The tokenization of real world assets on blockchain is quickly gaining traction as an innovative way to access liquidity, enable fractional ownership, and integrate traditional assets into decentralized finance (DeFi). But how exactly can you go about tokenizing assets like securities, commodities, real estate, and more on blockchain?

In this post, we’ll provide a guide to minting securities on Ethereum or other blockchain networks covering the benefits, steps involved, and key considerations.

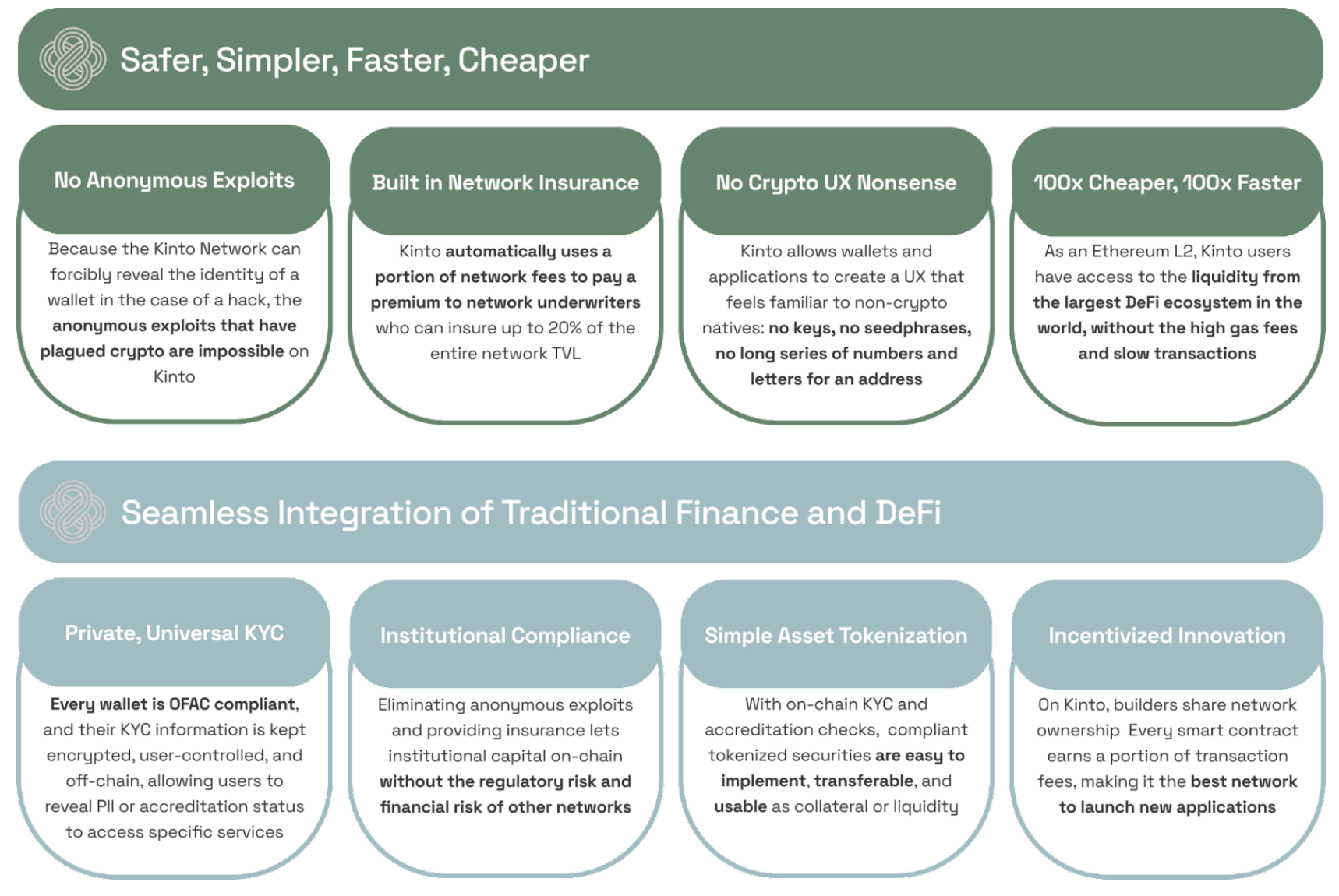

Throughout this blog post, we’ll explore how Kinto provides an optimal blockchain solution for tokenizing real world assets like securities. Kinto’s institutional-grade security and compliance features enable traditional financial institutions to safely and reliably participate in decentralized finance (DeFi) for the first time.

We’ll walk through the key steps involved in tokenizing your own fund or securities on the blockchain using Kinto’s platform. By leveraging Kinto’s technology, you can unlock the benefits of blockchain and DeFi for securities issuance and trading while maintaining regulatory compliance and security.

Defining RWAs and Securities

The U.S. Securities and Exchange Commission (SEC) defines securities under federal law, primarily in the Securities Act of 1933 and the Securities Exchange Act of 1934.According to the section Section 2(a)(1), a security is defined as:

The term “security” means any note, stock, treasury stock, security future, security-based swap, bond, debenture, evidence of indebtedness, certificate of interest or participation in any profit-sharing agreement, collateral-trust certificate, preorganization certificate or subscription, transferable share, investment contract, voting-trust certificate, certificate of deposit for a security, fractional undivided interest in oil, gas, or other mineral rights, any put, call, straddle, option, or privilege on any security, certificate of deposit, or group or index of securities (including any interest therein or based on the value thereof), or any put, call, straddle, option, or privilege entered into on a national securities exchange relating to foreign currency, or, in general, any interest or instrument commonly known as a “security”, or any certificate of interest or participation in, temporary or interim certificate for, receipt for, guarantee of, or warrant or right to subscribe to or purchase, any of the foregoing.

The SEC crafted an expansive definition of a security to cover a wide range of existing and future investment products. This broad scope was intentional – designed to adapt to financial innovation and bring emerging instruments under regulatory oversight.

The main goal behind these security regulations is to protect investors, promote fair markets, and support capital formation. While the foundational definition remains intact, its interpretation continues to evolve through legal precedents and rulings. Specific cases over time shape and clarify what is considered a security across different contexts. The definition expands in response to new products and market developments.

RWAS

Real World Assets (RWAs) refer to tangible real-world assets like real estate, commodities, and equipment or intangible assets like invoices and cash flows. While RWAs share similarities with securities, they have a broader definition.

Bringing RWAs into the DeFi space aims to bridge the gap between traditional finance and decentralized finance, allowing more liquidity and lending/borrowing mechanisms to be applied to physical and non-blockchain-native assets.

The process of tokenizing RWAs represents these real-world assets on blockchains. Tokens enable fractional ownership, trading, and integration with DeFi protocols. RWAs issue tokens that represent ownership rights or claims on the underlying asset. It unlocks liquidity, lending, and new opportunities by bringing real-world assets on-chain. The tokens act as a digital proxy for the asset on blockchain.

In crypto, “RWAs” generally refer to representing off-chain, physical assets in a digitized tokenized format. This allows previously analog assets to interact with blockchain systems and DeFi platforms. Tokenization unlocks new financial potential.

The Best Blockchain To Mint RWAs On.

For tokenizing real-world assets, Kinto provides distinct advantages over other blockchain platforms. Kinto bakes institutional-grade compliance and security directly into the protocol layer. This allows financial institutions to launch compliant token offerings out-of-the-box without custom development.

Benefits include:

⚙️ On-chain compliance tooling to create money legos that meet regulations and counterparty requirements. KYC/AML/KYT/KYB and accreditation checks are available natively on Kinto. Easily allow/restrict assets based on jurisdiction and/or accreditation directly on-chain.

💳 Sybil-resistant blockchain with higher security guarantees against smart contract hacks, frauds, and scams. Since many of these assets already require identification, government-issued IDs give us robust proof of personhood with the same guarantees as Tradfi.

🧙 Invisible crypto UI/UX. Thanks to native account abstraction, users won’t know they are interacting with the blockchain while remaining the sole owner of their funds through non-custodial wallets. A frictionless UX is needed to rival fintech applications like Robinhood.

🧱 Composability. Right now, RWA assets cannot be easily composed with each other. Within Kinto’s rollup, asset issuers can create composability between assets with the same compliance requirements. Kinto also offers composability with native digital assets like ETH or stETH.

💰 Access to institutional capital. Institutions can use Kinto while still being able to tick all their compliance needs. Counterparty requirements can now be easily satisfied. That means that investment products on Kinto will be accessible by institutional capital.

Why would you want to mint or tokenize anything onchain?

Here is a quick list of 11 reasons why you might want to list a real world financial product onchain.

Transparency: Blockchains provide a transparent ledger where all transactions are recorded and can be viewed by anyone (in public blockchains). This can provide a level of trust and accountability that isn’t always present in traditional systems.

Immutability: Once data is recorded on a blockchain, it’s impossible to change it This provides a tamper-proof record of financial transactions.

Cost Efficiency: Blockchain can reduce or eliminate the need for intermediaries in many financial processes, which can result in reduced fees and faster transaction times.

Global Access: Blockchain platforms are typically accessible to anyone with an internet connection. This can provide a global market for financial offerings and increase the potential pool of investors.

Programmability: Smart contracts enable the automation of complex financial transactions and conditional logic. This can be used to create innovative financial products and services that can’t easily be replicated in traditional systems.

Fractional Ownership: Tokenization allows assets to be divided into smaller fractions, which can be bought and sold on blockchain platforms. This can democratize access to investment opportunities, allowing more people to invest in assets like real estate, art, or startups with a smaller initial investment.

Liquidity: Tokenizing assets and listing them on decentralized exchanges or platforms can provide increased liquidity for assets that are traditionally illiquid.

24/7 Markets: Traditional financial markets have opening and closing hours, but blockchain platforms can operate 24/7, allowing continuous trading and transactions.

Financial Inclusion: Blockchain can provide financial services to the unbanked or underbanked, granting them access to the global economy.

Regulatory Arbitrage: Some entities might find it beneficial to operate in a blockchain-based environment due to perceived regulatory advantages or more favorable conditions. This, however, can be controversial and is subject to change as global regulations adapt.

Innovation and Differentiation: For startups and newer enterprises, adopting blockchain might be a way to differentiate their financial offerings from more traditional options and attract a specific demographic of users or investors.

Now that we understand the why, lets dive into the how.

Step by step guide to minting an RWA onchain

Disclaimer: This is not a perfect solution, nor should it be done by just anyone. This entire process is a legal gray area specifically in the United States and should not be taken as fact or legal advice. Thank you for understanding.

In order for us to understand how to actually mint an RWA onchain we need to understand tokenization. Which is defined by Gemini as follows. “Within the context of blockchain technology, tokenization is the process of converting something of value into a digital token that’s usable on a blockchain application. Assets tokenized on the blockchain come in two forms. They can represent tangible assets like gold, real estate, and art, or intangible assets like voting rights, ownership rights, or content licensing. Practically anything can be tokenized if it is considered an asset that can be owned and has value to someone, and can be incorporated into a larger asset market.”

This is a great straight forward definition. Keeping this in mind. Minting an RWA is as simple as tokenizing something and putting it onchain. These are some common steps that you can take, that we have seen other teams use to successfully mint something onchain.

How to Tokenize any asset on a blockchain

1.Consult with legal Engaging experienced legal counsel is crucial when tokenizing real-world assets, given the complex regulatory landscape.

Key areas for counsel to evaluate:

Classifying the asset type (security, commodity, utility token, etc) Jurisdiction for the offering and investors Crafting a compliant business model Registration and ongoing filing requirements Developing an offering structure that meets regulations

Regulatory costs may scale with investor pool size. Thoughtful planning and strategic advice from counsel specialized in blockchain assets is essential for creating compliant token offerings.

2.Select the asset(s) you want onchain The assets you choose to tokenize depend on your specific goals and target market.

When selecting assets, consider:

Is there demand within the decentralized finance community for tokenizing this asset? Analyze if it addresses a need. How can you generate interest and adoption? Marketing and building use cases are key. What business model and token utilities can you create to drive value? Does the asset provide attractive properties for blockchain like lack of liquidity, high cost, or slow settlement? While the tokenization process is similar across asset types, the assets themselves are unique. Choose assets that are compatible with blockchain benefits and for which you can build an ecosystem of users, products, and services. Research the space to identify niche opportunities that meet a market need.

3.Find a custodian of said asset A regulated, insured custodian is needed to hold the real-world assets backing tokens. The custodian:

Safely stores assets in custody Mints and burns tokens against the assets Manages asset flows in and out of custody Provides records for auditing Becoming a licensed custodian has regulatory and technical requirements. Partnering with an established digital asset custodian is generally optimal.

When evaluating custodians, consider:

Regulatory compliance Insurance coverage Security architecture and controls Tokenization experience Cost A qualified institutional-grade custodian brings trust and transparency to asset tokenization programs.

4.Organize an Omnibus accounting solution

Omnibus accounting enables consolidating assets from multiple owners into a single account managed by the custodian. This is cost-efficient and provides consolidated records.

The custodian tracks fractional ownership per owner in a ledger, even though assets are pooled together. Issuing tokens against the ledger enables scalability while preserving individual ownership data.

Popular stablecoins like USDC use omnibus accounting to hold fiat reserves while minting tokens. Adopt an accounting model that fits your program’s needs.

5.Find someone willing to tokenize the asset

A qualified tokenization provider can handle the technical minting and issuance of tokens against assets held by your custodian. The best partners have experience across multiple asset types and jurisdictions.

Evaluate factors like:

Compliance protocols and tokenized instrument standards Integration with regulatory agencies, exchanges, and DeFi platforms Existing integrations with qualified custodians Technical capabilities for asset servicing and tracking Experience designing compliant token economics Tokenizing through an established platform reduces regulatory uncertainty and execution risks while leveraging industry best practices.

You can also see some of the issuing partners that other protocols are using in their documents.

6.Accounting for assertions

Accounting onchain is easy. Keeping your records offchain, and trusting you are holding the correct amount of assets both onchain and offchain is going to take ongoing accounting checkups called assertions. These accounting assertions are done by credible 3rd party consultants or accountants that check your underlying to make sure that there is not some sort of fraud happening, or a mismatch between the number of tokens onchain vs the amount of securities backing it.

7.List tokens on exchanges

Get your tokens on centralized and decentralized exchanges to provide liquidity and enable investors to trade them.

7.Integrate with DeFi protocols

If regulation allows, integrate tokens into DeFi lending/borrowing, liquidity mining, and other protocols to access new opportunities.

Finally, take into account that launching a tokenized asset program involves significant ongoing costs. At minimum, you need an in-house team to provide management and oversight.

For startups with limited funding runway, a tokenized offering may be infeasible unless you have ample reserves. Conservatively estimate expenses across these areas before proceeding.

To cover costs, you need a sustainable business model – through transaction fees, service charges, or other value capture. Without sound unit economics, the overheads of maintaining a tokenized platform can quickly become prohibitive.

Minting and tokenizing assets

The tokenization of securities and real world assets is poised to grow exponentially as blockchain adoption increases across traditional finance. While regulatory uncertainty persists, new issuance platforms and protocols are rapidly emerging to make compliant tokenization easier.

If you want to help us build the future of finance, please join Kinto Launch Partner Program here: