’t due to traditional banking methods. Decentralized systems can offer a more streamlined capital distribution and collection experience to originators and borrowers to save time and money.

An Example Use Case

An SMB originator named Lending Shrub comes to the protocol and applies for a line of credit for $1M UST. They have a business and credit model that has been proven to work which has originated over $10M in loans. They fund plant based e-commerce companies through Merchant Cash Advanced loans. They request a credit line for $1M UST at 11% with a payback period of 12 months. At this stage, at least 7 randomly selected Lending Pool Operators must review their application and vote to approve it. The Lender may be requested to stake a portion of their own capital into the pool until there is a proven track record of consistent credit history with the Lending Shrub. Therefore creating a mixed collateral pool containing $500k deposited capital from Lending Shrub at least $500k from pool LPs. The pool could aim to have a debt utilization ratio of 50% allowing there to be a $2M in the total pool with 50% going into stable coin yields and 50% going to be lent out to Lending Shrub. These terms above are decided upon by the lending pool operators prior to the disbursement of funds.