Written: Nov 25, 2019, right after I went to Devcon 4, I was contributing to Prysmatic Labs at the time!

Ethereum is itself a living, thriving ecosystem that has its own multiplying network effects.

Ether as Money

Bitcoin, as a rather simply designed network, suits being a store of value extremely well. It’s very difficult to take control over and its main value is the ability for it to be scarce and maintain that strict scarcity regardless of the current world-wide geopolitical climate. Ethereum however has a severely different monetary policy which allows it to be more flexible, adjust for security funding and allows for more innovative changes submitted as Ethereum Improvement Proposals like EIP-1559.

While Ethereum is entirely permissionless and censorship-resistant like Bitcoin, it also hosts an entire ecosystem of decentralized applications (dapps) that provide additional value and usage to Ether as a currency and the network itself. Some people might not understand how large the ecosystem is and the network effects that exist within it. Most people likely only know the ERC20 tokens that are mainly associated with ICOs.

Ethereum is currently undergoing massive innovation around open financial applications reaching far beyond the over-hyped and flawed promises of ICOs. In this post, we’ll explore and map out this exciting ecosystem, and how each application being built adds to the rest of the ecosystem.

Where it begins — DAI

You may know DAI as a stablecoin on the Ethereum network, if not I highly recommend you look into it. To explain simply: Ether’s value by itself is highly volatile, and what DAI provides to the ecosystem is stability. DAI is designed as a loose peg to $1 USD and it can be used as reference of price stability that previously did not exist on the Ethereum network. One great benefit is that it allows applications on Ethereum to offer functionality in the context of a well-known stable currency, while still being entirely decentralized.

Having a stable token on Ethereum people can trust allows the ecosystem to expand in ways never possible before! While Ether can work great as money, it’s extremely difficult for a financial ecosystem to develop without any reference of stability.

What about the reserve-backed stable tokens like USDT or USDC? Well, while these can possibly operate as references of stability, they can also be externally controlled by their creators. This control can include blacklisting or freezing transfers, which would be absolutely horrible for dapps if that ability were in the wrong hands! Dapps can’t trust these tokens as much as DAI since it would be putting too much trust onto their creators.

Money verbs through DAI

The phrase “money verbs” describes any action you can perform with value. This can mean: (Name-dropping the relevant dapps, no need to look into them now)

- Spending/Earning — (sending transactions)

- Borrowing/Lending — (Compound, MakerDao, Aave)

- Exchanging — (Uniswap, Kyber)

- Pooling for interest — (Compound, PoolTogether)

- Staking as collateral — (MakerDao)

- Saving — (Compound, Dharma)

- Trading — (Kyber, OasisDex, IDEX)

- Leverage Trading — (dy/dx, Synthetix)

Most people might look at these money verbs and would mainly think of trading and lending/borrowing. Which in current financial systems, don’t really amount as much for most people.

But when you remove the middleman from all these actions, such as a bank or exchange, and allow them to cooperate with each other, some really amazing things can be done. We’ve been seeing this a lot lately with Compound’s lending system. While you on your own can loan out DAI for a nice variable-rate of ~6% yearly returns, not only are you earning interest, but the system that this is performed with is actually capable of delegation and transferring.

This could allow community members to simply lend out their money, for the sake of some organization or entity that needs funding, and help provide additional funding at no cost to anyone! Just simply lending out your DAI for a short time period! Once the needed funds have been raised, or you just don’t wish to lend in their name anymore, you can simply exit with all the money you started with.

Imagine if banks were removed from the financial system, and the interest they earned would go to the people, instead of banks exploiting fiat’s inflation for others to put their money in a bank.

There’s plenty more I’d like to go over regarding DAI, and there have been several spin-offs that plug into the economics of normal DAI which you can read about here, (I recommend you understand how DAI works before looking into these).

Financial systems in an open world

Since we now know that the network has a basis for stability, and how Compound offers a fantastic loaning/lending dapp, let’s go over how every dapp on ETH can cooperate openly with each other, producing network effects never seen before. This is what is referred to as composability or “money legos”.

As user experience in crypto improves, we’re starting to see applications called “smart contract wallets” that give you an incredible amount of power over your money compared to a standard wallet, while maintaining the same or even better security.

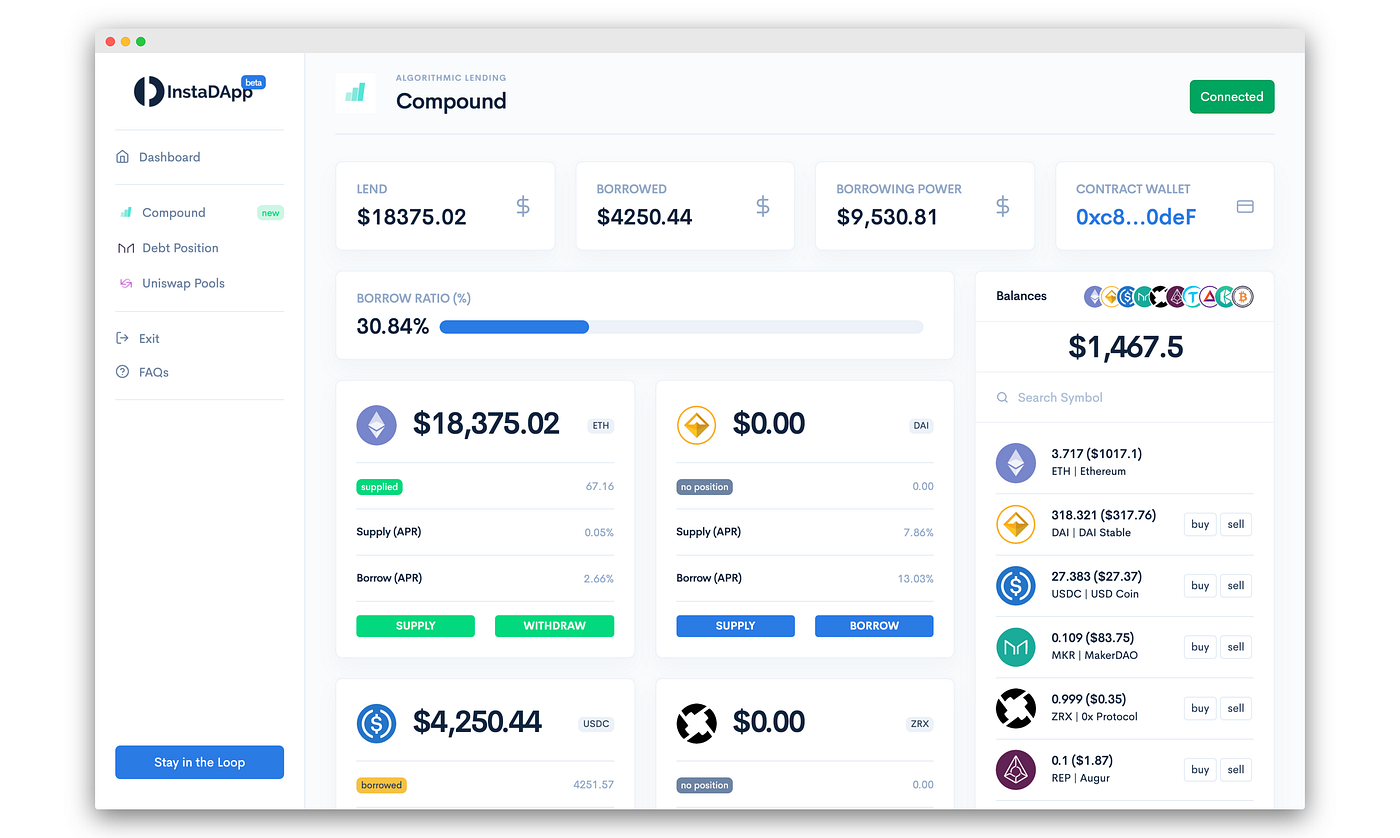

Applications that focus on this like InstaDapp and Argent are figuring out new ways to connect dapps to each other in a seamless way. InstaDapp for example lets you manage your MakerDao loan, Compound lending/borrowing, and Uniswap pooling (all of which are money verbs) entirely within the same layout, and usually compressed to 1 transaction, rather than multiple.

Argent (a mobile wallet) has an in-built exchange and also supports managing your Compound and MakerDao, both of which can be performed in 1 transaction with no gas fees, and an incredibly smooth UX. So you can see how applications can abstract away the normal complexities of dapps through various methods, making them more much approachable and understandable.

Network Effects of Open Finance

Now that you’ve seen how wallets can simplify the normal complexity of dapps, let’s see how dapps can interact with each other.

We’ll be starting with Uniswap, one of today’s leading decentralized exchanges (DEXs). For those who don’t know, someone in their mom’s basement was inspired by a blog post from Vitalik and started working on Uniswap. Once he had made a proof of concept, he presented it to the the Ethereum Foundation and received a $100K grant from them, and launched it as a first programming project.

Today Uniswap is a staple dapp in decentralized finance for being totally trustless and under no ones control whatsoever. It supports trading pairs with any tokens, including DAI of course, and recently reached $8,000,000 of trading volume! Since Uniswap received the funding it needed for its creation, it has no exchange fees! The only fees are for the people who provide liquidity to the exchange, called the market makers.

Mind you, there are multiple projects that function similar to Uniswap, but none are as decentralized and open, so Uniswap has easily risen to being the “mascot” of DEXs.

One amazing result of decentralization that we see the network effects of now is DEX.AG, which serves as an aggregator between all the leading DEXs. Aggregators are important because not only do they provide liquidity to all the exchanges they utilize, but they also help all the exchanges maintain similar prices.

Now, since Uniswap does technically have a ETH/USD trading pair (with DAI or USDC), we may see other dapps on Ethereum use the price of ETH on Uniswap as a method for detecting the current price. Currently, dapps on the Ethereum network can’t know how much Ether actually costs without trusting some service, so feasibly using a decentralized price source would be fantastic.We may also see dapps like Set Protocol (decentralized fund management) also use DEXs like Uniswap as a source of liquidity too!

Hopefully you can see how open finance on Ethereum has literally built itself on-top of the other applications that are hosted on it.

MakerDao has itself built on-top of ETH, in order to make a layer of stability with DAI. DAI is then used by applications like Uniswap, Set Protocol, and Compound to provide a reference of stability for exchanging, investing, and lending. Smart contract wallets like Argent, InstaDapp, and Zerion take away the complexity of using those dapps directly, and allow them to be accessible from everywhere, by anyone, providing additional functionality as well!

If you’re curious how much these services are actually being used. Feel free to check out DefiPulse for viewing all of the top dapps, since these are all financial applications on the same network, theres limitless ways to view the current network activity. For Uniswap theres uniswap.info, for MakerDao theres mkr.tools, MakerScan, and daistats. And for loaning theres loanscan!

I hope you enjoyed this blog post, if you liked it, feel free to follow my team Prysmatic Labs or myself, @0xKiwi_ on Twitter!

ADDED - July 27, 2022

Hello!!! Thank you for reading this article from past Kiwi! It is nearly 3 years old at the time of me adding this to Mirror! Wow!

If you're curious what I do nowadays, I built the protocol for NFTX V2 a decentralized NFT marketplace, and I have co-founded 2 anime art NFT projects, uwucrew and Killer GF. On top of helping with Persona Lamps and Aiko Virtual! Nowadays I'm building products to help form communities around supporting NFT artists!

You can follow me on (@0xKiwi_) Twitter to keep up with what I do!

Thanks for reading!!!