We are on the path to $100 trillion of crypto market capitalization. Crypto is officially a teenager, fourteen years after Satoshi’s original bitcoin whitepaper, with a current total market cap of $1.8 trillion. For friends seeking to jump into web3, this is my rallying cry: with less than 2% market penetration, it's not too late; we’re just beginning.

Using the benefits of token-based liquidity, Corporate Development programs are emerging to support cross-chain, cross-use case, cross-user projects through financial investment and acceleration opportunities (i.e., joint marketing and branding).

A buy/build/partner decision cranks the flywheel: more capital > more products and services built > more user engagement > more marketing opportunities > increased financial returns (and not just limited to investors, but specifically to tokenholders who earn rewards via contributions or staking).

For chains or projects seeking to build an investing workstream, I am open-sourcing a playbook built in tradfi institutions and web 2.0 tailored to crypto. There are plenty of opportunities to improve this and I hope you ping me @kishandao to improve:

1. Align on vision:

Rather than setting aside an allocated sum of investment dollars, “work backwards” from goals of the investment fund (i.e. achieving desired financial returns through adding more awareness of your project, enabling new product roadmap features or experiences, onboarding X# of projects or devs, etc).

Then confirm the total investment pool in terms of dollars to deploy, timeline, risk/reward curves (assume the earlier the stage, the higher the risk/reward and lower the check size).

2. Build tools and mechanisms to scale the end-to-end deal underwriting process:

Crypto projects can spool up DAO contributors (or centralized companies like Coinbase employees allocate nights/weekends) to build “investment tooling” to scale program efficacy and performance.

The craft of investing requires judgment, conviction and luck. The better the process, the higher likelihood of program success. Here is a framework to map out an individual deal process end-to-end:

-

Build a CRM (Customer Relationship Management software like Salesforce or Hubspot, but could be as lightweight as an Airtable/Coda/Google Sheet) to track pipeline of total projects, stages (raising, not raising, in-process, executed, missed).

-

Build a prioritization framework for buy / invest / build / partner. Understand what is critically important to your Engineering, Product and Marketing teams. Estimate the total amount of engineering, product, and marketing effort in hours (and accompanying dollars) to build similar experiences - your estimates may be completely off, but the process of thinking through this can calibrate your thinking in “hot” deal situations. If you find a truly visionary team or incredible project, you should move forward.

-

Create a standardized diligence process for the research and analysis you will conduct on each project. I like Soona’s template on “Raising Capital as a Pseudonymous Founder” where their template covers on-chain history, software commits, and community references.

-

Create a one-pager investment memo template to summarize the investment opportunity. Forcing a one-page limit increases the likelihood of getting high quality feedback (people don’t want to read 60 page slide decks) and forces a constraint on clear, concise thinking.

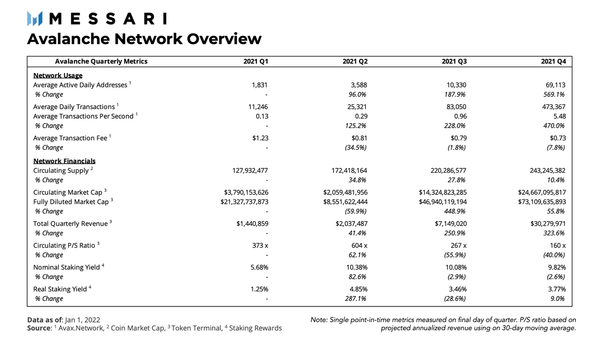

- I like covering: Founder Passion / Background, Market Opportunity, Deal Dynamic, Key Risks and Mitigants, and forward looking Financial Model with summarized KPIs (key performance indicators). Here’s an example from Messari on Avalanche/AVAX:

- Build an investment committee to guide decision making and approve investments. This can be centralized (limited highly vetted group of < 5 individuals to ensure accountability) or decentralized (snapshot based DAO style governance vote). Fund investments with the assumption the first check is an opportunity to continue exercising subsequent pro-rata. Build a follow-on diligence process for subsequent rounds.

- Create documentation to memorialize equity and token vesting / distributions.

- Build employee participation tools. I would love to see a front-end Emeris-like experience built for internal contributors.

- Support ongoing invested projects by deploying capital in liquidity pools, voting on governance proposals, running nodes, designing token feedback loops, providing mutual portfolio introductions, recruiting, and general shilling :)

All of the above could be slotted within a general Treasury Management diversification strategy.

3. Build the best proprietary research and sourcing machine:

What I love about web3 is the boundless information and research available (in most cases for free). Dune Analytics, Token Terminal, The Block, Messari, Delphi are great places to start.

Craft market landscape maps with proprietary themes and theses. Remix your views across different formats like blogs, video, Twitter Spaces, etc. Amplify content via chain-specific channels to reach the most engaged users. Each chain has its own media ecosystem - for example, Cosmos has CryptoCito and CoinBureau providing thought leadership. Promote your views on crypto panels, conferences, and in third-party content streams.

In the spirit of open-source, share research and analysis with project Founders and co-investors. I see two camps of institutional investors: (1) Ecosystem builders who build and fund dApps on-chain including Harmony, Alchemy Ventures, FTX Ventures, Solana Ventures, Coinbase Ventures, and (2) financial investors who are crypto-focused VCs and crossover funds.

Important: the best projects can come from within your own ecosystem, so building mechanisms to support existing contributor projects early will be valuable. A quadratic funding model built by Gitcoin could be employed.

4. Scale by hiring a specialized team.

Once you build out above (and know the basic frameworks to succeed), hire a team to specialize for sourcing, deal execution, tools/enablement, ongoing portfolio support and project marketing/acceleration.

About author:

@kishandao has 15 years of experience building high growth technology companies as a COO/CFO and was previously a growth equity investor at Goldman Sachs.