In the first post of this series I’ll share my journey and how I came to firmly beleive that liquid staking will be the dominant form of Chainlink Staking.

Disclaimer: I will be discussing protocols that might have resulted in virtual or real monetary losses for certain community members. If you find yourself in this situation and still experience strong emotions about it, I highly recommend stopping reading and taking a break in nature or engaging in some other relaxing activity. As Rafiki said to Simba: “Ah, yes, the past can hurt. But the way I see it, you can either run from it… or learn from it.”

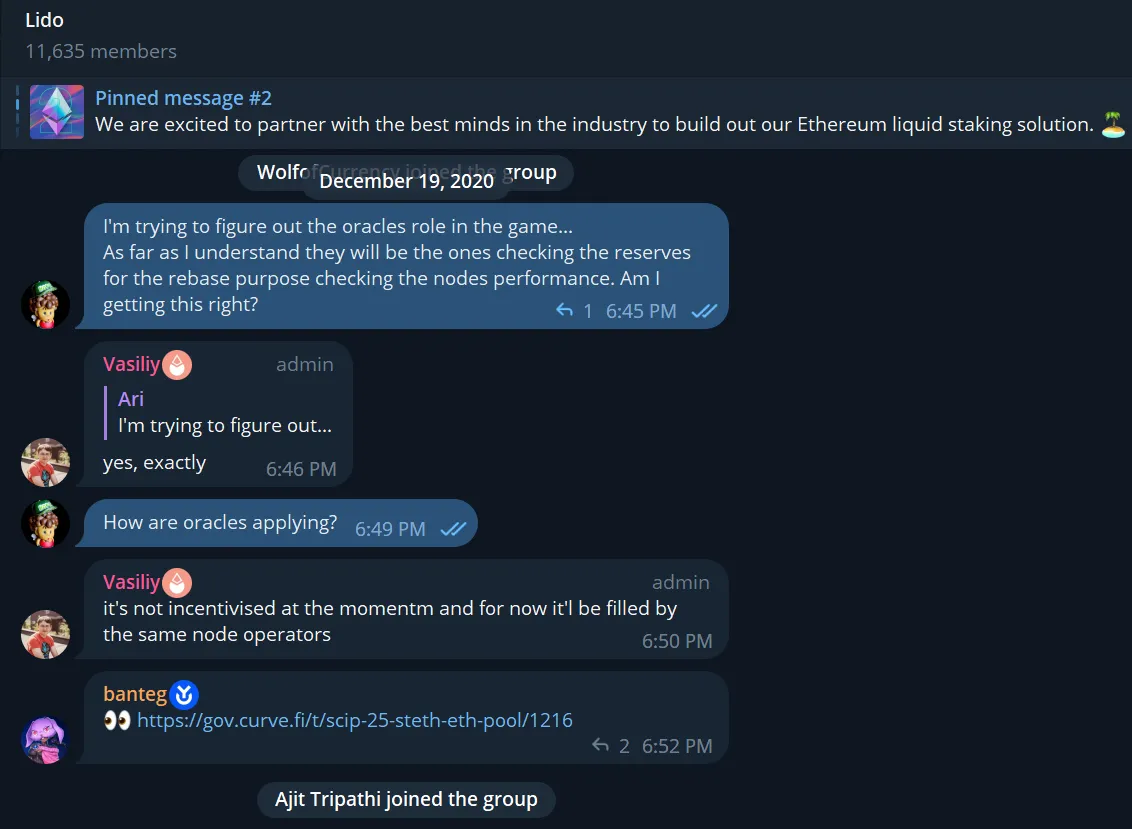

The first time I came across the concept of Ether liquid staking, it was during its early conceptual stage. I stumbled upon a series of tweets by notable figures like Banteg, Jordan Fish (aka CryptoCobain), Vasily Shapovalov, and Konstantin Lomashuk, who would later become the founding members of the LIDO Protocol. It didn’t take me long to grasp the profound importance of what would eventually evolve into the most substantial Ethereum protocol in terms of Total Value Locked (TVL). The idea was elegantly simple yet incredibly powerful: by locking ETH in the Beacon chain, you would receive stETH with a juicy APY. It was a win-win situation where you could have your cake and eat it too.

I recall that things kicked into high gear at a lightning pace. LIDO made its debut on the Goerli testnet in late November 2020, followed by the launch of the Beacon chain the next week. By the end of that year, the LIDO Mainnet was up and running. The team’s remarkable efforts resulted in the prompt establishment of the DAO, fundraising, securing support from prominent DeFi pioneers and node operators, all in a matter of weeks. Subsequently, they began integrating stETH into all relevant DeFi protocols one by one.

Interestingly, around the same time, I officially became a Chainlink Advocate. To give you some background, much earlier, fate led me to a Telegram group that stood out in several ways. I started asking any Chainlink-related question that came to my mind, and there was this anon who consistently provided the best answers imaginable. Back then, Chat-GPT didn’t exist, but if it had, this person could have been the one to train it. It felt like we were at the level of GPT-12. The depth of knowledge, the patience, and the confidence were palpable. Despite my intensity and sometimes critical approach, I never received a response like, “If you don’t believe me or don’t get it, I don’t have time to try to convince you, sorry.” I guess many of you know who this folk is.

IIRC we were like 60 members at that moment in time.

Today, it might be clearer why I’m discussing LIDO in a blog post with such a title. However, for those of you who were following the only team dedicated to a retail LINK staking solution, you’re aware that liquid staking wasn’t even considered back then. The few times I tried introducing the concept, it was swiftly dismissed. To be fair, I can’t blame anyone. On one hand, no one was certain about what LINK staking would entail in prod, and even now, I don’t believe many have a clear picture of what it will look like a year from now. On the other hand, the LinkPool community had been shaping a narrative around a design that was established years ago, guided by a very powerful leitmotif: “Staking allocations will be very scarce and exclusive for Node Operators.”

In March 2021, the LP-LPL migration was announced giving 25k ERC20 tokens per LP, a revamped staking app, LPLA allowance tokens that could eventually be lended once staking was live. I won’t delve deeply into the intricacies of this initial design because it has been extensively discussed within the community. However, I will mention some core issues that concerned me personally: 1) Incentive alignment between the team and the community was inexistent. 2) Everything, from the native protocol token to the eventual staked LINK, was non-liquid. 3) It was way too complex and centralised.

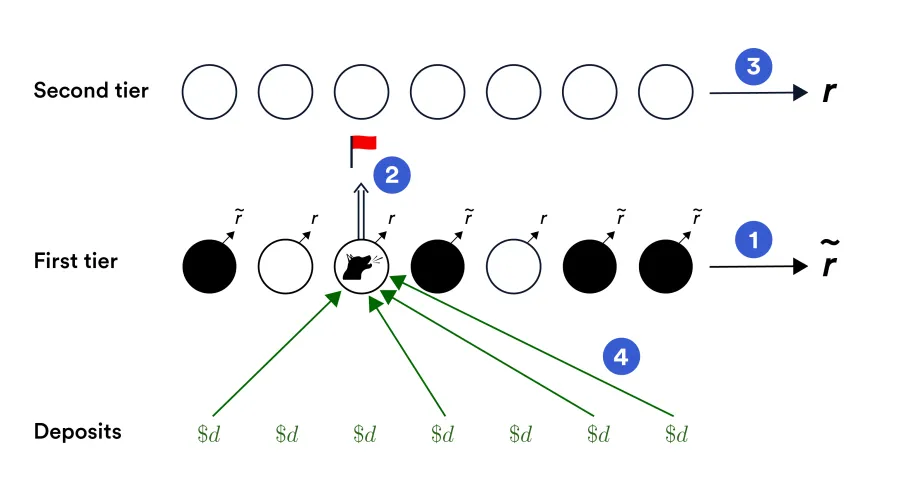

A month later, the Chainlink 2.0 Whitepaper was released, offering a broader perspective on what DONs (officially adopting the acronym) could bring to Web3. This expanded vision extended beyond Price Feeds and oracle services. The paper introduced newer and old concepts such as Keepers, Proof of Reserves, VRF, FSS, DECO, and dedicated approximately 20% of its content to explaining the staking mechanisms. Interestingly, today the community barely recalls the details of service-level agreements, the First and Second-Tier system, and the quadratic staking model, aka super-linear, overall.

Staking Mechanism: Sketch, page 88

What many probably remember are things such as:

“For example, a new oracle operator without a performance history and revenue stream can stake a large quantity of LINK as a guarantee of honest behavior, thereby attracting users and fees.” Chainlink whitepaper v2, page 80

Flashforward, what nobody saw comming a year later was:

“Another key goal of staking is empowering a greater number of community members to directly participate in the Chainlink Network by enabling them to stake their LINK tokens to support the performance of oracle networks.” Chainlink Staking: Exploring the Long-Term Goals, Roadmap, and Initial Implementation

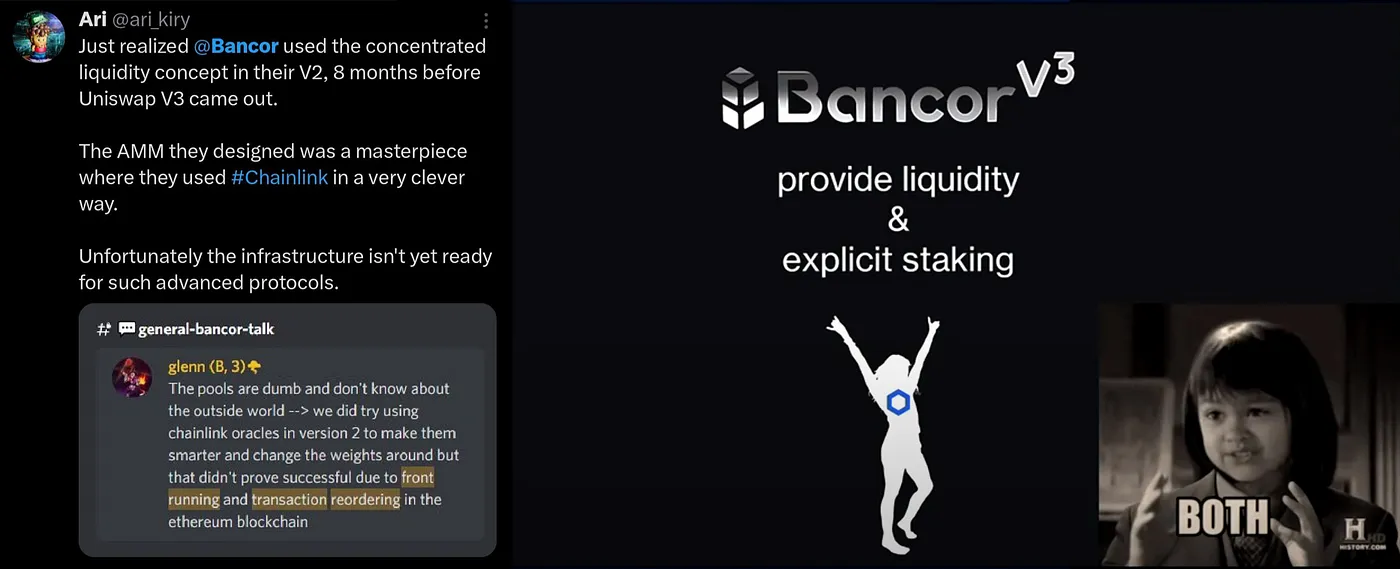

To keep things simple, let’s continue chronologically. In August 2021, SmartCon #1 took place, bringing the CCIP bomb and a lot of excitement. Among the presentations, Mark Richardson’s catched my eye. Why? Firstly, I still believe that if Bancor v2 had incorporated the recently launched Low Latency Oracles, it could have been one of the most successful AMMs to date. Moreover, thanks to Crypto Jiminy’s groundbreaking ideas, the Bancor team seemed genuinely interessted in solving the liquidity conundrum of Chainlink staking that was haunting me.

Jiminy’s design was exceptionally clear; its incentives and tokenomics not only made sense but also presented intriguing aspects. For example, how existing LINK holders in the Bancor protocol with different approaches could access a share of the staking allotments. However, there were also notable concerns, such as node operators potentially taking loans without providing any collateral.

As a side note, I want to share that I had been deeply intrigued by the design of the early Chainlinked project Ampleforth, which was the first to implement a rebasing system. The essence of it is that despite its seemingly straightforward and basic design, it sparked significant contemplation on my part. Now, you might be wondering why I’m mentioning this. Well, it happens to be the first token I provided liquidity for on Uniswap. Through this experience, I learned the harsh realities of impermanent loss and the challenges associated with integrating rebasing tokens into DeFi protocols.

As you can imagine, the ‘impermanent loss protection’ from Bancor was something I deeply related to. On the other hand, while I had been contemplating the rebase mechanism for some time, I never considered it for a simple application like LIDO did for stETH. Even though many protocols now leverage wstETH behind the scenes, witnessing the token rebase and seeing the ‘numba-go-up’ in your wallet is undeniably sexy from a psychological perspective.

Couldn’t find a similar proposal made earlier for uni v2, but you get the point.

The rebase token community wanted DeFi protocols to cater to their requirements, but that didn’t work out. So, following the principle of ‘if the mountain won’t come to Muhammad, Muhammad must go to the mountain,’ the LIDO team wrapped stETH solving related compatibility issues.

Despite everything I’ve discussed earlier, nobody had a clue about the release date for staking. However, this changed on January 1st, 2022, when Sergey made an epic 90-minute video and the excitement within the entire Chainlink community skyrocketed. According to the video, CCIP and staking were allegedly going to be launched that year. Although the exact date and process weren’t fully disclosed, we all anticipated the eagerly awaited ‘tonight!’ moment. The long-awaited day of LINK-based passive income was not so far away.

Of course, this occurred towards what we could consider the conclusion of the capitulation phase. In the ten days following Sergey’s talk, the price of LINK surged from $20 to a local high of $27, marking the onset of the anger phase. LINK, along with the broader cryptocurrency market, experienced a downtrend for several months until Terra Luna delivered the decisive blow with an epic “Finish Him!” Fatality. Crypto was officially a scam.

Oh, but hold on, this was just the beginning of the 2022 nightmare. The real purge began, and like domino pieces, every protocol that wasn’t resilient enough couldn’t withstand such market conditions. Just a month later, in June, another death spiral shocked many Link Marines. The Bancor Protocol suspended Impermanent Loss Protection, becoming one of the most popular hairdressing salons among the community exploring the taste of a LINK-based passive income.

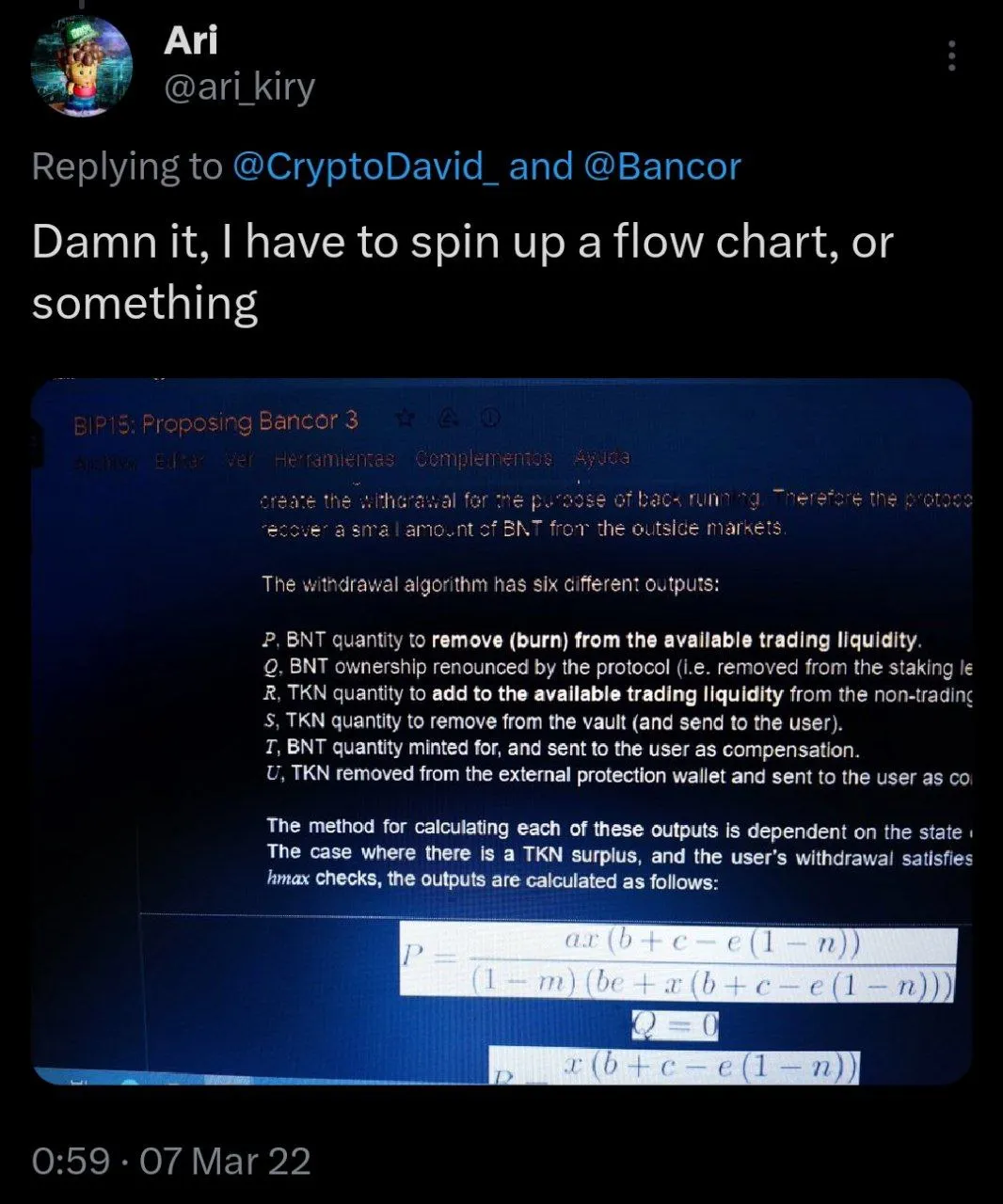

Maths is sort of my forte, but it actually took me 4 years from the first time I heard about Bitcoin in 2010 to grasp the protocol enough to feel comfy buying some. I never reached that level of understanding with Bancor v3, and looking back, I guess my slower grasp actually worked out in my favor.

At this point, I found myself between a rock and a hard place. Tensions at Bancor escalated quickly, especially among LINK LPs, and the LinkPool family appeared to have reached a point of no return with their LPLA staking allowance lending design long time ago, which did not align with my vision. With this backdrop, the well-known blog post ‘The Long-Term Goals of Chainlink Staking,’ published that same month and announcing community staking, prompted LPL holders to raise questions. Staking was planned for this year, 2022, but time was running out, and the most vocal community members were furious to see what had become the nadir of a long, downhill market.

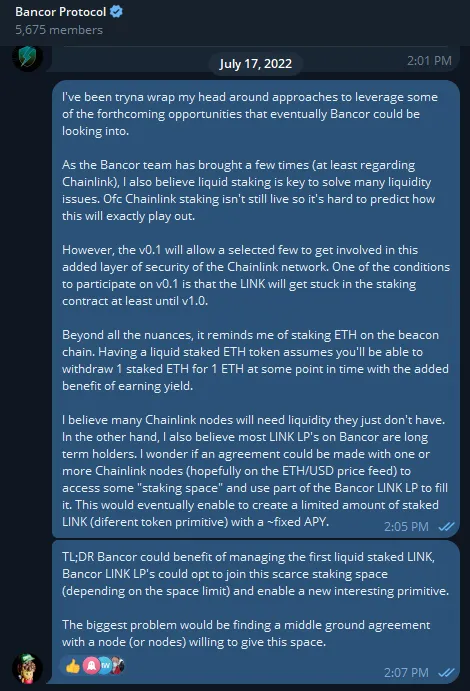

After much deliberation and in an almost desperate attempt, I tried to propose something to the Bancor community that thought could have brought hope. To my knowledge, no one had previously suggested a solution in this regard.

Clearly, Bancor had many fires to put out, and creating this infrastructure was likely not seen as a priority from an opportunity-cost perspective, especially given the friction that had arisen with the Chainlink community.

So it was over… or was it?