Summary

Driven by policy relaxation, active capital, and widespread public participation, South Korea is rapidly emerging as a key growth hub in the global cryptocurrency market. Compared to Singapore’s tightening regulations and the slower development in Hong Kong and Japan, South Korea demonstrates stronger policy enforcement and market momentum.

TL;DR:

-

Explosive Market Growth In 2024, South Korea’s total crypto market capitalization surpassed $74.8 billion, with the top five exchanges managing assets worth $73 billion. Daily trading volume in December soared to $10.7 billion, exceeding that of South Korea’s two major stock exchanges. The unique “Kimchi Premium” phenomenon (with premiums up to 10%) reflects the exceptionally high enthusiasm of domestic investors.

-

Economic and Social Drivers Limited investment channels: Weak performance in real estate and stock markets has driven funds toward highly volatile crypto assets. Korean won depreciation and low interest rates: Expectations of currency devaluation and loose monetary policy accelerate crypto asset allocation. Social psychology: Increasing wealth anxiety among young people positions cryptocurrencies as a “fast track” for social mobility.

-

User and Ecosystem Characteristics Nationwide participation: Approximately 25 million investors (nearly half the population) across all age groups, with a significant proportion of middle-aged and high-net-worth individuals. Highly concentrated exchanges: UPbit and Bithumb dominate 98% of the market share, while domestic projects known as “Kimchi coins” are highly favored. Chaebol deep involvement: Giants like Samsung and Kakao are engaged in public blockchains, exchanges, and hardware, driving a closed-loop ecosystem.

-

Future Trends Favorable policies: New President Lee Jae-myung promotes crypto ETFs, Korean won stablecoins, and STO pilot programs, with tax reforms postponed. Innovation tracks: DeFi, AI combined with blockchain, and RWA (Real World Asset tokenization) are key development directions. Global implications: The Korean model balances compliance and innovation, potentially becoming a benchmark for Asia’s crypto hub.

South Korea’s market prosperity fundamentally results from the combined effects of economic structure, social sentiment, and policy orientation, offering the global crypto ecosystem a unique example of “high activity + strong localization.”

1. Introduction

While the global cryptocurrency market is trending towards stability, South Korea continues to stage an "alternative prosperity" characterized by active trading and high enthusiasm.

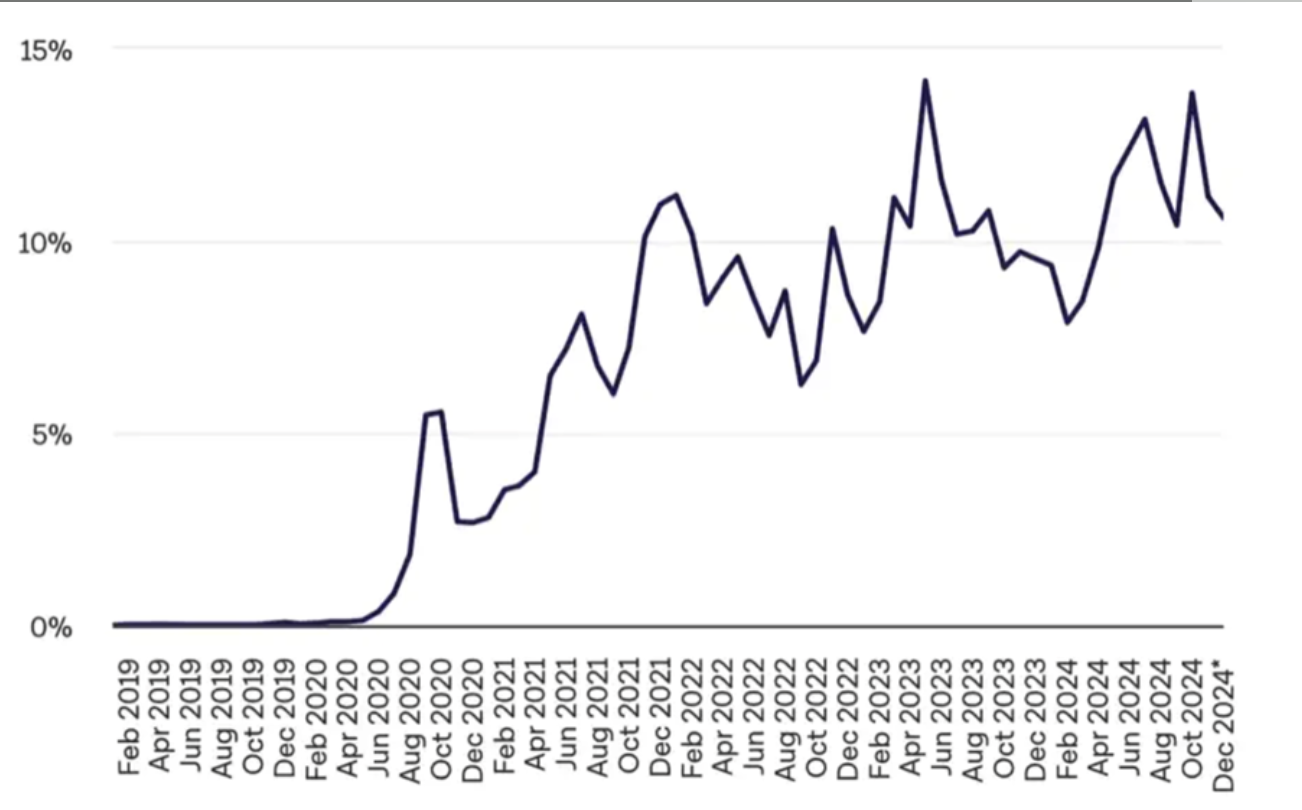

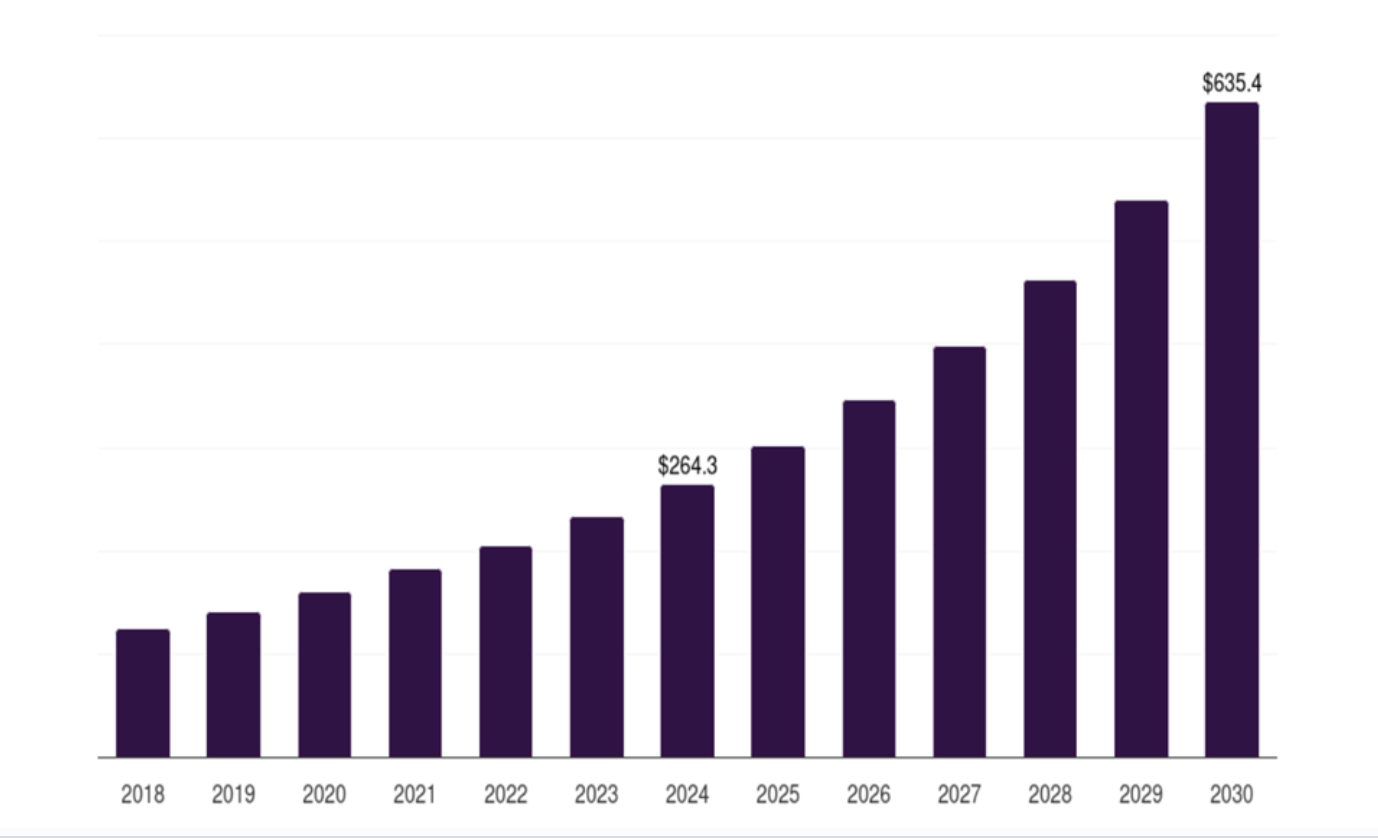

According to the "Annual Payment Settlement Report" released by the Bank of Korea on April 21, 2024, the total market capitalization of the South Korean market exceeded 100 trillion won (approximately $74.8 billion) by the end of 2024, with the five major domestic exchanges collectively managing $73 billion in assets. The average daily trading volume in December surged from $2.38 billion in October to $10.7 billion, surpassing the two major Korean stock exchanges in just two months. The annual revenue of the South Korean cryptocurrency market is expected to grow from $264.3 million in 2024 to $635.4 million in 2030, with a compound annual growth rate of 16.1%. As of April 2025, 25 million people have been confirmed to have opened accounts on virtual asset exchanges to invest in cryptocurrencies. Approximately half of South Korea's 51 million population has invested in the cryptocurrency market.

More notably is South Korea's unique "Kimchi premium" phenomenon, referring to the significantly higher prices of cryptocurrencies (such as Bitcoin and Ethereum) on Korean exchanges compared to other major global exchanges. In March 2024, this premium reached 8.5%, and in November it briefly peaked at 10%, far higher than the global average, reflecting extremely high enthusiasm from local investors and arbitrage demand under capital controls.

The massive capital flow, broad user base, and unique market price differential effect have collectively shaped the high activity and extraordinary enthusiasm of the South Korean cryptocurrency market, making it appear like a "gold country" of the digital era in the global crypto landscape.

Why has the South Korean cryptocurrency market exploded so rapidly? We will analyze this digital hotspot from three dimensions—driving factors, current landscape, and future opportunities—to explore the deep logic behind it: How have political and economic structures fostered strong risk aversion and speculative demand? How has the local ecosystem evolved from the "Kimchi premium" to a daily trading volume of $10 billion, creating world-leading trading vitality? Looking ahead, which tracks and innovations will continue to drive the South Korean market forward? Next, let's delve into this phenomenal prosperity.

2. Analysis of the Hot Korean Crypto Market

2.1 Economic Reasons

Limited Investment Channels

Within the framework of consumer choice theory, individuals allocate limited resources among different asset classes to maximize expected returns. When traditional investments like real estate and stocks face high prices, declining returns, poor liquidity, and high entry barriers, investors naturally seek alternative assets with higher marginal utility.

In Korea, traditional investment channels face structural challenges:

- Real Estate:

2023 South Korea’s economic growth was only 1.4%. Although it rebounded to 2% in 2024, consumer and investment sentiment remain weak.

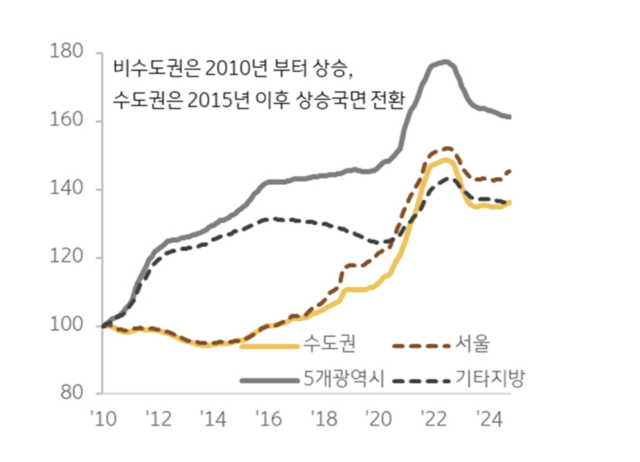

Against this backdrop, housing prices continue to stay high, revealing structural imbalances. Since 2010, prices in the capital region have risen 47.1%, while the five major metropolitan areas saw increases of 76.5%. In 2024, transaction volume in the capital region dropped 7.5% year-on-year, and Seoul experienced three consecutive months of decline from August to October (20.1%, 34.9%, 19.2%).

Facing high property prices, high loan rates, high interest rates, and low transaction volumes, traditional real estate no longer possesses widespread investment appeal, with market participation enthusiasm noticeably cooling. Young people and lower-income individuals have limited access to property ownership, driving them toward emerging investment channels like crypto assets with high volatility and high expected returns.

- Stock Market:

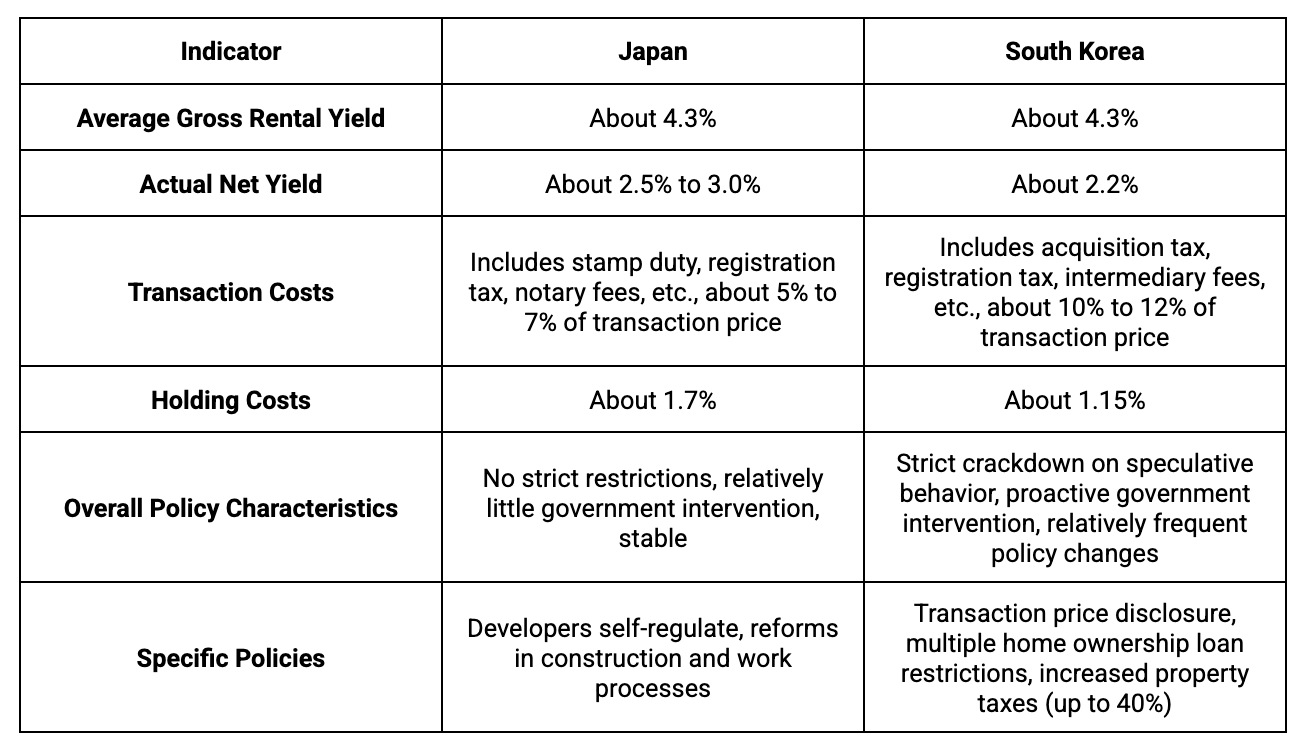

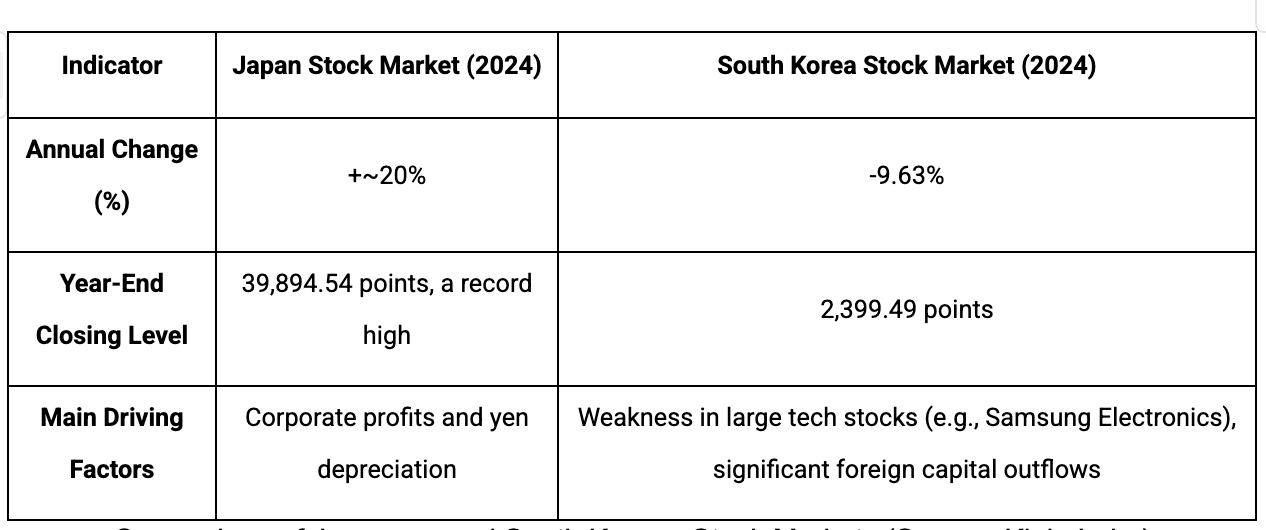

In terms of the stock market, in 2024, the KOSPI (Korea Composite Stock Price Index) fell by 8.03%, significantly underperforming compared to the Shanghai Composite Index, which rose by 12.68%, and the Nikkei 225, which increased by 17.06%. Meanwhile, the S&P 500 also surged, resulting in a 32.3% performance gap between the two markets and the Korean market, the highest since 2000. Amid a global stock market recovery, the Korean market exhibited an “isolated downturn (고립된 약세)” situation. Investor confidence has been significantly shaken.

Against the backdrop of the continued sluggish performance of the traditional Korean stock market and weak expectations for returns, some Korean investors have begun to turn their attention to the cryptocurrency sector, which offers higher volatility and greater potential returns.

Low interest rates and loose monetary conditions

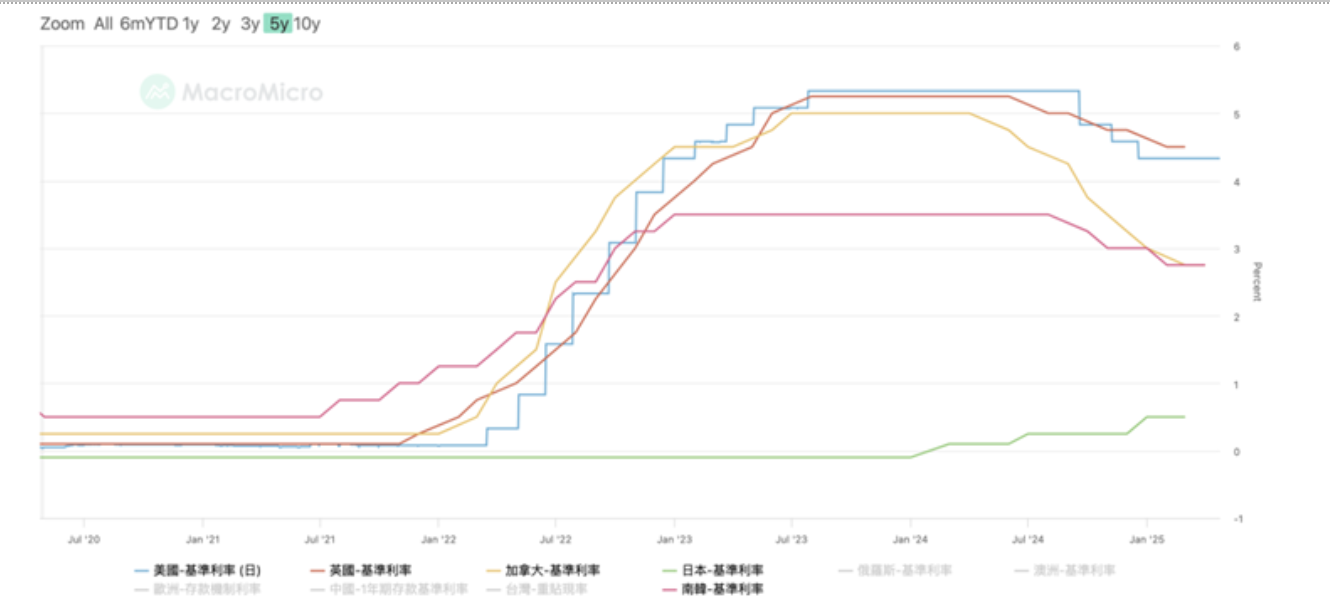

The long-term loose monetary policy and low-interest-rate environment have prompted Korean investors to accelerate their shift toward high-yield assets. Since the pandemic, the Bank of Korea’s benchmark interest rate has remained at 3.5%, significantly lower than the U.S. Federal Reserve’s rate of over 5%, leading to reduced attractiveness of savings and real returns that struggle to counter inflationary pressures.

Against this backdrop, the demand for high-volatility, high-return assets has increased. Cryptocurrencies, with their strong return potential, low entry barriers, and high liquidity, have become the preferred investment choice for risk-tolerant investors, particularly younger demographics. Overall, the low-interest-rate policy, while diminishing the appeal of traditional financial instruments, has further driven capital flows toward crypto assets.

Expectations of Korean won depreciation

In recent years, the Korean Won has continued to depreciate, with the exchange rate against the USD reaching a low of 1,473.75 KRW in April 2025, the lowest since 2009. The depreciation of the Won, combined with high oil prices and rising supply chain costs, has intensified domestic inflationary pressures. Data shows that in March 2025, South Korea’s CPI rose by 2.1% year-on-year, with kimchi and coffee prices increasing by 15.3% and 8.3%, respectively. This has eroded residents’ real purchasing power, putting pressure on economic recovery.

Cryptocurrencies, being dollar-denominated, globally circulating, and decentralized assets, have become a new avenue for investors to hedge against local currency depreciation and pursue asset preservation.

2.2 Social and Psychological Factors

According to economist Samuelson’s theory of “happiness = utility/desire,” when desires rise rapidly while utility acquisition is limited, individual happiness significantly declines.

-

Long-term social stratification, high competitive pressures, and economic volatility have intensified wealth anxiety among young people, making “money” a dominant life goal. According to 2024 Bank of Korea data, 72.4% of respondents identified “economic conditions” as the primary determinant of happiness. Additionally, a 2025 Statistics Korea report noted that 69.1% of people aged 20–39 listed “financial freedom” as their top life goal.

-

Amid such social sentiments, slogans like “돈이 최고야 (Money is the most important)” and “현실이 개차반이야 (Reality is awful)” have gained popularity.

-

With traditional paths such as employment, savings, and stock market returns failing to meet wealth aspirations, cryptocurrencies have become a preferred investment choice for young people seeking high utility and a way to break through class barriers, viewed as a potential pathway to achieving happiness and reversing their fortunes.

At the same time, the pursuit of “financial freedom” has led to profound changes in the consumption mindset of South Korea’s younger generation, further influencing their investment preferences.

According to media reports such as Asia Economy, South Korean youth exhibit two distinct consumption psychologies:

-

The “YOLO (You Only Live Once)” group emphasizes living in the moment and displays a high risk appetite.

-

The “YONO (You Only Need One)” group leans toward rational consumption and prioritizes asset accumulation.

Among the YOLO group, facing real-world pressures and class anxiety, many young people view the crypto market as a “get-rich-quick opportunity” that surpasses the stock market, offering a way to break through traditional wealth paths and achieve class mobility. Meanwhile, the YONO group, driven by considerations of asset preservation and hedging against economic uncertainty, is gradually shifting toward increased savings and investments. According to a 2024 Gen Z consumption trends survey, approximately 71.7% of young respondents indicated they prioritize savings and asset allocation. Cryptocurrencies, due to their high return potential, have become a new investment choice.

Despite differing consumption attitudes, both groups converge in their investment motivations for high-yield assets, with cryptocurrencies perfectly aligning with their shared pursuit of returns and wealth growth.

2.3 Why Is This Phenomenon So Prominent in South Korea and Not Japan?

2.3.1 Economic Perspective: The Relative Weakness of the Won Necessitates Alternative Pathways

-

Yen: Due to its extremely low interest rates and substantial foreign exchange reserves, the Japanese Yen is internationally regarded as a safe-haven currency. Even during Yen exchange rate fluctuations, its financing advantages remain intact, and markets prefer holding Yen-based assets during geopolitical risks or financial turmoil to hedge against downturns in other markets.

-

Won: With a smaller market size, weaker liquidity, and a tendency to fluctuate in tandem with global risk sentiment, the Won lacks the same status as the Yen. Additionally, South Korea’s foreign exchange reserves are relatively weaker, and certain capital controls further limit its ability to serve as a safe-haven currency.

As a result, compared to Japanese investors, South Korean investors have less long-term confidence and sense of security in local currency assets, leading them to seek non-local currency-denominated, globally circulating assets. Cryptocurrencies closely align with these investor needs.

2.3.2 Economic Perspective: Lower Returns from Traditional Investments Drive the Pursuit of Higher Returns

Real Estate:

Real estate investment accounts for over 50% of investments in South Korea, significantly higher than Japan’s 37%. However, actual returns are lower, and there are more restrictions on real estate investment in South Korea.

- Stock Market: In recent years, the South Korean stock market has consistently underperformed compared to Japan’s, but this gap was particularly pronounced in 2024:

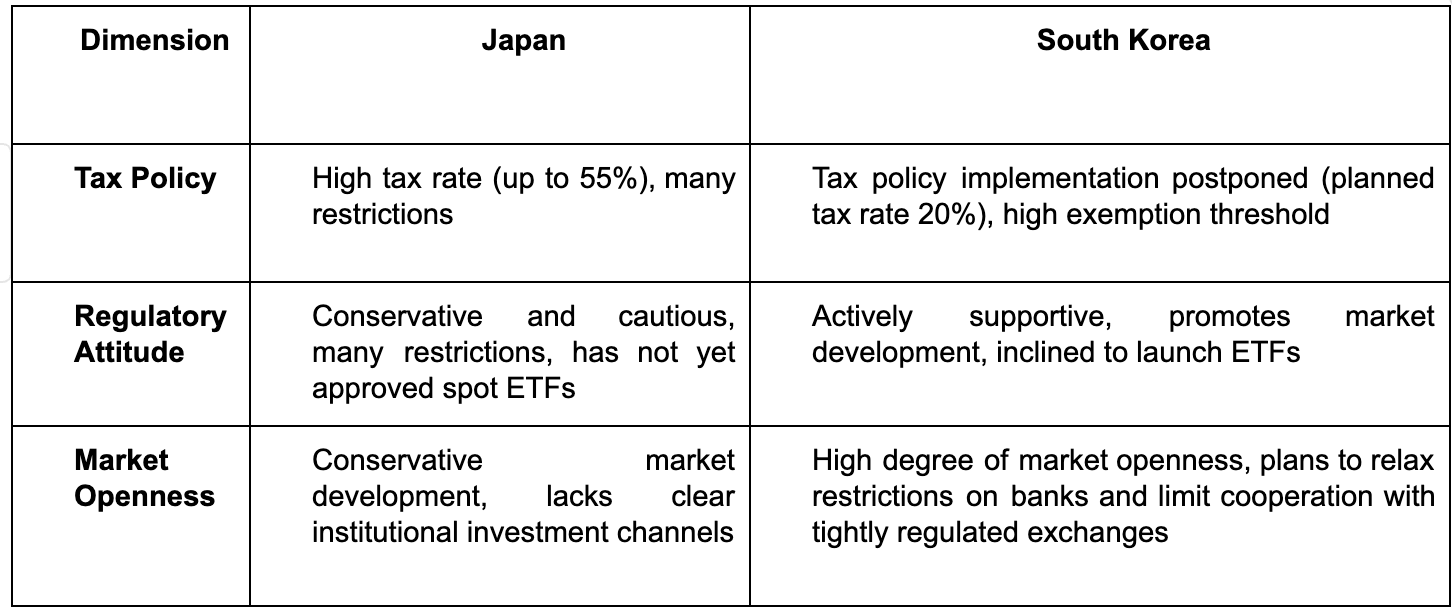

2.3.3 Policy Perspective: South Korea’s Open Attitude vs. Japan’s Conservative Restrictions

2.3.4 Cultural Perspective: South Korea’s Pursuit of Quick Wealth vs. Japan’s Focus on Steady Accumulation

-

Japan: Places greater emphasis on “accumulating wealth gradually” and “prudent financial management.” Proverbs such as “一生懸命働いて、少しずつ貯める” (Work hard your whole life and save little by little) and “家宝は寝て待て” (Family treasures come to those who wait) reflect the Japanese preference for long-term accumulation and stable growth, emphasizing values of restraint, accumulation, and patience.

-

South Korea: Emphasizes “rapid success” and “riding trends,” with popular concepts like “빨리빨리 (hurry up)” prevalent in society. People are more inclined to pursue short-term high returns, seeking to achieve rapid wealth through stock trading, cryptocurrency speculation, or real estate investments.

The prosperity of South Korea’s cryptocurrency market is fundamentally the result of investors making optimal trade-offs across macroeconomic conditions, traditional assets, government policies, and cultural mindsets. While Japan, as a fellow developed East Asian nation, shares somewhat similar conditions, it still lags behind South Korea’s standout performance in the global cryptocurrency market.

2.4 Insights from the Korean Model for the Global Crypto Market

As the landscape of the Asian crypto market quietly shifts, South Korea’s “middle way” approach is emerging as a strategic advantage. Compared to Singapore’s recent tightening of regulations on local projects providing token services overseas, and the slow pace of approvals and tax reforms in Hong Kong and Japan, Korea’s institutional flexibility, cultural alignment, and capital environment are forming a new comparative edge.

The Monetary Authority of Singapore (MAS) recently mandated that local projects cease offering token services to overseas clients by the end of June, eliminating any transitional support. This abrupt policy shift breaks Singapore’s previously “open and friendly” regulatory image. As a result, many crypto enterprises have begun reassessing their Asian market strategies, turning their attention to countries with more flexible regulations and greater room for practical implementation. Although Hong Kong is actively opening up, its complex regulatory layering and cautious pace make it difficult in the short term to absorb a large influx of project relocations.

Against this backdrop, South Korea is emerging as a strong contender in the next wave of competition for Asia’s crypto hub status, leveraging its ability to integrate local resources, efficiently implement technology, and maintain strong socio-cultural cohesion. For the global market, the key takeaway from the Korean model is that regulation can be encouraging and guiding rather than fully permissive; user education and cultural adaptation form the foundational logic for all growth; and infrastructure sovereignty alongside international collaboration are not contradictory but rather dual drivers for future development.

In the new policy dynamics across Asia, South Korea is no longer just an active consumer market but also holds potential as a regional source of technological innovation and a major asset management center. For the global crypto industry aiming for localized implementation, Korea offers a practical and instructive model worth emulating.

3. Korean Market User Analysis

3.1 Korean Market User Profile

Market and Account Types: Overall Rapid Growth

- Investor Scale Growth: As of January 2025, approximately 25.25 million individual investors were registered across Korea's five major exchanges (UPbit, Bithumb, Coinone, Korbit, Gopax), representing a 37.6% increase compared to the same period three years ago. This growth reflects the market's rapid expansion, attracting a large number of new user registrations, demonstrating the accelerating adoption of cryptocurrencies in Korea and gradually improving market penetration rates.

Actual User Growth: As of February 2025, the total number of cryptocurrency exchange accounts in Korea exceeded 25 million, with approximately 17.09 million accounts being active investors. With market conditions heating up in 2024, activity levels significantly increased: following Trump's re-election as president, the number of inactive accounts dropped from approximately 8.57 million at the beginning of 2024 to 8.01 million by year-end, indicating that investment confidence is gradually recovering and funds are flowing back into the crypto market.

Age and Gender: Significant Growth in Young Users, Rising Female Participation

-

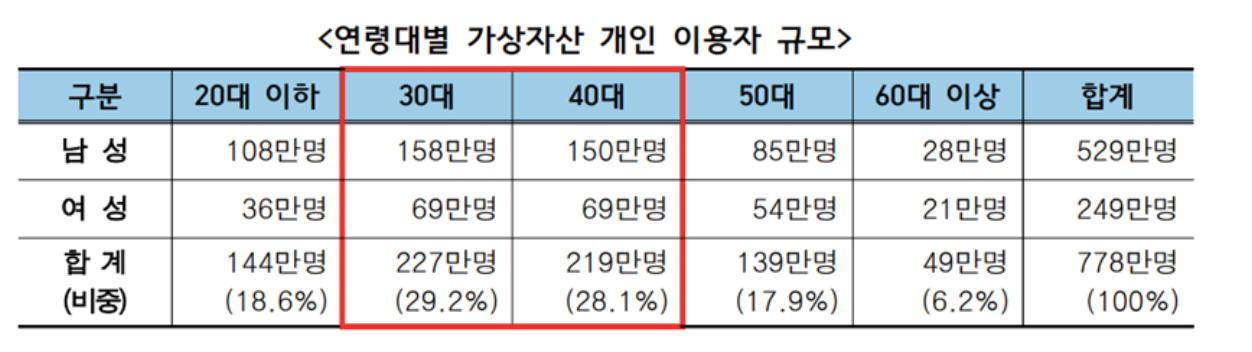

Korean cryptocurrency market users are primarily composed of the core demographic aged 30-40, collectively accounting for over 50% of users, showing that mainstream trading users are concentrated among groups with stronger economic capacity and more mature investment awareness.

-

The young user demographic under 20 years old also shows strong growth momentum, accounting for 18.6% of users. This data indicates that crypto assets are rapidly gaining popularity among younger generations, with young people becoming an emerging force in the market, bringing greater growth potential for the future market.

-

As age increases, the gap between females and males in the crypto market gradually narrows, especially with increased participation among middle-aged and elderly women. This indicates that although young women have a relatively low market share, female participation has significantly increased among economically stronger middle-aged and elderly groups.

Age and Fund Scale: Clear Generational Stratification

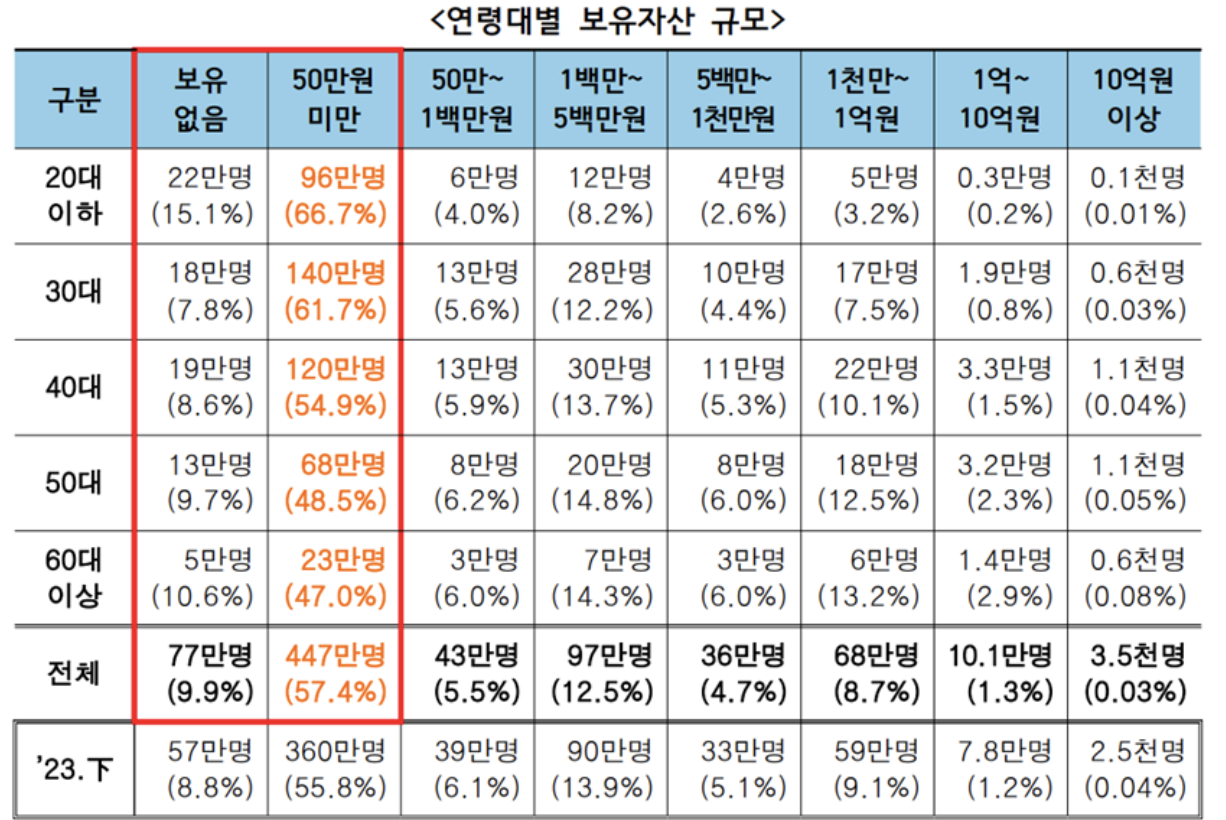

-

The Korean cryptocurrency market is dominated by small-scale investors, with most users holding less than 500,000 Korean won, particularly concentrated among young groups. Meanwhile, users holding over 10 million Korean won account for 10% of the total, a decrease of 0.2 percentage points compared to the end of 2023, while users holding over 100 million Korean won dropped to 104,000 people, reflecting a decline in the proportion of high-net-worth individuals in the market.

-

From the correlation between age and asset scale, young users tend toward small-scale investments (under 500,000 Korean won), while older users (50s and above) tend toward larger-scale investments (over 5 million Korean won), with this high-net-worth group becoming the value backbone of the crypto market.

-

Notably, investors over 60 years old, while representing a smaller proportion, hold virtual assets totaling 13.3795 trillion Korean won. They also have relatively conservative investment tendencies, managing retirement funds by investing large amounts in high-market-cap currencies like Bitcoin.

-

The Korean crypto market exhibits a "dual-layer structure" characteristic—young people primarily contribute user numbers and activity levels, while middle-aged and elderly groups control more assets and trading volume. This means the market has extremely obvious generational stratification characteristics in user composition.

3.2 User Behavioral Patterns

3.2.1 User Asset Preferences

Global Asset Proportion vs. Domestic Asset Proportion: Local Personalization Effects

-

Korea's virtual asset market continues to grow: Korea's domestic virtual asset market capitalization has reached $21.2 billion, a 46% increase from last year, showing rapid market expansion.

-

Bitcoin Dominates the Market: Bitcoin remains the dominant asset in the Korean market, with trading volume accounting for 37.2% of the total, far exceeding other assets.

-

Strong XRP Appeal in Korea: Despite its relatively low global ranking, XRP has a market capitalization of $588 million in the Korean market, ranking second, showing its very high popularity among Korean users.

-

High Concentration of Mainstream Assets: Korea's top ten virtual assets are basically consistent with the global top ten, reflecting Korean market preference for mainstream assets (such as ETH, DOGE, SOL).

3.2.2 Overall User Behavioral Characteristics

In Korea's cryptocurrency market, user behavior exhibits highly concentrated characteristics.

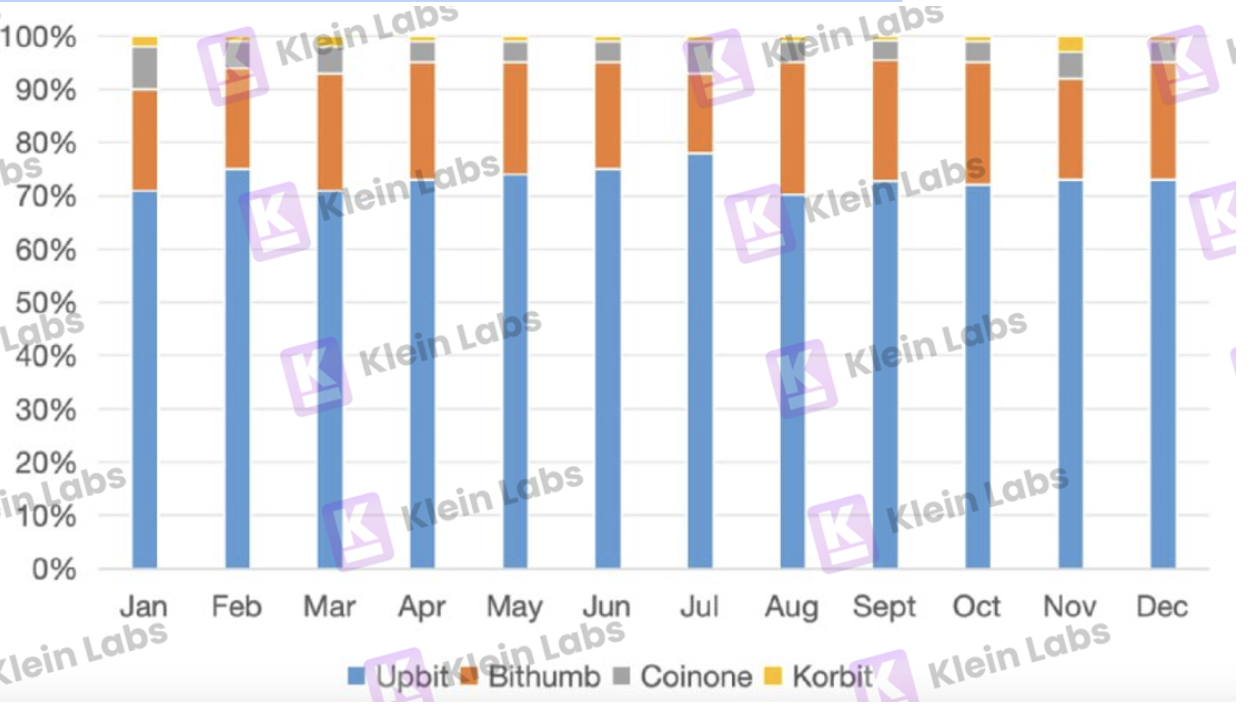

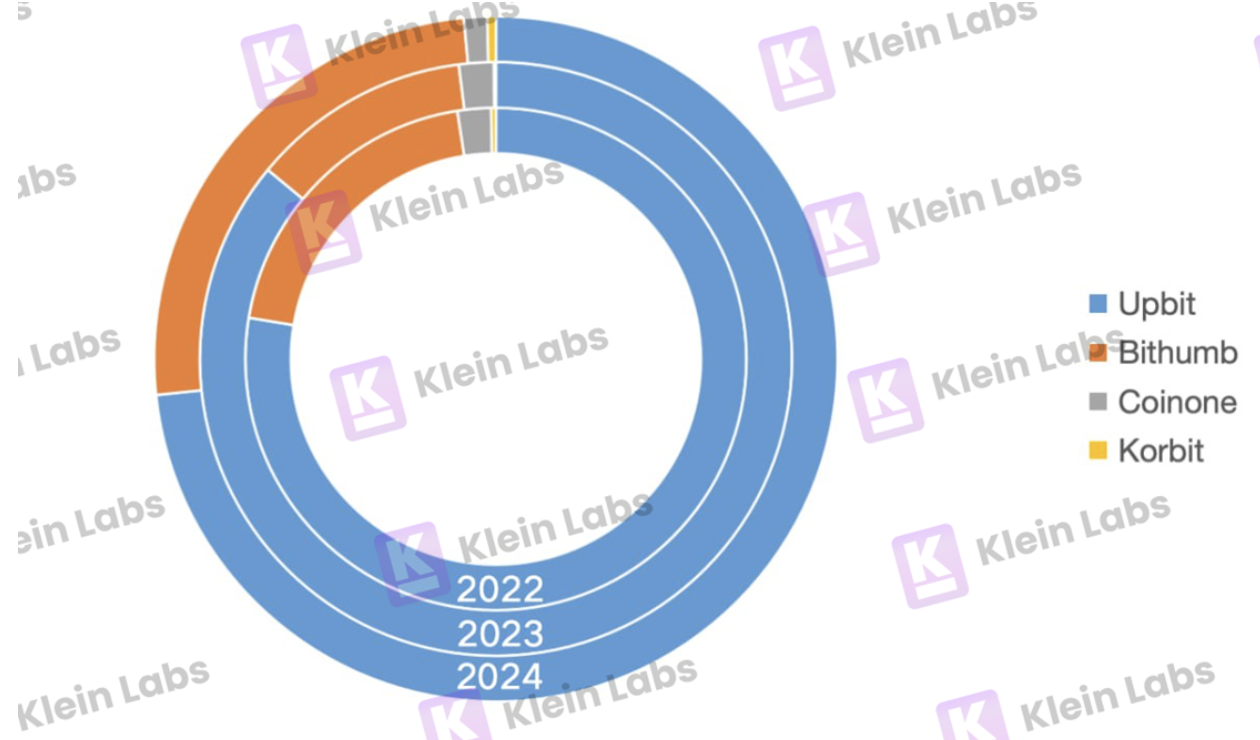

Concentrated Trading Platform Preferences: According to 2024 market data, Korea's largest cryptocurrency exchange UPbit occupies approximately 70% to 80% of the domestic market share, demonstrating its dominant position in the local market.

Concentrated Trading Configuration Preferences: Local project premiums and trust endorsements drive capital flows. Users are more enthusiastic about trading platform-exclusive "kimchi coins" (such as Steem Dollars, Moss Coin, Hippocrat), while trading activity for mainstream assets is relatively lower compared to global markets. Local exchanges further amplify the "kimchi premium" effect through large-scale promotional cooperation, attracting continuous capital inflows.

3.2.3 On-Chain Usage Situation

As the global crypto ecosystem evolves, decentralized trading is rapidly rising. As of December 2024, the global DEX spot trading volume ratio to CEX reached 13.76%, with daily trading volume reaching $54.84 billion. In comparison, Korea's market dependence on CEX remains significantly higher than the global average. Data shows that approximately 68.9% of trading volume is still concentrated on centralized platforms, with relatively low DEX and DeFi protocol usage rates, indicating that local users prefer stable, regulated scenarios in their trading habits.

However, Korea's on-chain ecosystem is rapidly awakening. In 2024, the DEX trading proportion rose from 8.57% to nearly 17%, and by early 2025, DEX trading accounted for 16.7%. Raydium and Phantom in the Solana ecosystem, due to low barriers and fast token listings, are favored by young Korean users, and platforms like Pump.fun have also stimulated retail enthusiasm for DEX, driving structural changes in trading behavior.

Despite strong development momentum, constrained by local regulations and capital flow restrictions, Korea's DeFi market has not yet fully exploded. To realize potential release, balance between "security and innovation" at the regulatory level is still needed to open growth channels for on-chain finance.

4. Overview of South Korea’s Cryptocurrency Market Exchanges

South Korean domestic exchanges exhibit a strong listing effect, particularly with leading platforms like UPbit. Once a project is listed, it often triggers significant market fluctuations, making these exchanges key indicators in the cryptocurrency market. This effect has driven many projects to prioritize “securing a listing on a Korean exchange” as a core objective when targeting the South Korean market. Additionally, Korea Blockchain Week (KBW) has become a globally recognized crypto event, serving as a vital platform for exchanges to announce listings, projects to debut, and capital to connect. This year’s KBW (X: @kbwofficial), scheduled for September 22–28, 2025, will be hosted by FACTBLOCK (X: @FACTBLOCK), attracting crypto professionals from around the world to Seoul.

The South Korean cryptocurrency trading market is highly concentrated, dominated by five major spot exchanges: UPbit, Bithumb, Coinone, Korbit, and Gopax.

Observing the market share of the four major Korean exchanges three years ago, we have initially drawn the following conclusions:

-

The combined market share of the top two exchanges (UPbit and Bithumb) accounts for over 98% of the total market, indicating a severe head monopoly effect.

-

Despite UPbit adopting the most conservative listing policies, its market share still grew from 78% to 86% last year.

-

Bithumb experienced the largest year-on-year sales decline, likely due to its zero-commission policy implemented in Q4 2023, which significantly reduced sales and profit margins. However, this policy may have positively impacted user trading activity, narrowing the market share gap with other exchanges and demonstrating its critical role in enhancing platform competitiveness.

-

Coinone and Korbit hold smaller market shares but can leverage differentiated strategies to meet niche demands, utilizing the long-tail effect to gradually expand their market share and improve competitiveness.

4.1 UPbit

Operated by Dunamu and backed by Kakao, UPbit has a broad user base and high compliance standards, being one of the first platforms in South Korea to obtain a Virtual Asset Service Provider (VASP) license. Since its establishment in 2017, it has rapidly grown to become the market leader in South Korea, supporting direct KRW deposits and trading, which is highly attractive to local users. UPbit is among the top five global cryptocurrency exchanges by trading volume. It offers KRW/BTC/USDT trading pairs, with the majority of its trading volume coming from the KRW market. UPbit’s robust liquidity ensures it consistently ranks among the top five globally for spot trading volume.

4.2 Bithumb

Established in 2014, Bithumb was once the market leader in South Korea and is currently the second-largest liquidity provider after UPbit. Bithumb is actively pursuing growth and plans to launch an initial public offering (IPO) in 2025. With its aggressive fee policies, Bithumb has recently regained market share and continues to play a significant role.

4.3 Other South Korean Exchanges

-

Coinone: Renowned for its exceptional security, Coinone has maintained a flawless safety record over its eight years of operation. It was the first South Korean exchange to list Ethereum and remains active in the meme coin sector.

-

Korbit: The oldest exchange, established in April 2013, Korbit was the first globally to offer KRW/BTC trading and the only South Korean exchange to experience the Bitcoin surge at the end of 2013. Korbit is also known for its high-quality content through Korbit YouTube and Korbit Research.

4.4 Overseas Exchanges in South Korea

In South Korea, overseas exchanges such as Binance, OKX, KuCoin, Kraken, Bybit, and Coinbase are gradually attracting a large number of investors. According to data from the South Korean Financial Services Commission’s investigation into Virtual Asset Service Providers (VASPs), fund transfers to overseas VASP wallets increased 2.3 times compared to last year. The primary reasons behind this trend are low stock market returns and political instability. Notably, following the martial law declaration in South Korea in December 2024, service disruptions at major local exchanges significantly undermined trust in their stability, prompting more investors to turn to overseas exchanges and DeFi platforms.

- Advantages:

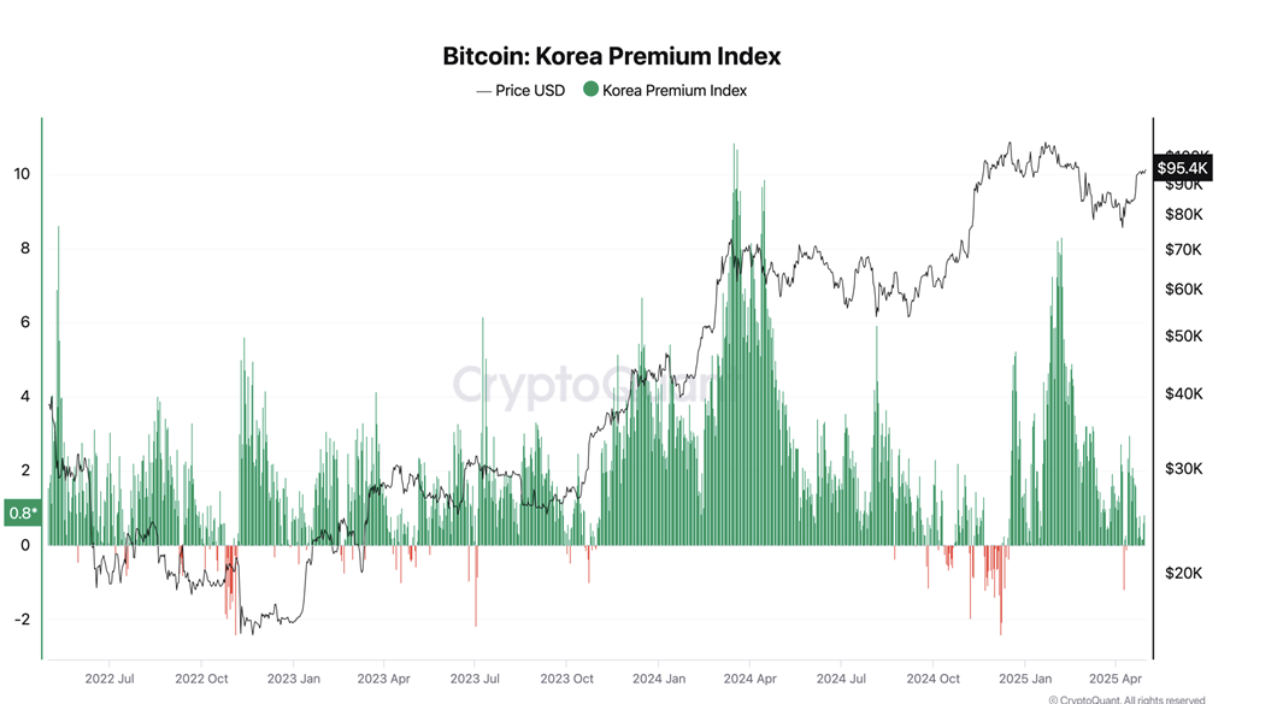

South Korea Premium Index = (South Korean Local Exchange Price − Global Average Price) ÷ Global Average Price × 100%

The South Korea Premium Index has consistently remained above 0, indicating that the South Korean cryptocurrency market has long exhibited a premium over the global average price, reflecting strong local demand or restricted capital flows.

-

The primary advantage of investing through overseas exchanges lies in the “Kimchi Premium,” where cryptocurrency prices on South Korean exchanges are typically higher than the global market, with premiums reaching up to 20%. Investors profit by buying at lower prices on overseas platforms and selling at a premium domestically.

-

South Korean exchanges primarily rely on trading commissions for revenue, with regulations limiting their business diversification. Due to the lack of derivatives trading capabilities, investors often turn to overseas platforms like Binance and OKX for margin trading to achieve higher returns.

Limitations: Government measures. South Korea’s Financial Intelligence Unit has banned access to 17 unregistered overseas crypto trading apps, restricting downloads and updates for platforms like KuCoin, MEXC, and Phemex.

5. Overview of Investment Institutions and Market Makers in the South Korean Cryptocurrency Market

South Korean crypto investment institutions exhibit three main characteristics: Types include pure cryptocurrency venture capital (VC), corporate venture capital (CVC), and multi-strategy hedge funds. Investment stages range from seed rounds to growth phases, with industry focuses including DeFi, NFTs, Web3 gaming, infrastructure, and artificial intelligence. Institutions differ significantly in geographic strategies, ecosystem building, and project incubation, with successful cases spanning globally recognized protocols and startups. Key investment institutions in the South Korean cryptocurrency market include:

Hashed

Overview: Established in 2017, headquartered in Seoul, Hashed focuses on early-stage Web3 project incubation in Asia, combining capital investment with ecosystem development. It strengthens community engagement through events like “Hashed Potato Club” and KBW. Notable Successes: Axie Infinity, The Sandbox, Decentraland, and other prominent gaming and metaverse projects. (X: @hashed_official)

Nonce Classic

Overview: Founded in 2018, it positions itself as a “social network-driven VC,” emphasizing team collaboration and information sharing, providing incubation support for portfolio projects through community mechanisms. Notable Successes: Seed-round investments in Eisen, Pilgrim Protocol, and Radius, primarily focusing on Layer 1 and DeFi infrastructure projects. (X: @nonceclassic)

Blocore

Overview: A corporate venture capital arm of Gameberry, specializing in “investment + incubation” for Web3 gaming and IP projects, supporting projects from seed to growth stages. Notable Successes: Early investments in Animoca Brands, The Sandbox, and Wemix, helping multiple gaming companies enter global markets. (X: @blocore_vc)

Samsung Next

Overview: The innovation investment arm of Samsung Group, covering diverse sectors like Web3 infrastructure, AI hardware acceleration, security monitoring, and asset management, bridging enterprise and consumer applications. Notable Successes: Participated in Sahara AI’s $43M Series A, and invested in Yuga Labs, LayerZero, and Berachain. (X: @SamsungNext)

Tiger Research (타이거 리서치)

Overview: Known for on-chain data analysis and quantitative research, leveraging proprietary price discovery algorithms and risk control models to provide precise market-making solutions for DeFi protocols and various trading pairs. Its “dynamic order placement” strategy adjusts order volumes based on market depth and trading trends. The team serves major exchanges like UPbit and Coinone and actively participates in local DeFi project testnet incentive programs. (X: @TigerResearch)

Klein Labs (클라인 랩스)

Overview: A research-driven Web3 crypto service provider, specializing in customized liquidity management, full-stack growth solutions, and capital strategies. It uses advanced data analytics and algorithmic strategies to optimize bid-ask spreads and minimize trading slippage. Beyond market-making, Klein Labs integrates marketing, listing, and fundraising support, offering one-stop solutions for projects in South Korea while engaging in early-stage venture capital and incubation. (X: @kleinlabsxyz)

6. Notable Projects in the South Korean Cryptocurrency Market

Several protocols in the South Korean crypto market have gained significant user recognition and growth momentum due to strong product-market fit, effective community operations, and channel adaptability. Below are some standout projects and protocols with robust performance, active community engagement, and high trading participation in the South Korean market.

6.1 Underlying Ecosystems

6.1.1 Kaia

Developed by Kakao and Naver, Kaia is an Asia-focused Layer 1 blockchain emphasizing distributed credentials and loyalty systems. It has generated over 38 million wallets, integrated 80+ mini-programs, and achieved 1–1.5 million daily active addresses.

(X: @KaiaChain)

6.1.2 Story Protocol

Positioned as a “programmable narrative engine,” it supports on-chain IP creation and licensing. It has launched 120+ DApps and partnered with South Korea’s top three mainstream media outlets and leading gaming companies.

(X: @StoryProtocol)

6.1.3 Arbitrum

Established a local community, “Arbitrum Korea,” collaborating with Delabs and Lotte Metaverse. It saw a 45% increase in registrations in its first month and accounts for 28% of South Korea’s Layer 2 trading volume.

(X: @arbitrum)

6.1.4 Aptos

Partnered with Supervillain Labs to host hackathons and developer meetups in Seoul, promoting Move education. Its community DApps have surpassed 5,000 monthly active users, with a 75% year-on-year increase in developer onboarding.

(X: @Aptos)

6.1.5 Monad

Released Korean-language documentation and SDK, collaborating with the Seoul Digital Asset Research Institute to launch the “Monad Analyst Certification” course. Its official Discord Korean community has grown to over 8,200 members.

(X: @monad_xyz)

6.1.6 ICP

ICP established an official hub in South Korea, with its ecosystem project Piggycell integrating with the country’s largest shared charging platform and being selected for the Olympus accelerator program.

(X: @dfinity)

6.2 DeFi

6.2.1 Mitosis

A modular multi-chain asset management protocol supporting cross-chain lending and strategy configuration. It has launched multiple pools with steadily growing trading volume.

(X: @MitosisOrg)

6.2.2 Keplr Wallet

A native Cosmos wallet with high adoption in the South Korean community. It formed a “Korea Hub” with local validators, with local staking volume accounting for over 40% of the network total.

(X: @keplrwallet)

6.2.3 Exponents Fi

Focused on automated yield and risk management with dynamic strategy adjustment capabilities. Its TVL grew by 20% in its first month, gaining popularity among professional users.

(X: @Exponents_Fi)

6.2.4 Xangle

A leading on-chain data service and solutions provider, helping businesses thrive in the dynamic Web3 environment.

(X: @Xangle_official)

6.3 GameFi

6.3.1 MapleStory N / Nexon

Developed by Nexon, MapleStory N has become a Web3 RPG hit, with its token $NXPC exceeding a $200 million market cap and listing on top exchanges.

(X: @MaplestoryU)

6.3.2 Delabs

A sub-brand of 4:33 Games, its game Rumble Racing Star features on-chain track asset mechanisms. The platform has attracted over 400 million global players, with airdrop events drawing significant participation.

(X: @DelabsOfficial)

6.3.3 Wemix

One of South Korea’s strongest GameFi infrastructures, with daily transaction volume reaching $20 million. It supports DeFi, NFTs, and SoFi modules, hosting over 100 games globally.

(X: @WemixNetwork)

6.3.4 Big Time

A time-travel-themed MMORPG combining elements of World of Warcraft and Diablo, attracting a large base of hardcore action game players in South Korea.

(X: @playbigtime)

6.3.5 FLOKI

Evolved from a meme coin into a full-stack community ecosystem, gaining a significant following in South Korea through education, DeFi platforms, and gaming sectors.

(X: @RealFlokiInu)

6.4 AI

6.4.1 FDN

Initiated by a South Korean AI team, focusing on Web3 data collection and model training, with applications in KYC, AIGC, and metaverse scenarios. It has received investments from Web3Labs and KuCoin Labs.

(X: @project_fdn)

6.4.2 FLOCK

A decentralized AI privacy computing protocol proposing a “federated learning block” paradigm, using on-chain mechanisms to replace data centers, emphasizing data sovereignty and composability.

(X: @flock_io)

6.5 SocialFi

UXLINK

Though not a South Korean native project, it is highly active in the Korean community. It integrates social asset management, content generation, and socialized trading via Telegram plugins, creating a highly engaged community structure.

(X: @UXLINKofficial)

7. South Korean Marketing and Promotion Landscape

7.1 Media Platforms

TokenPost

Overview: Founded in 2014, TokenPost has served as an official media partner for South Korean government blockchain forums, Asian crypto summits, and technical seminars. It has conducted multiple interviews with key industry figures like Vitalik Buterin, CZ, and South Korean chaebols. It has strategic partnerships with Investing.com (20 million users) and Nasdaq. The platform also operates a data service and industry research division, offering tailored intelligence for institutions and businesses. In 2025, its monthly visits exceeded 7 million, positioning it as a “South Korean window” for the global Web3 market.

(X: @tokenpostkr)

CoinNess

Overview: A leading South Korean cryptocurrency media platform specializing in real-time translation and dissemination of international news. Its Live Feed service provides investors with real-time updates. CoinNess is also South Korea’s largest provider of institutional crypto investment information, with an exclusive partnership with Yonhap Infomax, South Korea’s national news agency.

(X: @CoinnessGL)

Blockmedia

A professional blockchain media outlet focusing on traditional finance, crypto market trends, project updates, and regulatory developments. In 2023, it was cited 1,080 times on Telegram with 68% coverage. While less timely than CoinNess, it is renowned for its high-quality reporting.

(X: @Blockmedia)

Cobak

Overview: Founded in 2018, Cobak is a leading South Korean crypto platform offering global price tracking and an ad-free community. With over 500,000 users and 100,000 wallets, it has hosted reward events totaling 10 billion KRW and successfully launched 47 IDOs since 2019.

(X: @CobakOfficial)

FACTBLOCK

Since 2018, it has hosted Korea Blockchain Week (KBW), serving both media and advisory roles with global influence among Web3 leaders. The 2024 event attracted over 61,700 attendees, 870+ speakers, and 300+ sponsors, highlighting its unique advantage as an integrated media and industry event platform.

(X: @FACTBLOCK)

7.2 Marketing Agencies

Despread (디스프레드)

Overview: A consulting firm and KOL agency providing go-to-market strategies for the South Korean market.

(X: @DespreadTeam)

071 Labs

Overview: A leading South Korean marketing agency providing KOL support for prominent projects like Particle Network, UXLink, and Catizen, while also participating in early-stage investments.

(X: @071_labs)

7.3 KOLs

WeCryptoTogether

Overview: One of the most influential KOLs in the South Korean crypto community, with nearly 50,000 Telegram subscribers. It gathers active DeFi enthusiasts and investors, holding significant influence and user engagement in the local market. It has hosted over 10 major AMAs for local communities in 2024 and excels in bilingual (Korean-English) technical analysis and macro trend insights.

(Telegram: @WeCryptoTogether)

basixally

Overview: With over 16,000 subscribers to its Telegram community “베이지컬리 비트코인 시황,” it is a prominent Bitcoin analysis KOL in South Korea. Known for combining technical analysis with trend sensitivity, it focuses on swing trading and mid-term strategies, analyzing charts, K-line structures, trading volume, and macro interest rate cycles. In Q1 2025, its public BTC trading strategies achieved a 72% success rate, widely shared within South Korea’s Telegram investment circles.

(Telegram: @basixally98)

코인하려고 백수 된 남자 (The Man Who Became Jobless to Trade Crypto)

Overview: A highly influential YouTube-based educational KOL in South Korea with nearly 60,000 subscribers. Its content spans blockchain technology principles, investment logic, and market trend tracking, catering to both beginners and advanced investors. In H1 2025, it maintained high-frequency content output, covering global macro topics like Federal Reserve rate changes and ETF approvals with a local perspective. It is one of the most representative crypto content creators on South Korea’s YouTube platform.

(YouTube: @cobacknam)

Additionally, non-local KOLs like @delucinator (English community), @Jinrong_web3 (Chinese community), and @kodaiGrow (Japanese community) on X consistently follow and provide in-depth analysis of the South Korean market, offering high-value insights.

7.4 Community Channels

Among Telegram’s popular channels, the top two are “WeCryptoTogether” and “취미생활방 (@enjoymyhobby),” known for high activity and influence in private communities.

We had the privilege of interviewing @KimYoungTaek, the operator of “enjoymyhobby,” who provided the following key insights on “users–channels–market”:

-

Trading Volume Growth Drivers: Regarding the 200% trading volume growth over the past three years, Mr. Kim believes “cultural factors are the main driver,” reflecting South Korean users’ high adaptability to mobile apps and digital finance, as well as new investors’ strong interest in crypto assets.

-

Core User Profile: For the 20–35 age group, Mr. Kim notes they exhibit a “nimble ‘just do it’ mindset,” are “emotion-driven, pursuing brands or appealing aesthetics,” and “seek returns with quick entry and exit.” He finds their flexible and experience-focused investment style intriguing.

-

High-Leverage Trading Trend: On the preference for high-leverage derivatives trading, Mr. Kim observes that “when KOLs post proof of profits from futures trading or airdrops, such as ‘200% returns with 5x leverage,’ followers often experience strong FOMO,” highlighting the role of timely community information sharing in driving trading decisions.

-

KOL and Local Media Influence: On the impact of KOLs and local media on user decisions, Mr. Kim believes “KOLs act as bridges to close information gaps,” breaking down projects, influencing investment trends, and playing a key role in information dissemination and trust-building.

7.5 Other Promotion Channels

In addition to globally used platforms like X, Discord, and Telegram, the South Korean market has unique information dissemination and community operation channels:

-

KakaoTalk Open Chat Rooms: South Korea’s most widely used messaging app, with 48 million MAUs by the end of 2023, covering nearly the entire population. Chat rooms are capped at 1,500 users with simplified functionality, focusing on price and market discussions with low on-chain service engagement.

-

Coinpan: South Korea’s largest crypto community website, with 5.3 million MAUs in 2023 and a peak of 8,636 daily posts. Discussions focus on centralized exchange tokens and profit-sharing.

-

DCInside: An anonymous discussion platform with Bitcoin, Altcoin, and NFT galleries. Posts primarily focus on short-term speculation, with limited discussion on long-term technological value.

7.6 Promotion Recommendations

(1) Interface Accessibility and Low Entry Barriers as Core Competencies:

-

Quick Onboarding: South Korean users are highly sensitive to operational simplicity and interface familiarity. Projects should focus on “beginner-friendly” guides, simplified tools, and zero-barrier solutions to lower initial participation costs.

-

Channel-Driven Acquisition: Embedding educational and promotional content in native mobile channels like KakaoTalk and mini-programs can help overcome user migration barriers and improve local retention rates.

(2) Building Trust with Aesthetics and Instant Gratification:

-

Strong Trust-Building: Establish intuitive trust through systematic branding and authoritative endorsements, such as partnerships with UPbit, Bithumb, or local IPs, to create a reliable first impression.

-

Visual-Driven Experience: Targeting Millennials and Gen Z, prioritize UI/UX design, IP collaborations, and anthropomorphic branding to enhance emotional resonance and brand loyalty.

-

Instant Gratification Mechanisms: Catering to the “just do it” mindset of 20–35-year-olds, use one-click participation, limited-time airdrops, and blind-box interactions to boost conversion efficiency and virality.

(3) Native Media and KOL Matrix to Drive Market Penetration:

Collaborate with local media and KOLs to ensure information is quickly interpreted, widely disseminated, and backed by trust, while avoiding excessive hype around returns to mitigate regulatory and public sentiment risks.

8. South Korean Market Regulatory Landscape

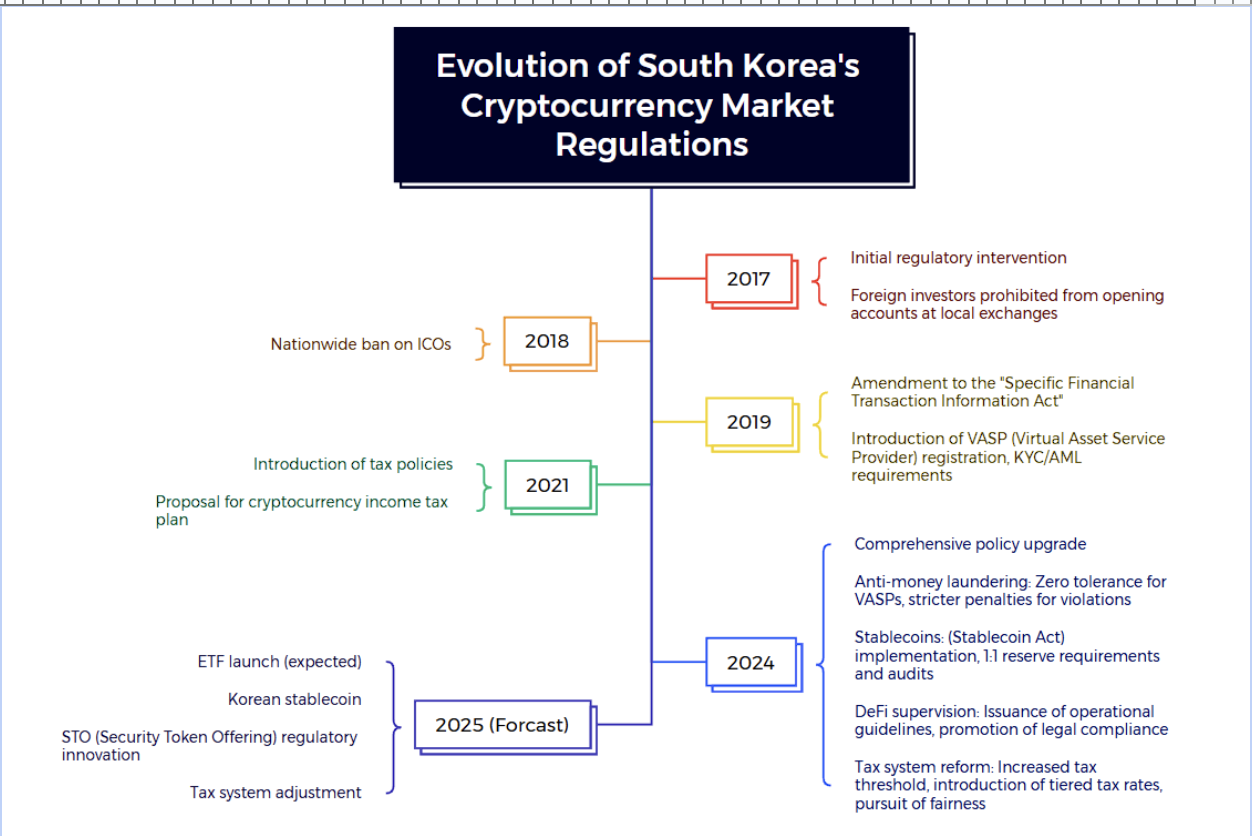

2017: The South Korean government intervened in the crypto market for the first time by banning foreign investors from opening accounts on local exchanges to curb international speculative activities.

2018: A comprehensive ban on Initial Coin Offerings (ICOs) was implemented to prevent fraud and excessive speculation, causing several Korean blockchain projects to relocate their fundraising activities to Singapore.

2019: The "Act on Reporting and Using Specified Financial Transaction Information" was amended, requiring Virtual Asset Service Providers (VASPs) to register and comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

2021: Plans were initiated to tax individual cryptocurrency gains, with implementation set for 2024 to increase tax revenue.

2024:

-

Strengthened AML and Stablecoin Regulations: New rules require all VASPs to submit compliance reports and undergo AML audits.

-

Innovation Support and Blockchain Ecosystem Development: Establishment of a National Blockchain Innovation Center to promote blockchain technology applications.

-

Regulatory Exploration for Emerging Fields: Release of the "Decentralized Finance (DeFi) Regulatory Guidelines" to enhance oversight of DeFi protocols.

-

Tax Policy Adjustments: Revision of cryptocurrency tax laws to raise the tax exemption threshold and implement a tiered tax rate system.

-

Green Blockchain Initiative: Promotion of carbon neutrality in the crypto industry, supporting mining operations powered by renewable energy.

9. Participation of South Korean Traditional Companies

9.1 Kakao

Kakao has become a core force in advancing South Korea’s crypto industry, deeply involved in exchange and blockchain development while planning future expansions.

-

UPbit Exchange: Through its subsidiary Dunamu, Kakao launched UPbit in 2017, which quickly became one of South Korea’s largest cryptocurrency trading platforms.

-

Kaia: A Layer 1 blockchain formed in 2024 through the merger of Kakao’s Klaytn and LINE’s Finschia, aiming to build Asia’s leading Web3 infrastructure.

9.2 Samsung

As a South Korean tech giant, Samsung is comprehensively penetrating the crypto ecosystem with cutting-edge technology, building a complete value chain from on-chain to off-chain:

-

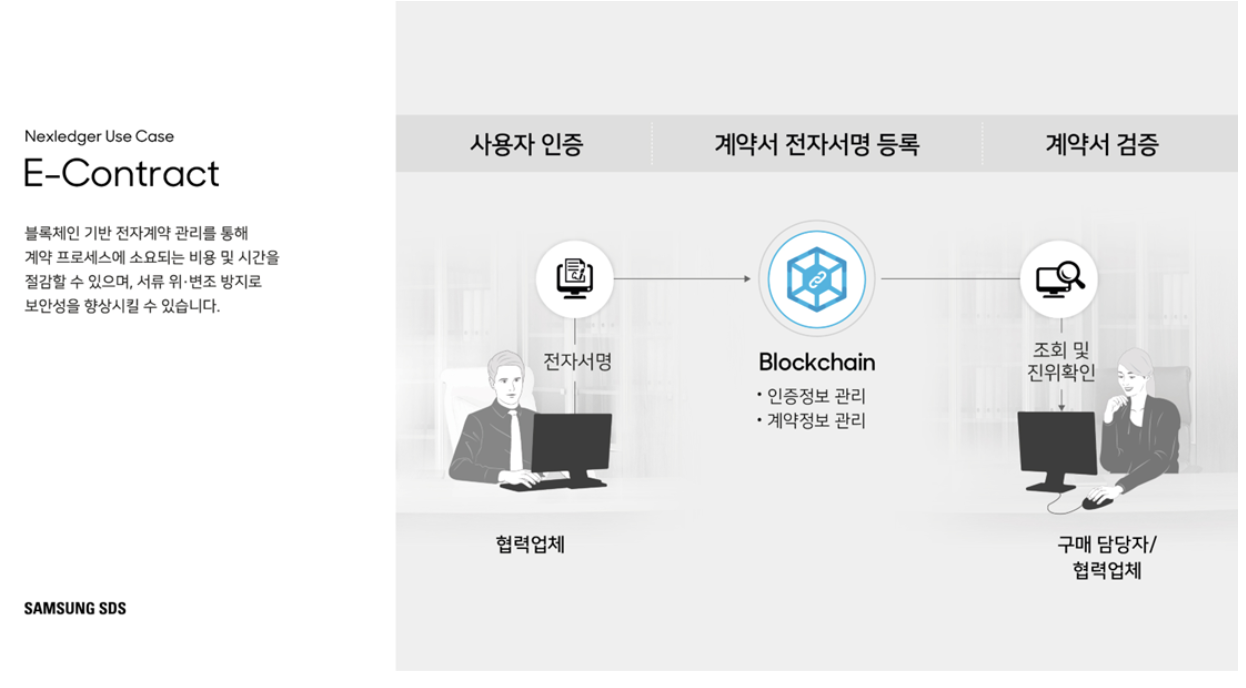

Blockchain Technology R&D: Through its IT arm, Samsung SDS, it developed Nexledger, an enterprise-grade blockchain platform with high performance, strong security, and multi-chain compatibility. Supporting smart contracts and various consensus mechanisms, it is widely used in finance, government, and manufacturing.

-

Cryptocurrency Wallet: Samsung integrated a crypto wallet into its Galaxy S10 smartphone, supporting Bitcoin, Ethereum, and other cryptocurrencies. The wallet leverages private key management to enhance asset accessibility. Samsung also collaborates with blockchain projects to promote blockchain integration in mobile devices.

-

ASIC Miner Manufacturing: Through its semiconductor division, Samsung produces ASIC miners for cryptocurrency mining. In 2016, its semiconductor revenue was approximately $50 billion, growing to $65.3 billion in 2017 (a crypto bull market year), a 30% increase, largely driven by Bitcoin-specific ASIC mining chip production and foundry services.

9.3 Participation of Other Chaebol Groups

South Korea’s major chaebols are actively engaging in the cryptocurrency and blockchain sectors:

-

SK Group: Through its investment subsidiary SK Square, it plans to issue its own cryptocurrency and has become the second-largest shareholder of the crypto exchange Korbit.

-

Nexon (NXC): Acquired a 65% stake in the Korbit exchange, actively expanding into blockchain and cryptocurrency. Additionally, its MapleStory game has issued its own token.

-

Shinhan Financial Group: Through its subsidiary Shinhan Capital, it is considering investing in Korbit to further expand its business in blockchain and cryptocurrency.

10. Future Trends Analysis of the South Korean Cryptocurrency Market

10.1 Investor Confidence and Market Sentiment

The current sentiment in the South Korean market is generally cautious, with significant divergence in confidence. While 75% of investors are optimistic about Bitcoin, 46% of respondents express concern or extreme concern, with only 24.7% being optimistic and 29.3% maintaining a neutral stance, reflecting a wary attitude toward high volatility.

Regarding altcoins, 36.7% of respondents anticipate an “Altcoin Season” in Q3 2025, indicating expectations for a phased recovery in non-mainstream assets. Overall, market sentiment shows characteristics of “strong expectations for major coins, partial altcoin recovery, and intensifying sentiment divergence.”

10.2 Scalable Growth and User Adoption

-

Market Size Expansion: According to Grand View Research, the South Korean crypto market is projected to achieve a compound annual growth rate of 16.1% from 2025 to 2030, with revenue expected to grow from $264.3 million in 2024 to $635.4 million by 2030.

-

User Base Breakthrough: Industry analysis suggests that by the end of 2025, the market could reach 20 million users, accounting for nearly 40% of the total population.

11. Cryptocurrency Policy Under the New Presidential Administration

June 2025: Lee Jae-myung Assumes Office as South Korea’s 21st President, Accelerating Crypto-Friendly Policies Lee Jae-myung’s “crypto-friendly” stance quickly translated into policy action upon taking office. Unlike his predecessors, whose reforms lagged, Lee immediately pushed forward the “second phase of crypto asset legislation,” accelerating the establishment of a digital asset framework that balances compliance and innovation.

11.1 High-Level Consensus and Policy Priorities

During the election campaign, Lee and several major candidates reached a “cross-party crypto commitment,” supporting institutional innovations such as spot ETFs, Korean won stablecoins, and Security Token Offerings (STOs). The new government focuses on three main directions:

-

Launching a tiered licensing system to clarify boundaries for various crypto businesses;

-

Initiating blockchain special zones to accelerate pilot projects;

-

Promoting legislation for Korean won-pegged stablecoins to strengthen financial sovereignty.

11.2 Dual-Engine Strategy: ETFs and Korean Won Stablecoins

The government has begun negotiations with exchanges on the trading mechanisms for Bitcoin spot ETFs, aiming to attract institutional investors like pension funds and lower entry barriers for retail investors. Simultaneously, to support the “internationalization of the Korean won,” South Korea is advancing stablecoin legislation, encouraging banks and digital asset firms to jointly issue won-backed stablecoins, while leveraging CBDC infrastructure to pilot cross-border settlements.

This dual strategy aims to hedge against capital outflows linked to US dollar stablecoins and enhance the Korean won’s role within Asia’s fintech ecosystem.

11.3 Tax Adjustments and Regulatory Upgrades

The originally planned 20% capital gains tax, set for 2025, has been postponed until 2027, with the tax exemption threshold raised to 50 million KRW. The government also plans to impose a comprehensive income tax ranging from 6% to 42% on high-frequency traders and is exploring on-chain wallet reporting mechanisms to encourage compliance while curbing “shadow trading.”

Additionally, the STO pilot program has been launched, allowing select projects to legally issue security tokens, opening new on-chain financial avenues.

11.4 Policy Benefits and Platform Restructuring

The new policies favor platforms like Upbit that already meet compliance standards, potentially solidifying their market dominance. Smaller exchanges unable to meet technical and risk control requirements face the risk of exit. Overseas platforms such as Binance and KuCoin will confront traffic restrictions due to tightened local regulations.

Lee Jae-myung’s administration is reshaping South Korea’s crypto market infrastructure through ETFs and stablecoins, while tax reforms and regulatory sandboxes create institutional space for industry innovation. South Korea is steadily advancing toward becoming a transparent, inclusive digital asset powerhouse.

Fueled by active domestic capital, widespread public participation, and relaxed policies, South Korea is rapidly emerging as a key growth center for global crypto assets. Compared to Singapore’s tightening regulations and the slower pace in Hong Kong and Japan, Korea demonstrates stronger policy execution and market momentum. For project developers, South Korea offers not only a highly active user base and clear compliance pathways but also opportunities to scale rapidly by leveraging chaebol resources and local social ecosystems.

References

-

Kaiko: State of the Korean Crypto Market

-

Financial Services Commission: 2024 First Half Virtual Asset Business Survey Results

-

Hankyung: 2025 Altcoin Outlook: Searching for High-Potential 'Hidden Gem' Altcoins

-

Klein Labs: Kaia’s Rise: Will LINE & Kakao Propel It Past TON?

-

Magazine Hankyung: From 'YOLO' to 'YONO': Gen Z Consumption Tailored to Financial Circumstances

-

Sidejobs: S&P 500 ETF vs. KOSPI 200 ETF Return Comparison: How Much Do Returns Differ by Investment Period?

-

Trump’s Return Sparks Excitement, 25.25 Million Domestic Investors: The Rapidly Growing Coin Market [New Coin Era]