Rationale

Arbitrage is an important concept that liquidity providers must be aware of. When liquidity pools become unbalanced, arbitrage opportunities open up which exploit the LPs. This guide will give you tips on how to deposit into the Curve rETH/wstETH pool without pushing the balance farther than 75/25 or 79/21, rETH/wstETH, respectively. The ideal balance is ~77/23.

Note: there are three different ways I outline for you to start and they will have different values to pay attention to.

THIS IS NOT FINANCIAL ADVICE. DEFI IS RISKY, DO YOUR OWN RESEARCH.

ETH -> rETH -> curve

Step 1: Stake ETH for rETH (stake.rocketpool.net)

- Note: You need to wait 24 hrs before proceeding

- Alternative: Purchase rETH in a DEX (uniswap/balancer) on L1 or L2 if the price is competitive to be worth moving to L1.

Step 2: Determine if you need to add wstETH to your deposit to avoid arbitrage

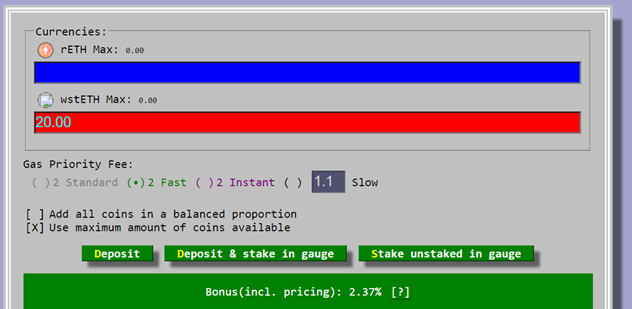

i. go to https://curve.fi/factory/89/deposit

ii. enter in your rETH amount and look at the slippage warning.

a. IF negative slippage warning >1.4% add wstETH until it is lower than 1.4%, OR reduce the amount of rETH deposited

b.

c.

ETH -> stETH -> wstETH -> curve

Step1: Trade ETH for stETH in the stETH curve pool

Step 2: wrap the stETH for wstETH on https://stake.lido.fi/wrap

- Note: it may be more cost-effective to trade ETH for wstETH directly, however, this method will guarantee you the oracle value of wstETH for your stETH.

Step 3: Determine if you need to add rETH to your deposit to avoid arbitrage

i. go to https://curve.fi/factory/89/deposit

ii. enter in your wstETH amount and look at the slippage warning.

a. IF bonus slippage <2.4% reduce wstETH until it is >2.4% OR add rETH until it is <0.9% (yes, this is confusing and may seem counter-intuitive)

b.

c.

Large sums of ETH -> rETH/wstETH -> curve

Step1: Trade 77% ETH for rETH and 23% for wstETH

Step 2: Deposit all at https://curve.fi/factory/89/deposit

Curve -> curve

Staking your LP tokens with Curve will allow you to immediately earn CRV tokens as soon as rewards start.

Step 1: Stake LP token in the gauge at https://curve.fi/factory/89/deposit

Curve -> convex

Convex will boost the APR of your CRV rewards ~2x, however, they will charge a fee and distribute your rewards slower.

Step 1: Take the LP tokens generated from one of the three given options and stake it at https://www.convexfinance.com/stake

Step 2: When you feel like it, claim your CRV rewards at https://www.convexfinance.com/claim

Curve -> yearn

Soon the yearn vault will be live that will auto compound CRV rewards back into more LP tokens. This guide will be updated once this is live.

EDIT: March 19th - Yearn vault is live:

Step 1: Take the LP tokens generated from one of the three given options and stake them at the yearn vault link above

Step 2. Withdraw when happy