Owning rental property can be a great way to make an income and build wealth, but it’s important to understand all the tax benefits of rental property ownership. Having the right bookkeeping system in place can help you to identify the available tax benefits and help maximize your return on rental property investments. Let’s take a look at 10 of these potential tax benefits that you should consider when owning rental property.

1. Depreciation

One of the most important tax benefits for rental property owners is the ability to depreciate it over time. The depreciation deduction allows landlords to deduct a portion of their building expenses from their taxes each year, allowing them to realize substantial savings.

2. Mortgage Interest Deduction

Another great way to save money on taxes as a landlord is through mortgage interest deductions. This tax benefit allows landlords to deduct the amount of interest they pay on their loans from their taxable income, helping to reduce taxable net income while applying leverage to control 100% of a rental property by making a small down payment and using other peoples’ money (OPM).

3. Investment Tax Credit

Landlords may also be eligible for investment tax credits if they invest in energy-efficient upgrades or make other improvements that qualify them for this type of credit. These credits can significantly reduce a landlord’s taxable income and lead to huge savings come tax time!

Photo by Amos Bar-Zeev on Unsplash

4. Travel Expenses

Landlords are eligible for deductions on travel expenses related to managing a rental property, such as trips taken to inspect or maintain the property or traveling to trade shows or conferences. This can be a great way for landlords to save money on taxes while still accomplishing necessary tasks related to managing their properties and continuing their education.

5. Insurance Premiums

Landlords may also be able to deduct insurance premiums paid for any insurance policies related directly to their rentals from their taxable income, such as liability insurance and damage insurance policies. This can help landlords save money while still having peace of mind knowing they’re covered in case something happens while renting out their units.

6. Repair Costs

Landlords are eligible for deductions on repair costs associated with maintaining their properties, including materials used in repairs and labor charges incurred during repairs done by professionals (such as electricians or plumbers).

Photo by Doris Morgan on Unsplash

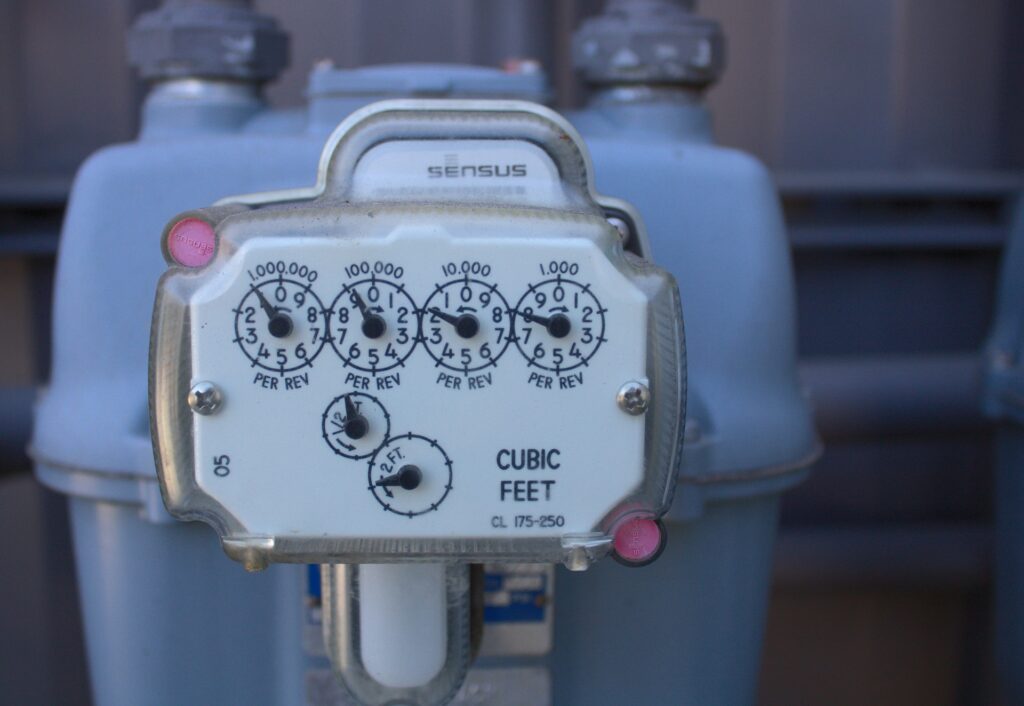

7. Utilities

Any utility charges incurred while renting out units—including water, sewer, electricity, gas, heating oil, etc.—are also deductible from taxable income each year by landlords who own multiple units or buildings with multiple tenants residing in them.

8. Advertising Costs

Landlords may also be able deduct any costs associated with advertising a unit that is available for rent from their taxable income each year; this includes both online ads placed via websites like Craigslist as well as print advertisements placed in newspapers or other publications.

9. Legal Fees

If landlords need legal assistance during any part of the process of renting out units—such as drafting leases or negotiating tenant disputes—they may be able to deduct legal fees paid that are directly related to these activities from their taxes each year.

Photo by micheile dot com on Unsplash

10. 1031 Exchange

A 1031 exchange – also known as a “like-kind exchange” by the IRS – lets investors defer capital gains taxes when selling an investment property by reinvesting all proceeds into another one within 180 days. This can be an incredibly effective way to increase returns while minimizing taxes paid, allowing investors to “roll over” profits into more lucrative investments without having them immediately taxed.

Conclusion

Unlocking all the potential tax benefits offered by owning rental property can help you maximize your return on investment over time and ensure that rental investments remain profitable over time even if market conditions change. By understanding these key tax benefits available to rental owners, you’ll be better equipped too make smart decisions about when to buy, how long to hold onto properties, and when to sell.

*Content created by J. Scott Digital freelance copywriting services. Featured photo by Alexander Schimmeck on Unsplash. *