GM

You & I may or may not despise JPEG’s, but regardless of the camp you’re in, there is always one common ground that collectors & haters alike can meet at: Your NFT bags are most definitely illiquid as fuck.

With the rise of greater MetaFi infrastructure aiming to solve the liquidity problem, be it unlocking more liquidity from your typically illiquid JPEG’s via borrowing, or selling into a liquidity pool that benefits the seller with instant liquidity, the collection as the floor isn’t bricked in order to appease potential bidders, and the buyer as they’ve already put up the liquidity to bid for any potential sellers. We all fucked around and found out when LUNA/UST died, but NFT collections see death spirals on an almost hourly basis.

Table of Contents

- The Current Problem with NFT Collections

- Bribes (Are Essential)

- Liquidity (The Goal)

- Connecting The Dots (Financializing NFT’s)

The Current Problems with NFT Collections

Most NFT teams are currently focused on building an unsustainable amount of hype, which is understandable as this is what drives volume and ultimately revenue via creator royalties, and more collection growth through collaborations & partnerships, in the form of attention and holders. Through all of this focus on everything except liquidity, collectors suffer. In some situations teams can suffer as well, as if you plan to pay contributors with collection NFT’s (huge price volatility in either direction) and small amounts of ETH, can drive runway into the ground if the collection floor is destroyed via under-cutters & flippers. Currently, the NFT scene is mostly a casino (so is most of crypto kek).

Given the endless hype chase in the NFT space, the most overlooked opportunity currently in this niche is the liquidity layer. Unfortunately, the massive innovation in the space is overshadowed by the next 10,000x free mint. However, I feel like these innovations will soon™ see the light of day.

Bribes (Are Essential)

I will not make this a shill piece on every single NFT protocol that exists and is coming into existence, but there’s a comprehensive list that Alex Gedevani put out that different verticals - some of these verticals may or may not be perfect environments for collections that utilize these protocols, to begin bribing for emissions and/or liquidity. Hidden Hand is poised to capture this opportunity as its become a cornerstone piece of governance infrastructure, for the financialization of NFT’s.

Let’s be real, most NFT teams/communities primary goals have nothing no intersections with DeFi, let alone governance. Therefore, making it as simple as possible for NFT collections to participate in bribing (key to the flywheel) is essential to the maturation of MetaFi.

It would be helpful to run a completely hypothetical scenario detailing why bribing is essential for NFT collections to deepen liquidity, and the overall health of the space:

Say I’m an NFT collection, the collectors have issues sizing in and out of their holdings and there are currently no liquidity pools that can offer instant liquidity, I’m aware of Floor DAO that may be able to help with such a cause (as well as other platforms such as ████, and ███) by creating buy pressure, creating a liquidity pool, etc.

Floor DAO votes every so often, on which collections to sweep, adding to their portfolio, and putting these swept assets to work by creating a liquidity pool. The benefits to a collection and its users are as follows:

- Increased trading volume = more revenue via creator fees.

- Co-marketing with Floor DAO for being apart of (and ideally winning) the vote.

- Deeper liquidity for collectors to both enter/exit the collection.

So, as the NFT collection, I know the potential upside to winning this vote, but I’m going up against a number of collections. How can I pull myself ahead? Bribing $gFLOOR holders.

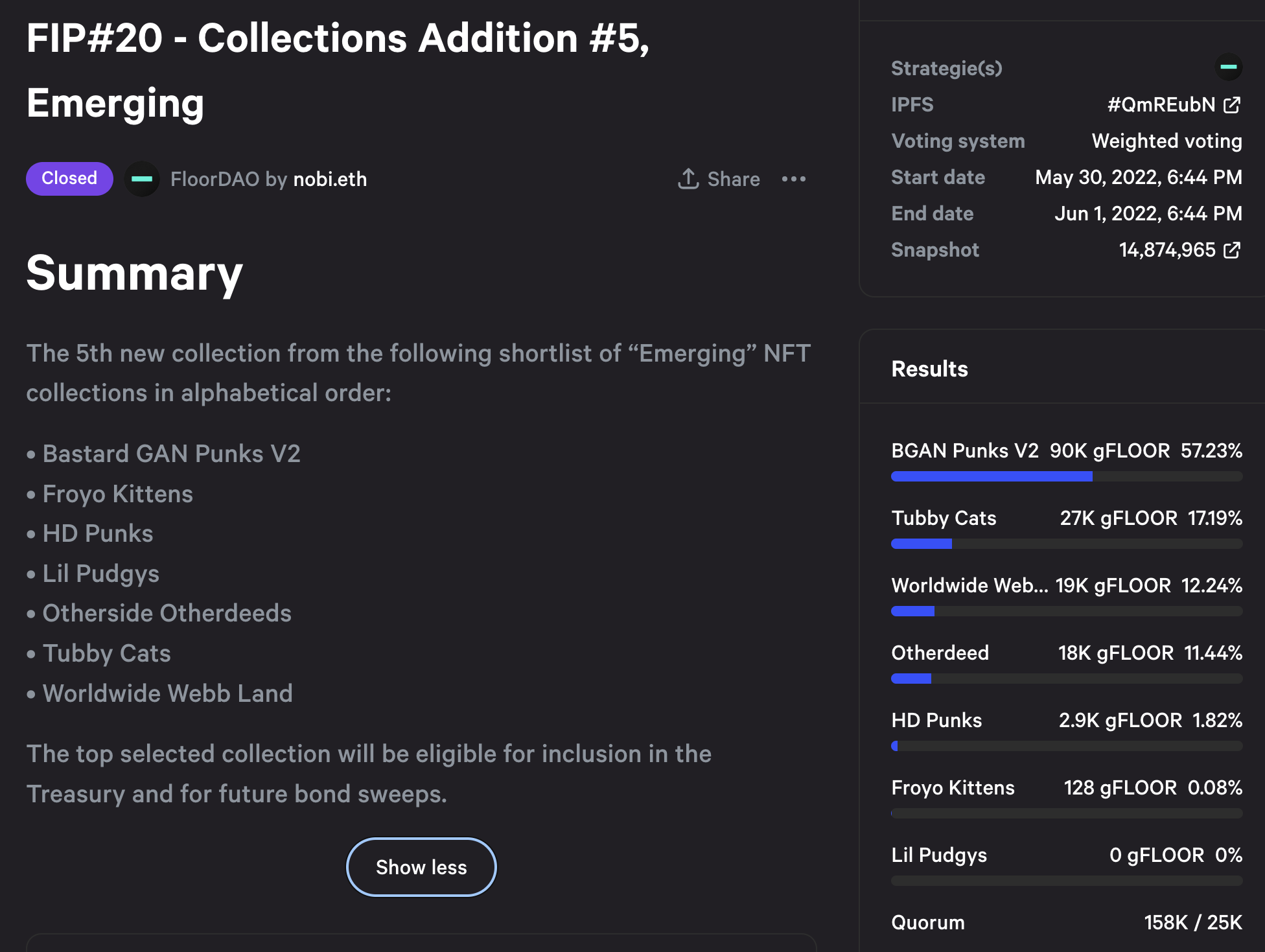

To the snapshots shown above, now we can contrast the mentioned scenario as to what transpired in reality, the BGAN Punks v2 community recently ended up bribing Floor DAO FIP#20, with $10k and ended up winning the vote, which has now translated into a liquidity pool that spans ~$54k of liquidity (WETH/BGAN). These bribes were put up via Hidden Hand, Hidden Hand is a generalized bribe marketplace and has become a cornerstone piece of governance infrastructure, when applied to the world of NFT’s, opens up an entirely new vertical in which NFT projects can now leverage governance to further bolster their collection value, by bribing, and ideally winning votes that deliver value to the overall collection. One can tell that collections are starting to catch on to this, as Hidden Hand saw 8x in bribe volume from collections communities in the 2nd Floor DAO vote.

Liquidity (The Goal)

As you saw above in the snippet of the WETH/BGAN LP on Sushiswap, there was $5.4k in trading volume which at $1.49k/ETH equates to 3.6 ETH in trading volume, out of 13.08 ETH in trading volume for BGAN Punks on OpenSea yesterday or 27.5%.

Although this is a small example, it is still a representation of the importance of liquidity in NFT collections. Below is the WIZARD/WETH LP on Sushiswap for example.

*All numbers at time of writing*

In the last 24hr, there’ve been 3 sales on OpenSea for the FRWC collection, totaling volume of ~$24.8k or 16.48 ETH, while the WIZARD/WETH LP on Sushiswap traded total volume of ~$21.6k or 14.35 ETH. What this shows is that there is demand on liquid markets (DEX/AMM’s) for NFT exposure.

Overall tiny comparisons to the types of liquidity in purely DeFi world. So let’s speculate a bit:

Say an NFT liquidity protocol were able to reach “Curve” status in NFTfi, and become the central hub for NFT liquidity. There would be a massive amount of ‘NFT LP’s’ who are vested in the long term health of a liquid NFT ecosystem, benefitting from trading volume regardless of price volatility. Say this NFT liquidity protocol had a governance token, $N, which was responsible for emitting said more $N (yield) to pools X, Y, & Z - which draws more LP’s as they want to capture their share of rewards. As an existing or new collection, I see this and want my share of the pie, I’m pool A and don’t have any rewards emitted to my pool, my LP’s only benefit from trading fees from my pool which consists of $NFT-ETH (for example). How do I squeeze my way in? Bribes. Remember I mentioned these are essential.

Now I’ve got $50k in ETH or $X to bribe $N token which governs the NFT liquidity protocol, I use Hidden Hand to bribe $N holders, and ideally they end up voting in my direction, resulting in me winning the vote, which leads to the protocol (yes, inflationary) emitting rewards in the form of $N to my pool. The returns on this are greater than the mere cost of my $50k bribe, as LP’s that come to said NFT liquidity protocol see the yield on my pool is juiced compared to perhaps others, incentivizing them to provide liquidity to pool A ($NFT-ETH). My collectors/traders benefit from much deeper liquidity (exit liquidity in some cases kek) and can enter/exit as they please, this helps the collection overall as A) the collection can provide liquidity and capture emissions/trading fees, and B) the attention driven to the collection from greater yield can increase holder count/buy pressure, and inversely, sell pressure, as we must understand that there are always pros/cons to growth.

There is a reason that the largest DEX by liquidity & market cap is entering the NFT space.

Connecting The Dots (Financializing NFT’s)

This is all pure speculation based off of current happenings, innovation, and data in the emerging cross-roads of MetaFi (Metaverse Finance or NFT’s x DeFi) which will eventually converge with greater clarity.

NFT’s have been able to capture a subset of attention that pure DeFi has a hard time attracting - retail. This is clear as entertainment (how do casino’s mostly profit? Entertainment, art, exclusivity, etc… kek) is a much easier vehicle to attract retail attention, than finance is, even though finance makes up much of the tangible world around us. At a deep human level, what motives us to understand and more importantly, utilize finance? Entertainment in all of its various forms. What better vehicle in Web3 to commercialize both entertainment and finance? NFT’s.

So you’re beginning to see why this convergence is not a matter of if, but a matter of wen. The flywheel in its current form, and for the foreseeable future, looks like:

NFT Collection → Bribes → Liquidity → Repeat

If you don’t agree with this or are working on a way to improve this process or change it for the better, I’m nothing but open to chat about it.

Disclaimooor

This is me channeling my thoughts in written pieces that may summarize current market thoughts but will never be to endorse any project, or method mentioned nor give any financial advice. Blz do not fomo into anything you may read from myself or any other anons. I also may or may not hold any of the tokens mentioned and/or contribute to any protocols/DAOs mentioned. Stay safe.

WAGMI,

0xOmnia