2025 is poised to become a pivotal year for cryptocurrency, particularly Bitcoin. As we approach mid-year, global developments—geopolitical, financial, and Bitcoin-specific—are converging to set the stage for significant momentum. Bitcoin (BTC) currently trades near $94,000 (see price chart), up sharply since April 21, when U.S. Treasury Secretary Scott Bessent eased tensions around tariff policy and President Trump quashed rumors of ousting Federal Reserve Chair Jerome Powell. While short-term volatility may persist over the next 2-3 weeks, the crypto market—and Bitcoin specifically—appears on the cusp of accelerated growth.

Macroeconomic Tailwinds Persist Despite U.S. Reassurances

Despite recent calming rhetoric from U.S. officials, the macro factors outlined in my earlier analysis—declining global trade, a looming U.S. recession, and eroding confidence in the U.S. dollar—remain intact and continue to favor Bitcoin’s upward trajectory. Secretary Bessent’s efforts to de-escalate the U.S.-China trade standoff may seem encouraging, but critical context is missing: proposed tariffs on China, while reduced, remain historically high post-deal. Furthermore, the U.S. administration’s new trade negotiation strategy—targeting six countries per week over three consecutive weeks—risks creating a divisive “tiered” system. Nations relegated to later negotiation rounds may balk at less favorable terms, potentially fragmenting global trade into competing blocs and accelerating the decline in cross-border commerce.

U.S. Recession Risks Intensify

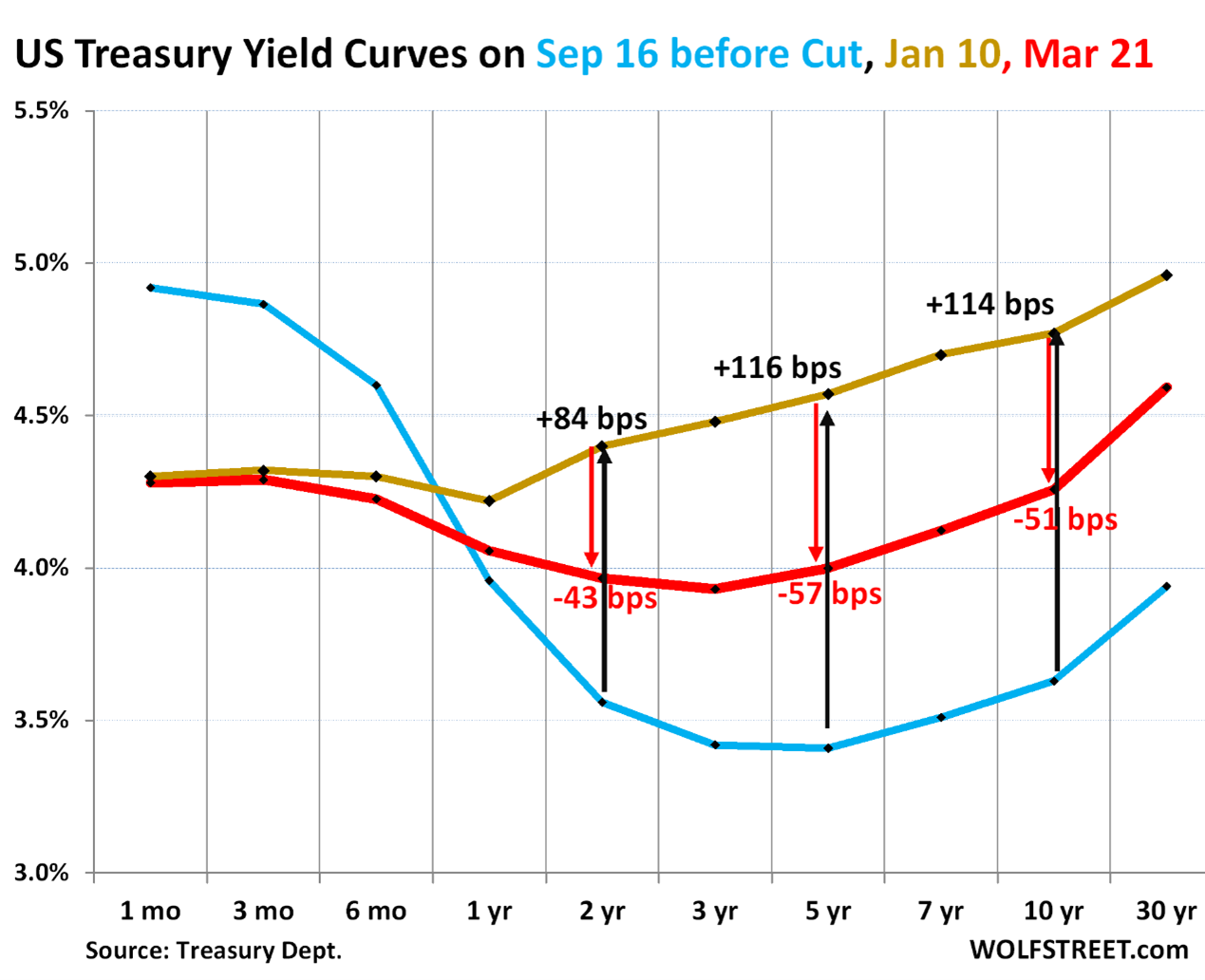

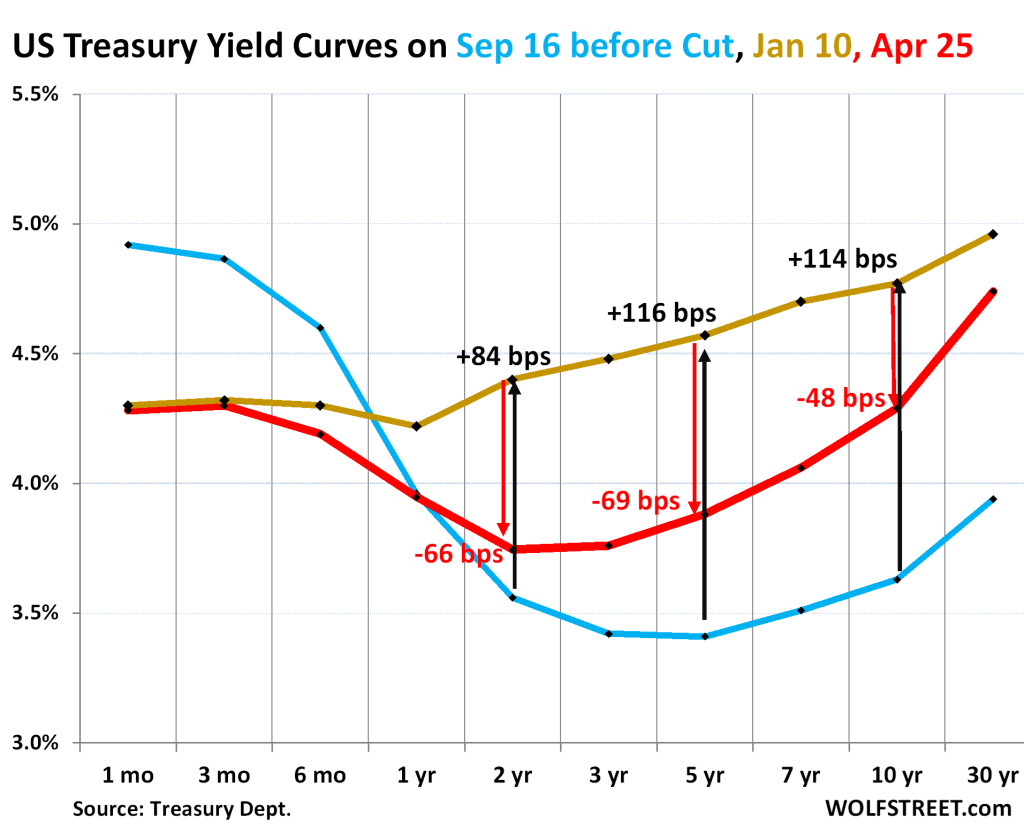

Mounting signals suggest the U.S. economy is nearing a downturn. A key indicator lies in the Treasury yield curve: between March and April 2025, the curve steepened notably as the 30-year yield rose while the 10-year yield fell (see chart). This shift implies investors may be rotating out of long-term bonds amid growth concerns, despite robust demand for 10-year Treasuries. Historically, a steepening yield curve following inversion often precedes recessions. Upcoming data—including PCE inflation, GDP revisions, and unemployment figures—will provide critical insight into the economy’s health in the weeks ahead.

The U.S. Dollar’s Dominance Under Strain

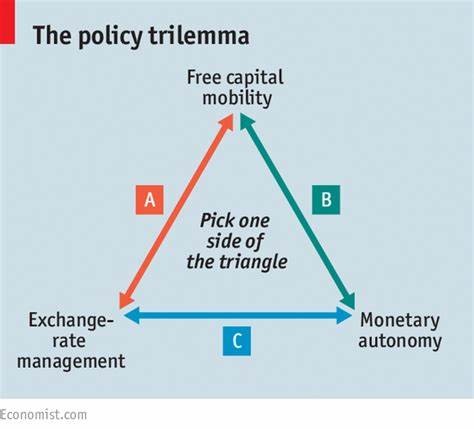

While recent remarks from Bessent and Trump have temporarily stabilized markets, doubts about the dollar’s long-term resilience persist. The administration’s frequent attempts to sway markets through public statements—a departure from traditional Fed independence—risk undermining confidence in the dollar’s stability. This dynamic underscores the impossible trinity (the economic trilemma where a country cannot simultaneously maintain a fixed exchange rate, free capital flow, and independent monetary policy). Investors should closely monitor Fed actions in coming months, particularly as global de-dollarization trends gain traction.

A Narrowing Window to Accumulate BTC Below $100K

Given these catalysts, Bitcoin appears primed for a breakout to new all-time highs by late 2025. Its correlation with gold—a traditional inflation hedge—is likely to strengthen as macroeconomic uncertainty deepens. The window to acquire BTC below $100,000 may soon close. Near-term volatility around key events—such as upcoming economic data releases and the June FOMC meeting—could create tactical buying opportunities. Once the Fed initiates rate cuts (expected later this year) and the global trade landscape solidifies, Bitcoin and the broader crypto market could enter a sustained growth phase.