Investing can sometimes feel like trying to catch a falling knife. Market timers spend endless hours staring at charts, waiting for that perfect dip to make their move. The intelligent investor uses a simple, time-tested strategy: dollar-cost averaging (DCA). Rather than waiting for the ideal moment, DCA involves investing a fixed amount at regular intervals, regardless of market conditions. And in today’s challenging investment and high-risk venture investing in the crypto, it might be the best way to ride out the storm.

Why Timing the Market is So Tempting (And So Dangerous)

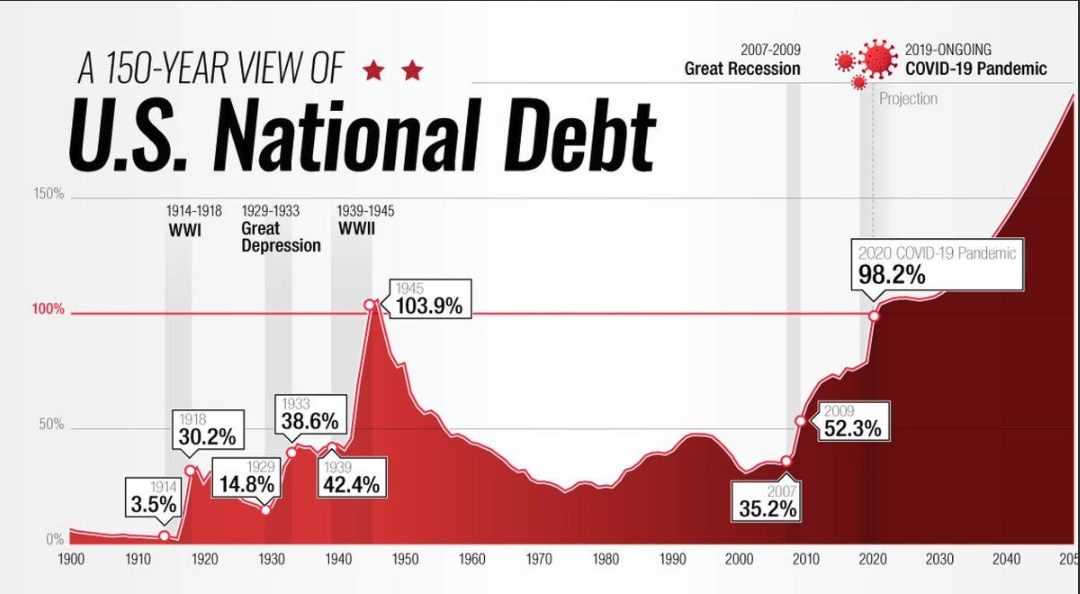

Balaji Srinivasan, in a recent article, America’s $175 Trillion Problem, about the unfolding debt crisis, notes several concerning economic trends that all lead to more momentum for Bitcoin as a store of value in the future of finance and financial trade. The US’s debt problems don’t directly lead to crypto and high investments' increased market demand, but the US Dollar’s decreased demand and value directly related to Bitcoin and eventually Ethereum as store-of-value assets that can generate passive income—bonds on steroids.

It will take time for the global markets to adopt my views, and that’s OK as a venture investor with a 5 to 10-year horizon. As a small fish in a big pond venture investor, I love to learn as much as I can from experts and those who can predict into 2029 - 2034 from where we are today. This is where the USA’s debt problems and an all-in agreement from experts that there’s only one way the USA will resolve it’s debt problems - printing more dollars and stealing from the poor to keep the US economy going.

Now let’s jump into some key topics on the USA’s debt challenges and the US dollar’s stance in global markets from Balaji’s article reference above. First confirmation from three billionaires on their view of a US debt crisis ahead.

*“As Elon, Dalio, and Jamie Dimon all recognize, the Western world is headed for a sovereign debt crisis. Just like the establishment was hiding the president’s senility, they’re also hiding the true state of the economy” - *Balaji

As governments rack up unprecedented levels of debt, the U.S. Federal Reserve has been forced to intervene with surprise interest rate hikes and emergency loans. This turbulence has many investors nervously eyeing the stock market, wondering when the next big drop will occur.

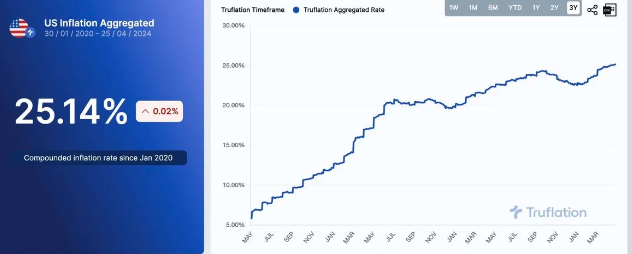

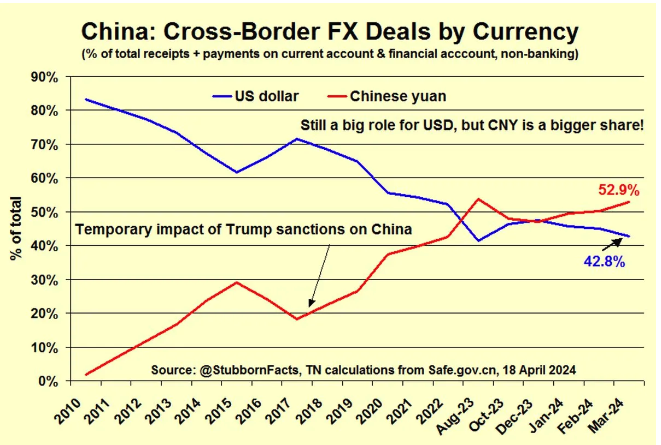

The U.S. dollar is devaluing rapidly, with its purchasing power down 25% in just four years. Add to that China’s treasury dumping and BRICS countries stacking gold, we’re faced with a perfect storm of global financial instability.

More de-dollarization than ever…China — which is the #1 trade partner of most countries in the world now — has just flipped to majority CNY for cross-border foreign exchange deals:

It’s clear that the US dollar is not the best asset to hold for maintaining purchasing power. To keep it simple, within crypto, I favor Ethereum, but there is also a great use case for Bitcoin based on this inflationary environment and government debt that will ruin fiat’s purchasing power. Regardless of what high-risk crypto assets you’d like to invest in, dollar-cost averaging is the industry standard to build a position unless you’re uber-rich and can pay a firm to do this for you.

Dollar-Cost Averaging: A Smarter Way Forward

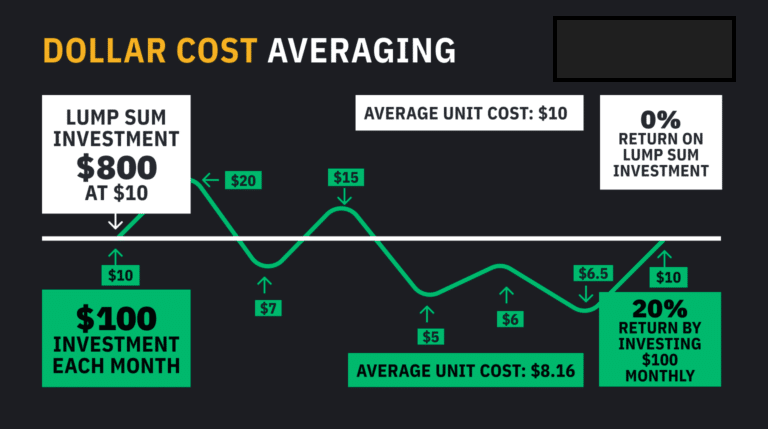

Dollar-cost averaging is a simple concept to comprehend. The hard part is fighting our emotions about changing the plan and not using a DCA strategy. This approach offers several key advantages, particularly in the face of economic uncertainty.

-

Takes the Emotion Out of Investing

Human psychology often gets in the way of making rational investment decisions. When the market drops, fear takes over, and many investors panic-sell. Conversely, when the market is booming, the fear of missing out (FOMO) kicks in, causing investors to buy at inflated prices. DCA eliminates these emotional extremes by sticking to a set schedule, regardless of the market's ups and downs. You’re buying in good times and bad, ensuring that you don’t miss out on long-term growth.

-

Reduces the Risk of Mistimed Investments

Waiting for the perfect moment to invest often backfires. As Balaji points out, we’re in an era of “more borrowing than COVID, more interest than defense.” By spreading your investments over time, you can lower the average cost of your investments, especially during market downturns when prices are low.

-

Harnesses the Power of Compound Growth

One of the often overlooked benefits of DCA is that it allows you to take advantage of compound growth. The earlier you start investing, the more time your money has to grow. Instead of waiting for a dip to invest, DCA encourages you to consistently put money into the market, ensuring that you’re benefiting from both regular contributions and the compounding interest on those investments.

Real-World Example: Bitcoin and Ethereum

Take Bitcoin and Ethereum as an example. Since 2017, crypto markets have seen wild swings, with massive highs followed by equally sharp corrections. Investors who tried to time their entry points were often left frustrated. But those who stuck to a dollar-cost averaging strategy saw their portfolios grow consistently over time.

By regularly purchasing BTC or ETH regardless of price, DCA investors took advantage of these assets' long-term upward trajectory while avoiding the stress of trying to pick the perfect moment to enter.

In today’s environment, where the U.S. dollar’s global influence is waning, and debt levels are at all-time highs, DCA into assets like Bitcoin and Ethereum makes even more sense. Balaji’s analysis of the debt crisis shows that traditional financial systems are facing unprecedented challenges. By adopting a DCA strategy in these uncertain times, you’re setting yourself up for long-term success while avoiding the pitfalls of market timing.

The Bottom Line: Consistency Wins

The U.S. appears to be headed toward a sovereign debt crisis worse than 2008. The true debt of the U.S. government is estimated at $175 trillion, a figure that dwarfs any previous crisis in history. You may miss the boat if you’re waiting for the perfect dip to buy into assets like stocks, Bitcoin (BTC), or Ethereum (ETH). The world is shifting rapidly — whether through de-dollarization or the rise of AI-driven markets — and waiting too long means you may never get a better entry point. DCA ensures that you’re always in the market, consistently building wealth over time rather than chasing elusive moments of perfection.

Venture investing is a marathon, not a sprint or even a 10K run. While the allure of catching a market dip may seem tempting, dollar-cost averaging offers a safer, more reliable path to building wealth.

Thanks for reading. Best of luck, and do your own research. This is educational content and not financial advice.