NFTs can be hard to sell. Not because you've developed an emotional attachment to your Ether Rock, although I don't blame you — but because there's a finite amount of people who can either (1) afford your rock, or (2) who want to buy your rock.

And this challenge extends to the entire NFT market, which, while growing fast, is still small compared to the market for fungible tokens or for traditional equities. This challenge — where we can't buy/sell things when we want — can be reframed as the "liquidity problem."

What is liquidity?

In short, it is the degree to which an asset can be quickly purchased or sold at a price reflecting its current value. In other words, a market is liquid if you can sell your asset when you want without taking a material loss.

How do you improve liquidity?

As you add more participants (i.e., new money) to a market, liquidity generally improves. This is because the more people you have in the market, the easier it is to enter/exit your position. But adding participants isn't easy when there's limited liquidity. If I can't easily buy/sell an asset whenever I want, I might avoid the NFT market entirely because there's a higher degree of risk relative to other more-liquid investments.

And here we find ourselves in a Catch 22. To add participants, you need liquidity, but to add liquidity you need participants. So how do we get ourselves out of this mess? How do we create liquidity without adding more users?

Luckily for us, there are few solutions out there already, and we are going to explore the following:

- Fractionalization: Increase asset accessibility (i.e., more people can afford your rock)

- Bonding Curve Contracts: increase asset transferability (i.e., more "people" want to buy your rock)

Fractionalization

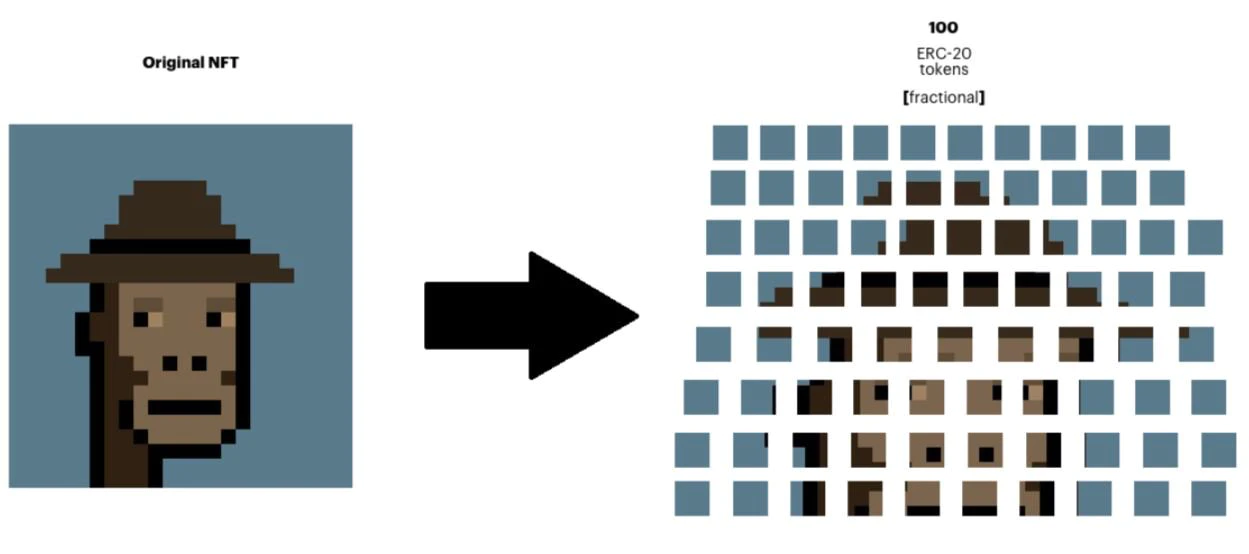

In the beginning of this article I defined the problem in two parts. Fractionalization solves part one, or "there's a finite amount of people who can afford your rock." NFT fractionalization is the act of dividing the ownership of an NFT into smaller fractions.

You can fractionalize an NFT by locking it in a smart contract (also called a vault) and then auctioning off ERC20 tokens that represent ownership of the locked NFT.

Fractionalizing our Ether Rock

So how does it work? If we were using something like fractional.art, we would first initiate an auction on our Rock and sell 10,000 ERC20 tokens (which we can label PEBBLEs). These PEBBLEs represent a claim on our Rock. Together, the PEBBLE holders determine a price they are willing to sell the entire Ether Rock NFT (this is called the reserve price). If a whale comes along and wants to buy the Rock in its entirety, he/she needs to pay the reserve price in ETH. Once paid, the PEBBLE token holders can now redeem their PEBBLEs for the reserve price paid in ETH — completing the "buyout." Now the whale owns the Rock and the PEBBLE holders (who traded in their PEBBLEs) own the ETH.

For the owner, fractionalizing facilitates efficient price discovery and reduces volatility. But more importantly, it improves the accessibility of NFTs. It provides people priced out of expensive assets, exposure. This means you don't have to wait for the right whale to come along to buy your Ether Rock, instead, you can fractionalize ownership across thousands of people, who have always wanted to be an Ether Rock owner.

Bonding Curve Contracts

Ok, so we made the Rock more accessible, and that's great! But how do we solve part 2? How do we find more people who want to buy our NFTs? Turns out, there is something that can help us, and it's called a bonding curve contract.

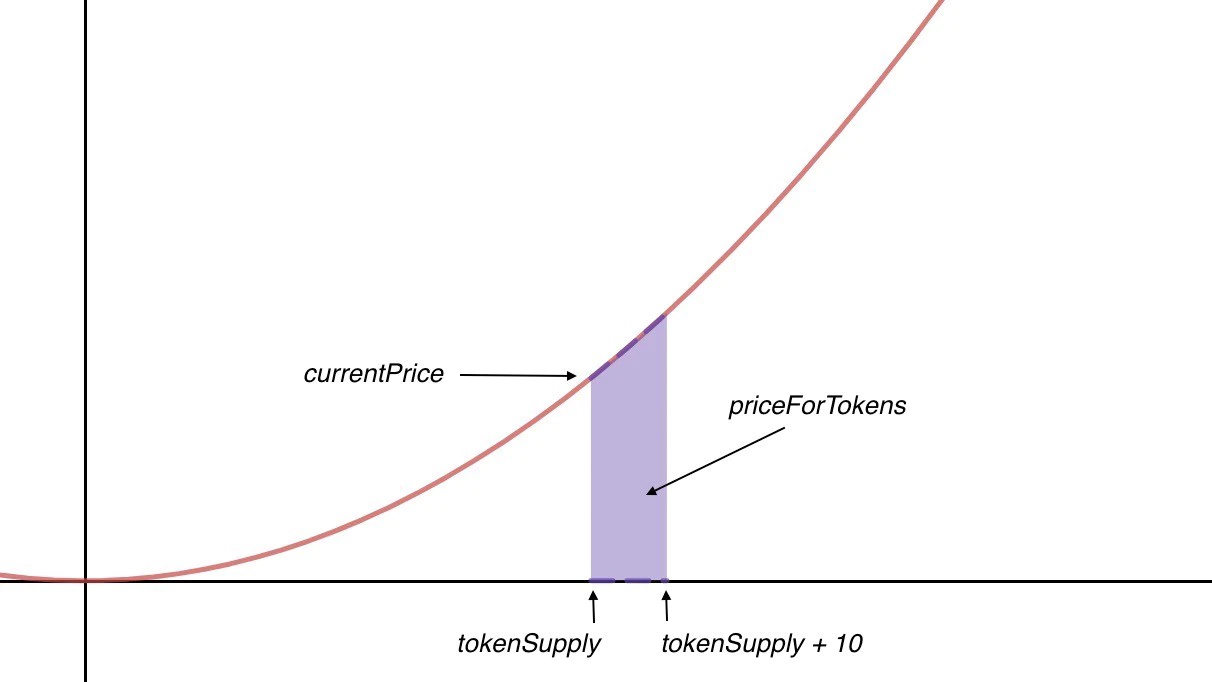

Bonding curves are smart contracts where you can not only buy a token, but you can sell it back at any point in time. To make this work, a bonding curve does two things:

- It automatically adjusts the token price based on the quantity of tokens outstanding. In most cases, this means that the more tokens are distributed, the more expensive the remaining tokens will be.

- It retains the funds used to purchase the tokens and uses these funds to buy back a seller's tokens.

Bonding our Ether Rock

Let's say a bonding curve contract holds 100 Ether Rocks and it is configured so the price increases 5% (from the initial price) with each NFT sold. If the initial price is set at $10, the first Rock would sell for $10, the 5th Rock would sell for $12, and the 100th Rock would sell for $59.50. If you were to buy the 5th Rock, and 95 others were subsequently purchased, you would then be in a position to sell your Rock at the price of the most recent purchase — which in this case is $59.50 (netting you a $47.59 profit) — and moving the current price down one notch on the curve to $59.

With a bonding contract, we don't need to auction our Ether Rock on a secondary market when we want to sell. We can just resell it back to the contract at price calculated by the bonding curve.

With a bonding curve, we now have a way to sell back our Ether Rock. It might not be at the price we originally paid, but it gives us security and at least partial liquidity that isn't guaranteed in the secondary market. Beyond that, it ensures we can price assets in a transparent, predictable, and immutable fashion.

Tying It All Together

Fractionalization and bonding contracts offer new ways to address the liquidity problem without introducing more participants (and new money) into the market.

They can also be stacked together in interesting ways. Imagine you own an NFT that collects royalties from a song. You could lock this NFT into a bonding contract and mint new ERC20 tokens that represent rights to these royalties. This is, in a way, fractionalizing an NFT to extend ownership across a wider audience. And this isn’t just some thought experiment — founders are starting to explore these concepts to improve how they price and distribute assets to investors. In fact, the founders of Decent, a decentralized music label, actually discussed this very thing on the BlockCrunch podcast. And Paul Kolhass, the founder of Molecule, considered using this model to improve the discovery, exchange, and development of intellectual property in the pharmaceutical space.