In February 2022, the global liquid crypto market is valued at $1.8 Trillion, with 18K unique cryptocurrencies. Concentration is deep: 61% of the total value is within two assets, Bitcoin and Ethereum. For context, Apple has a $2.7 trillion market cap, and there are 164 official national currencies.

In a two trillion dollar market, all outcomes and possibilities are available. Profit and loss, fundamentals and frauds, short-term traders and long-term investors. I find this endless noise to be highly distracting, and serve to offer five frameworks below to demystify the overall market for the crypto-curious.

1. Productive vs. Non-Productive

By far, the most common question I get is, “What are the use cases for crypto?” This can be boiled down to what a token owner wants to achieve with their crypto:

Source: Galaxy Digital Research

Productive assets: Layer 1 smart contract platforms like Ethereum, Solana, Avalanche provide payments, lending, and staking use cases.

My favorite example of this is Solana Pay, where a retail merchant can integrate their existing point-of-sale to accept payment for goods or services with the following benefits:

- Avoid fraud or chargeback risk

- Forgo the usual 2-3 business day settlement window

- Avoid a 3-5% payment processing fee on goods sold

- Employ loyalty and rewards marketing automation to manage customer relationships and accelerate revenue

- Simplify accounting reconciliation at a customer and transaction level

- Gain access to treasury management services (not typically offered to SMBs) to earn yield on revenue

- Simplify provenance and possession of goods, which is particularly helpful for any secondary market transactions and determining authenticity of goods. See the asset-backed NFT wave.

There are trillions of dollars of market cap of payment processors, loyalty and rewards marketing automation software, and banking services in this single announcement.

Non-productive assets: Bitcoin is a digital store of wealth (common analogy: digital gold) that is: (a) self-sovereign (not controlled by any single nation or state), (b) censorship-resistant (not tied to any political party or affiliation), (c) scarce (limited to 21 million bitcoin), and (d) secure (Bitcoin has never been hacked) money.

There are common misconceptions that name-your-country can ban Bitcoin, however a country cannot ban a decentralized network but impose limitations on mining, restrict access, and assert taxes.

The other risk with non-productive assets where the use-case is to buy and hold is security, where a holder’s wallet will be hacked. This is true and based on the walletholder’s internet promiscuity. It’s best to use a hardware wallet like Ledger or popular wallets like Coinbase Wallet or Metamask.

2. Abundance vs. Scarcity

Abundance: Anyone can create a cryptocurrency. In a permissionless world, builders can build with less friction. You can use an existing platform like Ethereum, fork (copy) an existing blockchain or use a software development kit (Cosmos SDK) to create your own blockchain built on existing rails (more here).

However, the endless abundance of crypto invites frauds and hucksters. To revisit the beginning of our post, there are 18K unique crypto currencies, and most folks have only heard of a dozen coins at most. Crypto gossip and salacious news headlines are generally in the form of “This cryptocurrency skyrocketed by 1000% in 2021” which detracts from its benefits.

Abundance may also come in the form of abnormally high supply (see Shiba Inu which has 589.7 trillion coins), but this may be misleading where demand may never catch up to supply and in turn permanently depress prices.

Scarcity: Assets like Bitcoin have a fixed supply of 21 million tokens. Non-fungible tokens, are unique one-of-one digital assets.

Digital scarcity is a paradox: in a permissionless world, anyone can create a digital asset, but assets are only valuable if there is increasing awareness leading to demand.

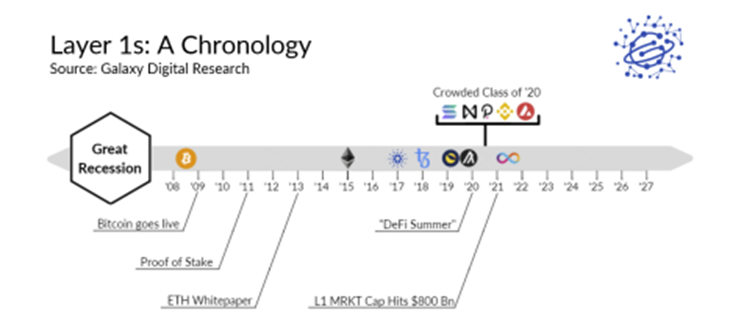

So for asset managers who live on the risk/reward curve of Cash > Bonds > Equities > Top 10 Crypto (~82% of total market cap) > Remaining ~18K coins (~18% of market cap), we can look to the Lindy Effect which teaches us that as something exists for longer, life expectancy increases. The dominance of Bitcoin (2008) and Ethereum (2015) are indicative of this.

3. Insiders vs. Outsiders

Insiders: Twenty years ago, if you wanted to engage in sophisticated financial strategies like lending, borrowing, hedging, and gaining exposure to structured products, you had to be located in a fancy hedge fund office in New York City, London or Tokyo.

You needed ivy league credentials, networks, expensive software, human-based risk managers (read: extravagant salaries and benefits), custody expenses, legal documentation (produced by $1000/hour+ lawyers), lines of credit blessed by a bank, financial licenses, and a bare minimum of tens of millions of dollars in capital to be granted a seat at the table.

Outsiders: The global 24/7 crypto market democratizes tools previously only available to insiders.

Today, anyone can be a “global macro investor” from their computer or mobile phone. You can take directional risk on asset price movement on popular US stocks (Tesla, Microsoft, etc) on platforms like Mirror.

You can get loans in minutes by depositing your crypto assets as collateral on Aave, with loans costing just a few percentage points of interest.

There are newer strategies like staking where you can delegate your owned tokens to a validator in exchange for a PIK (payment-in-kind) yield.

And of course, you can speculate on a wide variety of “alt-coins” if you are seeking higher risk / reward strategies.

4. Centralization vs. Decentralization

Centralization: When a single party (a company, government or individual) controls an entity, power is centralized. If you were to purchase crypto through a centralized exchange (CEx) like Robinhood, you would not own the keys associated with your tokens. You would not be permitted to stake, earn yield, or borrow against your crypto.

If Robinhood was down, you could not access your crypto. You could also not transfer your crypto to another wallet you own, or execute a peer-to-peer transaction. The common rallying cry is, “not your keys, not your crypto.”

However, if your account was hacked and funds were stolen, you could contact Robinhood customer service and they would likely do the right thing for their customers and credit your account.

Decentralization: through a decentralized exchange (DEx) like Uniswap, you can own your keys and trade, lend and stake your crypto in a permissionless 24/7 environment.

Centralization and Decentralization also refer to cryptocurrency architectures. Ethereum is fully decentralized vs Solana which provides lower transaction fees and faster transactions per second to users in exchange for a more centralized validator base.

5. Passive vs. Active

I’m not referring to popular asset management strategies, where an investor selects passive index funds or actively managed hedge or mutual funds. Instead, I focus on activity and how you can spend your time in crypto.

Passive: After the 2017/18 ICO (initial coin offering) boom and bust, the large web 2.0 social networks chose to ban crypto related advertising from their platform. This led to a passionate group of crypto builders generating self-created content in the form of videos, podcasts, and blogs to leverage the distribution of the internet to educate millions (and potentially billions) on the benefits of crypto.

Bankless has hundreds of podcast and youtube videos covering crypto and the decentralized finance landscape. The Block publishes several articles a day on the latest developments in digital assets. Subscriptions from Delphi and Messari provide market data, insights, and institutional-grade research. Crypto Twitter (Zhu Su, Brittany Laughlin, Balaji Srinivasan, Meltem Demirors, Kyle Samani, Matt Huang, Austin Federa and Irina Marinescu) has plenty of content ranging from market observations and developments to fun memes.

And of course, you can buy-and-hold cryptoassets over the long term.

Active: If you want to get more involved in crypto, here’s a list of activities to pursue your passions:

- Stake your purchased crypto to earn yield. Depending on risk/reward, you can earn 5% to thousands of APR %. H/T Staking Rewards.

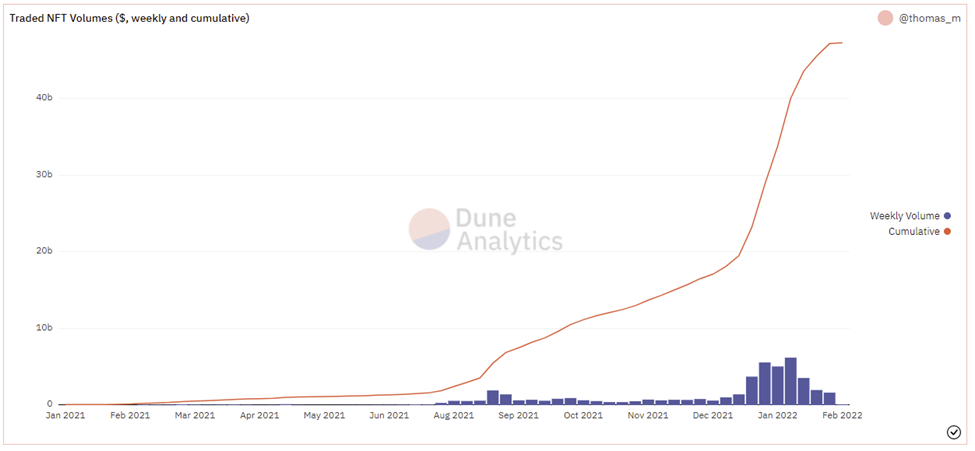

- Mint an NFT. Cumulative NFT sales increased from $71 million to $42 billion in 2021 (billions not a typo, below courtesy of Dune Analytics):

- Here’s a beginner’s guide to NFT minting courtesy of Coindesk.

- You can contribute to a DAO to buy a golf course, an F1 team, or even a fast food restaurant. Here’s my previous post for web 2.0 employees seeking to join DAOs.

- Get a Gitcoin grant to build public goods, or build cross-blockchain products through Harmony which is providing $300 million to launch 10,000 new startups.

About author:

@kishandao has 15 years of experience building high growth technology companies as a COO/CFO and was previously a growth equity investor at Goldman Sachs.