Frameworks are useful to ramp up on new problem spaces quickly. With all the constant change in DeFi, I use a high level framework to understand who the major players are in the ecosystem and to ramp on developing new yield farming strategies.

Note that this is more of a beginner’s framework for DeFi, and explicitly omits advanced financial products (derivatives, options, futures, etc).

This is inspired by Darren Lau’s original DeFi ecosystem map.

We’ll cover:

1/ What is the framework?

2/ What are the different components?

3/ How do you use the framework to onboard to new chains?

Note that if you are brand new to DeFi, I would read this guide first, then move onto this.

1/ What is the framework?

DeFi was born on Ethereum. However, gas fees on Ethereum make it unusable for beginners, and especially beginners who are trying their first transactions in DeFi. Fortunately, while much of the 0 to 1 DeFi innovation still occurs on Ethereum, a number of popular products with PMF are often ported onto cheaper alt L1s and L2s. If you’re new and interested in DeFi, it’s a lot easier to learn and try the basic principles on a chain where you aren’t paying $50/transaction.

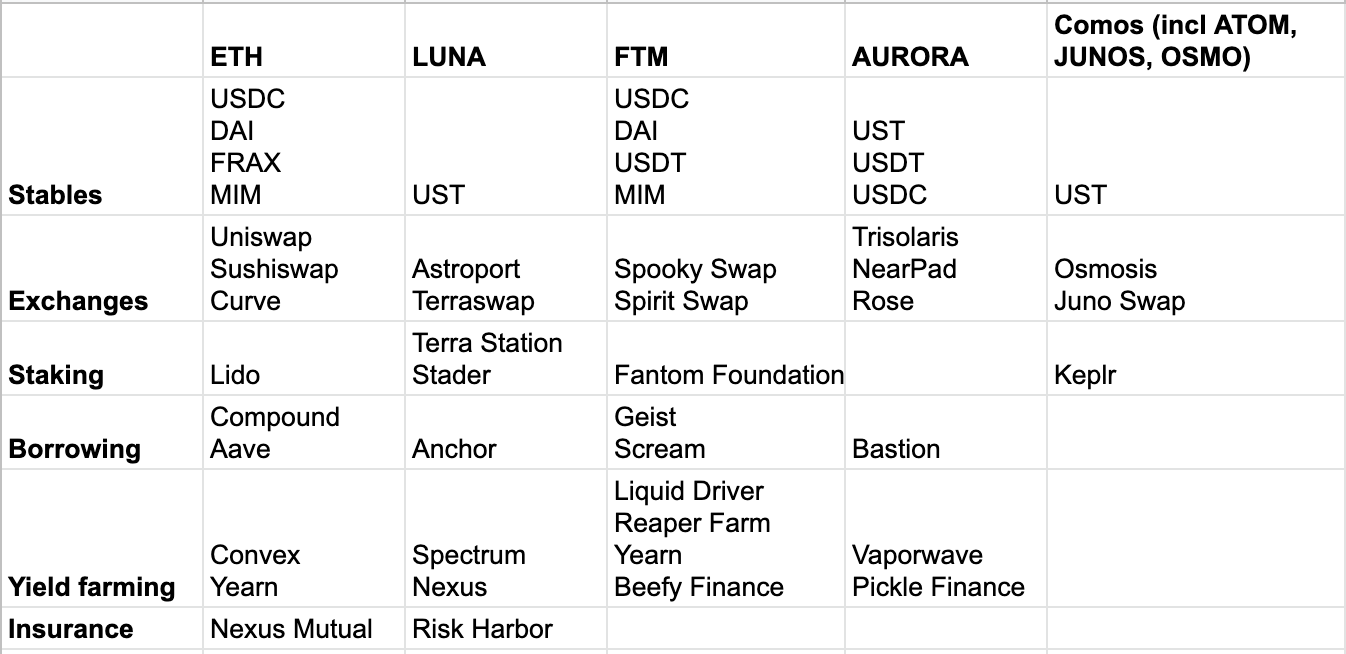

Whether or not you believe in a multi-chain world is a different topic, but the image below is how I map major financial primitives against a few of the chains that I’ve been exploring DeFi with. The map can get a lot more complicated, but the principles below will expose you to products that facilitate the key actions in DeFi 101.

2/ What are the different components?

- Stables

- Stables are critical in the crypto ecosystem given the volatility of the overall crypto market. Stablecoins are coins where the price is roughly pegged at $1. They can be backed by actually US dollars (USDC), a basket of collateral (DAI), or algorithmically backed (UST, FRAX). These are commonly used when people want to avoid the volatility of the market but still stay in the game as opposed to cashing out.

- Exchanges

- Exchanges are critical in DeFi because they allow for the swapping of tokens. AMMs/DEXs have been heralded as a true 0 to 1 DeFi innovation because of the nature of actual users providing liquidity for trades rather than trades being run from a centralized orderbook. Users like yourself can offer up your tokens for a cut of transaction fees and other rewards. When you swap a coin on Uniswap or Sushiswap, you are effectively swapping tokens from these liquidity pools.

- Note that some chains like Ethereum have exchange aggregators like Paraswap, Cowswap, or Matcha, which will route your order to the best provider.

- Staking

- Staking is a great way to get an extra 5-10% exposure on coins you already hold, while also helping validate transactions for the network you’re on.

- Borrowing

- When borrowing solutions are introduced to DeFi ecosystems, that’s when you’ll start seeing explosive growth. Borrowing, or liquidity markets, allow you to supply your collateral out for other borrowers, or borrow yourself to lever up on a position. If you want to play with borrowing, you’ll need to understand loan to value (LTV) ratios as that’s how you track how healthy your position is.

- Yield farming

- Remember when I mentioned how people provide liquidity pool pairs to help facilitate transactions within an exchange? When you do that, you usually have to manually go in to collect your rewards. Yield farming solutions and auto compounding yield farms will collect the rewards for you and automatically stack them. When people talk about DeFi, yield farming is where you’ll see these higher than 100% APRs.

- A couple of examples

- Reaper Farm: allows you to farm LP positions from Spookyswap. Rewards are automatically added on as extra LP tokens to your existing position

- Liquid Driver: collects your LP tokens and then pays out your reward in $LQDR tokens which you can stake for $xLQDR to collect yields for coins across the FTM ecosystem.

- Insurance

- Given DeFi is the wild wild west and there’s no customer support to help you if things go wrong, insurance is worth considering if you have positions you want some extra protection for. That being said, look into the fine print for these various insurance solutions, as they all have different nuances.

3/ How do you use the framework to onboard to new chains?

I like concrete examples as a way to understand how to tangibly apply frameworks. So I’ll walk through an example when I onboarded to Aurora. I heard about Aurora around December. The only thing I knew about it was that the main products to check out where Trisolaris, Rose, and SmartPad.

Assuming you’ve done your diligence on the chain overall (a separate topic) and you want to start understanding how it works and who’s on it, these are the steps I go through:

Steps:

- Map out a few players against the high level framework above

- Use DeFiLlama to get a sense of the largest players by TVL (total value locked) and figure out which ones are interesting

- Map the players against the framework above so you can get a sense of what parts of the ecosystem exist, and what parts may still come online

- Start playing with a few protocols on the chain

- Start by exploring a few of the protocols to see what features exist

- Deposit $10 to play around with the different chains and assess how fast/slow depositing is, test the ability to deposit and withdraw, etc

- Figure out how to track prices, common liquidity pairs, and expected yields

- Figure out how to track prices (for some of these newer alt L1s, their tokens may not be available on Coinmarketcap or Coingecko). Dexscreener is a good tool for this.

- Using Dexscreener, get a sense of the common liquidity pools so you can figure out how to actually exchange your coins

- Map out expected yields for different actions (e.g. staking, LPing) so you can see if it’s worth your time to farm

- Make a call on if you want to farm or not

Detailed walkthrough:

- Map out a few players against the high level framework above

- Use DeFiLlama to get a sense of the largest players by TVL (total value locked) and figure out which ones are interesting

- For Aurora, at the time, it was clear that the major players were Trisolaris, Rose, SmartPad, NearPad, and Vaporwave. I played with all of these and got the sense that:

- Trisolaris, NearPad, WannaSwap, etc - all AMMs that let you swap coins. Trisolaris was generally strong for ETH/Terra ecosystem coins, but NearPad had the most liquidity for Rose (more on that below). In terms of CT chatter, Trisolaris definitely seemed to get most of the noise

- SmartPad seemed also popular, but it looked like it was an incubation project where users could buy tokens to get early access to new projects launching in the ecosystem

- Vaporwave actually also showed up with Pickle Finance as the two major auto-compounding vaults. At the time, Vaporwave had decent coverage of most of the LP pools from the AMMs, vs Pickle only had 1-2. I was a bit uneasy about Vaporwave since no one was talking about it, so I also dug into their Discord to see what the team was like, and felt better when I saw there was a pretty active/friendly/helpful community.

- For Aurora, at the time, it was clear that the major players were Trisolaris, Rose, SmartPad, NearPad, and Vaporwave. I played with all of these and got the sense that:

- Map the players against the framework above so you can get a sense of what parts of the ecosystem exist, and what parts may still come online

- We can bucket the above protocols against the framework:

- Stablecoins: FRAX, UST, USDC, USDT, DAI

- Exchanges: Trisolaris, NearSwap, WannaSwap

- Staking: n/a for single-sided staking on Aurora

- Borrowing: n/a (when I first started this, but a lot of new things have launched)

- Yield farming: Vaporwave

- Insurance: n/a

- We can bucket the above protocols against the framework:

- Use DeFiLlama to get a sense of the largest players by TVL (total value locked) and figure out which ones are interesting

- Start playing with a few protocols on the chain

- Start by exploring a few of the protocols to see what features exist

- I picked out a few that I thought were most interesting and got a sense of what they offered:

- Trisolaris: ability to trade and swap most tokens on ETH and Terra, ability to add LP, stake $tri earnings from farming

- Rose: LP pools for stablecoins and ability to farm $rose, and ability to stake $rose with a slight lockup

- Vaporwave: primarily accepted LP tokens from all of the exchanges on Aurora

- I picked out a few that I thought were most interesting and got a sense of what they offered:

- Deposit $10 to play around with the different chains and assess how fast/slow depositing is, test the ability to deposit and withdraw, etc

- You can skip this step if you’re not interested in investing, but I had a hunch I was interested, so I tried some small test transactions to see how it’d work.

- The first thing to do is always figure out how to get gas money on the new chain. Crypto is not as optimal as it should be, and you don’t want your funds to get stuck on a chain without gas to run transactions! Fortunately, at the time, Aurora actually had zero gas fees which made it a no brainer to play around with. Many chains offer faucets where they’ll drip out a small amount of the token to get you started with your first swap. You can also sometimes get token bonuses from some bridges (e.g. Multichain) that get you started.

- Once you have gas money, figure out what makes sense for you. I bridged my money from Terra to Aurora using the bridgooooors guide. Then swapped to a few tokens to open some small LP pools to see how yield accumulated.

- My initials observations were:

- Transactions were pretty fast. Didn’t have to wait more than a few min to see transactions go through. No gas was also super nice.

- Trisolaris had a bit of a janky refresh experience (though it’s gotten much better since my initial experience in Dec). But hard refreshing (shift + cmd + R) generally got my LP pools to show up

- I had some issues with Vaporwave, but the community was pretty helpful, and they generally suggested using a VPN for Aurora transactions to run more smooothly

- Start by exploring a few of the protocols to see what features exist

- Figure out how to track prices, common liquidity pairs, and expected yields

- Figure out how to track prices (for some of these newer alt L1s, their tokens may not be available on Coinmarketcap or Coingecko). Dexscreener is a good tool for this.

- This was the first chain I used where Coinmarketcap/Coingecko were not sufficient for me to find token prices. I popped into one of the discords and asked around and learned about Dexscreener, which has fantastic coverage across most chains. I then used Dexscreener to get basics stats like token prices, market cap, FDV, etc.

- Using Dexscreener, get a sense of the common liquidity pools so you can figure out how to actually exchange your coins

- This was another step I didn’t expect. Given the nascency of the ecosystem, I was curious about how I could acquire some $rose. At the time, $rose only had liquidity on Nearpad and not Trisolaris, which threw me off since I was used to coins being generally liquid across most AMMS on Ethereum.

- You can use Dexscreener to see where different liquidity pools are and figure out the most optimal way of exchanging tokens while minimizing slippage.

- Map out expected yields for different actions (e.g. staking, LPing) so you can see if it’s worth your time to farm

- Finally, figure out the rough yields and if they make sense

- At the time, Trisolaris was yielding btwn 100-200% APR on a few liquidity pool pairs, Rose was doing 80% for Rose <> FRAX LPing, and Vaporwave was compounding some of these DEX LPs.

- A 150% APR roughly works out to about 0.4% per day. Even with impermanent loss, about 2 weeks in that pool assuming a 2x change in price difference would make up the loss.

- 2x change in price = 5.7% loss (more on impermanent loss here)

- 0.4% earned per day * 14 days = 5.6% earned

- Map out these different yields and see if they make sense for you. Generally yields that are >200% are very attractive, though they might not stick around, and even btwn 100-200% are still fantastic. But again, it depends on what your goals are.

- Finally, figure out the rough yields and if they make sense

- Figure out how to track prices (for some of these newer alt L1s, their tokens may not be available on Coinmarketcap or Coingecko). Dexscreener is a good tool for this.

- Make a call on if you want to farm or not

- I feel strongly that one shouldn’t copy trade in DeFi because everyone’s financial situation, goals, and risk tolerances are incredibly different. But, I’ll share the framework that I use when I think about this.

- To make a call on farming, I figure out:

- Strategic questions:

- Ecosystem/protocol investment narrative

- Is there a narrative that makes sense for this chain? e.g. P2E, L2s, etc are popular narratives right now

- Is the tech unique in some way? Does the L2 solve for something with a novel solution? Unless you are choosing to farm in a chain and then immediately sell out profits and leave, you are implicitly making a call on if you believe in the chain long run.

- Ecosystem/protocol team

- Is the team good? Doxxed? Experienced? The decision to yield farm requires a decision at both the ecosystem and protocol level. Make sure you feel good about the people who are building the solutions that you’re locking your money into.

- Ecosystem/protocol community

- How’s the community? Given the importance of community in web3, it’s worth seeing if the community is helpful, thoughtful, etc. Also pro tip: you can often pick up some interesting ecosystem alpha in the Discords for protocols, since you have a group of passionate people about a specific topic.

- Ecosystem/protocol investment narrative

- Execution questions:

- What the right entrypoint is

- While the general adage is time in market > timing the market… I have increasingly believed that if you are thinking about investing daily, this is not true. Entrypoints matter. For example, $PTP on Avalanche launched, pumped to almost $15, and then dropped down to stabilize at $2-3. I like the protocol a lot, but recovering from an entrypoint at $15 vs $2 is non trivial. Think about what makes sense. You can put in small investment to get start farming if you’re not happy with the price point, etc.

- Expected yield to risk

- 100-200% APRs are extremely tempting, but think about overall protocol risk, how mature the protocol is, etc, and other risk factors to weigh if the yield is worth the risk.

- For example, when I first started, Vaporwave’s TVL was so minuscule and no one CT was talking about them that while I wanted auto compounding vaults because I didn’t want to harvest myself, I was pretty skittish about putting my money in. I ended up rationalizing it by putting in a very small chunk to see how it went, and then readjusted the position over time.

- APRs can also swing a lot. I remember seeing the UST <> USDC pool on Pangolin when it first launched at 50% APY. After a few days, that pool is now XX. Not all yields last, and if you have to do a lot of bridging and swapping to work, it may not be worth it.

- There’s no formula here since risk is subjective to the investor. But generally, I’d optimize for decisions where you don’t need to look at your charts every day and just feel terrible if you see any drops. It’s too stressful otherwise.

- Expected time horizon

- Time horizon matters a lot, especially if you’re thinking about LP pools. If you want to sell at every drop, then the frustration of impermanent loss could deter you from LPing. Try single-sided staking instead. If you would have held the coin throughout the drops since you’re not a day trader, then LPing could make sense.

- Think about if you are planning to open this position with a short vs a long term time frame.

- What the right entrypoint is

- Strategic questions:

Long article, but hope this is helpful! DM if you have any questions or suggestions on other things for me to amend in my framework!