1. Perps: From Off-Chain to On-Chain

In Web3, 'Fully On-Chain' is widely regarded as the gold standard. By leveraging blockchain ledgers to establish ownership of assets and transparently record all transaction activities, this process rides the historical wave of decentralization, relentlessly churning the tides of wealth 24/7. Though the on-chain ecosystem may resemble a dark forest, it is the very soil upon which we depend for survival. It is an indisputable fact that blockchain is propelling the advancement of human financial civilization.

Against this backdrop, the migration of Perpetual Contracts (commonly referred to as "Perps") trading onto the blockchain represents a market opportunity with immense growth potential. Unlike traditional futures, Perps have no expiration date and can be held indefinitely, earning them the moniker "perpetual." Their high leverage, flexibility in switching between long and short positions, and other features have made them highly popular among Web3 investors. For instance, imagine a scenario where a sudden event occurs, and an investor, based on their trading experience, determines a high likelihood of a bullish outcome for Bitcoin. They execute a highly leveraged long position. As the event’s impact unfolds, this investor reaps substantial profits from the trade. The ability to generate significant returns with minimal capital is one of the key advantages of Perps. This also explains why, within traditional CEX, Perps have formed a highly active market with annual trading volumes reaching trillions of dollars.

However, the perpetual futures trading venues provided by CEXs are fraught with numerous drawbacks. Compared to Perps on centralized platforms, on-chain Perps offer several distinct advantages:

-

Self-Custody & Security

In the on-chain Perps model, user assets remain in their personal wallets at all times, achieving full self-custody and ensuring fund security. All transaction data is stored on-chain, allowing users to trace it anytime, guaranteeing transparency. In contrast, CEXs centralize user assets in platform-controlled wallets, exposing them to significant risks in the event of hacks or malicious actions by the platform (e.g., recurring incidents of exchange theft). Furthermore, CEXs often impose withdrawal limits and other rules that diminish users’ control over their assets.

-

Simplified Trading Process

CEXs typically require users to complete multiple steps—depositing, transferring, and withdrawing funds—potentially prolonging the process due to unsupported currencies. In contrast, Perp DEXs operate directly from users’ wallets, eliminating the intermediary steps of CEXs and significantly enhancing trading efficiency and convenience.

-

Transparency and Risk Control

Perp DEXs execute all transactions on-chain, ensuring full transparency and eliminating manipulative practices like "pinning." This significantly reduces the risk of fund misappropriation. The FTX collapse, where $32 billion in value vanished due to mismanagement, highlights the risks of off-chain matching and settlement on CEXs.

-

System Stability & Resilience

Perp DEXs rely on smart contracts for execution, avoiding liquidity-related withdrawal bottlenecks. Many platforms also support multi-chain functionality, reducing dependency on a single blockchain and enhancing overall system stability, thereby safeguarding user funds.

-

Regulatory Restrictions

Strict regulations in some regions restrict access to CEXs or limit their functionality. Perp DEXs, as decentralized platforms, allow users to trade crypto assets seamlessly with just an internet connection, bypassing these barriers.

These advantages have fueled the growth of on-chain trading, not only for spot markets but also for Perps. In this trillion-dollar market, early players like GMX and DYDX have laid the groundwork, while next-generation platforms like KiloEx are driving innovation and setting new standards for on-chain trading.

2. Bottlenecks on the Chain: Gas Fees

Although on-chain systems offer numerous advantages compared to CEX, they also come with certain drawbacks. For instance, the high gas fees on-chain represent an unavoidable issue. CEX platforms, due to their centralized data processing, can achieve lower friction costs. In contrast, on-chain systems require users to contribute gas fees to nodes for every operation, thereby maintaining the stability of the overall network. The existence of gas fees has become a constraint for some users. So, how can this problem be addressed to provide users with a better trading experience?

Two approaches can be considered. The first is to offer users subsidies for gas consumption. While this method achieves a zero-gas experience for users, it has two shortcomings: on one hand, it introduces transaction delays; on the other, the platform effectively bears the transaction costs. When high-frequency trading occurs, the platform incurs significant cost expenditures, preventing it from maximizing value to feed back into the ecosystem.

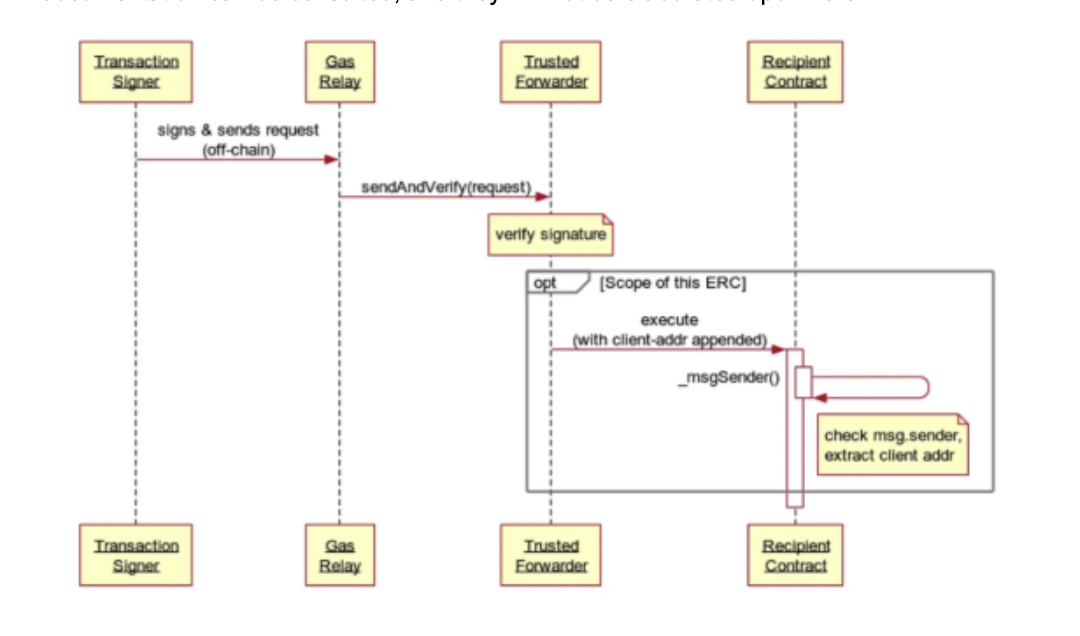

The second approach, adopted by KiloEx, involves innovation at the smart contract level. Currently, the primary methods for achieving gasless transactions are the EOA-Based Paymaster based on EIP-4337 and the Meta-Transaction approach under ERC-2771. KiloEx has opted for the latter technical pathway. For specific technical details, relevant documentation can be consulted, and they will not be elaborated upon here.

In simple terms, KiloEx uses smart contract innovations to offer near-zero gas fees, providing a CEX-like trading experience. Naturally, this approach remains exploratory on some non-EVM blockchains, but it has largely been achieved on mainstream EVM-compatible chains such as opBNB, BSC, and Base.

Beyond this, KiloEx introduces additional innovations to enhance the trading environment, including:

-

One-Click Trading: The KiloEx 1CT wallet streamlines the process by eliminating the need for users to interact with their wallets during trades, enabling highly efficient one-click transactions. With the introduction of a transaction authorization mechanism, users no longer need to manually sign each trade; instead, the 1CT wallet automatically handles transaction submissions, significantly boosting trading efficiency.

-

Extreme Optimization of Trading Speed: Through innovations at the code and contract levels, KiloEx dramatically reduces the time required for transactions, currently outperforming over 90% of Perp DEXs in terms of speed.

3. Features and Mechanisms of KiloEx’s Products

After recognizing the inevitability of migrating from off-chain to on-chain systems and addressing the shortcomings of on-chain trading experiences, we can truly begin to evaluate the value of KiloEx and affirm its mission as a landmark product. Guided by its product philosophy of “CEX-level experience, DEX-level control,” KiloEx is reshaping the usability standards of perpetual contract trading.

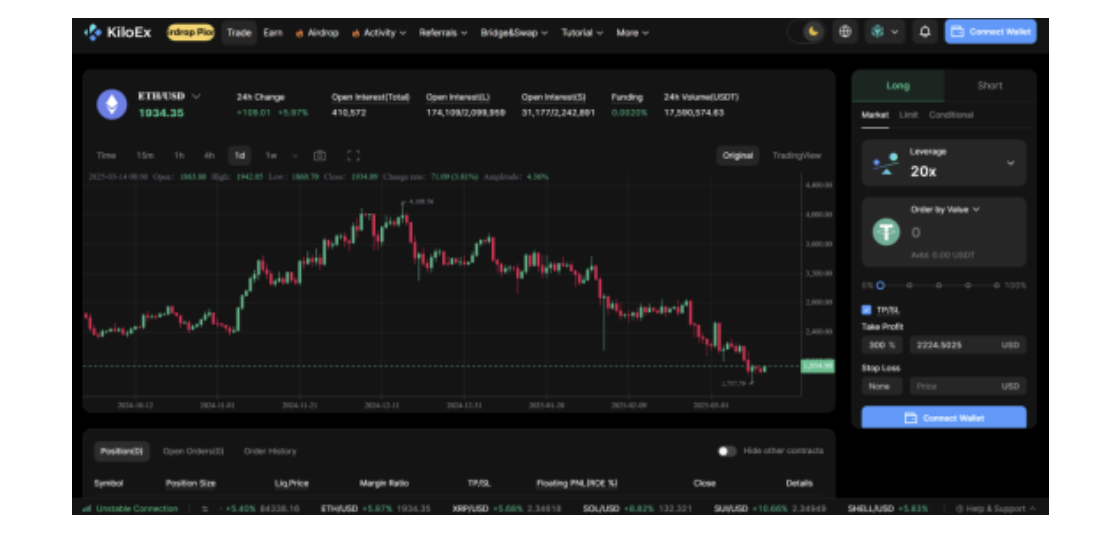

As the champion project of Binance Labs’ Season 6 Most Valuable Builder (MVB) program, KiloEx offers a fully decentralized perpetual contract protocol, providing up to 125x leverage trading for over 70 cryptocurrency assets (including BTC, ETH, meme coins, DeFi tokens, AI-concept assets, and forex trading pairs). Leveraging its unique Vault pool model, KiloEx achieves a breakthrough in liquidity efficiency and profit stability. It currently ranks first in TVL and trading volume across all tracks on opBNB, while consistently leading the derivatives sector on Manta and Taiko, rapidly establishing itself as a benchmark protocol for multi-chain derivatives DEXs.

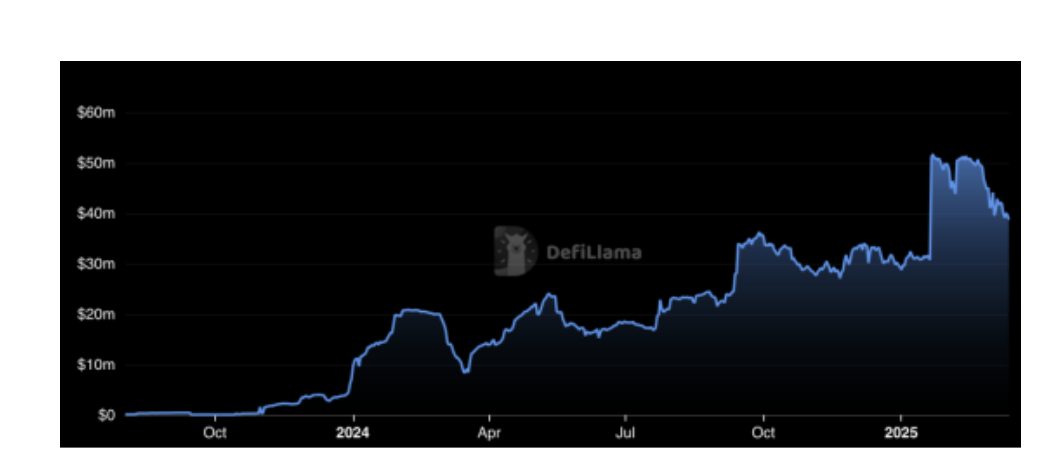

To date, KiloEx has recorded a cumulative trading volume exceeding $34 billion, with an average daily trading volume across various chains totaling approximately $100-200 million. The platform boasts nearly 800,000 total users, with over 1 million users on its Telegram application. Since its launch, KiloEx’s TVL has continued to rise, peaking at $50 million and currently standing at nearly $40 million.

In addition to what was mentioned earlier about gas fee optimization and transaction performance improvement, there are the following product features:

3.1 Dual-Pool Risk Isolation Architecture

KiloEx replaces the traditional order book model with a liquidity pool (LP) mechanism, eliminating slippage entirely. However, a single liquidity pool may struggle during extreme market conditions. To address this, KiloEx implements a dual-pool structure to mitigate liquidity risks:

-

Base Pool: Comprised of 70% USDT/USDC deposited by users and 30% of the platform’s transaction fee revenue, it provides a stable income foundation with an annualized yield of 22% on the opBNB chain (29% on the Taiko chain).

-

Buffer Pool: Absorbs fluctuations in trading profits/losses and funding rate income/expenses, acting as a cushion for the Base Pool. Only when the Buffer Pool is depleted will the Base Pool bear losses, significantly enhancing the stability of stakers’ returns.

With the launch of Vault 2.0 in Q1 2024, KiloEx introduced a dynamic rebalancing mechanism. During bullish one-sided uptrends, surplus from the Buffer Pool is converted into reserves for the Base Pool, reducing the impact of extreme market conditions on staking yields. Real-world data shows that during Bitcoin’s breakthrough above $70,000, yield volatility was reduced by 63% compared to older versions.

3.2 Innovative Profit Distribution

KiloEx’s dual-pool structure enables an innovative profit distribution model. Thirty percent of users’ transaction fees are contributed to the Vault, providing a stable growth source. When traders realize profits, funds are disbursed from the Buffer Pool; when they incur losses, funds are injected into the Buffer Pool. Base Pool stakers consistently receive a share of the transaction fees, and the long-term positive accumulation in the Buffer Pool forms a profit “safety cushion,” enabling yields to outperform mainstream yield aggregators (such as Yearn and Convex) during bear markets.

KiloEx also draws inspiration from CEXs by establishing a multi-tiered commission rebate system, currently boasting over 1,700 first-level nodes. After deducting 30% of the user's transaction fees for the Vault, 20-40% is returned to the channels. This mechanism is one of the key reasons behind KiloEx’s exponential growth. Unlike CEXs, KiloEx leverages smart contracts to secure this revenue for its channels, fostering mutually beneficial growth.

Following the issuance of KILO tokens, users can mint xKILO tokens at a 1:1 ratio and stake them to share in transaction fees and unlock VIP privileges. Additionally, xKILO will be used to incentivize users and partners in operational activities, as well as for treasury and other purposes. Transaction fees will be distributed among the xKILO single-sided staking pool, the ecosystem, and liquidity pools. All referral rewards and profits from copy trading will be paid directly in USDT for transaction fees. Specifically, 40% of transaction fees will be allocated to the ecosystem, 30% to xKILO holders, and the remaining 30% to liquidity pools.

3.3 Hybrid Vault

KiloEx's Hybrid Vault enables users to provide liquidity with a diverse range of cryptocurrencies, optimizing the capital structure while delivering substantial returns for LST (Liquid Staking Tokens) and other mainstream assets. The Hybrid Vault consists of two parts: USDT accounts for half of the Vault's total value, while other cryptocurrencies (non-USDT) make up the remaining half. The source of these high returns stems from the transaction fees provided by users within the Vault model.

For mainstream assets such as BTC, BSC, and MANTA, KiloEx's Hybrid Vault achieves a real yield of up to 12.87% for WBNB settled in USDT on the opBNB network, and a real yield of 16.21% for FDUSD. For non-mainstream tokens, KiloEx similarly offers relatively high real returns. For example, STONE holders on the Manta network can stake their assets in the KiloEx Hybrid Vault and earn approximately 8% in real USDT returns.

KiloEx has also developed coin-margined trading contracts, where the fees, margin, and Vault in contract trading can all be denominated in any project’s native token, further lowering the barrier to issuing contracts. Following a successful TGE, KiloEx will introduce a staking feature, allowing users who participate in staking to receive a share of the transaction fees. This will further reduce the circulating supply of KILO, creating a deflationary effect with a positive feedback loop.

3.4 Multi-Chain Deployment

To break down inter-chain barriers, KiloEx has deployed on multiple mainstream blockchains, including BNB Chain, opBNB, Manta, Taiko, and Base, with built-in cross-chain bridging functionality. This allows users to seamlessly switch networks, reducing gas costs while enjoying a smooth cross-chain trading experience. Currently, KiloEx is the largest application on opBNB. Plans are underway to expand to chains like Solana and Move-based blockchains, ultimately achieving multi-chain interoperability and unifying underlying liquidity.

3.5 User-Friendly Experience

For novice users, KiloEx offers a minimalist trading interface that hides complex parameters like funding rates and position sizes, condensing the process of opening and closing positions into three steps or fewer. Even in cases of liquidation risk, its partial liquidation mechanism only reduces positions proportionally, preventing users from losing their entire principal due to a single market fluctuation.

4. KiloEx Team and Funding

The KiloEx team combines CEX expertise with DeFi innovation, standing out in the derivatives DEX space with its strategy of "pragmatic speed and long-term dedication." Supported by Binance Labs incubation and a culture of efficiency, KiloEx has built a strong moat through its product, resources, and experience. In the future, if KiloEx can maintain technological iteration while increasing transparency, it may further attract institutional capital and mainstream users.

4.1 Team Background

The KiloEx team is composed of core members from top-tier exchanges such as Binance and OKX, bringing extensive experience in CEX operations, DeFi protocol development, and traditional financial derivatives design. In 2022, the team, with a modest size of 5-6 members, participated in the sixth cohort of the Binance Labs MVB (Most Valuable Builder) incubation program. Leveraging their exceptional ability to transform product prototypes into tangible solutions, they earned the prestigious title of MVB and subsequently secured investment from Binance.

4.2 Execution Culture

KiloEx consistently upholds a pragmatic and efficient cultural ethos, advocating a "minimalist execution" approach to work. For instance, during the incubator phase, when a Binance Labs mentor suggested developing a product landing page, the team completed the design and deployment overnight, delivering a fully functional page by the following day—an execution efficiency that far surpasses industry standards. Furthermore, KiloEx adheres to a low-profile, deep-rooted development strategy, recognizing that the core of the DEX sector lies in fostering long-term user trust rather than relying on short-term traffic hype. The team firmly believes in the enduring potential of perpetual contract DEXs and asserts that only through continuous product refinement and the establishment of a robust channel ecosystem can true Mass Adoption be achieved.

4.3 Funding

In its early stages, KiloEx secured strategic investment through the Binance Labs MVB incubator, with funding from investors including Yzi Labs (formerly Binance Labs), Foresight Ventures, Crescendo Ventures, and the Manta Foundation. Unlike competitors reliant on capital accumulation, KiloEx impressed Binance with its clear understanding of the sector and formidable team execution capabilities. Notably, its rapid product validation during the incubation period served as a critical advantage.

5. Competitive Analysis

5.1 Overview

TVL is a key metric for evaluating Perp DEX platforms, reflecting scale and user trust. As an emerging player, KiloEx has quickly reached a TVL of $40 million, a significant milestone in the Perp DEX sector. According to DefiLlama's Perp DEX rankings, KiloEx ranks 8th in 24-hour trading volume and 9th in 7-day trading volume, solidifying its position among the top Perp DEXs.

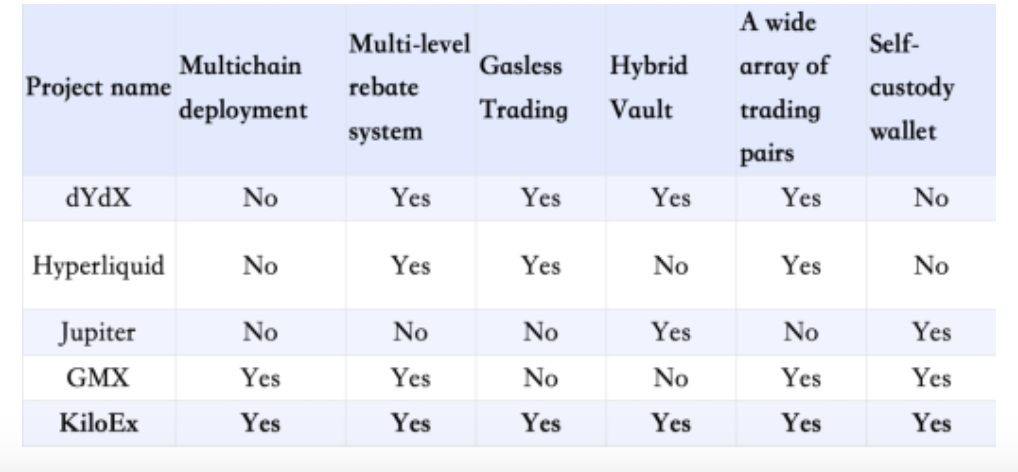

5.2 dYdX

dYdX is one of the earliest decentralized cryptocurrency derivatives platforms, offering perpetual contract and margin trading services. At its peak in 2022, dYdX reached a TVL of nearly $1.2 billion, but its TVL significantly declined during the subsequent bear market. The launch of dYdX V4 in 2024 revived its on-chain trading volume, though it has yet to regain previous peak levels. As competition in the decentralized derivatives space intensifies, dYdX faces growing challenges from other Perp DEXs.

dYdX’s hybrid model—combining an off-chain order book with on-chain settlement—presents two major drawbacks:

-

Centralization Risks: Off-chain order matching lacks transparency, as users cannot verify trades in real time. Additionally, centralized control over the order book introduces the potential for price manipulation.

-

Liquidity Constraints: During periods of low order book depth, large trades can cause sharp price fluctuations, impacting trade execution quality.

In contrast, KiloEx employs a fully on-chain AMM model. Its optimized price curves allocate liquidity efficiently while eliminating the risk of centralized market maker manipulation. By aggregating prices from oracles and applying a dual-vault point-to-pool mechanism, KiloEx offers zero-slippage trading and has demonstrated no price pinning or downtime to date, ensuring stability and fairness.

5.3 GMX

GMX is a leading Perp DEX platform, and its V2 version introduced a multi-asset pool, reducing risk and increasing trading capacity. However, this leads to liquidity fragmentation. KiloEx’s Hybrid Vault model offers greater liquidity aggregation, enhancing trading depth and capital efficiency.

5.4 Hyperliquid

Hyperliquid is a decentralized trading platform designed for high-efficiency trading, with core advantages being transaction speed and zero gas fees. However, it operates exclusively on its native L1 blockchain, limiting its adaptability in a multi-chain ecosystem. KiloEx, on the other hand, supports six networks, including BSC, OpBNB, Base, and Manta, and plans to integrate with Solana in its next phase.

Hyperliquid’s strategy design carries significant risks, as high-leverage traders can exploit margin strategies, potentially causing substantial losses for LPs. KiloEx mitigates such risks through its dual-vault mechanism, which absorbs initial losses during extreme market conditions.

5.5 Jupiter

Jupiter excels in Solana’s trading aggregation sector, handling over half of the trading volume. However, it supports fewer tokens and lacks a robust user marketing mechanism. KiloEx, in contrast, supports a variety of tokens across multiple chains and has implemented a comprehensive referral and trading competition incentive system.

Jupiter also suffers from higher fees due to its aggregator model, while KiloEx maintains low fees through wallet authorization and gas fee subsidies.

5.6 Competitor Summary

After comparing several leading Perp DEXs, KiloEx demonstrates clear competitive advantages:

-

0 Gas transactions

-

A trading-friendly environment that matches the order placement experience of CEX

-

Oracle protection ensures zero slippage for coins like BTC and ETH, with stable prices, no pinning or downtime, guaranteeing user fund safety

-

A refined mechanism that enables win-win outcomes for both traders and stakers during one-sided market trends

-

Hybrid Vault offers a diverse range of assets with yields surpassing typical DeFi protocols

-

Supports multiple chains and holds a significant position in the ecosystem

6. The Future of On-Chain Trading

The market is evolving through challenges. While TGE (Token Generation Event) is the finish line for many projects, KiloEx sees its upcoming TGE as a new beginning. Our vision encompasses the vast potential of on-chain trading. While CEX giants dominated the off-chain era, the on-chain era’s race for supremacy is just starting. It is only within a vast market space that truly great projects can emerge.

The rise of KiloEx is no accident. Anchored by the principle of “CEX efficiency, DEX trust,” it has carved out a structural breakthrough in the derivatives track. While the market debates whether DEXs can overtake CEXs, KiloEx has already provided the most straightforward answer: a 29% annualized yield on-chain, cross-chain transactions completed in seconds, and daily derivatives liquidation volumes reaching tens of millions of dollars.

This may well be the ideal form of Web3 finance: no need to compromise between efficiency and security, where all value ultimately finds its wildest yet most rational outlet.