What’s emerging is a clear split between crypto-native asset allocators embracing permissionless, composable infrastructure, and legacy-style wrappers still dependent on centralized rails, opaque pricing, and poor redemption mechanics. We’re moving toward a capital market design where execution, custody, and automation must be integrated, secure, and on-chain. We now see introductions of first actively managed risk-adjusted products in the markets by major industry behemoths and more balance sheets that handle collateral or better asset & liability management. Here are the top developments and scroll down if you want to read my thoughts on them:

-

Galaxy's GK8 is providing non-custodial wallet service for zkSync with uMPC

-

Centralized FDUSD depegged, being insolvent after falling short to serve redemptions

-

HongKong introduces a new regulatory framework for compliant staking

Actively managed strategies are needed to bring digital assets into portfolios:

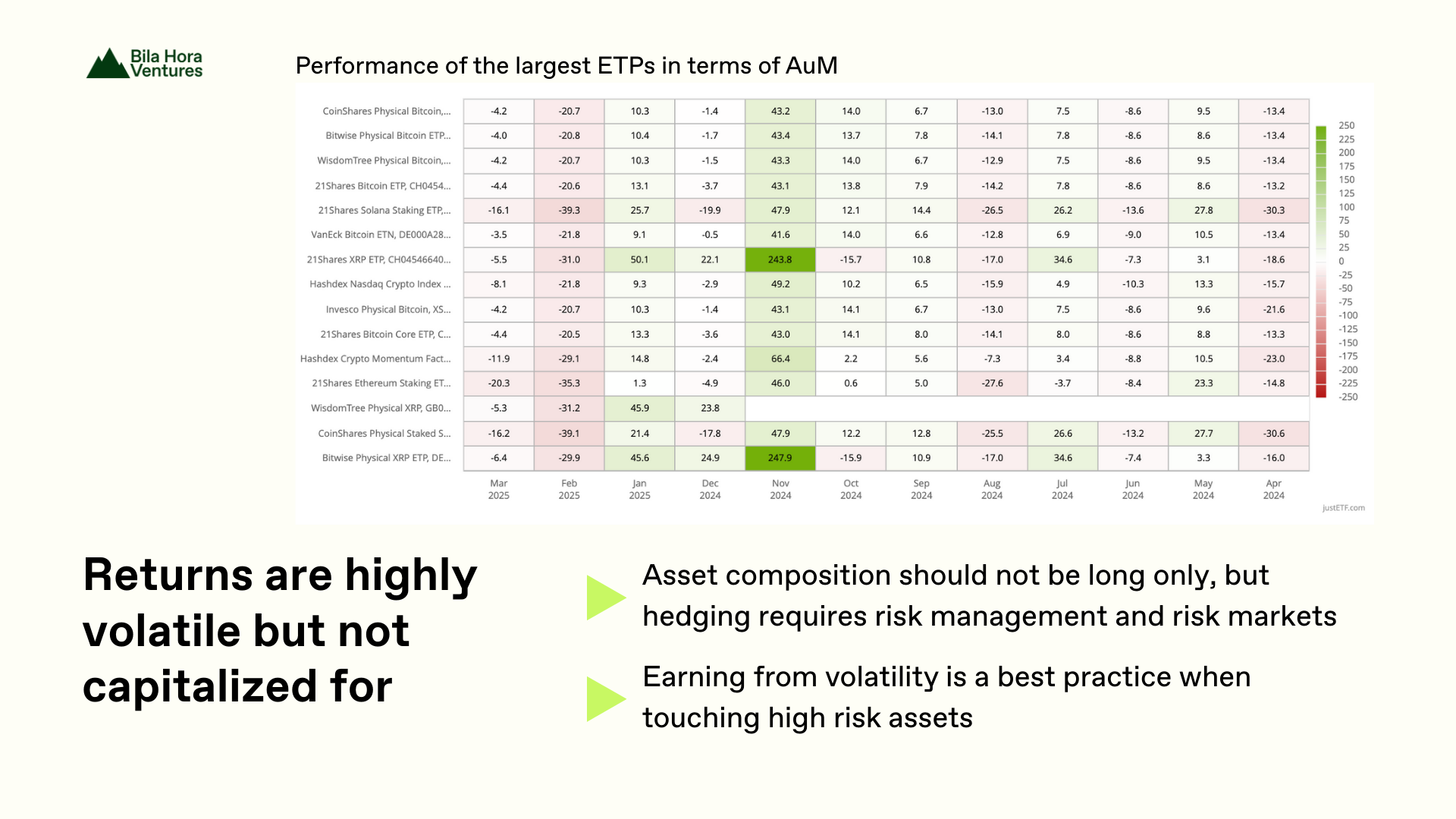

- Grayscale Lists 2 New Bitcoin ETFs Offering Income From BTC Volatility The issuer has launched 2 new actively managed Bitcoin Yield Strategy ETFs in the US: The Bitcoin Covered Covered Call ETF and the Bitcoin Premium Income (BPI) offer covered Call Writing Strategies: - Covered Call: selling call options to generate income on the premium covered; earn from Bitcoin Volatility, betting on rising BTC prices within a predetermined time and price - BPI: targets options with strike price that is well out of the money, prices much higher than spot prices

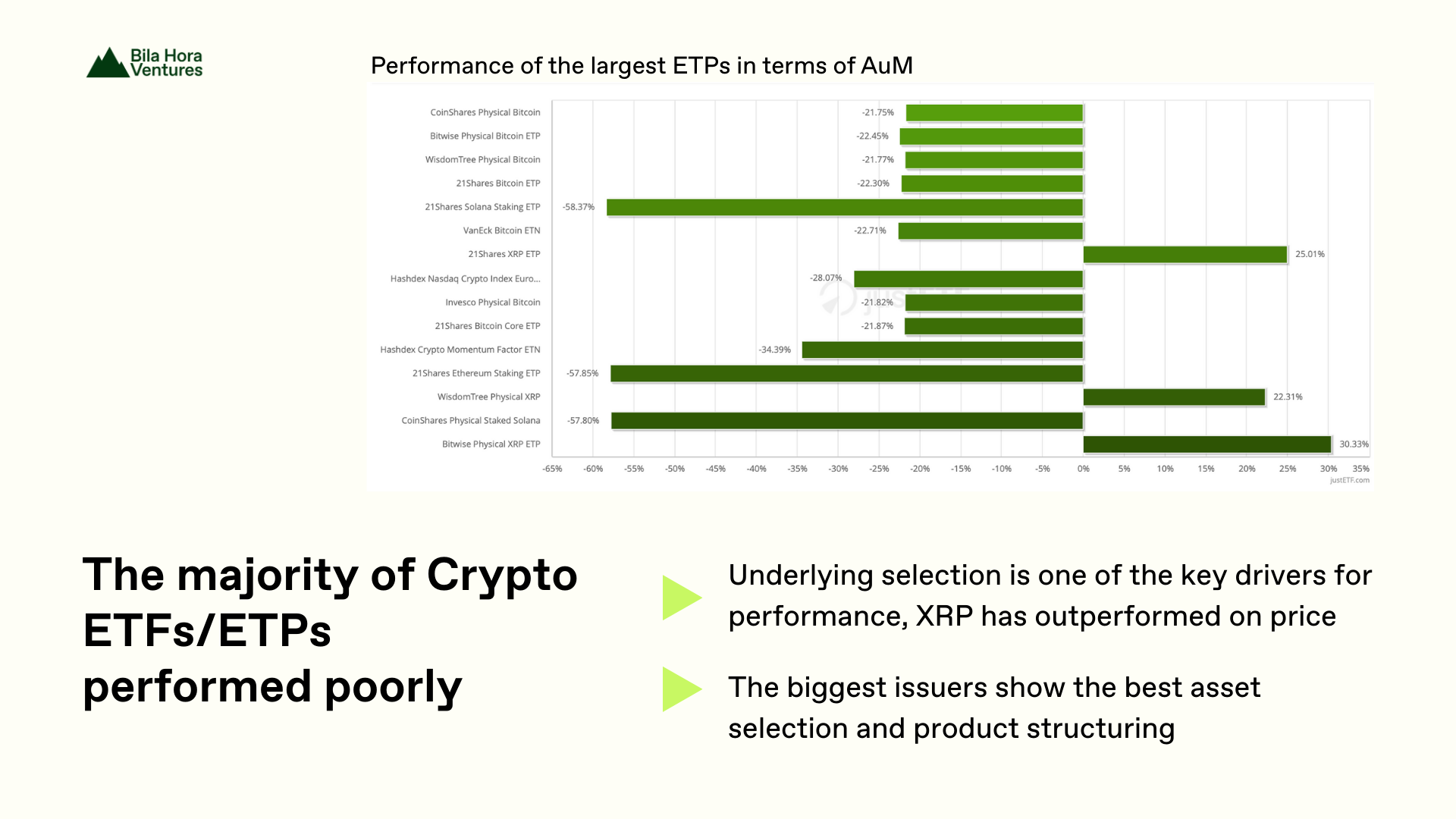

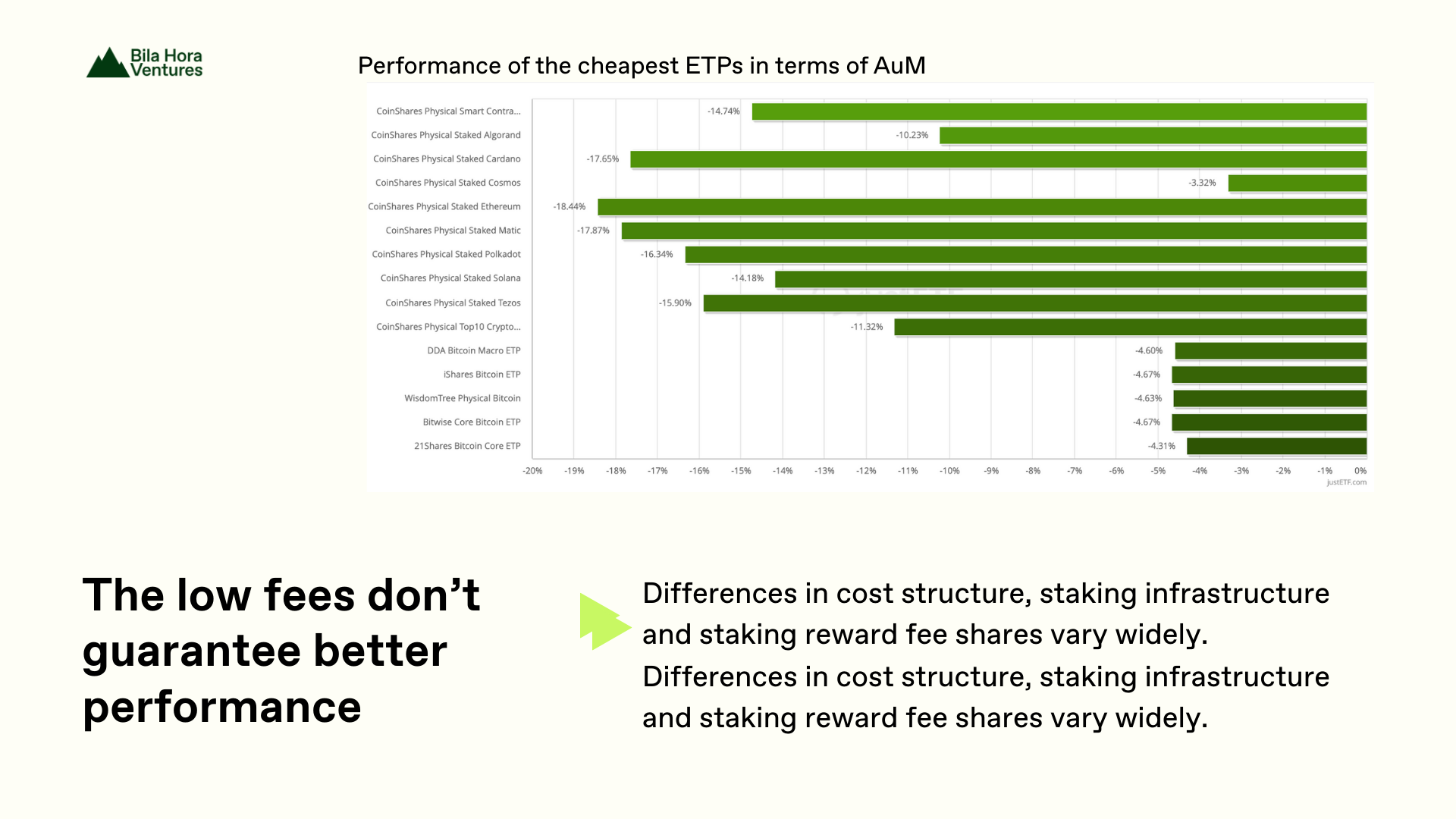

Previously long only Mutual Funds, stopped from launching ETFs, some even delisted and various ETPs stopped continuous pricing of quotes or end of day metrics, exposing investors to risk on their asset and liability management, as the only way to liquidate a position is via the issuer directly, with opaqueness on their balance sheet.

-

Immutable Insights initiated liquidation of the previously freshly approved asset manager in Jan 2025 The company's liquidation was initiated after the founders don't see fit for their long-only mutual fund. It was supposed to be set up as a Special AIF under the EU Framework for Collective Investment schemes in Germany § 284 KAGB. In a special AIF 80% of assets can be deployed in listed securities, 20% Digital Assets.

-

21Shares liquidating of 2 actively managed ETFs by ARK Invest with futures on Bitcoin and Eth managed with fundamental analysis 21Shares Delisting of 2 actively managed ETFs with futures on Bitcoin and Ethereum managed with fundamental analysis as a market-neutral strategy.

-

Figment ETH Staking ETP is experiencing massive NAV drag and price provision has been halted on major markets The ETPs is supposed to provide investors with exposure to ether prices while earning staking rewards, including maximum extractable value. The fund however, is not getting price provision at centralized securities exchanges. Quotes need to be inquired directly by the issuer.

-

Northstake stopped its own validators after poor performance and started supporting stVaults for its OTC Market Makers on its validator market place to allow investors to skip the ETH withdrawal queue via transferability of the vault for whitelisted participants

-

HongKong introduces a new regulatory framework for staking: staking providers need to get licensed and maintain custody/control of staked assets while implementing specific safeguards. This development marks a significant step as staking gains prominence as a 'risk-free' rate in crypto finance and could develop into a well-positioned crypto market to provide access to staking and DeFi yield, as it has already been the first to approve BTC and ETH spot ETFs last year.

The aftermath of the ByBit hack

The CeFi exchange relied on scrappy key management and poor procedure exposed vulnerabilities and led to a prompt security elevation, raising awareness on diligent technical design for best-in-class encryption levels:

-

ByBit exploit over via SafeByBit USD 1.5 billion exploit North Korean Hackers centralized cloud instances by through a SAFE frontend hack via a frontend hack via cloud instances injecting fraudulent call hash data in the userfrontend. Lazarus Group injected fraudulent call hash data in the user frontends.

-

Galaxy's GK8 is providing non-custodial wallet service for zkSync with uMPC

-

Palmera massive Q1 security update, thanks to heavy lifting by developers in the surge of adoption resulting from investors seeking exposure to alternative interfaces, when using the multi-sig tool and managing protocol teasuries. The SAFE powered Wallet Interface and tooling for protocol treasuries, is giving exposure to DeFi protocols, yield and liquiditiy pools and has reported in early march a TVL of $6.7B as end of Feb. Transaction volume processed was reported at and over 5k new wallets added within days after the SAFE ByBit Incident.

Centralized Stablecoins Still Face Elevated Depegging Risk

Suffering from transparency issues, and liquidaty shortfalls. But be careful with decentralized stablecoins, they can be a great a new money market vehicle, aloowing you to keep almost the full yield for your capital at risk, but have you checked how they manage their collateral? You better run for your money here:

-

FDUSD Depeg: ; trust in a single entity can result in liquidity shortages for collateral redemptions. This situation, akin to the USDC depeg during the Silicon Valley Bank incident, underscores the inherent counterparty risks in stablecoin design that necessitate risk-hedging.

-

Ethena's USDe has been classified as a security in GER: The mechanism backing USDe enables sUSDe, claiming to be crypto-native, reward-accruing asset, derived from liquid asset rewards (to the extent utilized in backing) and the funding and basis spread available in perpetual and futures markets. Did you take a look at the inherent risks, it's basically a tokenized DeFi yield play, that steers modules on the exposure to certain crypto lending and reward protocols and vaults. How stable is their Peg Stability Module?

-

Luckily there are now also risk markets for pegged assets where you can bet on future depegs and hedge your risk just like Cork Protocol

Scaleability Trade-Off: Are L2s really the better choice?

-

Who is not a founder in crypto or an aspiring L2? We can't count the number of new "scaleable", but ringfenced L2s or high TPS Ethereum wanna-be competitor in the race for insti adoption. Where will liquidity moove?

-

Ethereum narrative shifts from public good to open-source technology, prioritizing institutional-grade infrastructure development. Danny Ryan ,one of the former lead researchers who was also a key contributor to the merge from PoW to PoS, co-founds Etherealize to drive wallstreet adoption, most likely starting with Dark Pools

Why Institutional DeFi Still Faces Frictions—and What Needs to Change

There’s a huge crowd of investors eager to gain exposure to digital assets. But many are still held back. Why? Because key elements of the market—liquidity, risk management, and technical infrastructure—are still missing or fragmented.

To properly participate, institutions need cushions against volatility and tools for hedging. That includes functional derivatives markets like futures, perpetuals, or credit default swaps with continuous price provisioning. At the same time, they need a modular, secure way to manage key delegation and on-chain interaction.

The Cold Start Problem in Digital Assets

Digital assets inherently face a cold start problem. Every new asset or product creates a three-sided marketplace: issuers, liquidity providers, and investors. This complexity slows adoption. The products themselves are highly technical, but also powerful—they offer modularity, immutability, and composability that could instantly connect previously unlinked market participants.

We’re starting to see the first wave of risk-adjusted, actively managed products enter the market from major institutions. But the problem is, global markets remain segregated. Centralized exchanges, opaque pricing, and ringfenced vaults make automated execution nearly impossible. Without continuous price feeds and liquidity bridges across venues, strategies fail to execute.

Institutional Constraints and CeFi Bottlenecks

Many EU market participants struggle to implement or manage the required infrastructure for on-chain financial products. Most lack the engineering capacity and compliance framework to integrate modular finance products securely.

Take Northstake, for example. It acts more like a gatekeeper than an asset manager—offering access via a whitelisted, API-based interface connected to custodians. While it enables institutions to engage with certain digital assets, it doesn’t yet support active management or permissionless execution. Recently, it introduced support for stETH vaults, offering fund segregation for inflows and outflows. However, deeper functionality, like exiting validators via DVT (Distributed Validator Technology), still needs to be integrated.

The Illusion of On-Chain Exposure via Off-Chain Systems

Permissioned staking and CeFi-managed DeFi strategies fragment liquidity by design. Without native on-chain execution, these strategies get stuck in dry liquidity pools, OTC intermediaries, and ringfenced platforms. Attempting to replicate real-world products on-chain—without embracing permissionless, automated execution—only introduces more friction and risk.

True on-chain finance requires native, programmable infrastructure. This includes risk markets (futures, perps, options) and collateralized lending—all managed by regulated, crypto-native asset managers. But such activity typically triggers licensing requirements, which many current players, including Northstake, cannot meet today.

The Custody Layer is a Point of Failure

Here’s a little-known fact: some licensed crypto custodians outsource key management to technical service providers. These setups, often based on MPC (multi-party computation), involve sharding private key sets and storing them in places like bank vaults or notaries—some of which have even suffered from fires or physical failures.

MPC-based custody introduces another layer of actors and trust dependencies. Wallet-as-a-Service solutions like Fireblocks are widely used but add complexity and centralization. The sharding process itself becomes a weak point.

What’s Needed: On-Chain Asset Managers with Native Infrastructure

To manage structured products, run risk models, and execute hedging strategies, asset managers must operate on-chain. This requires:

-

Regulated, crypto-native asset managers

-

Permissionless trading rails

-

Smart accounts with session keys and threshold signing (no exposed secrets)

-

Continuous price feeds

-

Composability across DeFi protocols

Coinbase has a unique strategic position—offering both custodial services and a non-custodial Wallet-as-a-Service, along with its own L2 (Base). However, Base operates with centralized sequencers and risks in finality, especially when paired with opaque operations like staking addresses and ringfenced tokens such as cbETH.

Even chains with higher throughput face risks: block building delays, MEV vulnerabilities, or state finalization issues. Managing execution yield, arbitrage, and price discovery across segregated chains requires serious optimization and data engineering.

The Importance of Infrastructure for Security & Resilience

The recent Bybit hack underscores the need for resilient, decentralized key management. Vitalik Buterin’s concept of keystore layers — as discussed in his talk on account abstraction — offers a path forward: permissionless automation with session keys and threshold signing, minimizing delegation risk.

Projects like Functor Network are pioneering these ideas — combining zk proofs, threshold signing, and AI wallets to enable agentic execution. Some centralized exchanges are exploring similar upgrades post-hack, aiming for secure interfaces without sacrificing composability or data availability.

From Surveillance to Sovereignty

As we enter an era of dystopian surveillance capitalism, infrastructure needs to serve as neutral public goods and be recognized as an open-source technology — just like airspace or wireless internet. We need to be aware central points of failure and create transparent, secure systems that give users control over their assets.

Institutional DeFi enables banks to refinance risk, manage client funds, and allow direct yield participation — without counterparty risk. It can bring greenlighted capital into crypto, while also helping manage capital.

This isn’t just a crypto thing. It’s a next-generation financial architecture that can support economic resilience, sovereign tax bases, investor protection — and personal freedom through self-custody.

Reading recommendations for your pile:

-

REPORT: by Keyrock & Centrifuge on Permissionless DeFi & Liquidity

-

BOOK: The Fifth Risk by Michael Lewis, about when the Trump administration first took office

-

BOOK: The man who solved the market about Renaissance Capital's Founder James Simmons

-

PODCAST: Functor Network Co-Founder Doris G at Aztec NOIRCon on Encyrption Primitives

-

PODCAST: Etheralize Co-Founders on Bankless

-

BLOG: SAFE's CPO Rahul Rummala on the Costs of Self-Sovereignity

-

BLOG: Ramzi Risk gives an outlook on resilient industry in times of AI workforce