Ethereum's (ETH) recent price resurgence has captured significant market attention, signaling what many analysts believe could be the onset of a new growth phase. While cryptocurrency markets remain inherently volatile, Ethereum appears poised for sustained upward momentum in the coming months, bolstered by its fundamental technological advantages. To fully contextualize this potential inflection point, our analysis must examine three critical dimensions: the macroeconomic landscape driving digital asset adoption, evolving sector-specific developments within blockchain ecosystems, and Ethereum's unique positioning through its ongoing protocol enhancements.

Macro Perspective: Tariff Policies and Global Tensions Push Demand for Gold and Store-of-Value Digital Assets

Starting with the macro perspective, as discussed in previous articles, the U.S. dollar’s status as the global reserve currency faces mounting pressure. Tariff policies, geopolitical tensions, and a reordering of global trade dynamics are driving demand for alternative stores of value. This environment has buoyed gold prices and created fertile ground for digital assets like Bitcoin (BTC) to thrive. As Bitcoin rises, it historically lifts the broader crypto market—including Ethereum (ETH).

Crypto Market Perspective: ETH’s Correlation with Large-Cap Cryptos Tightens

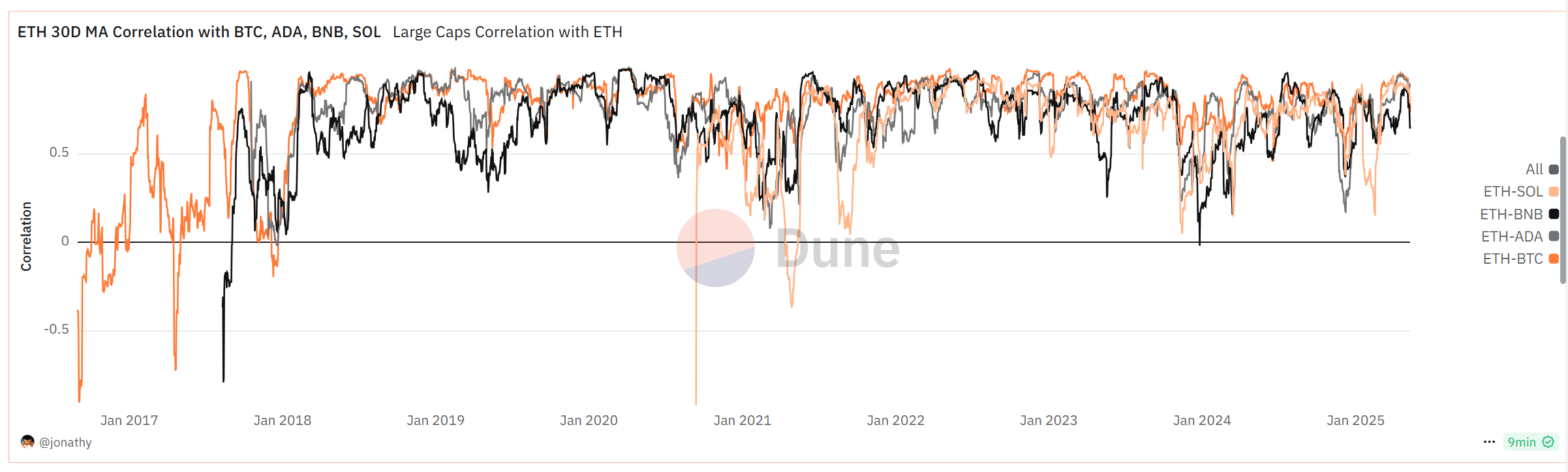

From a crypto market lens, Ethereum’s price action has grown increasingly correlated with other large-cap cryptocurrencies, particularly Bitcoin. Over the years—and notably in H1 2025—ETH’s volatility has aligned more closely with BTC, which is increasingly viewed as a "digital gold" hedge amid global uncertainty. With Bitcoin poised for rapid growth (potentially reaching $200K by year-end), Ethereum is likely to ride this wave, breaking free of its early 2025 lows.

Notably, ETH’s correlation with altcoins like Solana (SOL) and Cardano (ADA) has also risen in the past six months. As two of the largest altcoins by market cap, SOL and ADA often lead sentiment in the altcoin space. Their tighter correlation with ETH suggests Ethereum is reasserting its role as a bellwether for altcoins. However, this dynamic could shift if ETH outperforms its peers, mirroring the 2021–2022 cycle where decoupling signaled ETH’s dominance during the altcoin season.

Ethereum’s Fundamentals: Strong Demand and Institutional Adoption

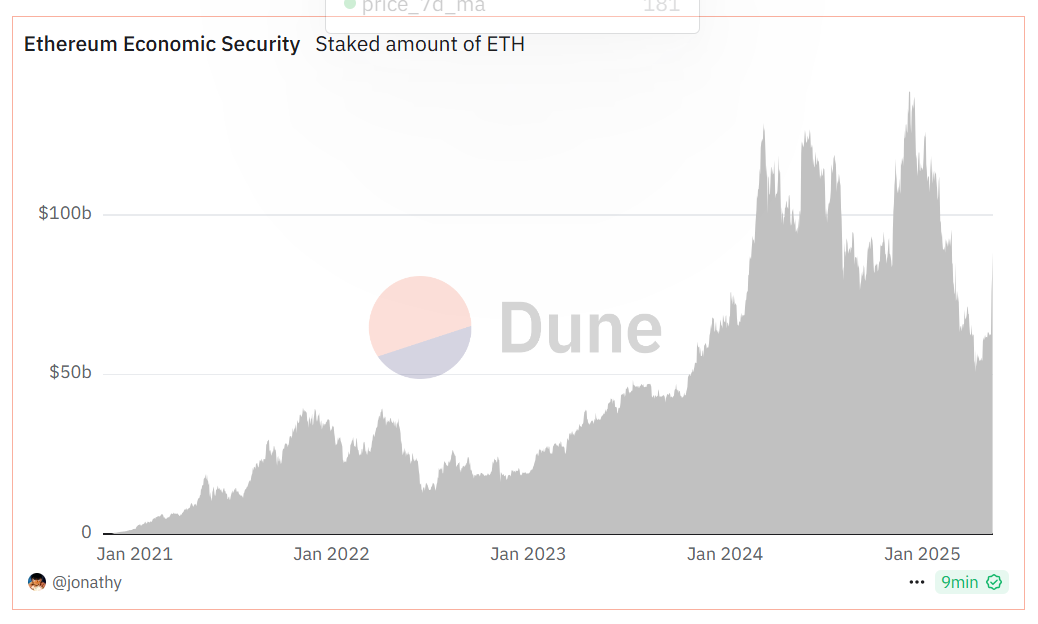

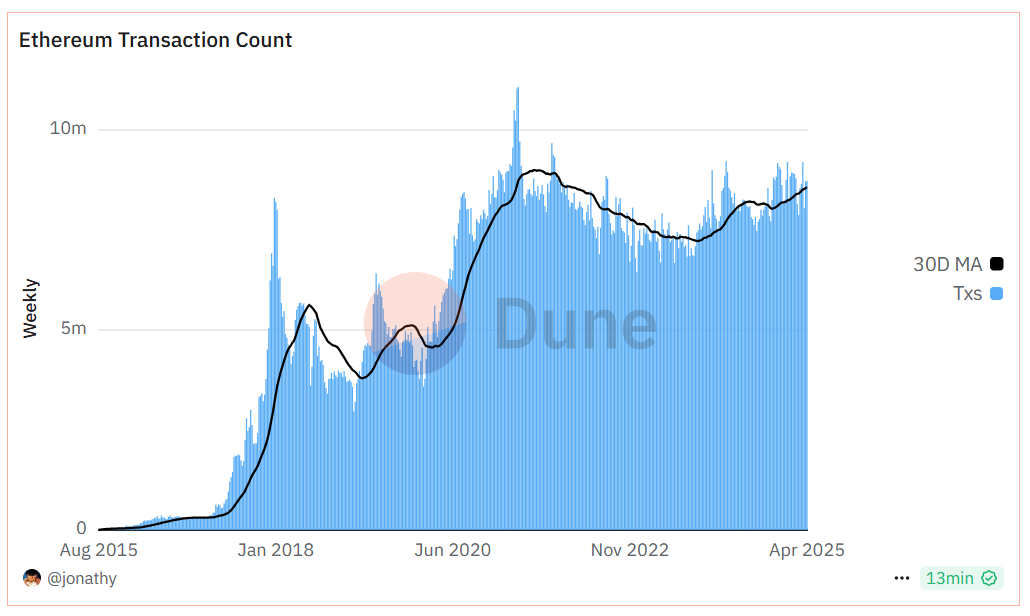

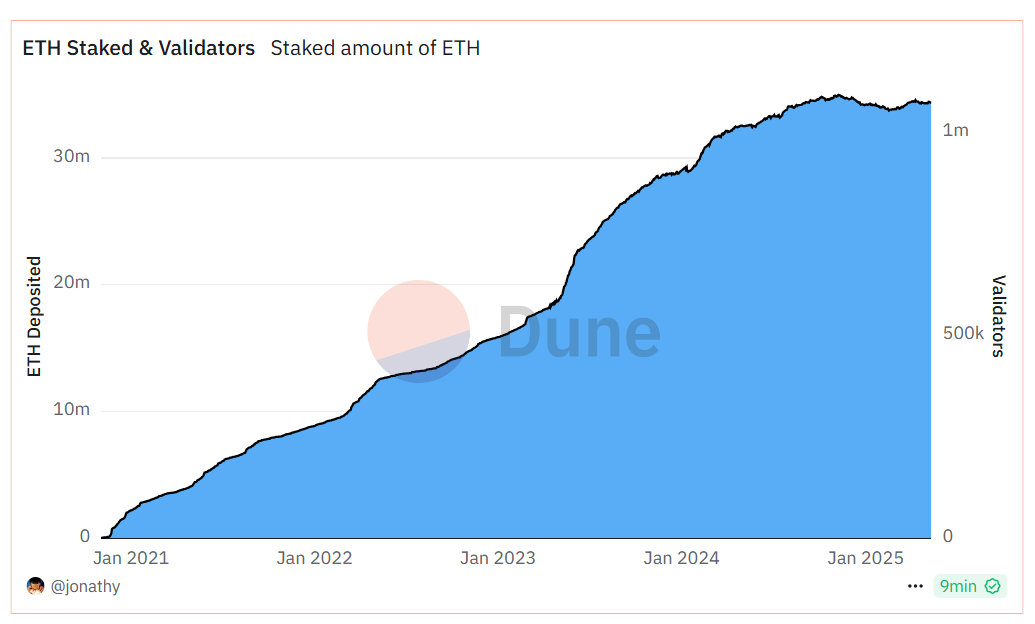

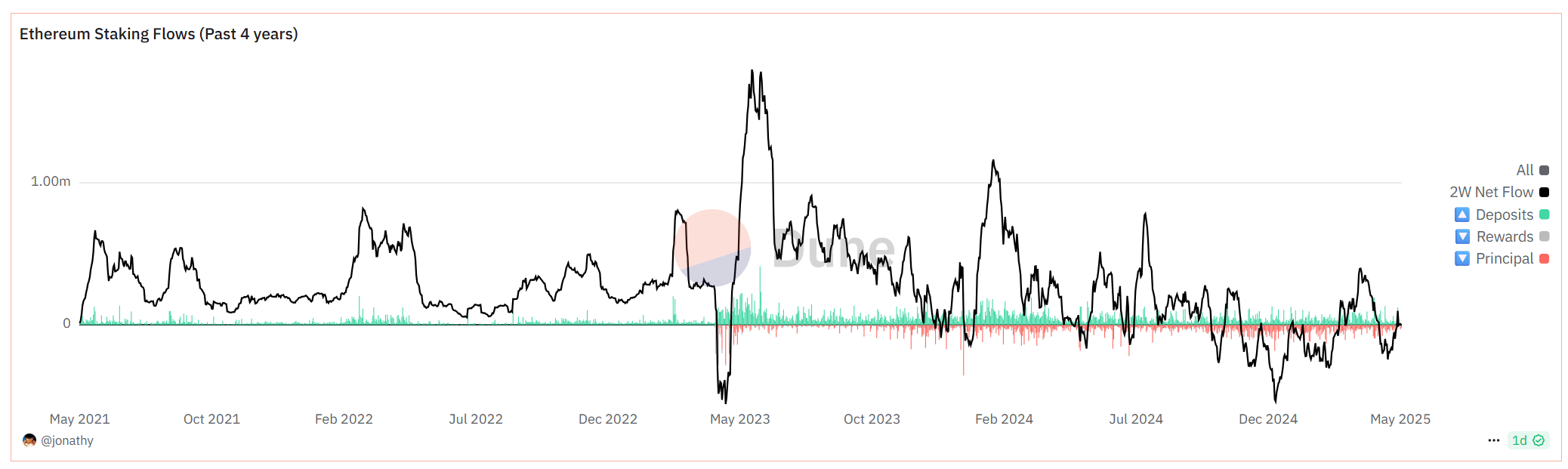

Beyond macro and market trends, Ethereum’s intrinsic strengths underpin its recovery. Despite price volatility from late 2024 to April 2025, demand for ETH has remained robust. Institutions like BlackRock’s BUIDL fund continue to stake ETH at scale, drawn by its security and yield potential. Data shows a steady upward trajectory in staked ETH, even during price slumps. The total value of staked ETH (in USD terms) has surged compared to 2021–2022, reflecting growing Ethereum economic security. On-chain metrics further validate demand—active addresses, returning users, and transaction counts have all trended upward, underscoring organic network usage.

While the amount of ETH deposited may appear to have stabilized since the beginning of 2025. Recent weeks have seen a turning point: net staking inflows rebounded as ETH’s price stabilized in April 2025. Retail and institutional holders appear to be locking in positions for yield farming, signaling renewed confidence and positive market outlook.

Ethereum Foundation’s Swift Response to Challenges

Critics have cited management missteps and competition (e.g., Solana) as headwinds for ETH’s price in early 2025. However, the Ethereum Foundation (EF) has acted decisively. A leadership overhaul appointed Hsiao-Wei Wang (technical expertise) and Tomasz Stańczak (governance) as co-executive directors, aiming to bolster technical rigor and developer relations. Additionally, the EF launched Etherealize—a startup tasked with enhancing ecosystem marketing and product strategy while preserving Ethereum’s decentralization.

These moves, paired with the recent Pectra upgrade, have reignited optimism. Pectra’s technical improvements (including enhanced scalability and RISC-V compatibility) have positioned ETH for renewed momentum, with the upgrade acting as a catalyst for its recent price surge.

A New Altcoin season? Perhaps—But Different This Time

If Ethereum’s recovery is indeed foundational, could an altcoin season follow? Possibly—but expect divergence from past cycles. With interest rates far higher than in 2021–2022, the market is less tolerant of speculative, narrative-driven projects. ETH’s outlook appears brighter, bolstered by upgrades like RISC-V and institutional adoption. Whether major alts like XRP can keep pace remains an open question—one we’ll explore in future analyses.