1. What is Pump.fun?

Pump.fun Overview

The term "Meme" originates from "The Selfish Gene," derived from the word "Gene," representing inheritable elements in social and cultural contexts. The financial manifestation of these elements became known as Memecoins, where people celebrate subcultures while investing time and money for both enjoyment and financial returns. Throughout crypto history, notable Memecoins like Doge and PEPE have led various trends. Pump.fun emerged during this super cycle of Memecoins, capitalizing on the carnival-like atmosphere surrounding these digital assets.

Meme platform Development, Pump.fun launched on Solana in late January 2024 as a specialized Meme token platform. By early September 2024, it expanded its blockchain support to include two additional networks: Blast, an Ethereum Layer 2 solution, and Base.

The platform's major innovation lies in its significant simplification of Memecoin creation and trading processes. Initially, users could create tokens for just 0.02 SOL, and since August, this service became completely free. The Pump.fun website features an engaging, meme-rich interface with vibrant visual elements that resonate with young crypto enthusiasts and their interaction preferences. The platform's design successfully captures the aesthetic sensibilities of modern crypto communities while maintaining user-friendly functionality.

Here are the main steps for launching a Memecoin on Pump.fun:

Step 1:Select your preferred token

Step 2:Purchase tokens through the bonding curve mechanism

Step 3:Sell tokens at any time to secure profits or cut losses

Step 4:Monitor market capitalization - it reaches $69,000 when sufficient buyers participate on the bonding curve

Step 5:$12,000 in liquidity is automatically deposited into Raydium (an Automated Market Maker on Solana) and then burned

2. Core Operating Principles of Pump.fun

- No Team Allocation and No Pre-sale Mechanism

Users can create and launch meme coins without any programming skills or technical background. Initially requiring a fee of 0.02 SOL, the service has been free since August. The process is straightforward: simply choose a name, ticker symbol, and upload a representative JPG image. This user-friendly approach and minimal cost have made Pump.fun the preferred platform for those looking to enter the memecoin market. Upon launch, all tokens are immediately released into public circulation, with no hidden team wallets or reserved liquidity pools. This design fundamentally eliminates the possibility of market manipulation by project teams for unfair gains, significantly enhancing market transparency and fairness.

- Bonding Curve

The bonding curve is a mathematical model widely used in cryptoeconomics, particularly in token economics and Automated Market Makers (AMM). The curve is typically designed so that token prices increase as the token supply increases. This design aims to reward early investors who purchase tokens when supply (and price) is low, allowing them to potentially profit as the market expands.

While Pump.fun has not publicly released their specific bonding curve formula, their principle maintains a constant product between the initial pool's token supply and pool's $SOL increases.

$SOL amount. As the product remains constant, the token quantity decreases as the

The derived formula is :

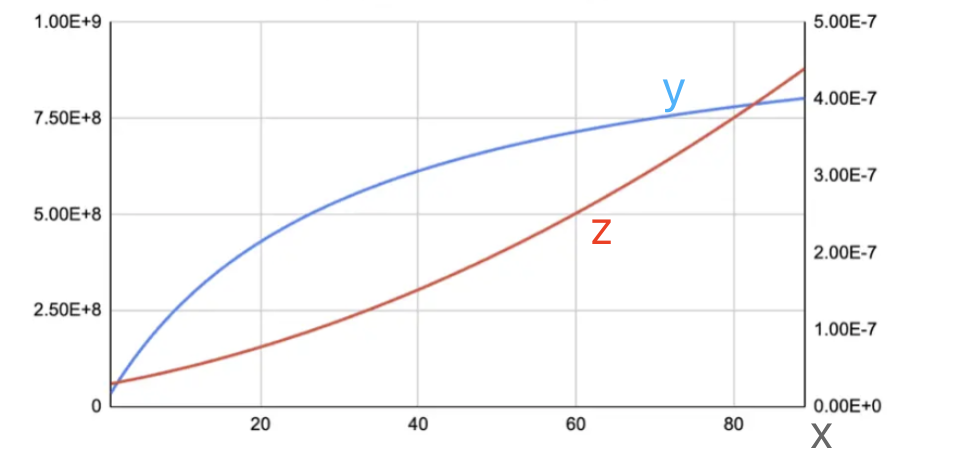

Where: 1073000191 represents the derived initial total token supply in the virtual pool, x is the amount of $SOL bought by users, y is the corresponding token quantity in the pool as $SOL is purchased, the price per token can be obtained by taking the derivative of x with respect to :

The resulting curve demonstrates two key components: A blue pricing curve, A red price curve, These curves exhibit the characteristic steep initial phase typical of newly issued Memecoins.

y/ token amount

z/ price

x/ total solana

- Automated Liquidity Injection and Burn Mechanism

When the token's total market capitalization reaches the critical threshold of $69,000, the system will automatically withdraw $12,000 from token sale proceeds to inject into the Raydium liquidity pool, followed by an immediate burn of the corresponding liquidity tokens. This operation ensures market liquidity remains free from manual manipulation while simultaneously reducing the token supply in circulation, potentially enhancing the token's market value.

3. Pump.fun Milestone Timeline

-

In April 2024, $MICHI (launched on April 8th) surpassed a market capitalization of $200 million, igniting market sentiment. Pump.fun reached its first major growth milestone during this period. This phase marked a turning point as Pump.fun began attracting widespread attention from mainstream media and the crypto community, gradually strengthening its position in the Memecoin market.

-

In May 2024, Pump.fun fell victim to a flash loan attack when a former employee exploited their privileged position within the company to misappropriate approximately 12,300 SOL (valued at around $1.9 million), causing significant impact to the platform. While this attack dealt a blow to Pump.fun's reputation, the platform team responded swiftly by implementing technical upgrades and providing user compensation, successfully regaining user trust and embarking on a path of exponential growth.

-

In August 2024, the project team reported that Pump.fun issued 10,000 new tokens during the 3-hour interview between Elon Musk and US presidential candidate Donald Trump on X (formerly Twitter), achieving a record single-day revenue of $35,000.

-

In September 2024, the income officially exceeded $100 million, just over half a year after its launch.

-

In October 2024, several significant milestones were achieved: A record-breaking daily revenue of $1.8 million was reached on the 15th, Founder Sapijiju confirmed upcoming token launch and airdrop initiatives, A new daily minting record was set on the 24th, exceeding 36,000 units, Reports indicate Pump.fun is preparing for a Token Generation Event (TGE).

4. Token Launch Performance on Pump.fun

As of October 29, 2024, the total number of tokens launched on Pump.fun has exceeded 2.7 million tokens. After experiencing a downturn that began in late August, the platform saw a significant increase in daily token launches starting from late September, breaking through the 15,000 mark. This upward trend has been particularly notable in recent days, with new daily issuance records being continuously set. The platform reached a historic milestone on October 24th when daily token launches surpassed 36,000.

Looking at Pump.fun's performance on Solana, since late September, its token issuance volume has been steadily climbing as a proportion of Solana's total token issuance, continuously expanding its market share. Currently, approximately 60% of Solana tokens are created through Pump.fun. This indicates that Pump.fun has gradually established a crucial position in the Solana ecosystem. The steady growth in its market share not only demonstrates the platform's activity level and user engagement but also reflects market acceptance of its innovative model, making it an indispensable component of the Solana ecosystem.

The increase in token issuance has been accompanied by varying quality levels. While some tokens have achieved notable market performance after launch, many have experienced significant market cap declines or even dropped to zero shortly after issuance. As of October 28, approximately 39.2k tokens reached the $69,000 market cap threshold on the platform, representing only 1.4% of total issuance. After excluding over 2k "graduated" tokens from the May 16 exploit, the graduation rate drops to just 1.3%.

In recent weeks, daily token issuance has stabilized at around 25k, with only 300-500 tokens "graduating" per day, maintaining a graduation rate below 1.5%. This low graduation rate indicates that while the platform attracts numerous token launches, the proportion of projects achieving initial market success remains very limited (though it's worth noting that successful "graduation" is just the beginning for Memecoin communities).

Among tokens listed on Pump.fun, only 4 had a market capitalization exceeding $100 million as of October 29, representing a mere 0.0001% of all listed tokens.

The top-ranked $GOAT was created by an anonymous developer and experienced a rapid market value surge thanks to promotion by Andy Ayre, founder of Terminal of Truths (ToT), on the X platform (@truth_terminal). ToT, an AI-driven bot, discovered the GOAT token through its training data after the anonymous developer tagged it with ToT. This led to its promotion, causing GOAT's market value to exceed $600 million within days. The unique and somewhat serendipitous connection between GOAT and ToT appears to signal the beginning of a new trend in the crypto market driven by popular culture.

Artificial intelligence has demonstrated significant power in driving assets like $GOAT, accelerating price surges and creating a "perfect storm" for Memecoins. As these AI-supported projects gain increased attention, they may redefine how the market values speculative assets, breaking traditional boundaries between memes and crypto investments. GOAT's meteoric rise further confirms the distinctive vitality and fervor of the Memecoin market.

The fourth-ranked $MICHI has maintained a market value above $50 million since its launch in May, frequently reaching the top position on Pump.fun. On October 19, $MICHI achieved an all-time high with a market value of $200 million. Marketing itself as "the internet's cutest cat," this Memecoin has demonstrated unusual longevity by maintaining a high market value for over six months. This success suggests that Memecoin value cycles can potentially last longer than previously anticipated.

Looking at Daily Active Users (DAU), the platform continues to experience growth despite occasional fluctuations, with user engagement remaining consistently strong. Since late September, Pump.fun has entered a new phase of explosive activity, with DAU showing significant growth. The platform reached a record high on October 18th, with nearly 100,000 daily active users, of which approximately 36% were new users. This surge in activity may be attributed to anticipation surrounding their token launch.

Pump.fun generates revenue through two primary channels: token issuance fees and trading commissions. Initially, users were required to pay approximately 0.02 SOL for each new token creation on the platform. While this fee may seem minimal, it generated substantial revenue due to the platform's large user base and high daily token issuance volume. On August 9th, Pump.fun implemented significant changes to their revenue model. The platform introduced free token creation and established economic incentives for creators who successfully complete the bonding curve. Under the new system, the token creation costs shifted from creators to the first token buyers. Additionally, creators who successfully complete the bonding curve now receive a reward of 0.5 SOL (approximately $80).

Additionally, Pump.fun charges a 1% transaction fee on all token trades, which continues until the token's liquidity reaches $69,000. This fee structure both incentivizes platform development and ensures a fair trading environment.

Since October, Pump.fun's daily revenue has doubled dramatically, maintaining an impressive level above $1 million, with a record-breaking $1.8 million achieved on October 15th. As of October 29th, Pump.fun's cumulative revenue has exceeded $140 million, remarkably achieved in just over 10 months since its official launch.

Looking at revenue data from the past month, Pump.fun ranks sixth, closely following industry giant Solana, with revenue nearly double that of Uniswap. Notably, among the top 10 revenue-generating projects, which primarily consist of chains, stablecoins, and DeFi platforms, Pump.fun stands out as the only Memecoin launchpad to make the list. This achievement not only demonstrates Pump.fun's unique position in a highly competitive market but also highlights the growing influence and appeal of Memecoin launchpads in the broader cryptocurrency ecosystem.

5. Key Success Factors of Pump.fun

-

Financial Innovation. Pump.fun's financial architecture incorporates a pre-built bonding curve for fair token launches and automatic liquidity pool (LP) deployment after curve completion. The platform empowers non-technical creators by providing tools to tokenize their influence or following, while ensuring seamless trading capabilities and improved token issuance efficiency. Additionally, token trading activities on Pump.fun generate benefits for various stakeholders, including network activity, DEX trading volume, Telegram bots, and MEV opportunities.

-

Social Features and Community Engagement. While many Memecoin investors struggle to find and assess project communities and discussion activity, Pump.fun serves as both a token launch platform and social interaction space. Users can enhance their token listings with images and descriptions, while engaging with others through the platform's built-in comment system. The addition of livestreaming capabilities allows new Memecoin launches and operations to be showcased through live broadcasts and videos, creating an effective channel for expanding reach and attracting capital.

-

Seasonal Drivers. There is a strong positive correlation between real-world events and Pump.fun activities, which is characteristic of memecoins. The success of Pump.fun is heavily dependent on the rise of meme coin culture, as evidenced by celebrity tokens like $daddy and $mother. This trend has gained momentum through endorsements and promotion from industry figures like @weremeow and Ansem, significantly boosting Pump.fun's visibility and recognition.

-

External Investment Environment. The majority of mainstream VCs and analysts rarely purchase tokens on Pump.fun. Instead, the platform attracts retail investors, X (Twitter) users, KOL followers, and trend-focused community members. During unfavorable funding conditions, retail capital typically shifts from VC tokens (low circulation, high FDV VC investment projects) to the Memecoin market.

6. Pump.fun FDV Analysis

Pump.fun holds a position in the Memecoin launch platform sector comparable to Uniswap's standing in DeFi.

-

Annual Revenue Performance: According to DeFiLlama, Pump.fun has achieved an annualized revenue of $358 million, while Uniswap generates $500 million. What's particularly noteworthy is that Pump.fun reached this $358 million revenue milestone in less than a year since its official launch, demonstrating exceptional monetization capabilities.

-

Valuation Multiplier Analysis: Uniswap currently has a Fully Diluted Valuation (FDV) of $8 billion, with an FDV-to-revenue ratio of approximately 16. Pump.fun demonstrates significantly stronger market dominance in the Memecoin issuance platform sector compared to Uniswap's position in the DEX space. Given Pump.fun's revenue scale and operational history, we project sustained and long-term profitability. Furthermore, considering the current bullish Memecoin market environment, a valuation multiple of 18-25 times FDV-to-revenue appears justified.

-

Based on the above assumptions, the calculated FDV range is $5.37 billion to $8.95 billion.

This valuation is based on speculative bull market conditions. If a bear market follows, Memecoin bubbles would likely burst and trading volumes would plummet. In such a scenario, Pump.fun's revenue and price-to-earnings ratio would need to be significantly adjusted downward.

7. Competitive Analysis

A comparative analysis of key Memecoin launch platforms: Moonshot (Solana), Sunpump (Tron Chain), Four.memes (BNB Chain), Flap.sh (BNB Chain), and We.Rich (Base).

Here's a clear comparison of the platforms. Looking at launch dates, most platforms were established after June this year. Pump.fun, the leading MEME token launch platform, was the earliest to market, debuting on Solana in January. As a result, subsequent MEME launch platforms are essentially Pump.fun imitators, and the trend has spilled over from Solana to other major blockchains including Tron, BNB Chain, and Base.

The first-mover advantage often creates significant competitive barriers. Looking at platform monetization, token issuance, and user engagement metrics, Pump.fun has demonstrated clear market dominance. While Sunpump shows stronger revenue compared to other competitors, its daily token issuance has recently decreased substantially. However, given the seasonal nature of Memecoins, another growth cycle could emerge soon. Regardless, Pump.fun clearly stands as the dominant force in the Memecoin launch platform space. Another noteworthy observation is the approximately 1% graduation rate across all these platforms. This suggests that meme tokens currently require new incentive mechanisms to extend the lifecycle of graduated Memes.

Before examining each platform in detail, let's review the ecosystem status of their respective blockchains. As of October 27th, Solana leads with the highest Total Value Locked (TVL) exceeding $7.2 billion, with TRON following closely behind. Solana maintains a commanding lead in revenue, market capitalization, and Fully Diluted Valuation (FDV). This presents a favorable environment for Pump.fun and Moonshot, which are deployed on Solana, allowing them to benefit from the ecosystem's advantages and further drive their platform development and growth.

Let's examine the popularity metrics comparison among these platforms (the popularity score is calculated through weighted normalization of platform search volume, click-through rates, user votes, and Twitter trend indices). The data shows that Pump.fun has consistently maintained the leading position in popularity, followed by Moonshot.

- Moonshot

Moonshot is based on the Solana blockchain and was launched by DEX Screener (one of the most well-known DEX aggregator platforms) on June 25. This platform is not a standalone website but rather an integrated page within the Dexscreener platform. In simple terms, Moonshot allows users to view trending new meme coins on DEX Screener, and players can issue their own meme coins on the platform. Once the market capitalization reaches 432 SOL (approximately $66,600), all remaining tokens and liquidity will be migrated to Meteora or Raydium.

As of October 28, over the past four months, the total issuance of Moonshot tokens has reached 106,000, with a recent daily issuance of approximately 300 tokens. A key advantage of Moonshot is its close integration with the DexScreener platform. Users can leverage DexScreener's powerful data analysis capabilities to gain better insights into market trends and optimize their investment strategies. Additionally, unlike Pump.fun, most tokens are traded on the stablecoin DEX Meteora (TVL: $356.07 million) rather than Raydium (TVL: $1.442 billion). It is noteworthy that 20% of the dynamic fees generated from tokens launched on Meteora will be permanently allocated to the token creators. This innovative incentive structure from Moonshot appears to be a significant step towards enabling meme coins to achieve long-term value through its launch platform.

- SunPump

SunPump launched on August 13, supported by Tron founder Justin Sun, and is the first Memecoin launch platform on the Tron blockchain. Like Pump.fun, SunPump employs a joint curve pricing mechanism. As the first Meme Launchpad supported by the TRON ecosystem, SunPump benefits from TRON's traffic support, gas subsidies, and a multi-million dollar incentive program. Within about a week of its beta launch, SunPump surpassed 10,000 projects created, generating revenue of 4.36 million TRX. One key difference is that SunPump targets the Asian market, leveraging strong community support in Asia, while Pump.fun primarily focuses on Western markets.

As of the latest data on October 29, SunPump has issued a total of 91,000 tokens in just two months, generating over 35 million TRX (currently valued at approximately 5.54 million USD). At the same time, the graduation rate reached 1.9%.

The following image shows the tokens on SunPump with a market value exceeding 10 million USD as of October 29:

Based on recent performance, the popularity of SunPump has rapidly declined. The daily trading volume of SunPump has dropped sharply from over 4,000 to just 30, and daily revenue has significantly decreased as well. However, with the strong support from the TRON ecosystem and Sun's influence, there remains a possibility that it could rebound or attract new market attention in the future. It is worth continuing to observe.

- Flap.sh

Flap.sh is a one-click token issuance platform focused on the concept of SocialFi, officially launching on the BNB Chain on July 1. Similar to Pump.fun, Flap.sh allows users to quickly create tokens and participate in market trading. When the market capitalization reaches $57,000, a liquidity pool of 16 BNB will be deposited and locked in PancakeSwap V3.

The platform's standout feature is the introduction of a "token PK mechanism," which intensifies competition between tokens. On the Flap platform, when a token's market capitalization reaches $100,000, it enters the duel candidate pool. Before going on a decentralized exchange (DEX), tokens in the candidate pool will engage in one-on-one duels. During these duels, both tokens can only be bought and not sold. After 30 minutes, the token with the higher net buying volume wins, while the liquidity of the losing token will be used to purchase the winning token in the market, thereby boosting its price. Users holding the losing token can burn their tokens in exchange for the winning token. If a token achieves a market capitalization of $1 million after participating in at least one duel, the remaining tokens in the bonding curve will form a liquidity pool and be listed on the DEX. This liquidity pool will be burned and locked. Currently, OKX Wallet has integrated Flap to enhance user interaction. Through this mechanism, Flap.sh aims to increase user engagement and market activity. Additionally, Flap.sh is integrated with Pump, allowing for direct import of tokens created on Pump.fun. Users can even participate in token issuance via X. By choosing Flap's Twitter token issuance model, users can achieve zero-cost token creation.

- Four.meme

Four.meme launched on the BNB Chain in early July this year. In addition to basic token issuance features, Four.meme offers a trading experience similar to other meme token platforms, including low issuance costs, a Bonding Curve mechanism, and initial liquidity settings. Specifically, the cost to issue a token on Four.meme is 0.005 BNB, which translates to approximately $2.67 based on current token prices. The trading fee on Four.meme is set at 0.5% (with a minimum fee of 0.001 BNB). Once a meme token reaches 100% of its Bonding Curve, Four.meme will automatically establish a liquidity pool on Pancake Swap with a pairing of 20% of the total circulating tokens and 24 BNB. Additionally, every token on Four.meme comes with a referral link. Traders can share their links, allowing them to earn 10% of the trading fees generated by those they refer.

It is noteworthy that Four.meme has recently been selected for the MVB Season 8 Accelerator Program by BNB Chain, with an acceptance rate of less than 7%. This program is known for incubating high-quality projects, which suggests that Four.meme may have future potential for listing on Binance. Latest data shows that within three months as of October 28, Four.meme has facilitated the issuance of 7,040 tokens, with 88 of these listed on Pancake Swap, resulting in a graduation rate of 1.3%. The total revenue generated amounts to 275 BNB (approximately $164,000).

- We.Rich

We.Rich launched on Base at the end of April and secured $2 million in seed funding in July, led by Folius Ventures and Animoca Brands. These two investment firms have extensive experience in the consumer application sector, providing We.Rich with strong endorsement and resource support. Additionally, We.Rich will collaborate officially with Mocaverse to offer a quick token issuance window for Mocaverse holders. The We.Rich team consists of members from tech giants like Tinder and Microsoft.

Building on the foundation of Pump.fun, We.Rich has added more features and optimized the user interface. One of the platform's standout characteristics is its official website, which features rap-style background music that creates a lively and trendy atmosphere for users.

- Memecoin launchpad on other chains

In addition to the platforms mentioned above, there are other launch platforms catering to different fields. For example, Memehub.AI is an AI-driven meme coin launch platform that went live on BNB at the beginning of September. The AI assistant provided by Memehub.AI allows users to generate meme coin-related concepts through a single sentence or keyword, including the full token name, logo, introduction, and marketing posters. In July of this year, Memehub.AI won second place in the Binance Hackathon competition and received support from the Binance incubation fund. Additionally, Memehub.AI has introduced an innovative external marketing mechanism. When users issue MemeCoins on the platform, they can choose to airdrop a portion of the MemeCoins to KOLs (Key Opinion Leaders) or partner communities. After receiving the airdrop, KOLs and communities will promote the project, boosting the marketing of the Meme Coin.

GraFun, launched in September, is also a launch platform on BNB that introduces an innovative Fair Curve model. This model breaks the limitations of traditional issuance methods, reduces price manipulation, and provides a truly fair starting point. GraFun has formed a strategic partnership with DWF Labs to further enhance the liquidity of tokens on the platform; however, the overall market capitalization of tokens on this platform remains relatively low. Nevertheless, according to data from DWF Ventures, GraFun performs well across various metrics such as revenue and unique users compared to other meme launch platforms on the BSC chain.

BlueMove is the first meme launch platform to be launched on Sui and Aptos, having just secured strategic round financing from Victus Capital on October 24. The platform is currently in its early development stage, with its total value locked (TVL) coming exclusively from Aptos. Degen Express, launched in 2023, focuses on meme launches on Sonic (Fantom). When the total market capitalization of tokens issued on this platform reaches $55,000, it will immediately deposit $12,000 into an automated market maker (AMM) for on-chain trading.

Additionally, Wonton.fun, which launched in June, is a dedicated launch platform for the TON blockchain. Satspump.fun targets the Bitcoin ecosystem, while Trugly.meme (launched in April) operates on Base, Pump.Flow (which just went live on October 26) is on Flow, and Fomowell and MemeFun.ai (which received a grant from the ICP Foundation) are available on ICP. The former NFT era's ApeChain is promoting its memecoin launch platform, Ape Express, leading to a 100% increase in the price of Ape tokens. Moreover, there are many similar platforms within the Bitcoin ecosystem, such as Ticket.fans and Satspump.fun.

With the emergence of various memecoin launch platforms, the memecoin sector has not only attracted the attention of individual investors but has also gained recognition and participation from various ecosystems. Since the beginning of this year, multiple ecosystems have launched their own ecological memecoins as launch platforms, solidifying consensus within the memecoin sector. Starting in the second half of 2024, many venture capitalists have announced plans to invest in memecoin infrastructure, marking a shift from previous resistance to increasing acceptance by VCs.

8. How to view the future of Memecoin launch platforms?

Reflecting on the first half of the year in the Meme coin project market, it is clear that Meme coins operate in a zero-sum game. On one hand, they heavily rely on significant funding and high liquidity brought in by whales and major players. On the other hand, they depend on compelling narratives, memorable content, and attention-grabbing backgrounds.

At TOKEN 2049, Meme coin KOL and analyst Murad presented the "super cycle" theory of Meme coins, emphasizing the sustainability of these community-driven assets and predicting that 2025 could be a breakout year for Meme coins. Although Memecoins lack intrinsic value in the traditional sense, the community sentiment behind them, the investors' desire for quick returns, and the prevailing resistance to risk-averse investment strategies keep Meme coins in the spotlight.

While we are currently still in an early phase focused on short-term gains, this situation offers valuable insights for future cultural finance and cultural currencies. For instance, similar to "lead generation products" in the Web2 ecosystem, Memecoins can initially penetrate the market to attract funding, which can then be funneled into the ecosystem's infrastructure, such as DeFi and lending products. This strategy of using Memecoins to draw in capital and subsequently launch practical products is one potential path for ecosystems and project teams to pursue. In fact, there are already pioneers in this space; for example, Foxy is a Memecoin launched by the parent company of MetaMask. Although initial information was limited, Linea chain and its associated parties are driving forces behind it. Foxy delivered approximately 40 times returns on its first trading day, thanks to a combination of KOL investments and promotional efforts.

From a data analysis perspective, there are currently no competitors in the market that can rival Pump.fun. The reasons for this can be summarized in three main points:

-

The hype surrounding meme coins has become cyclical, leading to concentrated market attention and liquidity. Pump.fun has secured an excellent ecological position due to its first-mover advantage.

-

New platforms struggle to create significant differentiation. A key characteristic of this industry is the lack of clear differentiation. Since Pump.fun has already established itself as a pioneer in this field, it will be difficult to shake its leading position unless other platforms introduce a distinctly innovative feature or concept in the future.

-

A low barrier to entry for issuing coins does not mean there are no barriers at all. Just because the participation threshold is low does not imply that users are willing to engage in unprofitable transactions. The focus of one-click coin issuance platforms remains on generating broader liquidity rather than merely facilitating player-versus-player (PVP) interactions.

At the same time, considering the high-risk and high-reward characteristics of Memecoins, let's explore how Pump.fun can provide a unique testing ground for the future Memecoin market from the perspectives of the "whale advantage," payout rates, and maximum returns. In traditional finance, these metrics have standard methods of measurement, while in the context of a Memecoin launchpad, Klein Labs offers a distinctive perspective and innovative interpretations:

-

Whale Advantage: In traditional financial markets, "whales" benefit from significant information asymmetry. In certain centralized online gambling platforms and more closed capital markets in some countries, the whale advantage is a poor indicator for retail investors. However, Pump.fun eliminates information asymmetry, allowing users to choose projects based more on community resonance and narrative strength, thus avoiding the instability caused by "whale dominance." The transparency of projects also brings investments closer to consensus and popularity.

-

Return Rate: The return rewards provided by the platform to users are indicative of a healthy financial market. For instance, in the NFT market, Blur has successfully surpassed OpenSea by offering airdrops based on trading volume to early participants. The same applies to airdrops in blockchains. In the context of Memecoin launch platforms, we have reason to expect airdrops (rewards) from Pump.fun for users; otherwise, it presents an opportunity for other platforms to gain an advantage.

-

Maximum Returns: Maximum returns reflect the highest potential multiple of user profits. For example, lotteries are games with very high maximum returns; although their house edge and return rates are relatively limited, the potential for significant maximum returns can attract many users. From this perspective, Memecoins seem to serve a similar function as lotteries. For instance, the GOAT token on Pump.fun saw its market capitalization exceed $600 million within just a few days. The wealth myths surrounding Memecoins greatly excite young people's interests.

In the future, there are still many innovative opportunities for Memecoin launch platforms and their related sectors. Some of the opportunities related to Memecoin launch platforms include:

-

Memecoin Launch Platforms on new blockchains:The tremendous success of Pump.fun on Solana serves as a great inspiration for new chains. Among those that have received substantial funding but have yet to launch their mainnet, there are likely similar market opportunities. Teams like Berachain, which inherently possess a Memecoin cultural gene, could be potential players.

-

Use of AI:AI can play a significant role in both the issuance and trading of Memecoins. For instance, in the issuance phase, AI can be utilized to create images and memes. In the trading phase, it can assist with smart money tracking and other analytics.

-

Further Socialization:While Pump.fun has done well in fostering community culture, there is still room for enhancing the social aspects of Memecoins. Building applications and promoting them on existing social media platforms like X, Telegram, Line, and Kakao could potentially increase the social attributes of Memecoins.

-

More Innovative Pricing Curves:Is the current pricing curve optimal? Are there more suitable pricing methods that could be explored?

We believe that during this super cycle of Memecoins, projects related to Memecoin launch platforms will continue to surprise us increasingly. Pump.fun is just the beginning, not the end.

We also welcome innovative Memecoin launchpad projects on other chains to connect with Klein Labs to explore investment and collaboration opportunities.