Archived from Nov 26, 2021 Commonwealth.im

Is Celer Network undervalued? Why or why not?

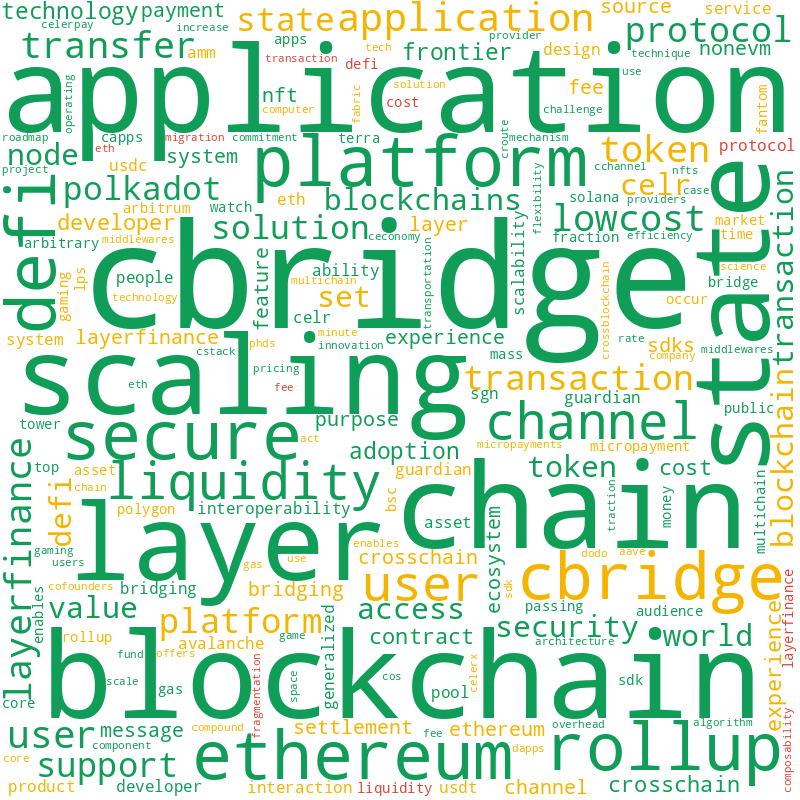

Celer Network is a layer-2 scaling platform that brings fast, secure and low-cost blockchain applications on Ethereum, Polkadot and other blockc [229.55]

Celer launched the world’s first Generalized State Channel Network and to push the frontier of layer2 scaling with advanced Rollup technology [199.07]

Celer State Guardian Network is a decentralized and general purpose watch tower layer to support optimal user experience

[185.36]

Core applications and middlewares like cBridge built on Celer have attracted audiences in DeFi, blockchain interoperability and gaming space [174.80]

CELR token is required to participate in the State Guardian Network and provide various layer-2 services for Celer Network users

[168.03]

(cEconomy) is a staking system that provides security, stable and abundant liquidity, and state connectivity for the Celer Network. [161.72]

cBridge is a multi-chain network that enables instant, low-cost and ANY-to-ANY value transfers within and across Ethereum’s layer-2 chains [124.25]

Celer’s rollup is suitable to solve the scalability challenge on L1 for a wide range of application scenarios with an initial focus on DeFi [123.95]

I strongly recommend to include Celer as part of the investment in Knoxfund. [119.42]

CelerX users can transfer instant and zero-fees payment through Celer Pay, and play diverse skill-based games [107.62]

Hence, i think Celer is undervalued based on the benefits and services it brought to crypto world [106.18]

Yes because Celer Support not only payments but also off-chain smart contracts [100.95]

Liquidity Providers can provide liquidity to highly efficient pool contracts without the overhead of operating cBridge nodes. [100.85]

Perhaps in the future, KNX token can be used for cross-chain knowledge mining and governance towards Knoxfund via Celer Network. [100.17]

Celer Network is an Internet-scale, trust-free, and privacy-preserving platform [98.18]

Growing in Layer 1 networks and the rising costs of using Ethereum, the use of bridges to move assets from one network to another has soared. [96.73]

CelerNodes join the state channel network by setting up a CelerPay channel with another node in the network. [89.71]

Celr stakers will be able to directly capture the value of cBridge via fees paid for processing transactions on the SGN blockchain [79.91]

Core applications and middlewares like cBridge and layer2.finance [77.88]

Layer2.finance is a novel solution that allows people to access all existing DeFi protocols at a fraction of the cost by acting like a “DeFi Pub [72.21]

In the future, cBridge will cover other layer-1s, and layer-2 on top of those other layer-1 chains. [63.82]

Layer 2 solutions to scaling establish an additional protocol that is built on top of blockchains like those of Ethereum and Bitcoin. [51.95]

User will be able to exploit liquidity-supply-based efficient pricing between chains and tokens. [45.32]

cBridge 2.0 enables user to transfer USDT, USDC, and ETH across Avalanche, Arbitrum, BSC, ETH, Fantom, and Polygon within minutes and with signi [38.02]

How is Symmetric different from Ubeswap/Sushiswap AMM DEX?

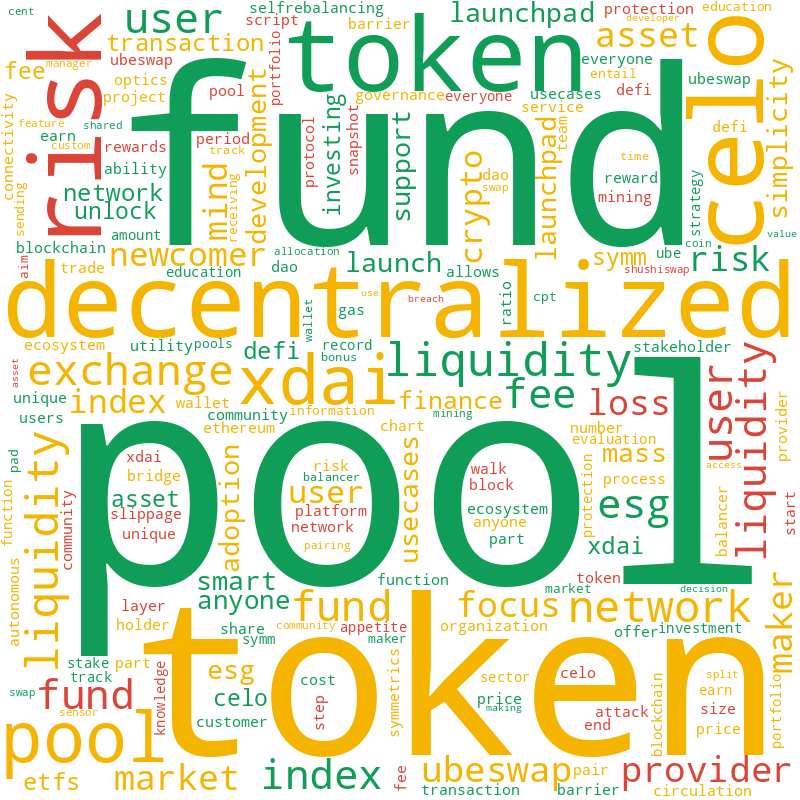

Symmetric is non-custodial meaning the Symmetric developers do not have access to your tokens. [173.34]

Symmetric has the ability to hold up to 8 tokens in a pool. [149.65]

Symmetric DAO will handle approval of claims when they are made to Symmetric Risk fund [146.17]

Symmetric is an Automated Market Maker (AMM) and a Decentralized Exchange (DEX), running on the Celo and xDai networks. [108.31]

All pools on Symmetric are “incentivized" by SYMM tokens on top of trading fees [116.78]

Symmetric’s roadmap includes further development of use-cases (such as a launchpad, crypto index funds, crypto ETFs & ESG funds) [99.17]

Every time someone makes a trade on Symmetric, liquidity providers get a small fee split evenly between all providers [90.71]

The Symmetric community fund will be a separate DAO function responsible for administering the community fund. [86.94]

Therefore, the Symmetric DAO runs on the xDai network which greatly reduces transaction fees to a few cent. [83.85]

Your tokens will get split into the pools so you can deposit one, some or all the coins into the pool without worrying it affecting your return [81.05]

Symmetric is built to drive mass adoption of Decentralized Finance with a focus on simplicity, it is designed with newcomers in mind. [76.68]

it uses liquidity pools like Balancer [58.41]

users can create index funds, launchpads, ESG focused funds and unlock more use-cases [35.84]

Anyone can create a pool, provide liquidity and earn fees with protection and a separate risk fund [35.62]

Its unique risk fund provides a protective layer to users and liquidity providers of the platform, reducing risk of loss due to malicious attack [28.73]

low fees, great customer support and Unique Risk Fund that increases safety [20.14]

Symmetric aims to let users and other decentralized protocols exchange native tokens through it with low fees and low slippage. [13.14]

Are we expecting a long crypto winter? If so what're the factors influencing it?

This strength indirectly affect crypto market, as investors take profits in the limping crypto industry and put in traditional investment venues [205.13]

Crypto market had been fueled by hot money due to QE (quantitative easing). But interest rate hike is coming soon. People will start take profit [118.30]

Joe Biden's new regulations on the tax reporting of crypto gains, as well as other blockchain assets like NFTs [123.83]

Yes, we should expect a long crypto winter 2021, a potential market crash before the end of 2021 [103.44]

Short-term economic and political challenges are compounding into a widespread crypto market selloff. Bitcoin dominance drop, Bitcoin price fall [101.91]

Crypto investors look at these provisions highly unfavorably, as they restrict the financial freedoms inherent in the digital currency industry. [80.33]

China’s broad-based crackdown on the crypto industry [79.16]

U.S congress wants to regulate crypto on a deeper level by designating Btc, Eth,and their hard-forks as commodities and regulate the transaction [79.06]

Twitter's CFO Ned Segal, who said crypto didn't make sense for it to invest corporate cash in crypto assets right now. [77.00]

A sign that the new small investor interest is waning and new retail money is stopping to enter [37.29]

There are few factors together influencing it, one of them is China continue to slam Bitcoin and crypto in general, calling it extremely harmful [27.79]

U.S congress intends to introduce foreign regulations into US law for all virtual asset service providers in the US (and with US clients). [21.51]

U.S stricter regulation will create legal uncertainty for all other crypto projects and ICOs by allowing them to be labeled as securities [16.44]

Kazakhstan, a favorite relocation for Chinese miners who escaped the nation’s regulations, appears to be slightly fed up with miners as well [11.34]

Congress pass legislation that would require stablecoin issuers to be regulated like banks may make sense for many of those assets [10.05]

the dollar continues to find strength; it is currently at a 16-month high, showing how far we’ve come in the economic recovery from the pandemic [1.98]

Liquidation of leveraged accounts will cause a strong selling pressure at lower prices to raise cash to cover the deficit. [1.55]

How can Celo attract high-quality games and NFTs to its ecosystem?

CELO needs to continue with their development camps and supporting financially the developers that have the best projects. It has been doing soo [236.76]

Getting the support of Celo by platforms like OpenSea or Rarible (which is already working on supporting new blockchains) is the key to adoption [204.48]

Celo should improve node technique [195.00]

Artists and developers need those kind of platform for promotion and to help building trust with their customers. [9.22]

OpenSea is the real market maker for NFT on ethereum. Having a similar platform's support is necessary to gain visibility for Celo's ecosystem. [7.05]

Marketing. Celo is one of my top 5 crypto projects, but you need a solid marketing strategy to bring more invertors and devs [0.00]