GM

If you’re reading this, you’ve seen that there’s been a rather large debate clogging the CT wave regarding royalties vs. no royalties. It’s best to understand both sides of the fence and ultimately find a common ground. This piece will have no visuals, it will be word intensive and ultimately, I challenge you to see both sides and even tell me where I’m wrong. I don’t think there is a right answer.

The Griftooooors

The greater ‘meta’ with NFT’s for the last 1.5yrs has been quite interesting to study: Trends change quick as fuck.

What hasn’t changed though? Is the ridiculous grifting that marketplaces charge users to ‘exit positions’. If you were a trader paying a minimum 2.5% tax fee (more like a tax lel) to exit a position of your chosen token, before royalties, you would probably never trade there, regardless of the fee distribution.

Marketplaces like OpenSea, to name the largest (being swiftly overtaken in volume by X2Y2) will likely not lower fees, at least that’s not my bet, they’ll very likely continue to charge their 2.5% per trade as this is what their business model heavily relies on. Collectors mostly trade there because of the “liquidity” but what they mean by this, is that more eyes are usually on OpenSea as they have ~40k daily users, however, collections are always at risk of the dreaded ‘death spiral’ as undercuttoooors rush for the exit. Creators charging 5 - 7.5% royalties make less as price gets rekt from flippers and malicious trading.

Would you rather make 10% of 100 trades? or 3% on 1,000?

The royalty argument is rooted in a PvP mentality, we have to look at it from a very different angle. NFT’s have best shone as social tools in a sense, they have become intertwined with modern culture as a source of monetization on a level that was only seen once before in history: Social Media.

NFT’s take this creator monetization scalability to completely new heights, but the problem over the last 1.5yrs quickly became realized and meme’d, all of our JPEG’s are illiquid. Not gud.

Liquid bags are gud bags.

Enter, Sudoswap

Sudoswap in essence, allows users to set up completely customizable buy/sell walls for users that want to size in or out of a collection, and even ETH-NFT liquidity pools that allow one to earn fees from trades routed through the pool. Users can set the spread + delta (bonding curve) at which price increases/decreases based on the trading activity in the pool.

This innovation has been critical in <1mo since Sudo’s launch, for the NFT space. It’s one crucial tool that Protecc will utilize (without dropping alpha), and in many ways NFT collections (teams) should utilize as well.

Sudoswap turns the NFT world on its head, because creators no longer need to rely on the benevolent/malevolent actions of traders to further grow their runway through charging thicc royalties. They can push collectors/traders to their AOL (Artist-Owned Liquidity) first popularized by Olympus DAO through POL (Protocol-Owned Liquidity) - as creators can charge a fee for users to trade in their pool, and have access to instant liquidity, eliminating the need to shamelessly destroy floor price of a collection just to incentivize prying eyes to bid on their holdings, just for the creator to end up earning less.

As an NFT collection it becomes -EV for one to simply “mint out” and move all volume to a secondary market place where liquidity and attention almost always, instantly dry up within 24-48 hours at a maximum in most cases. There are obviously outliers that end up outperforming the standard metrics but NFT traders already know what to expect after the same playbook has been repeated so many times. Trade pre-reveal, sell into reveal, buy immediately post-mint, etc… the same strategies are always employed. Next we’ll have NFT flipping courses (probably exists already…), we already sped-run the Amazon FBA/Dropshipping cycle that lasted a few of years, in <2yrs.

So, what happens when you put up a shit ton of liquidity (more than usual at least) for naturally inefficient markets to actually move freely within?

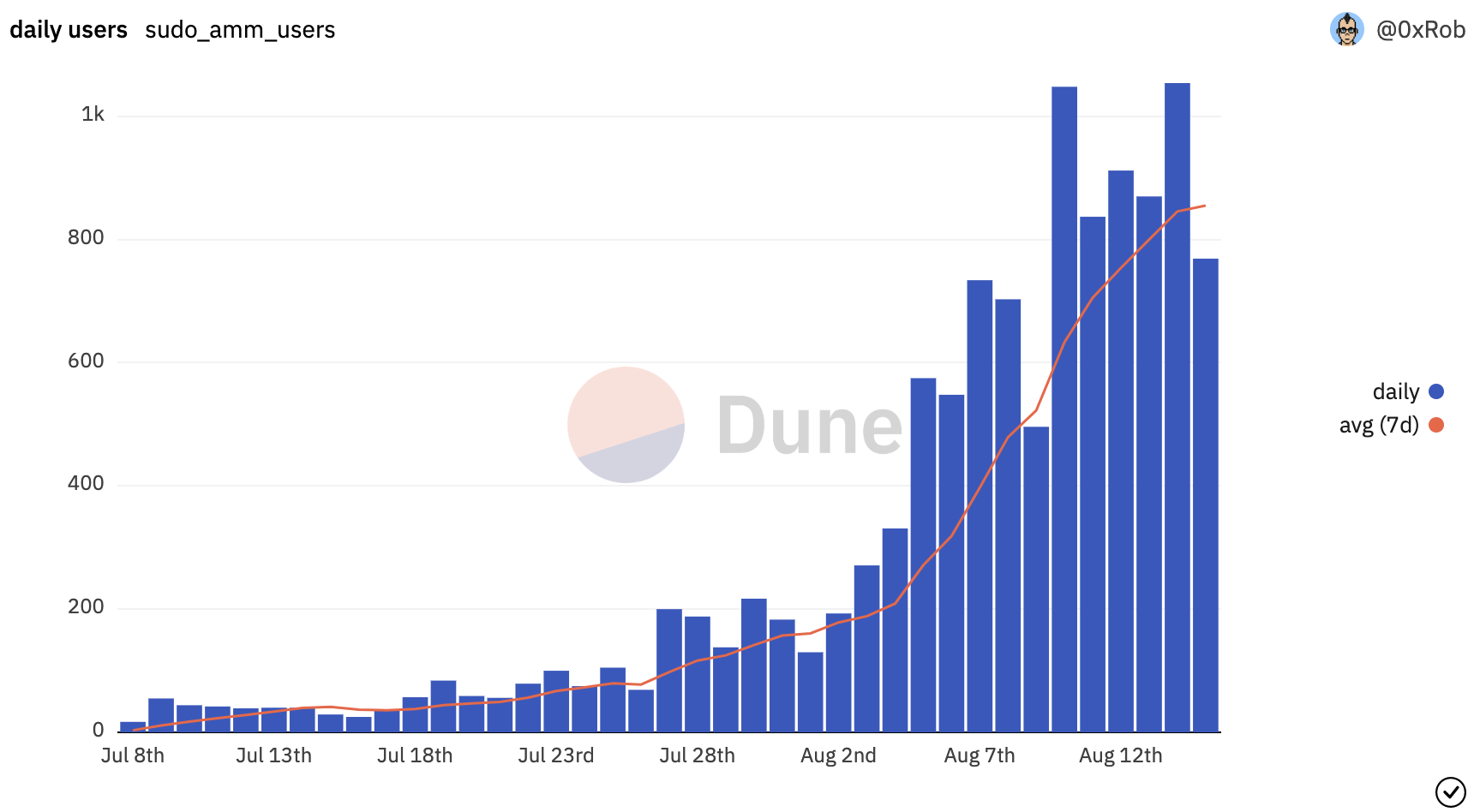

More users.

Racing to The Bottom

It’s a race to the bottom in fees. I see marketplaces being the last to drop fees, I see potential mimicking of Sudoswap in the future just as the mimicking season of Uniswap/SushiSwap was popping off post-DeFi summer. Sudoswap will maintain its mantle over other AMM’s just as Uniswap has, but for different reasons. NFT traders, like bees, naturally congregate around the queen bee (hence why they all stuck with OpenSea until now).

Honestly, there is no best way of doing this. I do really dislike seeing the royalty argument though, because there really is no “set” way of doing this. NFT’s are becoming more and more like goods at the end of the day, but at the same time they’re a tradeable asset with in some cases unlimited upside, in the form of access to information or just purely financial upside. We’ve seen this with DAO’s like Oz DAO, gmDAO, and more.

Cool visions that come to mind are making things like membership, and real estate, deeply liquid and tradeable assets outside of the normal parameters that currently define those niches, but thats for another time lol.

So, in closing:

Royalties = good (bad for some)

Swap fees = good (bad for some)

It really just depends what way a creator sees their collection being valued, and only the market decides this. I’m just happy to see value brought back to creators as a whole, and even happier that there are many more options as to how to go about doing so, that’s all. It’s important to consider collectors just as much as creators though, which is why I’m a fan of the latter, customizable LP model where swap fee (%) and delta (%) can be changed at will, in an uncensorable fashion.

Disclaimooor

This is me channeling my thoughts in written pieces that may summarize current market thoughts but will never be to endorse any project, or method mentioned nor give any financial advice. Blz do not fomo into anything you may read from myself or any other anons. I also may or may not hold any of the tokens mentioned and/or contribute to any protocols/DAOs mentioned. Stay safe.

WAGMI,

0xOmnia