A top point of discussion in the Terra ecosystem is whether UST will keep its peg.

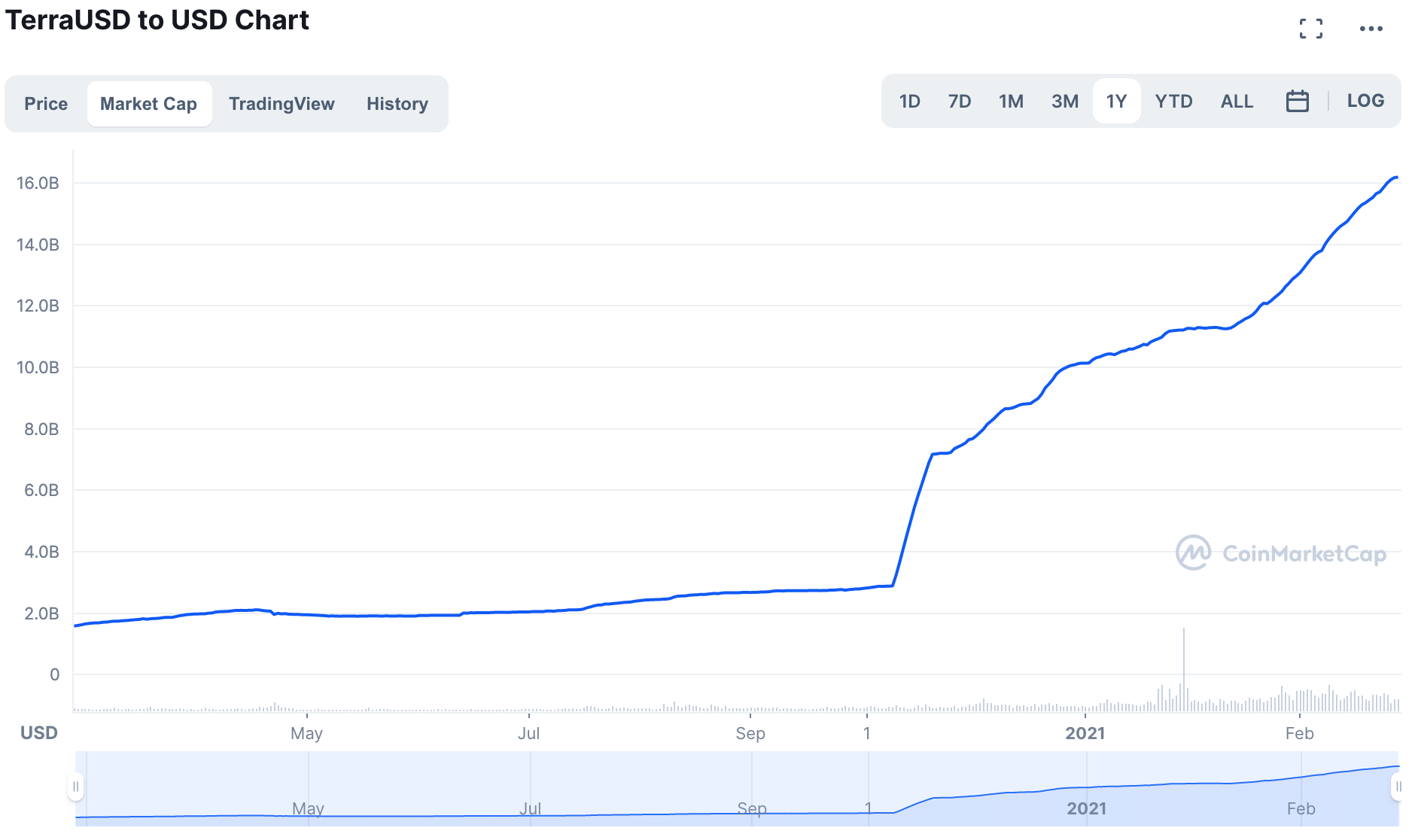

UST is the largest algorithmic stablecoin, with a market capitalization of $15.7 billion.

As an algorithmic stablecoin, UST is pegged to the US dollar but isn’t backed 1:1 by assets. It is considered controversial because of the “ponzinomics” it benefits from, but this is also what helps stabilize its price.

Because it’s unbacked, there is a small chance it “de-pegs” from the value of a dollar. This is only likely during times of extreme volatility in assets linked to the Terra ecosystem, but as the crypto market becomes increasingly interconnected, there are more potential risks to look at here.

If UST keeps its peg, enterprising investors will be able to profit from the minor price deviations that inevitably occur. Understanding the reasons for and against UST becoming unpegged help us evaluate those opportunities.

Why Investors are Worried About UST Losing Its Peg

Almost half of the TVL for UST comes from the 19.5% interest rate offered by Anchor Protocol. A project launched by Terraform Labs, Anchor may be the most important protocol on the Terra network right now (next to the LUNA/UST interplay).

Yields have always drawn people into protocols, and this is no different. But what happens when the yields disappear?

This is an incredibly high rate to earn for considerably less risk than protocols of comparable rates present. However, the worry is that UST is too dependent on Anchor for liquidity. If rapid deleveraging occurs, there may be a “bank run” on the yield farming strategy which could also put pressure on UST. Liquidations and panicked market news can both cause this problem.

We saw this specific problem play out when the Sifu/FrogNation scandal unfolded in February 2022. $500 million worth of UST coins were unwound from a strategy on Abracadabra Money, but the price of UST never dropped below $0.995

Further back, in the May 2021 market crash, LUNA was still quite fresh, and dropped significantly in value. Anyone who was borrowing against LUNA on Anchor got liquidated. The contagion dumped a large amount of LUNA into the market, burned that LUNA for UST, and pushed the price of UST down into a discount.

It hit $0.96 at the time, but luckily this has not happened since.

What many don’t realize about Anchor Protocol is that it pays out more than it earns. The 19.5% interest rate is subsidized by Terraform Labs (and therefore unsustainable). These subsidies help attract more users to the network, which makes it worthwhile for Terraform, but it’s not clear what happens when this ends.

In fact, founder Do Kwon has loosely alluded to the fact that they may replenish the Anchor yield reserves with as much as $300 million. This is great for current Anchor users, but when this unsustainable arrangement ends, what will happen to the Terra protocol?

The calculated borrow rate stands at 12.66% as of January, so the rate that Anchor would be able to pay after subsidies get cut off would be below that, and is estimated to be 9%.

The final risk is that Terraform Labs uses a single oracle to update the LUNA and UST prices. This has not only led to discrepancies that caused mass liquidations in December 2021, but also means Terraform Labs is the first to see updated price feeds and can frontrun liquidations.

The Main Reason to Believe In the Peg

One of the strongest arguments for UST holding its peg is that it has done so in the past in more extreme conditions. It becomes self-justifying as time moves on. By surviving large catastrophes early on, smaller problems appear less threatening.

The below chart of market capitalization shows that investors and users alike believe the same.

More importantly, the strong link between LUNA and UST means any inefficiencies may be arbitraged with the assumption that UST will regain its peg.

As long as LUNA stays above zero and is liquid, there should be enough support to hold the peg. That’s the way the system is designed and it has worked well since May 2021, despite volatile market conditions.

UST’s success is based on faith, just as the success of the USD is based on users of the system believing the system will survive. As long as the public believes in the efficacy of the peg, any deviations from perfect parity will be viewed as an opportunity for arbitrage rather than the end of UST.

Although not perfectly decentralized right now, UST is much more decentralized than USDC, USDT (and USD) and avoids the fraud and censorship risks inherent in those stores of value.

Protocols Are Already Supporting (and Benefitting from) the UST Peg

Seigniorage is the act of profiting based on the difference between issued face value and market value. Although not necessarily “complex”, the low margins and high resource requirements to make a sizable profit mean that usually only the wealthy do it.

However, with on-chain prices easily accessible and a rapidly growing Terra community constantly looking for profit opportunities, White Whale has brought a unique solution to market.

White Whale is decentralizing the enforcement of the UST peg. We’ve already discussed risks to the peg above, but assuming the peg is maintained, what can the retail investor do to benefit from price discrepancies?

White Whale is serving the market by making “whale-like” arbitrage accessible to all. The technical tools necessary to execute these types of strategies are no longer just in the purview of big hedge funds.

The protocol “sells” stability to the entire Terra Ecosystem while also selling profits to protocol users. Arbitrage is generally thought of as a privatized benefit not to be shared, but White Whale’s model turns that belief upside down.

White Whale’s flagship vault arbitrage uses seigniorage to arbitrage UST back to its peg. Although other arbitrage strategies are being added on in the future, ample returns are available with this simple strategy. And when there are no arbitrage opportunities, funds are kept in Anchor. Therefore, the total rewards available are equal to Anchor yields plus arbitrage profits.

On top of the withdrawal fee of 0.1%, 20% of the profits of each arbitrage trade made in each vault will be sent to the Treasury while 80% of the profits are added to the yield of the vault. Other vaults are planned to be added later on, but right now the UST vault is the primary focus of White Whale.

If You Believe UST Will Survive Low Anchor Yield Reserves…

Ignoring the worries around the Anchor yield reserve, it seems likely that UST maintains its peg. Assuming this is the case, investors are looking for ways to monetize this belief.

Based on the current Anchor reserves, Anchor has about 5 months left before they will either have to replenish their reserves or change their rates. At that point, there will almost definitely be volatility. The question is whether UST keeps its peg, therefore delivering high returns to White Whale users, or if it de-pegs entirely.

If UST keeps its peg, that is a major market opportunity for enterprising investors. If it doesn’t, that is a very different opportunity.

As the ecosystem continues to expand, more opportunities will pop up just like this. White Whale is just one of many who are turning these opportunities into protocols, allowing others to get in on it, and profiting from the protocolization of these opportunities.