Wave 5 of the DeFi Voyage focuses on LPs (Liquidity Providers) – the cornerstone of DeFi. This enables vital activities such as swaps, loans, and other operations in DeFi. Linea aims to increase user awareness about LP and Yield Farming and allows users to engage in these activities with specific DEXs within the Linea Ecosystem.

Wave 5 Timeline and Point

-

Duration: Dec 04, 7:00 PM | End: Dec 13, 7:00 PM

-

Point: 350

-

Link to join: Wave 5

Fundamental about LP and Yeild Farming

Liquidity provision and Yield Farming are crucial to DeFi.

LP plays a crucial role in the decentralized finance (DeFi) ecosystem, particularly for decentralized exchanges (Dexs). By contributing their assets as liquidity, these providers support the foundation of DeFi, facilitating user interactions such as token swaps and other financial activities. In return for their contribution, LPers earn from trading fees and additional rewards, making it a potentially lucrative endeavor. These incentives can include extra yields provided by the DeFi protocols themselves. The act of providing liquidity is essential for enabling key DeFi operations and helps maintain the ecosystem's functionality. Furthermore, earning yield in DeFi is a dynamic process, offering providers various opportunities to engage with different protocols and strategies to maximize their returns. This involvement in DeFi is not just passive but requires active participation and engagement with the ecosystem.

Types of Liquidity Provision

You can pick single-sided or dual-sided pools when you become a liquidity provider.

Single-Sided Liquidity Provision:

-

Involves depositing only one type of asset into a liquidity pool.

-

Simplifies the process for providers who prefer or can only supply one asset.

-

The protocol might automatically convert half of the asset into its pair, or use a design that supports single-asset pools.

Dual-Sided Liquidity Provision:

-

Requires contributing two different assets to a single pool.

-

Common in DEXs like an ETH/USDC pool, often with equal value of each asset.

-

Supports more complex operations and can include pools with more than two assets, such as stablecoin pools containing USDC, USDT, and DAI.

Risks of Liquidity Provision and Yield Farming

-

Impermanent Loss: A key risk for liquidity providers is impermanent loss, which occurs when the value of assets in a liquidity pool decreases compared to simply holding them. This loss is influenced by the price ratio changes of the two assets in the pool, particularly in volatile markets.

-

Yield Farming Risks: Yield farming is subject to inherent risks due to market volatility. The value of tokens used for farming and the rewards earned can fluctuate significantly. There's a risk that these tokens may lose value by the time they are unlocked or sold.

-

Complexity of Liquidity Provision: The process involves complex mechanisms, especially when engaging in multiple protocols. This complexity compounds the risks associated with each protocol and the overall strategy employed.

To effectively manage risks in liquidity provision, it's crucial for liquidity providers to conduct extensive research before engaging with any DeFi protocols. This includes:

-

Reviewing Documentation: Carefully read and understand the official documents of the protocols, which explain their mechanisms and risks.

-

Engaging with Community Forums: Participate in discussions on platforms like forums or social media where users and experts discuss the protocol, providing valuable insights and experiences.

-

Comprehending Protocol Operations: Gain a clear and thorough understanding of how the protocols function, including their unique features and potential risks.

Task to do

Core Tasks

Provide liquidity to selected pairs (list bellow) on supported DEXs (at least $25 deposited finally, in total) in one transaction on Linea

Task Instructions

The core task for this wave will be focused on learning how to provide liquidity on any selected token pair. You can choose any DEX from the list to do it!

The total amount of liquidity provided must be at least $25 as the sum of the equivalent value of the two tokens you will use for this task.

Step-by-Step Guide

-

Choose the partner app of your choice & click “Continue”

-

Watch the walkthrough video to learn how to provide liquidity via the app

-

Click on “Go to project now” to go to the app of your choice

-

Make sure the selected network is Linea.

-

Choose the pool you want to provide liquidity to

-

Approve the tokens (if needed), and then complete the transaction

-

Ensure that you are providing at least $25 worth of liquidity. (Total worth of the tokens supplied should be $25)

-

Only transactions done during this wave will get verified, not older transactions.

Example: Provide Liquidity on MetaVault

Bonus Tasks

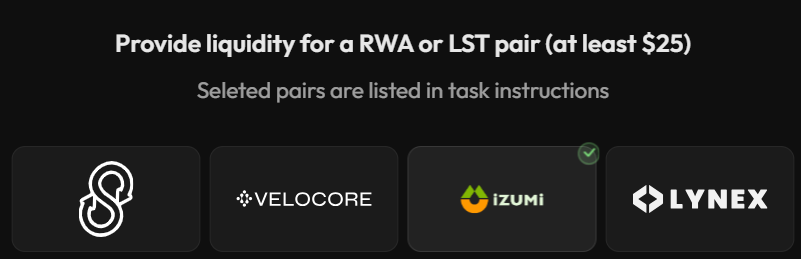

Provide liquidity for a RWA or LST pair (list inside) on supported DEXs (at least $25 deposited finally, in total) in one transaction on Linea

- Provide liquidity for a RWA or LST on IziSwap here

Provide at least $25 liquidity to a ve(3,3) stable pool, promoting the use of advanced AMM models.

- Provide Liquidity to a ve(3,3) stable pool on Velocore here

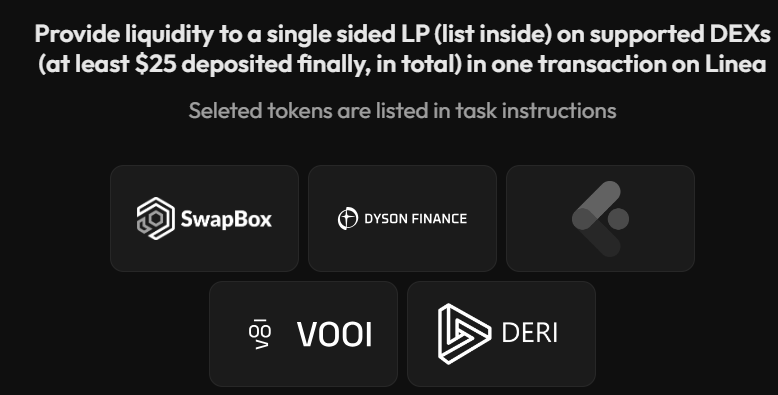

Provide liquidity to a single sided LP (list inside) on supported DEXs (at least $25 deposited finally, in total) in one transaction on Linea

- Provide LP to single sided LP on Dyson Finance here

Review your favorite dapp of this wave on DappSheriff

- Write your experience in Wave 5 here

Conclusion

Wave 5 is over half of the journey in Linea's DeFi Voyage. You can track the next wave in our first article, 'DeFi Voyage Overview.' The Linea Ecosystem will provide updates as soon as they become available. Be sure to subscribe to receive our latest articles.

You can also support us by minting our articles, which we truly appreciate.