1. Overview of AILayer

1.1 Project Introduction

1.1.1 Establishment and Development History

Over the past year, with the emergence and explosive popularity of ChatGPT, AI has suddenly bridged the gap with the public, becoming the "new darling" of the capital markets. At the same time, Bitcoin has repeatedly broken historical highs, surpassing $100,000, ushering in another bull market for the cryptocurrency industry. Against this backdrop, the narrative of "AI + Web3" undoubtedly holds significant imaginative potential. Today, we will take a look at a rising star project cloaked in a "double golden armor"—AILayer.

AILayer is a very young project, established in early 2024. Despite this, it has secured strategic investments from well-known institutions such as Amber Group, Waterdrip Capital, Bitmart, Satoshi Lab, and MH Ventures within just over six months of its mainnet launch.

The vision of AILayer is to become a bridge connecting AI and blockchain technology. Officially, AILayer is defined as an AI-driven modular Layer 2 solution for Bitcoin that is also compatible with EVM and has passed an audit by ScaleBit, a leading security audit team specializing in ZKP, Layer 2, and cross-chain applications.

As a Bitcoin-based Layer 2, it combines AI with blockchain to address some of the most critical issues in the development and deployment of artificial intelligence applications. By decentralizing AI and connecting it to the secure and transparent Bitcoin network, AILayer provides developers and users with a way to build, scale, and access AI models and services without the need for expensive cloud infrastructure or centralized control.

In simple terms, AILayer has four main features:

-

Seamless integration of Bitcoin Layer 2 with powerful AI capabilities.

-

Support for various AI applications to meet diverse computing and training needs.

-

Cross-chain interoperability between the Bitcoin ecosystem and other chains (EVM).

-

Establishment of a sustainable economic model to ensure the long-term stability of the system.

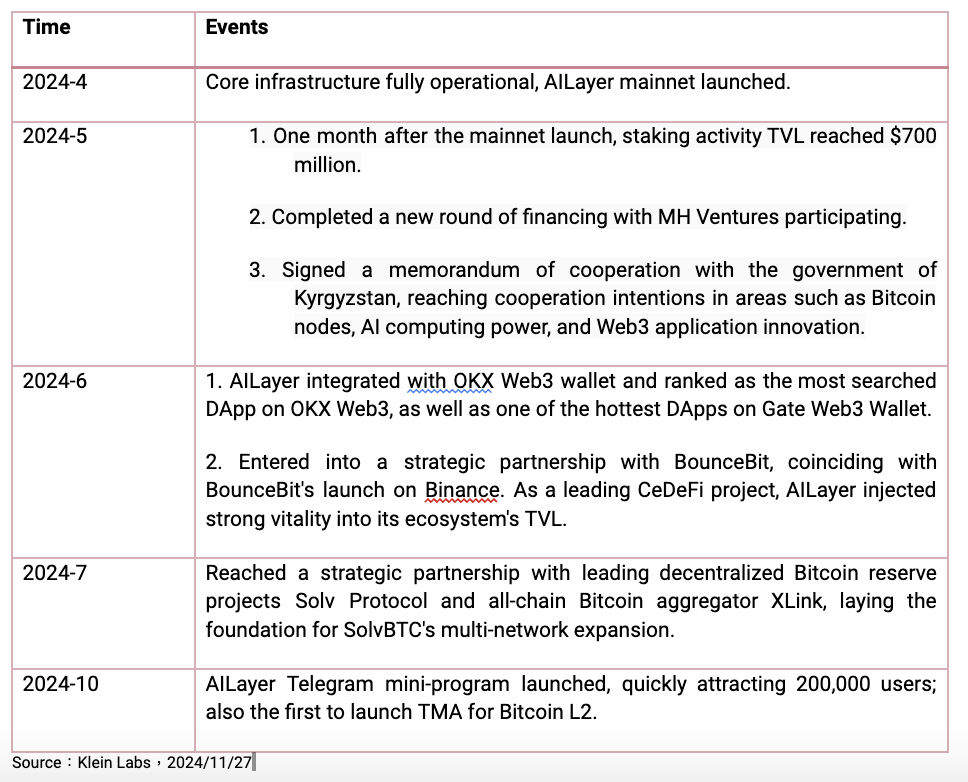

1.1.2 Important Time Points

Looking ahead, here are the key developments expected in the coming months:

Token Generation Event (TGE): The TGE will introduce the $AIL token to the public, marking a significant milestone for AILayer. The $AIL token will serve multiple utilities within the ecosystem, including governance, staking, and transaction fees.

Expansion of AI Hub: AILayer plans to launch the AI Hub, a central platform for training and deploying AI models. This hub will enable developers to leverage AILayer's infrastructure to create their AI applications, fostering a vibrant community of innovators.

Launch of AI Mining Controller: The AI Mining Controller will be launched soon, simplifying the mining process for AI models and allowing developers to earn rewards by contributing computing power to the network.

Further Development of AI Service Layer: The ongoing enhancement of the AI service layer will enable developers to create more complex AI applications, integrating features such as real-time data analysis and machine learning capabilities.

Partner Expansion: AILayer will actively seek new partnerships with emerging projects and established platforms to further enrich its ecosystem. Collaborations will focus on cross-chain compatibility, AI applications, and (DeFi) solutions.

Infrastructure for AI Agents: AILayer will serve as the infrastructure for the issuance of AI Agents, allowing them to be launched at a lower threshold through the AILayer public blockchain. Simultaneously, AI Agents will become assets on AILayer, gaining value through mechanisms similar to PumpFun's Bonding Curve. Furthermore, AILayer's ecosystem projects will provide a range of support for AI Agents, including AI-generated text, voice, images, and more.

1.2 Data Overview

1.2.1 Project-Related Data

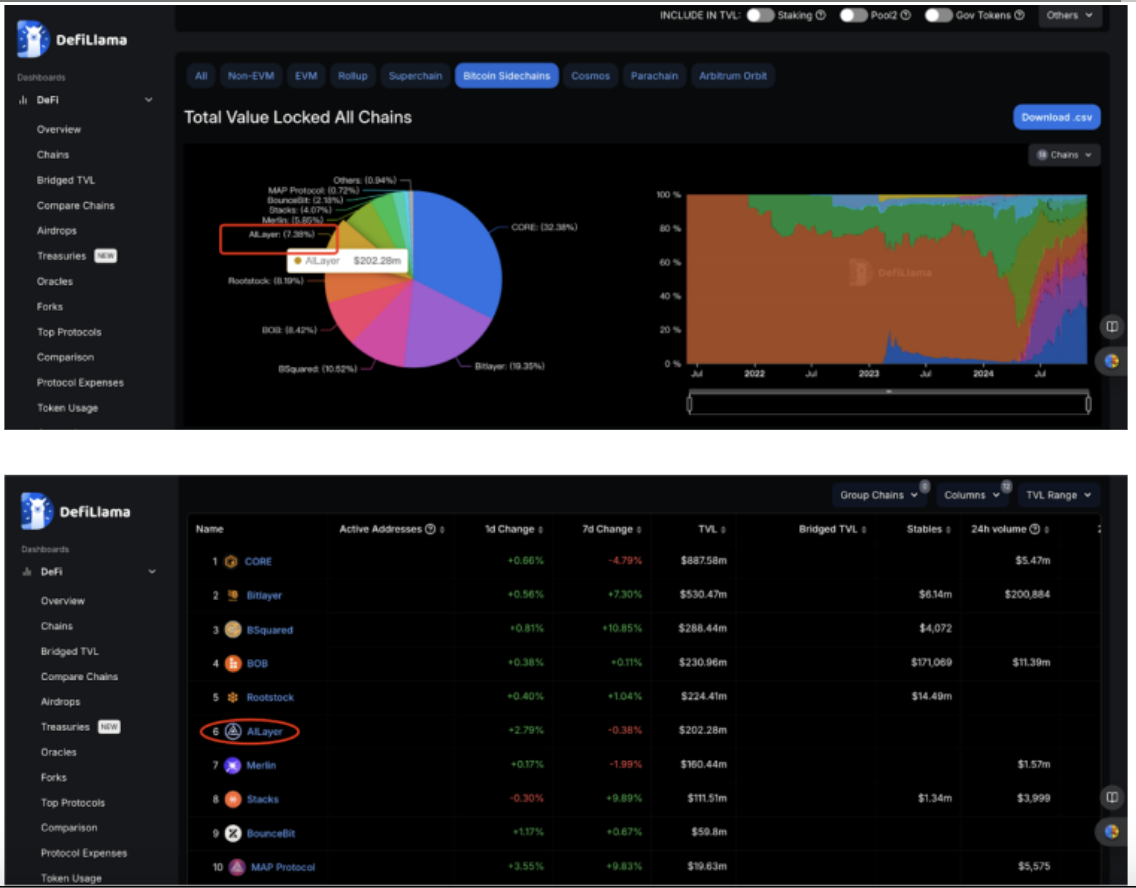

According to data from DeFiLlama, on November 14, AILayer's TVL surged to $200 million, making it the sixth-ranked Layer 2 project in terms of TVL within the Bitcoinecosystem. The top-ranked project in this ecosystem is BitFi, followed by DeSyn, AllinSwap, and Pell Network.

Although it has only been six months since the mainnet officially launched, AILayer has already achieved a total trading volume of 3.44 million, with the latest daily trading volume nearing 2,000. The number of wallet addresses has approached 1.03 million, and Bitcoin trading volume reached 1.84 million.

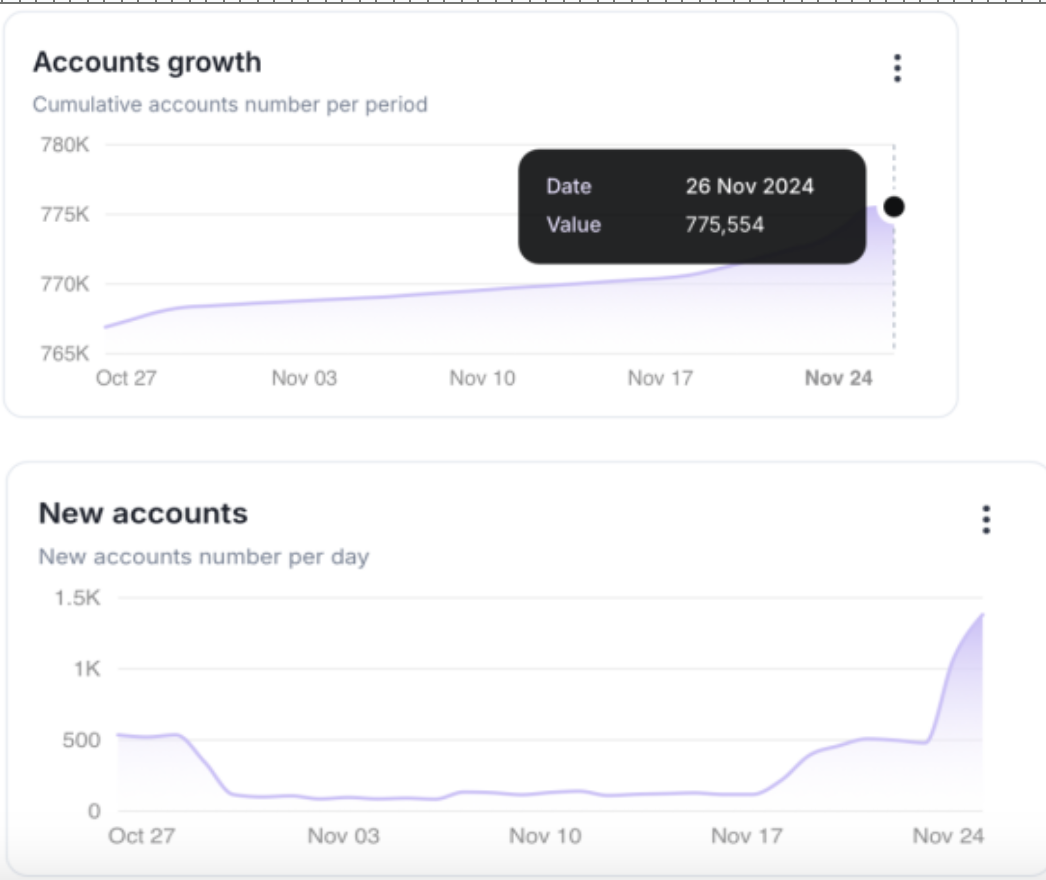

In terms of account numbers, there has been a significant growth trend over the past month, with the total nearing 800,000. Daily new account registrations have seen explosive growth in recent days, reaching approximately 1,500, which is more than three times the previous levels.

As of today, the AILayer ecosystem is experiencing exponential growth. AILayer boasts over 1,000,000 active addresses and more than 1.7 million transactions, along with over 100 ecosystem projects. Its total value locked (TVL) on the Bitcoin chain ranks 6th, slightly surpassing the previously popular Bitcoin Layer 2 network, Merlin Chain.

1.2.2 Social Media-Related Data

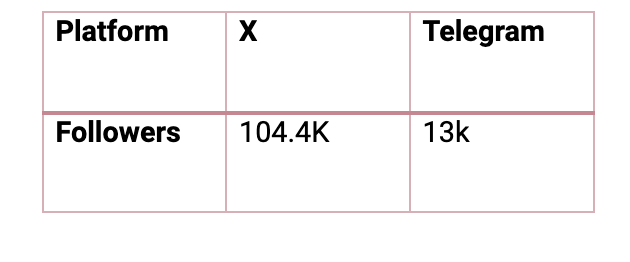

AILayer has accumulated over 100,000 followers on X and frequently updates its content. Below is a summary of specific data across various platforms:

Additionally, in terms of activities, AILayer holds weekly X Space sessions to engage in in-depth discussions with various project teams while actively interacting and communicating with the community, prioritizing community demands as the top priority. This is also one of the reasons why AILayer has a strong community culture.

Furthermore, AILayer is committed to expanding its global market presence. The company places particular emphasis on the Japanese and Korean markets by establishing dedicated Korean community sections for users in Japan and Korea, along with appointed ambassadors to address inquiries. Additionally, AILayer has made strategic moves in markets such as Indonesia, Bangladesh, Turkey, and Russia.

1.3 Technical Architecture

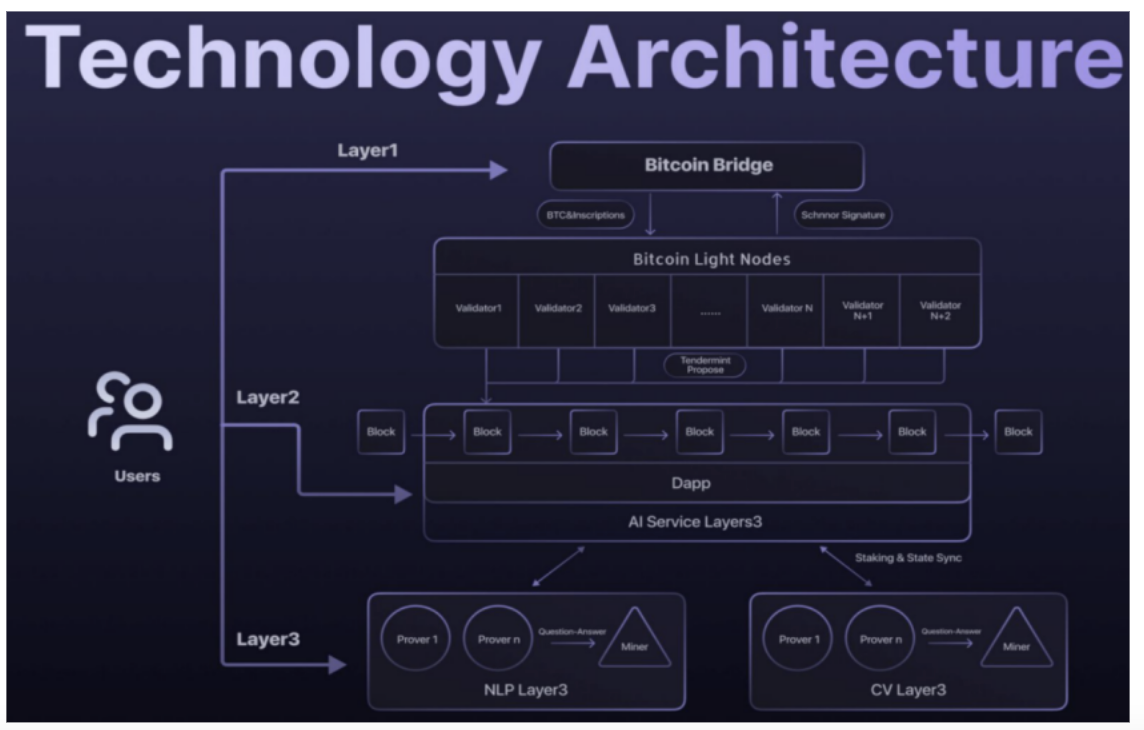

The technical path of AILayer balances the development of decentralized AI and Bitcoin while maximizing compatibility with the existing vast developer ecosystem. Built on the foundation of the Bitcoin network, AILayer establishes a three-layer architecture, which includes the Bitcoin mainnet, a Layer 2 settlement network, and an AI layer.

1.3.1 First Layer (Basic Layer)

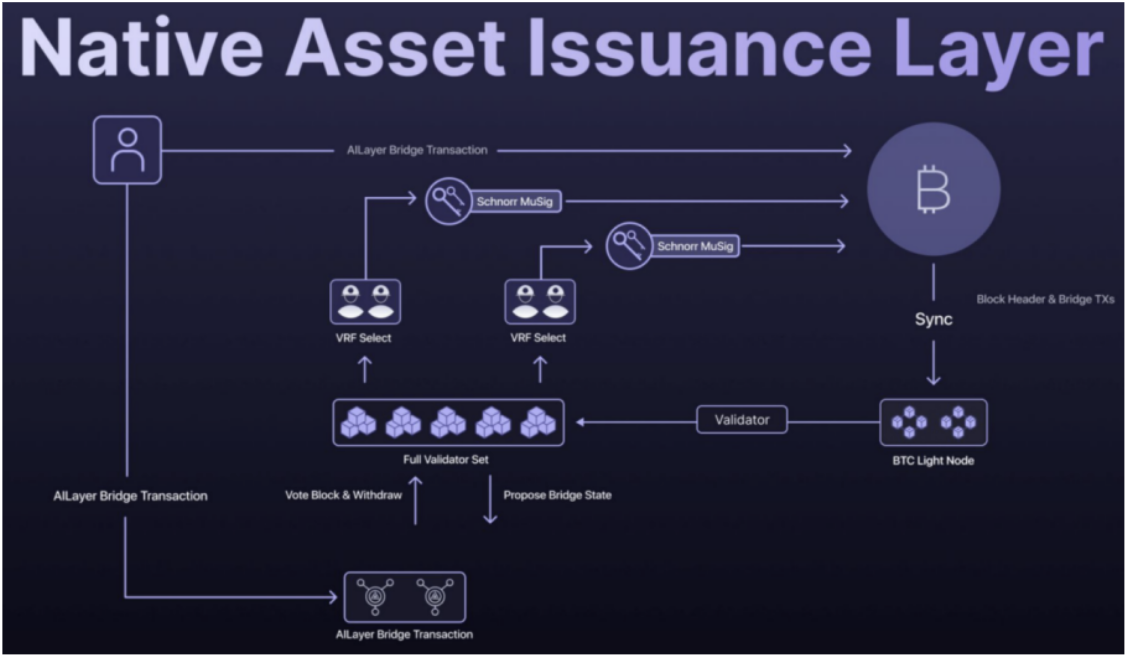

This is the foundational layer of AILayer, built on the security of Bitcoin (distributed ledger and mature consensus mechanism), providing a secure and immutable record for all transactions. At this layer, AILayer utilizes Bitcoin's native asset (BTC) as the primary medium for transactions and value transfers. Additionally, this layer supports the issuance and circulation of various Bitcoin-derived assets, laying the groundwork for a more diverse range of digital asset applications. Furthermore, the basic layer is responsible for the supervision and auditing of the entire AILayer system.

Moreover, the basic layer is also tasked with overseeing and auditing functions across the entire AILayer system. It is managed by a funding committee composed of 15 nodes. Each node corresponds to an independent shard stored in a Trusted Execution Environment (TEE), operated by large capital or security firms with very high security standards. Even if a shard is hacked, only fragmented data would be compromised, preventing any systemic threat to the overall system.

1.3.2 Layer 2 (Layer2)

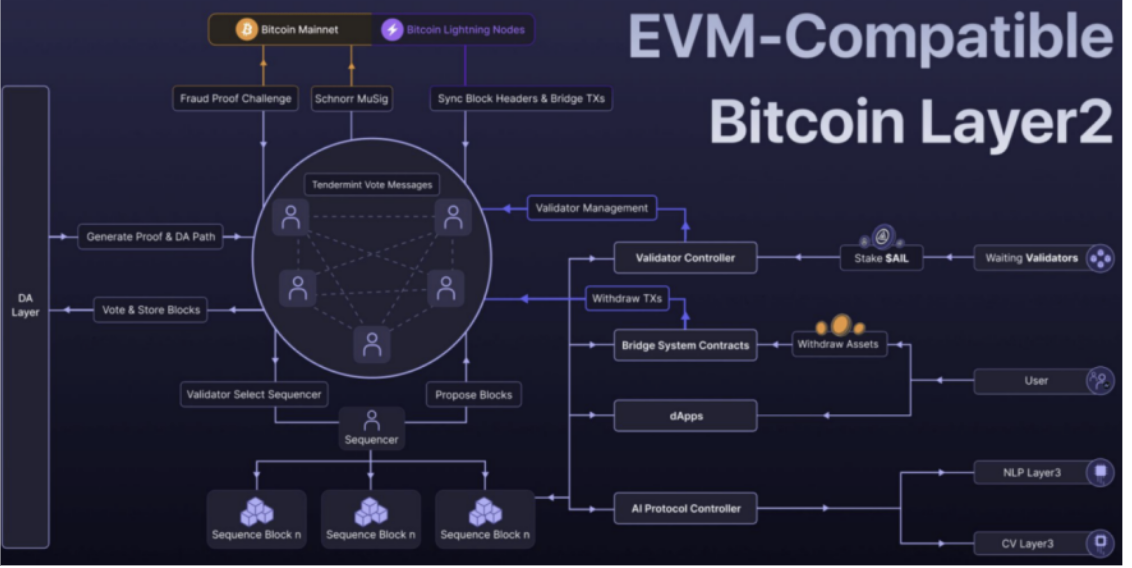

This layer serves as the core of AILayer, functioning as a Layer 2 solution for Bitcoin, utilizing advanced scaling technologies to enhance the performance and efficiency of Bitcoin transactions. The main functions of this layer include:

-

Increased Transaction Throughput: By introducing Layer 2 technology, the transaction speed of Bitcoin can be elevated from seven transactions per second to thousands per second, comparable to "light speed." This capability enables AILayer to meet the real-time and high concurrency demands of digital asset applications.

-

Optimized Transaction Costs: AILayer significantly reduces transaction fees, making it more affordable for a larger number of users.

-

Smart Contract Support: The layer provides support for decentralized applications (dApps), enhancing their flexibility and richness.

-

Cross-Chain Interoperability: AILayer's mainnet is compatible with the Ethereum Virtual Machine (EVM), allowing developers to leverage existing tools and smart contract functionalities within the AILayer ecosystem. This EVM compatibility not only simplifies the development process but also facilitates cross-chain interactions, broadening the scope for developers to create interoperable applications that connect Bitcoin with other blockchains. Additionally, AILayer's official cross-chain bridge utilizes decentralized nodes, achieving maximum realization of Satoshi Nakamoto's vision through secondary development based on the Map Protocol's decentralized protocol.

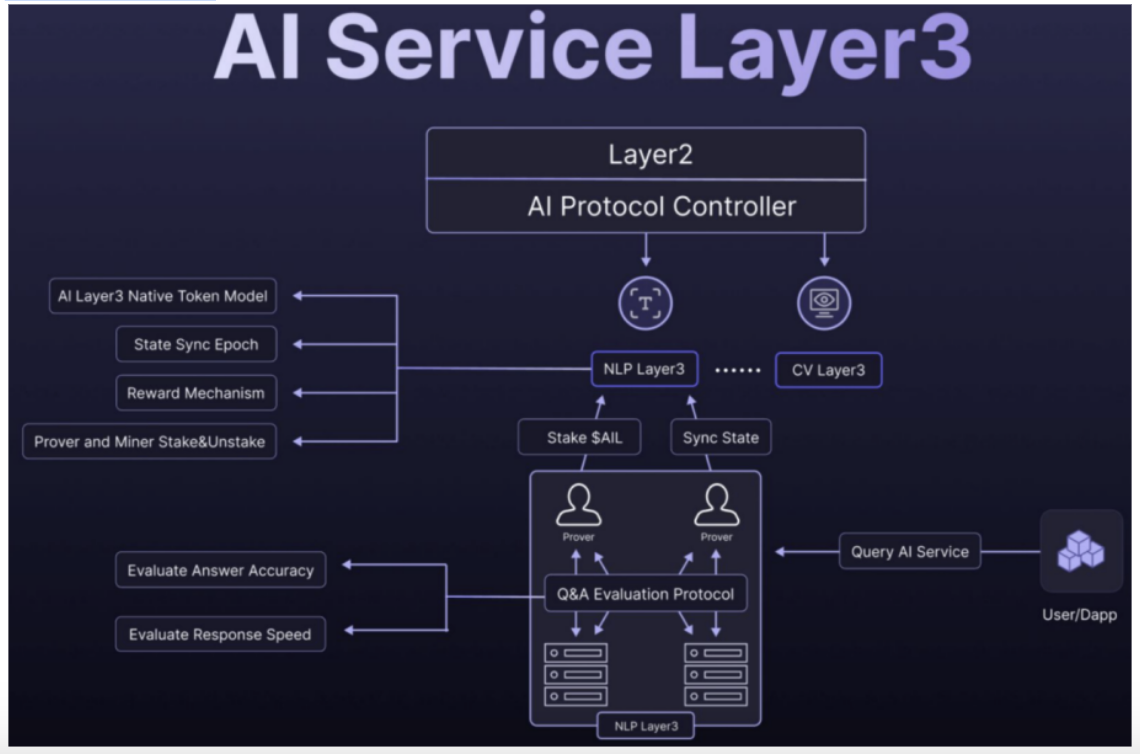

1.3.3 Layer 3 (AILayer)

This is the top layer specifically designed for AI services, responsible for hosting and executing artificial intelligence models. It supports decentralized applications that require advanced AI processing, including model training, high-performance computing, and secure asset management.

This layer is divided into multiple subnets based on the type of model, with each subnet aggregating a specific category of models. Each subnet functions like an "industrial cluster" in the AI world, providing targeted services to users. For example, the NLP Layer 3 subnet focuses on natural language processing models, while the CV Layer 3 concentrates on computer vision models, handling tasks like image recognition and object detection to support scenarios such as AI driving and medical image analysis.

Miners provide model training and hosting services by offering graphics cards and computing power in exchange for AILayer tokens as rewards. Additionally, there is a role known as Prover, which acts as a "judge" that scores the performance of graphics cards based on speed, accuracy, and other metrics, then uploads the results to the AI Protocol Controller (which manages miner registration, withdrawal, and scoring records). This scoring system is decentralized; the performance of each miner is evaluated by multiple Provers to ensure fairness and transparency, eliminating "behind-the-scenes manipulation."

When users make requests, Prover acts like a "waiter," selecting the best-performing graphics card from the top miners to fulfill the service. This approach not only guarantees high-quality service for users but also ensures that miners' contributions are fairly rewarded.

1.3.4 Object-Oriented Approach

Based on these characteristics, AILayer targets a very broad audience, including the following:

-

Web3 and AI DevelopersWeb3 and AI developers are seeking a robust infrastructure to create decentralized applications (dApps). AILayer serves as an excellent platform for them, supporting secure asset management, smart contract functionality, cross-chain interoperability, and high-performance AI services, all leveraging Bitcoin's security.

-

DeFi and dApp InnovatorsDevelopers in the DeFi space and the broader dApp ecosystem can utilize AILayer’s scalability and security to build applications with real-time transaction capabilities and minimal fees. The EVM compatibility of AILayer allows for easy porting of DeFi protocols and applications, facilitating new use cases that combine DeFi and AI.

-

Institutional Partners and Enterprise SolutionsEnterprises and institutions exploring blockchain-based AI solutions can benefit from AILayer's secure and scalable infrastructure. For instance, collaborations with entities in Kyrgyzstan exemplify the potential for government and institutional partnerships.

1.4 Business Model

Currently, AILayer primarily charges three main fees:

-

Transaction Fees: AILayer will charge a small fee for all transactions conducted on its platform, including but not limited to smart contract executions, asset transfers, and cross-chain operations. These fees will support the operation and maintenance of the network. As the ecosystem grows, the increasing transaction volume will provide the platform with recurring revenue.

-

AI Service Fees: Users can buy and sell various AI models and services here, such as GPU rentals. The platform will charge a service fee for each transaction to cover operational costs and technological development.

-

Staking Rewards: Users can stake tokens on the AILayer platform to earn rewards. AILayer will take a portion of the staking rewards as platform income. This staking mechanism not only enhances the network's security and stability but also provides users with additional income opportunities

1.5 Competitive Landscape

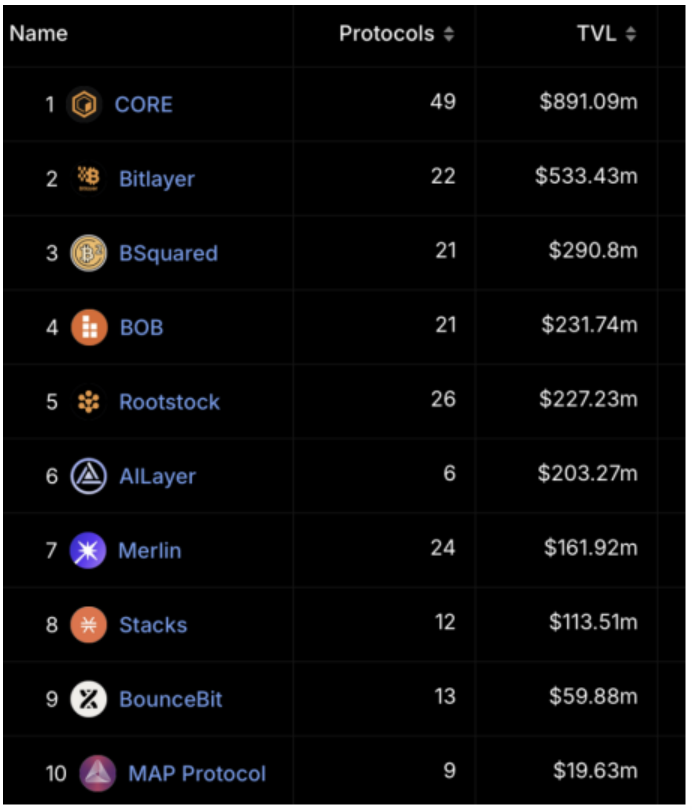

According to data from DeFiLlama, AILayer holds the sixth position on the Bitcoin chain with a total value locked (TVL) exceeding $200 million, slightly above the highly popular Bitcoin Layer 2 network, Merlin Chain. We categorize the top ten Bitcoin chains into two tiers based on TVL thresholds of $100 million and $500 million.

First Tier: CORE, Bitlayer

Second Tier: BSquared, BOB, Rootstock, AILayer, Merlin, and Stacks

In both tiers, we will select representative chains for comparative analysis.

1.5.1 CORE

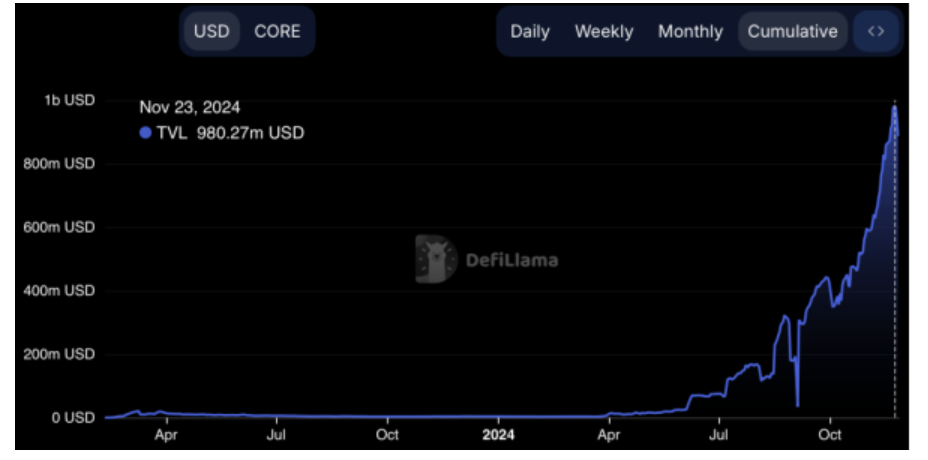

The Core Foundation and Core DAO were established in May 2022, with the mainnet launching in January 2023 and the $CORE token officially launching in February. In April, Core DAO partnered with Bitget and MEXC to launch a $200 million ecosystem fund. Currently, Core maintains the highest Total Value Locked (TVL) on the Bitcoin chain.

The Core Foundation is self-funded, comprising contributors such as Rich Rines (former Head of Transfer Engineering at Coinbase, founder and CEO of AutoReach), CJ Reim (Co-founder and Managing Partner at Amity Ventures, an investor in Ethereum's genesis block), Lindsey Haswell (former Chief Legal Officer at Blockchain.com and MoonPay, Regulatory Director at Uber), and Jack (who has 10 years of experience in blockchain and Web3 technology, previously a software engineer at BI). The foundation has garnered 2.28 million followers on X.

Core Chain stands out in the competitive landscape due to four key features:

-

Satoshi Plus: A novel consensus mechanism that combines Delegated Proof of Work (DPoW) and Delegated Proof of Stake (DPoS). DPoW is executed by Bitcoin miners and mining pools, who delegate existing Bitcoin hash power to validators chosen on the Core chain. DPoS allows CORE token holders to stake their tokens with selected validators on the Core chain. The combined hash power from DPoW and staked assets from DPoS helps calculate weighted scores to determine which validators are eligible for the next round of block creation. Currently, the weight ratio is two-thirds for hash power and one-third for staked assets, a variable set by Core DAO. This hybrid model separates block production from Bitcoin miners, eliminating any potential incentive for miners to censor the Core chain.

-

Core DAO: A decentralized autonomous organization that manages governance on the chain.

-

EVM: A modified Ethereum Virtual Machine used for executing smart contracts. Although originally designed for Ethereum, this environment has been adopted by many other networks including BNB, Avalanche, Arbitrum, Optimism, and zkSync.

-

coreBTC: The native bridge for Bitcoin within Core. The protocol includes a BTC bridge that locks BTC to mint coreBTC on the Core Chain.

Currently, CORE's TVL has shown a linear growth trend approaching $900 million, with Pell Network contributing the largest share at 43%.

1.5.2 Merlin Chain

Merlin Chain was established in 2023, and its $MERL token officially launched in April of the same year. Within just 50 days of its mainnet launch, the Total Value Locked (TVL) surpassed $3.9 billion, with 88% of this amount consisting of native assets such as BTC and Ordinals. In the first half of the year, the market capitalization of M-BTC reached $1.2 billion, making it one of the most popular Bitcoin chains this year.

As a pioneer in Bitcoin sidechains, Merlin integrates multiple sidechain technologies to enhance the functionality and scalability of the Bitcoin network. Through its innovative multi-signature and zero-knowledge proof (zk-proof) solutions, it ensures the security of funds and the reliability of the network. In terms of ecosystem development, Merlin has successfully built an active ecosystem by offering diverse asset entry methods and a wide range of financial activities, including lending, liquidity provision, and trading. Its applications focus on Bitcoin's native assets (such as Ordinals, BRC-20s, and Runes) and span various fields like DeFi, gaming, AI, and SocialFi, showcasing its leadership in expanding Bitcoin's role within the broader Web3 ecosystem.

AILayer and Merlin represent two intriguing developmental paths within the current Bitcoin Layer 2 landscape. AILayer focuses more on integrating AI with the Bitcoin ecosystem, aiming to achieve mutual empowerment between AI models and Bitcoin through zero-knowledge proofs (ZKP), cross-chain compatibility, and decentralized architecture. In contrast, Merlin concentrates on constructing an efficient and secure on-chain data verification mechanism that optimizes the generation and verification processes of zero-knowledge proofs while relying on Bitcoin's finality and decentralization.

Although they differ in goals and functionalities, both projects share certain technical commonalities. For instance, AILayer's ZKP solutions are similar to Merlin's Prover nodes in that both utilize decentralized networks to enhance computational power and security. Additionally, AILayer plans to introduce an AI mining controller aimed at incentivizing participants through network computing contributions, which logically aligns with Merlin's Prover mining pool architecture.

The distinction lies in AILayer's broader positioning; it not only deeply integrates the Bitcoin ecosystem with AI models but also accommodates EVM chains, thus enabling more possibilities for smart contract applications. Meanwhile, Merlin is more focused on foundational infrastructure development for Bitcoin Layer 2 by reinforcing on-chain data verification through multi-signatures and challenge mechanisms. This directional difference highlights the diversity within the Bitcoin Layer 2 space: AILayer expands application boundaries through AI technology while Merlin ensures system reliability via innovative data verification processes.

From a technical ecosystem perspective, AILayer demonstrates the limitless potential of combining Bitcoin with AI, whereas Merlin emphasizes the core value of decentralized verification within Layer 2 ecosystems. Whether exploring emerging technologies or optimizing underlying architectures, these projects contribute new imaginative possibilities to the Bitcoin ecosystem.

1.5.3 B² Network Overview

B² Network was established in 2022 as an EVM-compatible Rollup based on Bitcoin's zero-knowledge proof verification commitment. The Rollup data and zk-proof verification commitments are recorded on the Bitcoin network, ultimately confirmed through a challenge-response mechanism. In September, B² Network announced the completion of a new funding round led by Spartan Group, Animoca Brands, Alliance, and P2 Ventures.

The technical architecture of B² Network primarily consists of two layers: the Rollup layer and the Data Availability (DA) layer. This architecture can be understood simply: a virtual machine is needed to process user transactions, and there must be a place to store data and verify transactions.

In the Rollup layer, B² employs a zkEVM solution in collaboration with Polygon Labs to extend the Polygon CDK to Bitcoin. Through account abstraction, users can interact using either Ethereum or Bitcoin accounts, accommodating users accustomed to both ecosystems. Popular wallets like Unisat and MetaMask can continue to be used, thus lowering the learning curve for users. All user transactions are submitted and processed in the Rollup layer, where user states are stored. The network generates relevant zero-knowledge proofs, which are packaged and sent to the DA layer for storage and verification.

The DA layer includes decentralized storage, B² nodes, and the Bitcoin network for verifying Rollup's zero-knowledge proofs. It permanently stores copies of the Rollup layer's data and ultimately engraves this data onto the Bitcoin network through inscriptions.

In the Ethereum network, Rollups transfer Layer 2 network data into mainnet contracts via calldata for transaction validation and data storage. However, the Bitcoin network does not support automatic smart contract validation. ZK-Rollups write zero-knowledge proofs and aggregated data into Bitcoin via Taproot, ensuring that ZK-Rollup data is anchored in Bitcoin and remains immutable. Yet, it does not guarantee the validity or correctness of transactions within ZK-Rollups nor does it leverage Bitcoin's strong consensus capabilities to secure Layer 2 ZK-Rollups. Thus, B²'s approach involves writing zero-knowledge proof commitments on the mainnet, allowing challengers to dispute these commitments within a specified timeframe. If a challenge is successful, the Rollup will revert, and the challenger will win assets locked by nodes. If no challenges occur or if challenges fail within the timeframe, the Rollup receives final confirmation on BTC.

Overall, B²'s design incorporates several clever elements:

-

Account abstraction reduces user learning barriers by lowering asset access thresholds, enabling users to connect wallets based on where their assets reside.

-

The EVM compatibility of the Layer 2 network facilitates developer engagement and migration from Ethereum's ecosystem.

-

The overall strategy employs a hybrid model similar to zk+op using zk for data verification to lower transaction costs while adopting an op challenge model to mitigate limitations of BTC's verification capabilities.

In terms of ecosystem development, B² collaborates with leading projects. For instance, it uses Particle Network for account abstraction and partners with Raas’s AltLayer. Currently, it is working with Polygon Labs to create the first BTC use case for Polygon CDK.

Additionally, B² has launched a $1 million grant program to encourage developers to build on this emerging BTC Layer 2. The first round has already seen numerous projects receive grant sponsorships, including GlowSwap (a native DEX for BTC-related assets on B²), Protocol X (an Ordinals-based protocol aimed at helping more DApps and gaming applications establish asset systems within the BTC ecosystem), and L2scan (a block explorer focused on L2 Rollups). The vision of B² Network extends beyond merely being a BTC Layer 2; it aspires to become a central hub for BTC Layer 2 solutions akin to Cosmos Hub or Op Stack.

1.5.4 Stacks

Stacks is a Bitcoin Layer 2 solution that introduces smart contract functionality to Bitcoin without altering the Bitcoin protocol itself. The development of Stacks began in 2013 at Princeton University's Computer Science Department, initially branded as Blockstack. In 2017, it raised $52 million through an Initial Coin Offering (ICO) by issuing the STX token, and in 2019, it became the first cryptocurrency company to qualify for SEC regulations, raising an additional $23 million through Reg A and Reg S offerings. Currently, according to CryptoRank, Stacks has a total funding amount of $95 million, with notable investments from prominent venture capital firms in the crypto space such as IOSG, Blockchain Capital, and HashKey Capital. The STX token officially launched in 2019.

Stacks employs a pyramid architecture: at the base is the foundational settlement layer (Bitcoin), above which is the smart contract and programmability layer (Stacks), and at the top is a layer designed for scalability and speed (Hiro's subnet).

How Stacks Introduces Smart Contracts to Bitcoin

Stacks implements a new consensus algorithm known as Stacking. This mechanism utilizes a consensus method called Proof of Transfer (PoX), which ensures that Stacks blocks are immune to forks, achieving 100% finality on Bitcoin and inheriting its security features.

Additionally, the smart contract programming language Clarity, designed specifically for the Stacks blockchain, can access the state of the Bitcoin main chain. This allows smart contracts on the Stacks layer to read Bitcoin's state and be triggered by standard Bitcoin transactions. Consequently, transactions can settle on the Bitcoin chain in a trustless manner, verifying all smart contract and transaction records similarly to Bitcoin transactions.

Stacks also features an innovative decentralized mechanism called sBTC, which is pegged 1:1 with BTC. This mechanism aims to enable trustless writing to the Bitcoin blockchain within smart contracts, unlocking hundreds of billions of dollars in BTC assets.

According to on-chain data from DefiLlama, the total value locked (TVL) in Stacks and its ecosystem approaches $650 million. The top three projects include StackingDAO, ALEX, and Zest.

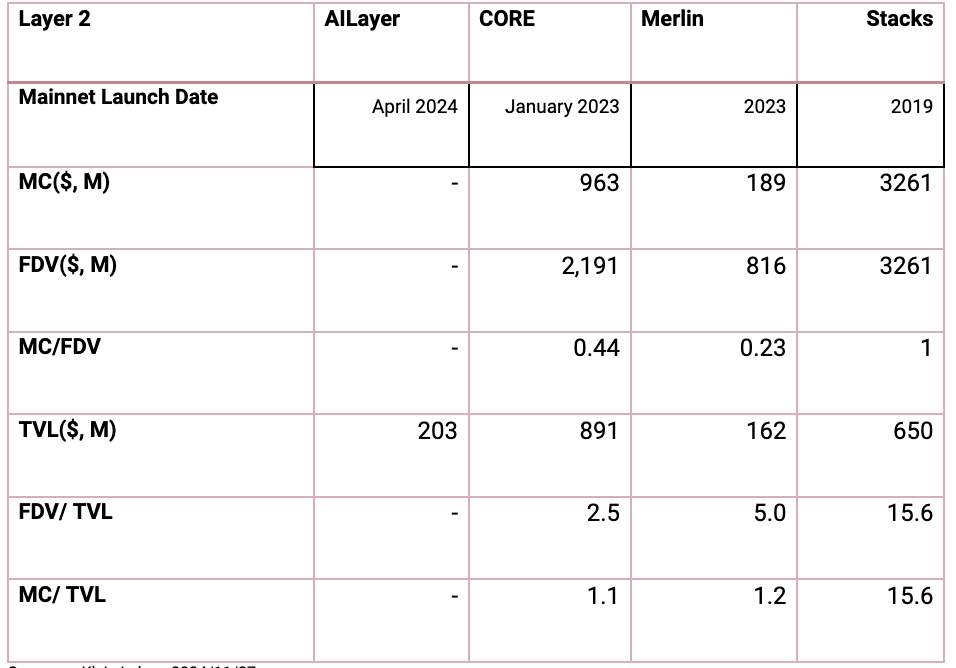

1.6 Preliminary Value Assessment

The token listing plan for AILayer is currently in preparation. Before its launch, it is worthwhile to examine and compare market data from other Bitcoin chains. At present, the value of CORE is at a highly cost-effective stage. As the newest entrant in the Bitcoin ecosystem, AILayer possesses unique technological advantages and narrative potential, which may lead to surprising performance in the market. From the perspective of Total Value Locked (TVL), AILayer's token is expected to align with that of Merlin, which operates in the same tier.

2. AILayer Ecosystem

The ecosystem of AILayer is the cornerstone of its success, with significant potential for user growth and a diverse range of projects developed on the platform. Specifically, AILayer's ecological projects are categorized into three main types: BTC-related, AI-related, and infrastructure-related.

Here, we will also analyze the leading projects within its ecosystem from these main categories.

2.1 BTC Track

2.1.1 BitFi

Project Overview: BitFi is a decentralized finance platform powered by artificial intelligence algorithms, offering lending and staking services. It is revolutionizing Bitcoin staking by providing real, sustainable returns. By combining advanced CeFi strategies with robust risk management, BitFi delivers low-risk, stable Bitcoin returns to its users.

Funding Status: In July, BitFi completed a seed funding round, the amount of which remains undisclosed, with a valuation of $50 million. Investors include Fundamental Labs and IBC Group Ventures.

X: @Bitfi_Org with over 30,000 followers.

2.1.2 DeSyn Protocol

Project Overview: Established in 2021 and launching its mainnet in 2023, DeSyn Protocol is a decentralized asset management platform (re-staking platform) that transforms the airdrop space through its unique D-Airdrops structure. It offers users low-risk, high-return yields while providing multiple DeFi protocol airdrop rewards through a single investment. In October, DeSyn Protocol officially partnered with AILayer, achieving a total value locked (TVL) of $1.3 billion just two days later on November 23.

Funding Status: DeSyn Protocol raised a total of $5.4 million across two funding rounds in 2021, with a post-funding valuation of $40 million. Investors include SNZ Holding and OKX Ventures.

X: @DesynLab with nearly 160,000 followers.

2.1.3 Map Protocol

Map Protocol serves as an interoperability layer across blockchains, built on ZK light clients. It acts as a gateway for developers and users within the Bitcoin ecosystem and facilitates interoperability between various Bitcoin Layer 2 solutions and both EVM and non-EVM ecosystems.

X: @MapProtocol with nearly 120,000 followers.

2.1.4 Solv Protocol

Project Overview: Solv is a decentralized platform allowing Bitcoin holders to utilize their BTC and earn yields through decentralized Bitcoin reserves. Users can earn points by holding SolvBTC and interacting with the SolvBTC ecosystem through staking and providing liquidity. Recently, Solv announced the launch of its token $SOLV and is preparing for its Token Generation Event (TGE).

Funding Status: After several funding rounds, the latest being a strategic financing round of $11 million completed last month, Solv Protocol has reached a valuation of $200 million. Investors include Nomura's subsidiary Laser Digital, Blockchain Capital, and OKX Ventures.

X: @SolvProtocol with nearly 300,000 followers.

2.1.5 Taker Protocol

Project Overview: Founded in 2021, Taker Protocol is a yield expansion layer built on the NPOL consensus mechanism. It provides liquidity and yields to the Bitcoin ecosystem through a strong incentive structure, while offering EVM compatibility and robust demand for Taker tokens.

Funding Status: The most recent funding round was a seed round on September 22, 2021, which raised $3 million.

X: @TakerProtocol, with nearly 190,000 followers.

2.1.6 Pell Network

Project Overview: Pell Network aims to create a decentralized token economy leasing platform for the Bitcoin ecosystem. By building a network that aggregates native BTC staking and LSD re-staking services, it allows stakeholders to choose verification based on new software modules constructed within the Pell Network ecosystem. Stakers can opt-in by granting Pell Network smart contracts additional conditions on their staked assets to enhance crypto-economic security. Pell Network currently supports various networks such as BNB Smart Chain and Core DAO, and has established partnerships with protocols like Lorenzo Protocol and Solv Finance. Since its launch in September, Pell's TVL has shown significant growth, surpassing $600 million.

Funding Status: In October, Pell completed a pre-seed funding round, raising $3 million from investors including Mirana Ventures.

X: @Pell_Network, with nearly 200,000 followers.

2.2 AI Track

2.2.1 CycleX

Project Overview: CycleX is an innovative platform focused on Real-World Assets (RWA), offering a comprehensive suite of features, including real-time RWA market data, tokenized fund issuance, and advanced decentralized exchange (DEX) trading. CycleX has launched AI-themed RWA funds on the AILayer platform.

Funding Status: CycleX has signed strategic cooperation agreements with several SPAC sponsors to jointly issue a tokenized fund worth $15 million.

2.2.2 PublicAI

Project Overview: PublicAI is a decentralized marketplace specializing in AI data annotation, founded by a team with extensive experience in AI algorithms, including members from the Chinese University of Hong Kong's Institute of Future Networks. In February and March of this year, it partnered with Amazon Web Services (AWS) and AI data service provider ABAKA.AI, becoming the first AI+Web3 project to join the Amazon Cloud Incubator. It has also received support from the Solana Foundation and Foresight Ventures.

Funding Status: In April, PublicAI completed a private fundraising round, though the amount remains undisclosed.

Social Media: X: @PublicAI_, with 110,000 followers.

2.2.3 NGPU

Project Overview: NGPU is a decentralized AI computing network dedicated to providing cost-effective and stable GPU resources for various AI applications. With innovative features such as task-based billing, intelligent resource allocation, and efficient data transmission, NGPU enables permissionless access, low latency, and high reliability in AI-driven services. It is also an AI ecosystem partner of ICP.

Social Media: X: @ngpu_ai with nearly 220,000 followers.

2.2.4 Sweety.AI

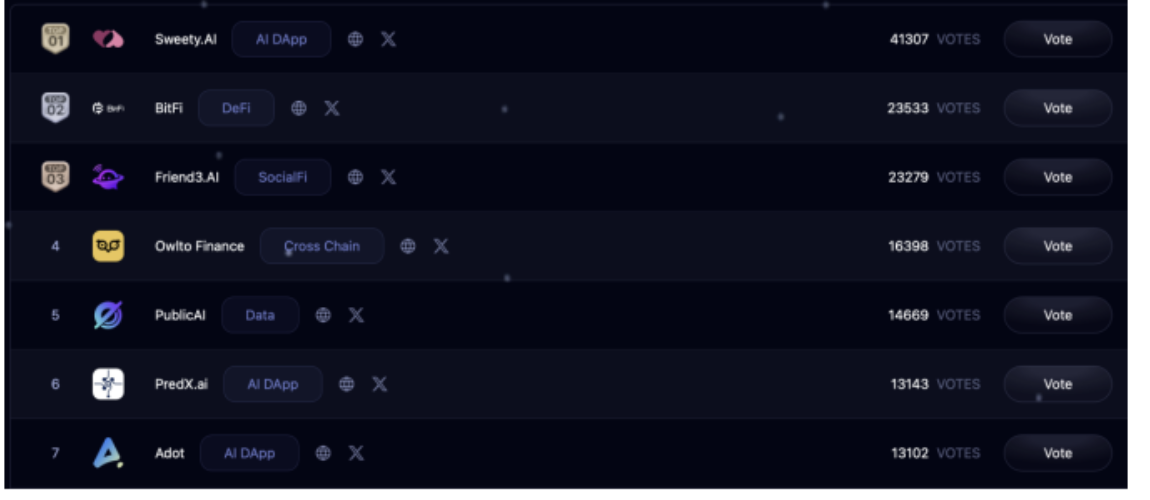

Project Overview: Sweety.AI is a blockchain-based, AI-driven open immersive SocialFi platform where users can create their own AI agents for chat interactions. Currently, it leads in the AILayer DApp incubator with over 40,000 votes.

Social Media: X: @SweetyAI_Labs, with nearly 30,000 followers.

2.2.5 4EVERLAND

Project Overview: 4EVERLAND is a Web3 cloud computing platform that integrates decentralized protocols and networks such as IPFS, Arweave, and DFINITY. It provides developers and Web3 projects with core capabilities for decentralized storage, computing, and networking, creating a connection layer between the underlying decentralized storage layer and application layer.

Social Media: X: @4everland_org

2.2.6 PredX

Project Overview: PredX.ai is an AI-driven prediction market built on a mini-program platform within Telegram. It allows users not only to predict events but also to feed back the prediction results into models.

Social Media: X: @PredX_AI

2.3 Infra Track

2.3.1 SpaceID

Project Overview: SPACE ID is developing a comprehensive platform for discovering, registering, trading, and managing Web3 domain names. Its token has already been launched on Binance.

Twitter: @SpaceIDProtocol - Nearly 800,000 followers.

2.3.2 Tomo Wallet

Project Overview: A social wallet supported by Polychain that offers all-in-one functionality.

Twitter: @tomo_wallet - 210,000 followers.

2.3.3 Particle Network

Project Overview: A leading Layer 1 solution backed by Binance Labs, designed to unify all chains through universal accounts and address user and liquidity fragmentation in Web3.

Twitter: @ParticleNtwrk - Nearly 900,000 followers.

2.3.4 UXLINK

Project Overview: UXLINK is the largest Web3 social platform and infrastructure globally, enabling users and developers to discover, distribute, and trade crypto assets in a unique social and group-based manner. It is currently very popular in the South Korean market.

Twitter: @UXLINKofficial - Over 1 million followers.

2.3.5 ZkLink Nova

Project Overview: A multi-aggregator Layer 3 zkEVM network that has formed a strong partnership with AILayer to collaborate on cross-chain interoperability and ecosystem empowerment.

Twitter: @zkLinkNova - Nearly 180,000 followers.

2.3.6 Owlto Finance

Project Overview: Focused on decentralized cross-chain interoperability protocols for Layer 2, Owlto Finance supports cross-chain transactions across over 60 networks within the BTC, ETH, SOL, AVAX, and Ton ecosystems, boasting over 2 million users from more than 200 countries. In late April, it integrated with AILayer to enable seamless bridging of $BTC across AILayer and other networks like Ethereum, Arbitrum, BNB, BTClayer2, and Merlin.

Funding Status: Completed a strategic financing round of $8 million in May this year and announced a new funding round in July at a valuation of $150 million, with participation from Matrixport among others.

Twitter: @Owlto_Finance - Nearly 350,000 followers.

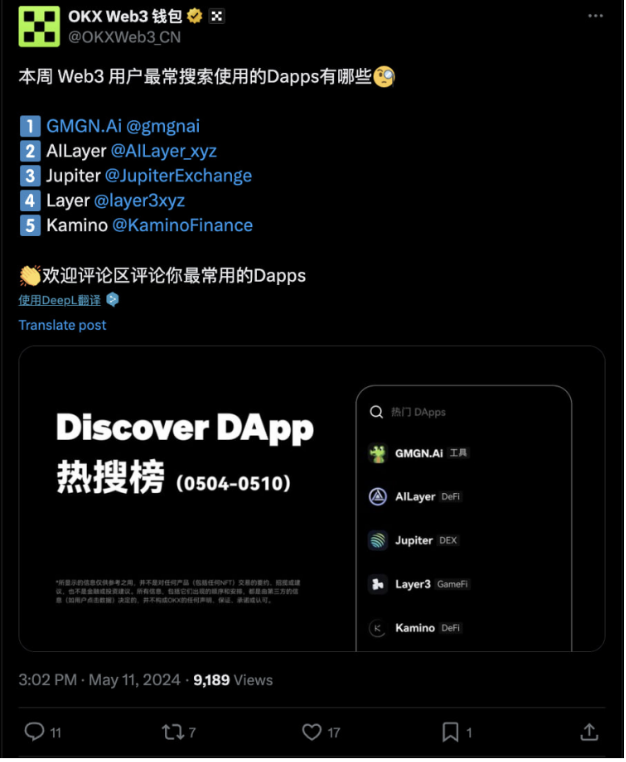

Additionally, AILayer has integrated various mainstream Web3 wallets and established strategic partnerships, including an airdrop incentive campaign with the OKX Web3 wallet, frequently ranking among the top dApps on the OKX Web3 wallet platform.

2.4 Other Efforts in Ecological Activity Construction

AILayer is committed to cultivating a vibrant ecosystem where developers, users, and stakeholders can contribute and collaborate.

2.4.1 Social Activities

To actively enhance brand awareness, AILayer has implemented comprehensive social and promotional activities. Users have the opportunity to earn points by creating, replying to, and quoting tweets, as well as by inviting friends.

Additionally, daily check-ins and adding (💜AILayer) to their X account usernames also allow users to earn points each day.

The first phase of AILayer's social activities lasted two weeks and attracted over 140,000 users. The second phase saw participation from more than 200,000 individuals. These initiatives successfully raised awareness of the AILayer ecosystem and encouraged user engagement.

2.4.2 Staking Activities

Users can stake their Bitcoin assets to earn rewards, calculated using the formula: Daily TVL Points = Base Points + Invitation Points + Reward Points, where Base Points = Number of Assets Staked That Day * 10,000.

In this staking activity, users can create their own teams and invite others or join existing teams. Each team is limited to 1,000 members. Inviting or joining other teams using a code will also yield additional points.

2.4.3 DApp Incubator

Projects within the AILayer ecosystem can encourage user voting by offering various rewards, thereby improving their ranking and visibility. Users can earn "boost points" through voting. According to the official website, the top-ranked projects currently are Sweety.AI and BitFi.

2.4.4 Strategic Cooperation

AILayer has signed a strategic cooperation agreement with the Ministry of Digital Development of Kyrgyzstan, becoming the third Web3 project globally to enter into a contract with a Central Asian government, following Binance and Tether. This agreement sets a precedent for the adoption of blockchain and AI at the government level.

2.4.5 Product Innovation

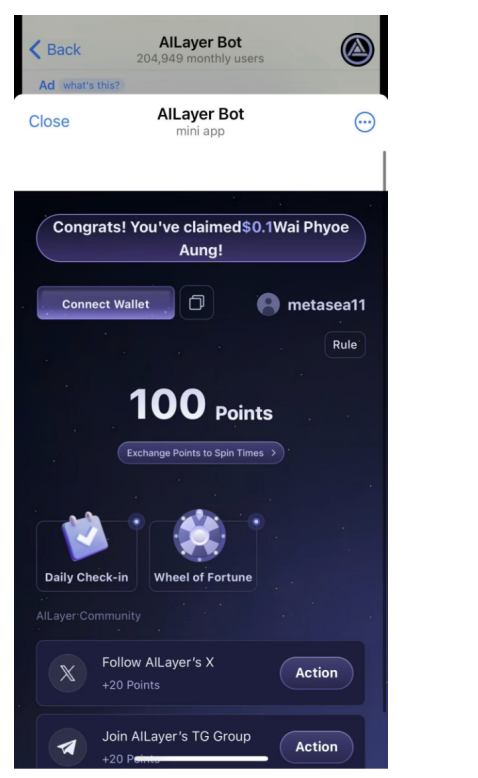

AILayer has also made innovative strides in responding to market demands. It is the first Bitcoin Layer 2 network to actively integrate with the Telegram ecosystem through its launch of the Telegram Mini app, connecting hundreds of millions of Telegram users seamlessly to the AILayer ecosystem. This initiative aims to enhance user engagement, foster community development, and reward active users through real-time incentives, including earning $AIL tokens, winning prizes in lotteries, and participating in leaderboards; since its launch, it has attracted over 200,000 users.

Key Features of AILayer's Telegram Mini App:

-

Earn Points through Tasks and Spins: Users can complete tasks to earn points that can be converted into $AIL tokens. Additionally, they can spin a fortune wheel for a chance to win prizes, with jackpots reaching up to $500.

-

Referral Earnings: One of the app's standout features is its referral earnings mechanism, allowing users to invite friends to join the platform. Users earn points each time a friend registers using their referral link, which can later be redeemed for rewards.

-

Leaderboards and Rankings: Users can track their progress on leaderboards that rank participants based on the number of successful referrals accumulated over two weeks. Those who invite the most friends will improve their rankings, with top-ranked users receiving significant rewards.

Additionally, AILayer will launch the infrastructure for the issuance and trading of AI Agents, marking a significant product innovation in the AI Agent sector. Users will be able to issue their own AI Agent assets and discover value through a specific bonding curve. Furthermore, AILayer's ecosystem projects will provide a range of support for AI Agents, including AI-generated text, voice, images, and more.

3. Highlights Summary

In just over six months since its mainnet launch, AILayer has demonstrated remarkable data and strong development momentum, showcasing unique competitiveness in the intersection of Bitcoin Layer 2 and AI. Here are the multiple highlights of AILayer: Deep Integration of AI and Bitcoin Layer 2 The "AI + Blockchain" narrative that AILayer embodies is currently at an unprecedented market peak. By leveraging Bitcoin's ecological advantages, AILayer has not only timed its technological and market developments perfectly but has also maintained industry interest through continuous technological innovations. AILayer employs a modular design that combines the security of the Bitcoin network with the efficiency of AI computation, supporting distributed computing needs for various AI applications while achieving cross-chain interoperability between Bitcoin and EVM chains. This integration enhances Bitcoin's programmability and allows for the efficient application of AI's powerful computational capabilities within the blockchain ecosystem. Strong Partnerships and Capital Support AILayer has secured strategic investments from several renowned international institutions, including Amber Group and Waterdrip Capital, further validating its potential in technology and ecosystem development. Additionally, a strategic agreement with the Kyrgyzstan Ministry of Digital Development positions AILayer as a significant representative of Web3 innovation in Central Asia. Solid Total Value Locked (TVL) and Maturing Ecosystem AILayer boasts a TVL exceeding $200 million, showing consistent stability as the sixth-largest Bitcoin Layer 2, indicating substantial future growth potential. The ecosystem is continually integrating BTC, AI, and related applications, providing ongoing infrastructure for linking both ecosystems. Clear Future Roadmap AILayer plans to launch over 100 AI models in Q1 2025 and introduce the AI Odyssey application to build an open AI Hub platform. Future expansions will focus on enhancing interoperability with other blockchain ecosystems and collaborating with more governments and enterprises to implement blockchain and AI solutions globally. Additionally, infrastructure for AI Agents will be one of the methods through which AILayer aims to capture more high-quality assets. Technical Audits and Security Assurance Through comprehensive audits by the leading security audit team ScaleBit, AILayer ensures the safety and stability of its technical architecture, providing a reliable environment for developers and users. AILayer's ultimate vision is to deeply integrate Bitcoin—the world's most valuable network—with AI—the most advanced productive force—enabling Bitcoin to provide autonomy, security, and revolutionary capabilities to AI while allowing AI to confer intelligence, scalability, and applicability to Bitcoin. We believe that the intersection of these two domains represents a beacon of human civilization's progress.