This is an obvious deviation from the consumer tech and web3 content I plan to post on this blog; however, I think this is important enough to make an exception (however, expect the consumer content to come back soon). As a current MBA student recruiting for VC, I was unsure about what’s considered standard pay for an intern. I scoured the internet high and low, and though I found sources that covered VC as a whole, I couldn’t find data analysis around compensation for VC interns specifically. This left me confused and frustrated because I had no baseline to compare to. After talking to my classmates and other MBA students, I realized I wasn’t alone.

So I’m creating this resource to help myself, my classmates, and anyone else looking for a VC internship. To get this data, I posted a Google Form to every VC-related communication channel I’m a part of and let the internet do its thing. After two weeks, I received 143 responses. One of them was an extreme outlier ($280/hour), so I threw it out before calculating mean, standard deviations, and medians, as well as running a regression. Here are five things I’ve learned from the analysis.

It’s common knowledge (at least amongst MBAs) that VC interns do not get paid, especially compared to our classmates recruiting for consulting or banking. The data shows that idea is not entirely accurate, as only 23% of respondents reported not getting paid at all.

However, that doesn’t mean riches for paid interns. Overall, interns get paid $25.08/hour on average and a median of $25/hour. Looking at the histogram, the peak of the data falls in the $0-10/hour range with minor peaks in the $20-30/ hour and $30-40/hour ranges, creating a right-skewed distribution - meaning even when VC interns do get paid, it is mainly on the lower side.

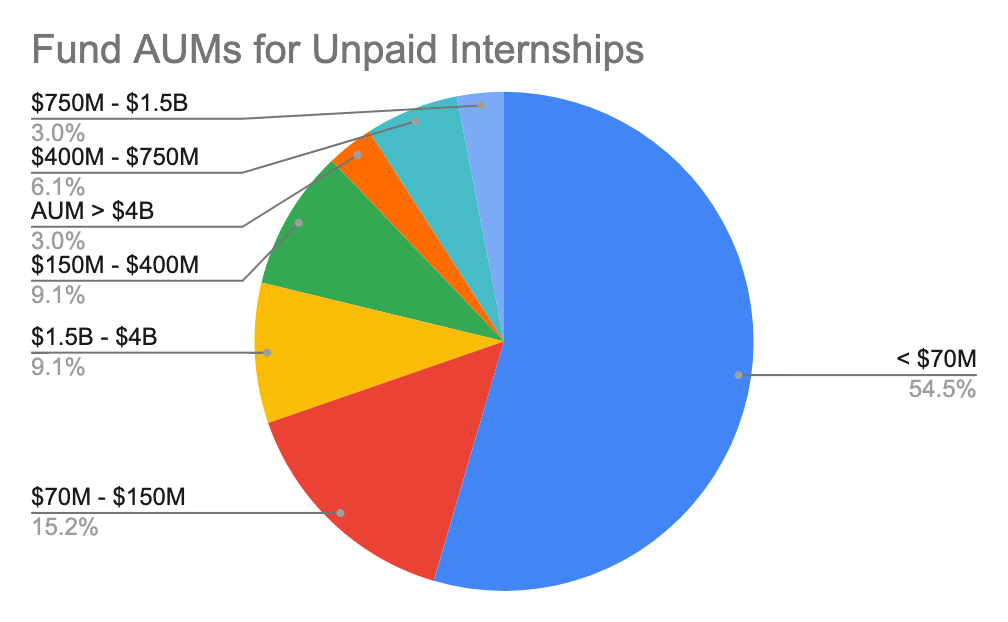

According to the data, funds with AUMs under $70M provided the lion's share of unpaid internships, making up 54.5% of all unpaid internships. From there, funds with an AUM of $70M - $150M came in at the second-highest, making up 15.2% of unpaid internships. Interestingly enough, larger funds also made more use of unpaid interns than I expected, with $1.5B-4B funds tied with $150M - 400M for fourth highest.

Fund with the lowest instances of unpaid internships? $750M - 1.5B and > $4B funds; both making up 3% of all unpaid internships. Fun fact, most unpaid VC interns are men, making up 60.6% of unpaid interns, bringing us to the next point...

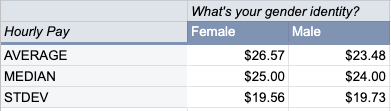

It’s well documented that there is a pay disparity between men and women in the broader job market, and I expected the data to reflect the same. To put it short - I was wrong. According to the data, female respondents get paid $26.57/hour on average, male respondents $23.48/hour - meaning that women get paid $3.09/hour more. Median pay rates indicated something similar; female respondents came in at $25/hour, their male counterparts at $24/hour.

The regression analysis backs this up. I created a dummy variable for gender in multiple regressions using “Male” as the baseline variable. For those who are new to stats, for variables to be significant, the p-values have to be lower than the threshold, which is dependent on the confidence level used (in this case, I used a 95% confidence level, resulting in a 0.05 threshold. Each time, the p-values for gender came in around ~0.7, much higher than the 0.05 significance cutoff. In every regression output, the gender p-values were far higher than the 0.05 threshold - around 0.7, ultimately forcing me to take gender out of the final regression analysis.

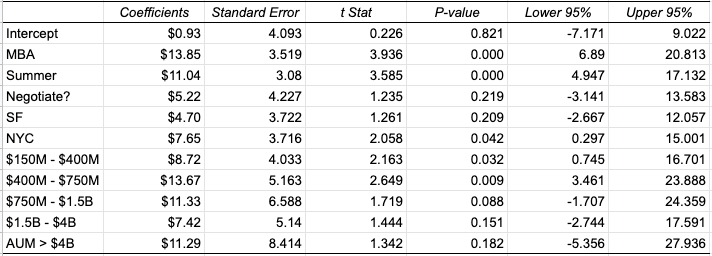

With VC internships - details matter. According to the regression, interns at funds based in NYC can receive a $7.65/hour pay boost, SF, $4.70/hour. However, looking at the descriptive statistics, NYC and SF are nowhere near the highest paying cities for VC interns. I think the discrepancy comes from the fact that there weren't a ton of submissions outside of NYC and SF, leaving the averages and medians more easily influenced by outliers. Consequently, I would take the averages and medians for smaller markets with a large grain of salt.

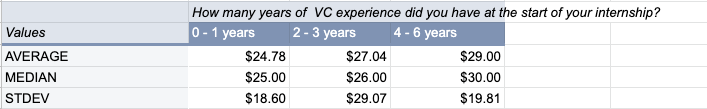

Additionally, the regression suggests that MBA candidates can expect $13.65 more an hour than other candidates, and interns working over the summer can expect $11.04/hour more than internships during different times of the year. While VC experience didn’t meet the significance threshold, the descriptive stats suggest that pay increases with more years of VC experience.

Only 15.49% of respondents negotiated their offered pay; of that group received a 59.09%pay increase. Our respondents successfully negotiated an average increase of $7.50/hour. The regression supports this conclusion with negotiation correlating with an additional $5.22/hour.

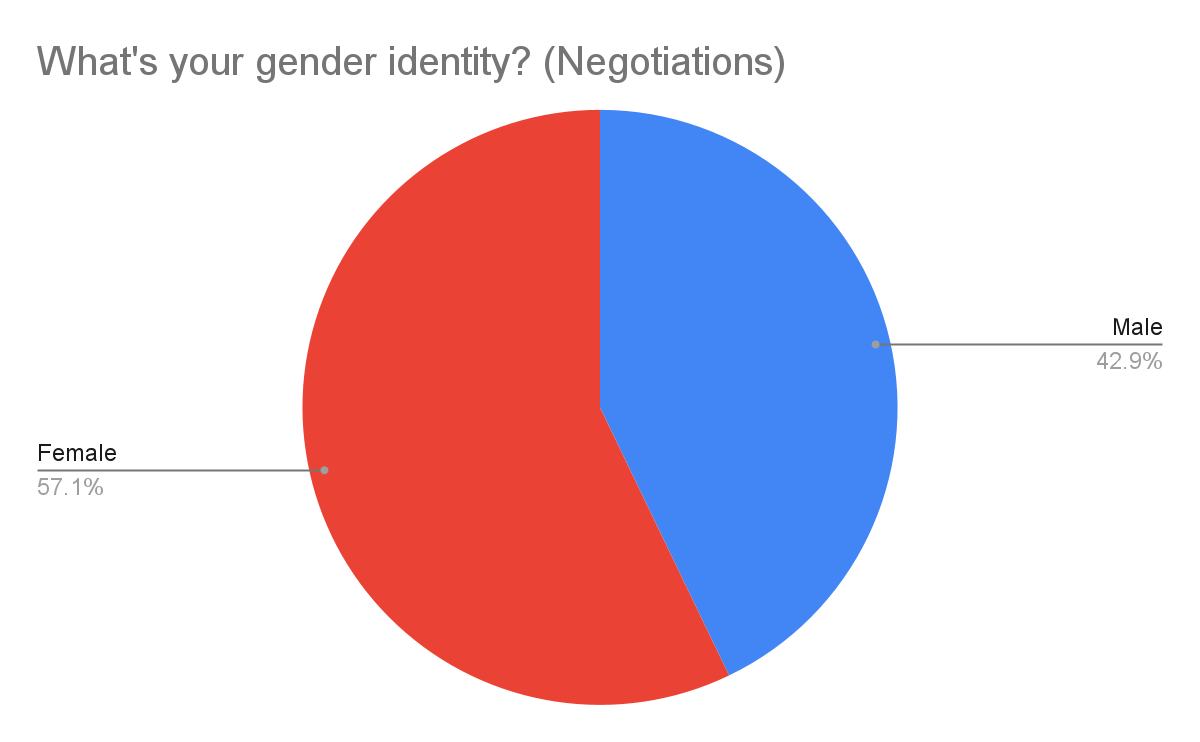

Interestingly enough, most of the respondents that negotiated their pay were women - making up 57.1% of interns that negotiated - flying in the face of the oft-repeated narrative that women don’t negotiate their pay. More interesting, 72.7% of successful pay negotiations (successful being any difference between actual and offered pay greater than zero) were by female interns.

I want this data to be a resource for students and other people trying to break into VC. For that purpose, a copy of the spreadsheet with all the data and analysis used to make this post will be publicly available. It includes a salary calculator based on the output from the final regression; hopefully, it provides an accurate estimate of what you can expect from whichever internship you’re recruiting for or starting. I encourage everyone to download a copy and play with the data to see what else you can find - I didn’t cover everything, and I’d love to see the discussion continue.

I want to give a special thank you to following - I really couldn’t have done this without you 💙✨:

-

VC Unleashed (@VcUnleashed)

-

Raquel Scott (@theraquelscott)

-

Shelby Rudd (@ShelbyRudd_VC)

-

Adetola Olatunji (@AdetolaTweets)

-

Ben Hassler (@benhasslerr)

-

Josh Ogundu (@JoshuaOgundu)

-

And to the 143 individuals who took the time to respond to my survey and the countless people who shared it with their networks

-

I created a survey using Google Form and shared it on Twitter, LinkedIn, various Slack groups, and other online spaces frequented by students and other aspiring VCs

-

After conducting the survey, I converted the responses into a Google Sheet and got rid of one outlier entry ($280/hr)

-

Created the descriptive statistics for the pay data and pie charts of respondents’ demographic data.

-

I ran a regression using the following baseline values:

-

Non-MBA

-

In-Semester Internship

-

Didn't Negotiate pay

-

The internship is not in SF or NYC

-

Fund AUM < $150mm

-

-

The following independent variables had p-values > 0.05 in the regression:

-

Negotiate? - Left it in because leaving it out didn’t significantly increase the adjusted R-square, and I wanted to show the effect negotiating could have on hourly pay

-

SF - I left it in because SF is a larger market for VC internships (making up 26.1% of all responses). As a result, I thought it was still worth comparing against the broader market

-

$750M - $1.5B, $1.5B - $4B, AUM > $4B - I left independent variables for funds over $750M in because taking it out would confuse the baseline values and hurt the interpretability of the regression.

-